by Tanay Ved & Kyle Waters

Not Your Keys, Not Your Coins

The fall of FTX in early November 2022 sent shockwaves across the crypto industry. The misappropriation of user funds, commingled balance sheets and misuse of its own token (FTT) as collateral led to a calamitous series of events. The fallout was further amplified by a daisy chain of intertwined entities. FTX was the type of centralized entity that is referred to in the digital assets industry as a centralized exchange (usually with the acronym “CEX”), as it facilitated the trading of digital assets with a central limit order book and held user funds in its own wallets. But an emerging phenomena in the last few years has been the rise of decentralized exchanges (DEXs) that use on-chain smart contracts to automatically determine trade prices—without the need for an intermediary and central order book. Attention has recently fallen on these decentralized counterparts, as they highlight the value proposition of autonomous and permissionless trading infrastructure in contrast to trusted entities.

Through this issue of State of the Network, we seek to explore usage and adoption trends of decentralized exchanges after the downfall of FTX. DEXs like Uniswap, Sushiswap and Curve have formed a key pillar of the decentralized finance (DeFi) ecosystem—enabling the trading of crypto-assets through smart contracts and automated market makers (AMM). Using data from Coin Metrics’ DEX data feed, we examine the underlying activity on Uniswap and Sushiswap to understand usage of this trading infrastructure.

