by Jake Zheng

NFT, Non-Fungible Token, is a digital asset that serves as proof of ownership or authenticity for a unique item or piece of content, such as artwork, collectibles, music, videos, virtual real estate, or in-game items. Although NFTs do not inherently generate wealth on their own, they can facilitate the transfer of wealth or value between parties. The value of an NFT is determined by factors such as its uniqueness, scarcity, demand, and the subjective value assigned by buyers and collectors.

NFTs share characteristics with luxury goods, consumables, and investment assets. They are often associated with luxury items due to their exclusivity and uniqueness. Similar to high-end fashion or art, NFTs can be seen as status symbols or collectibles that hold cultural or social significance. Some NFTs are designed as consumable goods, offering temporary or limited-time access to specific content or experiences. Additionally, people often buy NFTs with the expectation of their future price appreciation, making them akin to traditional investments such as stocks, real estate, or precious metals. Buyers believe that the price of a particular NFT will rise over time, allowing them to sell it later for a profit.

Moreover, NFTs can be utilized in the fundraising mechanism, akin to ICOs (Initial Coin Offerings). While ICOs primarily involve token sales for blockchain projects, NFTs have gained popularity as a way for creators and artists to monetize their digital content and raise funds. While NFTs can have monetary value and be bought and sold, they are not only a means of establishing ownership and provenance for unique digital assets, but also a dedicated vehicle for transferring wealth. Despite similarities in fundraising use, NFTs primarily focus on representing ownership or authenticity of unique digital assets, whereas ICOs involve the sale of tokens that often serve specific functions within a blockchain ecosystem. This report will illustrate the current protocols and potential development of NFTs in the upcoming bull market.

Content

- • Introduction

- • Uniqueness and Scarcity

- • Authenticity, Traceability, and Accountability

- • NFT Protocols and Proposals

- • Current Protocols

- • Protocols to be Explored and Expected

- • Valuation and Assessment

- • Cash Flow Method

- • Subjective Method

- • NFT Utility and Business Models

- • Potential Risks

1. Introduction

NFTs are digital assets that symbolize ownership and authenticity of distinctive items or content. These tokens possess unique characteristics that set them apart from other cryptocurrencies. Unlike fungible assets such as cryptocurrencies, NFTs are not interchangeable with one another. They are built on blockchain technology, ensuring secure and transparent verification of ownership and transfer. Over the past years, NFTs have surged in popularity, enabling creators to monetize their digital content and allowing collectors to possess and showcase exclusive items within the digital realm.

1.1 Uniqueness and Scarcity

NFTs are characterized by their inherent uniqueness, making each token one-of-a-kind and possessing its own distinct value. This uniqueness stems from the fact that NFTs represent exclusive digital content, including art, music, videos, and tweets, among others. This attribute makes NFTs highly valuable to collectors who seek to possess exceptional digital items.

Scarcity is another crucial determinant of NFT prices. The scarcity of an NFT is determined by the limited number of tokens available for a specific asset. The rarity of the asset enhances its desirability among collectors. Additionally, the scarcity of NFTs plays a vital role in market growth. As more individuals invest in NFTs, the demand for scarce assets increases. Consequently, this heightened demand drives up the value of these assets, presenting an attractive investment opportunity in NFTs.

Meanwhile, insurers of NFTs must exercise caution in managing the mintage, as the quantity of supply can impact prices and subsequently affect the reputation of insurers. Careful consideration is necessary to maintain a delicate balance between supply and demand, ensuring the stability and integrity of the NFT market.

1.2 Authenticity,Traceability&Accountability

NFTs possess a significant attribute of authenticity. Being constructed on blockchain technology, NFTs are inherently genuine and cannot be replicated. This characteristic makes them highly valuable for collecting rare and prized items. The utilization of blockchain ensures that NFTs can be traced back to their original creators or owners, thus enhancing their value and authenticity. NFTs can be likened to digital certificates of authenticity, serving as proof of ownership for unique digital assets. This feature is especially advantageous for creators, as NFTs offer a means to safeguard their intellectual property and ensure fair compensation for their creations.

NFTs exhibit a transparent and easily traceable nature. Every transaction involving an NFT is meticulously recorded on the blockchain, facilitating seamless tracking of ownership and transfer of ownership. This transparency imbues NFTs with a heightened level of security and accountability that surpasses traditional collectibles such as physical artwork or trading cards. Furthermore, this transparency fosters an efficient and secure process for transferring ownership, particularly when dealing with high-value items. The ability to easily verify ownership and track the history of transactions adds an additional layer of trust and reliability to the NFT ecosystem.

2. NFT Protocols and Proposals

There are multiple NFT protocols, which encompass a set of rules and standards dictating the creation, storage, and transfer of NFTs. Each protocol possesses distinct features and advantages, such as reduced transaction fees or faster processing times. The selection of a protocol depends on the requirements and preferences of creators and collectors. While many startups and investment institutions have been exploring the utilities and potential of existing NFT protocols, it is important to note that they may not provide a comprehensive foundation for NFT continuous long-term development. Let’s delve into an analysis of the current NFT protocols below.

