At the end of last year and the beginning of this year, I wrote two articles to introduce ZetaChain. After several months, I have had some new ideas. Looking back at the two articles that were previously confined to the theoretical level, I actually felt that there were always some points that were not thoroughly discussed, nor did I truly understand where the essence of ZetaChain lies.

During these past few months, ZetaChain has accomplished numerous noteworthy advancements: on one hand, ZetaChain will gradually increase support for Solana, Ton, and Base in the future, progressively fulfilling its practice of the concept of chain abstraction. Regarding its already supported BTC, with recent discussions becoming more intense about the over-centralization of WBTC, ZetaChain has stated its commitment to supporting the application of native Bitcoin in a decentralized manner to enhance its implementation.

On the other hand, exchanges including OKX, Coinbase, and Crypto.com have either already added or are planning to add support for ZETA staking. Companies such as Alchemy, Ledger, Tenderly, MintScan, and Keplr are also progressively increasing their support for ZetaChain.

In terms of its own R&D iterations, ZetaChain has upgraded its universal L1 blockchain Gateway, UniversalKit, and the new Localnet and Devnet networks. The Gateway allows Universal Apps to natively connect to any blockchain, including Bitcoin, thus improving user experience. UniversalKit offers prefabricated React components for the interfaces of Universal Apps, while Localnet and Devnet have expedited the development process. Data from ZetaScan indicates that ZetaChain has attracted over 3.6 million independent wallets.

Especially after examining Delphi’s research report on ZetaChain, I discovered that the current market may have significantly underestimated ZetaChain’s potential to emerge as a universal infrastructure within the domain of chain abstraction.

What is the true nature of ZetaChain?

In the article “How to Add Omnichain Interoperability to Bitcoin? ZetaChain Provides a Completely New Answer,” the author’s summary of ZetaChain’s cross-chain mechanism is “In simple terms, it can be understood as using the chain itself as a reliable guarantee for message transmission between chains. Once the block containing the relevant message is packaged, it can be confirmed, and the large number of widely distributed validators and the assets they stake are the greatest safeguard for security.”

At that time, I understood ZetaChain as a relay for cross-chain message transmission using the chain itself, which is not entirely wrong, but indeed has a certain degree of inaccuracy. Interestingly, the actual mechanism of ZetaChain is more interesting than previously described.

In the report, Delphi also mentioned that ZetaChain is actually more like an advanced version of THORChain, in Delphi’s own words, it is a “THORChain with smart contract capabilities.” However, the single feature of smart contracts alone opens up the ceiling of imagination.

The implementation mechanism of THORChain is roughly to utilize its token RUNE as a medium for transactions, trading token A with RUNE on the THORChain, and then exchanging RUNE for token B. Tokens A and B come from two different chains, such as Bitcoin and Ethereum, But they are tokens that are cross-chained to THORChain.While this model may not be as convenient as most cross-chain solutions, it provides solid price support for the RUNE token.ZetaChain draws on this model. The transaction of the two tokens does not just use the chain to process cross-chain information, but actually mints the ZRC-20 token for conversion on ZetaChain.

As for why this model has a lot of room for imagination, we will leave it to the end of the article to explain.

Empirical data shows: Compared to LayerZero and Wormhole, ZetaChain offers lower cross-chain costs.

In the Omnichain/chain abstraction race, it’s inevitable to compare with LayerZero and Wormhole. After my actual testing, I found that ZetaChain’s mechanism, which “seems to have a more complex process,” actually results in less wear and tear for certain cross-chain transactions.

