by David, LBank Legal Department

This article begins with a discussion of the regulatory battle between the SEC and the CFTC in the cryptocurrency field. Due to the advantages of the SEC in terms of budget, personnel, enforcement will, and regulatory status, even if Congress prefers to grant most of the jurisdiction over cryptocurrencies to the CFTC, the SEC still has the ability, power, and motivation to classify certain cryptocurrencies as securities based on their characteristics, thereby bringing them into its own regulatory scope.

It is necessary for all stakeholders such as project developers, institutions and retail investors, cryptocurrency exchanges, legal compliance personnel, etc., to understand the logic and standards used by the SEC to identify securities, i.e., the Howey Test. The DAO investigation report is the first time the SEC applied the Howey Test to the field of cryptocurrencies. From this detailed report, people can understand the analytical logic of SEC staff. The SEC’s published “Analytical Framework for Digital Assets ‘Investment Contracts'” specifically unfolds the two most important standards of the Howey Test for the situation of cryptocurrencies and lists the specific factors and behaviors that will lead to certain types of cryptocurrencies being identified as securities from both positive and negative perspectives.

Regulatory Battle: The “Jurisdiction” Dispute Over Cryptocurrencies

Regulatory uncertainty, multi-head regulation, and regulatory games

The lack of federal legislation in the United States that clearly defines cryptocurrencies has led to a state of regulatory uncertainty in the cryptocurrency industry. This regulatory uncertainty is like a Sword of Damocles hanging over the heads of U.S. cryptocurrency practitioners, which not only leads to a large number of cryptocurrency practitioners going “abroad,” transferring industry innovation and shutting down U.S. operations by cryptocurrency exchanges, but also hinders the flow of U.S. capital into the cryptocurrency market. For example, with the SEC’s recent lawsuits against Binance and Coinbase, rumors are swirling that market makers Jane Street and Jump Trading are exiting the U.S. cryptocurrency trading business, triggering market turmoil and a liquidity crunch.

| 2023.1 | The SEC has accused Genesis and Gemini of unregistered offering and selling of securities to retail investors through the Gemini Earn crypto asset lending program. |

| 2023.2 | The SEC has accused Kraken of failing to register the offering and sale of its crypto asset collateralized services program. |

| The SEC has issued a Wells notice to BUSD issuer Paxos, asserting that BUSD is an unregistered security. | |

| The New York State Attorney General has accused cryptocurrency trading platform CoinEx of failing to register as a proprietary securities and commodities broker in the state. |

| 2023.3 | The New York State Attorney General has accused cryptocurrency EXchange KuCoin of violating securities laws. |

| The SEC has accused cryptocurrency trading platform Bittrex and its co-founder and former CEO, William Shihara, of operating an unregistered securities exchange, brokerage, and clearing agency. | |

| The SEC has filed a lawsuit against Justin Sun and his affiliated entities for the sale of unregistered securities TRX and BTT, and for fraudulently manipulating the secondary market for TRX. | |

| The SEC has issued a Wells notice to Coinbase and has categorized its lending service as a security. | |

| The SEC has leveled multiple charges against cryptocurrency exchange Beaxy and its executives. | |

| The CFTC has accused Binance and CZ of violating the Commodity Exchange Act by providing, entering, confirming the execution of, or otherwise dealing with off-exchange commodity futures trading; violating the Commodity Exchange Act by providing, entering, confirming the execution of, or trading off-exchange commodity options; soliciting and accepting orders for commodity futures, options, swaps, and retail commodity transactions, or acting as a counterparty in agreements, contracts, or transactions; operating a swap trading or processing facility without registering as a Swap Execution Facility (SEF) or being designated as a Contract Market (DCM); failing to diligently supervise Binance activities related to CFTC registration requirements; failing to implement effective KYC procedures or otherwise comply with applicable provisions of the Bank Secrecy Act; and deliberately conducting activities outside of the U.S., including entering agreements, contracts, and transactions, and constructing entities, with the intent to evade or attempt to evade laws and regulations. |

| 2023.6 | The SEC has accused Binance entities and CZ of operating an unregistered securities exchange, brokerage, and clearing agency; charged the Binance entities with illegally offering and selling unregistered securities; and accused the Binance entities of making false statements to investors regarding Binance.US, while raising approximately $200 million from private investors and attracting billions of dollars in trading volume. |

| The SEC has accused Coinbase of operating its crypto asset trading platform as an unregistered securities exchange, brokerage, and clearing agency, and of failing to register the offering and sale of its crypto asset collateralized services program. |

