By ROUTE 2 FI

The other day I asked a question on Twitter about staking. This got me thinking of all the different options out there – had me wondering, what would be the best option for me and how I can be most efficient with my conviction holdings.

Staking options have been around for a very long time and sometimes, you may wonder as well, is it worth your time? At what portfolio size would you consider it and how the strategy may change with growth?

Read on and find out anon.

Now, in this week’s newsletter feature, I want to go back and fine-tune some basics: staking. Staking is something everyone in the scene has heard of, at least once, but how much do we actually know about it? Is there an opportunity you should capitalize on? I’ve got you covered anon, the opportunities out there, and your options.

The most conventional understanding of a “blockchain” is the idea that blocks are used as building blocks which allow information/transactional content to arrive at the correct order; to put it simply, in TradFi if we backdate financial transactions, we are able to deduce the “truth” and blockchains and its transparency allows for this data to always be true in the purest way.

Traditionally we had the proof-of-work (PoW) consensus protocol, which is what Bitcoin (BTC) follows. With PoW, it follows that block producers (known as miners) compete in producing subsequent blocks via the literal proof of the amount of work done by a block producer to propose a new block, the issue however is that only ONE block producer’s work is accepted.

Meaning there would be a ton of work wasted and resources heavily expanded – as seen with the China Bitcoin mining issue which took a ton of electricity and space. To take a change in this consensus model, there has been a different approach: proof-of-stake (PoS).

PoS systems on the other hand elect miners instead of challenging them to a race, avoiding the whole issue of heavily expanded and wasted resources. Ethereum, as of 2022 adopted the PoS consensus as a more secure and energy-efficient way to validate transactions and add new blocks.

PoS consensus systems select these block producers based on the total amount of tokens that particular miner stakes. This is where we start to talk about staking and why it matters; in order for one to become a “validator” (block producer for lack of a better word), there are certain thresholds that have to be met both in staking requirements and hardware requirements.

Take Ethereum for example, one fundamental issue with staking that prohibits your average retail user is that you would need a minimum of 32 ETH to run a validator ($58,000 approx.). Generally, this would be out of the price range of your average crypto user. So where would we benefit from staking?

Traditionally, staking was introduced as a sort of a web3 alternative to fixed deposits. Users were able to stake tokens for a specific duration chosen by them, and this duration could be as low as a week to even up to years. In TradFi, banks would incentivize their clients to lock up capital for long periods of time via fixed deposits, in exchange they would yield a higher rate of return as compared to a regular savings account. The issue with staking an asset such as Ethereum until the recent Shanghai upgrade would be that previously users who staked Ethereum could not withdraw regardless of market conditions. This issue caused a low staking ratio, especially on Ethereum and led to the uprise of a behemoth narrative: Liquid Staking Derivatives (LSDs).

As mentioned above, retail users would have to front a whopping 32 ETH to run a validator, and most would be outpriced, but with the introduction of LSDs, retailers with much lower quantities of ETH could participate in staking. Staking participants would also NOT lose access to their staked assets – so how does this even work?

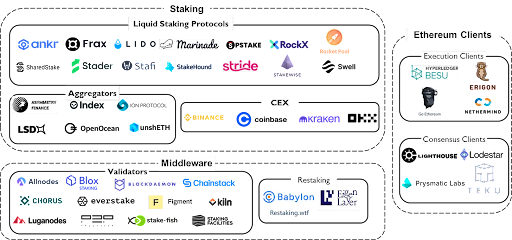

Essentially, as proof of a participant staking their ETH, the staking derivatives give out receipt tokens These LSDs would also create various pools and deposit them in batches of 32 ETH so users are able to participate in running a validator as a group, even with much lower quantities of ETH. Why do staking derivatives matter and how to capitalise on it? Well, let’s dive into the 3 staking derivative models and the landscape of staking derivatives.

Rebase model

Protocols following the rebase model will give their users the same number of receipt tokens as the ETH that they have staked into the protocol. If a user were to stake 5 ETH into Lido’s deposit contract, they would get back 5 stETH.

Over time, the quantity of stETH in that user’s wallet will go up slowly as staking rewards. This simple model is efficient and it gets the job done, however with legislation differing from country to country, it may be problematic as the influx of new tokens into one’s wallet may be taxable.

Reward-Bearing Model

Protocols who follow the reward-bearing model such as Coinbase, act in a similar fashion; when users stake for example 5 ETH, they would get back 5 cbETH. Rewards will cause a premium in the price of cbETH therefore the token’s value is the changing variable instead of the actual quantity as compared to the rebase model.

