Table of Contents

1. Overview

2. STO, the Birth of a New Security?

3. What Changes Will STOs Bring?

4. Why Choose Real Estate Over Securities and Bonds?

5. How is Real Estate Tokenization Progressing in South Korea?

6. How Can Token Securities be Utilized in Real Estate Development Investment?

7. How Can Token Securities Be Utilized in Physical Real Estate Investment?

8. Conclusion

1. Overview

(Source: Yahoo Finance)

Larry Fink, CEO of BlackRock, the world’s largest asset manager, emphasized that the future of financial markets lies in asset tokenization. This observation suggests that the trajectory Wall Street has quietly pursued in blockchain and ditigal assets revolves around asset tokenization. Likewise, JP Morgan, the largest investment bank in the United States, is actively developing a tokenization platform through its blockchain entity, Onyx. Citibank, one of the top three banks in the US, projects in its report “Money, Tokens, and Games” that the global asset token market will reach approximately $5 trillion by 2030. Just as derivatives have expanded the financial market, asset tokenization is expected to unlock new avenues in financial investments by leveraging traditional financial assets. Notably, the real estate market in South Korea exhibits promising potential in security token offerings (STOs). This article seeks to explore the opportunities and applications of STOs in the South Korean commercial real estate market.

2. STO, the Birth of a New Security

The financial landscape in Korea has evolved significantly, driven by legal and institutional advancements, with the Capital Market Act serving as the bedrock for regulating the entire capital market. Under the current Capital Market Act, financial investment products are classified into “securities” and “derivatives.” Securities are defined as financial instruments where investors provide funds and receive profits or rights in return. They are further divided into six categories based on the type of rights they represent:

- Debt Securities: Examples include government bonds, municipal bonds, and special bonds, representing the right of claim.

- Equity Securities: These encompass shares and preemptive rights, indicating ownership interests.

- Profit-making Securities: These signify the right to income from trusts.

- Investment Contract Securities: These denote rights associated with investments in joint ventures.

- Derivative-linked Securities: These indicate rights tied to the price of underlying assets.

- Depository Receipts: These reflect rights related to depositing securities and the deposited securities.

