By Kyle Waters & Matias Andrade Cabieses

A data-driven look at digital asset markets after a milestone ruling in SEC v. Ripple

In a significant development for the digital assets industry as a whole, the U.S. District Court for the Southern District of New York issued a partial summary judgment on July 13th, favoring some of Ripple Labs Inc.’s defense in its protracted enforcement case with the U.S. Securities and Exchange Commission (SEC). The SEC had alleged back in December 2020 that Ripple’s XRP token was sold as an unregistered security, a claim that has now been partially dismissed by the court.

This ruling, coming just under two months after the SEC’s latest allegations against digital asset exchanges Coinbase and Binance—which saw a slew of tokens including BNB ($37B) and SOL ($10B) alleged as securities—could potentially provide a supportive precedent for these cases. In this week’s State of the Network, we explore interesting slices of market and on-chain data in the wake of this milestone ruling.

Market Impact and Legal Intricacies

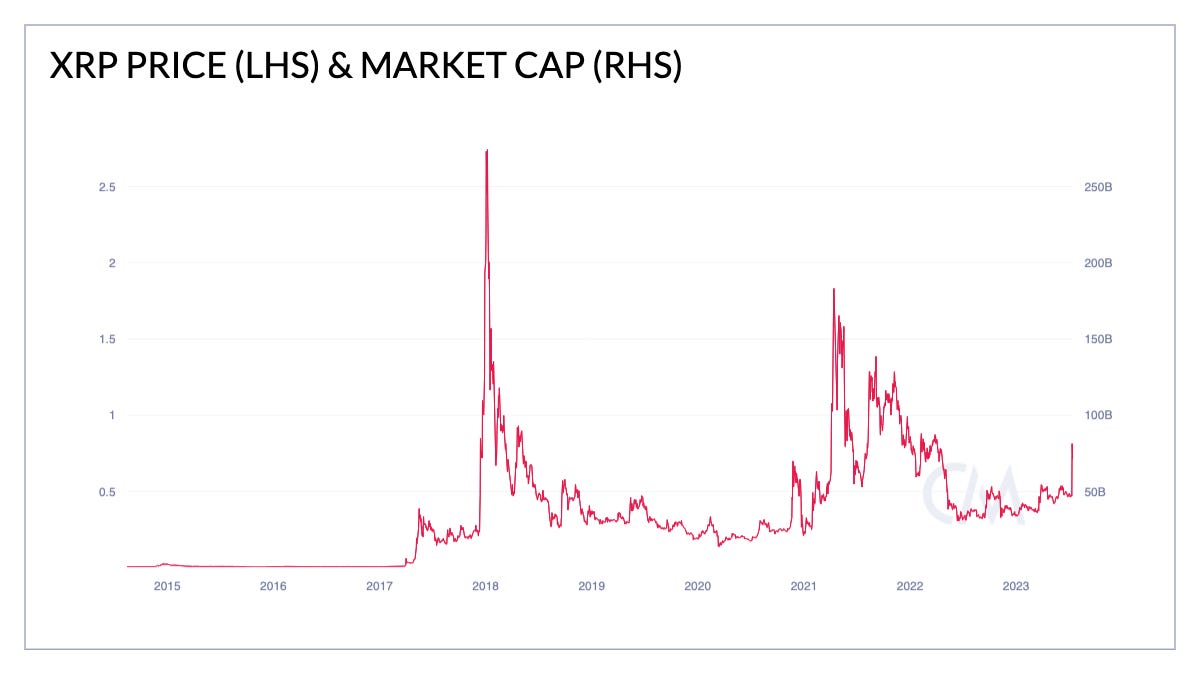

In a year rife with regulatory developments deemed by some to be sweeping overreach, markets were swift to react to this decision’s change in the current. The response to the ruling was quick and decisive: XRP’s price surged by over 70% as participants weighed the news. As of Monday afternoon, the price of XRP was at 75 cents while its market cap stood at around $75B, the highest in over a year. However, this is well below XRP’s all-time high of $2.74/$274B observed in January 2018.

