By 汉洋 MASTERPA AND MAVIS WANG

Who are the brains behind the company that climbed to global dominance in just 165 days?

Binance stands as a tech titan. Despite the relative obscurity outside the blockchain space, it’s making waves far beyond the regular sound bites of its peers. This crypto giant has a reported staff up to 8,000 (this number might drop significantly due to foreseeable layoffs), a workforce dispersed globally and not tethered to any physical head office. With most employees likely to have never met face-to-face yet seamlessly contributing to the company’s success, Binance might be seen as an archetype of the Future of Work. Its distributed organizational structure is an important internet-era creation, impossible for future studies on tech industry evolution to ignore.

The importance of Binance in blockchain becomes even starker, when drawn in parallel with Apple, the pacesetter of the smartphone market. According to Tokeninsight, in Q2 2023, Binance’s share of the crypto exchange market reached 50.6%, overshadowing Apple’s 24% across all smart phone brands in Q4 2022, Apple’s best ever Q4 performance (as per StrategyAnalytics). Despite market volatility in 2022, Binance’s spot trading volume soared to $5.29 trillion, whereas Apple’s App Store ecosystem pulled in $1.1 trillion in turnover the same year. Binance benefited from a commission revenue model, but for Apple, a whopping 90% of sales incurred no commission at all. By this measure, Binance’s dominion over crypto even outshines Apple’s stronghold of smartphones.

Binance, with its impressive dominance and pioneering operational model, is undeniably one of the most successful companies of our time.