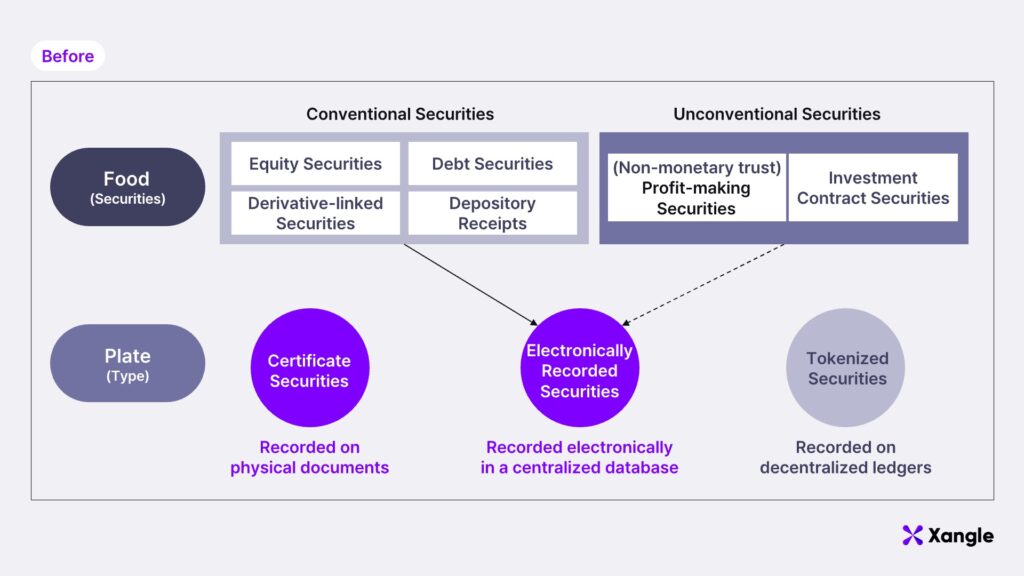

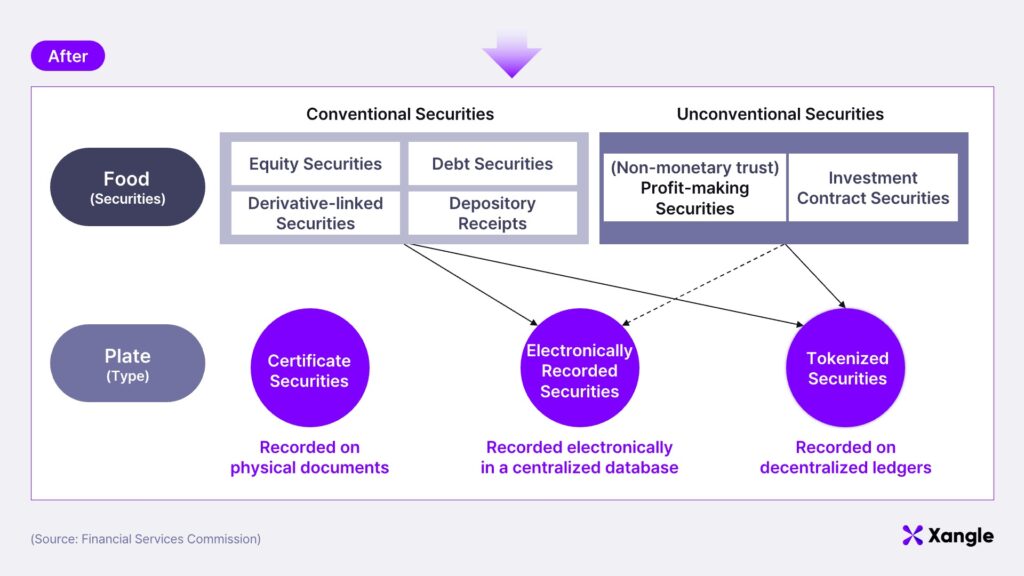

As outlined, the Capital Market Act clearly defines ‘securities’ within the six mentioned categories. However, what exactly constitutes an electronic security, a term often referenced but not explicitly defined above? Unlike the categories specified by the Capital Market Act, electronic security isn’t a distinct type of security; rather, it signifies the format in which securities can be issued and traded. This concept parallels the historical shift from physical securities (paper certificates) to electronic form.

The management of physical securities posed numerous challenges, including storage and complexity in exercising rights. To address these issues, the Electronic Securities Act was enacted in 2019, facilitating the conversion of physical securities into electronic form. This transition resembles the evolution from paper currency to credit cards for payment transactions.

Similarly, security tokens represent an alternative format for issuing and trading securities, akin to electronic securities. They don’t introduce a new category of security under the Capital Market Act’s classification but rather signify a novel method of distribution, comparable to the shift from physical to electronic securities. To revisit the analogy, the progression from electronic securities to security tokens resembles the addition of mobile payment methods alongside credit cards, following the transition from physical to electronic securities. This discussion aims to explore the potential implications of STOs in the Korean real estate market.

3. What Changes Will STOs Bring?

The advent of new products or services tends to be more perceptible to consumers than to providers. This is because consumers directly experience the value of the product through their interactions. Conversely, changes within systems are more keenly felt from the provider’s perspective as they strive to enhance the efficiency of internal processes. The transition from physical securities to electronic securities within the financial system wasn’t strongly felt by us, the financial consumers, precisely because of this. Therefore, to anticipate the forthcoming changes introduced by STOs in the Korean real estate market, it’s essential to consider what changes consumers can perceive through advancements in the system, rather than solely focusing on the token securities themselves.

With the implementation of electronic securities, numerous changes have occurred, including reduced issuance costs and improved transaction transparency. From the standpoint of financial consumers, the most significant change lies in the exercise of shareholder rights. Previously, physical securities required shareholders to retain them despite the risk of loss, enabling direct participation in shareholder meetings, capital increases, and dividends. To exercise shareholder rights, verification of shareholder status through the substantial shareholder registry system was necessary. However, with the introduction of the Electronic Securities Act, the process of exercising shareholder rights under the Commercial Act and the existing custody system has been streamlined and electronicized. Consequently, shareholders can now exercise their rights online without attending physical shareholder meetings.

