by Kevin Owocki, founder of Supermodular and Bankless contributor

We grade crypto’s global impact to find where it can do better.

It’s no secret that the bad parts of web3 have been very loud this year.

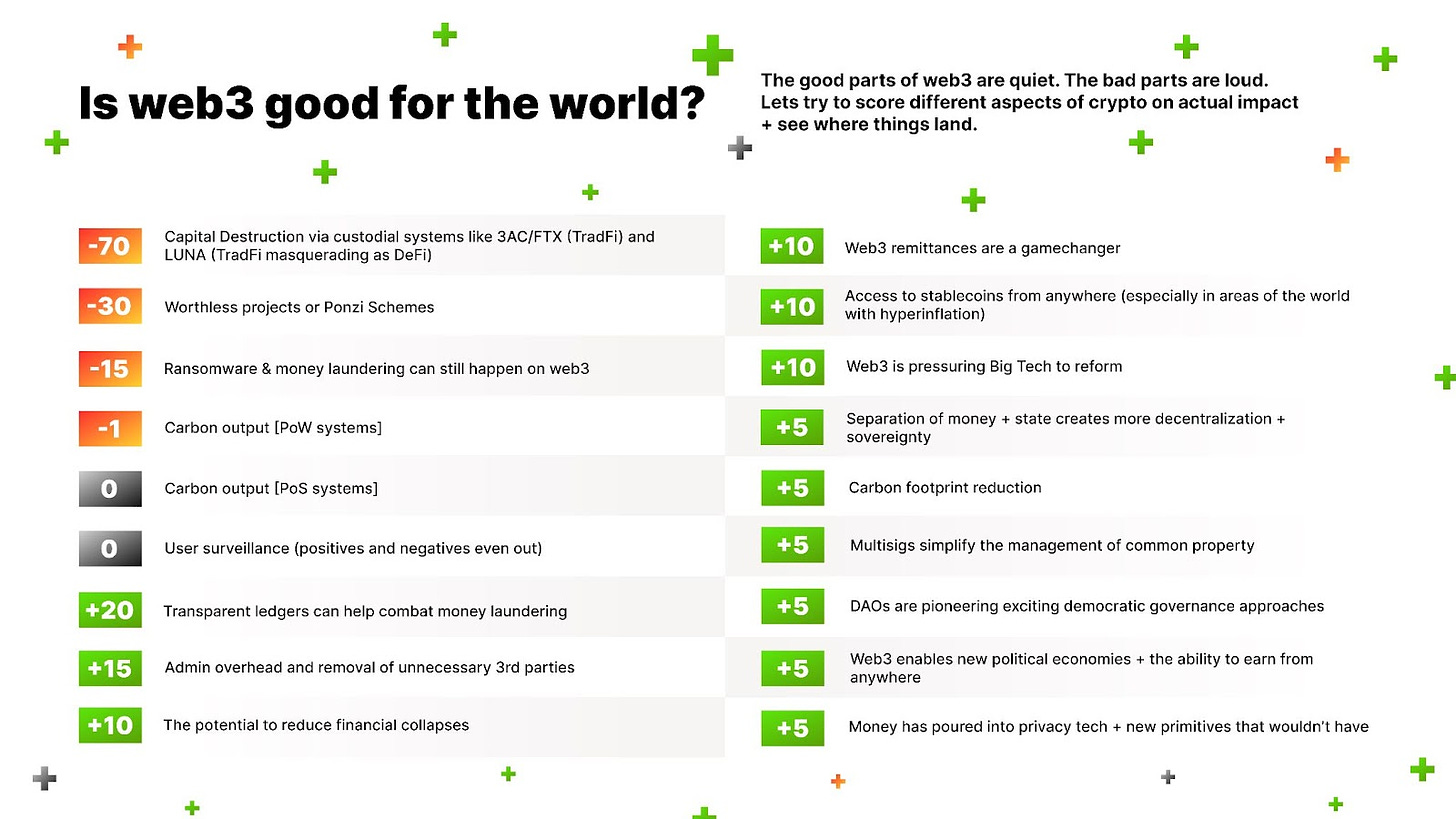

Reflecting on the current post-FTX climate, I thought it would be helpful to catalog and weigh the positive and negative social impacts of the web3 space.

