Author: Kernel Ventures Jerry Luo

Editor(s): Kernel Ventures Rose, Kernel Ventures Mandy, Kernel Ventures Joshua

TLDR:

- Along with the rise of inscription, the existing application layer of the Bitcoin network is unable to sustain market activities and is the main focus of the current Bitcoin ecosystem development.

- There are three mainstream Layer2 solutions for Bitcoin: Lightning network, Sidechain, and Rollup

- The Lightning network enables peer-to-peer payments by establishing an off-chain payment channel, which is settled on the main network after the channel is closed.

- Side chain locks BTC assets on the mainnet through specific addresses or multisig addresses, while mints equivalent BTC assets on the sidechain. Merlin Chain is able to support multiple types of inscription assets across the chain, backed by the Bitmap ecosystem, and its TVL has reached nearly 4 billion dollars.

- BTC Rollup is based on the Taproot circuit, which can simulates smart contracts on-chain, and it performs packing and computation operations outside the main Bitcoin Network. The B2 network is at the forefront of this implementation, with over $200 million on-chain TVL.

- Cross-chain bridges built specifically for Bitcoin aren’t very common. There are more multi-chain and full-chain bridges that integrate with mainstream blockchains, one of which is Meson.Fi, that has established relationships with a number of Bitcoin Layer2.

- Stablecoin protocols on the Bitcoin network are mostly implemented in the form of over-collateralization and support other DeFi protocols to bring more yield for users.

- There are various DeFi projects in the Bitcoin ecosystem, from those that migrated from other chains, to those that are built on the native Bitcoin network during the current development boom, and those that were built during the last bull market and deployed as a sidechain. Overall Alex provides the most variety of trading products and the smoothest trading experience, but Orders Exchange has a higher growth ceiling.

- Bitcoin will be an important narrative in this cycle of bull markets. It is necessary to pay close attention to top tier projects in each vertical of the Bitcoin ecosystem.

1. Background

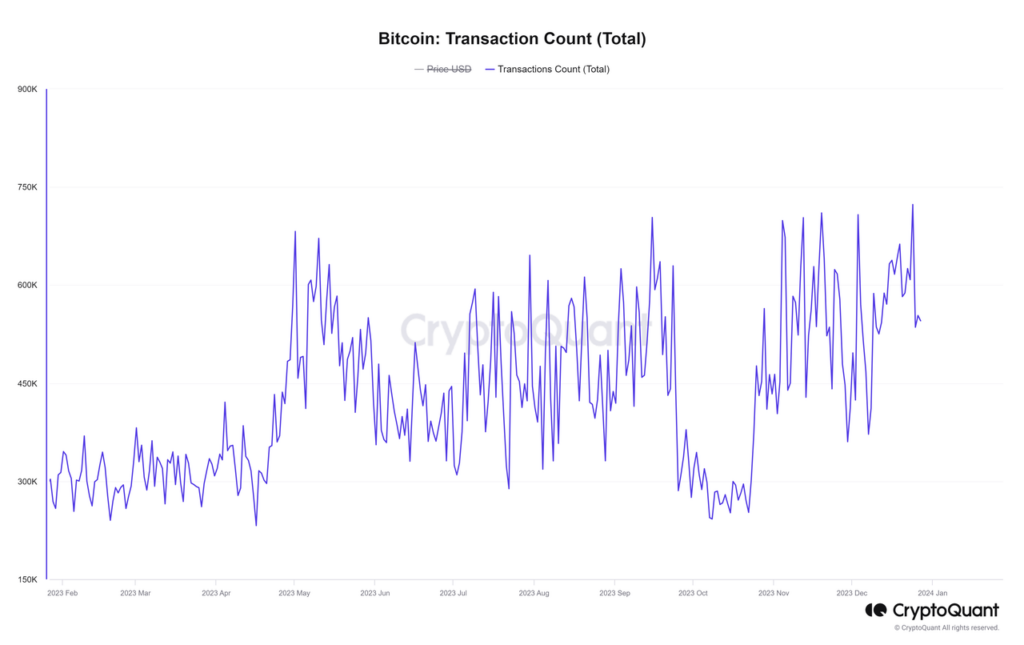

With the overflow of inscription assets due to the Ordinals protocol, Bitcoin network, which was once characterized by lack of smart contracts, inefficent for developing, and in dearth of infrastructure and scaling capabilities, is experiencing a data boom on chain (refer to Kernel’s previous research article: Can RGB Replicate The Ordinals Hype for more details). Similar to what happened when the Ethereum network first came into established, formatted text, images, even videos were being scrambled to 4MB Tapscript scripts that would have never been executed. While this surge in on-chain activities contributed to the growth and development of the Bitcoin ecosystem and infrastructure, it also created a surge in transaction volumes and a huge storage burden on the network. In addition, for a wide variety of inscriptions, simple transfers can no longer satisfy users’ transaction needs, and users are looking forward to the introduction of a wide range of derivatives trading services in Bitcoin. Hence the development of the Bitcoin application layer has become relatively urgent right now.

