How do we create sustainable cash- or value-flow for tokenized communities? This essay outlines 9 strategies and their pros and cons.

Forefront is particularly interested in the incubation, development, and opportunity of tokenized communities: DAOs primarily concerned with the funding of community projects to proliferate a brand or mission.

However, how tokenized communities reach economic sustainability is not prescribed by their form. Over the last few years, we’ve seen communities experiment with various economic models, each with their own benefits and drawbacks.

This piece aims to outline the 9 economic models for community sustainability used across the ecosystem, and briefly discusses their history and ideal use cases.

Treasury Diversification

Treasury diversification refers to the process by which a DAO votes to sell tokens to investors at a fixed rate in exchange for stablecoins like USDC or other liquid assets like ETH. This model allows the DAO to accumulate a diversified treasury, which can be used to fund various projects and employees, manage liquidity, and provide a financial buffer for the community. Without money in the DAO, tokenized communities have no funds to allocate to community projects to kick off the flywheel.

This model proved to be the most straightforward path to liquidity for many communities. Early tokenized communities, like FWB, Forefront, Cabin, and more, all conducted at least one “treasury diversification round,” involving both angels and institutional venture investors. While the influx of capital was necessary for the DAOs’ respective survival, it’s clear that fixed token sales created unideal dynamics for the long-term development of the DAO, and inflexibility in the token models.

For example, selling tokens at a fixed rate may not always reflect the true market value of the token, potentially leading to undervaluation or overvaluation. Additionally, reaching consensus among decentralized community members on the appropriate rate and timing for selling tokens can be challenging, which may slow down the decision-making process.

Introducing new stakeholders who may not actively participate in the DAO can create negative incentives for the community at large, as these investors may prioritize exponential returns on their investments over the long-term success and stability of the DAO. This misalignment of incentives may lead to conflicts of interest and put pressure on the community to make decisions that cater to investor demands rather than the broader community’s well-being.

Additionally, institutional investment in a specific token, especially early in the lifecycle of a community, restricts that community’s ability to introduce alternative token models that may be better fits long-term. This is seen in FWB’s recent Membership NFT proposal, which incorporates ERC20s in part because of the investment expectations of the ERC20 during treasury diversification rounds.

Perpetual Auctions

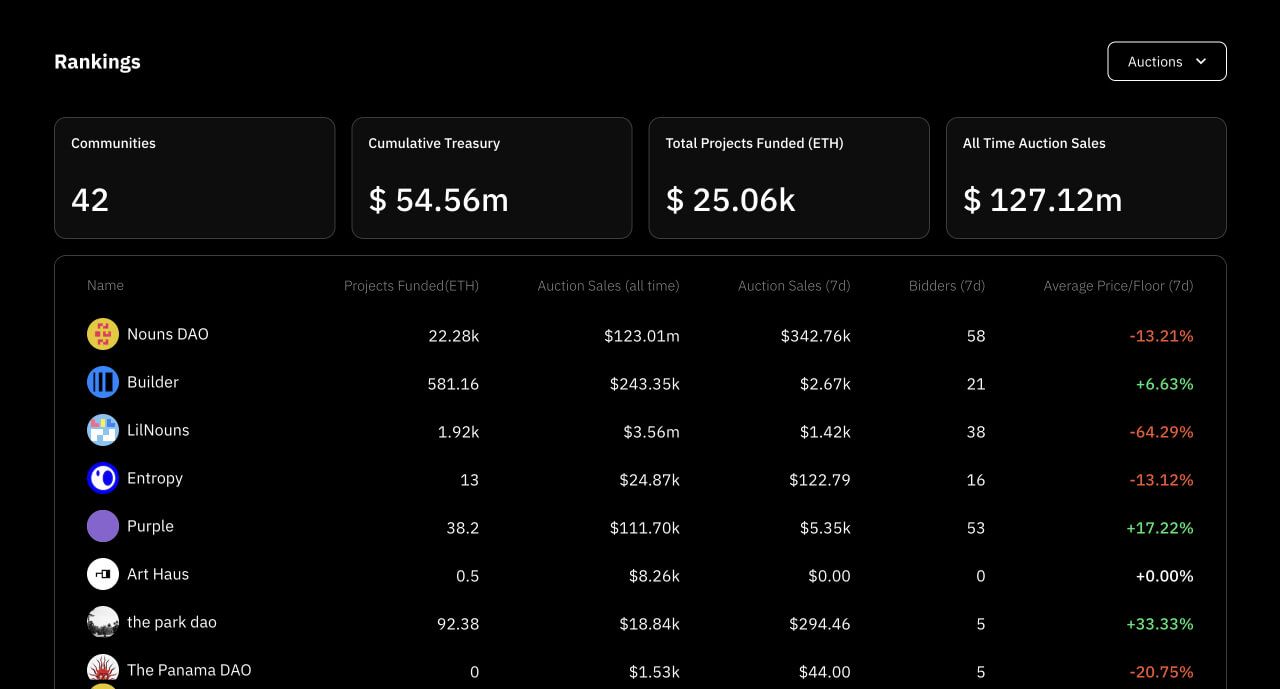

Perpetual auctions involve continuous token sales, with a fixed percentage of newly minted tokens being sold at regular intervals to raise funds for the DAO. Nouns DAO is an example of a tokenized community that utilizes perpetual auctions to generate revenue. Nouns DAO mints and auctions off a unique NFT, called a “Noun,” every day, with the proceeds going to the DAO’s treasury.

