This is my secret method to finding insane alt-coin gems before they pump!

Some people were able to make millions of dollars from a meme coin Pepe with possibly just a few hundred dollars of investment.

But, ordinary folks like you and me never saw Pepe emerging until it was already way too high to be diving into, and if you did dive in later, they’d be sitting on red now.

So, how do we find these coins just before they’re about to pump?

Well, I’ve found an incredible free tool, and I’m going to show you a simple three-step process exactly how to use it. If you’re patient enough to read through for the next six to seven minutes, I’m also going to reveal a tool that will really up your game at finding new high alpha crypto projects.

Pepe turned people into literal millionaires in a matter of weeks. So, how do we find these coins?

The answer is, you don’t. These tokens don’t come up in any fundamental analysis no matter how much you’re good at it. So how do we go about it then?

The way forward, you see, is we need to identify those who have insider information and have been buying those coins before the general public even hears about it. If we can follow these wallets, then we can potentially do something very special as well.

Now, here’s what we’re going to do: first, we’ll go to CoinMarketCap and choose Pepe (Or you can choose any coin you want. Think about a coin that has seen an aggressive pump in the last few months). We want to find people who are on the inside and know more than we do.

Pepe coin, as we know, had an insane rally between 27 Apr — 6 May. It did a 1000x increase in just about a week. About a few days before the pump, the price of Pepe was pretty stagnant and was moving sideways. So, what do we need to do?

We need to go back a few days prior to the meteoric pump, and then we’ll copy the Ethereum contract address from here. In fact, you can look for any Ethereum-based coin in the top 50 that has experienced a significant pump. Copy its contract address.

Then come along to the Token Analyzer. Here, paste the token address where it’s required, and the number of days prior to today (here we want to check for 25th Apr’23 which is 112 days ago).

We’re going to search for data from around the bottom before the pump. Select the Ethereum chain, and hit enter.

As you can see, today 350 wallets have been created, with a total of 222,430 new wallets. Pay attention to the number of wallets being created when looking at coins that have already boomed. If you see a high number of wallets created, it’s likely too late to invest.

Now move down to the “Top 100 Trades by Estimated ProfitTrades” section, we want to ignore the top trades by MEV Bots engaging in front-running activities. Instead, we’ll look for contract addresses associated with real people. We should find examples of wallets that made significant profits but didn’t necessarily hold on for the entire pump.

One such wallet at the top made $1.095 million on the 30th of April.

If we go back to CoinMarketCap, we can see that the 30 April was right before the major pump. This individual knew something others didn’t, and they took profits at the right time. This illustrates smart money in action. Click on the wallet address to check if it’s not a Mev bot. As you can see, this is a real person.

To further analyze the wallet’s holdings, use Debank, which is another useful free tool.

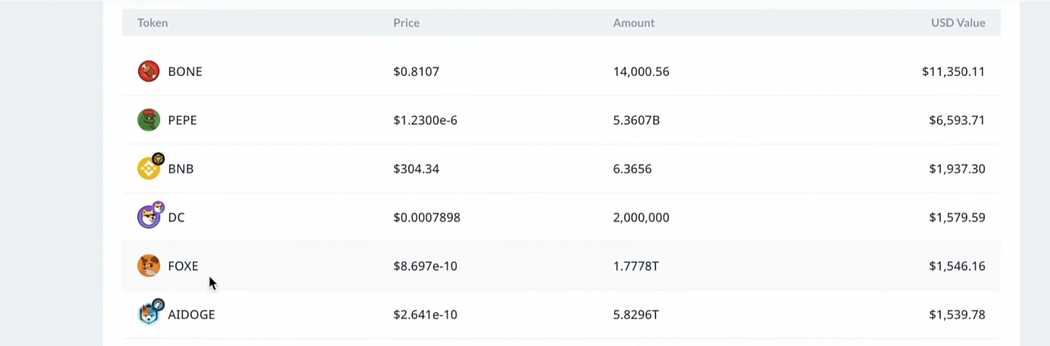

Paste the code in there to see the wallet’s current holdings. While this individual made $1 million on Pepe coin, their current wallet holds various meme coins. Even though the quantities might not be massive, you can follow this wallet to monitor strategy and invest in a few tokens.

So down below, you can see all of these assets. So, what we can do is create an account and then set up a notification bell.

This way, every time he makes a trade, buys or sells, I’ll get a notification on my phone. For instance, if he buys Pepe coin, I’ll know about it. If a wallet that you are tracking is investing heavily in a coin you’ve never heard of, it should at least put it on your radar. It’ll be worth considering.

Something else we can do on debank, just to cover all bases, is checking out the “Whales” section.

You can go down the list and find out what assets the big players are holding. They might not have anything particularly risky in there given the market conditions. But down the line starting now, you want to follow the big money, as they’ll show you opportunities you will not have seen otherwise.

Now, if you’ve managed to stick around this far, I’ll show you something else that’s extremely cool —

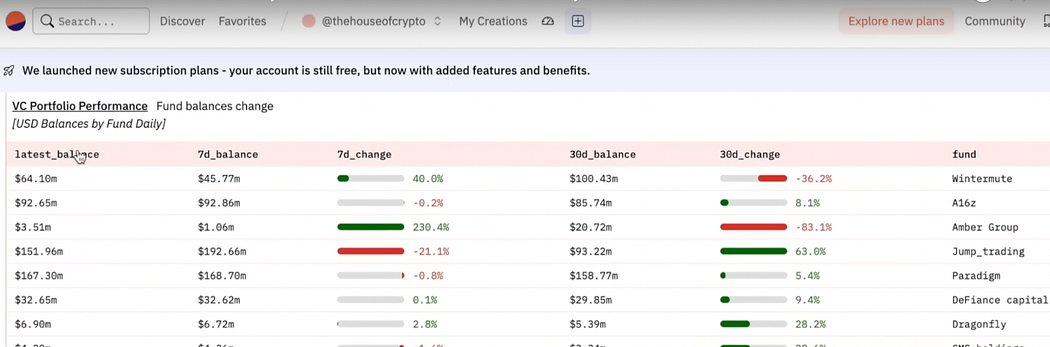

Again, on dune.com, you can click down below, and this is the Venture Capital “Track Door”. What’s really cool is that you can see Venture Capital, which represents the big money buying into various projects.

In this section, you’ll find VC portfolios — these are the big players buying into projects. What’s fascinating is that you can see the latest balances of these Venture Capital firms. They vary from a few million to hundreds of millions of dollars. You can also check their 30-day balances.

Looking at the performance of one of these, Wintermute Trading, which has seen 40% gains in the last few days. So, we go to its portfolio. The total portfolio value is $45 million. What’s crucial here is that you can see the assets they’re currently holding.

Keep in mind that these levels of investments might be beyond what you’re currently able to manage, but the insights from following these big players are invaluable.

So we learned today that in the dynamic realm of cryptocurrency investing, the stories of massive gains and missed opportunities highlight the need for innovative strategies. The journey to discovering high-potential coins involves navigating the cryptic landscape of early movers and smart money.

By unveiling the tools and techniques to monitor wallet activities, track Venture Capital involvement, and follow the footsteps of those with insider insights, this article offers a glimpse into the world of crypto fortunes in the making. Armed with these unconventional tactics, investors can redefine their approach, positioning themselves to catch the next wave of explosive growth before the rest of the world even realizes its building.