Source: CryptoQuant

2. Bitcoin Layer2

Unlike Layer2 on Ethereum, which is dominated by Rollup, Layer2 solution for Bitcoin is still vague. Bitcoin is not able to write smart contract on its own scripting language, and the publication of smart contracts must rely on third-party protocols, so applying a similar solution to Bitcoin can not guarantee the same level of security as an Ethereum Rollup. As a result, a variety of Layer2 solutions exist for the Bitcoin, including Lightning network, side chain, and Rollup based on TapScript.

2.1 Lightning network

Lightning network is the earliest Bitcoin Layer2 solution, first proposed by Gregory Maxwell in December 2015. The Lightning network stack, known as BOLT, was released by Lightning Labs in January 2017. Since then, it has undergone upgrades and improvements. The Lightning network allows users to make peer-to-peer, off-chain payment channel transfers of any size and number without fees until the Lightning network is closed. At that point, all previous transactions are settled with a single transaction. The Lightning network has the potential to achieve up to 10 million TPS (transactions per second) due to its use of off-chain channels. However, there is a risk of centralization with off-chain channels. And to successfully transact between two addresses, the off-chain channel must be established either directly or through a third party. Additionally, both parties must be online during the transaction for secure execution.

Source: Kernel Ventures

2.2 Side Chain

The side chain solution on Bitcoin is similar to that of Ethereum, with a new token pegged to Bitcoin 1:1 is issued on a new chain. This new chain would not be limited by transaction speed and development bottlenecks of the Bitcoin network, allowing for the transfer of Bitcoin-pegged tokens at a much faster rate and lower cost. The side chain solution presumably inherits the asset value of the mainnet, but not the security of the mainnet, and all transactions are recorded and confirmed on the side chain.

2.2.1 Stacks

Stacks 2.0 was released in 2021, where users can lock BTC on the Bitcoin mainnet and receive the equivalent value of SBTC assets on Stacks, but their transactions on the side chain require payment of STX, the Stacks’ native token, as gas. Unlike Ethereum, Bitcoin network doesn’t allow for a smart contract address that can effectively manage the locked BTC. Therefore, locked BTC is sent to a specific multisig address. The release process is relatively simple, requiring a request to the Burn-Unlock contract on Stacks to destroy the SBTC on Stacks and send the locked BTC back to the original address, since the Stacks network allows Clarity language for smart contract development. The block release process of the Stacks network uses the POX consensus mechanism. Bitcoin miners send BTC bids for block opportunities, and the higher the bid, the higher the weight of the miner. Ultimately, the winner is selected by a specific verifiable random function to package the blocks on the Stacks network, and receives a reward in the form of the corresponding STX. At the same time, this part of the bidding BTC will be distributed in the form of SBTC to the holders of STX tokens as a reward.

Source: Kernel Ventures

In addition, Stacks is expected to push Satoshi Nakamoto upgrade in April, which will include optimizations to its development language, Clarity, to lower the barriers for developers. Secondly, Stacks has optimized the security level of the network, confirming transactions on Stacks to be settled on Bitcoin mainnet, upgrading the security of Stacks from a sidechain to Layer2, which is the same as that of Bitcoin’s mainnet. Finally, Stacks has also made significant improvements to its block rate, reaching 5 seconds per block in the testing phase (compared to 10-30 minutes per block in the current phase). If Satoshi Nakamoto upgrade is completed successfully, Stacks can narrow, perhaps even eliminate the gap between Layer2 on Ethereum, which should attract a lot of attention and stimulate the development of ecosystem.

2.2.2 RSK

RSK (RootStock) is a Bitcoin side chain without native tokens, and transactions on the side chain are currently handled on Bitcoin. Users can exchange BTC from the mainnet for RBTC at a 1:1 ratio on RSK through the built-in PowPeg protocol. RSK is also a POW chain, but with the introduction of a merger mining mechanism, the infrastructure and setup of Bitcoin miners can be fully applied to the RSK mining process, which reduces the cost of Bitcoin miners to participate in RSK mining. Until now, transactions on RSK are three times faster than on the mainnet and cost 1/20 as much as on the mainnet.

Source: RSK White Paper

2.2.3 BEVM

BEVM is an EVM-compatible POS side chain that has yet issued its own native token. It uses Schnorr’s multisig algorithm on the Bitcoin network to store incoming assets in a multisig script address controlled by 1,000 addresses, which corresponds to the 1,000 POS verifiers on BEVM. The automated control of assets can be achieved by writing MAST (Merkelized Abstract Syntax Tree) scripts in the TapScript area, where the program is described in a number of independent chunks, each of which corresponds to a portion of the code logic, with no need to store a large amount of logic in the Script, only the hash result of each chunk. That has greatly reduced the amount of code that needs to be stored on the blockchain. When a user transfers BTC to BEVM, this part of BTC is locked by the script program, and the locked BTC can only be unlocked and sent back to the corresponding address if signed by more than 2/3 of the verifiers. BEVM is EVM compatible, so that allows for cost efficient migration of dApps originally built on Ethereum, trading with the above BTC-pegged assets while using it for gas expenses.