Source: Coin Metrics Charting Tools

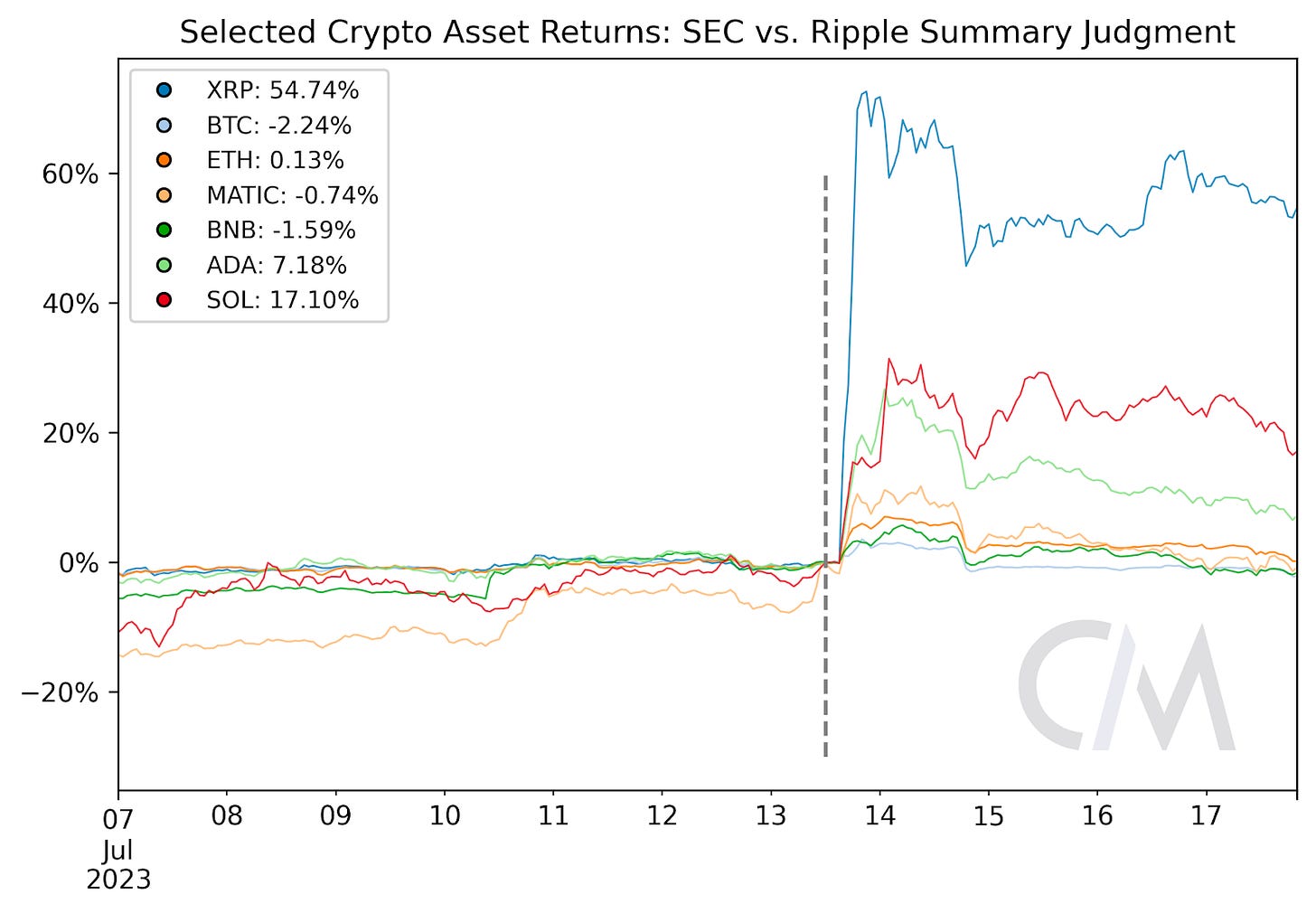

Other tokens alleged as securities also responded strongly including Solana (SOL) which was up 17% through Monday afternoon (EDT). Despite pulling back slightly on Friday, XRP was still up 55% as of Monday afternoon. The two market giants BTC and ETH, accounting for $800B in market capitalization, both moved slightly higher on the news, before receding going into the weekend.

