by Russian DeFi

Say Hello to Highly Liquid Markets for Traders, LPs, Treasuries & Devs

Where Does Maverick Come In?

As the DeFi industry grows at a breakneck pace, outdated protocol models are holding users back.

This has created a market opportunity for protocol models like the Maverick Protocol to develop solution-based mechanisms to provide users greater access to liquidity assets.

Users can lower their risk with Maverick Protocol by staking any ERC-20-supported token as collateral while the company works to improve its machine learning and business team.

Maverick offers greater access to liquidity assets

A Short History of AMMs

In Vitalik Buterin’s words, AMMs are “fully automated on-chain mechanisms that act as always-available counterparties for people who want to trade one type of token for another.”

AMMs manage deposits of assets provided by liquidity providers, which the AMM makes available to traders participating in peer-to-contract trades.

DeFi is primarily based on AMMs. AMMs replace traditional intermediaries such as centralized order books and market makers to enable permissionless blockchain trading.

An AMM powered by Maverick’s Automated Liquidity Placement – ALP mechanism is similar to Uniswap V3, but with one key difference: ALP natively automates the dynamic rebalancing of concentrated liquidity to achieve the best of both worlds—lower slippage than non-concentrated models but lower IL than other concentrated models.

The Best of Both Worlds !

What is Maverick?

Maverick Protocol provides a new decentralized finance infrastructure to facilitate the most liquid markets for traders, liquidity providers, DAO treasuries, and developers. It is powered by a revolutionary Automated Market Maker – AMM.

Maverick AMM helps users maximize capital efficiency by automating liquidity concentration as prices move.

More liquid markets result from increased capital efficiency, which means better prices for traders and higher fees for liquidity providers.

This built-in feature also assists LPs in avoiding the high gas fees associated with adjusting positions based on price.

Liquidity providers can now track an asset’s price in a single direction, effectively betting on the price trajectory of a specific token.

These directional bets are similar to single-sided liquidity strategies in that the liquidity provider will be exposed to a single asset in a given pool to a greater or lesser extent.

These technological advancements represent a paradigm shift in how smart contracts manage liquidity. Maverick is the first Dynamic Distribution AMM capable of automating liquidity strategies that required daily maintenance or the use of metaprotocols in the past.

The Maverick Team

The Maverick development team is made up of innovative cryptocurrency experts. They have created many unique cryptocurrency infrastructures, including a swap aggregator, Ethereum layer2, PoS public blockchain, DEX, decentralized storage networks, crypto lending, a crypto debit card, and quantitative digital asset investment.

The team’s members and advisors have worked for companies like Metamask, BitTorrent, Abra, TrueFi, Paxful, and LedgerPrime.

Maverick AMM Features

- Custom LP distributions – LPs no longer have to stake their liquidity in a uniform price range

- Low LP maintenance – Automatic concentrated liquidity fee compounding

- Increased capital efficiency –LPs can have the Maverick AMM smart contract automatically reposition their liquidity distribution to track the price so that their allocation is in range more often.

The Revolutionary Dynamic Distribution AMM That Enables Directional LPing

Maverick’s Dynamic Distribution AMM introduces the novel AMM concept of Directional LPing, which allows liquidity providers to better control their capital and offers massive improvements in capital efficiency. Maverick introduces LPing to a whole new class of market participants by allowing them to choose a direction and earn excess returns if they do so correctly.

Directional LPing with Maverick Staking Modes

The major innovation in Maverick is that LPs can instruct the AMM to move their liquidity as the AMM’s price changes. An LP can dramatically increase its capital efficiency and express directional price beliefs by moving liquidity.

An LP can stake one of four modes for each position they open in a pool. The mode choice determines how their bins and associated liquidity move concerning price. The modes are as follows:

- Mode Static – Bins do not move with price and are essentially the same as the existing range AMM LPing

- Mode Right – Bins move right as the price increases and do not move when the price decreases

- Mode Left – Bins move left as the price falls and does not move when the price increases

- Mode Both – Bins move with price in both directions

Pros and Cons of AMMs in DeFi

Pros

- The automated market maker model is a more efficient alternative to traditional order book exchanges, allowing users to trade digital assets without using intermediaries.

- Users can trade using AMM’s liquidity pools without the need for counterparties.

- Because AMMs are highly automated, users do not need to worry about manually managing their order books.

- Because the system costs are low, AMMs charge low fees to traders.

- AMMs provide more liquidity than traditional exchanges, which can benefit traders.

Cons

- Price slippage and impermanent loss can cause significant losses for traders when using AMMs.

- Because AMMs are typically limited to trading only a few assets, traders may require access to the full range of markets available on traditional exchanges.

- Because AMMs are automated, they can be exploited by malicious actors.

- AMMs can be complicated, and users may need assistance understanding their work.

- Because AMMs are still in their early stages, they may contain bugs or flaws in their code.