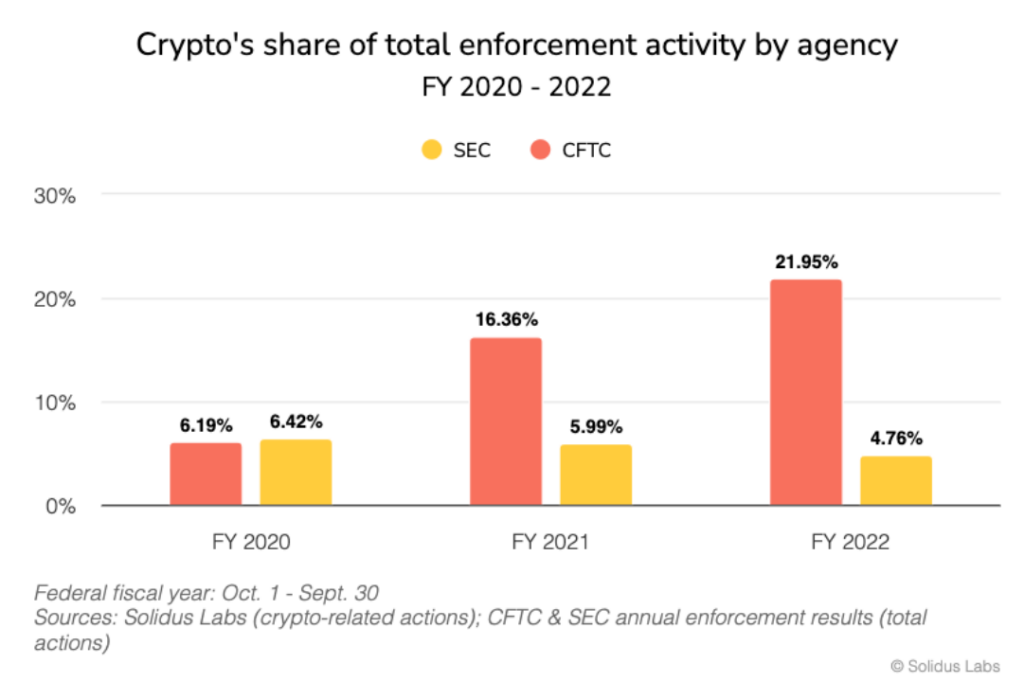

The proportion of crypto enforcement actions by the SEC and CFTC respectively in all enforcement actions for fiscal years 2020-2022

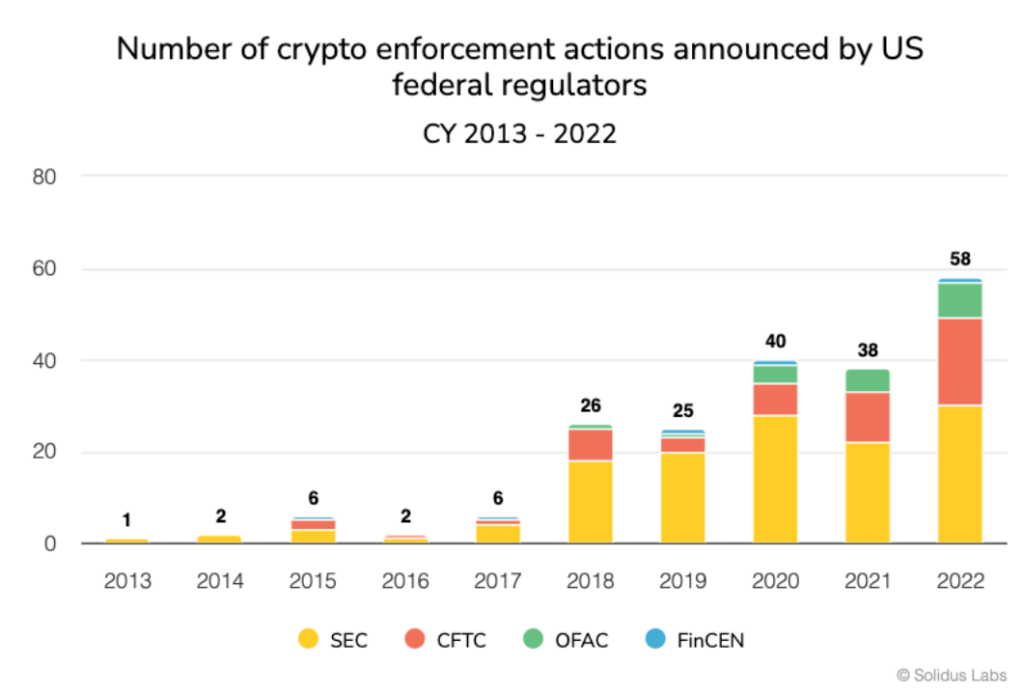

This legislative level of regulatory uncertainty has also triggered a state of multi-headed regulation and regulatory gamesmanship in the United States. In recent years, with the booming development of the crypto industry, the United States Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have stepped up their “hunting” of the crypto industry. However, they are not on the same front, and cryptocurrencies seem more like a platform for their “battles.” In 2022, when Coinbase was involved in insider trading, both the SEC and CFTC had intervened in the investigation, but the CFTC had to put the investigation on hold because the SEC listed the nine cryptocurrencies involved as securities. The SEC has always wanted to regulate as many cryptocurrencies as possible as securities, while CFTC Chairman Rostin Behnam and former Chairman Christopher Giancarlo have criticized the SEC’s regulatory enforcement of the crypto industry, stating that the CFTC they lead is the experienced regulator. Christopher Giancarlo believes that compared to the CFTC-regulated BTC futures market, which is liquid, transparent, well-regulated, and orderly, the SEC has not established any form of cryptocurrency regulatory market. This is because the CFTC has had a DNA of innovation since its establishment, unlike the more cautious and conservative SEC. Therefore, they operate differently. As the CFTC’s “backer” on Capitol Hill, the House Agriculture Committee has also repeatedly stated its support for CFTC’s regulation of cryptocurrencies. Due to the more cumbersome and stricter registration procedures and more frequent enforcement actions of the SEC compared to the CFTC, it is generally believed in the market that if the entire crypto market is regulated by the SEC, the compliance cost of the crypto industry will be unaffordable.

The increasing crypto enforcement actions by U.S. federal regulatory agencies year by year

CFTC’s Regulation of Cryptocurrencies

The CFTC is an independent federal agency established in 1974, responsible for regulating futures and derivatives markets. Its power primarily derives from the Commodity Futures Trading Commission Act of 1974 and the Commodity Exchange Act of 1934. These laws grant the CFTC the authority to regulate commodity trading.

The CFTC’s regulation of cryptocurrencies began in September 2015 with Bitcoin. In a public announcement, it formally defined Bitcoin as a commodity. The CFTC believes that Bitcoin has characteristics similar to traditional commodities; it can serve as a tradable item of value and can be used to measure value and as a medium of exchange. This means that the agency’s regulatory responsibility for derivative trading, such as Bitcoin futures contracts, has been confirmed. Subsequently, the CFTC also defined LTC, BCH, ETH, ETC, and other cryptocurrencies as commodities. In 2017, the CFTC approved the first Bitcoin futures contract, marking the first time the CFTC approved a derivatives contract involving a cryptocurrency.