Source: Coin Metrics Reference Rates

However, amid the clamors to declare total victory, it is noteworthy that the court’s decision was not without nuance. While the court struck down some of the SEC’s claims, it did not throw everything out. Though sales of XRP on secondary markets were not deemed as illegal sales of a security, the judgment argued that primary sales of XRP directly to institutional investors did constitute illegal securities offerings. This dual-sided decision underscores the complexity of the regulatory landscape and the application of securities laws to digital assets. The ruling also offers a preliminary indication that token distribution models are an important piece of the puzzle. For example, initial coin offerings (ICO) and private distributions may be treated distinctly from more decentralized activities like airdrops and mining.

Legal nuance aside, the ruling provided a much-needed boost amid the on-going regulatory uncertainty, and also gave exchanges in the U.S. the confidence to re-list XRP to their platforms.

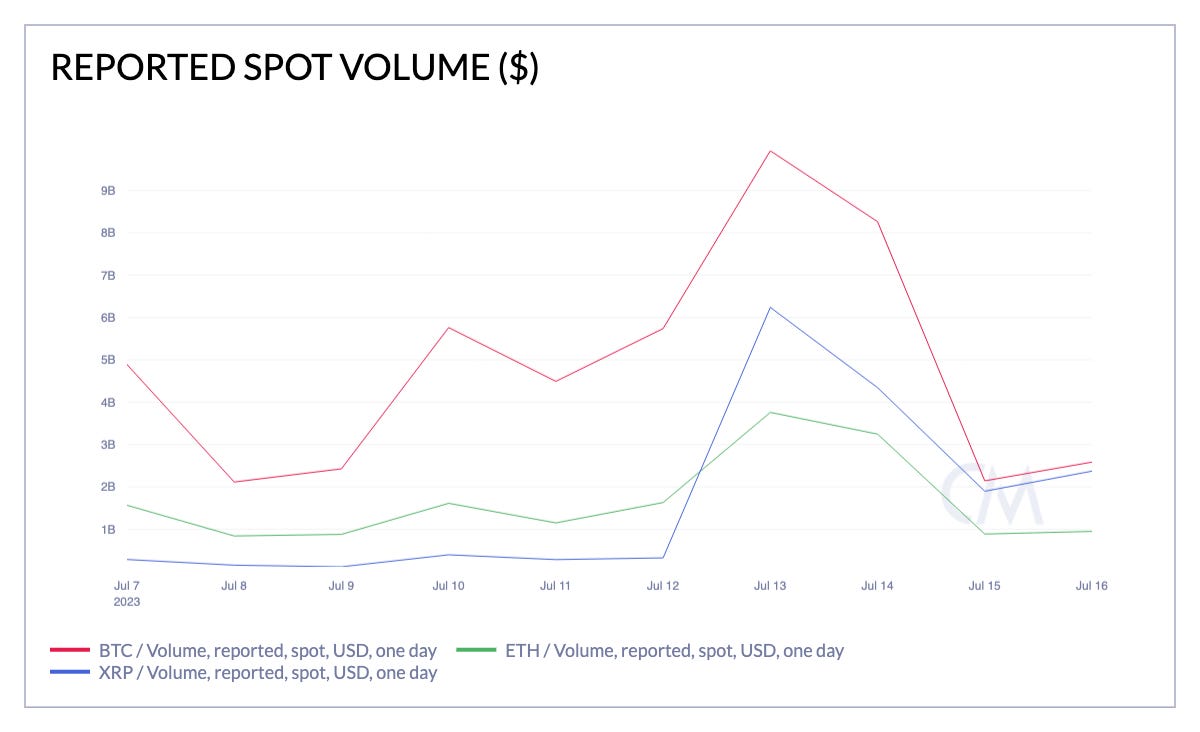

XRP Returns to U.S. Exchanges

After the SEC filed its complaint against Ripple on December 2020, US exchanges including Coinbase quickly moved to de-list the token. Until last Thursday’s announcement, XRP trading was concentrated on off-shore exchanges, with the majority of volume on Binance. XRP volume surged on Binance on July 13th, totaling $2.4B out of the $6.2B total reported spot volume across the exchanges Coin Metrics tracks. XRP reported spot volume has even notably surpassed ETH in the days after the ruling.