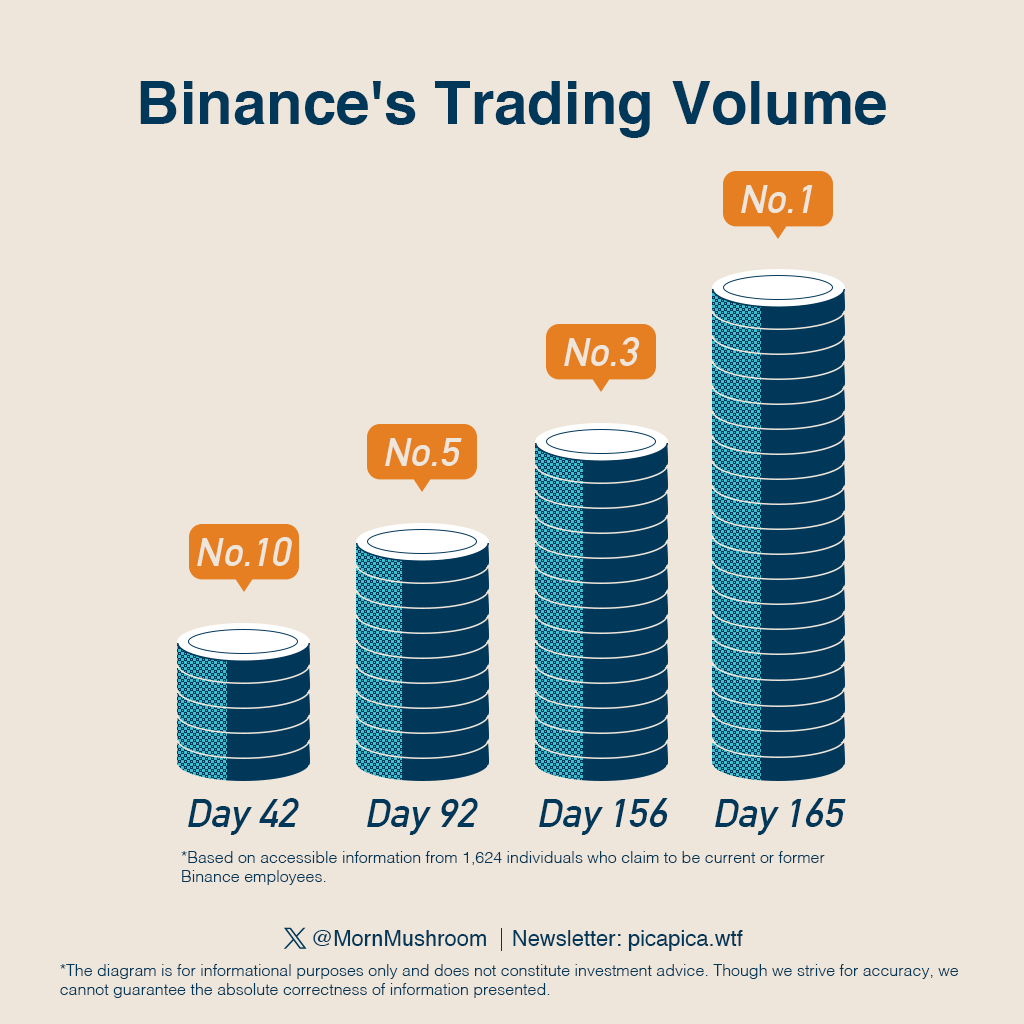

Yet, its success is shrouded in mysteries. Binance may well be the greatest mystery on internet. Few companies with such gravity in tech remain elusive to understand. The rise of Binance was astonishing: it broke into the world’s Top 10 crypto exchanges in trading volume just 42 days post-launch. By Day 92, it claimed the fifth. By Day 156, the third. Since Day 156, it has reigned supreme.

So what’s Binance’s secret sauce?

The allure of solving Binance’s mystery is irresistible. Having consumed nearly every piece of literature on Binance, I’m still left grappling with its peculiarities: what sets Binance apart? What fuels its meteoric rise? Driven by curiosity, I’ve set to fill in the missing pieces about Binance through meticulous interviews and investigations.

The data in this article was gleaned from a pool of 4,182 individuals who claimed to be current or former Binance employees. Given the inherent ambiguity of information on the internet, let’s say we have fairly comprehensive, accurate data for 3,714 of them. Among these, 1,624 identified as full-time workers, the rest as interns, part-timers, or freelancers. Unless indicated otherwise, our following discussion pivots on the 1,624 full-timers.