2.1 Current Protocols

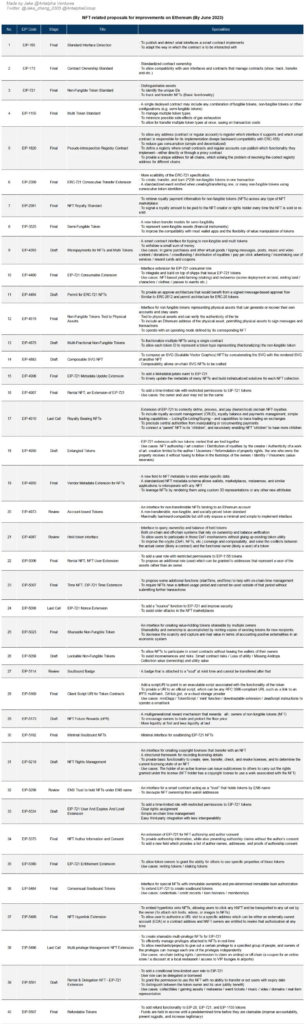

Ethereum stands as the predominant NFT network, offering a prime example. Its EIP-721 and EIP-1155 standards provide developers with a robust framework for creating and managing NFTs on the Ethereum blockchain. However, it is essential to acknowledge that certain NFT improvement proposals may be in stagnation stages. Apart from EIP-721 and EIP-1155, there are other notable NFT protocols on the Ethereum network that have gained popularity.

Source: Ethereum EIP

Developers have presented over 60 proposals encompassing diverse perspectives in NFT development. Those proposals have introduced various characteristics of NFTs in a multitude of scenarios, including gaming, music, collectibles, and more. However, it is important to acknowledge that certain proposals may be in a state of stagnation. Building upon the previously discussed developed protocols. Building upon the previously discussed developed protocols, let us proceed to analyze and discuss the distinctive features of NFTs as follows.

2.1.1 Composability

Composability refers to the ability to combine different elements to create something entirely new. In the realm of NFTs, NFTs can be merged with other NFTs or digital assets to generate entirely novel entities. Improvement proposals, such as EIP-4883, EIP-5501, EIP-5606, EIP-5633, and EIP-6220, have played a crucial role in enabling composability. The smart contracts facilitate automated transactions while ensuring transaction integrity, and they also serve as the foundation for NFT composability.

NFTs, as virtual assets, possess the unique capability of being composable in various contexts, particularly evident in gaming scenarios. NFTs can be combined in diverse ways to create new digital assets. Moreover, NFTs can be aggregated to form collections, such as a collection representing an art exhibition or a series of music albums.

The significance of NFT composability lies in the frontier it opens up for the digital world. It enables the creation of digital assets that were previously inconceivable, fostering innovation and exploration. It creates fresh opportunities for content creators. Consequently, NFTs can serve not only as tokens of ownership for digital assets but also as representations of membership or access to exclusive content.

2.1.2 Shareability and Permission Authorization

With the aim of addressing certain rights that are exclusive to NFT holders, new proposals have emerged to develop advanced structures that separate ownership, usage rights, and lease rights. Notable examples include EIP-5023, EIP-5218, EIP-5496, EIP-5554, and EIP-5585, which propose the authorization and commercialization of rights associated with NFTs. These proposals introduce the concept of minting copies of existing tokens to enable shareability and ownership among new recipients.

For instance, EIP-4907 suggests using a smart contract to establish rules and codes that separate the commercial usage rights of an EIP-721 NFT from its ownership. This enables the independent management of those rights. Another protocol, EIP-5496, leverages the functionality and utility of NFTs by providing additional data to record diverse privileges within an NFT collection and facilitates their management.

These protocols have established a foundation for various scenarios related to the commercialization of NFT copyright and authorization. By introducing innovative structures, these proposals contribute to the ongoing evolution of NFTs and provide opportunities for more diverse commercial applications.

2.1.3 Rentability

Rentability of NFTs offers owners the opportunity to generate cash flow from their assets while providing users with the privilege of accessing and utilizing NFTs. The rentability of NFTs hinges on various factors, including demand, scarcity, and the reputation of the creator, all of which contribute to determining the value of NFTs. Renting out NFTs presents creators with a means to monetize their creations and establish a recurring income stream.

Exploration into renting NFTs has been undertaken by proposals such as EIP-4400, EIP-4907, EIP-5006, EIP-5501, and several other proposals. These protocols delve into the mechanisms and frameworks for enabling NFT rentals. As the popularity of NFTs continues to surge, it is likely that their rentability will witness a corresponding increase.

Through the aforementioned protocols, NFTs can be made available for rent, allowing individuals to pay for the temporary usage of a digital asset. The rental price is determined by the owner and can vary based on the demand for the asset and other market factors. This flexibility provides an avenue for NFT owners to derive additional value from their assets while granting users the opportunity to engage with and experience exclusive digital content for a specified period.

2.1.4 Licensing

NFTs serve as effective tools for managing rights and licenses associated with digital content, including music, videos, and software. Licensing provides a secure and transparent method to track and govern the usage of such assets, while also enabling creators to monetize their work through licensing agreements. Various improvement proposals, such as EIP-5218, EIP-5554, EIP-5585, and EIP-5635, have outlined potential terms and conditions governing the relationship between the licensor (content creator) and licensee (content user). These proposals offer valuable insights into establishing comprehensive frameworks for licensing digital assets using NFTs. By leveraging NFTs and associated protocols, creators can protect their intellectual property rights, while licensees can obtain authorized access to and usage rights for digital content in a transparent and accountable manner.