Dual Token Model

Protocols following this model such as Frax, give stakers TWO receipt tokens instead of one. The first token represents their position, whereas the other represents the rewards. Stakers on Frax will be given frxETH and sfrxETH, where frxETH maintains a peg with ETH and sfrxETH is designed specifically to accrue staking yield.

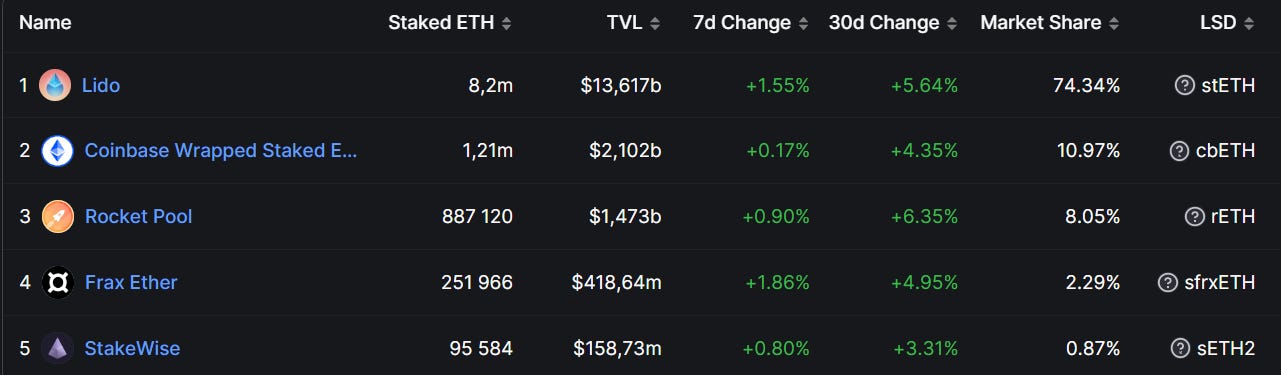

Now let’s have a look at the top staking derivative options by marketshare.

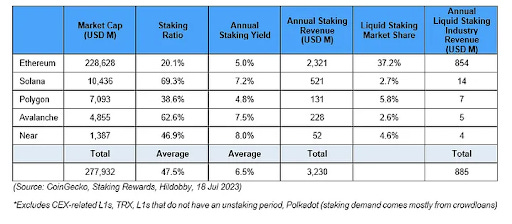

Arthur0x put together the potential size of liquid staking revenue that is dictated by four growth drivers: [(L1 Token Market cap) x (L1 Staking Ratio) x (Staking Yield) x (Liquid Staking Market Share)]

With these drivers put together, it gives rise to a sector that could potentially accrue millions of dollars in revenue annually. According to CoinGecko, the top 5 PoS chains are Ethereum, Solana, Polygon, Avalanche and Near; from these 5 chains alone, they produce approx. $893m revenue annually from liquid staking protocols, with $854m coming from Ethereum alone.

Lido has immense dominance in the LSD market with a market share of 74%, in the last 30 days (as of 14th Aug 2023) alone generated $5.38m in revenue showing great potential for this narrative in the space.

Lido represents one of the few protocols in the space which are able to make money from idle assets, without having to worry about market volatility, which in simple words, capitalising on laziness, so going back to how you can capitalise on it – what I would do at different portfolio sizes in regards to staking and the staking derivatives landscape. Let’s look at when its advised to start considering staking your ETH, when will it be worth it?

When is it worth staking your ETH?

Generally, with investments, everyone is advised to assess risk. One fundamental question every investor will ask themselves before putting in the capital is whether or not your expected returns on the investment are higher than your initial cost. If it were in a simple world, yes to the question would mean it is a good investment, if the answer were no, it would be a bad investment. So, what is the value capture of top protocols in the scene such as Lido?

Ever since the Shanghai upgrade and withdrawals were enabled, the amount of ETH being staked has been going upward, if we expect ETH staking ratio to increase from 20% to 30% then the staking yield is likely to fall by around 0.3% to 0.4%. Assuming the price of ETH were to reach back to ATH ranges ~ $4000 it would mean Lido DAO’s potential annual revenue would be insanely good. But how would this affect us retailers?

Well, we have the option to invest in LDO as a coin rather than staking since the staking rewards are likely to decrease – especially if we have a limited quantity of ETH. You must be wondering, when do we look at staking as a means to grow our portfolio? Here you go.

