The Last Puzzle Piece for Ethereum Staking: Shanghai Fork in March 2023

Various Staking Methods

Staking Pool Protocols

Investment Ideas for Staking Protocol Tokens

Risk #1. Impact of Withdrawal Feature on Staking Ratio

Risk #2. Competition between Individual Staking Protocols

Conclusion: The Ethereum Staking System is Complete

Links

Disclaimer

by Trinito (Written by SungPil Huh (Head of Investment at Trinito) and contributions from Jiyon Kim (Associate at Trinito).)

The Last Puzzle Piece for Ethereum Staking: Shanghai Fork in March 2023

The Shanghai Fork, a nickname for Ethereum upgrade EIP-4895, is fast approaching, with its expected date set for March 2023. The exact date of the upgrade remains uncertain, as Ethereum has postponed its major upgrades several times in the past. Nevertheless, progress is being made, as the test network with its withdrawal functionality has already begun operation in February. The essence of this fork is the addition of the “withdrawal feature” to staked ETH.

The consensus algorithm of the Ethereum network has undergone a complete transition from the Proof of Work to Proof of Stake through multiple upgrades. In Ethereum’s Proof of Stake, validators who verify the validity of the transactions recorded on the network must stake a certain amount of ETH as collateral before performing their attestation tasks. If the verification is performed correctly, the validators receive additional ETH as a reward, and if not, the staked ETH is lost through “slashing.” Throughout this process, it has not yet been possible to retrieve the ETH that has been staked, but with the upcoming Shanghai Fork, this is expected to change.

Various Staking Methods

There are four main ways to stake ETH from a user’s perspective: solo staking, Staking-as-a-Service, staking pool protocols, and centralized exchange services. Solo staking is the most difficult, as it requires setting up a computer and collecting a minimum of 32 ETH, but it is also the most profitable as there are no intermediary costs like fees. Centralized exchange services are the most convenient but may have a negative impact on the decentralization of the Ethereum network if too many staked ETH is delegated to the exchange, and there may also be fees reducing the user’s profitability. Staking-as-a-Service or staking pool protocols are alternatives to consider for those who don’t want to use a centralized exchange service, but also don’t want to set up their own staking environment or collect 32 ETH. Most staking pool protocols also have their own unique tokens that one may consider investing in.

Staking Pool Protocols

Most staking protocols issue derivative tokens (e.g. stETH) that can be freely traded when ETH is staked, thus the name Liquid Staking Protocols (LSD). Notable staking pool protocols include Lido Finance, Rocket Pool, StakeWise, Frax, and Ankr. Lido Finance is the market leader, with a market share of around 30% of the total Ethereum staking market. In the staking protocol market, its market share exceeds 85%, and increasingly consolidating the first mover advantage of in the staking protocols market such as Uniswap in AMM or Curve in lending protocol. Rocket Pool is a protocol that started early in 2017 and attracted investment from ConsenSys Ventures. Other services include StakeWise, Frax, and Ankr, which provide staking services for a variety of PoS tokens, but with slightly different emphasis for each service. However, their market share in the Ethereum market is minimal, around 1%.

Comparing the metrics of staking protocols in the table above, it can be seen that while Lido Finance holds a high market share, most staking protocols offer a return of 4% or less. A noteworthy metric is the TVL/MC ratio, calculated by dividing the TVL (Total Value Locked, amount of ETH locked) by the market capitalization of the protocol token. Representing the amount of ETH locked per dollar of the protocol token market capitalization, a higher ratio indicates a relatively lower valuation.

Comparing Lido Finance and Rocket Pool, despite Lido Finance holding a leading position in the market, it is roughly four times cheaper than Rocket Pool on a TVL/MC basis. This is a phenomenon that is contrary to the common market environment where premium is added to the value evaluation of leading companies with high market share and monopolistic positions. The market is giving a much higher score to Rocket Pool, which has the potential to erode the market share of larger players as the overall Ethereum staking market expands, rather than Lido Finance, which can only grow as the market expands and has high market share. The higher growth potential of players with low market share comes with the risk of not being able to successfully invade the market, and considering that the environment is rapidly changing, the value evaluation standards are not widely known, and there is a large emotional fluctuation in the volatile crypto market, the market is being formed with more weight given to the faster growth potential than the risk of protocol failure.