Source: BTCStudy

2.2.4 Merlin Chain

Merlin Chain is an EVM-compatible Bitcoin side chain that allows direct connection to the network through Bitcoin address generated by Particle network, with an unique Ethereum address generated. It can also be connected directly to an RPC node with an Ethereum account. Merlin Chain currently supports the transfer of BTC, Bitmap, BRC-420 and BRC-20 assets across the chain. The BRC420 protocol is developed by the Bitmap asset community based on recursive inscriptions like Merlin Chain, and the whole community has also put forward projects such as RCSV’s recursive inscription matrix and the Bitmap Game meta-universe platform based on recursive inscriptions.

Source: Merlin Docs

Merlin Chain went live on February 5th, followed by a round of IDOs and staking rewards allocating 21% of the governance token MERL. The direct and massive airdrop attracted a large number of participants, Merlin Chain’s TVL has surpassed $3 billion by now, with Bitcoin’s on-chain TVL surpassing Polygon’s, reaching #6 on all blockchains.

Source: DeFiLlama

During People’s Launchpad’s IDO, users can stake Ally or more than 0.00025 BTC to earn bonus points that could be redeemed for MERL, with a cumulative bonus stake limit of 0.02 BTC, which corresponded to 460 MERL tokens. Allocation of this round is relatively small, accounting for only 1% of total amount of MERL. However, considering OTC price of $2.90 MERL today, it has created a return of over 100%. In the second staking incentive round, Merlin allocated 20% of its total tokens, allowing users to stake BTC, Bitmap, USDT, USDC, and part of BRC-20 and BRC-420 assets on the Merlin Chain through Merlin’s Seal. User’s assets on Merlin will take an hourly snapshot of their value in USD, and the final daily average price multiplied by 10,000 will be the amount of points the user receives. The second round of staking is based on Blast’s team model, where users can choose to be leader or team member. Leaders will receive an invitation code to share with their team members.

Merlin is relatively mature in the current Bitcoin Layer2 ecosystem, liberating the liquidity of Layer1 assets, and allow Bitcoin transfers on Layer2 at a lower cost. The Bitmap ecosystem behind Merlin is very large, and the technology is relatively sound, so it is probable to have good development in the long run. The stake on Merlin has a high rate of return. In addition to the expected return of MERL, there are also opportunities to obtain the corresponding Meme or other tokens airdropped by the project, such as the official airdropped Voya tokens. Staking of more than 0.01 BTC can obtain airdropping of 90 Voya tokens, whose price has been rising since the launch of the program, and the highest of which reaches 514% of issuance price. Voya’s current price is quoted at US$5.89, and the yield is as high as 106% when calculated according to the average price of Bitcoin at US$50,000 when staked.

Source: CoinGecko

2.3 Rollup

2.3.1 BitVM

BitVM is based on Optimistic Rollup for Bitcoin Layer2. Similar to Optimistic Rollup on Ethereum, traders first send transactions to Layer2 on the Bitcoin network, where they can be calculated and packed, after which the results will be sent to smart contract on Layer1 for verification while time is given to the verifier to challenge the prover’s statement. However, Bitcoin does not support native smart contract, so the implementation is not as simple as Ethereum’s Optimistic Rollup. The whole process involves Bit Value Commitment, Logic Gate Commitment, and Binary Circuit Commitment, which can be summarized as BVC, LGC and BCC below.

- BVC (Bit Value Commitment): BVC is essentially a level result with only two possibilities, 0 and 1, similar to a Bool type variable in other programming languages. Bitcoin is a stack-based scripting language, where bool type doesn’t exist, so bytecode combinations are used to emulate it in BitVM.

<Input Preimage of HASH>

OP_IF

OP_HASH160 //Hash the input of user

<HASH1>

OP_EQUALVERIFY //Output 1 if Hash(input)== HASH1

<1>

OP_ELSE

OP_HASH160 //Hash the input of user

<HASH2>

OP_EQUALVERIFY //Output 0 if Hash(input)== HASH2

<0> In BVC, the user needs to submit an input first, then the Bitcoin network will hash the input and unlock the script only if the hash result is equal to HASH1 or HASH0 with HASH1 having an output of 1 and HASH2 having an output of 0. In the following section, we will summarise the entire snippet into an OP_BITCOMMITMENT opcode to simplify the description process.

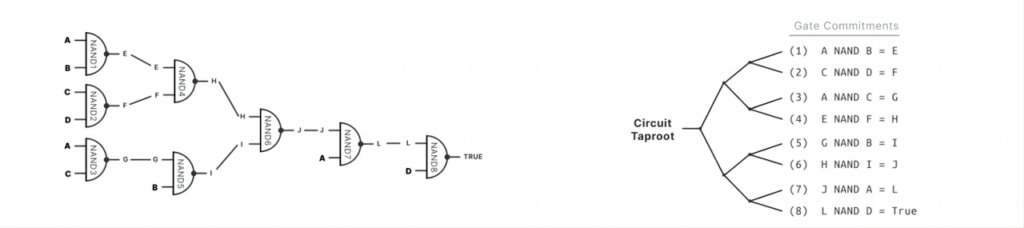

- LGC (Logic Gate Commitment): All functions in a computer are essentially a combination of a series of bool gates, which can be simplified to a series of NAND gates. That’s to say, if we can simulate NAND gates in the Bitcoin network through bytecode, we can essentially realize any function. Although Bitcoin does not have a direct implementation of the NAND opcode, it does have an AND gate, OP_BOOLAND, and a NOT gate, OP_NOT, which can be superimposed to reproduce the NAND. For the two output levels obtained from OP_BITCOMMITMENT, we can form a NAND output circuit with the OP_BOOLAND and OP_NOT opcodes.