Although the CFTC has extensive regulatory powers over the futures market, including setting rules for market participants, exchanges, and intermediaries, its regulatory authority over the spot market is not clear. The CFTC states that its power to regulate the spot market is limited to preventing market fraud or manipulation, but it cannot establish comprehensive rules for spot market participants as it does for the futures market.

In June 2022, Senators Cynthia Lummis and Kirsten Gillibrand formally introduced the Lummis-Gillibrand Responsible Financial Innovation Act. This is the first bipartisan attempt in the U.S. to establish a comprehensive regulatory framework for digital assets. If the bill passes, the CFTC would regulate BTC and ETH, which comprise a large portion of the cryptocurrency market volume. According to the bill’s definition, most cryptocurrencies on the market, which do not confer equity or dividend rights and meet disclosure conditions, would be classified as commodities rather than securities, clarifying the CFTC’s exclusive jurisdiction over all non-security cryptocurrencies in the spot market.

Put simply, securities generate returns from general enterprises or companies. A commodity is typically a “basic good” that can be bought, traded, or exchanged—think grains, beef, or gold. Commodities are often seen as a store of value because they maintain their value over time. Some crypto assets (like Bitcoin) certainly have characteristics of commodities. They are inherently decentralized and therefore do not generate returns from a joint enterprise or company. Christopher Giancarlo believes that if the CFTC is granted jurisdiction over the spot market, traders will not only have a regulated cryptocurrency futures market but also a regulated spot market. This would allow traders to have a complete suite of trading products.

SEC’s Regulation of Cryptocurrencies

The SEC is an independent agency and quasi-judicial body directly under the U.S. federal government. Its establishment can be traced back to the Wall Street stock market crash of 1929 and the subsequent Great Depression. This financial crisis exposed issues in the securities market, such as lack of transparency, existence of manipulation and fraud, and inadequate protection of investor interests. To restore public confidence in the securities market and ensure its stable development, the U.S. government enacted the Securities Exchange Act of 1934 and established the SEC in the same year.

The SEC’s powers primarily stem from two laws: the Securities Act of 1933 and the Securities Exchange Act of 1934. The Securities Act aims to protect investors from the harm of unregistered securities sales, requiring issuers to register before offering securities to the public and provide necessary information disclosures. It ensures that investors have access to accurate and complete information and the right to know what they are investing in. Sections 5(a) and 5(c) of the Securities Act prohibit the unregistered offering or sale of securities in interstate commerce (15 U.S.C. § 77e(a) and (c)). The Securities Exchange Act grants the SEC broad regulatory authority. It establishes the regulatory framework for the securities market and ensures fair, transparent, and efficient securities transactions. These laws empower the SEC to oversee and investigate various activities in the securities market, including the issuance of registered securities, securities trading, compliance with disclosure requirements, and market manipulation and fraud.

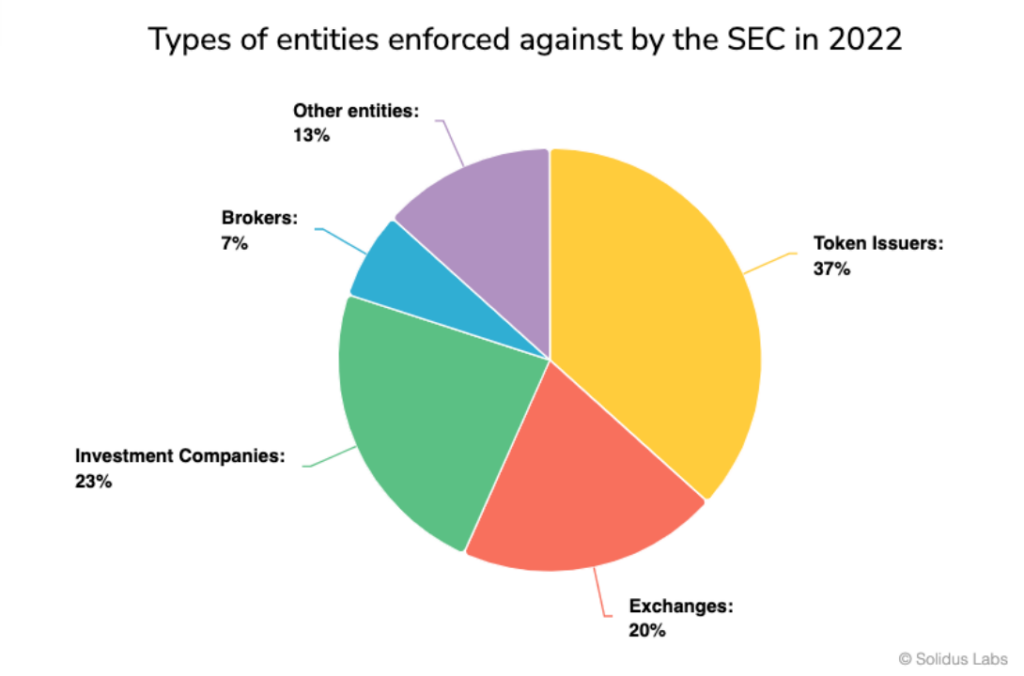

SEC Chairman Gary Gensler’s logic for enforcement actions against cryptocurrency exchanges is that since most cryptocurrencies fall under the purview of securities laws, most cryptocurrency intermediaries must also comply with securities laws. For regulators, they cannot act without authority from the law. The authority granted to the SEC is limited to the securities market. Therefore, if it wants to take action against cryptocurrencies, it must define them as securities. The SEC’s charges against exchanges such as Binance, Coinbase, and Bittrex for violations of securities laws and the Securities Exchange Act are based on the premise that the cryptocurrencies traded on their platforms constitute securities. According to the definitions in Section 2(a)(1) of the Securities Act and Section 3(a)(10) of the Securities Exchange Act, the term “security” refers to any note, stock, stock certificate, bond, debenture, company credit instrument, investment contract, transferable share, investment contract, trust certificate, or depositary receipt for securities, among other instruments (15 U.S.C. §§ 77b-77c). Thus, the Securities Act brings the broad catch-all category of “investment contracts” into the framework of securities. The specific definition of “investment contract” is established by the Howey Test.

