A significant evolution in the realm of digital assets investment is the anticipated introduction of spot Exchange-Traded Funds (ETFs). The arrival of spot ETFs could substantially simplify investment in digital assets, broadening the scope of investment products on offer, particularly for American investors. Currently, investment options are predominantly futures-based. These instruments carry inherent intricacies, including fixed expiration dates and an established term structure, which can inadvertently impose unanticipated costs on investors. Alternatively, investments may be managed through a trust, as exemplified by Grayscale’s offerings, which have some quirks of their own.

In this edition of the State of the Network, we delve deeper into Grayscale’s digital asset trusts, comparing their operation to that of a potential spot ETF. Moreover, we discuss recent market trends ignited by the buzz around the imminent possibility of spot ETFs finally receiving approval from the SEC.

A Trust Product for Trustless Assets

The desire for exchange-traded products within the digital assets domain has been steadily growing among investors for various reasons. A critical one centers on the differentiation between tax-advantaged accounts and self-custody of assets. The process of self-custody, while granting complete control over the assets, involves significant complexity and requires extensive technical knowledge to ensure safe and successful implementation. Additionally, investments made in this fashion are subjected to substantial tax obligations, proportional to capital gains tax and income tax, where applicable.

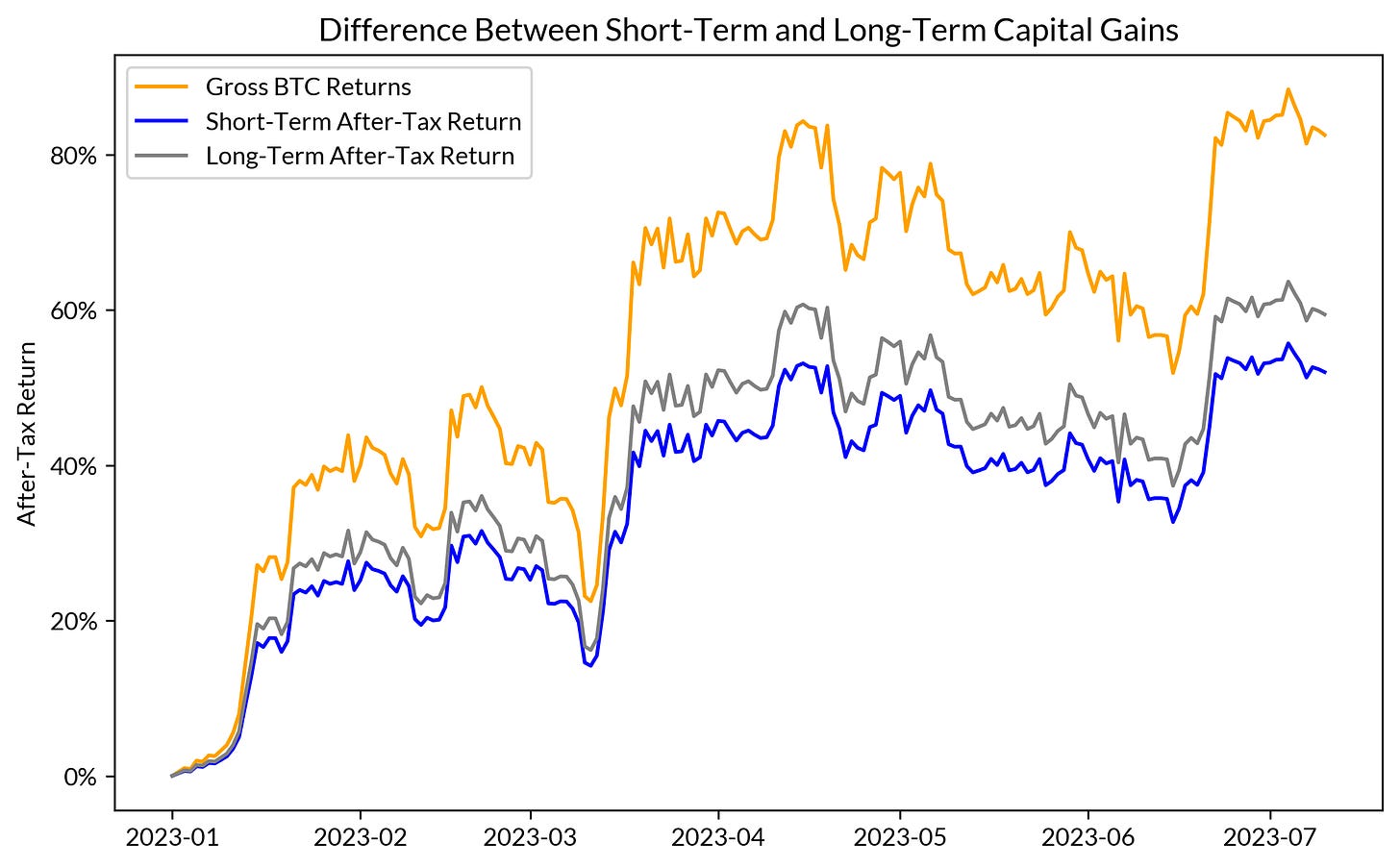