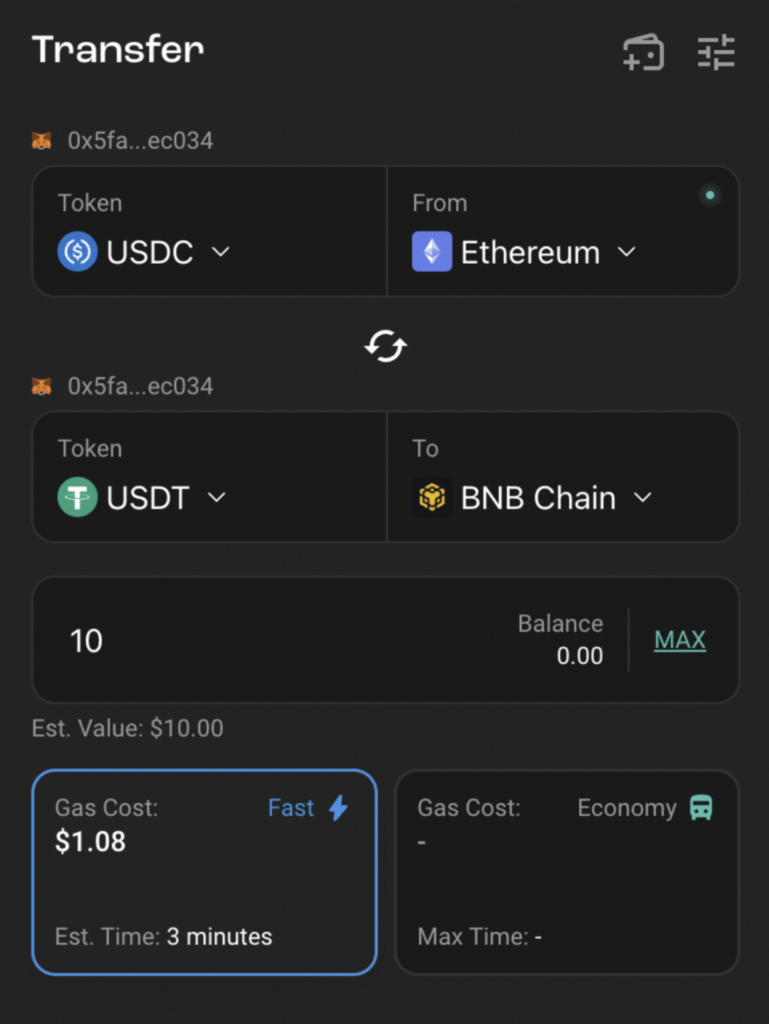

Firstly, LayerZero and Wormhole are fundamentally cross-chain bridges that support the transfer of only one type of token across different chains, like the movement of USDT across various chains or the transfer of ETH between Ethereum and different L2 networks. In contrast, ZetaChain, using the chain as a central hub and through its own liquidity pool, facilitates the exchange of native assets on different L1 networks. For instance, it allows users to trade native ETH from Ethereum for native BNB on the BNB Chain or native ETH for native SOL on Solana with a single click. The detailed process will be explained later, but in terms of user experience, it has indeed realized ‘one-click trading’.

If LayerZero and Wormhole want to realize transactions of different types of tokens, such as trading ETH on Ethereum for BNB on BNB Chain as just mentioned, they still need to rely on the DEX on the corresponding chain.

At present, if you want to solely conduct cross-chain transactions of stablecoins or ETH between EVM-compatible chains and L2s, LayerZero is a solid option. Naturally, this assessment comes with the understanding that ZetaChain’s support for chains is relatively limited at the moment. When it comes to direct cross-chain trading of different tokens, however, ZetaChain’s strengths become quite apparent. Let’s take the example of trading Ethereum’s ETH for BNB Chain’s BNB (ETH > BNB).

