We notice more and more headlines about the September dump of Bitcoin every day. The top crypto editions publish analytical and technical articles about high-volatility Bitcoin and create price predictions based on personal experience. Well, I read all this analytics, and now let’s discuss modern Bitcoin and the facts you need to know about it this week.

At roughly 500 days, the current bear cycle on the cryptocurrency markets is the longest ever.

Trader’s thesis’s

The greatest quote I’ve ever heard, but in the crypto market, we say,

“Read the traders’ predictions, but make your own research”.

Michal van de Poppe, CEO and founder of MN Trading, stated on 28 August that the present bear market is largely analogous to what we saw in 2015. He added that it was essentially a period of sideways action, where the faith in crypto is slowly getting lost too, “despite the fact of solid fundamental growth.”

The longest bear market in history for #Bitcoin

— Michaël van de Poppe (@CryptoMichNL) August 27, 2023

It might feel like a ghost town in crypto. It might feel like there's not even going to be a bull cycle anymore and I understand why these thoughts are there.

But why?

Well, people base their decisions on history. 👇… pic.twitter.com/Ljtv9wmw12

He published the post of the intriguing headline “When is the volatility coming back on Bitcoin?”

According to his statement:

Investment thesis: If you expand towards the previous cycles and seasonality, you’ll quickly understand that August and September aren’t the greatest period for Bitcoin, as it usually corrects. However, in investing and trading you’ll have to be focused on the outlook in the future, through which you can quickly see that October-December are great periods. Not to mention the case of a potential approval of the ETF or the Futures ETF’s on Ethereum. In that regard, it’s currently the period to DCA and accumulate your positions and I’d be taking a weekly/monthly DCA approach on this, through which you can get a balanced position into the markets. Timing the bottom is simply impossible.

When is the volatility coming back on #Bitcoin?

— Michaël van de Poppe (@CryptoMichNL) August 28, 2023

Prices have been stalling, after we've been witnessing a significant collapse and liquidation cascade. More than $1 billion has been wiped out of the markets ten days ago.

The largest cascade in this bear cycle. What's next? 👇… pic.twitter.com/Zrjg6O4e0d

No doubt, as much as we read and learn about trading strategies, the more we realize that we don’t know anything. So do not try to comprehend everything at once; the skills will come gradually during the practice. Explore the new blockchain options, tools, and crypto exchange features. It’s difficult to become a professional trader and develop analytical skills. It’s not a fairy; it’s hardworking.

Bitcoin Trading Strategies

The same story is true of Bitcoin strategies. In the era of Google, AI technologies, and ChatGPT, users can easily find numerous crypto strategies and immediately start to use them without checking all the details about the crypto assets they plan to use this strategy on.

According to a dozen analytical articles, I would highlight the most useful and suitable trading strategies for Bitcoin:

1.Scalping

According to Coincodex definition:

Scalping is a popular trading approach based on making numerous trades to leverage small price movements to generate consistent returns. Given the large price volatility of cryptocurrencies, scalping can provide a lucrative venue to generate profits from short-term price fluctuations.

2.Range trading

For instance, you may have noticed that the price of Bitcoin has been fluctuating for a few days between $27,200 and $27,900. An appropriate opportunity to use the range trading technique in this situation would be when the cryptocurrency is falling towards the lower bound (the support level) and is approaching the higher bound (the resistance level). As long as the price is in the price channel you have identified, you should repeat the operation.

3.Margin trading

Trading on margin enables traders to take larger positions with borrowed money, increasing their exposure to the market. This makes scalping possible, which by default results in a very modest profit of about 1.7% on your investment, or $1.7 in the case of a $100 Bitcoin investment. However, by leveraging margin at a 5x rate, the identical price movement would result in a profit of $8.5, or the same amount as if Bitcoin’s spot price increased by 8.5% to $31,465.

4.Long-Term Position Trading

Even if it might not be the primary emphasis for many active day traders, long-term position trading can nonetheless have an impact on their strategy. The longer time frame is examined by including monthly and quarterly price charts in this method. A trade setting is anticipated to be held for a longer amount of time than with many other methods if it occurs on a monthly chart. To effectively maximize returns and take advantage of any market movement, a longer time horizon is required.

5.News, Social Media, Google Trends

Monitoring the crypto market situation might help users understand the full picture of asset status. Observing social channels gives you the benefit of getting the necessary information about market sentiment. Users can categorize the social media sentiment indicators for analyzing the various trends, insights, and news. Because of my personal experience and my research, I can claim that the Bitcoin dump and pump depended mostly on the crypto market’s status. The main indicators can be political, economic, or internal crypto cases. Moreover, it may be helpful to determine the expectations and future for Bitcoin by examining whether certain searches, such as “bullish on Bitcoin,” are trending higher or decreasing.