For starters, if we for example have a portfolio within the 1-10 ETH range ($2-20k approx.), ideally we’d be looking to grow our portfolio at a more rapid rate as compared to someone in the 10-25 ETH range, taking on more risk. The reason we do not look for staking options at this sizing is due to the fact that the APR as quoted on Lido for staking ETH is a mere 3.8%, this of course is not ideal at this sizing. This is by no means financial advice, but if it were me, 30% of my portfolio at this sizing would be allocated to blue chips, a further 20% would be allocated into “strong” projects, L1 alternatives or strong L2 alternatives – and the remaining 50% would go into altcoins, DeFi projects with potential for growth.

So in the context of staking and what has been discussed in this feature, if you want to get exposed to staking derivatives, an option would be to look for available staking derivative protocols, and perform a calculation to find the FDV to revenue ratio – if there are options with a high ratio and relatively low FDV, it may be more worth it to purchase some of the native tokens and hold/flip for a profit rather than participate in the staking itself. One thing to note would be there may or may not be an airdrop for EigenLayer, so it may be worth exploring some re-staking options on that end, especially since airdrops are known to be of decently high value for the cost/time to farm it.

At a small portfolio size, the reason we do not consider ETH staking options as a means to profit regardless of the growth in this sector is that an increase in the staking ratio would mean a decrease in rewards. Therefore we only want to consider ETH staking as an option for those with larger portfolios, 50 ETH and above would be feasible.

At 50 ETH you would have approx $100k to stake, and at a rate of 3.8% you would yield 1.9 ETH annually, pretty decent amount of yield on idle funds; now for those who may be wondering, are there ways you could further optimise yield?

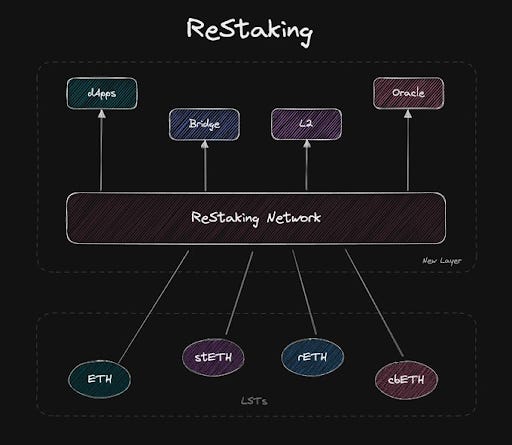

Well, of course there are, enter the idea of re-staking. Re-staking is a simple concept, you take your receipt tokens (for example Lido’s stETH) and stake it again on a different protocol to enhance its security, in exchange you obtain additional yield. EigenLayer is one of the protocols you’re able to do so. On EigenLayer, ETH stakers are allowed to validate protocols BEYOND Ethereum and earn rewards, it provides validators the option to validate other projects whilst still being engaged in Ethereum validation. The yield as of current is unknown since it is not launched.

There is an alternative option for higher yield on staking ETH for larger portfolios; this option is extremely risky and would require a ton of risk management to successfully conduct. Essentially users can use their LSTs such as stETH to deposit into Aave to borrow ETH, and then redeposit the ETH into Lido to get stETH again, rinse and repeat, therefore compounding their positions. This would then cause their “safe” position of staking ETH into a dangerous one, where market fluctuations may liquidate your entire position.

Now for some closing thoughts, ETH staking as of recently has grown insanely popular, and with it, has given rise to staking derivative protocols – however as this sector in crypto grows, we also see a decrease in the yield for staking ETH.

As of current the ETH staking yield is 4.3%, to obtain this yield users would need 32 ETH; with the introduction of staking derivatives, we are now able to deposit any amount, no matter how little or much with roughly 3.5-3.8% APR.

If and when the sector grows, this yield may decrease/increase in proportion to the staking ratio, when this happens we will start to see some growth in protocols focused on re-staking, such as EigenLayer.

Re-staking would ensure that validators maintain the way Ethereum is now, via having their ETH still staked, whilst allowing them to obtain better yields via their liquid staking tokens (LSTs). EigenLayer at the moment is not live so the yield is unknown, however as of current, their stETH, cbETH and rETH pools have hit their TVL caps of 15,000 ETH each – they will also be re-opening deposits and increasing the TVL cap, further showing the demand in re-staking protocols.

Here is a good thread on EigenLayer and how you could benefit from it!

Okay, that’s it for today!

Have a great weekend.