- BCC (Binary Circuit Commitment): Based on LGC circuits, we can construct specific gate relationships between inputs and outputs. In BCC gate circuits, this input comes from the corresponding hash-primary image in the TapScript script, and different Taproot addresses correspond to a different gate, which we call a TapLeaf, and the many TapLeafs make up a Taptree, which serves as the input to the BCC circuit.

Source: BitVM White Paper

Ideally, a BitVM prover would compile and compute the circuits off-chain and return the results to the Bitcoin network for execution. However, since the off-chain process is not automated by smart contract, to prevent the provers from committing fraud transactions, BitVm requires the provers on the network to conduct a challenge. Verifier first reproduce the output of a certain TapLeaf, then add it with other TapLeaf results provided by the provers as inputs to drive the circuit. If the output is false, the challenge is successful, which means that the prover has provided a fraud message, and vice versa. However, to accomplish this process, the Taproot circuit needs to be shared between the challenger and the prover in advance, and, only the interaction between a single prover and a single verifier can be realized.

2.3.2 SatoshiVM

SatoshiVM is an EVM compatible zkRollup Layer2 solution for Bitcoin. The implementation of smart contracts on SatoshiVM is the same as on BitVM, using Taproot circuits to simulate complex functions. SatoshiVM is divided into three layers, the Settlement Layer, the Sequencing Layer and the Proving Layer. The Settlement Layer, also known as the Bitcoin mainnet, is responsible for providing the DA layer, storing the Merkle Roots and Zero Knowledge Proofs of transactions, and settling transactions by verifying the correctness of the Layer2 packaged transactions through the Taproot circuit. The Sequencing Layer is responsible for packaging and processing transactions, and returning the results of the transactions to the mainnet along with the zero-knowledge certificates, and the Proving Layer is responsible for generating zero-knowledge certificates for the tasks received from the Sequencing Layer and passing them back to the Sequencing Layer.

Source: SatoshiVM Docs

2.3.3 BL2

BL2 is a zkRollup Bitcoin Layer2 based on the VM Common Protocol (the official preconfigured VM protocol that is compatible with all major VMs). similar to other zkRollup Layers, its Rollup Layer mainly packs transactions and generates the corresponding zero-knowledge certificates through zkEVM. BL2’s DA layer introduces Celestia to store bulk transaction data and only uses the BL2 network to store the zero-knowledge proofs, and finally returns the zero-knowledge proofs validation and a small amount of validation data, including BVC, to the main network for settlement.

Source: BL2.io

BL2’s official X account has been updated daily, and it has also announced its development plan and token program, which will allocate 20% of its tokens to OG Mining, as well as the launch of a testnet in the near future. At this stage, the project is relatively new compared to other Bitcoin Layer2 and in its early stage, with only 33,000 followers on X. It’s worth paying attention to as it introduces some of the more recent concepts such as Celestia and Bitcoin Layer2. However, there are no actual technical details on the website, with only a demo of what to expect, and no whitepaper for the project. At the same time, the goals are quite big, such as the abstraction of accounts on Bitcoin and compatibility with the VM protocol of mainstream virtual machines. Whether the team will be able to achieve this goal is still questionable, so we will consider taking a more reserved approach.

Source: BL2’s X Account

2.3.4 B2 Network

The B2 Network is a zkRollup Layer2 with Bitcoin as the settlement layer and DA layer, which is structured into a Rollup Layer and a DA Layer. User transactions are first submitted and processed in the Rollup Layer, which uses a zkEVM scheme to execute user transactions and output the associated proofs, followed by storage of user state in the zkRollup Layer. The batch transactions and generated zero-knowledge proofs are forwarded to the DA Layer for storage and validation. The DA Layer can be subdivided into three parts: the Decentralised Storage Node, the B2 Node, and Bitcoin mainnet. The decentralised storage node receives the Rollup data and periodically generates temporal and spatial zero-knowledge proofs based on the Rollup data and sends the generated zero-knowledge proofs to the B2 Node, which is responsible for off-chain validation of the data, and then records the transaction data and corresponding zero-knowledge proofs in TapScript on the Bitcoin mainnet after validation is completed. The B2 Node is responsible for confirming the authenticity of the ZKP and finalising the settlement.

Source: B2 Network White Paper

B2 Network has a good influence among major BTC Layer2 programs, with 300,000 followers on X, surpassing BEVM’s 140,000 and SatoshiVM’s 166,000, which is also a Zk Rollup Layer2. At the same time, the project has received seed round funding from OKX and HashKey, attracting a lot of attention, and the TVL on the chain has exceeded $600 million.