- AMMs are not always regulated, making users vulnerable to a hack or scams.

Problems That Maverick Protocol aims to Solve

1) Concentrated Liquidity Isn’t Always Capital Efficient

Although liquidity concentration was a game changer for capital efficiency, its implementation in current AMMs requires users to move their liquidity. As prices move out of concentration areas, this leads to misallocation and decreased efficiency.

Currently available concentrated liquidity AMMs enable LPs to focus their liquidity within a specific range. As long as the pool price stays within that range, their capital efficiency remains high, implying that their capital is being used, generating fees for them – more than they would earn in a constant product AMM, for example.

The issue arises when the pool price moves outside an LP’s price range. At this point, their capital efficiency is zero because their capital needs to be put to work in the AMM. If the LP wants to keep its capital efficient, it must move its liquidity to a new range, which costs time and gas fees.

The Maverick Solution:

Maverick AMM helps users maximize capital efficiency by automating liquidity reconcentration as prices move. LPs can choose from several liquidity-shifting modes that monitor prices and reconcentrate liquidity on their behalf.

More liquid markets result from increased capital efficiency, which means better prices for traders and higher fees for liquidity providers. This built-in feature also assists LPs in avoiding the high gas fees associated with adjusting positions around the price.

2) Current Native AMMs Are Built for a Sideways Market

With any existing AMM in the DeFi universe, an LP makes an implicit bet that the price of the pair of assets in their pool will move sideways, allowing them to collect trading fees without significantly shifting the ratio of their deposited assets. If that bet is incorrect, if the price moves in any direction other than sideways—the LP will incur a temporary loss that may exceed any fees collected.

This is a significant limitation in today’s AMM landscape, as many asset holders who want LP have a directional belief in their assets. If a user is bullish on ETH, for example, no existing LPing option allows them to make a simple bet that the price of ETH will rise and collect trading fees from that bet.

This needs to be improved in the tools available to LPs to prevent many users from entering the market, resulting in thin markets and poor pricing.

The Maverick Solution:

Liquidity providers can now track an asset’s price in a single direction, effectively betting on the price trajectory of a specific token. These directional bets are similar to single-sided liquidity strategies in that the liquidity provider will be exposed to a single asset in a given pool to a greater or lesser extent.

As the price moves in the desired direction, the AMM will reconcentrate liquidity to follow it and capture more fees. If an LP correctly predicts price direction, they can use this mode to enjoy re-concentrated liquidity around the price as it moves in their favor without incurring any temporary loss.

3) LPs Can’t Control Their Liquidity

Existing AMMs allow LPs to define a price range for their liquidity, which the AMM then distributes for them across that range. As a result, the LP’s liquidity is flat across the range, with no efficient way for them to arrange a different type of distribution.

Again, this restricts the options available to potential LPs, who might be more willing to commit capital to pools if they had more say over how it was distributed.

The Maverick Solution:

Maverick allows LPs to configure their liquidity distribution across a pool’s price range. Maverick offers several pre-designed distributions, but an LP can also tune its custom liquidity strategy bin-by-bin.

While it is possible to configure a complex liquidity distribution in other concentrated liquidity AMMs, it usually requires users to open multiple positions and mint several NFTs to support them. Maverick allows you to create custom distribution in a single place using only one NFT.

Why Should Users Choose Maverick?

Liquidity Providers

- Active Liquidity Strategies: Maverick natively automates liquidity reconcentration. This means you can set up an operational liquidity strategy that you won’t have to manage alone, saving you time and money on gas.

- More Fees for LPs: Automated reconcentration also eliminates opportunities for third-party DApps to profit from Maverick liquidity provision, leaving more money on the table for LPs.

- Custom Liquidity Distributions: Using our user-friendly interface, you can choose where to place your liquidity in each pool. Implement tried-and-true risk management strategies or devise your own. Maverick AMM has made what used to take multiple positions and cost more gas fees even more efficient.

Traders

- Better Prices: Maverick ensures a broad base of liquidity support around the market price by automatically shifting liquidity to follow trading activity. For traders, this means better pricing and less slippage.

DAO Treasuries

- Low-maintenance Market Making: Maverick’s intelligent liquidity-shifting mechanism simplifies the process of bootstrapping liquidity for new markets while protecting against volatility and market manipulation. This provides projects a tool for establishing token markets and gaining price exposure to other assets.

- A More Flexible Launchpad: Maverick’s easily customizable liquidity distributions can help guide the market to the desired price for your token while rewarding early adopters for their support.

The Maverick dApp

The Maverick dApp is now available on Ethereum. Users can use Maverick AMM to trade and provide liquidity by connecting their wallets. These docs explain the Maverick app’s features and provide simple walkthroughs on how to use it.