Source: Coin Metrics Market Data Feed

But shortly after the Southern District of New York released its filing on Thursday and the sale of XRP on exchanges was judged to not meet the criteria of an illegal securities offering, U.S. digital asset exchanges including Coinbase and Kraken moved to offer XRP trading on their platforms, while Gemini said it would explore listing XRP.

Coinbase processed a total of $250M of XRP spot volume between July 13th and July 16th, but this represents only about 4% of the $5.7B in total spot volume recorded those days. For comparison, BTC and ETH had spot volumes of $1.9B and $1.1B on Coinbase over that time period, respectively.

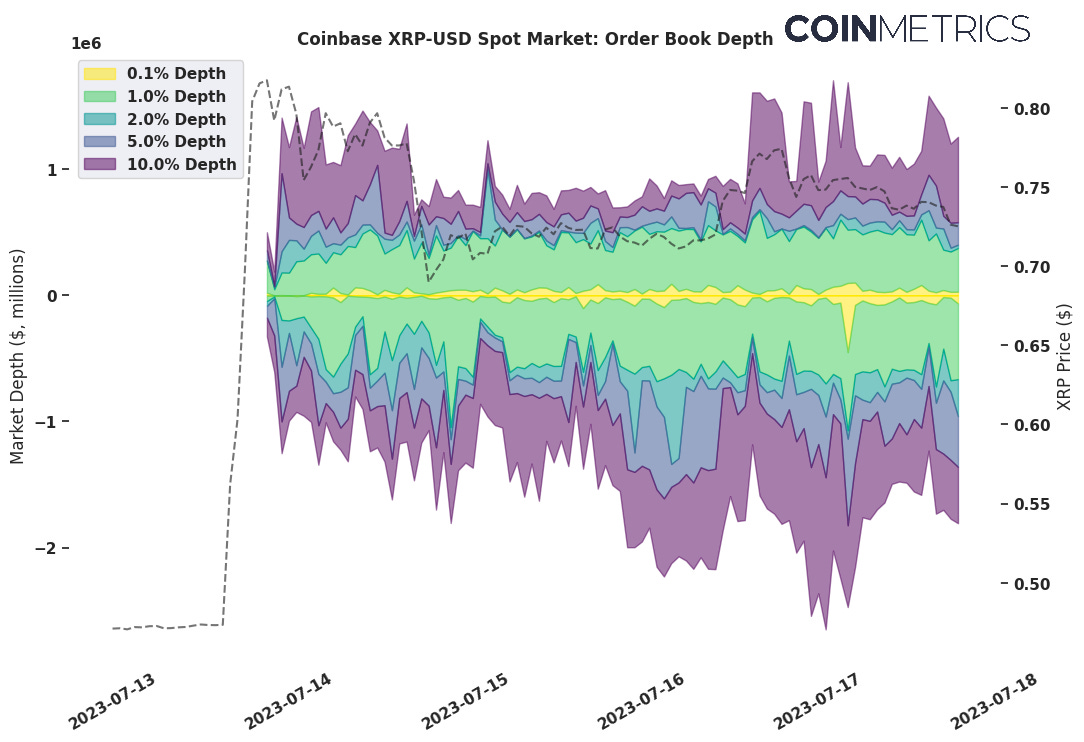

The depth of the XRP–USD spot order book on Coinbase has slowly been building as trading activity in the token has returned to the exchange.

Source: Coin Metrics Market Data Feed

XRP On-Chain Activity

Ripple was launched in 2012 with an original focus on cross-border transfers of money and financial payments infrastructure.

But over time, both increasing competition and the regulatory environment around XRP have made it more difficult for Ripple to achieve this mission. The rise of smart contract platforms, pioneered by Ethereum, provided the original tooling for the development of the nascent set of emergent decentralized financial services known collectively today as DeFi. Moreover, the ubiquity of token standards like ERC-20 has helped fuel the $100B+ rise of stablecoins, which are often pitched as a modern offering for services like cross-border settlement and fiat payments over borderless public blockchain infrastructure.