Currently, key tax-advantaged accounts accessible to a majority of investors, including Individual Retirement Accounts (IRAs), 401(k) plans, and Health Savings Accounts (HSAs), don’t allow direct investments in digital assets, with notable exceptions including Fidelity, public mining companies and, arguably, Microstrategy. This restriction inhibits the ability to defer or offset taxes associated with digital asset investments, a considerable disadvantage for investors. Even for those investors who opt for self-custody, these vehicles remain significant, since the potential to lessen capital gains tax payments, even slightly, can noticeably impact the overall performance of an investment (especially when the short-term capital gains tax rate applies, as seen below).

Note: Assumes 28% and 37% for the long-term and short-term tax rate respectively, considering the maximum short-term rate that applies within the U.S.

We can go even further and consider the fact that, for most people today, self-custody is simply not a feasible option, either due to a lack of technical knowhow or because regulatory or legal restrictions interfere with such ownership, especially for corporate entities. Given these obstacles, exchange-traded products are not just convenient alternatives but essential elements in the digital assets investment landscape. They fill a similar role to that in other asset classes, where self-custody might be possible but not practical, as is the case with precious metals.

However, it’s crucial to understand that not all exchange-traded products are created equal. Each has unique characteristics that could impact an investor’s portfolio differently. In this context, we turn our attention to Grayscale’s array of products. We aim to delve into the specific attributes of their offerings to better grasp their nuances. By doing so, we can gain a clearer understanding of why the potential introduction of spot ETFs is creating such a significant stir in the market.