One challenge in doing so is that the good parts of web3 are quiet. The bad parts are impossible to avoid. It’s natural for the space’s shortcomings and disappointments to suck up most of the attention + oxygen in the news (and our minds). This negativity bias is the human brain’s tendency to place more psychological focus or importance on the negative, even when the amount of positive things outweigh the bad.

In this piece, I attempt to take a sober, neutral, and rational approach to scoring whether web3 is good or bad for the world.

The above scorecard is certainly not the be-all, end-all. These are my own weights and opinions. I invite you to create your own scorecard, if you wish, by forking this visual in Figma. Share your thoughts in the comments below!

Let’s start by taking a look at the Negative Impacts on the world, which I’ve attempted to grade on a relative rating scale:

Capital destruction via custodial systems like 3AC/FTX/LUNA

My score: -70

The most negative thing we’ve seen in web3 this year is the capital destruction & damage to investors that’s happened when firms like 3AC or FTX collapsed. If you are a retail investor who had money in TradFi crypto firms like BlockFi, FTX, or Voyager then you lost money this cycle and that’s really bad.

The meme of “not your keys, not your coins” means that people should have self-custody of their coins, because if they let other entities custody their money and borrow on behalf of it, they risk losing their funds. My hope is that more people start using DeFi and self-custodying their projects, which makes the system less fragile in the future.

Worthless projects or Ponzi schemes

My score: -30

Worthless projects and Ponzi schemes that are built on top of web3 are bad because they sell the promise of crypto, but don’t actually deliver any utility or value. These “rug pulls” often only pay off for their founders and make the whole space look bad.

What the ecosystem really needs is to build a decentralized immune system against bad actors. Don’t give them any oxygen, if they get oxygen on their own, then call them out, and generally make sure they can’t prey on people.

Ransomware & money laundering

My score: -15

While the transparency of distributed ledgers can enable law enforcement to track funds in web3, computer security needs to be improved and engineered from first principles for us to build an immune system against the ransomware problem. Until we can build those immunity tools, criminal actions in web3 will be negative for the world.

Carbon output [PoW systems]

My score: -1

The negative carbon impact of blockchains has been a central argument against their mass use and adoption. With The Merge, Ethereum recently moved from Proof of Work to Proof of Stake, massively reducing the carbon output of the Ethereum ecosystem by ~99.95%. So, this is not really a valid criticism of Ethereum.

Bitcoiners have many complicated & unproven arguments about how Bitcoin incentivizes renewable energy and allows us to spend energy in remote places that otherwise would go to waste. In my opinion, the facts don’t bear this out and it seems like an attempt to rationalize Bitcoin’s PoW energy system.

In my mind, Ethereum’s successful Merge proves that PoS is the future and that with their near zero carbon output PoS systems impact can be almost net-neutral.

Next, let’s dig into some Net-Neutral Impacts on the world:

Carbon output [PoS Systems]

My score: 0

Because they require so much less energy to operate, Proof of Stake systems enable web3 to have an almost neutral carbon impact. Moving from negative to neutral is a laudable positive achievement for the web3 space and impactful for the world.

User surveillance

My score: 0

Because blockchains are transparent and incorruptible, user surveillance is easier. This leans negative due to privacy concerns but is also positive because it makes it easier for law enforcement to keep an eye on where money is going. The positives and negatives even out.

Lastly, let’s unpack some Positive Impacts that web3 brings the world:

Transparent ledgers can help combat money laundering

My score: +20

Transparent ledgers allow traceable money trails to combat money laundering. Transparent ledgers make it much easier for law enforcement to do their jobs when it comes to “following the money” in dark enterprises. Web3 can be positive for humanity in this area.

Removal of unnecessary third parties

My score: +15

The old financial system has all these intermediaries that extract value at different parts of the system. If we can remove those third parties and by employing protocol based smart contracts, we could have a race to the bottom to the most efficient way of transferring value around the web. Removing unnecessary third parties would simplify the system and make things cheaper.

Potential to reduce financial collapses

My score: +10

This is a big argument for DeFi. If you have a financial system running on transparent smart contracts, then you can track assets and risks. You can get ahead of a contagion event before it happens and spreads. With transparent web3 systems, we can avoid the types of financial collapses that occurred in the 2008 banking and financial crisis.