ZetaChain’s transaction fees

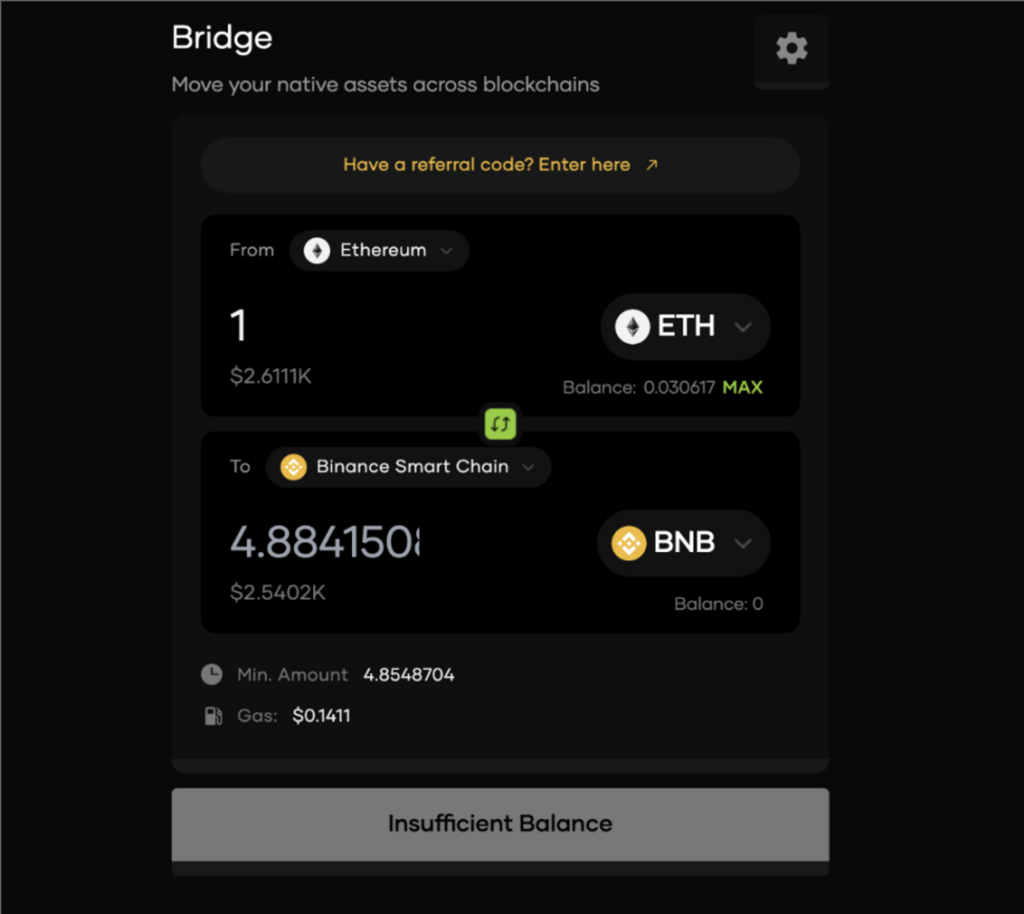

When using ZetaChain’s cross-chain pathway (taking Eddy Finance as an example), the cost to trade one Ethereum is only about 0.3 USD (the ZetaChain chain Gas fee shown in the figure below, plus the Gas fee required for the transaction execution on Ethereum).