Volume Trends

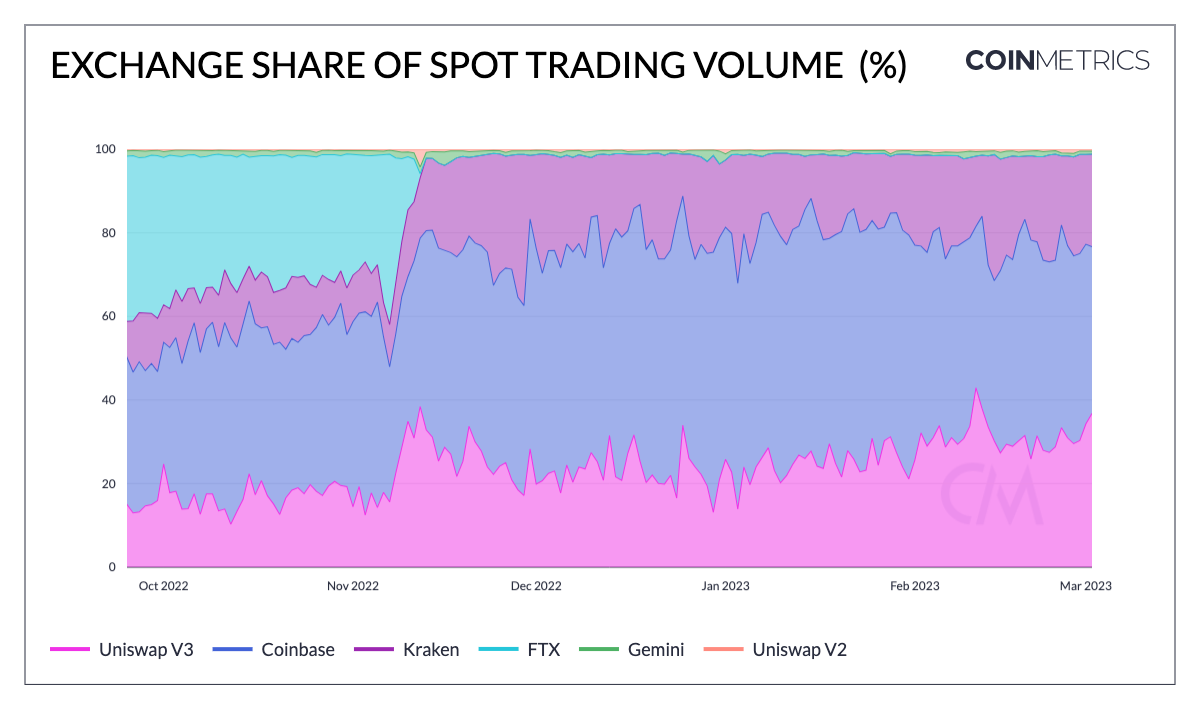

Trading volume is a crucial metric in determining activity on exchanges. Looking at the chart below, FTX’s large presence prior to its collapse is evident with its spot market share falling flat from nearly 35% in early October. With the omission of Binance— which facilitates the lion’s share of volumes (~80%), Coinbase has filled the void and holds ~50% market share followed by Uniswap V3’s share rising to over 30% since the FTX fallout.

Source: Coin Metrics Market Data Feed

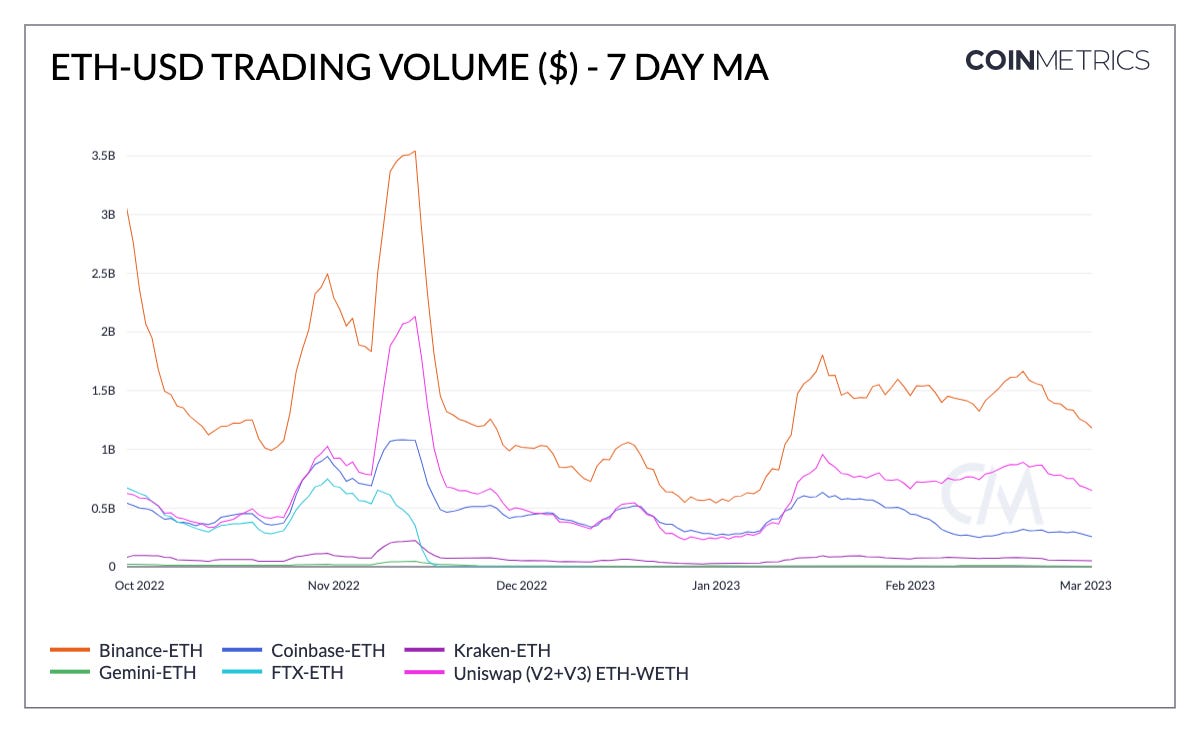

The chart below measures the 7-day moving average of ETH-USD spot volumes on selected exchanges against Uniswap V2 and V3’s cumulative volumes. Binance’s dominance is immediately visible with ETH-USD trading volumes reaching $3.5B during the FTX fallout and now hovering at ~$1.5B. Volumes on Uniswap more than doubled during the event and have gained some steam to begin the year ranging between $650M – $900M and peaking in line with high volume on CEX’s. It’s also interesting to note the gap between Coinbase and Uniswap widening to ~$400M after being in lockstep during parts of the 5-month period. Overall, daily trading activity on CEX’s and DEX’s indicate a strong correlation driven by market participants on these venues.

