GM,

The other day I read a short book titled Evil Tokenomics.

As the title implies, it’s a manual on how you can structure your tokenomics in a way that give you maximum profit at the expense of the retail investors. Along the way, it also explains why VCs like tokens a lot (quick liquidity events 🌊) and how you can diffuse allocation so it doesn’t look like an outright enrichment scheme.

The funny (or depressing) thing is, after reading it, you go and look at some tokenomics and price curves, and you’ll find the tokenomics described are the norm.

Of course, the book generalizes quite a bit, but if you look at the stats and see that 99% of Uniswap tokens are rugs and scams, then maybe the generalization isn’t that unfair.

Anyway, in the same vein, why not explore how you can ruin things with crypto? Because leave it to web3 to ruin the things that are holy to us.

There’s this website called Bad Unicorn that publishes terrible startup ideas. I feel we should do the same for crypto. Except, most of the bad ideas will eventually be executed by someone. So whenever I think of an idea myself, or I see one in the wild, I’ll write them down. That’s also why this is just #1, I am afraid many more will follow.

#1 Friendship

They say the best things in life are free. Not anymore. Maybe it does give some new meaning to the “real treasures are the friends we made along the way” saying. That is if you bought into them early enough.

Since launch, over 40k ETH have been traded on Friend. Tech and its popularity continues growing. The app already generated more than $2.8 million in protocol fees outpacing popular DeFi protocols.

While it was an invite-only platform, someone smart out there built an interface called Friend. Mex, leaning into BitMex, the notorious derivatives exchange, which enables anyone to start buying and selling… well, friends.

https://cdn.embedly.com/widgets/media.html?type=text%2Fhtml&key=a19fcc184b9711e1b4764040d3dc5c07&schema=twitter&url=https%3A//twitter.com/_anishagnihotri/status/1690455865382318081%3Fs%3D20&image=https%3A//i.embed.ly/1/image%3Furl%3Dhttps%253A%252F%252Fabs.twimg.com%252Ferrors%252Flogo46x38.png%26key%3Da19fcc184b9711e1b4764040d3dc5c07

How has the app become so popular?

Well, it surely isn’t their smooth user experience nor their careful compliance with GDPR. As of now, 100k users have signed up for the app, even though we’re supposedly in a bear. Maybe it’s the boredom or the excitement of having an actual app to use — a welcome change to farming potential airdrops of upcoming L2s or being toxic on governance forums.

For one, they relied on a playbook that worked well in the past: invite-only, viral loops, and getting creators on quickly that others want to talk to. It’s a similar spiel to Bitclout — with the difference that they didn’t just mint every popular person’s profile without asking.

They got picked up by crypto personas like Frank DeGods, and gainzy which helped further spread the app.

The SocialFi platform doesn’t bring anything new. It’s more of a rehash of an old idea: creator tokens. On Friend.Tech, you can buy “keys” (previously shares) of your connections. Whenever you purchase a share, you gain access to the person’s private chatroom. It’s unclear if here is a requirement for people to respond. However, you’d assume that if someone paid so much, you might want to answer just to make sure they don’t sell you.

Popular creators’ shares trade above 1 ETH, making them once again impossible for normal people to purchase. But then, this aspect of speculation and the ability to make a quick buck is what probably put fuel in the fire 🔥.

After all, are you a real crypto-native if you don’t blindly ape into anything that is hyped and promises a profit — while you try to dodge the existential dread that would come when asking wtf are we even doing here?

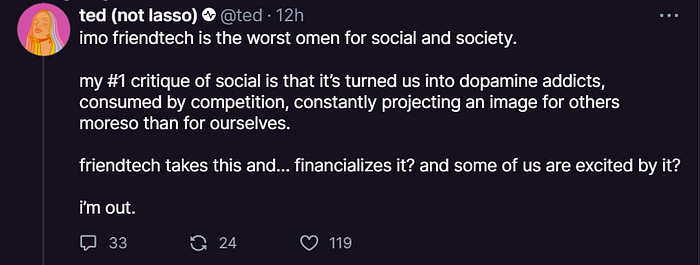

Of course, Friend.Tech doesn’t exactly make friendship worse. It takes an existing product with bad outcomes and makes it worse.

Social + Money = maybe not

There’s probably no need to reiterate the negative impact of Social Media. Crypto Twitter Addicts, more than anyone, are probably aware that constantly seeking validation from a bunch of anons isn’t a healthy way to live life.