The transaction fees for LayerZero and Wormhole

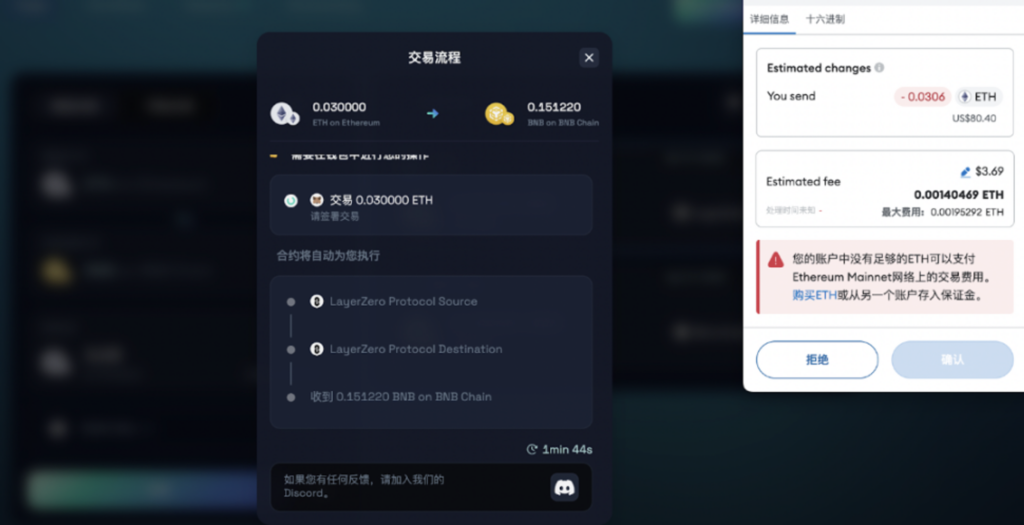

The same transaction, within the same time period, if the transaction is performed using OmniSwap integrated with LayerZero, the fees incurred include the fee of trading ETH to USDC through Uniswap on Ethereum, which is approximately $3.7;

I only have 0.03 ETH in my wallet, but it will not have much impact on the actual gas fee generated on Ethereum.

Using LayerZero for cross-chain transactions costs approximately $1.5. Considering that LayerZero currently supports converting some tokens into Gas fees on the target chain, the author provisionally assumes that the trading fees on PancakeSwap are also included in the cross-chain fee, as the fees shown on Stargate are slightly less than those displayed on OmniSwap:

Based on this, for the same transaction, if the route via LayerZero is taken, the actual cost would be around $5.2, significantly higher than the cost of executing the transaction through ZetaChain.

For Magpie, which is integrated with Wormhole, the Gas fee is even higher, approaching $10. When the author captured the transaction data on Magpie, the Ethereum Gas was at 2 GWei, which is double compared to the 1 GWei when previously comparing ZetaChain and LayerZero. Consequently, the trading fee on Uniswap also nearly doubled. The transaction path is almost identical to that of OmniSwap, except for the difference in how the stablecoin is bridged through LayerZero and Wormhole, so I will not elaborate further.

Analysis of the differences in fees

Why is there such a significant difference in costs? Let me provide a detailed analysis of the two pathways.

When explaining the trading path through ZetaChain, one point I need to clarify in advance is the method of token representation used on Eddy Finance.

- For native assets, Eddy directly uses their original names for representation, such as ETH and BNB, which refer to the native ETH on Ethereum and the native BNB on BNB Chain, respectively.

- For ZRC-20 assets on ZetaChain, which are assets that have been crossed over from different paths, Eddy uses the format of x.y for expression. For example, USDC.ETH denotes “USDC crossed over from Ethereum to ZetaChain,” while USDC.BSC refers to “USDC crossed over from BNB Chain to ZetaChain.”

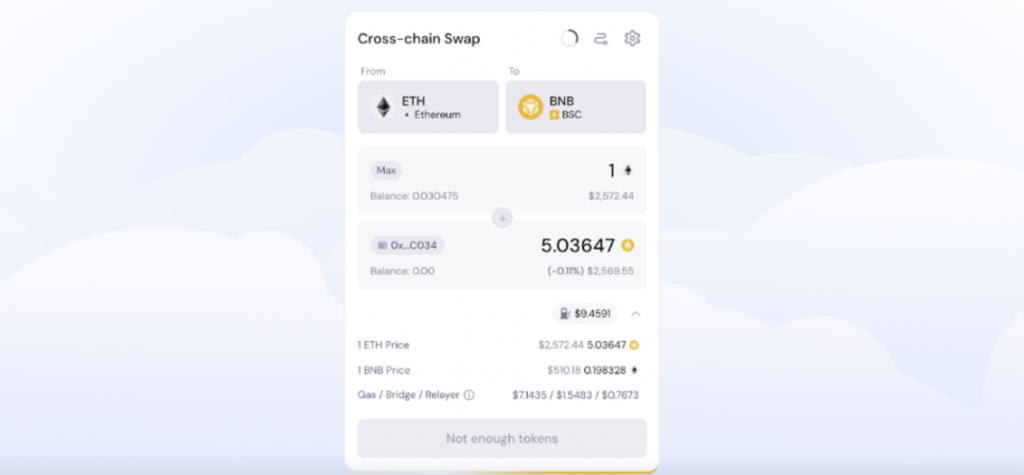

When trading through ZetaChain, the path for exchanging ETH for BNB is as follows:

- ETH is crossed over to ZetaChain via the ZetaChain cross-chain contract and is marked as ETH.ETH.