Source: Coin Metrics Market Data Feed

Usage & Adoption

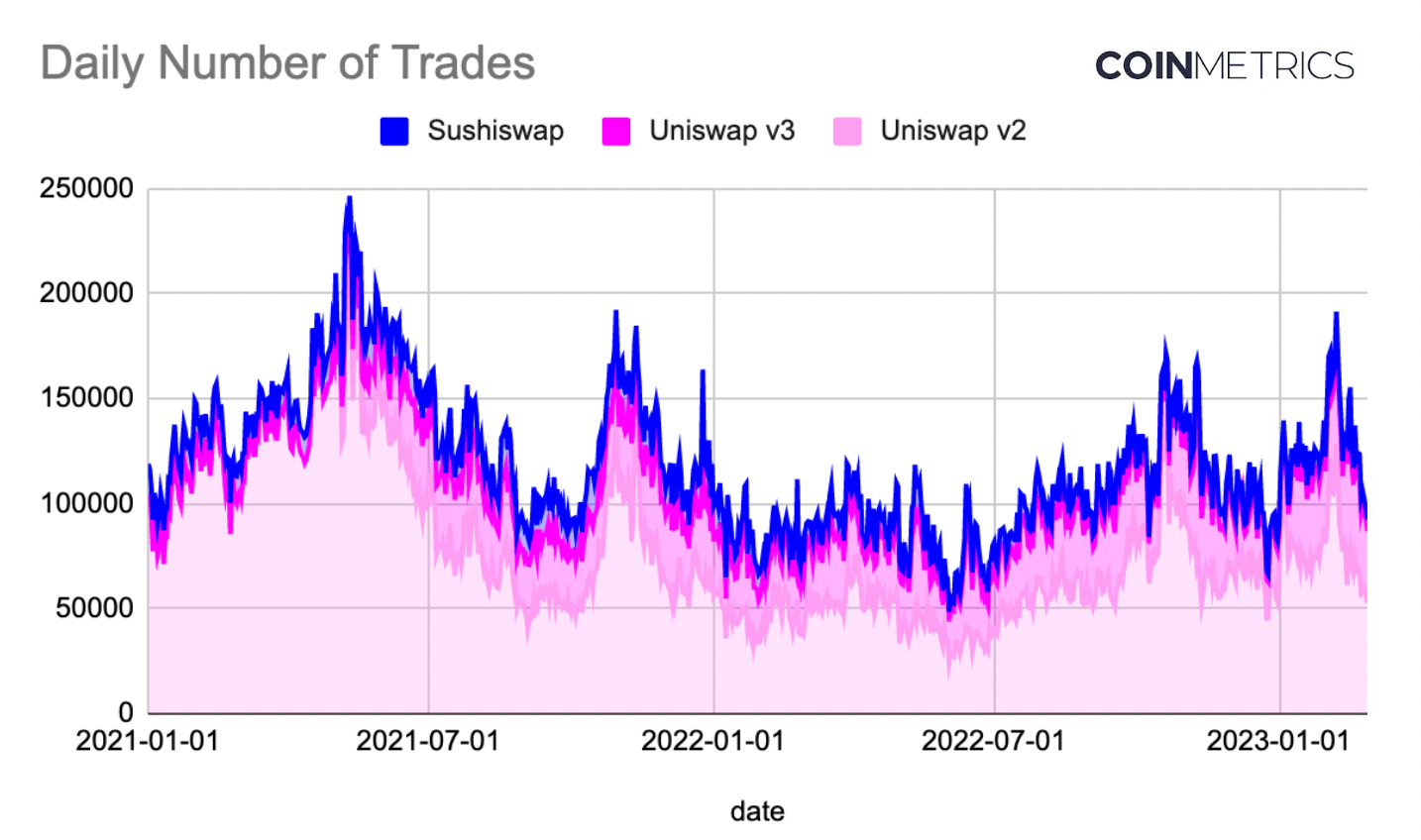

On a larger timeframe, daily trades on Uniswap and Sushiswap peaked at ~250k in May 2021, coinciding with volatility induced from a marketwide drawdown. Usage on DEX’s remained low during the summer of 2022, impaired by the UST/Luna fiasco. As news of FTX’s insolvency gained steam in November, DEX usage experienced a significant increase, but did not sustain at those levels likely due to a result of volatility driven trades. Daily trades this year, however, have been off to a strong start—peaking at ~200K.