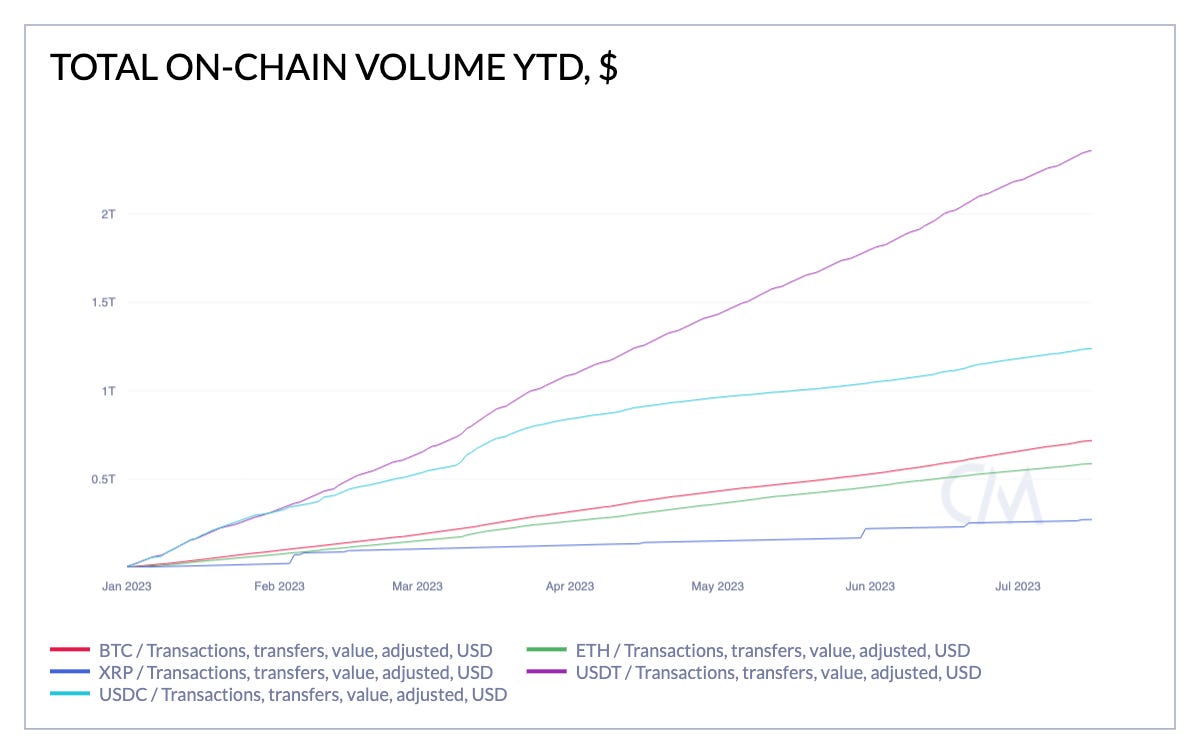

Looking at Coin Metrics’ adjusted on-chain volume, XRP has lagged behind BTC, ETH, and the major stablecoins USDC and Tether in terms of total dollar volume settled on-chain year-to-date.

Source: Coin Metrics Network Data Pro

However, boosted from a partial victory against the SEC, Ripple’s supporters are now hopeful that banks will begin to adopt XRP for cross-border transactions and other services.

Conclusion

Despite complexities in the ruling, the outcome is a victory for Ripple and holds many ramifications for the industry’s future at large. However, the battle is not yet over. Ripple is still headed to trial unless a settlement is reached or the SEC decides to drop the remaining pieces of its case.

The ruling represents a crucial juncture in the ongoing tug-of-war between the crypto industry and regulators. The market’s immediate reaction to the ruling underscores the impact regulatory decisions have on the future of the industry. Ripple is not alone in this battle: $74 billion or 6% of the entire $1.1 trillion crypto market consists of assets alleged as securities by the SEC, including XRP, BNB, SOL and a handful of other multi-billion market cap projects. Nearly $500 billion (43%) of the market consists of assets with no clear classification.

Which assets are classified as securities and how these decisions are made remains an open question. Securities laws were motivated by a need to equalize information asymmetries. With blockchains allowing unprecedented transparency, it raises the question: can on-chain data reveal clues to identify which crypto assets are securities?