- ETH.ETH is traded on ZetaChain through the liquidity pool to become BNB on ZetaChain, which is represented as BNB.BSC in Eddy. The trading path in between involves exchanging ETH.ETH for ZETA, and then ZETA for BNB.BSC.

- Finally, BNB.BSC is crossed over to the BNB Chain via the ZetaChain cross-chain contract, and the user receives the native BNB on the BNB Chain.

In this process, the costs are divided into three parts: the cross-chain fee from Ethereum to ZetaChain for ETH, the trading fees on ZetaChain, and the cross-chain fee from ZetaChain to the BNB Chain for BNB. The cross-chain fee for ETH is quite low because it is only for generating an “encapsulated token” of ETH on ZetaChain. The trading fees on ZetaChain are minimal and almost negligible, comparable to most EVM-compatible alternative Layer 1 (Alt L1) chains. Thus, the overall cost of the transaction is quite low.

If the same trade is executed via LayerZero, the pathway would be:

- ETH is traded for USDC on Uniswap within the Ethereum network.

- USDC on Ethereum is converted to USDT on BNB Chain through Stargate cross-chain transactions

- The USDT on the BNB Chain is traded for BNB on PancakeSwap.

The process of incurring fees in this case includes transactions on Uniswap, cross-chain fees on Stargate, and trading fees on PancakeSwap.

There are two important points to note in this process. First, if you are simply crossing over a stablecoin, such as transferring USDT from Ethereum to BNB Chain using LayerZero-based Stargate, calculating the amount of USDT you will receive on the BNB Chain requires considering the liquidity of the USDT pool to a certain extent. Therefore, the contract has relatively high computational requirements, which is also an important reason why Stargate’s cross-chain fees were exceptionally high when it was first launched.

For ZetaChain, the process involves only locking USDT in the Ethereum contract and then minting an equivalent amount of USDT on ZetaChain. The subsequent steps, like trading USDT.ETH for USDT.BNB on ZetaChain before crossing over to the BNB Chain, are also about locking and releasing. Even though there are more procedures, the actual resources consumed are minimal. Hence, I venture a bold guess that if ZetaChain supports the corresponding tokens in the future, its cross-chain fees might also be lower than, or at the very least, not exceed those of Stargate.

Maybe just from the examples given, it’s not possible to fully grasp the huge disparity, since a $5 cross-chain fee might still be tolerable for most people. But this figure is predicated on Ethereum Gas fees being in the single digits. If there is a repeat of the extremely active on-chain activities like those in 2021, the difference in fees for the two cross-chain transactions could be very exaggerated.

Additionally, cross-chain projects, including LayerZero, almost always require a certain cross-chain fee to ensure the sustainable operation of the protocol. This makes projects, including Axelar, not support small-amount cross-chain transactions, as they might not even cover the fees charged by the protocol. In contrast, ZetaChain, due to its own chain infrastructure, can rely on transaction fees (Gas fees) for revenue and does not need to charge extra for cross-chain services, thereby significantly reducing the fees that users have to bear.

The positive flywheel brought by token empowerment

The report on ZetaChain by Delphi is extremely comprehensive; interested parties are encouraged to read it in depth. I singles out a point that may not have attracted attention in the current market, which is the positive feedback loop that can be generated by empowering tokens.

I seldom opt to employ the term “positive feedback loop,” as it is often exaggerated in most contexts where it is used, but ZetaChain truly merits this accolade. In the vast majority of cross-chain and Omnichain projects, the introduction of tokens does not necessarily confer significant benefits to the project itself; the main advantage for holders is the potential to earn a portion of the cross-chain transaction fees through staking.

