Global politics appear to be taking over center stage again, with the unexpected snap election called by French President Macron after his allies’ crushing defeat during the European elections over the past week. Significant poll gains by the country’s RN/National Rally (led by Le Pen) appear to suggest an outright majority for the far-right on June 30th, raising risks of an eventual ‘Frexit’ and dire warnings of a financial crisis from the current finance minister.

Global politics appear to be taking over center stage again, with the unexpected snap election called by French President Macron after his allies’ crushing defeat during the European elections over the past week. Significant poll gains by the country’s RN/National Rally (led by Le Pen) appear to suggest an outright majority for the far-right on June 30th, raising risks of an eventual ‘Frexit’ and dire warnings of a financial crisis from the current finance minister.

The National Rally party’s gains marks a turbulent period in European politics where far right parties have been making substantial gains against mainstream incumbents on rising tensions over immigration policies and rising costs of living. In a historical year for democratic elections, where over 70 countries across the globe are holding federal elections, right-wing politicians have been gaining votes across Germany, France, the Netherlands, Spain, Italy, Argentina, and others. Will this be a preview for a further pivot towards nationalist issues in the upcoming US elections? It certainly looks that way.

The National Rally party’s gains marks a turbulent period in European politics where far right parties have been making substantial gains against mainstream incumbents on rising tensions over immigration policies and rising costs of living. In a historical year for democratic elections, where over 70 countries across the globe are holding federal elections, right-wing politicians have been gaining votes across Germany, France, the Netherlands, Spain, Italy, Argentina, and others. Will this be a preview for a further pivot towards nationalist issues in the upcoming US elections? It certainly looks that way.

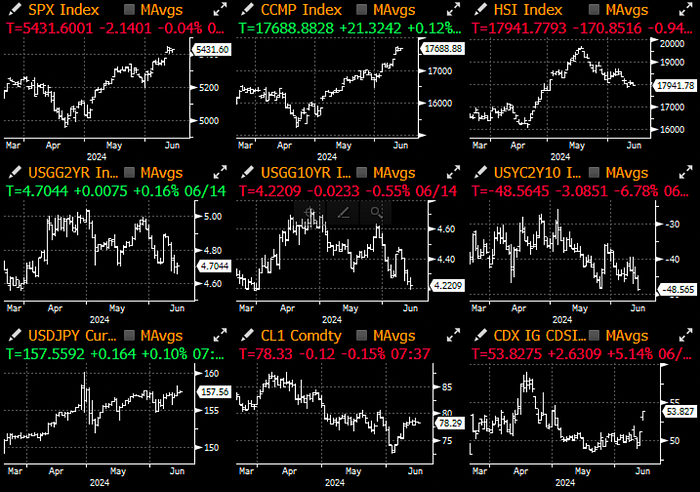

Market sentiment soured right from the get go, first with French equities and bonds in the morning, then quickly spilling over to credit markets as US 5yr IG CDS spreads saw a 2.5 -sigma+ widening on short-notice. Liquidity was reportedly poor across the board, with one-way de-risking flows coming out of Europe against historically expensive levels in US credit.

Market sentiment soured right from the get go, first with French equities and bonds in the morning, then quickly spilling over to credit markets as US 5yr IG CDS spreads saw a 2.5 -sigma+ widening on short-notice. Liquidity was reportedly poor across the board, with one-way de-risking flows coming out of Europe against historically expensive levels in US credit.

Other macro US assets held up for the most part, with SPX and Nasdaq hovering near YTD highs thanks to AI optimism, and the (admittedly) tired-story of thinning leadership breadth continues to stick out like a sore-thumb. Said in another way, there are AI stocks, and then there is everyone else.

Other macro US assets held up for the most part, with SPX and Nasdaq hovering near YTD highs thanks to AI optimism, and the (admittedly) tired-story of thinning leadership breadth continues to stick out like a sore-thumb. Said in another way, there are AI stocks, and then there is everyone else.