Perpetual auctions can offer a predictable and transparent pricing mechanism, helping to attract investors and maintain a healthy market for the token. In the case of Nouns DAO, the daily auction of Nouns creates an ongoing revenue stream and a sense of urgency for potential buyers. Perpetual auctions also have the advantage of building a community slowly over time, rather than having thousands of governance participants on day one. This gradual growth allows for more manageable and meaningful participation in governance, fostering stronger connections and engagement within the community.

Furthermore, perpetual auctions enable the DAO to capture the additional value generated over time, even years after the project is launched. Unlike treasury diversifications, which are based on a set price at a single moment in time, perpetual auctions allow the value captured by the DAO to grow alongside the community’s popularity and productivity, ensuring a more sustainable and adaptable revenue stream.

Various “nounish” DAOs have experimented with different cadences for perpetual auctions. Lil Nouns auctions off a token every 15 minutes, and Public Nouns auction occurs every 12 hours.

One of the main drawbacks of perpetual auctions is the lack of initial capital, as funds are raised over time through ongoing auctions. This can limit the DAO’s ability to invest in larger projects or address immediate financial needs. Another challenge is maintaining attention over time to keep the auction alive. As the novelty of the auctions wears off, the community may struggle to generate consistent interest and participation, potentially leading to diminishing returns and reduced funding for the DAO. We see this clearly in the data: the vast majority of nounish DAOs have struggled to maintain auction activity past a certain (relatively short) time threshold.

Additionally, the reliance on continuous token sales may lead to overvaluation or speculative behavior, causing instability in the token’s price.

Subscription Access Tokens

In this model, members purchase subscription tokens that grant access to premium content, services, or features within the DAO. Subscription access tokens can draw parallels to traditional community and media subscriptions, where members pay a recurring fee for access to exclusive content or benefits. However, one key advantage of subscription tokens is their portability across platforms, allowing users to enjoy the benefits of their subscription in various contexts within the broader decentralized ecosystem.

Subscription access tokens can encourage users to participate more actively in the community, driving value and fostering growth. The portability of these tokens across platforms allows for greater flexibility and increased value for users, as they can access premium content and services across multiple interconnected platforms.

Many media-focused communities, such as Folklore, Water & Music, and more, have implemented robust subscription access token models, each giving various levels of access throughout their ecosystems. Both communities have committed to “seasonal” subscriptions to encourage community activity over longer time horizons.

On the other hand, the subscription model may exclude potential members who are unable or unwilling to pay for access, limiting the overall reach and diversity of the community. Currently, it is difficult to create automatic recurring purchases on-chain, which may limit the ease of use and adoption of subscription tokens. However, this issue is expected to be addressed with the introduction of new account abstraction capabilities, enabling more seamless and user-friendly subscription management within the blockchain ecosystem.

Lifetime Membership Tokens

Lifetime membership tokens grant holders permanent access to the DAO and its benefits. This model can help to raise funds upfront and encourage long-term commitment from members.

Lifetime membership tokens can create a sense of loyalty and dedication among members, potentially increasing the stability and longevity of the community. Membership is deeply rooted given the perceived commitment.

On the other hand, the one-time payment structure may not provide a sustainable revenue stream for the DAO, and early adopters may have disproportionate influence over decision-making. A significant drawback of lifetime membership tokens is their inability to capture value over time, particularly if a community starts providing new services or content that is of much greater value than the original membership price. This may result in an imbalance between the value provided to members and the revenue generated for the DAO.

Perpetual auctions, in their current state, can be seen as a form of lifetime membership. As tokens are continuously sold through perpetual auctions, once a user acquires a token, they gain permanent access to the DAO and its benefits. However, unlike traditional lifetime membership tokens, perpetual auctions have the potential to capture value over time, as the continuous auction process adjusts to the community’s popularity and productivity. This allows the DAO to generate revenue that is more reflective of the value it provides to its members, ensuring a more sustainable and adaptable funding model.

Lifetime memberships are also often used in conjunction with subscription access tokens. For example, Dirt has both lifetime “Founders Passes” and more seasonal memberships.

DAO Drops and Open Editions

DAO drops refer to any media, product, or collectible released by the DAO itself, with the release generally being collectively voted on and happening on-chain. These drops can generate revenue for the DAO through sales and royalties, while also fostering user engagement.

Open editions are a specific type of DAO drop, where the DAO chooses to mint a specific NFT as an open edition, allowing for an unlimited number of collectibles to be minted during a specified time frame. Similar to DAO drops, open editions also generate revenue through sales, with the funds returning to the treasury and potentially to other stakeholders if approved by the DAO.