Source: bsquared.network

B2 Network has launched B2 Buzz,and in order to use B2 Network, you need an invitation link. B2 Network uses the same communication model as Blast, which provides a strong two-way benefit binding newcomers and those who have already joined the network giving them sufficient motivation to promote the project. After completing simple tasks such as following the official X account, you can enter the staking interface, which supports the use of assets on four chains: BTC, Ethereum, BSC and Polygon. In addition to Bitcoin, inscriptions, ORDI and SATS can also be staked on the Bitcoin network. If you stake BTC, you can transfer the assets directly, whereas if you stake an inscription, you need to inscribe and transfer, and it is important to note that since there are no smart contracts on the Bitcoin network, the assets are essentially multisig-locked to a specific BTC address. The assets staked on the B2 network will not be released until at least April this year, and the points gained from staking during this period can be exchanged for mining components used for virtual mining, of which the BASIC miners only requires 10 components to activate, while the ADVANCED miner requires more than 80 components.

Officials announced a partial token program, 5% of the total tokens will be used to reward virtual mining, and the other 5% will be allocated to ecological projects on B2 network for airdrop. At the time when much attentions are paid for Tokenomics fairness, 10% of the total amount of tokens is difficult to fully mobilize the enthusiasm of the community. It is expected that B2 network will have other staking incentives or LaunchPad plans in the future.

2.4 Comprehensive Comparison

Among the three types of BTC Layer2, Lightning Network has the fastest transaction speed and lowest transaction cost, and has more applications in real-time payment and offline purchase. However, to realize the development of the application ecosystem on Bitcoin, it is difficult to build all kinds of DeFi or cross-chain protocols on Lightning network in terms of stability and security, and thus the competition in the application layer market is mainly between the sidechain and Rollup types. Sidechain solutions do not need to confirm transactions on the main network, and have more mature technical solutions and implementation difficulties, and thus have the highest TVL among the three. Due to the lack of smart contracts on the Bitcoin main network, the confirmation solution for Rollup data is still under development, and it might take a while for actual usage.

Source: Kernel Ventures

3. Bitcoin Cross-chain Bridge

3.1 Multibit

Multibit is a cross-chain bridge designed specifically for BRC20 assets on the Bitcoin network, and currently supports the migration of BRC20 assets to Ethereum, BSC, Solana, and Polygon. In the process of cross-chain bridging, users first need to send their assets to a BRC20 address designated by Multibit, and wait for Multibit to confirm the transfer of the assets on the main network, then the users will have the right to cast the corresponding assets on other chains, and to complete the cross-chain bridging process, users need to pay gas to mint on the other chain. Among the cross-chain bridges, Multibit has the best interoperability and the largest number of BRC20 assets, including more than ten kinds of BRC20 assets such as ORDI. In addition, Multibit also actively expands the cross-chain bridging of assets other than BRC20, and currently supports the Farming and cross-chain bridging of governance tokens and stablecoins of Bitstable, the native stablecoin protocol of BTC. Multibit is at the forefront of cross-chain bridges for BTC-derived assets.

The Cross Chain Assets that Multibit supports, Source: Multibit’s X Account

3.2 Sobit

Sobit is a cross-chain protocol between Solana and Bitcoin network. Cross-chain assets are mainly BRC20 tokens and Sobit’s native tokens. Users collateralize BRC20 assets on the Bitcoin mainnet to a designated Sobit address, and wait for Sobit’s validation network to verify that the user can then Mint the mapped assets at the designated address on the Solana network. At the heart of SoBit’s validation network is a validator-based framework that requires multiple trusted validators to approve cross-chain transactions, providing additional security against unauthorized transfers. Sobit’s native token is Sobb, which can be used to pay for cross-chain fees for the Sobit Cross-Chain Bridge, totaling 1 billion coins. Sobb distributes 74% of its assets in a Fair Launch. Unlike other DeFi and cross-chain tokens on Bitcoin that have gone a upward trend these days, Sobb’s price has been on a downward cycle after a brief uptrend, dropping more than 90 percent, not picking up any significant momentum along with BTC’s uptrend, which may be caused by Sobb’s chosen vertical. Sobit and Multibit’s market orientations are very similar. But at this stage, Sobit can only support cross-chain for Solana, with only three kinds of BRC20 assets that can be bridged cross-chain. Compared with Multibit, which also provides cross-chain bridging of BRC20 assets, Sobit is far behind in terms of its ecosystem and completeness of cross-chain assets, and thus can hardly gain any advantage in the competition with Multibit.

The Price of Sobb, Source: Coinmarketcap

3.3 Meson Fi

Meson Fi is a cross-chain bridge based on the principle of HTLC (Hash Time Locked Contract). It supports cross-chain interactions between 17 mainstream chains including BTC, ETH and SOL. In the cross-chain process, users sign the transaction under the chain, then submit it to Meson Contract for confirmation and lock the corresponding assets in the original chain. Meson Contract broadcasts the message to the target chain through Relayer after confirming the message. There are three types of Relayer: P2P node, centralized node and no node, P2P node has better security, centralized node has higher efficiency and availability, while no node requires user to hold certain assets on both chains, which user can choose depending on actual situation. LP on the target chain also calls the Lock method on the Meson Contract to lock the corresponding asset after checking the transaction through postSwap of the Meson Contract, and then exposes the address to Meson Fi. The next operation is the HTLC process, where the user specifies the address of the LP on the original chain and creates a hash lock, removing the asset by exposing the hash lock original image on the target chain. This is then followed by the HTLC process, where the user specifies the LP address and creates a hash lock in the original chain, exposing the hash lock image in the target chain to retrieve the asset, and then the LP retrieves the user-locked asset in the original chain through the original image.