The types of entities targeted by SEC’s crypto enforcement actions in 2022

On June 2nd, Patrick McHenry, Chairman of the House Financial Services Committee, and Glenn Thompson, Chairman of the House Agriculture Committee, released the Digital Asset Market Structure Proposal. This proposal focuses on token classification, the jurisdiction of the CFTC and SEC, and open crypto trading, establishing a functional framework to bridge the regulatory gaps between the CFTC and SEC. The proposal sets up a process for token issuers, allowing their tokens to be treated as commodities as long as the project is sufficiently decentralized. It states, “The proposal includes definitions for decentralized networks and functional networks and provides a certification process where digital asset issuers can demonstrate to the SEC that the network associated with the digital asset is decentralized.” The CFTC’s role is to oversee digital commodities, and token projects seeking to be treated as commodities must go through the CFTC’s certification process, which includes detailed disclosures about their operations. However, if the SEC can present a compelling argument, it may attempt to classify tokens as securities. The proposal states, “If the SEC determines that the certification does not comport with this proposal, the SEC may object to the certification but must provide detailed analysis for doing so.” Furthermore, the proposal calls for the SEC to amend its rules to allow broker-dealers to custody digital assets, permit digital commodities to be resold after initially being sold as investment contracts, and allow digital asset trading platforms to register as Alternative Trading Systems. However, it is doubtful whether this proposal can pass in the Democrat-controlled Senate and become law during the current term. Additionally, even if the proposal becomes law, the SEC still has the authority to classify certain cryptocurrencies as securities based on their characteristics, thereby bringing them under its regulatory purview. It is important to be prepared for all scenarios, as the industry believes the SEC will likely prevail in the race to regulate cryptocurrencies. This is not only because the SEC has a significantly larger staff and budget than the CFTC but also because the SEC, with its strong enforcement inclination, frequently intervenes in enforcement actions that would typically be led by other agencies. Companies that aspire to go public in the U.S. dare not challenge the authority of the SEC. In this context, strategies, resources, and industry dynamics will play a more significant role than the legal definitions of securities or commodities. Therefore, industry participants need to closely monitor the SEC’s regulatory discourse and frameworks regarding cryptocurrencies.

The Genesis of SEC Jurisdiction: The Howey Test

The Howey Test, which has gained recognition in recent years due to the SEC’s enforcement actions in the crypto industry, originated from the Supreme Court case SEC v. W.J. Howey Co. in the mid-1940s. W.J. Howey Co. was a company based in Florida that sold citrus grove plots. The company allowed buyers to lease the land back to them, and in return, the company would cultivate the citrus groves, sell the fruit, and share the proceeds with the buyers. The SEC sued W.J. Howey Co. for not registering the transaction with them. The Supreme Court ultimately ruled in favor of the SEC.

Based on the Howey case and subsequent precedents, an “investment contract” is defined as an investment of money in a common enterprise with expectations of profits solely from the efforts of others. The Howey case’s definition embodies a “flexible rather than static principle, which is capable of adaptation to meet the countless and variable schemes devised by those who seek the use of the money of others on the promise of profits.”

Subsequently, the definition of an “investment contract” was refined into four elements, known as the four prongs of the Howey Test. All four prongs must be satisfied simultaneously for a transaction to be classified as a security:

- Investment of Money: Investors contribute funds in the form of currency, assets, or other forms of investment capital.

- Common Enterprise: This requirement aims to distinguish investment contracts from one-on-one private contracts. In a “common enterprise” scenario, individual investors lack the incentive to gather information through due diligence and communication with other investors due to the high costs involved. They also have no ability to prevent negotiations between the collective and the project’s initiators. As a result, investors are wholly reliant on the initiators to generate profits, and the initiators play a significant role in the project, creating an unequal relationship between them and the investors. Defining an investment contract as a security helps bridge this power disparity, enabling investors to assess investment projects’ pricing and protect their interests. There are generally three interpretations of a “common enterprise.” The first is the horizontal approach, which focuses on the idea that all investors contribute funds to the same enterprise. The second is the vertical approach, which is understood as an investment where the success of investors is linked to the success of the party being invested in. The last is the broad vertical approach, which defines a common enterprise as one that depends on the expertise of the promoter or a third party.

- Expectation of Profit: This prong examines the investors’ intent when purchasing the asset. Are they buying the asset with the expectation of making a profit, or are they merely trying to store wealth? If it’s the former, this prong is satisfied. If it’s the latter, then it’s likely to be classified as something other than a security. For example, classifying stablecoins as currency is more appropriate than as investments.

- Derived from the Efforts of Others: The realization of profits must depend primarily on the efforts, management, or operation of others, i.e., the so-called third parties (non-investors). If investors have a significant influence on the success of an investment, it is unlikely to be deemed an investment. This prong also facilitates the identification of the responsible parties in investment contracts and provides clarity in fulfilling securities disclosure obligations.

If a transaction encompasses all four elements mentioned above, it will be considered a securities transaction subject to regulation under U.S. securities laws. This means that companies or projects involved in such transactions need to comply with the disclosure, registration, and regulatory requirements set forth by securities laws to protect investor interests and maintain market fairness and transparency.