Smaller protocols like Frax and Ankr have lower TVL/MC ratios, but their services involve not only Ethereum staking but also other token staking and stablecoins, so one may be cautious to compare them with Lido Finance and Rocket Pool.

Investment Ideas for Staking Protocol Tokens

The imminent Shanghai Fork has given rise to various investment opportunities, including staking and investing in Ethereum. This article will examine the staking protocol tokens from an investor’s perspective. Staking protocol tokens can be considered a high-beta play in the Ethereum ecosystem, offering higher volatility and risk compared to ETH investment. The staking protocol token is poised to become a key infrastructure component within the Ethereum ecosystem and its growth is expected to result in higher volatility compared to ETH. The higher volatility means the potential for greater upsides but also heightened risks. The two notable risks are as below.

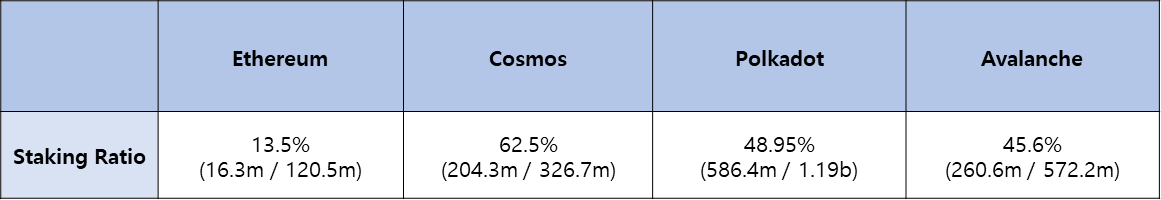

Risk #1. Impact of Withdrawal Feature on Staking Ratio

The impact of the withdrawal feature on staking participation rates after the Shanghai fork should be considered. A higher staking rate could result in increased market size for the staking pool protocols and, in turn, for the token prices. Currently, the Ethereum staking participation rate stands at around 14%. Compared to other protocols with stabilized staking systems, this figure is still low. There appears to be no compelling reason to believe that the staking ratio in the Ethereum ecosystem will remain low. On the other hand, there are concerns that the addition of the withdrawal feature could result in a flood of existing staking supplies into the market. While short-term concerns over increased circulating supply may place downward pressure on both ETH and staking protocol token prices, there is a higher likelihood that this presents a positive investment opportunity in the long-term.

Risk #2. Competition between Individual Staking Protocols

The prominence of Lido Finance as a leader in the staking protocol market is evident. However, there is no guarantee that such market orders will remain unchanged in the fast crypto market. Challenges such as centralized exchanges offering services with high accessibility to general users, or smaller competitors seeking to capture the market with new solutions and marketing strategies, may pose additional risks for individual protocols, even if the overall Ethereum staking market grows as expected. While not perfect, one way to mitigate these risks is to acquire a basket of staking protocol tokens based on market capitalization or Total Value Locked.

Conclusion: The Ethereum Staking System is Complete

The Shanghai Fork marks a milestone event in the completion of the Ethereum Staking system. With the addition of the withdrawal feature, the staking cycle is complete and this will lead to increased attention toward various staking methods and services. The completion of the Ethereum Staking system holds significance from various perspectives, including solving energy concerns, discovering crypto risk-free interest rates, and computer engineering and game theoretic initiatives.

The Ethereum Staking system represents a major shift in crypto and also a great investment opportunity as the largest smart contract platform introduces a proof of stake. The staking protocol tokens are assets at the center of this change and are expected to be an intriguing investment target.

Link

https://ethereum.org/en/staking/

https://pro.nansen.ai/eth2-deposit-contract

https://www.coindesk.com/tech/2023/01/12/number-of-staked-eth-passes-16m/

https://www.stakingrewards.com/earn/ethereum-2-0/metrics/

Disclaimer

This is not investment advice and is for informational purposes only. You should not construe any such information or other materials as legal, tax, investment, financial, or other advice.