Today — May 6 2023 marks one year after the historic Collapse of algorithmic stablecoin UST, and its governance token LUNA. This was a collapse of an unprecedented scale in the cryptoverse that continued to ripple through the industry and caused over $40 billion in losses.

To put this in perspective, crypto hacks in 2022 only account for about $3.8 billion.

A brief recap

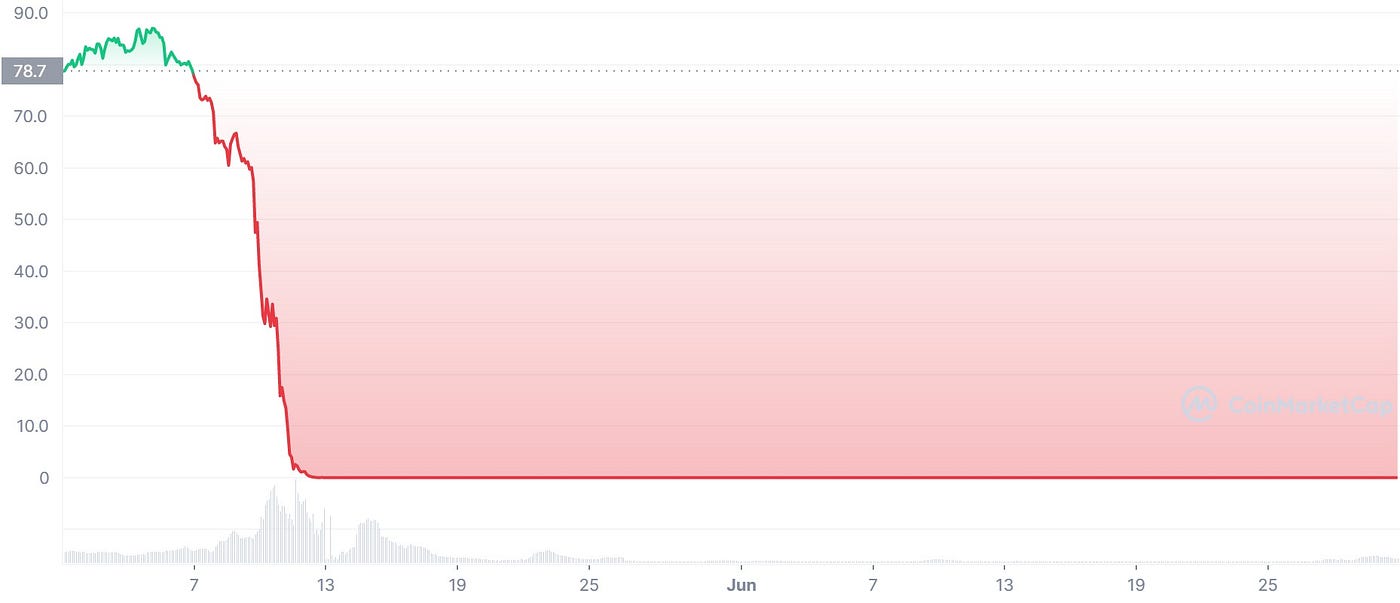

Allow me to paint you a brief picture of the first three days of the collapse. The LUNA chart reads $79 and some people buy the dip, since it’s a considerable “discount” from the $119 all time high.

Come May 7, it dips by another 10%. In the meantime, UST took a small hit and was trading at $0.995 but no major events happening on the surface. However, the foundation was already shifting beneath everyone’s feet.

An anonymous user dumped over $84 million worth of UST on the market, and the Terra foundation responded by withdrawing over $150m UST from the Curve liquidity pool in order help assimilate the dump.

People started responding to the withdrawal by panic selling, so their liquidity is not locked, and this is when the arbitrage exploit and death spiral began.

The Death Spiral

By May 9, the LUNA Price was down to $50 and UST was trading at $0.96. One more day goes by and LUNA continues to rapidly collapse closer to the $30 level while UST trades at $0.80.

LUNA and UST were connected, in that each token would help manage the supply of the other. You could burn LUNA in exchange for UST, and then redeem your UST for USDT or UST.

And that’s exactly what people did. Since USDT was trading at less than a dollar, but could always be redeemed for $1 USD, all that people had to do was burn LUNA, get UST and exchange it to UST.

By May 10, you’d earn $.20 just exchanging UST to USD. People were quick to the exploit and by May 11 the “stablecoin” UST was trading at just $0.39. Meanwhile LUNA continued to nosedive and trade at just $17 on May 11.

People kept exploiting this arbitrage mechanism until both coins lost nearly their entire value.

LUNA dropped 99% and was trading at $1. The next day it dropped 99% more, and another 99% the following day.

It was absolutely wild many people, myself included were in disbelief that we’re witnessing a crash of such proportion.

The Recovery Plan

After the collapse, Do Kwon, the founder of Terra LUNA announced a Terra Recovery plan that the community agreed on at the time. It was decided that the old chain be left to crash and burn, while they deploy a new Terra 2.0 chain, and airdrop some new Terra to people who lost money on the old chain.

The recovery plan was a joke and did nothing to re-establish trust or make anyone whole. Everyone who’s ever lost money on LUNA got airdropped a minimal amount of the new LUNA token, which also began to tank as no one with living brain cells would keep holding onto it.

Shortly after, the attention started focusing on Do Kwon, who has recently been apprehended by the Montenegro Police after being caught with false documents.

The LUNA Domino Effect

Once the smoke started to settle, it was only a matter of time until the domino effect would come into play. Because Terra was as big as it was, many other crypto companies would hold a significant amount of their reserves in UST or LUNA.

3AC

One of the first to crumble was Three Arrows Capital (3AC), a prominent crypto hedgefund that backed up many projects over the years including Solana. Due to significant exposure to Terra LUNA, 3AC was forced to default on a $670 million dollar loan to Voyager, and would shorly be declared insolvent.

Voyager

Voyager, a mobile cryptocurrency investing app that allowed users to stake crypto followed soon after. Voyager acted as an intermediary between the 12 biggest cryptocurrency exchanges and the end-users promising to find the best possible price on the market. In order to consolidate a more predictable cashflow, Voyager started offering loans to crypto companies, one of them being 3AC.

Due to 3AC defaulting on their loan, Voyager was decided to halt all trading activity and platform withdrawals, and was forced to file for bankcruptcy.

Celsius

Celsius, a lending platform not dissimilar to Voyager, promised high returns to users by reinvesting their liquidity in speculative projects such as the Anchor protocol and Lido Finance.

They also heavily invested in Terra’s Anchor protocol, which offered high returns on Terra LUNA. However, as the value of Terra LUNA declined, Celsius withdrew a significant amount of liquidity, contributing to the Terra LUNA crash.

Terra LUNA today

There is no coming back from a disaster of this proportion for Terra itself. Today LUNA Classic trades at $0.0000941 while LUNA 2.0 at $1.12. The stablecoin USTC trades at $0.01762, but it’s a valuable lesson for Crypto, that I hope everyone has learned.

There is actually more than one lesson —

- Algorithmic Stablecoins that use governance tokens to balance supply have been proven time and time again not to work.

- If you see a building collapse, get out of the blast radius.

- Don’t try to look for gold among the ruins — there likely isn’t any.

- Know when to cut your losses and move on.