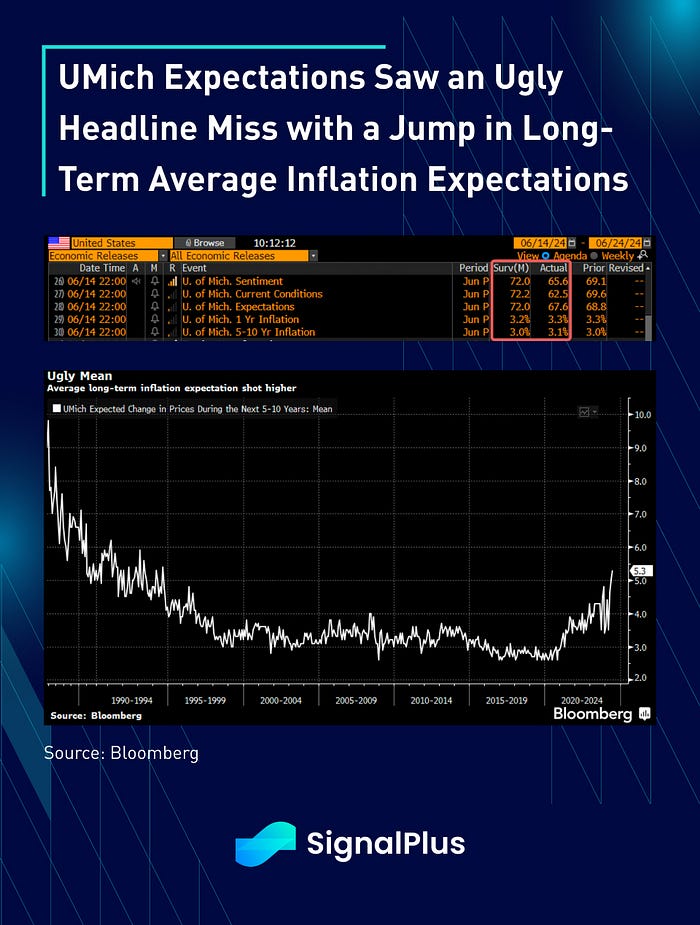

Economic data certainly didn’t help on Friday either, with an ugly UMich sentiment survey which saw a large headline miss of 65.6 vs expectations of 72, the lowest print since November. Furthermore, the inflation expectations component also moved in the wrong direction with the key 5–10 year median stuck at 3.3%, and the average long-term expectations rocketing up to 5.3% for the highest print since 1994. Yikes!

Economic data certainly didn’t help on Friday either, with an ugly UMich sentiment survey which saw a large headline miss of 65.6 vs expectations of 72, the lowest print since November. Furthermore, the inflation expectations component also moved in the wrong direction with the key 5–10 year median stuck at 3.3%, and the average long-term expectations rocketing up to 5.3% for the highest print since 1994. Yikes!

Crypto prices were weak last week as sentiment remains in the doldrums with no catalyst, with the last 2 weeks seeing a string of long-future liquidations in a slow-bleed. Quarterly performance was also weak with a -5% performance versus widespread gains in global equities, commodities, and even gold, with a concerning drop in new Bitcoin addresses being registered YTD. This is consistent with our long-thesis that the current rally is different than previous cycles, as it is driven primarily by TradFi interests over a handful of tokens — or just BTC really. Meanwhile, crypto-native influence is shrinking as many ‘pedestrians’ have moved onto the next hottest thing (AI), and the remaining builders are largely focused on improving blockchain and capital market efficiencies, a still noble but much longer-term project than crypto’s usual ‘get-rich-now’ schemes. Who says crypto can’t grow-up after all?

Crypto prices were weak last week as sentiment remains in the doldrums with no catalyst, with the last 2 weeks seeing a string of long-future liquidations in a slow-bleed. Quarterly performance was also weak with a -5% performance versus widespread gains in global equities, commodities, and even gold, with a concerning drop in new Bitcoin addresses being registered YTD. This is consistent with our long-thesis that the current rally is different than previous cycles, as it is driven primarily by TradFi interests over a handful of tokens — or just BTC really. Meanwhile, crypto-native influence is shrinking as many ‘pedestrians’ have moved onto the next hottest thing (AI), and the remaining builders are largely focused on improving blockchain and capital market efficiencies, a still noble but much longer-term project than crypto’s usual ‘get-rich-now’ schemes. Who says crypto can’t grow-up after all?