The Grayscale Trust Products

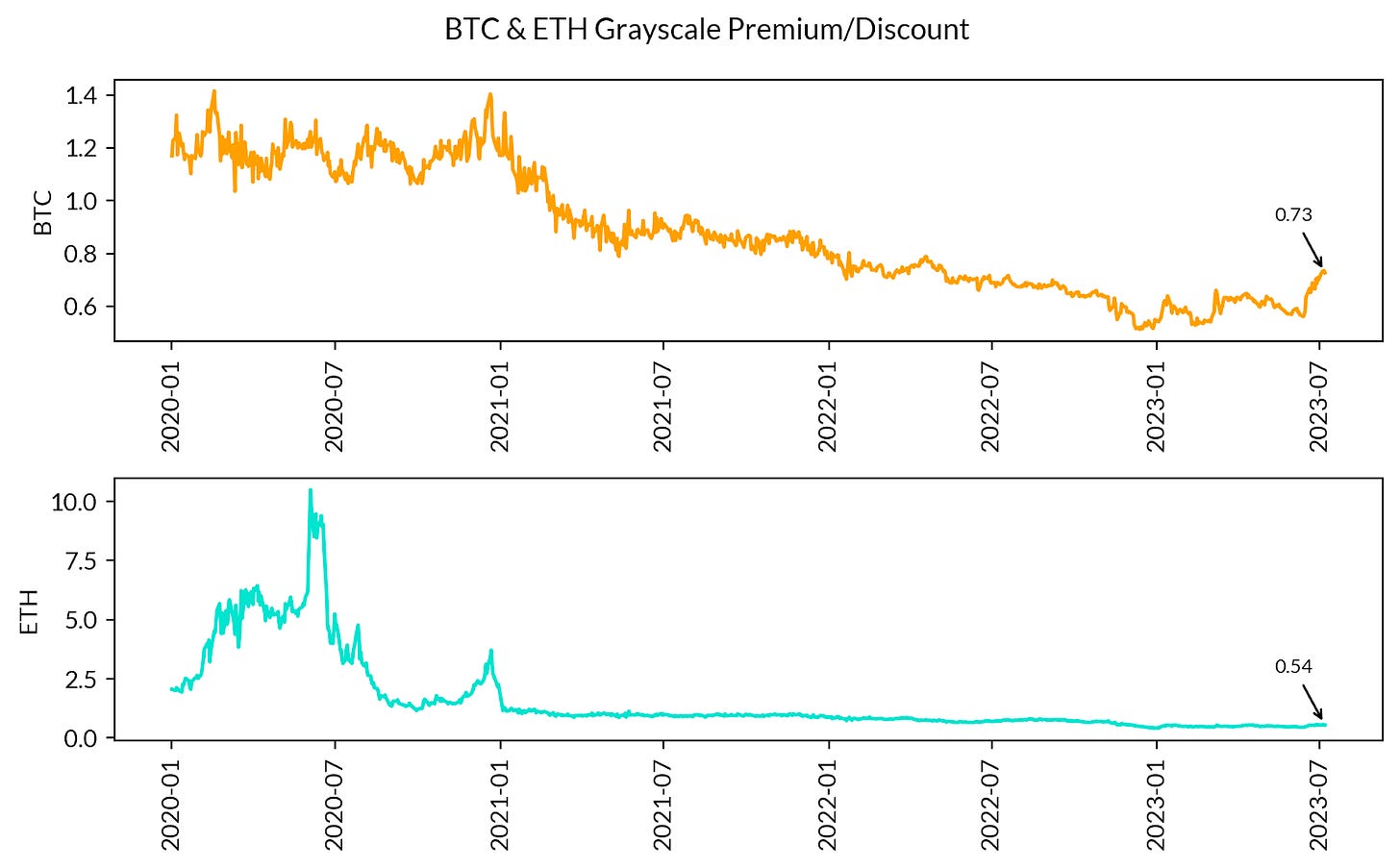

Grayscale provides an array of investment products that give exposure to individual digital assets (like BTC, ETH, and others) or to various indexes tracking a portfolio of multiple assets. What all of Grayscale’s products have in common is they are structured as a trust, which means that the value of the shares is allowed to float with respect to the value of the underlying asset portfolio. Throughout its history, Grayscale’s Bitcoin Trust (GBTC) has seen the share value surpass the value of the underlying Bitcoin during the peak periods of the 2020-2021 bull run. At other times, shares have traded below the value of the underlying Bitcoin, even as low as 50% of its value. These variations are typically referred to as premiums and discounts.

Source: Coin Metrics Institution Metrics

These trust product dynamics are consequential for two primary reasons. Firstly, as an investor, you are obligated to purchase shares at the current market price. This implies that you may acquire exposure to Bitcoin at a discount or a premium—based on the market conditions at the time—potentially altering the risk profile of your investment, and especially compared to spot investments which have no annual management fee. The second reason this is noteworthy is that sophisticated investors are capable of profiting off mispriced assets through trading strategies known as arbitrage. Thus, when GBTC was trading at a premium over bitcoin, a risk free trade was possible by selling or shorting GBTC while simultaneously buying bitcoin in spot or futures markets. Investors could then profit from the price convergence of these two positions, theoretically with minimal risk.