2.1.5 Subscription and Membership

NFTs have the potential to serve as endorsements for individual and group rights, particularly in the domains of digital identity and citizenship. Through the use of NFTs, individuals can establish verifiable proof of their identity, citizenship, and ownership of valuable digital assets. In terms of technical support, proposals EIP-4885 and EIP-5643 empower creators by allowing them to design custom subscription models. This flexibility opens up new revenue streams and paves the way for decentralized distribution and delivery models.

One application of NFTs in subscriptions is through the offering of exclusive content or access to specialized services. For instance, a music streaming platform could provide an NFT as part of a premium subscription package, granting access to exclusive concerts, backstage meet-and-greets with artists, or even unique merchandise. Similarly, a gaming platform could offer an NFT that unlocks access to exclusive in-game content, such as rare items or restricted game areas. Another subscription model involving NFTs is the creation of membership programs that reward members with NFTs. This NFT could be used to unlock exclusive content or even provide discounts on future subscriptions.

By integrating NFTs into subscription models, businesses can enhance their offerings, incentivize customer loyalty, and create unique value propositions for their users. NFTs provide a versatile and innovative mechanism to enhance subscription-based services across various industries.

2.1.6 Identification Verification, Certification, and Documentation

The inherent non-duplicable nature of NFTs makes them an ideal tool for verifying identity. By leveraging NFTs for identity verification, individuals and organizations can establish a secure and decentralized method of confirming identity, eliminating the need for reliance on third-party intermediaries and enabling secure interactions and transactions across various domains.

Proposals EIP-4950, EIP-5646, and EIP-6059 have paved the way for multiple approaches to confirming identity and authorizing associated rights. These proposals offer innovative solutions to address the challenges surrounding identity verification using NFTs. Through the implementation of these protocols, individuals can securely assert their identities and gain access to various services and privileges.

2.1.7 Relationship and Hierarchy

In the realm of relationships, NFTs offer a unique opportunity to symbolize and commemorate the bonds between individuals or entities. Protocols such as EIP-5521 and EIP-6150 provide functionalities for querying, tracking, and analyzing these relationships, enabling users to create and manage relationship-based NFTs.

Furthermore, NFTs can be utilized in hierarchical structures to represent varying levels of authority or access. Organizations can leverage NFTs to establish a system where different job titles or levels of security clearance are represented by unique tokens. By assigning these NFTs to employees, the organization can effectively manage and track access to specific information or restricted areas.

2.1.8 Royalty

Royalties play a crucial role in compensating artists and content creators for their work, and NFTs offer a promising solution for tracking ownership and distributing royalties automatically. EIP-2981 has introduced an NFT royalty standard, ensuring universal support for royalty payments across various NFT marketplaces and participants in the ecosystem.

Additionally, EIP-4910 provides a framework for establishing hierarchical royalty structures, referred to as royalty trees. This allows for logical connections between a “parent” NFT and its “children,” enabling recursive expansion of NFT “children” to have further descendants.

To illustrate this concept, consider a musician who sells a song. By associating the song with an NFT, the artist can receive a percentage of the profits as a royalty payment each time the song is sold or licensed. Similarly, an artist can create an NFT representing a digital painting, and whenever the painting is sold or licensed, the owner of the NFT receives a percentage of the profits as a royalty payment.

The implementation of NFT royalties provides several benefits for artists and content creators. Firstly, it establishes a transparent and immutable record of ownership and usage, eliminating the need for intermediaries to track and distribute royalties. Secondly, it enables artists to continue receiving income from their creations even after the initial sale, ensuring ongoing compensation for their work. Moreover, NFT royalty standards promote fairness and accountability in the digital art and content industry.

2.1.9 Real-World Asset

Real-world assets, including tangible items such as real estate and automobiles, can be represented and tracked using NFTs. Protocols EIP-4519, EIP-5050, EIP-5505, EIP-5570, EIP-5700, and EIP-5791 have explored ways to establish a connection between NFTs and physical assets. For instance, EIP-4519 standardizes the relationship between NFTs and real-world assets, ensuring the authenticity of the connection. This protocol allows physical assets to sign messages and transactions, operating in accordance with the corresponding NFT.

By leveraging NFTs, the transfer and verification of ownership for real-world assets become seamless, rendering extensive legal documentation unnecessary. This streamlined process significantly improves the efficiency and cost-effectiveness of buying and selling such assets. Moreover, the utilization of NFTs facilitates efficient verification and authentication, ultimately bolstering the trust and inherent value associated with collectibles.

Furthermore, NFTs possess the capability to represent ownership of intellectual property, encompassing patents, trademarks, and copyrights. The ease of transfer and verification offered by NFTs acts as a deterrent to intellectual property theft, safeguarding the rights of creators and ensuring they receive the appropriate compensation for their artistic works.

2.1.10 Interest-bearing Feature

NFTs can be thoughtfully designed with an interest-bearing feature, enabling owners to earn passive income on their investments. This innovation presents a new avenue for investors to generate revenue while simultaneously enhancing the liquidity and value of NFTs. The standardization of interfaces, as exemplified by EIP-5023, facilitates the creation of non-fungible value-holding shareable tokens. By minting copies of existing tokens for new recipients, NFTs can expand the pool of stakeholders, leading to positive externalities, even though these copies may not be tradable or transferable. Additionally, smart contracts, such as those proposed in EIP-5725, offer solutions for sharing economic interests among previous holders. Through the implementation of the nFR (NFT Future Rewards) proposal, a trading ecosystem is formed, fostering a giving circle where creators, buyers, and sellers all benefit. Consequently, owners can enjoy increased NFT prices not only when they sell their tokens, but also when subsequent owners engage in transactions. While this economic model encourages participation in transactions, it is important to note that it can potentially lead to market bubbles.