The irony is that despite being more connected than ever, loneliness has become the epidemic of the time. I lived in Japan. It’s extreme over there; all that workaholism probably doesn’t help. And what’s weird is that some people have come to prefer interactions with social media or AI girlfriends (boyfriends for the sake of equality) because real humans are too much effort. Yet, I doubt you get the same sense of fulfillment from interacting with technology.

Anyway, Friend.Tech is taking Social Media and financialzies it. Of course, the name itself is somewhat misleading. Real friends won’t ask you to buy a bunch of keys in you just so you can message them. If they do, they are not your real friends.

Imagine you’re meeting with a friend for a walk in the park. And then, before you can start talking to them, you have to transfer them $10? Financial incentives can ruin a relationship and entirely change the premise of it. Of course, if paid, your counterparty might tell you what you want to hear rather than be honest — to continue the flow of money.

Fortunately, we’re far from tokenizing everyone and access to them (I hope it never happens).

Yet, Friend.Tech takes an already toxic platform and makes it worse by adding money to the mix. While everyone is hyped and big creators are earning money, sure, we might all be happy. It’s a win-win until it’s not.

Who is to say that it remains that way? What if people get bored? Or maybe even start demanding back money because whoever they bought rights to talk to won’t respond to them in the way they desire?

If we learned anything from years of spending time on Social Media, it’s that the net benefits might be smaller than the downside. It can get toxic really fast, and adding money to it seems like a surefire way to add some serious damage not only to people’s wallets but mental health (which, if you work in crypto, is probably damaged anyway 😏)

The bonding curve mechanism ensures that the more people buy into a group, the more its share price goes up — it can only end with very expensive in-groups and, eventually, prices going down. Because at some point, maybe the “value” you get from being in that group chat does not exceed the value of what you can make when selling.

Incentives for both creators to continue talking in the chat and for users to stick are short-term at best. Who ultimately benefits is the creators cashing out fast and whoever sells before everyone else.

Maybe, Friend.Tech is just becoming the place where your internet friends become exit liquidity — this, at least, would be a more honest marketing message.

As so often, the speculation-driven app wins while more sensible use cases probably struggle.

Yet there are some interesting lessons from Friend.Tech.

“Utility” > UX sometimes

For example, people didn’t care so much about buggy UX when they had their eyes on being among the first to join this platform and profit from it.

When something has enough utility, as an economist would say, you’ll use it regardless of the friction you encounter. Just like I’m forced to use the clunky eID services on a mobile browser — not because the UX is so fun, but because it really is more convenient than sitting 4 hours in a citizen’s office.

Obviously Friend.Tech didn’t bring in any new users. Since it’s on base, that would be quite a long journey for anyone outside of crypto. Yet, it raises an interesting point, At times, the clunky UX is more of an excuse for why a product has so little usage. The more realistic reason might just be that whatever it is, it’s not all that useful to people.

Small teams can do a lot in crypto.

It’s also quite the feast for such a small team to build and maintain a dApp that surges to thousands of users in a short amount of time. They continue making changes, so that’s probably something we need more of.

Someone once said that if you don’t release your product while it feels embarrassing, you launch too late. Maybe there’s some truth to it — at least you get a feel for what people using it want if you do.

That aside, I still think the premise of buying and selling your friends’ (fake internet friends) is a rather terrible way to use crypto and will probably end up making a few people richer at the expense of many. Nothing new — just a new-ish way.

I do believe there is room for decentralized social that enable people to gather in small communities — like Reddit before it started being all about hitting numbers for their IPO. It just won’t necessarily be a model where you pay for access to people’s inboxes and ponzinomics.

Personally, I quite enjoy Farcaster. It’s the place where a lot of real builders who care more about empowering vs. the latest Ponzi happen to be. Lens has similar vibes. There are a lot of artists on there, and people mint their art — this seems a more sensible approach to supporting them. Lens also has some interesting tools where you can turn your followers into a DAO, I believe.

All of that said, crypto does foster some very unhealthy online habits — and money usually increases the stickiness. Another good reason to stay away.

I believe many in the crypto crowd will benefit from connecting with their local communities. Maybe then they’ll even come up with an idea that addresses an issue where people will want the “utility” so much they use it regardless of UX.

Just sayin

So long,

Don’t turn your friends into exit liquidity!