Beyond Borders

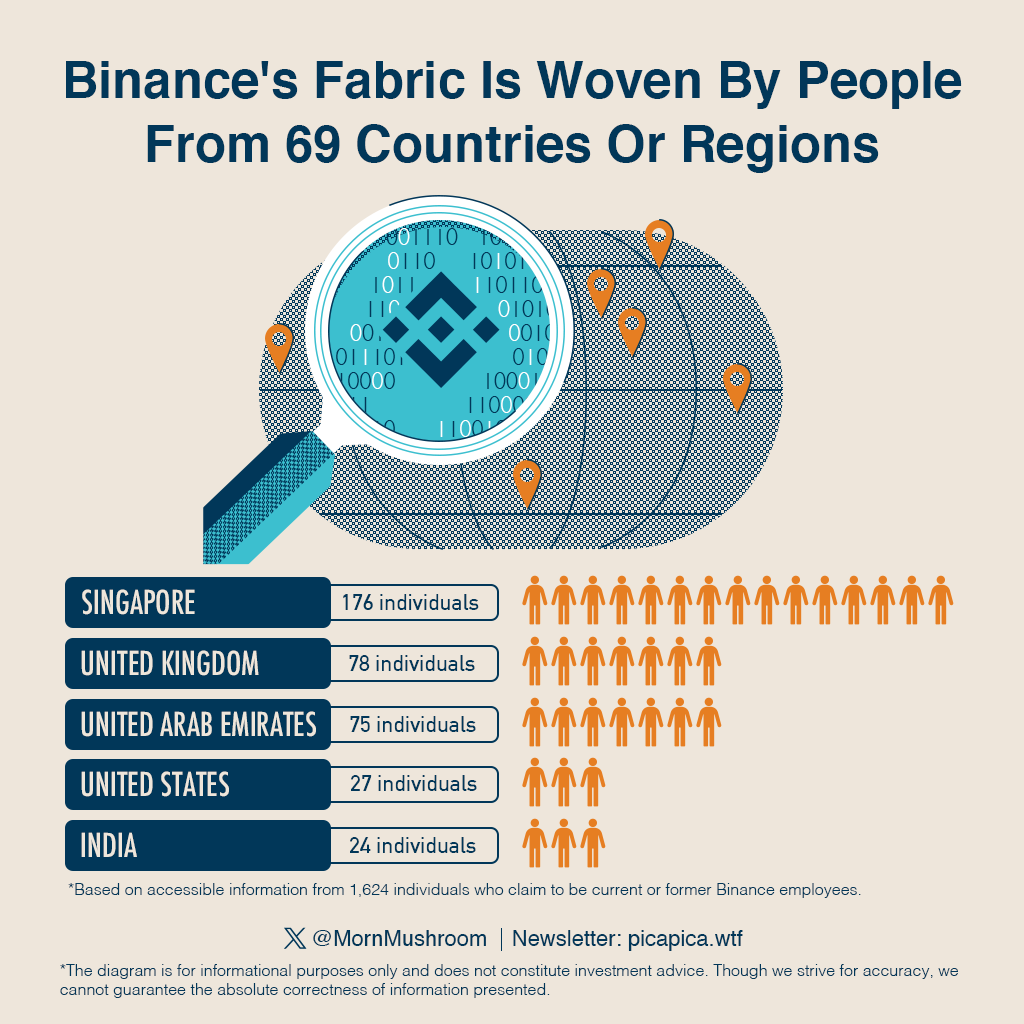

By its very nature, blockchain transcends borders, yet most companies it birthed are still quite confined within geographical borders. However, Binance skewed this paradigm, racing closer to “borderless” than any of its peers. According to our data, the fabric of Binance is woven by people from an impressive 69 countries or regions, for instance:

Singapore: 176 individuals

United Kingdom: 78 individuals

United Arab Emirates: 75 individuals

United States: 27 individuals

India: 24 individuals

We can see Binance’s significant Singapore presence fits the prevailing stereotype of Singapore as the crypto hub. What’s also noticeable, is that there’s even an employee stationed in the Cayman Islands, a locale mostly known for corporate registration purposes.

What about Dubai, given that Binance’s co-founders CZ (Changpeng Zhao) and He Yi both operate out of this place. Dubai, while an economic hub of the UAE, is a city, not a country. If we focuses on cities, Dubai tops the list: Binance’s workforce is distributed across 86 cities, the top three are Dubai (65), London (64), and Amsterdam (16).

Comparatively, Binance maintains a minimal presence where it was founded – China. Only one individual is based there. Still, we can’t discount the likelihood that some employees in China intentionally may obscure their footprints.

Before Binance, GitLab was the poster child for remote work. Emblematizing open-source software, GitLab proclaims itself the world’s largest remote company with 2,038 employees (and 358 pets) spanning 65 countries or regions.

Had we a richer data spectrum, Binance might well “usurp” GitLab’s claim to the title of the “world’s largest remote organization”. This isn’t just a “numbers game”. The point here is to underscore Binance’s commitment to a remote corporate structure, using GitLab as a benchmark. Binance’s remote modus operandi elicits skepticism as well. Some suggest Binance may be leveraging “remote work” as a risk-averse strategy, or its distributed workforce doesn’t differ from that of any typical multinational. That’s a misread. Binance, like GitLab, embodies the ethos of a remote-first principle, setting the standards for remote work.

Of the 3,714 people linked to Binance, their roots span 114 countries or regions, dwarfing that of the Apple Store, which is present in just 26 countries. However, juxtaposed with Apple Music’s presence in 167 countries, Binance’s operations in 47 seems somehow modest.

Also, Binance’s full-timers lack some educational diversity. Three of the top five universities attended are in Singapore, once again underscoring the city-state’s stature as a crypto hub:

National University of Singapore: 54 individuals

Nanyang Technological University Singapore: 47 individuals

University of London: 25 individuals

Singapore Management University: 24 individuals

National Taiwan University: 23 individuals

Interestingly, though, if we turn to see the profiles of all the 3,714 people associated with Binance, something intriguing emerges: a noticeable presence of individuals with study experience in the UK:

University of Cambridge: 219 individuals

National University of Singapore: 179 individuals

Nanyang Technological University Singapore: 128 individuals

Singapore Management University: 90 individuals

University of London: 90 individuals

One hypothesis hinges on Binance’s pronounced appetite for talent. For a fast growing organization, interns are pivotal. For a Chinese-led, globally expanding firm, bilinguals are gold. Given the challenge and risk of hiring such talent directly in China, overseas Chinese students are an attractive pool. The UK, boasting 170,000 Chinese students, naturally becomes a prime recruiting ground.