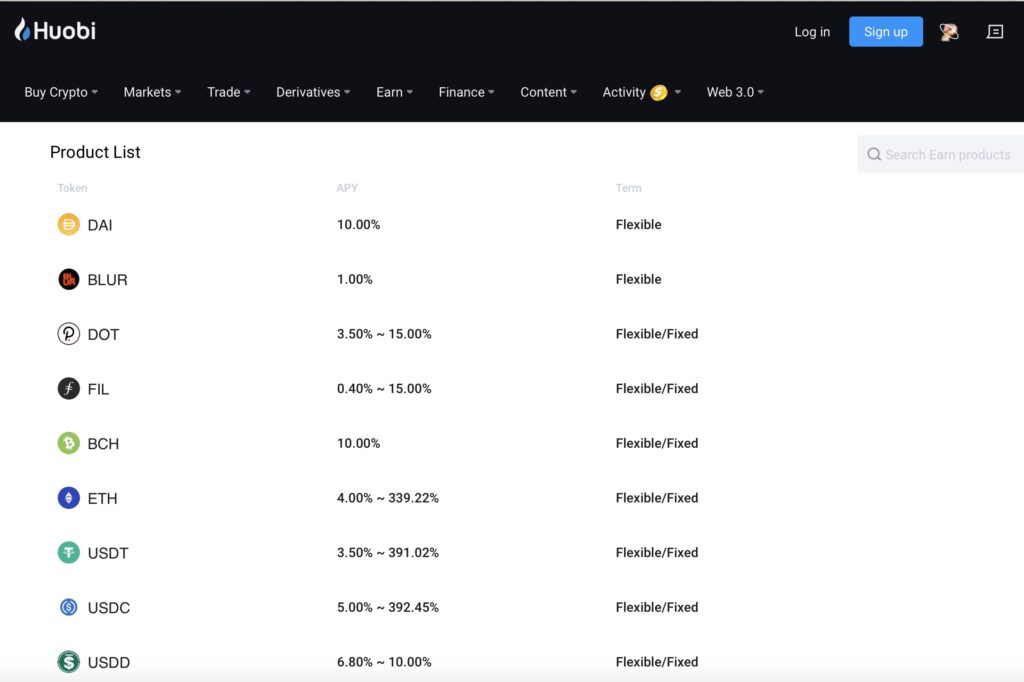

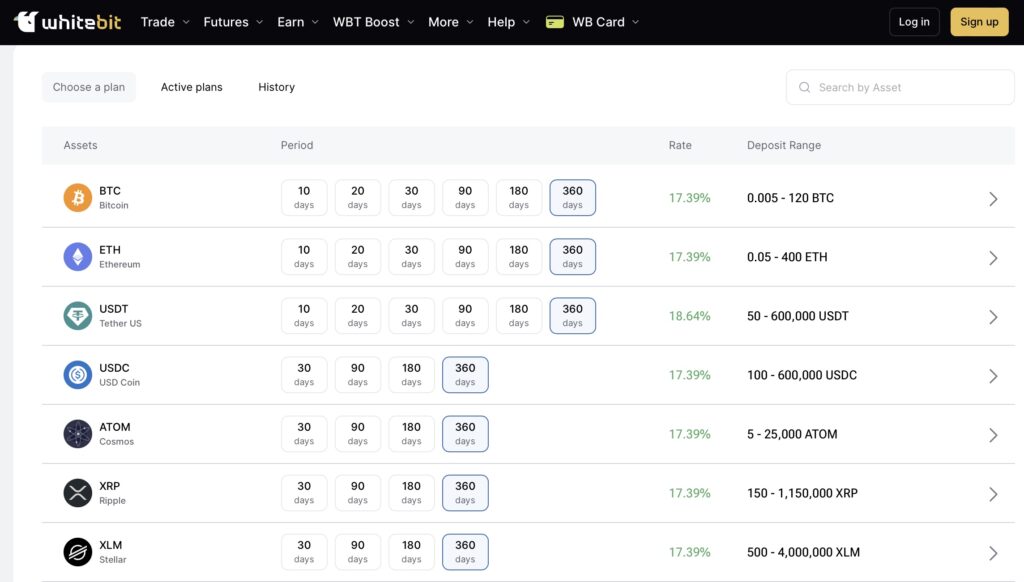

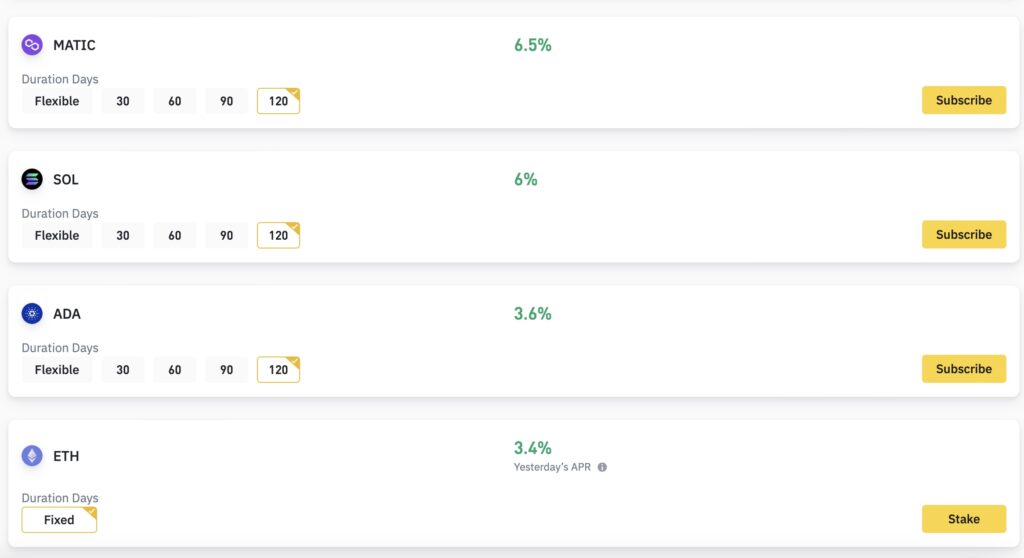

Crypto Staking

I guess that not only advanced users have already become acquainted with the opportunity for passive income in crypto. That can be a tip for continuing to invest in crypto and avoiding the risks. The option of staking becomes more and more useful and suitable for users who are afraid of losing their earnings on the high-volatility crypto market.

It offers numerous benefits:

- – Potential for high passive income

- – There are no operating or maintenance expenses

- – Investors have quick and easy access to their investments

- – Less risk than traditional trading

- – Reinforced protection and network engagement

- – Long-term strategy

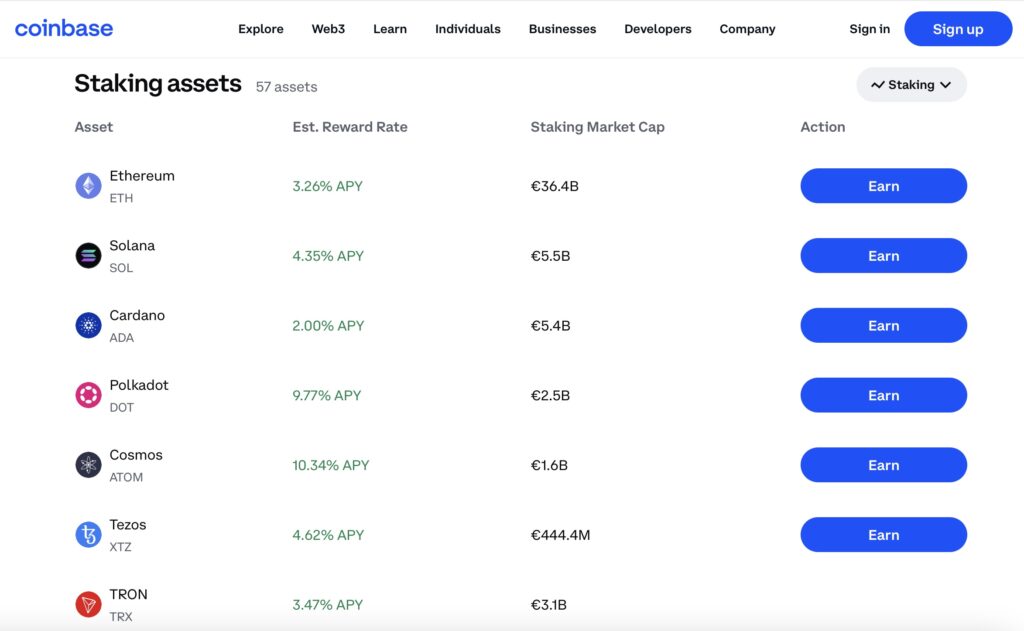

That’s why the leading crypto exchanges have, step by step, started to integrate into the new feature a potential option like crypto staking. It’s easily used on the Coinbase exchange, which is called “Coinbase Earn.”

At the same time, as with any financial tool, staking also has certain risks:

Project-Dependent: Your money through crypto staking will be at the mercy of the project’s strength and ability to attract more investors.

Diminishing Returns: Volatility means that you run the risk of receiving rewards that may be worth less than your initial investment.

Liquidity Risk: If you stake a micro-cap altcoin with little liquidity, it can be hard to sell or convert your staking rewards into bitcoin or stablecoins.

That’s why checking the security level of the exchange is one of the most essential parts of any investment. It is obviously important to verify the existence of AML checking and the number of assets in the cold storage of the exchange. If a platform has these two points, the level of security is automatically at a good level.

Conclusion

My dear beginners and advanced traders, no one has created the magic way to earn in crypto. But I wouldn’t say it’s never happened. Like people say, “Never say never”. This way, it’s possible to earn money on Bitcoin even in a bear market. But the most significant thing is to never stop doing research and to believe in profit. And obviously — to work hard for profit.