Source: Coin Metrics Market Data Feed

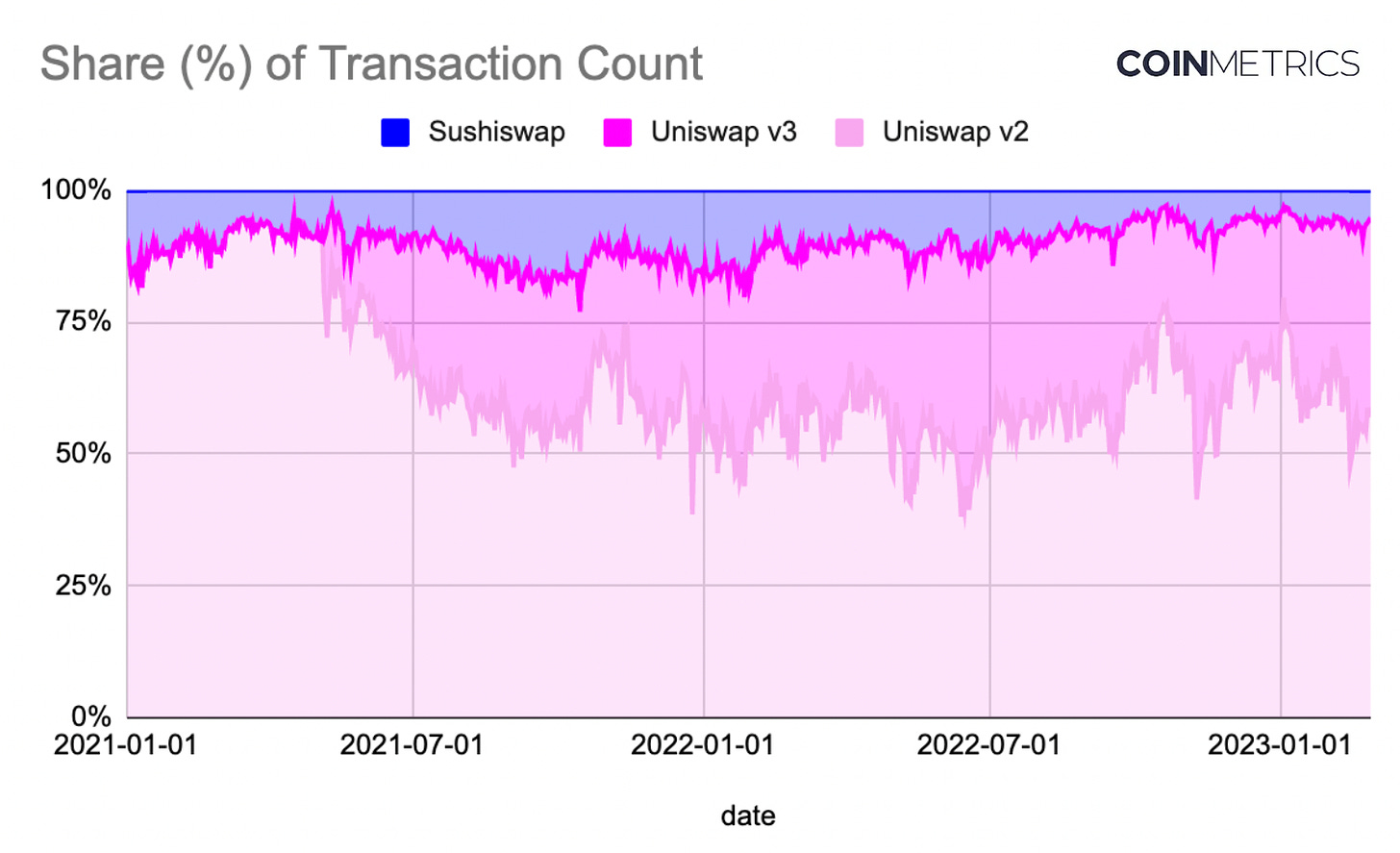

The share of DEX transaction counts also paints an interesting picture. Although Uniswap V2 holds a larger share of transaction quantity (50%) in comparison to its third iteration V3 (30%), trading volumes on Uniswap V2 pale in comparison to its counterpart. Significantly larger trading volumes in USD terms seen on Uniswap V3 indicate greater participation of whales (individuals/entities with larger holdings) attributable to its concentrated liquidity model. With users having to actively manage liquidity within custom price ranges, the new model is less suited to passive liquidity providers. The market share of Sushiswap, on the other hand, has seen a gradual decline.