From a systemic perspective, the most noteworthy development is the emergence of a format capable of accommodating investment contract securities, which were previously not covered under the existing framework of “electronic securities.” While standardized securities like equity securities and debt securities, widely used in the financial market, were suitable for distribution as “electronic securities,” limitations existed in distributing non-standard securities such as investment contract securities and (non-monetary trust) profit-making securities as ‘electronic securities.’ Therefore, the changes driven by security tokens are expected to primarily revolve around the utilization of non-standard securities like ‘(non-monetary trust) profit-making securities’ and ‘investment contract securities,’ rather than the creation of new types of securities.

4. Why Choose Real Estate Over Securities and Bonds?

(Source: Blackstone)

Securitization involves the process of transforming assets into tradable securities within the capital market. Its primary goal is to boost liquidity by leveraging securities for fundraising and expanding investments.

The Korean financial industry places a significant emphasis on liquidity, a focus influenced by past events. During the 1997 financial crisis, companies prioritized securing liquidity through their real estate holdings. However, unlike stocks and bonds, which can be securitized and traded in the market, real estate assets faced challenges due to their lower liquidity. At that time, the legal and institutional frameworks for real estate securitization were inadequate, leaving sales as the only option to liquidate real estate holdings. Consequently, many corporate-owned real estate properties were sold off at undervalued prices to foreign investors. In response to these challenges, the Asset Liquidation Act was swiftly enacted in 1998. This led to the introduction of the Corporate Restructuring Real Estate Investment Trust (CR-REIT) as an indirect real estate investment mechanism aimed at enhancing liquidity. Subsequently, real estate funds were introduced, and the enactment of the Capital Market Act in 2009 further facilitated the securitization of real estate assets through various investment vehicles.

More specifically, the trend has been towards securitizing the assets of vehicles that primarily hold real estate portfolios, rather than focusing on the liquidity of individual real estate assets. Investing in REITs entails investing in shares of a company that invests in real estate portfolios as a whole, rather than individual properties. In other words, purchasing HYBE stock does not directly equate to investing in NewJeans. Furthermore, real estate funds have predominantly shifted towards private funds due to the limited activity in the profit-making securities trading market, resulting in a concentration on large-scale commercial real estate.

Consequently, it is anticipated that real estate, with its pronounced liquidity needs compared to stocks and bonds, where direct asset liquidity is feasible, will emerge as the most sought-after asset in the STO market.

