We’re Ready.

Dear Bankless Nation,

Every single year, EthCC gets a bit bigger, a bit more organized, and way more productive. The signal from EthCC this year was particularly strong!

EthCC is a unique conference. It’s one of the oldest and most well-run Ethereum conferences that we have. So here we are, post-EthCC 2023. The noise of the bull market is behind us. The tourists are gone and only the settlers remain.

So… where are we now, halfway through 2023? With EthCC offering such a strong checkpoint in the arc of Ethereum and crypto broadly, I’ve taken a moment to take stock of my main reflections and takeaways from the endless supply of conversations at EthCC 2023.

Let’s take a look at a few of the biggest theses I’m tracking! 👇

Protocols are turning into commodities

tl;dr By the time the next bull market rolls around, there will be no shortage of compute and cheap storage for Web3. We’ll be ready to host the world.

With the Dencun upgrade just around the corner, the Ethereum community is gearing up for the hardfork that finally introduces a massive scalability upgrade in EIP4844 (aka protodanksharding) giving Ethereum rollups access to a new cheaper form of blockspace on the L1 called ‘blobspace’. This long-awaited upgrade allows these L2s to finally become the most scalable versions of themselves.

This upgrade marks a moment in crypto’s development where we are approaching theoretical minimums of crypto-economic resource costs. It’s not just Ethereum either, many different protocols are all seemingly approaching final forms in which they’ve minimized the cost to access whichever resource they’re optimizing for.

“Data availability” is the leading category – the type of resources that EIP4844 and alternative data availability solutions address. For the first time, Ethereum’s blockspace is becoming cheap! But Ethereum isn’t the only protocol optimizing for cheap data availability. Celestia, Avail, and EigenDA are all data availability protocols exogenous to Ethereum, which are scaling blockchains to levels we never thought possible just a few years ago!

It doesn’t stop at data availability. Espresso Systems had a glowing reception at the largest EthCC side-event, the Modular Summit. With their shared sequencer testnent and Eigenlayer partnership, Espresso isn’t waiting for L2s to each build their own shared-sequencer system, instead focusing on one thing and one thing only: optimizing shared sequencing.

Over in the zkRollup world, the ‘prover’ is the critical component that enables end-users to verify the validity of the zk-proof that scales zk-rollups. zkSync released their ‘Boojum’ upgrade, which boasts proofs capable of running on mid-to-high-end gaming GPUs. The significance here is that provers are now capable of running on consumer hardware rather than highly specialized enterprise-grade machines, meaning zk-proofs can more meaningfully decentralize these networks.

These were only a few of the announcements that came out of EthCC, so apologies to all the teams building things that deserved to be included here! The few I highlighted represent just how far we’ve come in lowering the resource requirements to host and maintain trustless compute networks. There’s plenty left to do on this front, but for the first time we are able to see a finish line, and many teams are racing there as quickly as possible.

Protocol convergence and verticalization

tl;dr – DeFi apps are discovering that their logical conclusion is a vertically-integrated superapp through which they supply a suite of services. Some of these apps are beginning to look a lot like each other. L2s all have their SDKs for scaling out new chains – the last missing pieces are chainbuilders and blockspace consumers (aka, apps)

Aave, the money-market, now has a decentralized stablecoin GHO. MakerDAO, the decentralized stablecoin, now has a money-market “Spark”. Frax has already been developing their own stablecoin-money-market-LSD ecosystem vertical for over a year now. These three protocols are experiencing some strong convergent evolution towards the same basin of attraction, and are now all competing in the same areas: TVL, stablecoin supply, and – most importantly – fees.

