Following 170 days of freedom and 363 Twitter posts, can the former leader of Binance successfully rebrand his public image?”

Bright,Foresight News

Since returning from California, CZ has been extremely busy.

It’s been nearly six months since his comeback. In 170 days, CZ posted 363 tweets. Although he stepped down as Binance CEO in November 2023, his enthusiasm for posting, attending events, and exploring new ventures has surpassed his time leading the exchange.

Recently, Binance announced a $2 billion investment from Abu Dhabi’s MGX. The “MUBARAK” meme, featuring a sheikh headdress, soared to a $157 million market cap through CZ’s frequent interactions. The sight of CZ, known for promoting “BUIDL” creating memes like a rotating BNB Chain animation has sparked intense debate.

This raises speculation: After quiting the title of “CEO of the world’s largest crypto exchange,” is CZ rebuilding his industry influence network with greater freedom?

The former Chinese crypto tycoon immediately resumed his “tech evangelist” persona post-release, vowing to focus more time and funds on charity/education while continuing to invest in blockchain/decentralization, AI, and biotech. But in a sluggish VC market, CZ hasn’t clung to the “BUIDL” narrative. Instead, he’s become the de facto “BNB Chain Community Manager” amid meme mania and netizen banter.

Return to Crypto: From DeSci Pioneer to Meme Master

CZ’s first major move was hyping DeSci (decentralized science), a sector combining blockchain and biotech that represents real-world applications on the chain.

In November 2024, CZ and Vitalik attended a DeSci conference in Bangkok, suddenly drawing hot money and media attention to this niche field. Binance Labs (now Yzi Labs) then invested in Bio Protocol, a project aiming to use blockchain for rightsizing scientific research data, transparent grant distribution, and commercialization revenue sharing.

Today, Yzi Labs explicitly mentions biotech investments on its website and Twitter. Four.meme, BNB Chain’s top meme launch platform, even offers DeSci tags for new tokens.

DeSci’s rise is attracting researchers, following the footsteps of DeFi (traditional finance professionals) and NFTs (artists). Scientists may now join Web3, bringing fresh narratives and growth.

Beyond sector investments, CZ extends his influence by engaging with market novelties.

Take meme coins: CZ evolved from dismissing their value to embracing them. His actions – from watching community FOMO over “Broccoli” naming rights to joking about TST paying for Binance logo usage, from launching a donation address sparking a meme donation trend to controversially promoting Ronaldinho’s celebrity coin, and finally to the Abu Dhabi-inspired MUBARAK – have created every major BNB Chain meme hit.

The MUBARAK saga showcases CZ’s masterclass in influence:

March 13: Binance announces MGX investment, CZ retweets with “mubarak”

March 14: Retweets “MUBARAK=CZ” meme

March 15: Posts Mubarak-themed GIF, causing 150% price surge

March 16: Buys 1 BNB of MUBARAK/TST, pushing MUBARAK to $100M+ market cap

This “tweet-community creation-on-chain action” trifecta directly converts CZ’s influence into market momentum. MUBARAK went from concept to $100M in 4 days with $88.1M daily volume but <$5M liquidity, demonstrating “attention = capital” in CZ’s meme economy. This contrasts with the “Broccoli” incident, where passive engagement briefly created $20M in hype. BNB Chain memes have now become a systematic attention-driven operation.

While CZ distances himself from direct meme coin involvement, his evolving stance reflects changing community dynamics and teaches top KOLs how to sustain ecosystem liquidity through “attention economics” during bear markets.