In practical scenarios, professional organizations are strongly motivated to create or invest in NFTs that symbolize a share in revenue-generating assets, such as artworks, music albums, or games. By owning these NFTs, individuals receive a portion of the generated revenue, turning the NFT itself into an enticing investment opportunity.

Another approach to developing interest-bearing NFTs involves the implementation of a staking mechanism. Through staking, individuals can lock up their NFTs as collateral and, in return, earn rewards in the form of tokens or other valuable assets. This strategy amplifies the scarcity of the NFT and has the potential to elevate its value over time.

Interest-bearing NFTs can also prove to be impactful tools for fundraising purposes. For instance, a charitable organization can create an NFT that represents a charitable donation. Supporters have the opportunity to purchase the NFT, with the organization utilizing the funds generated to advance their cause. By incorporating interest-bearing features into the NFT, supporters can not only contribute to the charitable endeavor but also earn rewards for their participation and support.

2.1.11 Non-Transferability

During NFT transactions, activities such as rent-seeking, arbitrage, and speculation can significantly impact NFT prices. This often leads to the misconception that NFTs are tools for money laundering, speculation, and Ponzi schemes. To address these concerns and mitigate the drawbacks associated with NFT transactions, developers have been exploring various methods to reduce or eliminate certain transaction opportunities and transferability. These approaches specifically target lock periods, tradability, and soul-bound solutions to enhance the consumption characteristics of NFTs.

Different protocols, including EIP-4973, EIP-5192, EIP-5484, EIP-5516, and EIP-5727, have devised ways to restrict transactions by introducing soul-bound or account-bound NFTs. Additionally, EIP-5753 incorporates parameters “lock” and “unlock” to adjust transferability. Some use cases, such as academic degrees, badges, memberships, and NFT-collateralized loans, may necessitate lockable or non-tradable NFTs.

Non-transferability can be seen as a double-edged sword. On one hand, it enhances the value of the NFT by making it a rare and exclusive asset. On the other hand, it limits the liquidity of the asset, making it challenging to sell or trade in the future. Furthermore, non-transferability raises concerns regarding inheritance and estate planning.

Numerous investment institutions and startups have been contemplating futuristic business models and development trends based on the aforementioned protocols. Some of these models have already proven successful, with startups thriving in the NFT space. However, it is important to note that NFTs, as significant virtual assets in the blockchain world, may possess additional features supported by new protocols that are yet to be discovered. These underlying protocols will be further analyzed in the next chapter.

2.2 Protocols to be Explored and Expected

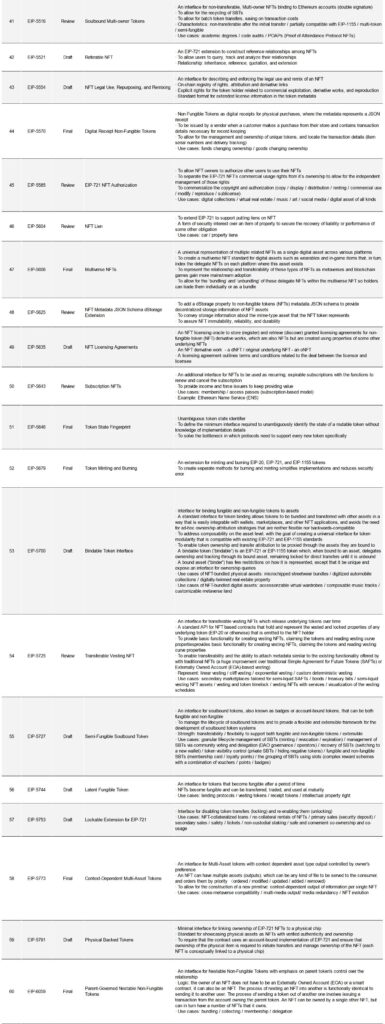

The diverse features of NFT assets and their associated rights suggest the existence of numerous potential protocols that are yet to be discovered. To embark on the exploration of these protocols, it is crucial to first review the categories of assets. This comprehensive analysis will provide a framework for deeper understanding and shed light on the distinct characteristics and functionalities they possess.

Assets are valuable resources owned or controlled by individuals or companies, representing potential future economic benefits. As illustrated earlier, these assets and liabilities can be categorized into various classifications. By drawing inspiration from the distinctive characteristics exhibited by various asset categories, valuable insights can be leveraged to conduct a thorough and comprehensive analysis of NFT assets.

2.2.1 Depreciability or Amortizability

Currently, NFT proposals lack the inclusion of the “time” parameter, which is essential for considering the depreciation or amortization of these digital assets. Depreciable assets are expected to decline in value over time due to factors such as wear and tear, obsolescence, and other relevant aspects. To address this devaluation, depreciation is recorded as an expense against the asset’s value throughout its useful life. As the NFT market continues to expand, it becomes crucial for developers to incorporate this parameter into their protocols. EIP-5007 introduced the concept of incorporating time, but there is still room for further exploration regarding depreciation and amortization.

Introducing the “time” parameter would enable NFTs to undergo a gradual decrease in value, similar to physical assets such as cars, real estate, and electronic devices. This mechanism could involve reducing the value of an NFT by a certain percentage each year or month, depending on the specific protocol. By implementing this feature, NFTs would be prevented from being overvalued, ensuring that their value aligns more closely with their actual worth. Consequently, the inclusion of a “time” parameter in NFT protocols would establish a sustainable and equitable pricing model for these digital assets.