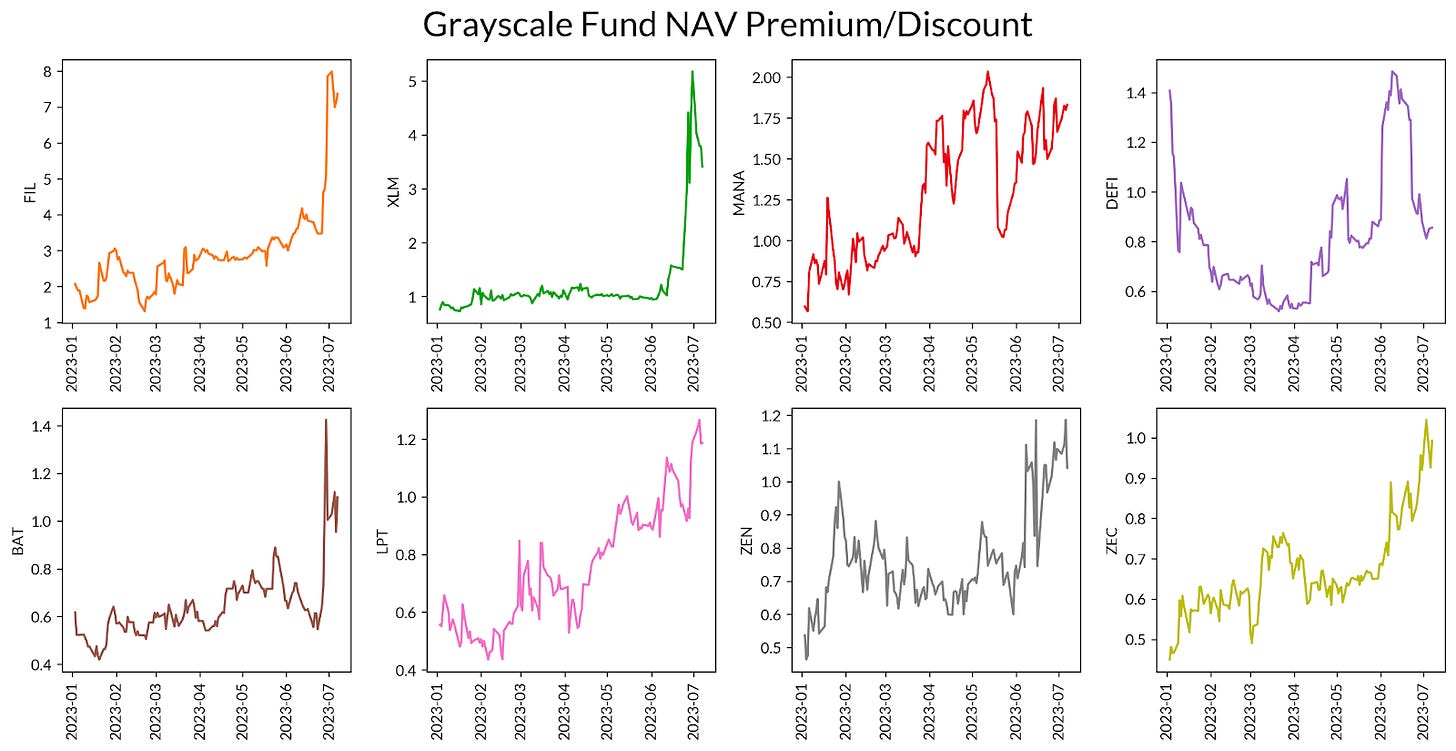

Source: Coin Metrics Institution Metrics

If we take a look at the chart above, we can see that the various trusts set up for different assets have developed very differently. While ETH hovers around 50% discount, BTC, BCH, LTC,and ETC have trended closer towards parity, with LINK actually exceeding it, trading at a 270% premium over parity. This trend is possibly caused by investors that realize that, with recent news that Blackrock has filed to create a spot bitcoin ETF, since the price would match parity if Greyscale also got approval to convert these funds into ETFs. While we might think this sounds far-fetched (because it implies people are paying nearly three times the spot price), this can be quite common for investment vehicles that are particularly illiquid, especially when speculative fund flows predominate. We can see this same behavior over the other trusts offered by Grayscale, as seen below.

Source: Coin Metrics Institution Metrics

Filecoin (FIL) and Stellar (XLM) are seen trading at 8x and 4x the spot price, respectively. These price dislocations are significant and are a good indication that these funds are very illiquid and that there is limited access to these assets within the U.S. since arbitrageurs could easily crush the premium while making a profit. It is, however, indicative that some people are willing to get access to these assets at a huge premium, an observation that will be interesting to consider as we keep track of these developments.

Conclusion

In conclusion, the evolution of the digital assets investment landscape, especially with the anticipated introduction of spot ETFs, promises to bring transformative change. Currently, options such as futures and trust-based investments, like those offered by Grayscale, come with their unique set of challenges. The potential introduction of spot ETFs, however, could simplify these complexities, presenting a more efficient and straightforward way for investors to gain exposure to digital assets. As we continue to navigate this fascinating digital investment landscape, the adaptability and innovation demonstrated by investors, coupled with regulatory advancements, will undeniably play a pivotal role in shaping the future of digital asset investments.