DAO drops and open editions can incentivize token holding, create excitement, and drive demand for the token and associated collectibles. By directing the funds generated from these sales back to the treasury, the DAO can further fund its initiatives, ensuring a sustainable revenue stream.

Still, overreliance on DAO drops and open editions may lead to market saturation, reducing the perceived value of the collectibles over time. Additionally, the success of these drops depends heavily on the community’s ability to consistently produce attractive and valuable media, products, or collectibles, which may become increasingly challenging as the market evolves and competition grows.

This model is further discussed in “Releasing as a DAO.”

Protocol Fees

In this model, the DAO generates revenue by charging fees for the use of its protocol or platform. These fees may include transaction fees, network fees, or other usage-based fees that contribute to the treasury.

A revenue-generating protocol generally sits adjacent to a tokenized community, with money flowing back to the DAO.

A well-designed fee system can be positive-sum for all stakeholders, ensuring that the costs associated with maintaining and developing the protocol are fairly distributed among its users. Protocol fees can generate a sustainable revenue stream for the DAO, allowing it to invest in further development and improvements and not be dependent on external investors with misaligned incentives.

Implementing fees may create friction for users and negatively impact adoption, as the burden of fees can deter potential users from participating in the platform. Additionally, given that most protocols are open source, they can easily be forked with no fees, leading to a race to the bottom and reducing the competitive advantage of the original protocol.

It is crucial to carefully consider the structure of the fee system and who bears the burden of the fees, as this can impact activity on the platform and the overall success of the protocol. In order to maintain a competitive edge, the protocol must continually innovate and provide value to its users, ensuring that the benefits of using the protocol outweigh the costs associated with the fees.

Identity & Collectibles

This is a tricky one.

This economic model focuses on creating decentralized identity systems that are supported by an individual’s existence and participation within a given community, and on generating revenue through the sale and trade of collectibles that represent a person’s identity within that community. PFPs are a great example, but there can be much more complexity (i.e. focus on reputation) depending on the community.

Decentralized identity systems offer users greater control and privacy over their digital identities while ensuring the integrity and authenticity of their information. Interoperability of identity across ecosystems is another advantage, allowing users to seamlessly access and participate in multiple platforms using a single digital identity. Collectibles, such as PFP projects, can help users craft their digital identity while generating revenue for the DAO through sales, royalties, and marketplace fees.

From a revenue perspective, the key is for the identity to be tied to your community and brand. ENS is a fantastic example here.

Redundancy across identity systems and communities can be a drawback, as users may need to manage and maintain multiple digital identities in different ecosystems, leading to a fragmented and cumbersome user experience. Additionally, while collectibles can generate revenue, their value is often tied to the whims of the market and the popularity of the project, which can be volatile and unpredictable.

It is also important to consider potential privacy and security concerns associated with the aggregation and management of personal data in decentralized identity systems, as well as the potential for the misuse of that data by bad actors.

Project-based Revenue Sharing

Sometimes a DAO funds a project, and in return, the project shares a portion of its onchain revenues with the DAO. This arrangement creates a mutually beneficial relationship between the project and the DAO, aligning their incentives and fostering collaboration. This is common with DAO drops, but there is plenty of underexplored design space here with independent projects sharing revenue onchain.

Project-based revenue sharing allows the DAO to benefit from the success of the projects it supports, creating a diversified and sustainable source of income. This model can incentivize innovation within the community, as projects have access to funding and support from the DAO, while the DAO stands to benefit from the project’s success.

The main challenge of this model is the need for effective due diligence and risk management, as the DAO must carefully assess the potential of each project before investing. Additionally, the revenue-sharing arrangement may create a dependency between the project and the DAO, which could limit the project’s autonomy and long-term growth prospects. Finally, there are definitely legal implications that need to be addressed with revenue-sharing, regardless of the decentralized nature of the organization.

Project-based Ownership Sharing

In project-based ownership sharing, a DAO funds a project, and in return, the project shares ownership, usually in the form of tokens, with the DAO. This allows the DAO to benefit from the project’s success by holding a stake in its ownership.

This model aligns the interests of the DAO and the funded project, as both parties benefit from the project’s success. The DAO can leverage its ownership stake to influence the project’s direction and decisions, ensuring that the project aligns with the DAO’s values and goals. Additionally, the DAO can generate revenue through the appreciation of the project’s tokens or by participating in its governance and receiving rewards.

Similar to project-based revenue sharing, effective due diligence and risk management are crucial in this model, as the DAO must carefully evaluate each project’s potential before committing funds. There is also the risk of over-diversification, as the DAO may hold stakes in numerous projects, which can dilute its focus and impact. Lastly, the ownership stake may expose the DAO to potential liabilities and regulatory scrutiny, depending on the nature of the projects it invests in and the jurisdictional requirements.

Tokenized communities continue to gain momentum and find their footing. Experiments with new and old economic models will be absolutely critical to their development and proliferation over time.