One of the primary benefits of integrating this parameter into NFT protocols is the promotion of sustainable pricing for these digital assets. Presently, NFTs can be sold for exorbitant sums of money, with no guarantee of maintaining their value. By incorporating a “time” parameter, buyers would gain a better understanding of the NFT’s potential long-term value, which would increase their willingness to invest in it.

Another advantage of this parameter is its ability to prevent market manipulation. Currently, some individuals engage in the buying and selling of NFTs solely to artificially inflate their value. This behavior can create a speculative bubble, where NFTs are traded for much more than their actual worth. However, by including the “time” parameter, it would become more challenging for individuals to manipulate the market, as the value of the NFT would gradually decrease over time.

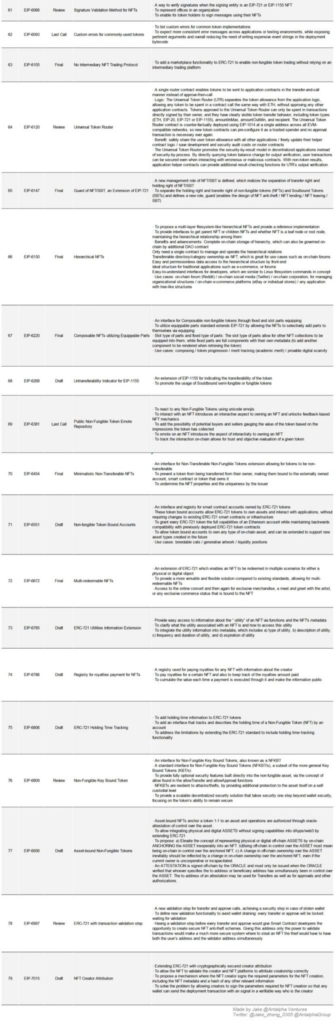

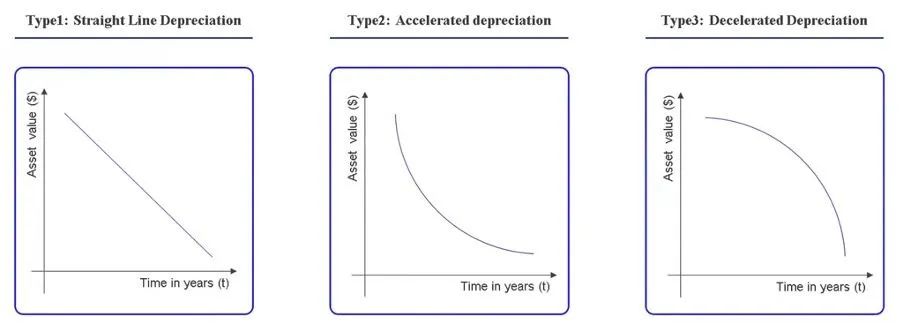

Regarding depreciation and amortization, NFTs can adopt three main approaches to account for the loss in value, with one particular situation. The depreciation approaches are visualized in the accompanying graphs below.

- Type 1: In straight line depreciation, the value of an asset decreases by an equal amount over each period of its useful life. This approach assumes a linear decline in value over time. This constant reduction would continue until the NFT reaches its estimated residual value or useful life ends.

- Type 2: Accelerated depreciation allows for a faster reduction in the value of an asset during the earlier years of its useful life. This method acknowledges that assets often lose value more rapidly in their initial years due to technological advancements or market demands. For NFTs, an accelerated depreciation model could involve applying higher depreciation rates in the early years, gradually tapering off in subsequent years.

- Type 3: Decelerated depreciation, also known as the opposite of accelerated depreciation, assumes that an asset’s decline in value slows down over time. This method suggests that assets hold their value relatively well over the long term. For NFTs, a decelerated depreciation model could involve applying lower depreciation rates in the early years and gradually increasing them in subsequent years.

2.2.2 Time and Cash Flow

One of the distinctive characteristics of NFTs is their ability to generate cash flows for their owners at various points in time. Unlike traditional assets, NFTs can be designed to generate revenue not only upon purchase but also in the future. Outlined below are several scenarios that give rise to cash flow associated with NFTs.