Source: Kernel Ventures

Meson Fi is not a cross-chain bridge specifically designed for Bitcoin assets, but a full-chain bridge like LayerZero. However, major BTC Layer2 such as B2 Network, Merlin Chain, and BEVM have all established partnership with Meson Fi and recommend using it to cross-chain bridge their assets during the staking process. According to official reports, Meson Fi processed more than 200,000 transactions during the three-day Merlin Chain staking event, as well as about 2,000 cross-chain staking of BTC assets, including transactions across all major chains to Bitcoin. As Layer2 on Bitcoin continues to release and introduce staking incentives, Meson Fi’ is more likely to attract assets for cross-chain, and see an increase protocol revenue.

3.4 Comprehensive Comparison

Overall, Meson Fi and the other two cross-chain bridges are two different kinds of cross-chain bridge. Meson Fi is essentially a full-chain cross-chain bridge, but happens to work with many of Bitcoin’s Layer2s to help it bridge assets from other networks. Sobit and Multibit, on the other hand, are cross-chain bridges designed for Bitcoin’s native assets, serving BRC20 assets as well as other DeFi and Stablecoin protocol assets on Bitcoin. Comparatively speaking, Multibit offers a wider variety of BRC20 assets, including dozens of assets such as ORDI and SATS, while Sobit only supports three BRC20 assets so far. In addition, Multibit has partnered with some of the Bitcoin stablecoin protocols to provide cross-chain services and stake revenue activities, providing a more comprehensive range of services. Finally, Multibit also offers better cross-chain liquidity, providing cross-chain services for five major chains, including Ethereum, Solana, and Polygon.

4. Bitcoin Stablecoin

4.1 BitSmiley

BitSmiley is a series of protocols based on the Fintegra framework on the Bitcoin network, including the Stablecoin Protocol, the Lending Protocol, and the Derivatives Protocol. Users can mint bitUSD by over-collateralization of BTC in BitSmliey’s stablecoin protocol, and when they want to withdraw their collateralized BTC, they need to send the bitUSD back to the Vault Wallet for destruction and pay a fee. When the value of the collateralization falls below a certain threshold, BItSmiley will enter into an automatic liquidation process for the collateralized assets, and the formula for calculating the liquidation price is as follows:

$$𝐿𝑖𝑞𝑢𝑖𝑑𝑎𝑡𝑖𝑜𝑛 𝑃𝑟𝑖𝑐𝑒 = \frac{𝑏𝑖𝑡𝑈𝑆𝐷𝐺𝑒𝑛𝑒𝑟𝑎𝑡𝑒𝑑 ∗ 𝐿𝑖𝑞𝑢𝑖𝑑𝑎𝑡𝑖𝑜𝑛𝑅𝑎𝑡𝑖𝑜}{𝑄𝑢𝑎𝑛𝑡𝑖𝑡𝑦 𝑜𝑓 𝐶𝑜𝑙𝑙𝑎𝑡𝑒𝑟𝑎𝑙 } $$

The exact liquidation price is related to the real-time value of the user’s collateral and the amount of bitUSD minted, where Liquidation Ratio is a fixed constant. During the liquidation process, in order to prevent price fluctuations from causing losses to the liquidated, a Liquidation Penalty is designed in BItSmily to compensate for this, and the longer the liquidation time, the greater the amount of this compensation. The liquidation of assets is done by Dutch Auction, in order to complete the liquidation of assets in the shortest possible time. At the same time, the surplus of the BitSmiley protocol will be stored in a designated account and auctioned at regular intervals, in the form of a British auction with BTC bidding, which can maximize the value of the surplus assets. The BitSmiley project will use 90% of the surplus assets to subsidize on-chain collateral, while the remaining 10% will be allocated to the BitSmiley team for daily maintenance costs. BitSmiley’s lending agreement also introduces a number of innovations to the settlement mechanism for the Bitcoin network. Due to the 10-minute block rate of the main Bitcoin network, it is not possible to introduce a prediction machine to judge price fluctuations in real time like Ether, so BitSmiley introduces a mechanism to insure a third party against failure of the other party to deliver on time, whereby the user has the option to pay a certain amount of BTC to the third party in advance to insure the transaction (which both parties are required to pay for), and when one party fails to complete the transaction on time, the transaction will be insured by the third party. When one party fails to complete the transaction on time, the guarantor will compensate the other party for the loss.

Source: BitSmliey WhitePaper

BitSmiley offers a wide range of DeFi and stablecoin features, as well as a number of innovations in its settlement mechanism to better protect users and improve its compatibility with the Bitcoin network. BitSmiley is an excellent stablecoin and DeFi model in terms of both settlement and collateralization mechanisms, and with the Bitcoin ecosystem still in its infancy, BitSmiley should be able to capture a significant share of the stablecoin competition.

