Traders who are just starting often use borrowed funds to increase potential profit, ignoring the high risk of losing their own deposit. Borrowed funds can be considered an excellent way to earn, as they allow for a significant increase in potential profit. There are some risks to consider when trading, but in skilled hands, everything will work smoothly. I wrote this article so that you do not make mistakes and also protect your money. In this article, you will find useful information about this tool for profit.

How Crypto The Margin Trading Works?

Thanks to margin trading, investors acquire financial instruments with funds that can greatly exceed the size of their account.

Features of opening positions with leverage:

To open a leveraged position, a trader must deposit margin. For example, with a 1:10 leverage, the margin is one-tenth of the total trade size.

If market fluctuations cause the investor’s balance to fall below the margin threshold, they will receive a margin call — a request to top up the account. If the trader cannot meet the margin call and there is insufficient margin in their account to cover the lender’s losses, the trade will be closed.

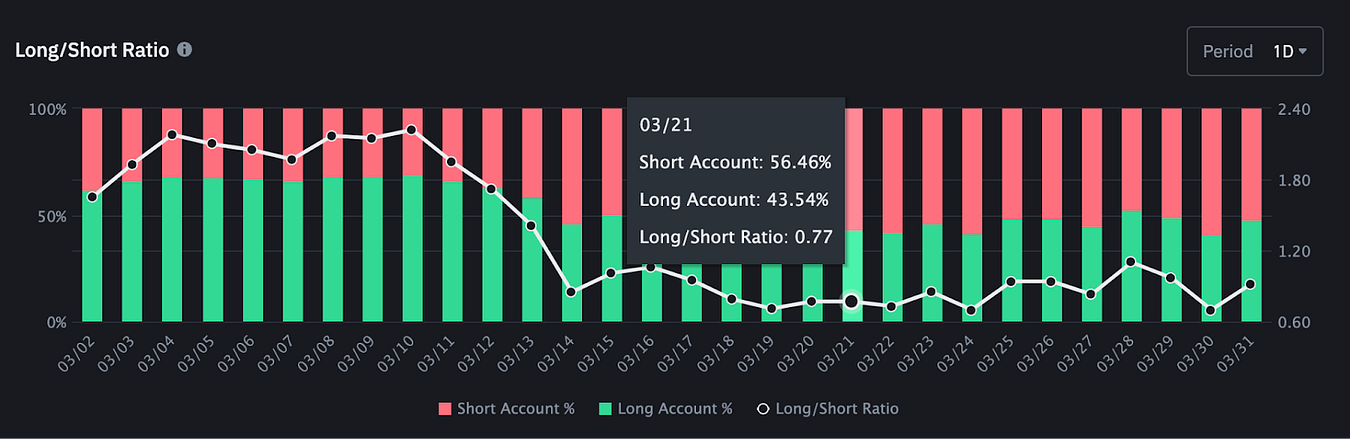

Leverage increases both potential profits and losses in market fluctuations. If the market moves in the wrong direction, leveraged trades can be closed with higher losses compared to trades without leverage. Trading with leverage can be done in both long and short positions. Opening a long position means the investor expects the price to rise, while shorting enthusiasts usually profit from price drops.

Example of a Long and Short Position with Leverage

Example of a Long Position with Leverage

Without leverage, you can buy 0.01 ETH for 18 USDC at the current ETH/USDC rate of 1,800 USDC. With 10x leverage, you can open a position with 180 USDC (and buy 0.1 ETH). If the ETH/USDC rate rises to 2,000 USDC, a leveraged trade will bring a profit of 20 USDC, while a trade without leverage will only yield 2 USDC.

Example of a Short Position with Leverage

Now, suppose a trader wants to short ETH on margin for 18 USDC with 10x leverage (the ETH/USDC rate is still at 1,800 USDC). They borrow 0.1 ETH, equivalent to 180 USDC, and sell it at the current market price. If the ETH/USDC rate drops to 1,600 USDC, the trader can buy back 0.1 ETH, return them, and make a profit of 20 USDC.

Less Leverage Makes You Happier

Features of Trading with High Leverage:

- Can bring incredible profits; however, if you try working with 100x leverage on a demo account for fun, you will see that with 100x leverage, your deposit can disappear in a matter of seconds.

- Too impulsive and risk-prone, traders are not recommended to use leverage greater than 5x. Many exchanges offer leverage ranging from 1x to 10x for this reason.

Features of Trading with Low Leverage:

- You limit potential profits but reduce the risk of potential losses. Trading will yield smaller profits compared to high leverage, but this trading method is better suited for novice traders.

What Is Margin in Cryptocurrency Trading?

Crypto margin trading involves trading with leverage. The term “margin” itself means a portion of the deposit that the user transfers to the trading platform’s account via a bank transfer and uses as collateral to cover the leverage.