The purpose of the Howey Test is to ensure consistent regulatory standards for transactions that resemble investment opportunities, regardless of whether they take on the traditional form of securities. It has played a crucial guiding role in determining whether cryptocurrencies, token sales, equity crowdfunding for startups, and other similar investment transactions constitute securities transactions.

The Howey Test applies to any contract, scheme, or transaction, regardless of whether it exhibits typical characteristics of securities. Its focus lies not only on the form and terms of the contractual instrument itself but also on the crypto environment and the manner of issuance, sale, or resale (including secondary market sales). Therefore, issuers of cryptocurrencies and individuals or entities engaged in marketing, issuance, sale, resale, or distribution of any cryptocurrency need to analyze the relevant transactions to determine the applicability of federal securities laws.

The DAO Report: SEC’s First Application of the Howey Test to Cryptocurrencies

In 2016, The DAO, the first decentralized autonomous organization, was created under the leadership of a German company called Slock.it. It was a community-controlled investment fund. The DAO offered and sold approximately 1.15 billion DAO tokens, successfully raising 12 million ETH (worth around $150 million at the time) from over 11,000 investors. DAO tokens were intended to directly control proposals on The DAO platform, and anyone meeting the minimum DAO token requirement could create proposals. Investors would vote by allocating DAO tokens to specific proposals. The DAO community also appointed 11 influential individuals in the industry as “curators” of The DAO. They verified the identities of proposal submitters and ensured their legitimacy before whitelisting their projects. Investors would then vote on which projects should receive funding. Any individual holding DAO tokens could participate in the voting process and receive a share of potential profits from the projects in case of their success. However, within less than three months of The DAO’s launch, it was subjected to a “reentrancy attack” by a “black hat” hacker. Over the following weeks, the hacker transferred around 3.6 million ETH from The DAO’s smart contract. The DAO incident not only led to the fork of Ethereum but also attracted the attention of the SEC in the midst of the market turmoil caused by significant losses for investors.

One year after The DAO incident, the SEC issued an investigative report addressing whether DAO tokens constituted securities and determining issuer liability. This marked the SEC’s first application of the Howey Test to cryptocurrencies and became a powerful tool in its enforcement actions against the crypto industry, exerting a lasting impact on the U.S. and global crypto industry.

The report concluded that the Howey Test provides a flexible and fair framework for comprehensive disclosure of many types of instruments in our business world that fall under the concept of investment contracts. Therefore, when analyzing whether something is a security, the focus should be on the economic realities behind the transaction rather than the form or additional labels. The report applied the Howey Test to analyze the economic realities behind the issuance of DAO tokens.

Investors in The DAO made investments of funds

While the Howey Test mentions an “investment of money,” cash is not the only form of contribution or investment that can give rise to an investment contract. It can take the form of goods and services or other forms of value exchange (Uselton v. Comm. Lovelace Motor Freight, Inc.). In the case of SEC v. Shavers, the court pointed out that investments in Bitcoin, a virtual currency, satisfied the first prong of the Howey Test. Investors in The DAO used ETH to make their investments and received DAO tokens in return. This investment represented a type of value contribution.

Investors in The DAO had a reasonable expectation of profits

Investors who purchased DAO tokens invested in a common enterprise, and when they sent ETH to The DAO’s Ethereum blockchain address in exchange for DAO tokens, they had a legitimate expectation of earning profits through the enterprise. Profits included “dividends, periodic payments, or the increased value of their investments.” The report stated that, based on various promotional materials disseminated by Slock.it and its co-founders, investors were informed that DAO was a for-profit entity with the purpose of funding projects in exchange for investment returns. ETH was pooled together and made available to The DAO for project funding. If a funding proposal was whitelisted by curators, DAO token holders could vote on whether The DAO should fund those projects, and DAO token holders could share in the potential profits of those projects. Therefore, a rational investor would be incentivized at least in part by the profit prospects of their investment of ETH in The DAO.

Profits were to be derived from the efforts of others

First and foremost, the efforts of Slock.it, its co-founders, and the curators of The DAO were crucial to the enterprise. The marketing of The DAO and the active interaction between Slock.it and its co-founders triggered investors’ expectations. To market DAO and DAO tokens, Slock.it created The DAO website, where they published a white paper explaining how the DAO entity operated and describing their vision for the DAO entity. Slock.it also created and maintained other online forums for providing information to DAO token holders on how to vote and perform other tasks related to their investments. Slock.it seemed closely engaged with these forums, answering questions from DAO token holders on various topics, including the future of The DAO, security concerns, the basic rules of how The DAO operated, and the expected roles of DAO token holders. The creators of The DAO presented themselves as experts in Ethereum, the blockchain protocol on which The DAO operated, and informed investors that they selected influential people in their field to serve as curators. Additionally, Slock.it informed investors that they anticipated launching the first substantial for-profit proposal – a blockchain enterprise in their domain of expertise. Through their actions and marketing materials, Slock.it and its co-founders led investors to believe they could rely on them to provide significant managerial efforts necessary for the success of The DAO.

Investors in The DAO had a reasonable expectation that Slock.it, its co-founders, and the curators of The DAO would provide significant managerial work after The DAO’s launch. The creators and curators of The DAO played important roles in monitoring the operations of The DAO, safeguarding investor funds, and determining whether proposed contracts should be put to a vote. Investors had no choice but to rely on their expertise. At the time of the offering, The DAO’s protocol had already been predetermined by Slock.it and its co-founders, including the control rights that could be exercised by curators. Curators had significant control over the order and frequency of proposals and could impose their subjective criteria on whether a proposal should be whitelisted for DAO token holder voting. While any DAO token holder could propose a replacement curator, such proposals were subject to the control of the current curators, including approving the new address to which tokens associated with such proposals would be directed. Essentially, curators had the power to decide whether proposals for replacing curators should be put to a vote.