4.2 BitStable

BitStable is a Bitcoin stablecoin protocol based on over-collateralization, and currently supports collateralization of ORDI and MUBI assets from Bitcoin mainnet, as well as USDT from Ethereum. Depending on the volatility of the three assets, BitStable sets different overcollateralization ratios, with USDT at 0%, ORDI at 70%, and MUBI at 90%.

Source: Bitstable.finance

BitStable has also deployed corresponding smart contracts on Ethereum, and the DALL stablecoin obtained by staking can be exchanged 1:1 on Ethereum for USDT and USDC. Meanwhile, BitStable has adopted a dual-token mechanism, in addition to the stablecoin DALL, it has adopted BSSB as its own governance token, through which holders can participate in the community’s governance and share the revenue of the network. The total number of BSSBs is 21 million, which are distributed in two ways. The first is by staking DALL tokens on the Bitcoin network to earn the corresponding BSSB governance tokens, with the project distributing 50 percent of the BSSB tokens through staking rewards. The second method was the two rounds of LaunchPad on Bounce Finance at the end of November last year, in which 30% and 20% of the BSSBs were distributed through staking Auctions and Fixed Price Auctions. However, there was a hacking attack during the staking Auctions, which led to the destruction of more than 3 million BBSB tokens.

Source: coinmarketcap

During the hacker attack, the project team responded in a timely manner. The remaining 25% of the tokens that were not affected by the hacker attack were still issued, although at a higher cost, but this measure better restored the community’s confidence, and ultimately prevent the clash of price.

5. Bitcoin DeFi

5.1 Bounce Finance

Bounce Finance consists of a series of DeFi ecosystem projects, including BounceBit, BounceBox and Bounce Auction. It is worth noting that Bounce Finance was not originally a project that served the BTC ecosystem, but an auction protocol set up for Ethereum and BSC, which shifted gears last May to take advantage of the Bitcoin development boom. BounceBit is an EVM-compatible POS sidechain for Bitcoin, and will select verifiers based on who are staking Bitcoins from the Bitcoin mainnet. BounceBit also introduces a hybrid revenue mechanism, whereby users can stake BTC assets on BounceBit to earn revenue on-chain through POS validation and the associated DeFi protocol, and can also securely transfer their assets to and from CEX by mirroring the assets on-chain and earning revenue on CEX. BounceBox is similar to the application store in Web2, in which the publisher can custom design a dApp, that is, a box, and then distribute it through BounceBox, and then users can choose their favorite boxes to participate in the DeFi activities. Bounce Auction, the main part of the project on Ether, is an auction for various assets and offers a variety of auction options, including fixed-price auctions, UK auctions and Dutch auctions.

Bounce’s native token, Auction, was released in 2021 and has been used as the designated staking token for earning points in several rounds of Token LaunchPad on Bounce Finance, which has fueled the recent rise in the price of Auction tokens. What’s more noteworthy is that BounceBit, the new staking chain that Bounce has built after switching to Bitcoin, is now open for on-chain staking to get points and test network interaction points, and the project’s X account clearly indicates that points can be exchanged for tokens and that token issuance will take place in May this year.

Source: Coinmarketcap

5.2 Orders Exchange

Orders Exchange is a DeFi project built entirely on the Bitcoin network, currently supporting limit and market pending orders for dozens of BRC20 assets, with a blueprint to introduce swaps between BRC20 assets in the future. The underlying technology of Orders Exchange consists of Ordinals Protocol, PSBT and Nostr Protocol. More information on the Ordinals Protocol please refer to Kernel’s previous research article, Kernel Ventures: Can RGB Replicate The Ordinals Hype. PSBT is a key feature on Bitcoin, where users sign a PSBT-type signature consisting of an Input and an Output via SIGHASH_SINGLE | ANYONECANPAY. PSBT is a bitcoin signature technology that allows users to sign a PSBT-X format consisting of an Input and an Output, with the Input containing the transaction that the user will execute and the Output containing the the prerequisite for user’s transactions, which requires another user to execute the Output content and perform a SIGHASH_ALL signing on the network formula before the content of the Input finally takes effect. In Exchange’s Pending Order transaction, the user completes the Pending Order by means of PSBT signature and waits for other party to complete the transaction.

Source: orders-exchange.gitbook.io

Nostr is an asset transfer protocol set up using NIP-100 that improves the interoperability of assets between different DEXs. All of Orders Exchange’s 100 million tokens have been fully released. And although it emphasized in the whitepaper that ttokens are only experimental and do not have any value, the project’s elaborate airdrop plan still shows a clear intention of token economy. There were 3 main directions for the initial token distribution, 45% of the tokens were distributed to traders on Orders Exchage, 40% of the tokens were airdropped to early users and promoters, and 10% were distributed to developers. However, the 40% drop was not described in detail on either the official website or the official tweets, and there was no discussion on X or in Discord’s Orders community after the official announcement of the drop, so the actual distribution of the drop is still questionable. Overall, Orders Exchange’s buy order page is intuitive and clear, and you can see the prices of all buy orders and sell orders explicitly, which is of high quality among the platforms offering BRC20 trading. The subsequent launch of the BRC20 token swap service on Orders Exchange should also help the value capture of protocols.