Source: Coin Metrics Market Data Feed

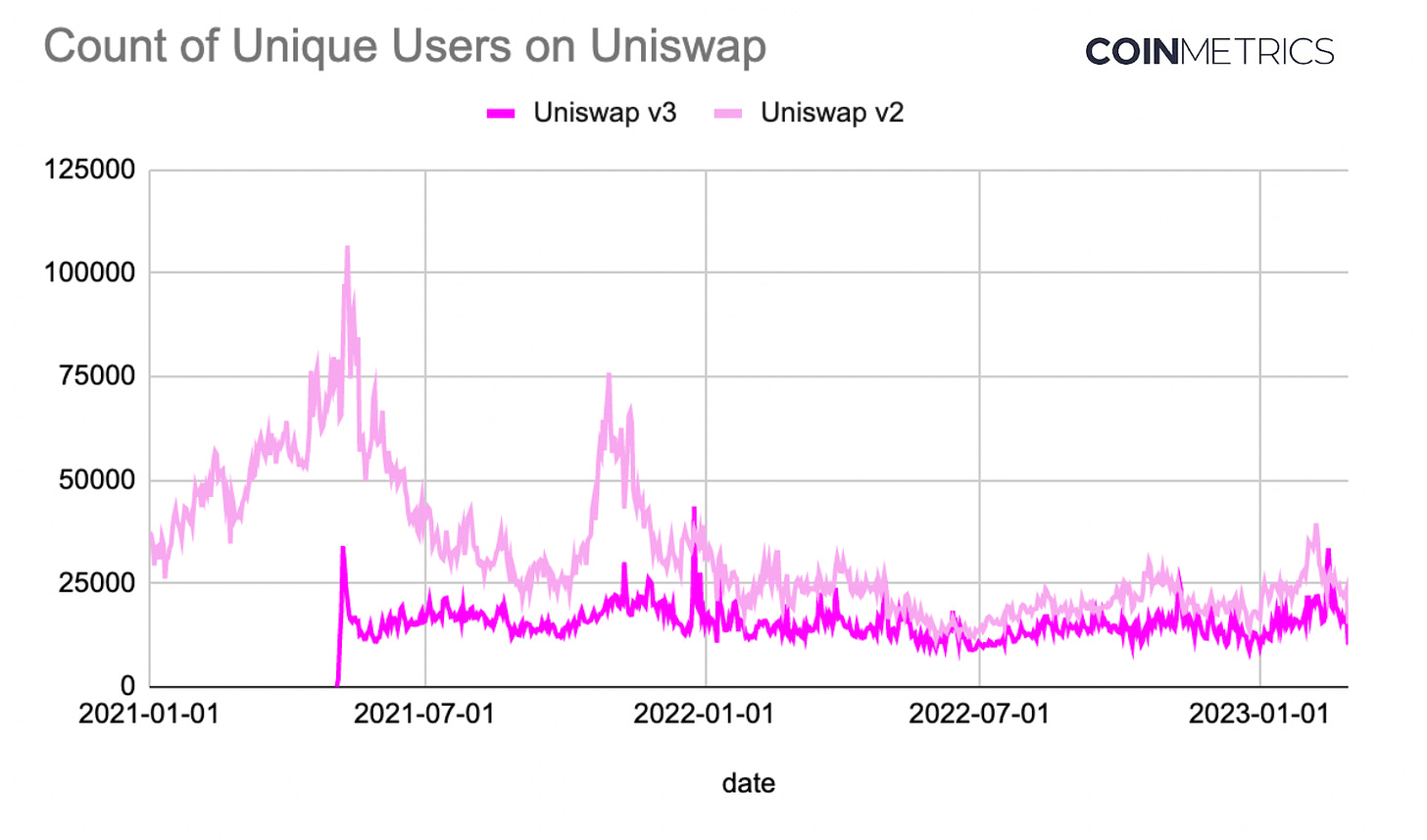

The count of unique daily users also supports this observation with a higher number of distinct addresses trading on Uniswap V2. The number of users have declined since May 2021 and haven’t experienced a noteworthy increase after the FTX fallout.

Source: Coin Metrics Market Data Feed

Transactions in a Low Fee Environment

It’s also important to factor in Ethereum gas fees, as they play a crucial role in dictating swap sizes. Users attempting to make small trades in a high fee environment tend to get priced out, presenting a barrier to greater adoption on Ethereum mainnet. As seen in the chart below, which shows the bottom 5th percentile of daily swap size in the WETH-USDC 0.05% pool against the average transaction fee ($), a close relationship between fees and swap sizes is noticeable. This dynamic, along with the proliferation of Layer-2 networks has seen DEX activity increase on Arbitrum, Polygon, and Optimism due to the lower fees on these networks.

Sources: Coin Metrics Market Data Feed & Network Data

The Role of Futures Exchanges

With FTX’s specialization in futures and derivatives trading, decentralized perpetual exchanges such as GMX and dYdX also saw an increase in volumes and users. Although this sector has newer entrants and hosts a relatively lower number of users in comparison to decentralized spot exchanges such as Uniswap, they present a promising area to capture growth as market participants look to trade sophisticated financial instruments using non-custodial infrastructure.

Conclusion

Our analysis of fundamental DEX metrics 4 months after FTX’s collapse do not yet reveal an immediate shift in user behavior and adoption. Having said that, the fall of FTX has created greater awareness of the resiliency offered by on-chain alternatives, and their ability to retain liquidity of user funds without an intermediary.

DEXs are critical pieces of open-source software that sit at the center of the core DeFi value propositions of composability, programmability, transparency, and permissionless access. By simply being open-source code, DEXs are deployed with ease on Layer-2 (L2) networks such as Arbitrum, Optimism, and Polygon where fees are cheaper and expand use cases. It is likely that Coinbase’s recently announced BASE L2 network will also be a positive catalyst for DEX usage. Moreover, enabling the trading of tokenized real-world assets (RWA’s) also presents an impetus for increased adoption by widening access to more participants from traditional finance. With these developments in play, decentralized exchanges are poised to continue their growth as essential trading infrastructure.