Venturing into Education: A Billionaire’s Social Transformation Initiative

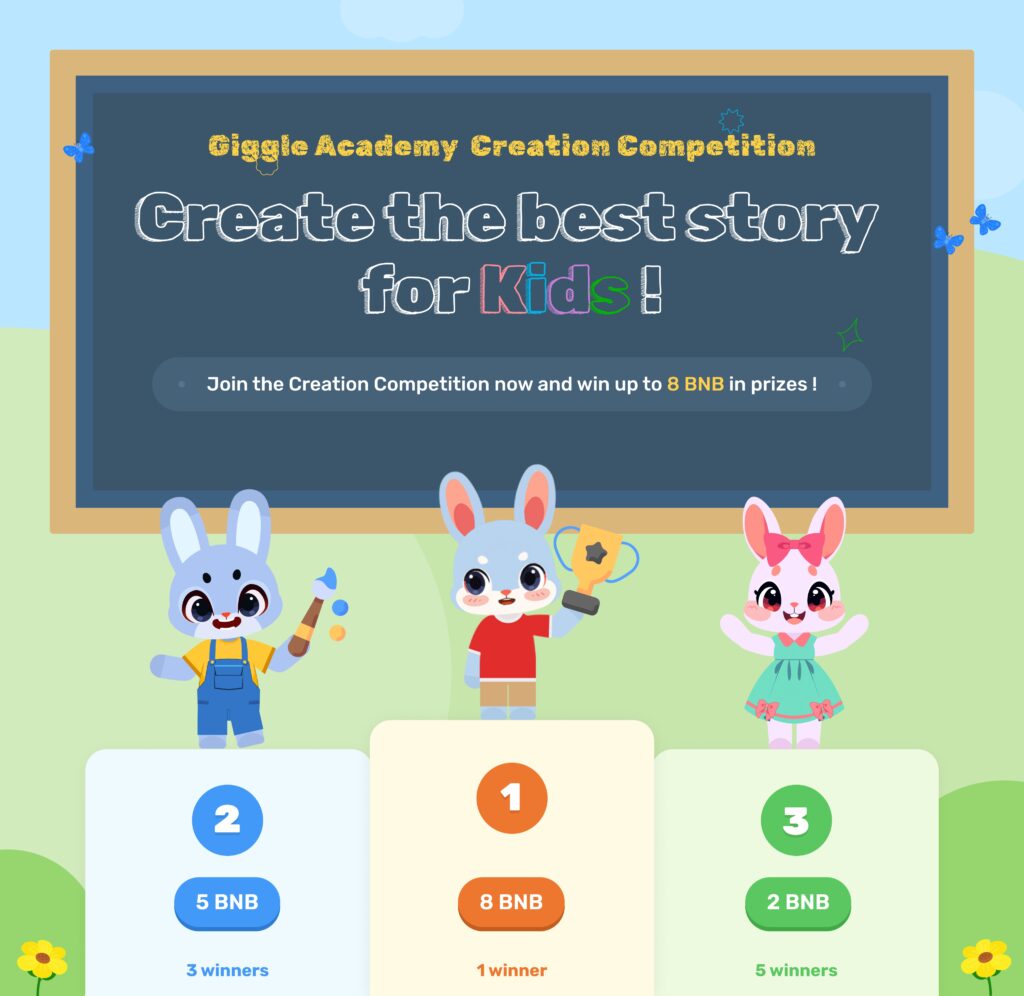

However, CZ’s most frequent advocacy is for Giggle Academy, his strategic re-entry project. On March 3, he celebrated reaching 6,000 users with “One kid at a time, times 6000 now.”

Launched March 19, 2024, Giggle Academy gamifies foundational education (math, literature, STEM, finance, coding, AI) using blockchain. It reimagines learning credentials through NFTs and on-chain badges.

The platform addresses two key issues:

Improving retention through gamification (23% longer daily usage than traditional e-learning)

Combating degree inflation by creating verifiable, tamper-proof learning records

CZ emphasizes, “Give a man a fish vs. teach him to fish. Education is the key to global inequality, and blockchain provides transparent solutions.”

Notably, Giggle Academy won’t issue tokens or use “Learn to Earn” models, distinguishing itself from speculative Web3 projects. Instead, it uses a referral rewards system based on points, not crypto. This “anti-Web3 bubble” approach reflects CZ’s pragmatic vision for blockchain-based education transformation.

Crypto Leadership: Balancing Industry and Individuality

In 170 days, CZ averages 2.135 daily tweets on X (37% more than CEO days), with over 60% focusing on trends, projects, and investment philosophies. This isn’t retirement leisure but a calculated identity reinvention – shifting from “exchange mogul” to “crypto ecosystem enabler.”

Pre-prison, as a crypto evangelist and centralized exchange leader under regulatory pressure, CZ explicitly avoided meme investments to maintain compliance. His persona was that of a “builder,” urging industry participants to focus on long-term development. He even admitted never using DeFi until February 23, 2024, when he posted about his first DEX experience, causing a stir.

Post-prison, after Binance settled with the DOJ and CZ left management, he became the de facto top influencer for BNB Chain and the broader Binance ecosystem. As BNB memes gained traction, market participants looked to CZ to lead the next ecosystem boom. His engagement evolved from cautious experimentation to systematic promotion.

However, CZ remains inseparable from his crypto empire. As Binance’s largest shareholder, he still influences major decisions. His statements can cause market fluctuations, highlighting the “same source of profit and risk” inherent in his Binance-derived influence.