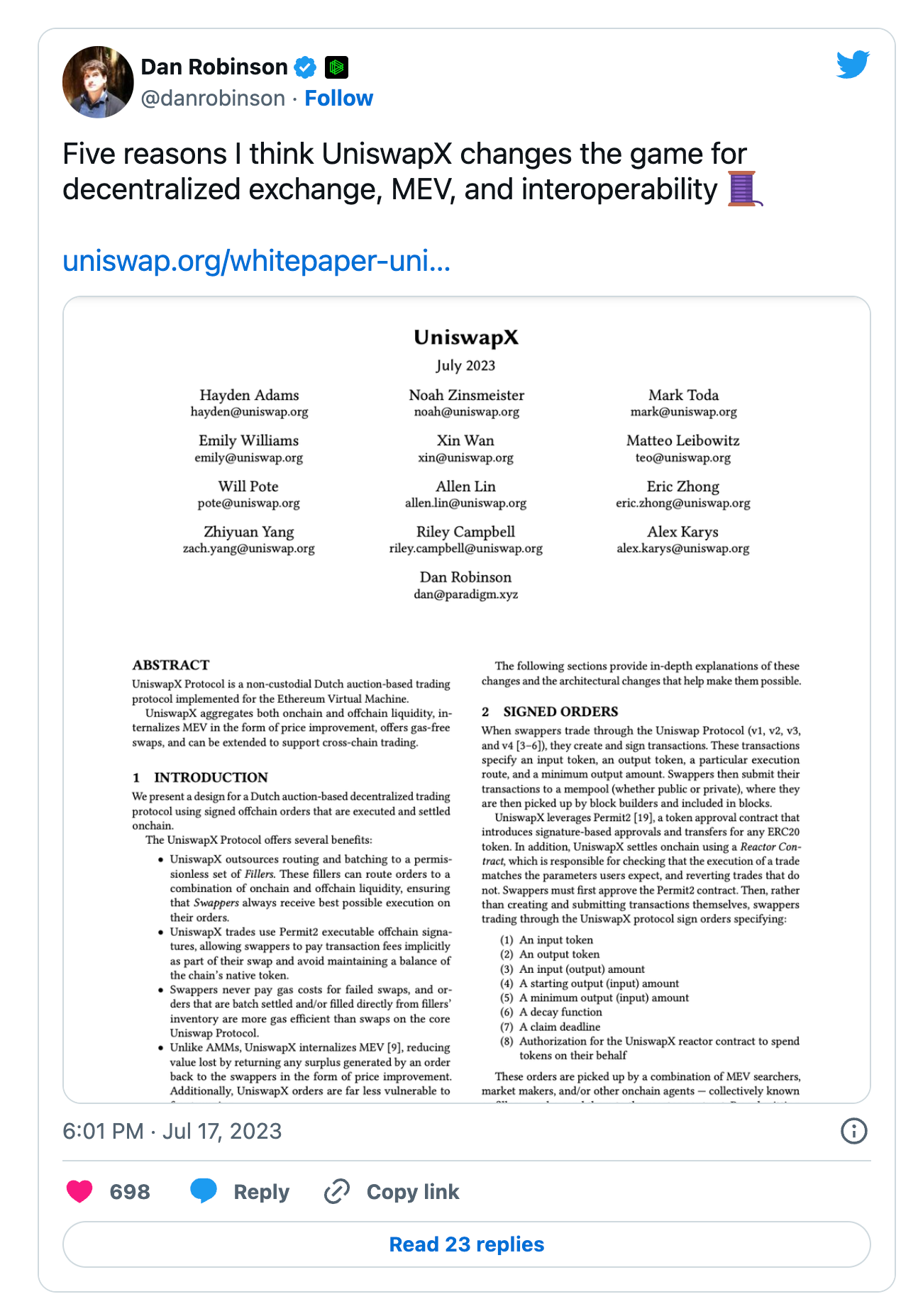

Just take a look at the launch of UniswapX, a free-market competition-based order fulfillment protocol to facilitate best-possible decentralized order execution, that can also act as a bridge-abstraction layer by allowing the free market to choose their own solution for how to fulfill cross-chain DEX swaps – i.e. I have Token A on Chain 1 and want Token B on Chain 2, so who can give me the fastest, bestest rate?

My interpretation? UniswapX is the yin to the Uniswap AMM’s yang.

Uniswap’s iterations each increased in complexity; with v4’s addition of hooks, there is increasingly no guarantee of Uniswap AMM pool homogeneity. With the number of chains hosting potential Uniswap deployments also expanding, the order-routing optimization problem is becoming too unwieldy to be corralled by a rigid on-chain smart contract system. UniswapX builds a new vertical that harnesses whatever complexity Uniswap V1-V4 can throw at it, by simply allowing order execution and fulfillment to be done off-chain, with the minimum-viable-proof being made to ensure correctness.

Here’s a useful thread from Dan Robinson on the UniswapX design – or just wait for the podcast we’re recording soon!

Even after all of that, the L2 ecosystem still takes the cake on rapid convergence of similar design patterns.

- We got the OP Stack from Optimism

- Then we got Orbit from Arbitrum

- zkSync released the ZK Stack

- And finally, with Polygon 2.0, we now have Supernets

Just like the L2s themselves, they’re all a little different. They each have their own strategy. But they’re all effectively going after the same vision that eventually there will be as many chains spawned from Ethereum as webpages spawned from HTTPS.

So, which standard is going to produce a Cambrian explosion of chains?

Optimism is unequivocally in the lead here, with three large chains and a smattering of minor ones. Polygon has ImmutableX. Arbitrum has Nova (albeit, internally produced), and while the ZK-stack is still looking to land its first large-scale adopter, more than a few startups have reported their choice of the ZK Stack to build their custom ZK chain.

This, along with the Base mainnet coming sometime early August, is setting up Ethereum for the L2 summer that we’ve been crossing our fingers for since 2021.