2.2.2.1 Annuity

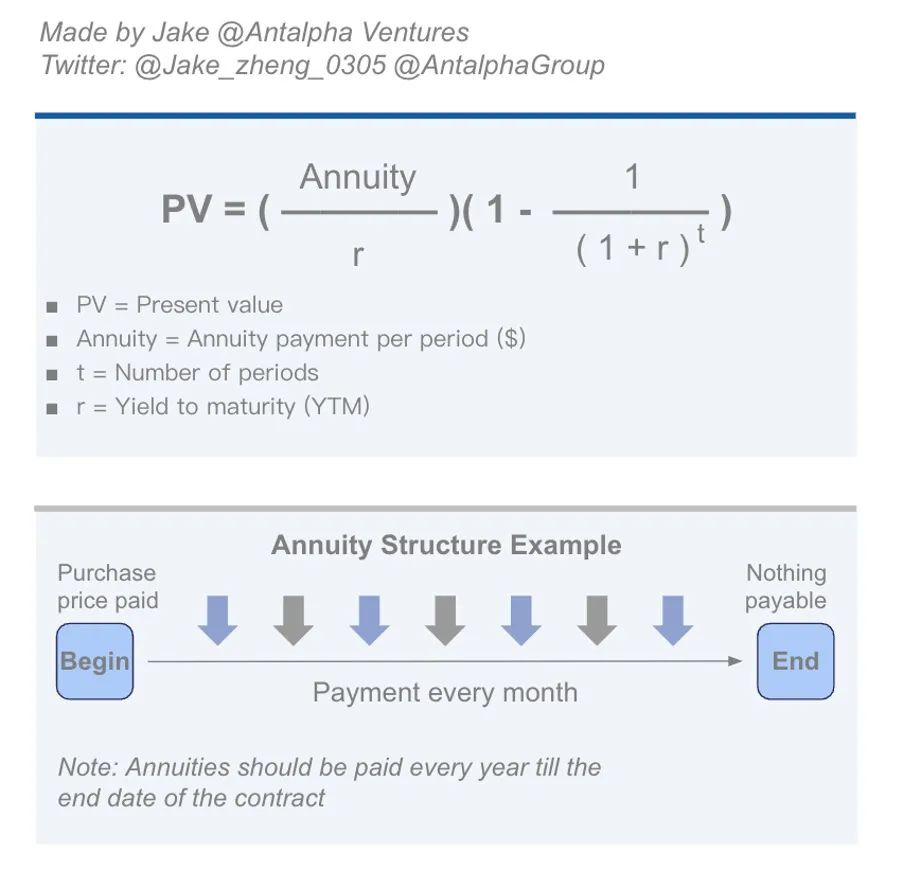

The term “annuity” can be applied to describe a specific type of cash flow that occurs consistently over a predetermined duration. This structured cash flow arrangement can involve counterparties exchanging fixed-term payments through specialized vehicles. However, in the context of NFTs, the concept of annuities can extend to scenarios where both parties engage in the transfer of varying amounts within fixed or adaptable time periods. While this flexibility expands the potential applications of annuity-like arrangements with NFTs, it also introduces additional risks and uncertainties.

One way to incorporate annuity concepts into NFTs is by creating annuity-based NFTs. These NFTs would represent contracts that entitle the owner to receive payments from an annuity contract over a specific timeframe. These assets could generate regular income streams, such as rental income from real estate or interest payments from bonds. By being tradable on the blockchain, these annuity-based NFTs provide liquidity to the annuity market, enhancing financial and trading capabilities. The NFT would signify ownership of the asset and the associated annuity income stream. This would enable investors to acquire fractional ownership in annuity-based assets and receive periodic income accordingly.

Apart from borrowing and lending scenarios, there are other potential applications of annuity-like arrangements with NFTs. These include credit purchases through installment plans, loan repayments in installments, pension payments, and funding projects through installment-based models.

By integrating annuity concepts into NFTs, a wider range of financial possibilities can be explored, offering innovative methods for generating and distributing cash flows. It is important to consider the associated risks and uncertainties that arise with these expanded applications of annuity-like structures in the NFT ecosystem.

2.2.2.2 Dynamic Interest Generation

The concept of dynamic interest generation for NFTs draws inspiration from real-world scenarios where assets may accrue interest or generate cash flow under certain circumstances. NFTs have the potential to incorporate a similar system, wherein the value of an NFT increases over time through automated interest generation. This can be facilitated through the utilization of smart contracts, which can be programmed to generate interest for NFT holders based on specific criteria.

By implementing a dynamic interest generation system, NFT holders are incentivized to retain their NFTs for longer periods, consequently boosting their value. This engenders a positive cycle wherein more individuals acquire, hold, and utilize NFTs, leading to increased interest generation and higher valuations.

When determining the value of the interest generated, it is crucial to adhere to the principles of diminishing marginal returns. This ensures that the economic system remains sustainable in the long term, preventing a collapse. Additionally, the interest rate can be dynamic, taking into account various real-world factors such as prevailing interest rates, political stability, and financial policies.

By incorporating dynamic interest generation mechanisms into NFTs, the ecosystem can foster greater value retention and engagement among NFT holders, contributing to a more robust and dynamic NFT economy. It is essential to carefully consider the design and implementation of such systems to ensure their viability and long-term sustainability.

2.2.3 Tax Model

NFTs have the potential to generate cash flow, as discussed in the previous analysis. However, the tax treatment of NFTs remains uncertain, leading taxpayers and tax professionals to grapple with understanding the tax implications associated with the buying, selling, and holding of NFTs. In this context, there are two possible methods that authorities may employ to impose taxes on stakeholders involved in NFT transactions.

2.2.3.1 Purchasing or Selling NFTs

When acquiring an NFT, it is crucial to maintain a record of the cost basis associated with the asset. The cost basis represents the amount paid by the buyer for the NFT, inclusive of any transaction fees. This cost basis plays a pivotal role in determining the potential gain or loss when the NFT is eventually sold.

Considering that NFTs can be viewed as investment assets, individuals may sell them at a higher price than the initial purchase cost. In such cases, sellers are liable to pay capital gains tax on the difference between the cost basis and the selling price. The tax rate will depend on whether the NFT was held for a short-term or long-term period before the sale. If the NFT was held for less than a year, it will be subject to short-term capital gains tax. Conversely, if the NFT was held for over a year before being sold, it will be subject to long-term capital gains tax. The precise tax rates applicable to capital gains depend on various factors specific to each jurisdiction.