5. How is Real Estate Tokenization Progressing in South Korea?

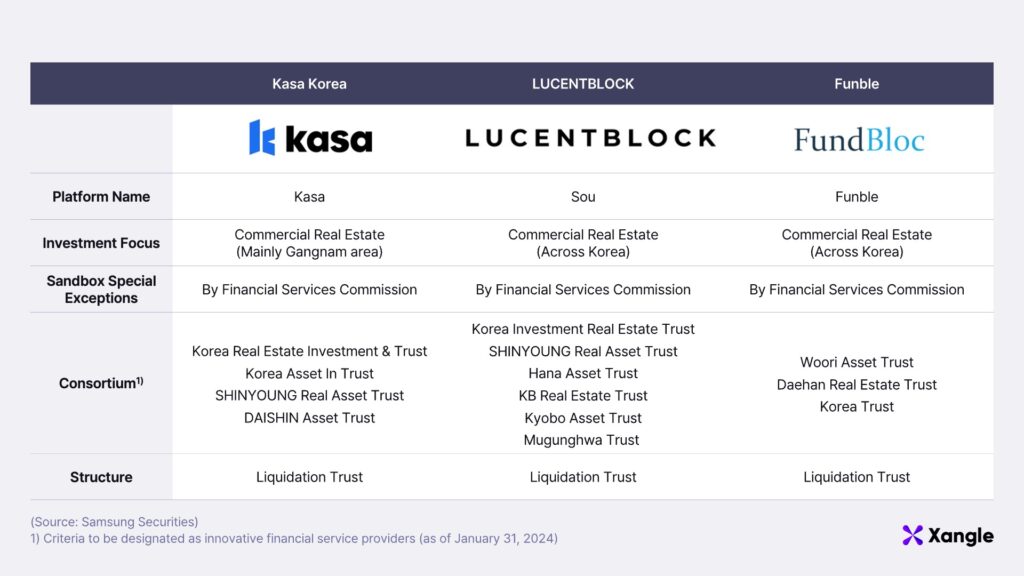

Presently, several South Korean companies, including Kasa Korea, Lucentblock, and Funble, have been designated as innovative financial service providers by the Financial Services Commission. These entities are actively involved in the real estate token securities market, operating platforms for fractional investment in real estate assets under the Sandbox Special Exceptions, utilizing “(non-monetary trust) profit-making securities.”

Initially, real estate tokenization relied on Special Purpose Companies (SPCs) as the prevailing structure. However, to address issues like conflict of interest and enhance structural stability, all three companies have transitioned to issuing profit-making securities in the form of token securities using trustee disposal trust structures. In this setup, property owners (trustors) seeking to tokenize real estate delegate disposal authority to trustees. Subsequently, trustees issue profit-making securities based on the asset, distributing token securities through the platforms operated by the three companies. This structure enables direct investment in individual real estate properties, unlike REITs, and facilitates immediate trading via order books, similar to stocks. Additionally, investors can exercise voting rights at income beneficiary meetings through the platform.

However, since this approach is limited to physical assets, the benefits for financial product consumers are somewhat restricted beyond the advantages of liquidity through fractional investment. For instance, when proceeding with fractional investment through real estate tokenization, it is necessary to purchase the building with 100% equity without utilizing loans. This presents a significant difference from the real estate private investment market, where leverage can be maximized through the use of vehicles with the most leverage effect and optimization of investment structures.