5.3 Alex

Alex is a DeFi Protocol built on top of the Bitcoin sidechain Stacks, currently supporting Swap, Lending, Borrow, and some other transaction types. At the same time, Alex has introduced some innovations to the traditional DeFi transaction model. The first is Swap, the traditional Swap pricing model can be divided into two types: x*y=k for ordinary pairs and x+y=k for stablecoins, but on Alex, you can set up the trading rules for pairs, and set it to be a linear combination of the results of the two calculations according to a certain ratio, x*y=k and x+y=k. Alex has also introduced OrderBook, a combined on-chain and off-chain order thinning model that allows users to quickly cancel pending transactions at zero cost Finally, Alex offers fixed-rate lending activities and has established a diversified collateral pool for lending services instead of the traditional single collateral, which consists of both risky and risk-free assets, reducing the risk of lending.

Source: Alexgo Docs

Unlike other DeFi projects in the BTC ecosystem, which entered the market after the Ordinals protocol had blown up the BTC ecosystem, Alex started working on the BTC DeFi ecosystem as early as the last bull market, and has raised a seed round of funding. Alex is also excellent in terms of performance and the different types of transactions, even many DeFi projects on Ethereum do not have much competitive edge over Alex’s transaction experience. Alex’s native token, Alex Lab, has a total supply of 1 billion, and 60% of it has already been released, which can still be earned by staking or by offering as a liquidity provider on Alex. However, revenue will hardly reach the level it was at during early launch. As one of the most well-established DeFi project on Bitcoin, Alex’s market cap is considered not that high, with the Bitcoin ecosystem probably being an important engine in this bull market. In addition, the sidechain where Alex was deployed, Stacks, will execute an important Satoshi Nakamoto upgrade, of which Stacks will be greatly optimized in terms of both transaction speed and transaction cost, and its security will be backed by the Bitcoin mainnet, making it a true Layer 2. This upgrade will also greatly reduce Alex’s operating costs and improve its transaction experience and security. The Stacks chain will also provide Alex with larger market and trading demand, bringing more revenue to the protocol.

6. Conclusion

The application of the Ordinals protocol has changed the inability of the Bitcoin network to implement complex logic and issue assets, and various types of asset protocols have been introduced on the Bitcoin network one after another, improving upon the idea of Ordinals. However, application layer is not prepared to provide services, and in the case of the surge of inscription assets, the functions that can be realized by Bitcoin applications appear to be anachronistic, and thus the development of applications on Bitcoin network has become a hotspot for all parties to seize. Layer 2 has the highest priority among all types of applications, because all other DeFi protocols, no matter developed they are, if they do not improve the transaction speed and reduce the transaction cost of the Bitcoin mainnet, it will be difficult to release the liquidity, and the chain will be flooded with new transactions for speculation purposes. After improving the speed and cost of transactions on the Bitcoin mainnet, the next step is to improve the experience and diversity of transactions. Various DeFi or stablecoin protocols provide traders with a wide range of financial derivatives. Finally, there are cross-chain protocols that allow assets on Bitcoin mainnet to flow to and from the other networks. Cross-chain protocols on Bitcoin are relatively mature, but not exclusively since the development of the Bitcoin mainnet, as many of the multi-chain bridges and mainstream cross-chain bridges were designed to provide cross-chain services to the Bitcoin network. For dApps like SocialFi and GameFi, due to the high gas and latency constraints of the main Bitcoin network, no excellent projects have appeared so far, but with the speed up and scaling of the Layer2 network, it is likely that they will emergeon Layer2 of the Bitcoin network. It is certain that the Bitcoin ecosystem will be at least one of the hot topics in this bull market. With plenty of enthusiasm and a huge market, although the various ecosystems on bitcoin are still in the early stages of development, we are likely to see the emergence of excellent projects from various verticals in the bull market this time.

Source: Kernel Ventures

Kernel Ventures is a research & dev community driven crypto VC fund with more than 70 early stage investments, focusing on infrastructure, middleware, dApps, especially ZK, Rollup, DEX, Modular Blockchain, and verticals that will onboard the next billion of users in crypto such as Account Abstraction, Data Availability, Scalability and etc. For the past seven years, we have committed ourselves to supporting the growth of core dev communities and University Blockchain Associations across the world.

References

- BEVM White Paper:https://github.com/btclayer2/BEVM-white-paper

- What is a Bitcoin Merkelized Abstract Syntax Tree:https://www.btcstudy.org/2021/09/07/what-is-a-bitcoin-merklized-abstract-syntax-tree-mast/#MAST-%E7%9A%84%E4%B8%80%E4%B8%AA%E4%BE%8B%E5%AD%90

- BitVM White Paper:https://bitvm.org/bitvm.pdf

- Bitcoin Scripting Principles:https://happypeter.github.io/binfo/bitcoin-scripts

- SatoshiVM Official Website:https://www.satoshivm.io/

- Multibit’s Docs:https://docs.multibit.exchange/multibit/protocol/cross-chain-process

- Alex White Paper:https://docs.alexgo.io/

- Merlin Technical Docs:https://docs.merlinchain.io/merlin-docs/

- Sobit WhitePaper:https://sobit.gitbook.io/sobit/