Web3 remittances are a game changer

My score: +10

Before web3, if you were an immigrant who wanted to send money back to your family in your home country, your only options were to pay Western Union (for example) 10% of your money to facilitate the transfer. The fact that you can use Ethereum and Bitcoin for remittances completely changes the game by letting people keep more of their money while enabling quick transfers.

Access to stablecoins (especially in areas with hyperinflation)

My score: +10

Access to stablecoins from anywhere, especially in parts of the world with hyperinflation can be life-changing for millions of people in terms of wealth stability and secure savings.

Web3 competition pressuring Big Tech to reform

My score: +10

Because of innovation in the web3 space, pressure is being put on Big Tech to reform. Web3 developers are building decentralized versions of Amazon Web Services, decentralized search engines, and decentralized social networks.

There are now web3 projects that are getting off the ground that can compete with the network effects Big Tech companies have. This competitive pressure on Big Tech coming from web3 is a really big game changer for everyone. For instance, with Lens Protocol I can start a new web3 social network. I can use Lens Protocol’s social graph which means I don’t have to start my own social graph from scratch to compete with Facebook. We can all do it together as an industry.

Separation of money + state creates more decentralization + sovereignty

My score: +5

The separation of money and state creates more decentralization and sovereignty, but it is also the responsibility of end users to self-custody their assets (back to “not your keys, not your coins”).

If you live in a part of the world where there is hyperinflation – Argentina for example – the separation of money and state means that you can now have access to US dollars or a more stable currency, meaning you won’t see your savings erode as much. For people in developing nations this is a really big deal.

Also, there are parts of the world where there can be civil asset forfeitures of your property without due process. It is a lot easier to hide or protect crypto assets. You can even memorize a private key or seed phrase in your head and not have to hide it from the state.

Carbon footprint reduction

My score: +5

The Merge, carbon credit markets, and numerous DAOs are working to reduce humanity’s carbon footprint. These are all positives for the world and for human thriving.

Multisigs simplify the management of common property

My score: +5

Multisigs are an easier way of managing common property than the complex legal mechanisms that existed before. The ability to set up a smart contract wallet where multiple members of a group can sign off on a transaction and broadcast it to a transparent ledger makes common property management much easier. Multisigs allow us to manage common property more easily and from places all over the globe.

DAOs are pioneering exciting democratic governance approaches

My score: +5

The creation of DAOs and their democratic governance structures allow for a lot of exciting new ideas that have a lot of untapped potential upside as they evolve. Look at GitcoinDAO. Look at quadratic funding. This collective intelligence poster is a great visual of the progress being made in this space.

Web3 enables new political economies + the ability to earn from anywhere

My score: +5

We can now program our values into our money. This opens up the conversational space around new political economies and creates opportunities for people to earn from anywhere.

You can earn on Gitcoin. You can earn with quadratic funding. You can earn on Mirror. Web3 has the potential to unleash the Internet of Jobs— a subject I’ve written about on Bankless before.

Money has poured into privacy tech + new primitives

My score: +5

Because of web3, money has poured into privacy tech and new financial primitives that are accessible to anyone. Ex: Self-Repaying Loans. Since blockchain based systems are built on open source software that emphasizes privacy tech and cryptography, privacy tech and new financial primitives get more funding.

Hopefully, more public goods get funded because we’re now able to use market-based approaches for building better collective intelligence and better common resource allocation.

It’s all up to us.

Whether or not web3 is ultimately good for the world or not is up to us. The future is an unwritten story at this point.

The takeaway here is not whether or not web3 is overwhelmingly good for the world right now, but that web3 has the incredible potential to regenerate the world if we continue to build upon web3’s positive impact opportunities.

So, how can we rotate capital, attention, and talent away from the projects that have the best Ponzi-nomics and towards the projects that are going to have the most positive impacts on the world?

The great challenge ahead of us in the next market cycle is to continue building things that are pro-social and good for the world. We need to move the web3 space in a regenerative direction where the projects that are positive for the world get the capital, attention, and talent they need to make good on web3’s promise for humanity.

Here’s my challenge to you — read my Green Pill book. Build an ImpactDAO. Get involved in the regen web3 movement and help make it actually happen.

If we don’t do this, then it won’t happen. If we do “do this”, then it will happen.

Let’s make it happen.