We called it!

- DXY (Dollar Index): “I’m still bullish on the dollar with the next target coming in at 104.7 … I’ll be expecting the 102.9–103.5 pocket to hold as support for price to push higher.” ✅

- XAUUSD (GOLD): “As long as it holds, I’m favoring another price leg up to the 1935 Daily Orderblock.” ✅

- Bitcoin: “I’m looking for a reclaim of the VAL of this current range (26400) on a HTF basis to get a rotation back up to the range POC (28000)” ✅

Recap

- The Labor Department reported that employers added 187000 jobs during the month of July. This was higher than the forecasted value but it also marks the third straight month where the report came in at under 200000, with main declines once again coming in the warehousing and transportation sectors.

- The unemployment rate also rose to 3.8% in August, with the raw number of unemployed people increasing to 6.4 million people. While the labor market continues to show signs of cooling and the economy continues to show resilience in the face of the current monetary policy, inflation is still well above the Fed’s target of 2%.

- The dollar index started off the week on a weak note and dipped down all the way to my key level of 102.9 before rallying Thursday and Friday to end the week green. Conversely, EU and GU both pushed higher towards buy side liquidity before tumbling.

- Gold started its week early and pushed up higher into our target Daily OB at 1834 and flipped it into support. Meanwhile Bitcoin reclaimed our VAL of 26400 on a daily timeframe and pushed to our 28000 POC target before giving back all it’s gain and losing the 26400 support level.

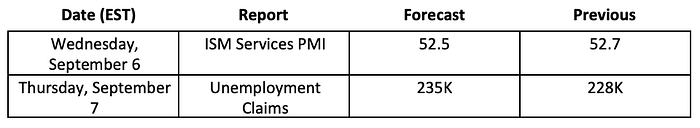

Coming up in the week ahead

Cryptocurrency News

The cryptocurrency market saw a strong start to the last week as US court ruled in favor of Grayscale Investments on its case against the SEC regarding Bitcoin ETFs. This triggered a 9% increase in Bitcoin’s price within a span of a couple hours.

Unfortunately, this was short lived as the SEC decided to delay its decision for all applications for spot Bitcoin ETFs. They chose to hold off from making any decisions and opted instead to wait for its next deadline, October 17. This wasn’t out of line with what the SEC normally does; they tend to use every bit of review period they have to come to a final decision. Bitcoin, along with the rest of the market, gave back all of it’s gain in a massive selloff that saw price eventually tap the 25200 level.

Technical Analysis

DXY (Dollar Index)

I’m still leaning higher for the dollar index with the 104.7 highs coming up first and eventually the 106.0 highs. The key level tapped last week was the weekly breaker we had our eyes on. The 102.9 swing low made at that level needs to be protected for the bullish bias to hold. If broken, further downside towards the 101.7 equal lows would be the next draw on liquidity.

GBPUSD

GU is likely to push lower as long as the dollar continues to push higher. I’m looking for the 1.262–1.265 level to be resistance before a push lower. Aft er a chopping grind lower the last couple of weeks, we finally seem to have gotten some displacement lower. The next draw on liquidity seems to be the 1.248 level and then the swing low sitting right above the 1.23 point. A similar analysis can be made for EU but GU seems to have a cleaner setup at this point.

USDCAD

Our USDCAD analysis from last week is still applicable as price hasn’t quite reached my target yet. The 1.35 support level given from a couple of weeks ago is still holding price. 1.356 will be the area I look for possible longs into our equal highs and Daily FVG sitting at the 1.37 price pocket marked below. As long as the dollar index continues to push higher, this pair is likely to push higher as well.

XAUUSD (GOLD)

The weekly market structure is still currently forming lower highs and lower lows. Until we trade and close above the 1987 swing high, that doesn’t change. However, the local structure on the daily timeframe has flipped bullish for now, which is why I am expecting price to continue rallying. I’m looking for the daily fair value gap (small yellow shaded box) to hold as support as we push towards the 1960 level where we should make a pitstop. The ultimate target is the 1993 fair value gap within the bigger yellow box.

ES

I was bearish on the stock market going into last week but that idea was easily invalidated as we are now trading above the last swing high at 4485. The current price action suggests that price wants to continue trading higher before going lower. The first draw is the volume imbalance waiting at the 4580–4600 level though we likely will push up all the way to the equal highs at 4631. We tapped the level last month but did not seem to really raid the high which is why I’m leaning towards another tap of the level. I’ll be expecting 4490 (yellow shaded box) to hold as support and for the low of the week. There is another scenario which would depend on NQ and YMI, both of which are presented below.

NQ and YMI

Both NASDAQ and Dow Jones have a clearer bearish case, in my opinion. We’ll have to see which one prevails this coming week as ES will follow is NQ and YMI choose to fall in spite of its bullish case presented above. NQ is currently at its own daily fair value gap and YMI is at the key resistance marked out from last week. If YMI continues to close within or below the shaded level at 35000, I suspect it will go lower to the 33750 level next. NQ, similarly, has equal lows sitting at the 14250 level as well as a volume imbalance below it. Both ES and NQ have local bullish market structures as they’re trading above their previous swing high, but YMI seems to be showing the most weakness. It’s unclear which of the two scenarios will play out this week, but those are the plays I’m watching.

Bitcoin (HTF)

Bitcoin had a massive pump into our 28000 levels (POC of range) last week before getting rejected and coming all the way back down. This level was given last week and is shown again below. I’m still waiting for the VAL at 26300 to be reclaimed on this weekly timeframe to really believe that we’re going to have another rotation to the range highs without it being a fake out like last week. As long as we continue closing below the 26300, I’m leaning for sub-25000.

Bitcoin (LTF)

Bitcoin is back within the tight range we were in prior to the breakout. The VAL of this range is 25750 and is a must hold to prevent further downside to 25200 and below. However, with the HTF picture in mind, I am looking for the POC of this range and 26150 to act as resistance and possibly push price lower to take out the equal lows set at the end of last week at 25200. If we reclaim the POC as support then there’s a good chance we push up into range high at 26500.

Polkadot (DOT)

This is one of my favorite coins on a fundamental note, but we likely will continue falling lower. Thankfully, I am looking for longs now as I don’t think downside will continue for too much longer. DOT has been one of the weaker alts lately and we’re currently holding onto the 4.28 support for dear life. I’m expecting price to fall below this and tap into the 3.53 lows next. The level to break to get out of this downtrend is the 5.5 shaded box. Until then I want to see us break below this support level and tap into the 3.53 level. If we can fall below it as a liquidity grab and reclaim it, I’m going to be a big buyer.

For live updates, you can follow me on twitter here and my telegram here!