6. How Can Token Securities be Utilized in Real Estate Development Investment?

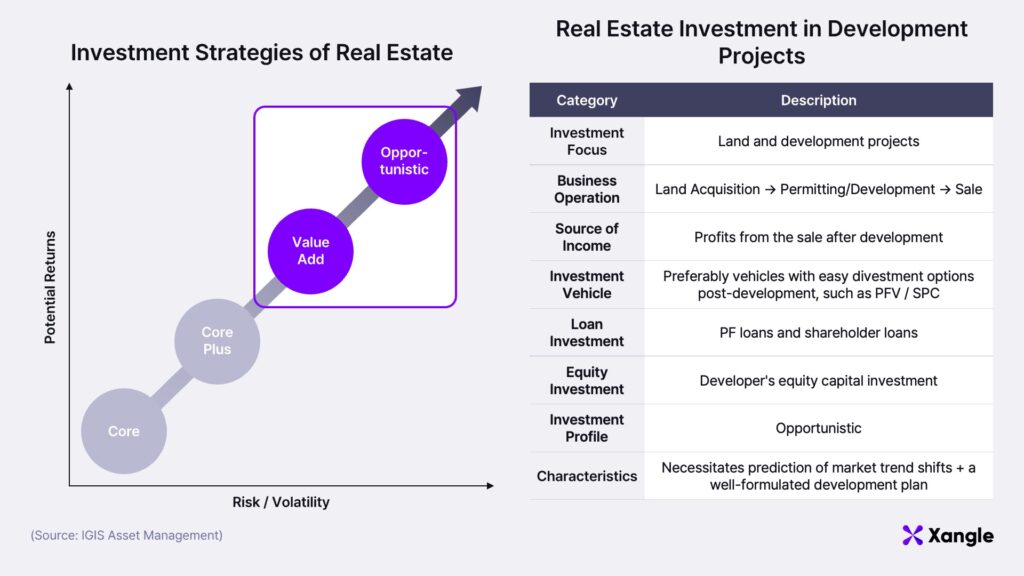

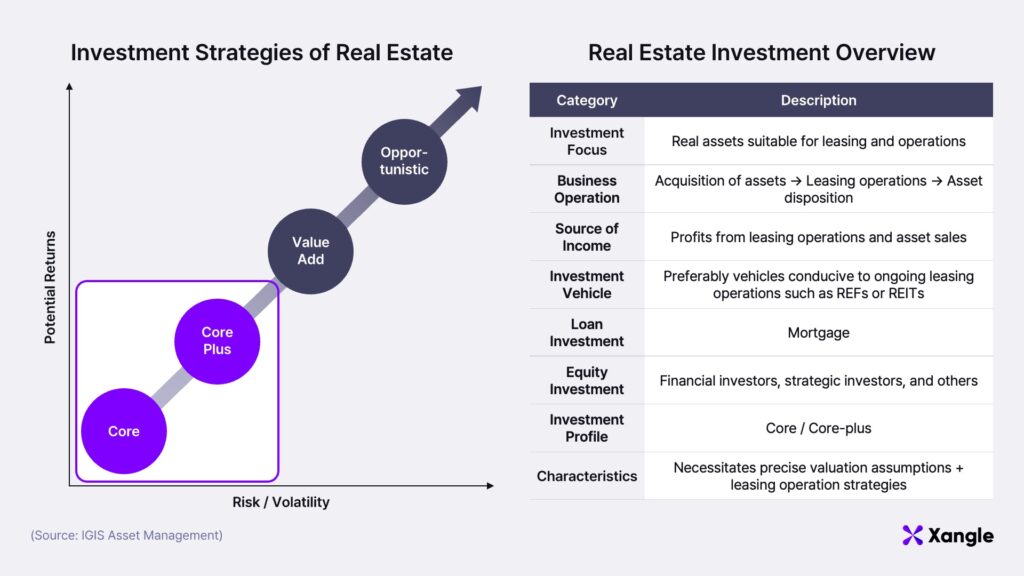

Real estate investment can be divided into two primary categories: physical real estate investment and development real estate investment. Physical real estate investment, known as Core and Core-Plus investments, typically involves investing in stabilized physical assets such as office buildings, hotels, and logistics centers with the aim of generating rental income. Development real estate investment, referred to as Value Add and Opportunistic investments, involves acquiring properties for redevelopment or remodeling existing assets to target future development profits. Redevelopment and reconstruction investments fall under this category.

Real estate development projects in Korea often entail complex financial structures, especially compared to physical real estate investments. Unlike physical real estate, which typically involves tangible collateral assets, evaluating the value of development projects can be challenging, requiring various collateral and credit enhancement mechanisms. Throughout stages like land acquisition, permitting, development, and sales, a diverse array of financial instruments such as bridge loans and project financing are utilized. During this process, developers may need to offer additional collateral or meet construction milestones to secure financing. Consequently, significant funds are often tied up to bolster the creditworthiness of development projects.

The necessity for liquidity in assets used to bolster credit in development real estate investment is significant. Hence, the utilization of token securities is expected to be substantial from a funding perspective. For example, land held as collateral for bridge loans during the pre-construction permitting period could be tokenized and utilized as fractional investment products. Similarly, priority bonds for project financing (PF) loans could be tokenized once construction begins. Additionally, tokenization could streamline the sell-down process by offering stakes to investors interested only in specific development stages. Beyond asset collateralization, there’s potential for tokenizing real estate funds or preferred shares with dividends ranging from 6 to 10%.

In real estate development projects, structured ideas are likely to be crucial for tokenization. This could provide an opportunity for individual investors to participate in the private real estate finance market, which is mostly dominated by foreign real estate investment companies. However, the Financial Services Commission currently prohibits the issuance of token securities for real estate development projects and PF loans due to stability concerns. Addressing this issue will likely require strengthening safety measures during the future institutionalization process

7. How Can Token Securities Be Utilized in Physical Real Estate Investment?

While token securities can serve to “liquidize” collateral tied up for credit enhancement using non-cash trust profit-making securities in real estate development investments, in the context of physical real estate investment, the primary focus lies in the “commodification” facilitated by investment contract securities. Physical real estate encompasses various asset types such as offices, retail spaces, hotels, and warehouses, all primarily structured around rental income. Essentially, the essence of physical real estate investment lies in maximizing rental income through efficient space utilization.

