Crypto airdrops are changing. Stay ahead of the curve.

How Airdrops Are Evolving

Airdrops remain the go-to model for rewarding communities and decentralizing protocol ownership. However, gone are the days of Uniswap-style retroactive airdrops.

No longer will a simple transaction or LP position qualify you for a drop! Even the most basic airdrops are now designed with tiered criteria and sybil resistance in mind.

While Arbitrum has certainly proved to be 2023’s hottest airdrop (to date), the airdrop left something to be desired, from both the technical performance and token distribution perspectives. Today, we’ll dissect some pitfalls of the ARB airdrop and explore how other prominent protocols have iterated on airdrops past to align communities, attract liquidity and minimize disruptions.

ARB Autopsy

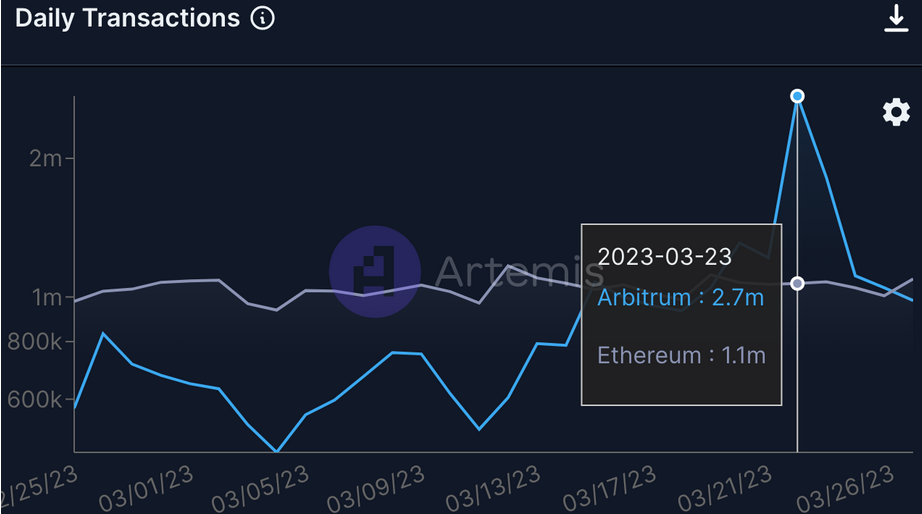

On March 23, over 1.16B ARB were airdropped to 625k unique wallets, with distributions ranging from 625 to 10,250 tokens per address. Much of the claiming activity was front-loaded, with 52% of allocations claimed within the first four hours.

Arbitrum saw extremely elevated levels of on-chain activity during ARB launch day, setting an all-time daily record of 2.7M transactions from 612k active addresses, outperforming Ethereum by 145% and 32%, respectively.

Heavy traffic crashed the Arbitrum sequencer and resulted in RPC endpoint failures across public providers.

Quick Q&A on llamaswap:

— 0xngmi (@0xngmi) March 23, 2023

– Claim button is gray -> change your rpc in metamask for another one

– txs are failing -> sequencer appears to be having trouble processing txs, it affects everyone

– It says nothing to claim -> rpc error

– metamask says i have 0 eth -> rpc error in MM

While Arbitrum’s tech is currently some of the best in the game, offering increased throughput and call data compression with Nitro, the limits of blockchain technology were evident over the hours that followed the ARB drop.

Arbitrum’s Web2 infrastructure also failed to handle the load. Frontends for the recommended claim portal, arbitrum.foundation, and blockchain explorer, Arbiscan, were down in the hours following ARB’s release. A cohort of Arbitrum users and airdrop claimers voiced frustrations on Crypto Twitter.

Iterating and Improving

Retroactive airdrops and simplistic criteria are so 2022. Today’s hottest protocols recognize the potency of airdrops and are designing novel distribution strategies to best capitalize on their potential.

Airdrops are undeniably the single largest “expense” many protocols will ever incur, so how do they maximize value?

🎯 Targeted Distribution

Any airdrop’s primary goal should be to fairly reward a variety of on-chain activities, aiming to distribute tokens to those least likely to sell and most likely to participate in governance. Targeted distribution criteria is key in accomplishing this pursuit!

Protocols have begun increasingly rewarding numerous categories of on-chain interactions, outside of basic usage.

- Optimism chose to allocate OP tokens to DAO voters, multisig signers, and Gitcoin L1 donors, aligning HODLers with the chain’s Retroactive Public Goods Funding efforts from day one.

- Sudoswap carved out SUDO allocations specifically for holders of project team-designed “0xmon” NFTs, providing extra rewards for those who have already displayed a financial commitment to the Sudoswap universe.

While Arbitrum provided allocations for DAOs to spend at their discretion, the rollup missed out on the opportunity to directly reward good citizen behaviors in the ecosystem and seemingly neglected “Enter the Odyssey” NFT holders.

While not intended to completely replace transaction value and use-based criteria, additional categories can be used to reward desirable behavior. For example, Arbitrum could have included governance participation among its list of qualifying actions.

