by Ismail Abdulraheem

Each time you go on Twitter, you see people talking about how they got into a project early and made x profits or how a whale bought a memecoin and was able to double their capital in days.

At first, I thought maybe they were just part of the development team or just the lucky few.

But then I decided to dig deeper to see how lucky I could get too.

Here are the top tools that I used and believe could make you “lucky” too.

Yes, Twitter has a lot of Alpha Callers who are busy doing research daily. I follow these accounts, and when they make calls, I just don’t go straight into buying them; instead, I do more research using other tools.

Sometimes the tokens pump immediately after the alpha caller makes the call. Be careful not to buy at the peak but instead wait for a retracement.

DefiLlama

From yields to protocols, this free tool will help you discover gems yourself.

What I do is find the trend and follow where the money is flowing, and you can get that by comparing TVL on each chain. After that, I look at the category with the most inflow of funds because it shows that there’s a lot of interest there.

Then I do further research on the projects in the category, like security checks on the projects, the team behind them, the utility, tokenomics, and models.

De.fi

Part of my research involves security checks, and that’s where de.fi comes in.

Initially, I was using tokensniffer, but I found out de.fi is more accurate to some extent.

You just copy the project’s contract address from etherscan and search it on the website.

As you can see from the image, the project in the example scored 97/100, which means it is safe to invest in.

A project with a red score of about 17/100 is a No for me.

Understand that the tool is just checking the project’s on-chain qualities, and it takes more than that for a project to succeed, so don’t just invest because the score is high.

DeBank

What this tool does is, it shows wallet balances across all chains.

I use it to monitor whale wallets to see what they are buying or selling.

So if I see any project with a lot of hype (example: $Pepe), I just check who are those that bought into it early and then add their wallets to my list.

Here is an example of such list:

https://cdn.embedly.com/widgets/media.html?type=text%2Fhtml&key=a19fcc184b9711e1b4764040d3dc5c07&schema=twitter&url=https%3A//twitter.com/OnchainDataNerd/status/1643625991816790016&image=https%3A//i.embed.ly/1/image%3Furl%3Dhttps%253A%252F%252Fabs.twimg.com%252Ferrors%252Flogo46x38.png%26key%3Da19fcc184b9711e1b4764040d3dc5c07

When next these wallets are buying into any project, I’ll know in time and then decide if I will buy in or not.

Dune Analytics

Dune Analytics allows you to explore dashboards and datasets built by a community of blockchain analysts.

You can build a dashboard too if you can write in SQL, though with restrictions because it has paid plans.

Flipside

Like Dune, Flipside allows you to view other dashboards and also build your own if you can write SQL.

While Flipside is completely free with no restrictions or plans like Dune, its datasets are not as organised as Dune’s, and the community around Flipside is smaller.

I use both, and I’ll talk about how I use AI to write SQL in a future post.

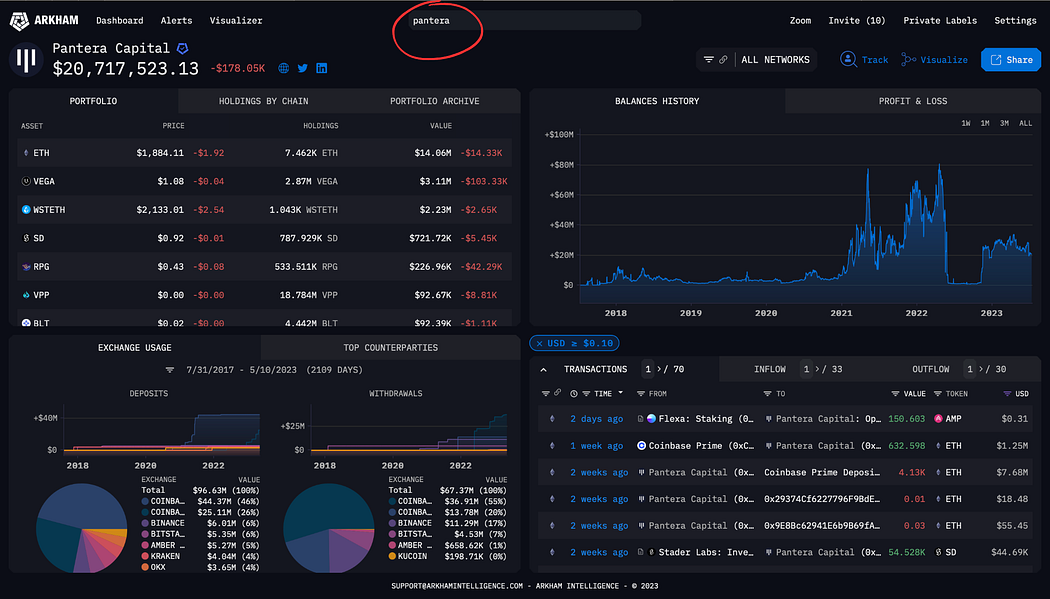

Arkham

If you can’t go through the technical process of writing a dashboard in Dune, the Arkham platform is a good alternative.

I use it mostly for Crypto VC wallets, and as you can see from the screenshot above, it shows you the portfolio of Pantera Capital.

I monitor them and other VCs closely, and if there’s any small project they are buying into, I’ll check it out and most likely buy too.

Conclusion

While I’m still exploring more tools, these are the top ones I’ve used and have given me great results so far.

I will suggest you familiarise yourself with them and build your own pattern and strategy.

This list from Dynamo Defi contains more tools, and you might want to check it out.

I hope you find this helpful, and if there’s anything you want me to add, let me know in the comment below.