Physically invested real estate benefits from stable cash flow and secured, high-credit tenants, rendering it a stable investment. However, vacancies can significantly diminish the profitability of such investments. Given the characteristics of tangible assets, the limited physical space imposes constraints, leaving no option but to attract a restricted number of tenants who can accommodate the existing spaces. Given the characteristics of tangible assets, the limited physical space imposes constraints, leaving no option but to attract a restricted number of tenants who can accommodate the existing spaces. Moreover, issues such as lease protection laws and rigid practices demanding high security deposits from tenants make resolving lease problems challenging.

To address leasing challenges and mitigate vacancy risks, token securities can prove to be invaluable. For example, contracts guaranteeing leases for real estate properties with partial vacancies could be tokenized. In a previous instance, a domestic brokerage firm bolstered the lease structure of an office building, reducing vacancy risks through a lease guarantee fund. Although utilizing funds made the structure complex, leveraging investment contract securities could simplify such intricate arrangements. Alternatively, revenue rights from a building’s parking lot could also be tokenized as investment contract securities. This approach allows for the granularization and commodification of rights associated with spaces held by physical assets.

Currently, companies like Kasa Korea, Lucentblock, and Funble are offering fractional investments in physical real estate, primarily focusing on retail properties like shopping malls. While Lucentblock recently attempted to diversify its offerings by introducing office assets as fractional investment products in high-potential areas, product diversity remains limited. Moreover, there is a lack of innovative real estate investment products utilizing token securities. Token securities issued by these companies for retail assets primarily offer simple coupons or discounts. However, the essence of fractional investment utilizing token securities lies in diversifying ownership rights. It’s crucial to provide owners with options such as the right to select music in the space or the discretion to lease pop-up stores, thus diversifying their rights as property owners.

8. Conclusion

The Financial Services Commission’s release of the “Basic Asset Requirements Guidelines” on December 14, 2023, provided clarity regarding token securities. This announcement addressed longstanding uncertainties surrounding real estate tokenization. Key highlights included the prohibition of tokenizing real estate development projects linked to development land, PF loans, bridge loans, and similar entities. Additionally, tokenization of residential properties and casinos was strictly forbidden. Notably, the announcement stressed the challenges in obtaining approval for token securities resembling existing securities or aimed at regulatory circumvention. Essentially, the issuance of token securities was confined to fractional investments in tangible assets.

However, significant limitations persist with token securities. Secondary trading under the Sandbox regulatory exemption faces challenges due to limited liquidity, resulting in wide spreads between bid and ask prices. Furthermore, integration with the crypto industry, referred to as Web3, remains unattainable due to issuance via private blockchains. Consequently, some critics argue that there is little incentive to tokenize currently attractive assets.

However, these restrictions and the issuance of guidelines regarding token securities are not necessarily viewed negatively within the STO industry. The primary challenge facing the financial market is the uncertainty stemming from the lack of clear financial policies. While the current legal framework for token securities may be inadequate, it is crucial to address and resolve uncertainties to integrate them into the regulatory framework. At this stage, the various issues raised are seen as necessary compromises for the transitional period.

In recent times, a significant trend in the commercial real estate market is the concept of “flight to quality,” which essentially involves selectively investing in high-quality assets. With increasing uncertainty in both domestic and international commercial real estate markets, there is a growing preference for investing in assets offering high stability. This trend is expected to lead to increased demand for high-quality offices characterized by superior physical specifications and selective tenants. It is anticipated that this trend will also apply similarly to the real estate token securities market. Ultimately, the value of financial products is determined by the fundamentals of the underlying assets. While blockchain technology and infrastructure may be crucial factors in the early stages of the business, the ability to select and secure high-quality small to medium-sized real estate assets demanded by investors will ultimately become the core competitive advantage of the STO industry.