And despite partnering with Nansen to weed out sybil attackers, clear vulnerabilities in Arbitrum’s sybil detection are evident. An analysis performed by X-explore found approximately 4k sybil communities, controlling 150k addresses eligible to claim 253M tokens (21% of ARB user allocation), were included in the ARB drop.

Three prominent sybil communities alone claimed over 4.2M ARB.

Data shows that there are three giant ARB sybil addresses.

— Wu Blockchain (@WuBlockchain) March 24, 2023

– 0xe1e271a26a42d00731caf4c7ab8ed1684510ab6e collected 2.1M ARB from >1200 addresses.

– 0x770edb43ecc5bcbe6f7088e1049fc42b2d1b195c collected 1.19 million ARB from 1375 addresses.

-… https://t.co/0sOUuKEqhy

While not a bulletproof solution, niching down criteria and rewarding diverse actions more characteristic of human on-chain behavior can help to limit the number of tokens distributed to sybil farmers. Additional criteria and multipliers serve to curate airdrop distribution and provide tokens to addresses that have displayed commitments to the ecosystem beyond financial value.

💨 Push v. Pull

Creating a smooth claim process should be a focus for protocols looking to build goodwill with their communities.

Pull-style airdrops, which require recipients to claim the drop, appear attractive for many projects. Gas fees are avoided and funneling claiming activity through a team-run frontend presents protocols the opportunity to dissuade sellers by promoting governance, as seen in Arbitrum’s claiming process.

However, given the present limits of blockchain technology, network-wide pull airdrops can create on-chain pandemonium, hampering chains’ abilities to process transactions and providing difficult claim experiences.

Optimism’s Airdrop 2 took a push approach, gaslessly distributing 55M OP to over 330k unique addresses seamlessly, without causing broader network disruptions. While pull drops are viable for protocols attempting to bootstrap governance participation for large initial airdrops, recurring network airdrops to a large number of wallets are best pushed.

👯 Attracting Users

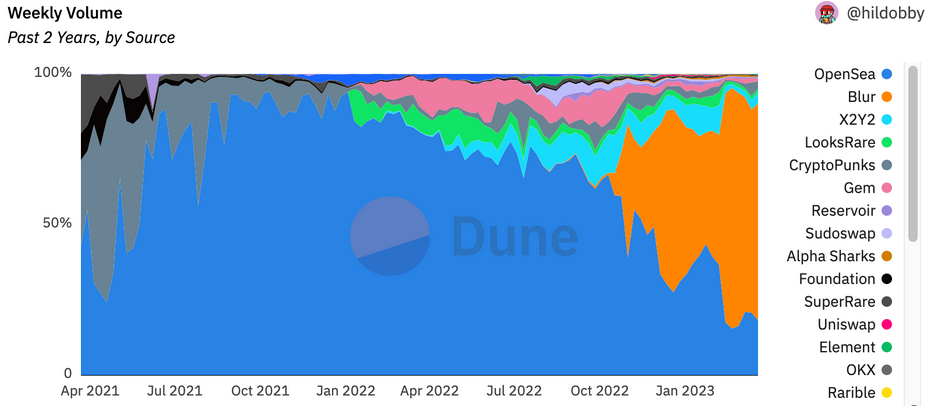

What crypto application doesn’t like attracting more TVL? Airdrops provide a convenient format to do just this. NFT marketplace Blur innovated on the retroactive airdrop model and opted to proactively announce airdrop qualification criteria to attract usage.

Since launch, the platform has publicly marketed its intention to airdrop tokens to various user categories and much of the NFT marketplace’s initial adoption came from users attempting to maximize their airdrop eligibility. Currently, Blur processes 72% of weekly NFT trading volume, in part a result of the preannounced Season 2 airdrop.

Despite the demonstrated success of Blur’s tactics, Arbitrum stuck to a token distribution based solely on past activity, missing out on an opportunity to attract additional users and TVL to the chain.

Dominance in the NFT trading scene may fade as incentives eventually dry up, however the preannounced airdrops have helped Blur locate a foothold in the competition against behemoths like OpenSea.

Tokens can also be viewed as direct-to-consumer marketing spend via retroactive allocations. While these allocations do not need to be large, granting tokens to users of competitive protocols can help to establish a relationship and provide an opportunity for capture of new liquidity and users. Both Optimism and Sturdy Finance rank among protocols utilizing this approach, with each allocating a portion of their tokens to users of competitive protocols.

Learning From Our Mistakes

Airdrop best practices are far from settled territory: protocols are continuously updating distribution methods — attempting to optimize eligibility, attract liquidity, and create frictionless user experiences.

The metas are constantly shifting, but it’s clear that Arbitrum’s latest airdrop was not the final form and that other projects have seemed to be innovating the humble airdrop further. Arbitrum’s token launch was a big moment for the industry, it will also be a moment that plenty of project founders analyze endlessly as they aim to boost the gains from their own eventual token distribution efforts.