Focusing on consumers

tl;dr – Our protocols are maturing to the point of consumer readiness. At the same time, our regulatory battles are cleaning up the industry and paving the way for increased adoption of crypto rails at higher levels in commerce, business, and society.

If you’ve read this far, you’ve hopefully gathered how far along our protocols and infrastructure are. I declare that the protocol and infra sides of crypto are… solved problems. There is surely plenty left to do here, but exploring and settling this frontier has turned into a science. The frontier of crypto protocol development, for the first time in crypto’s history, is at a level of maturity that allows us to see the endgame.

So now, with all of those big hard problem behind us… won’t somebody PLEASE build some apps?

- L2s have supplied more blockspace than we’ve ever needed before!

- Data costs are approaching their minimums!

- Latency and responsiveness are better than ever!

- It’s time to build apps again!

Who is going to consume all of the L2 blockspace? Now that we have an ample supply of cheap and secure blockspace, let’s start doing something with it. But, let’s not stop at blockchain apps! Let’s go even higher up the stack and start productizing these systems! Won’t someone think of the consumer?

It’s time to go to market – as an industry.

Let’s build consumer-facing apps. Let’s hire crazy talented UX/UI designers whose job it is to service those without private keys, or those who only have their funds on Coinbase or Kraken. Let’s build applications for users who have never touched a blockchain before.

Our protocols are becoming sufficiently cheap that their use can become subsidized by user acquisition. With cheaper and cheaper blockspace, new revenue models can begin to subsidize user transactions on our increasingly cheap L2s.

A small but growing number of people have identified this current meta that we are in, and I’m hoping this post can emphasize this for the rest that haven’t figured this out yet. We’re (basically) done. Our protocols are ready. Let’s start doing the hard stuff of user research, clever abstraction mechanisms, and consumer-ready applications.

Looking for some examples of this energy emerging out of the ether? Check out Gnosis – they debuted Gnosis Pay and Gnosis Card at EthCC.

In the Gnosis ecosystem, there is now:

- Gnosis Safe (your high-security crypto vault)

- Gnosis Chain (high-speed L2 zkEVM Polygon Supernet)

- Gnosis Pay (Payments-focused chain built on Gnosis Chain)

- Gnosis Card (Fintech payments on top of Gnosis Pay)

With Gnosis, we now have a world of trad-payments in the front with crypto protocols in the back. It’s truly a “buy your coffee with crypto” backend that has been discussed since the inception of Bitcoin. It’s up to Gnosis to turn this into something uniquely competitive to traditional payments, but it’s worth noting that our infrastructure is now capable of spanning the Web3/TradFi gaps.

At the same time that Ethereum is entering its era of consumer-readiness, crypto is fighting some of our largest regulatory battles ever. I don’t see these things as coincidences – the universe has a funny way of timing things.

Once we’re on the other side of all of these regulatory trials… once we’ve finally defeated Gary Gensler, reformed the SEC, won our right to fairly issue tokens, and gotten quality legislation approved through Congress, crypto will be in the most regulatory-friendly state that it’s ever been in. Right now, crypto is currently “doing the hard things” on the regulatory front. We’ll never be accepted by larger players until we’ve gone toe-to-toe with the regulators and legislators, and come out the other side with a stamp of approval.

You can’t kill crypto, so going through this regulatory battle is bullish no matter what. We’re going to come out intact and approved. We’ll have won some critical court battles, scammers and fraudsters will have had their reckoning, the good guys will once again be in the driver’s seat, and large external players will have the green light that it’s safe to play in Web3.