As per the guidelines provided by the Internal Revenue Service (IRS), NFTs are classified as capital assets, signifying that they are subject to capital gains tax upon sale or exchange. It is crucial for individuals engaging in NFT transactions to be aware of and comply with the tax regulations governing their jurisdiction. Seeking professional advice and staying informed about tax obligations is advisable to ensure proper reporting and compliance with applicable tax laws.

2.2.3.2 Holding NFTs

If an individual holds an NFT for personal use, such as for a digital art collection, it is possible that it may be categorized as a collectible, potentially subject to perpetual tax rates. Perpetual tax rates differ from other types of taxes, such as income tax or sales tax, as they are not based on specific transactions. Instead, they are based on the assessed value of the property, similar to real estate taxes in the United States. Consequently, property owners are obliged to pay these taxes irrespective of whether they are selling or utilizing the property.

It is true that NFTs can be considered collectibles depending on their nature and purpose. Collectibles are subject to higher tax rates compared to capital assets, which may result in a greater tax liability. However, the precise classification of NFTs as collectibles is still a matter of discussion and interpretation.

Perpetual tax rates are typically calculated based on the current market value of the NFT property. The rates are usually expressed as a percentage of the NFT property’s value, established by the local government. It is important for NFT property owners to familiarize themselves with the applicable tax rates in their respective areas to ensure compliance with tax obligations.

2.2.4 Adjustability and Flexibility

As discussed and analyzed previously, the flexibility and adjustability of NFT attributes in certain Web3 applications are influenced by various factors, including the macroeconomic environment, project development, and holder growth. Introducing adjustable attributes would be a significant advancement compared to the current setup, allowing for post-purchase modifications of NFT attributes.

One compelling use case for adjustable attributes is within the gaming realm. Consider a scenario where an NFT represents a character in a video game. With adjustable attributes, players would have the ability to modify the character’s appearance, abilities, or even backstory, enabling a highly personalized gaming experience. Efforts such as EIP-5606 have made progress in exploring composability and adjustability, but additional protocols are needed to fully support a truly immersive gaming experience in the Web3 world.

Moreover, adjustable attributes would enable NFTs to evolve over time. As owners of NFTs, individuals could adjust the attributes to reflect changes in the value or significance of the underlying asset that the NFT represents. This dynamic feature enhances the adaptability of NFTs in response to evolving circumstances.

However, it is essential to acknowledge that the adjustability of NFTs raises some concerns. Critics argue that NFTs lose their uniqueness if they can be modified after creation. Furthermore, the complexity of smart contracts and the potential for errors or bugs pose legal and financial risks for NFT owners.

2.2.4 Compatibility and Interoperability

The emergence of new protocols supporting various aspects of NFT development highlights the need for compatibility and interoperability across different platforms. Seamless integration between NFTs, marketplace platforms, blockchain networks, and wallets is essential for their effective functionality and easy transferability.

Compatibility plays a pivotal role in the success of NFTs by expanding their reach and accessibility. NFTs that can seamlessly operate on different platforms can be bought and sold across a wider range of marketplaces, thereby enhancing their visibility and value. Furthermore, compatibility enables NFTs to be traded on diverse blockchain networks, facilitating broader participation in the NFT market by a more diverse user base.

Additionally, compatibility with wallets is crucial to ensure that users can conveniently store and manage their NFTs. A compatible wallet allows users to access their NFTs from any device, simplifying activities such as buying, selling, or trading.

In the context of extensive virtual world development, compatibility takes on even greater significance. It signifies that NFTs, as a form of virtual assets, can be utilized across multiple platforms and scenarios, contributing to the creation of a more comprehensive metaverse.

3. Valuation and Assessment

The current valuation of NFTs is influenced by various factors, including the rarity of the asset, the reputation of the creator, and buyer demand. However, these factors often lack objectivity and fail to provide a comprehensive reflection of the true value of an NFT.

To address this, the implementation of a pricing and assessment system for NFTs would establish a standardized approach to evaluate and determine the value of these assets. This system could incorporate a combination of objective and subjective criteria. Objective criteria may include assessing the uniqueness of the NFT, evaluating the quality of the artwork or design, and considering the historical sales data. Subjective criteria might involve expert opinions or community consensus on the artistic or cultural significance of the NFT.

By establishing a pricing and assessment system, NFTs can be recognized as a legitimate asset class. This recognition would attract more investors, increase market transparency, and enhance overall demand for these digital assets. The valuation of NFTs through such a system would provide a more accurate representation of their worth and facilitate informed decision-making for buyers and sellers.

There are two primary approaches that can be employed to evaluate NFTs:

3.1 Cash Flow Method

This method is rooted in the principle that an asset’s value is derived from the cash flows it generates. As highlighted in the analysis in the previous chapter, certain protocols enable NFT holders to rent out their NFTs, thereby generating cash flow for the renters over a specific period. In addition to renting, there exist multiple avenues to facilitate cash flow for NFTs as well. This demonstrates that NFTs can be considered as assets that can be evaluated using cash flow methods, as outlined in the following steps.

- Assess the expected cash flows: The initial step is to evaluate the anticipated cash flows that the NFT is likely to generate in the future. This assessment can be complex, particularly for newly introduced NFTs with limited historical data. However, it is possible to estimate potential cash flows based on factors such as market demand, scarcity, and potential use cases.

- Discount the cash flows: Once the expected cash flows are determined, they need to be discounted to their present value. Future cash flows are typically assigned a lower value compared to present cash flows due to the time value of money. The discount rate used in this process will depend on the associated risk level of the NFT.