The app consists of three pages:

- Swap – the trading interface for executing spot swaps on Maverick AMM

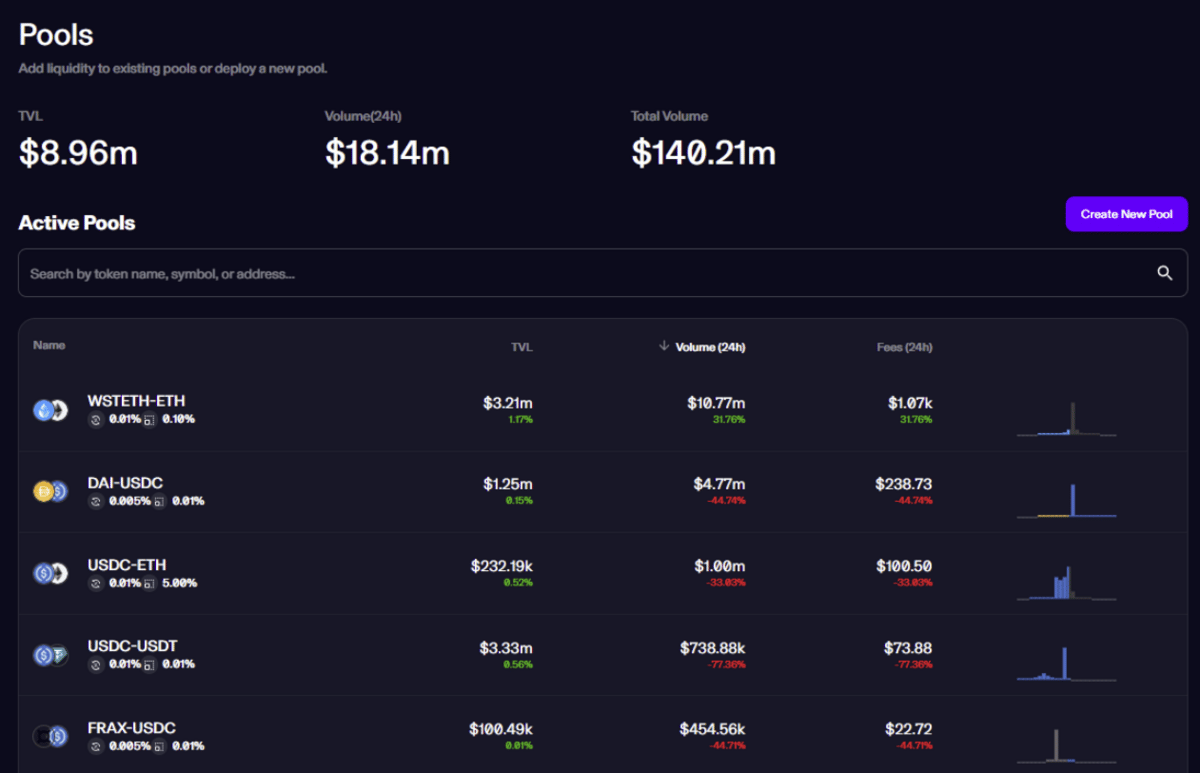

- Pools – the liquidity provider interface, where LPs can add liquidity to Maverick AMM pools

- Portfolio – once you have added liquidity, your liquidity position(s) will appear here

Maverick works like most spot swap DEXs: LPs deposit tokens into Pools, where traders can swap them at AMM-set prices. We go into greater detail about each step of this process in the guides linked below.

The MAV Token

Maverick wishes to give every MAV token holder a voice. MAV tokens can be used to propose protocol improvements or to vote on proposals such as approved assets, partnerships, and protocol direction.

Maverick Ecosystem

Maverick is supported by:

- Pantera Capital

- Jump Crypto

- Altonomy

- Circle Ventures

- Coral DeFi

- Gemini

- GoldenTree Asset Management

- LedgerPrime

- Shima Capital

- Spartan Group

Summary

Maverick’s unique selling point is its dynamic automated market maker, which allows investors to capture more fees and maximize revenues by providing liquidity through a customizable liquidity distribution tool.

According to the most recent news, Maverick Protocol’s AMM algorithm provides investors with greater customization and the potential for higher profits than the top decentralized exchange UniSwap.

- On Maverick, crypto traders can access six liquidity pools with an initial liquidity TVL of over $10 million.

- Maverick integrated Lido Finance, a popular liquid staking protocol, making its wrapped ether derivative a key pool asset.

- Maverick also collaborated with decentralized stablecoin issuer Liquity to offer trading pools for its LUSD stablecoin against ETH and wstETH and with Galxe for a wstETH/GAL pool. Those who deposit wstETH into the pools may earn the derivative’s staking reward and the standard revenue by providing liquidity.

According to Crunchbase, the protocol’s developer firm raised $9 million in venture capital from backers including Circle Ventures, LedgerPrime, and Jump Crypto, with Pantera Capital being the most recent investor last year, according to Maverick.