https://platform.twitter.com/embed/Tweet.html?dnt=false&embedId=twitter-widget-0&features=eyJ0ZndfdGltZWxpbmVfbGlzdCI6eyJidWNrZXQiOltdLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X2ZvbGxvd2VyX2NvdW50X3N1bnNldCI6eyJidWNrZXQiOnRydWUsInZlcnNpb24iOm51bGx9LCJ0ZndfdHdlZXRfZWRpdF9iYWNrZW5kIjp7ImJ1Y2tldCI6Im9uIiwidmVyc2lvbiI6bnVsbH0sInRmd19yZWZzcmNfc2Vzc2lvbiI6eyJidWNrZXQiOiJvbiIsInZlcnNpb24iOm51bGx9LCJ0ZndfZm9zbnJfc29mdF9pbnRlcnZlbnRpb25zX2VuYWJsZWQiOnsiYnVja2V0Ijoib24iLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X21peGVkX21lZGlhXzE1ODk3Ijp7ImJ1Y2tldCI6InRyZWF0bWVudCIsInZlcnNpb24iOm51bGx9LCJ0ZndfZXhwZXJpbWVudHNfY29va2llX2V4cGlyYXRpb24iOnsiYnVja2V0IjoxMjA5NjAwLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X3Nob3dfYmlyZHdhdGNoX3Bpdm90c19lbmFibGVkIjp7ImJ1Y2tldCI6Im9uIiwidmVyc2lvbiI6bnVsbH0sInRmd19kdXBsaWNhdGVfc2NyaWJlc190b19zZXR0aW5ncyI6eyJidWNrZXQiOiJvbiIsInZlcnNpb24iOm51bGx9LCJ0ZndfdXNlX3Byb2ZpbGVfaW1hZ2Vfc2hhcGVfZW5hYmxlZCI6eyJidWNrZXQiOiJvbiIsInZlcnNpb24iOm51bGx9LCJ0ZndfdmlkZW9faGxzX2R5bmFtaWNfbWFuaWZlc3RzXzE1MDgyIjp7ImJ1Y2tldCI6InRydWVfYml0cmF0ZSIsInZlcnNpb24iOm51bGx9LCJ0ZndfbGVnYWN5X3RpbWVsaW5lX3N1bnNldCI6eyJidWNrZXQiOnRydWUsInZlcnNpb24iOm51bGx9LCJ0ZndfdHdlZXRfZWRpdF9mcm9udGVuZCI6eyJidWNrZXQiOiJvbiIsInZlcnNpb24iOm51bGx9fQ%3D%3D&frame=false&hideCard=false&hideThread=false&id=1683265848612618240&lang=en&origin=https%3A%2F%2Fwww.bankless.com%2Fdavid-ethcc-2023&sessionId=70795c5c2fe071fb642a941f7ee2184aad3b1c26&theme=light&widgetsVersion=aaf4084522e3a%3A1674595607486&width=550px

Modular Summit vs EthCC

tl;dr – The modular ecosystem is a coalition of many different teams and projects that make up the Web3 stack – and it’s found its groove solving hard problems faster than the multi-chain ecosystem can present them.

The Modular Summit, hosted the Friday and Saturday after EthCC, was sufficiently large and intellectually rich enough for the descriptor of ‘EthCC side event’ to not do it justice.

EthCC has always been a welcome home to the Cosmos ecosystem and the developer rigor that it has attracted. That same energy has morphed into the modular side of crypto, which Ethereum is both a part of, and distinct from.

I call this corner of the crypto ecosystem the ‘begrudgingly Ethereum-aligned’ side of crypto, where the modular pieces of infrastructure naturally find useful homes in the Ethereum landscape, but so many of these platforms would have totally enjoyed sitting on the monetary throne if ETH hadn’t already completely filled that seat (Celestia, Cosmos 😏).

But I’m letting my tribalism get the best of me here – after all, modularism > maximalism 😆

It’s funny to see the different archtypes that find the modular community home and resonate with it more than the 100% purely Ethereum crowd. It’s also interesting to see these communities naturally come together, as the technology form factors pair so well. Ultimately, Ethereum will come to absorb all the useful modules that the modular community will produce – ’tis the nature of the system to aggregate all useful open-source code into one single superstructure.

Without question, the modular ecosystem is blazing into new technological frontiers faster than any other space in crypto. This should make sense – modularity means focusing resources on one single problem, rather than spreading out and trying to tackle multiple frontiers at once. The intellectual rigor being expressed by this corner of crypto has attracted all of the brightest minds in the space. I think you can expect great things coming from this corner of the industry.

The Bankless meetup!

Huge shoutout to all of the Bankless citizens that came to our meetup at EthCC!

We sadly didn’t think to capture a photo of the entire squad (just the team photo below), but being at our own private venue (with plants!) where everyone was there under the same context was a welcome respite from the hectic conference energy.

The next Bankless meetup at Permissionless is going to be our largest yet! Permissionless is the home of IRL Bankless, since it’s the only conference that Ryan actually goes to and the spiritual anniversary of when we actually met for the first time.

Next stop: Permissionless

There are TWO (2) conferences left for me this year. Permissionless (September, Austin) and Devconnect (November, Istanbul).

Permissionless is the ideal balance between a well-refined operational conference machine that has been Blockworks’ flex since inception, mixed with the crypto-nativeness that both Bankless and Blockworks brings to the content tracks being hosted there. If there’s just one conference to go to every year, it’s Permissionless. It’s the perfect stepping stone into diving deeper into the world of in-person events – newcomer friendly, crypto-native, and a ton of fun.

Devconnect is going to be buzzing too. Devconnect is the younger sibling to the well-established Devcon, the only two events organized by the Ethereum Foundation. This event is truly meant for the Ethereum researchers, protocol devs, and those working on the hardest of problems in this space. But naturally, that focus attracts many to come and nerd-out with the rest of Ethereum.