Major Marketplaces See Active Users Plummet.

Perhaps it was the end of tax season. Or a touch of regulatory fatigue after all the recent saber-rattling from the SEC.

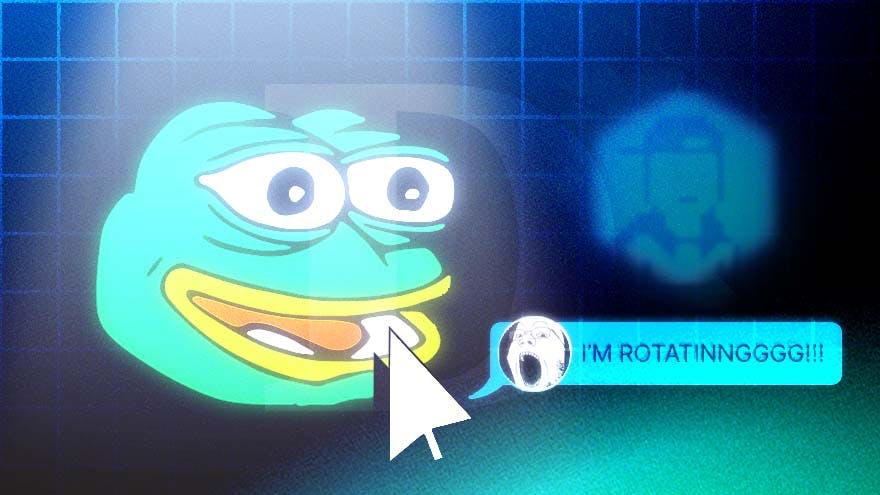

Whatever the cause, the PEPE token launched last Friday kicked off a memecoin fever reminiscent of the dog coin mania of early 2021. Ethereum gas prices spiked this week as speculators rush to find the next PEPE, routinely spending $30 or more on simple token swaps.

Meanwhile, there’s been no dearth of memecoin launches on Arbitrum, currently the hottest Layer 2 network after its billion-dollar airdrop last month. AIDOGE ran to a market capitalization of over $50M on Apr. 19, spurring a wave of copycats.

At the same time that the memecoin rally picked up, the number of NFT traders dropped off, with marketplaces like OpenSea and Blur losing over half their active users this week, according to Dune Analytics.

Could it be that NFT holders craving for an adrenaline rush that JPEGs just aren’t delivering in this market, are turning to memecoins? Some say yes.

Meanwhile, Uniswap’s daily user count is hitting levels last seen in 2021.

As an active collector and member of various NFT discords, I’ve witnessed the shift firsthand. There’s been a lack of interest in new NFT mints, and most ‘alpha’ channels are now dedicated to scouring the mempool for the latest memecoin.

“There were quite a few people in here yesterday learning how to set slippage manually on Uniswap – so definitely a lot of newcomers to memecoins,” Ramosaurus, a core team member at UDO, an invite-only Discord group, told The Defiant.

“Been trading NFTs for a couple of years, got into memecoins ‘cause I’m just trying my luck and saw another member made, like, insane profits,” said Not Easy, a UDO member.

The scene is similar in Admit One, a holders-only Discord run by NFT influencer Gmoney, with members asking whether anyone had alpha on “100000x shitcoins.”

But while NFT traders are no strangers to volatility, memecoins are proving to be a wild ride even for seasoned JPEG traders.