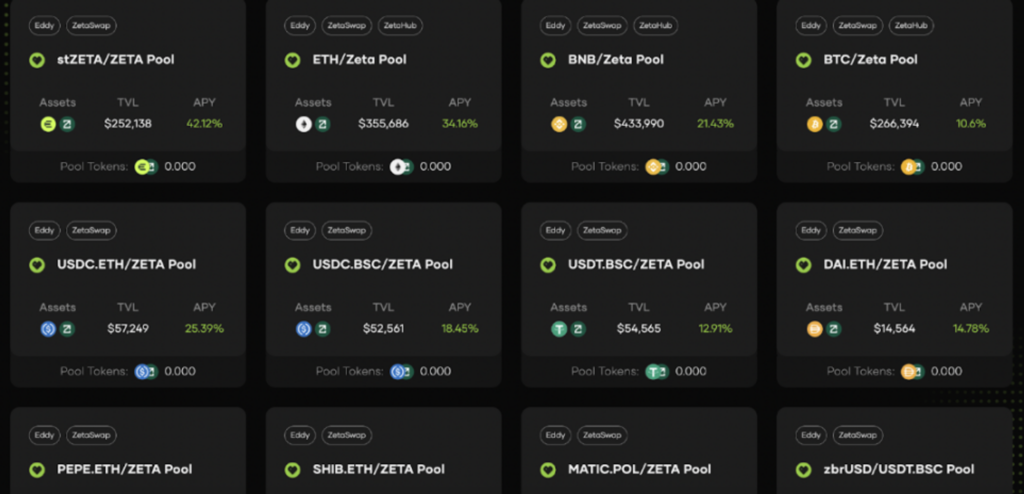

But ZetaChain’s design in terms of tokenomics completely breaks away from this established framework. As mentioned earlier, ZetaChain’s mechanism is partially similar to THORChain, so when you look at the liquidity pools on ZetaChain, you will notice that there are no liquidity pools established with two tokens other than ZETA.

This is where the ingenuity of ZetaChain’s design lies; its cross-chain process actually involves first crossing the token over to ZetaChain, completing the trade on ZetaChain, and then crossing it over to the target chain. The cross-chain process itself is ‘lossless’ because it does not involve liquidity; it is merely akin to an ‘encapsulation’ process. On ZetaChain, all tokens must establish a liquidity pool with ZETA, which is equivalent to trading token A for ZETA, and then ZETA for token B. The ZETA token becomes an indispensable part of the cross-chain segment. Therefore, the more ZetaChain’s cross-chain is utilized, the higher the demand for ZETA. High demand for ZETA drives up its price, which in turn can further increase liquidity on ZetaChain, thereby reducing the wear and tear of cross-chain transactions.

Thus, its cost advantage will attract more cross-chain demand, demand will boost the price of ZETA, and an increased ZETA price reduces wear and tear. This is a perfectly positive closed-loop model. Even if the market environment deteriorates, its cost advantage still exists and can mitigate the degree of reduced demand.

And the wear and tear mentioned here actually returns to what I said at the beginning about being “underestimated by the market.” Although the fees are low, it can be observed that when trading 1 ETH for BNB, the actual amount of BNB obtained through ZetaChain is significantly less than when using the LayerZero method. The underlying reason is that the liquidity on ZetaChain is still relatively low at present, and substantial cross-chain transactions may incur greater slippage, resulting in wear and tear.

But it is precisely for this reason that liquidity on ZetaChain represents an untapped gold mine. Coupled with ZetaChain’s support for blockchains that do not support smart contracts, such as Bitcoin and DOGE, although the current market environment does not showcase the power of the positive feedback loop, once the on-chain market features application scenarios with high wealth effects like DeFi, ZetaChain may reveal its true value as on-chain activities become more vibrant.