Moreover, my research suggests Chinese students in the UK face stiffer competition for internships and full-time placements compared to their counterparts in North America. This peculiar dynamic, as a result, could funnel more students towards blockchain firms that hire globally, including Binance. Anecdotal evidence also echos a gravitation of UK-based Chinese students towards the blockchain industry.

Compounding this is the UK’s fairly stringent post study work policy. The majority of Binance’s interns may inevitably have to relocate, primarily back to China, which leads to career pivots or the underplaying of their experience at Binance. Contrastingly, Singapore, with its 50,000 international students (of which a third are from China), offers a more modest intern prospect pool.

CZ at the Helm

In my interviews, a recurring narrative from Binance’s former execs portrayed CZ as a bibliophile. In its early days, Binance had a core cohort of over 40 senior managers, who often found themselves receiving CZ’s latest reads – a gesture intended to align their thinkings. Half-jokingly, CZ would warn his top brass of the potential peril if not keeping up with his reading list.

The books were primarily on corporate management and business history. CZ favored the chronicles of Uber and Netflix, with Uber’s regulatory battles echoing Binance’s own challenges. He also drew actionable insights from his reading. A testament was his strategic hiring of quite some ex-Uber professionals. Crunching the numbers, we found 110 ex-Uber employees, making Uber the sixth on our list. The Top 5 companies that Binance hired from are:

Amazon: 204 individuals

Shopee: 153 individuals

Citi: 134 individuals

Agoda: 119 individuals

Coinbase: 111 individuals

What exactly are these people doing at Binance?

Business-related: 761 individuals (46.86%)

Technical: 329 individuals (20.26%)

Operational: 243 individuals (14.96%)

Uncertain: 291 individuals (17.92%)

A significant 17.92% couldn’t be determined in our analysis due to the constraints of our dataset. Yet, strikingly, nearly half of the positions are tied to the business aspect. This emphasis on business development, sales, marketing, and strategy might be viewed as Binance’s vigorous chase of growth and market share expansion.

A relevant anecdote comes from an individual involved in rebranding CoinMarketCap (CMC) after Binance’s acquisition. In a meeting, CZ scrutinized ads placements on the homepage, weighing the CPM outcome. His decision? To remove all major placements, save only a few minor spots. It was a move that prioritized user experience over immediate gains. Though ads were crucial to CMC’s revenue, CZ saw the relationship between user experience and market share and refused to compromise the long-term for a spike in income. By realigning staff’s KPIs accordingly, he proved his commitment to a broader, more strategic goal and earned wide praise for his overarching vision.

While there are countless stories to be told about Binance, our concentration in this article shall remain with our dataset.

Rising from Within

In my effort to identify the industries Binance primarily recruits from, tech and finance unsurprisingly topped the list. What caught my eye in our dataset was the promotion rate of around 26.46%, which shows an evident inclination to elevate from within, shifting employees across different teams or branches.

While analyzing how the employees describe their positions, I found a concentration on three core areas: cryptocurrency and blockchain knowledge, customer service skills, and compliance and anti-money laundering expertise – Binance seems particularly attuned to compliance.

Yet, Binance’s compliance is riddled with controversies. In many countries, it is, at best, contentious. The simmering tension with the SEC is yet to reach its boiling point. The fiercest battles, arguably, still loom on the horizon. It’s worth noting, though, this isn’t a side story – compliance remains central to Binance’s chronicle, which we will delve into later in this series.

The snapshot presented in this article is a mere glimpse into the intricate world of Binance. A tech superstar that navigates the volatile waters of blockchain, with an intrinsic leaning towards internal growth and an unwavering eye on compliance. Yet, beneath these surface observations lies a labyrinth of questions, challenging us to unravel the deeper truths. How does a globally distributed organization orchestrate its symphony of growth? What fuels its relentless pursuit of market dominance? What lessons and warnings are encrypted in its story? These questions are not merely the ending of an article but the opening of a broader inquiry—an invitation to explore the very nature of innovation, ambition, and the future of a digital frontier.