Furthermore, in practice, Slock.it and its co-founders actively supervised The DAO. They closely monitored The DAO and intervened to address issues, proposing the suspension of all proposals until vulnerabilities in The DAO’s code were addressed and appointing a security expert to monitor potential attacks on The DAO. When the attacker exploited the code vulnerabilities and transferred investor funds, Slock.it and its co-founders intervened to assist in resolving the issue.

Furthermore, the voting rights of DAO token holders are limited.

While DAO token holders are granted voting rights, the significance of these voting rights is constrained, as they do not provide meaningful control over the organization. DAO token holders largely rely on the management efforts of Slock.it, its co-founders, and curators. Even if investors’ efforts contribute to the profitability of the organization, those efforts may not equate to the significant management efforts of the founders or control over the organization.

Firstly, as mentioned earlier, DAO token holders can only vote on proposals approved by the curators. Moreover, this approval process lacks any mechanism to provide sufficient information to DAO token holders for making informed voting decisions. In fact, based on specific facts about The DAO and discussions in online forums, there are indications that proposals may not offer enough information for investors to make prudent voting decisions, rendering their control insignificant. Additionally, the co-founders of Slock.it have presented their own proposal drafts and, in response to requests for clarification and negotiation of proposal terms (posted on the DAO forum), the founders of Slock.it explained that the proposal was intentionally ambiguous and essentially inconsequential whether investors accept or reject it.

Secondly, the anonymity and decentralization of DAO token holders make it difficult for them to unite for change or exert meaningful control. Investments in The DAO were made anonymously (thus, the true identities of investors remain unknown). While Slock.it did create and maintain an online forum where investors could submit posts with proposal suggestions, these forums were not limited to DAO token holders alone (anyone could post). Furthermore, DAO token holders are anonymous, and their posts on the forum are as well. These facts, along with the number of DAO token holders, potentially limit the effectiveness of the forum if investors desire to consolidate their voting power into a sufficiently influential group for actual control. This was later evidenced by the fact that DAO token holders were unable to effectively address the hack without assistance from Slock.it and others. The anonymity and decentralization of DAO token holders dilute their control over The DAO. These facts weaken the ability of DAO token holders to exert meaningful control over the collective enterprise through the voting process, making their voting rights similar to those of shareholders in a company. As per the contract, in practice, DAO token holders rely on the significant management efforts provided by Slock.it, its co-founders, and curators, as stated above. Their efforts, rather than the efforts of DAO token holders, are deemed “undeniably significant” for the overall success and profitability of any investment in The DAO.

The DAO is considered an issuer

The report classifies The DAO as a securities issuer in its entirety. Unless a valid exemption applies, the issuer must register the issuance and sale of DAO tokens.

The definition of an “issuer” broadly includes “every person who issues or proposes to issue any security” and “person” includes “any non-natural person” (15 USC§77b(a)(4)). The term “issuer” is given a flexible interpretation because it encompasses the issuer of new methods for issuing securities, expanding the definition of securities themselves. If an individual or entity supports a collective enterprise and bears primary responsibility for its success or failure, they will be deemed an issuer.

The report asserts that The DAO is a non-natural person organization and a securities issuer, with the information about The DAO being “material” to the investment decisions of DAO token holders. The DAO is “responsible for the enterprise’s success or failure” and is thus the entity from which investors require information material for their investment decisions. During the offering period, The DAO offered and sold DAO tokens in exchange for ETH through The DAO website, which was publicly accessible, including by individuals in the United States. Since DAO tokens qualify as securities, The DAO must register the issuance and sale of DAO tokens unless a valid exemption for such registration has been obtained. Therefore, those involved in the issuance and sale of unregistered securities without a valid exemption are held accountable for violations of securities laws.

Analysis framework for the “Investment Contract” of digital assets: Crypto version of the Howey Test

Shortly after the release of The DAO investigation report, Initial Coin Offerings (ICOs) began to flourish and proliferate. In this context, the SEC issued a document in April 2019 titled “Framework for ‘Investment Contract’ Analysis of Digital Assets” (referred to as the “Framework”). The Framework adopts the Howey Test but provides detailed criteria specific to cryptocurrencies in the third and fourth prongs of the test. It also enumerates behaviors and factors that may indicate the “de-securitization” of cryptocurrencies, reducing the likelihood of them being classified as securities.

Reliance on the efforts of others

According to the Framework, the determination of whether a purchaser relies on the efforts of others has two core elements: (1) whether the purchaser reasonably expects to rely on the efforts of active participants, and (2) whether those efforts are of a managerial nature that significantly affects the enterprise.

Specifically, the stronger the following factors, the more likely it is that the purchased cryptocurrency relies on the efforts of others:

- Active participants (i.e., project initiators, sponsors, or other third parties and their affiliates) are responsible for the development, improvement, and enhancement of the network. When the network or cryptocurrency is still in development and has not fully achieved its functionality at the time of issuance or sale, the purchaser can reasonably expect the active participants to exert efforts in the future to achieve the functionality of the network or cryptocurrency, either directly or indirectly. This is particularly relevant when active participants make promises regarding the value preservation or appreciation of the cryptocurrency. For example, in the case of Binance and CZ, the SEC pointed out that the information publicly disseminated by Solana Labs, including information since the initial sale of SOL, led SOL holders, including those who purchased SOL since September 2020, to reasonably view SOL as an investment in the efforts of Solana Labs to develop the Solana protocol and expect to profit from it, thereby increasing the demand and value of SOL.

- The essential tasks and responsibilities are expected to be performed by active participants rather than a non-affiliated, decentralized network user base (commonly referred to as a “decentralized” network). For example, in the case of Binance and CZ, the SEC noted that Protocol Labs boasted its expertise and leadership in developing the Filecoin network before and after the 2017 FIL sale.