Margin is typically represented as a percentage of the trade’s volume. For example, if 1,000 tokens are involved when opening a position and the margin is 10%, the trader will only deposit 100 tokens. Knowing the margin size, traders can calculate broker trading fees.

Learn to Make Trades and Read Charts

Before you start trading cryptocurrency pairs, you need to study patterns for crypto trading, learn to analyze charts using indicators, and analyze news.

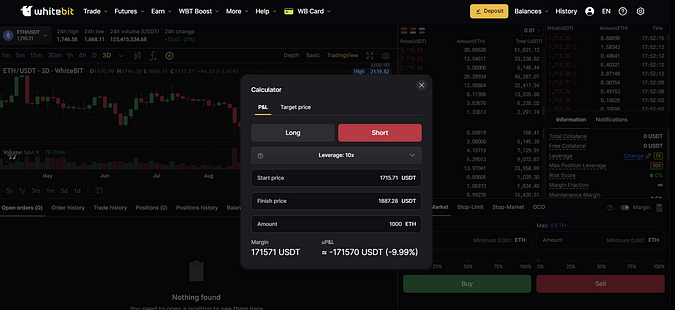

Here’s what the WhiteBIT exchange platform looks like. Similar tools for buying and selling cryptocurrencies and analyzing charts are available on the best cryptocurrency exchanges.

Trading Psychology as the Key to Successful Trading

Trading psychology is important regardless of where you trade: on cryptocurrency exchanges, Forex, or the stock market. Every user, regardless of gender, trading on the exchange can be susceptible to emotional behavior.

Traders buy and sell under the influence of logical and sometimes emotional factors: hopes for price increases, news, fear of losses, desire for greater earnings, and so on.

A perfect example of emotional trading is “locked traders.” To avoid losses, they do not close positions when signs of a reversal appear. They hope for the price to move in the right direction for a long time. The result is closing trades with significant losses.

To avoid this, one of the most influential aspects of trading is emotional control. Based on personal experience, I can say that through consistent analysis, you can achieve stable profits rather than making impulsive decisions.

Features of Choosing a Cryptocurrency Exchange

There are many trading platforms with unique features. There are centralized exchanges and decentralized exchanges with an internal trading account. Some platforms charge high trading fees. On some platforms, you can even engage in demo trading of cryptocurrencies, i.e., trading with virtual funds, without risk.

To describe the nuances of well-known cryptocurrency exchanges, it would take more than a whole article, so I will highlight the main features of these platforms:

- 1. Custodial (have an internal exchange account) and noncustodial (do not hold client assets).

- 2. Support for fiat currencies. On cryptocurrency exchanges, you can at least buy cryptocurrencies with fiat money. Some trading platforms support crypto trading with traditional currencies and allow fiat payments for trading fees.

- 3. Access to spot (classic) trading, futures (with settlement at specified times or without expiration), CFDs, margin trading, options, indices.

- 4. Whether the cryptocurrency exchange is regulated by government authorities, whether there are taxes, and other non-trading fees.

- 5. Whether the cryptocurrency exchange requires user verification and KYC.

- 6. Trading commissions — what they are charged for and at what rates. How clients pay trading fees. Study the advantages of different platforms and choose the best cryptocurrency exchange for yourself.

One of such exchanges that encompasses the aforementioned features, trading with leverage and margin, is best started on the WhiteBIT platform. The exchange offers traders flexibility in terms of leverage and a competitive fee structure.

What Are the Benefits of Margin Trading on WhiteBIT?

- 1. Flexible leverage from 1x to 10x.

- 2. One of the key advantages of margin trading on WhiteBIT is the low fees. The commission rate for using borrowed funds with any level of leverage is 0.0585%. Additionally, platform users who hold the native coin, WBT, can receive a discount of up to 100% on Maker fees.

- 3. Furthermore, users can utilize other assets in their “Collateral” balance. This allows for a wide range of assets to secure all positions, although the margin weight should also be considered. The fee for using borrowed funds is only charged if the order is at least partially executed, helping to reduce unnecessary expenses.

- 4. Moreover, unlike spot trading, when opening a leveraged position, it is possible to create an OCO (One Cancels the Other) order.

Conclusion

The decisions between high leverage and low leverage in trading is a critical one that every trader must make carefully. It’s essential for traders to prioritize emotional control, proper analysis, and risk management regardless of their chosen leverage level. Novice traders are often better suited to low leverage, which limits potential profits but minimizes the risk of catastrophic losses.

Additionally, the choice of a cryptocurrency exchange is crucial, considering factors such as fees, regulation, available trading options, and user verification requirements. Ultimately, successful trading requires a thoughtful balance between potential gains and prudent risk management.