- Active participants create or support the market or price of the cryptocurrency. This includes active participants (1) controlling the creation and distribution of the cryptocurrency or (2) taking other actions to support the market price, such as limiting supply through buybacks and burning tokens to ensure scarcity. For instance, the SEC mentioned in the case of Binance and CZ that since the launch of the Solana network, the “current total supply” of SOL has been reduced through burning transaction fees and planned token reductions. This market-driven burning of SOL, as part of the Solana network’s “deflationary mechanism,” leads investors to reasonably expect potential profits from the purchased SOL due to an inherent mechanism that reduces supply and increases the price of SOL.

- Active participants play a dominant or central role in the ongoing development of the network or cryptocurrency. This includes active participants being dominant or central in determining governance issues, code updates, or how third parties participate in transactions involving the cryptocurrency. For example, in the case of Binance and CZ, Protocol Labs continued to actively participate in the development and promotion of the Filecoin network after the protocol’s release in October 2020. The launch of the “Filecoin Virtual Machine” by Protocol Labs researcher Raul Kripalani was described as a core pillar for the further development of the decentralized storage ecosystem.

- Active participants make ongoing managerial decisions or judgments regarding the network, features, rights represented by the cryptocurrency. This includes active participants deciding whether and how to compensate individuals who provide services to the network or entities responsible for supervising the network, determining if and where the cryptocurrency will be traded, determining who will receive additional cryptocurrency and under what conditions, playing a significant role in verifying or confirming transactions on the network or being responsible for the network’s ongoing secure operation. For example, in the case of Binance and CZ, 70% of FIL tokens were allocated to Filecoin Miners for “providing data storage services, maintaining the blockchain, distributing data, running contracts, and more,” as outlined in Filecoin’s token economics documentation.

- Purchasers can reasonably expect to benefit from their active participation and the efforts of active participants to enhance the purchaser’s interests and the value of the network or cryptocurrency. This includes active participants having the ability to realize capital appreciation from the value of the cryptocurrency, compensating management with the cryptocurrency, linking compensation to the cryptocurrency’s secondary market price, directly or indirectly owning or controlling intellectual property rights associated with the network or cryptocurrency, or monetizing the value of the cryptocurrency, particularly when the functionality of the cryptocurrency is limited. For example, in the case of Binance and CZ, 12.5% of the initially minted 500 million SOL tokens were allocated to Solana Labs’ founders, including Yakovenko and Gokal, and an additional 12.5% were allocated to the Solana Foundation, a nonprofit organization based in Switzerland.

- When evaluating whether a cryptocurrency was previously sold as a security, additional considerations related to “the efforts of others” need to be reassessed for the asset’s issuance or sale afterward.

Reasonable Expectation of Profit

The evaluation of a cryptocurrency should also consider whether there is a reasonable expectation of profit. This profit can arise from capital appreciation resulting from the initial investment or project development, or from the return on funds used by the purchaser, among other factors. Price appreciation solely influenced by external market forces, such as inflation affecting underlying assets, is typically not considered “profit.”

Specifically, the more of the following characteristics exist, the more likely there is a reasonable expectation of profit:

- The cryptocurrency grants holders the right to share in project revenue or earnings or realize capital appreciation from the cryptocurrency.

- The cryptocurrency can be transferred or traded on secondary markets or platforms, or there is an expectation of future transfers or trades. For example, the SEC noted in the case of Binance and CZ that since October 2020, FIL could be bought, sold, and traded on Binance.com, and since June 2021, FIL could be bought, sold, and traded on Binance.US.

- Purchasers have a reason to expect capital appreciation of the cryptocurrency through the efforts of active participants, thereby allowing them to benefit from their purchase. For example, the SEC mentioned in the case of Binance and CZ that the information publicly disseminated by Protocol Labs, including after the initial FIL sale, led FIL holders, including those who purchased FIL since October 2020, to reasonably view FIL as an investment in the efforts of Protocol Labs to develop its protocol and expect to profit from it, thereby increasing the demand and value of FIL. Protocol Labs stated, “The success of Filecoin will reward your investment by simultaneously driving down storage costs and increasing the value of Filecoin tokens that incentivize miners to provide storage. We are excited by your broad and enthusiastic interest and look forward to keeping you involved as we succeed.”

- The cryptocurrency is more widely offered to investors than to actual users of the network’s functionality or services.

- The supply and purchase quantities of the cryptocurrency indicate investment intent rather than quantities for individual user consumption. For example, the quantities offered and purchased far exceed what any individual user would reasonably need or the practical usage within the network.

- There is no apparent correlation between the purchase/offering price of the cryptocurrency and the market price of specific goods or services that can be exchanged with the cryptocurrency.

- There is no apparent correlation between the quantity typically traded in the cryptocurrency (or purchased by purchasers) and the quantity typically purchased by typical consumers for use or consumption of underlying goods or services.

- Active participants have raised funds beyond what is necessary to establish the functional network or cryptocurrency.

- Active participants can benefit from their efforts as they possess the same category of cryptocurrency as the one distributed to the public. For example, the SEC noted in the case of Binance and CZ that according to the Sandbox whitepaper, 19% of the initially minted 3 billion SAND tokens were allocated to the Sandbox founders and team, with an additional 25.8% allocated to company reserves.

- Active participants can continue to expend funds received from earnings or operations to enhance the functionality or value of the network or cryptocurrency. For example, the SEC mentioned in the case of Binance and CZ that Protocol Labs continued to use the funds raised from the sale of FIL to develop, expand, and promote the Filecoin network since its launch in October 2020.

- The cryptocurrency is marketed directly or indirectly in a way that suggests it is an investment, and the expected use of the proceeds from the cryptocurrency sale is for the development of the network or cryptocurrency. For example, the SEC noted in the case of Binance and CZ that the Filecoin Token Sale Economics document stated, “Protocol Labs needs substantial funds to develop, launch, and grow the Filecoin network. We must develop all the software needed: mining software, client software, user interfaces and applications, network infrastructure and monitoring, software that wallets and exchanges need to support Filecoin, integrations with other data storage software, tools for network applications and Dapps to use Filecoin, and more. We must deploy the network, promote its growth, market to and onboard miners and clients, bring in key partners to the ecosystem, and more.”

- Commitment to building a business or operation rather than delivering existing goods or services for use on an existing network. For example, the SEC mentioned in the case of Binance and CZ that Protocol Labs continued to release “roadmaps” or “overall plans” showcasing the future development of the Filecoin network online or through recorded video demonstrations. For example, in September 2022, Juan Batiz-Benet, the founder and CEO of Protocol Labs, presented the “Filecoin Master Plan” at the FIL Singapore Conference, which included the establishment of the world’s largest decentralized storage network.

- The cryptocurrency’s immediate transferability is a key selling feature. For example, the SEC noted in the case of Binance and CZ that in their blog post announcing the “exchange listings,” Sandbox touted its efforts to obtain “listings” and the liquidity of the SAND token on the secondary market. For instance, in a Medium blog post on September 21, 2021, Sandbox stated, “SAND is listed on over 60 cryptocurrency exchanges worldwide, including more than a dozen of the largest exchanges by market capitalization.”

- The potential profitability of network operations or the potential appreciation in value of the cryptocurrency is emphasized in marketing or other promotional materials. For example, the SEC mentioned in the case of Binance and CZ that the Filecoin Primer boasted of “massive value creation,” explaining that the Filecoin network “will create value in multiple ways, and the total impact of the network could be massive. The growth of the network will drive demand for the token. The more value the Filecoin network creates, the more people and organizations spend Filecoin, the greater the token’s worth and value.

“Decentralization” Factors

The stronger the following usage or consumption characteristics, the less likely the Howey test is satisfied:

- The distributed ledger network and cryptocurrency are fully developed and operational. This guides project developers or other active participants to avoid issuing and selling tokens before the project is fully developed.

- Cryptocurrency holders can immediately use it for the intended functionality on the network. This follows from the previous point. Only when the project is developed to a stage where it can function properly can token holders use the cryptocurrency to obtain goods or services on the network.

- The creation and structure of the cryptocurrency are designed and implemented to meet user needs rather than to satisfy speculative value or network development. For example, the cryptocurrency can only be used on the network and is typically held or transferred in amounts corresponding to the purchaser’s intended usage.

- The prospects for value appreciation of the cryptocurrency are limited. For example, the design of the cryptocurrency keeps its value stable or even decreases over time, so a rational purchaser would not expect to hold the cryptocurrency as an investment for an extended period.

- For cryptocurrencies referred to as “virtual currencies,” they can be immediately used for payment in various situations or as substitutes for real currency. This means that the cryptocurrency can be used to pay for goods or services without first converting it to other cryptocurrencies or fiat currency. If it qualifies as a virtual currency, the cryptocurrency essentially functions as a store of value that can be stored, retrieved, and subsequently exchanged for valuable items. Examples include stablecoins like USDT and USDC, which are pegged to the US dollar.

- For cryptocurrencies representing rights to goods or services, they are currently exchangeable within the developed network or platform to obtain or use those goods or services. There is a correlation between the purchase price of the cryptocurrency and the market price of specific goods or services that can be exchanged or traded with the cryptocurrency. If the underlying goods or services behind the cryptocurrency can only be obtained using the cryptocurrency or can be more efficiently obtained through its use, the intent to consume the cryptocurrency may be more pronounced, thus avoiding classification as a security.

- Any economic benefit from potential value appreciation of the cryptocurrency is accompanied by the right to use it for the intended functionality. In contrast, if the cryptocurrency grants holders the right to share project revenue or earnings or realize capital appreciation from the cryptocurrency, it would meet the “expectation of profit” standard and fall within the Howey test.

- The cryptocurrency is marketed emphasizing its functionality rather than the potential for market value appreciation. This guides active participants in their marketing direction.

- Potential purchasers have the ability to use the network and use (or have used) the cryptocurrency for its intended functionality. This informs project developers that, to avoid their issued cryptocurrency being classified as a security, they should only sell or distribute the cryptocurrency to users who have already used their product and guide purchasers or potential purchasers to use their product.

- Constraints on the transferability of the cryptocurrency align with the asset’s utility rather than facilitating a speculative market.

- If active participants facilitate the creation of secondary markets, the transfer of the cryptocurrency may only occur among users of the platform and within the platform.

It should be noted that even in cases where the cryptocurrency is usable for purchasing goods or services on the network, and where the capabilities of the network or cryptocurrency are developed or improved, there may still be securities transactions if the following conditions exist:

- The cryptocurrency is provided or sold to purchasers at a discount to the value of goods or services.

- The cryptocurrency is provided or sold to purchasers in quantities that exceed reasonable usage.

- The resale of these cryptocurrencies is subject to limited or no restrictions, particularly when active participants continue to make efforts to increase the value of the cryptocurrency or promote secondary markets.

While the SEC states that the Framework is not a rule, regulation, or statement of the SEC, and neither the Commission nor its staff has approved or disapproved its content, and the Framework does not replace existing case law, legal requirements, or statements or guidance from the Commission and its staff, it provides an understanding of how SEC staff will analyze digital assets within the existing securities law framework. It serves as an operational manual and work guide for their enforcement actions and undoubtedly has significant implications for future enforcement actions. Therefore, the Framework is of great importance as a reference for cryptocurrency project developers, as well as for exchanges, institutions, retail investors, industry researchers, and legal compliance professionals.