- Calculate the net present value (NPV): The net present value represents the present value of the expected cash flows minus the initial investment. A positive NPV indicates that the NFT is potentially a worthwhile investment, whereas a negative NPV suggests that investing in the NFT may not be favorable.

3.2 Subjective Method

However, it is important to note that not all NFTs are expected to generate sustainable cash flows in every circumstance. In such cases, the subjective method becomes crucial for evaluating the prices of these NFTs, particularly in the context of collectibles. It is difficult to provide an exact formula in this situation since the prices of collectible NFTs are heavily influenced by emotions such as desire and fear. The subjective method can be outlined as follows.

Price (NFT) = F(M, U, O, S, Pe, Q, L, CF, X)

Based on the subjective method, the prices of NFTs are heavily influenced by several factors, including but not limited to:

- M represents the market conditions, encompassing factors such as interest rates, consumer sentiment, inflation rate, and other influential elements that impact the market dynamics.

- U represents the utility derived from NFTs. By offering practical applications, products, and associated services, project managers can cater to diverse demands, prompting buyers to acquire NFTs for their various needs.

- O represents operational management by the project team. Employing methods such as identity marking and community establishment, project managers can enhance user retention. This fosters self-identity, peer communication, and the potential for satisfaction, enjoyment, and cultural identity through NFTs and social communities. Unlike other identity management and communication tools, NFTs enable users to connect with peers sharing similar wealth levels, aesthetics, and consumption preferences.

- S represents the scarcity of NFTs, wherein the quantity available influences their prices.

- Pe represents the future price expectations of NFTs. Rational investors may purchase NFTs at lower prices with the anticipation of selling them at higher prices, considering the expected price to surpass the current price.

- Q represents the quality of NFTs. The quality of the attached images and attributes plays a significant role in the quantity demanded. In recent years, NFTs featuring high-quality images have attracted more buyers compared to others.

- L represents the liquidity of NFTs, which also affects transaction prices. If the expected prices from buyers and sellers differ, sellers may lower their prices to gain additional liquidity. Achieving a balance between both parties influences transaction liquidity.

- CF represents the potential cash flow generated by NFTs. Although certain protocols are still under development, some NFTs enable holders to obtain cash flow through borrowing and lending mechanisms. As mentioned earlier, certain protocols allow holders to acquire stable cash flow over a period of time.

- X represents other factors that influence the price of NFTs, encompassing elements not covered by the factors mentioned above. An example of such a factor is royalty rates, which can impose additional costs on users and clients.

While the quantity demanded of NFTs does influence the price, it is not explicitly included in the price function discussed earlier since the demand side is considered an exogenous variable. However, it is important to acknowledge that changes in quantity demanded can impact NFT prices.

In an attempt to ascertain NFT utility, some projects have explored NFT-Fi methods, including fragmentation, automatic market makers, and various lending approaches. Nevertheless, the current lack of well-established protocols and valuation methods may result in buyer confusion and price fluctuations within the NFT market. These challenges highlight the need for proper evaluation methods that can effectively assess the cash flow and financialization of NFTs.

Both the methods mentioned above offer valuable insights for evaluating NFTs in the blockchain world. By further developing protocols and refining valuation techniques, the industry can establish more reliable frameworks for understanding the utility and financial aspects of NFTs.

4. NFT Utility and Business Models

NFT projects necessitate a dedicated team proficient in managing various aspects of the operation, such as strategy and planning, marketing and promotion, community management, as well as forging partnerships and collaborations. However, relying solely on the sale of NFTs may not guarantee sustainable growth for these projects. Hence, exploring alternative utility and business models becomes crucial for NFT projects. Here are some potential NFT utility and business models that can prove advantageous:

- Brand partnerships and licensing: Business models for brands in NFT projects focus on harnessing the power of established brands, intellectual properties, and licensed content to develop and monetize NFT collections. This opens up avenues for brand extension, heightened engagement, and the generation of new revenue streams. By collaborating with NFT partners, brands can unlock new opportunities for creativity, engagement, and revenue generation in the digital realm. The partnerships allow brands to tap into the growing NFT market and leverage their existing brand equity to attract collectors, enthusiasts, and fans alike. Through the creation and sale of NFTs, brands can expand their reach, deepen customer relationships, and explore innovative ways to monetize their intellectual assets.

- Franchising IP assets: Owners of highly successful intellectual properties establish NFT-based franchises that enable creators and collectors to actively participate in the creation of new content or collaborate on derivative NFT creations. This immersive approach allows fans to engage with the IP in innovative and interactive ways, fostering a vibrant and dedicated community around the franchise.

- Virtual world integration: IP owners form collaborations with NFT projects or virtual worlds to seamlessly integrate their branded content into captivating digital environments. This integration involves the development of virtual experiences, branded items, or notable landmarks within the virtual world. These elements can be acquired and traded as NFTs, enhancing the overall user experience and further immersing users in the world of the IP.

- Brand licensing: Brand owners have the opportunity to license their intellectual properties, such as characters, artwork, or other assets, to NFT creators or platforms. Authorized partners can then create and distribute NFTs featuring these licensed assets, leveraging the brand’s recognition and appeal to attract collectors and fans. This mutually beneficial arrangement enables brand owners to expand their reach in the NFT market while providing NFT creators with valuable content to engage their audience.

- Collaborative NFT collections: Brands forge partnerships with NFT platforms or artists to curate exclusive NFT collections showcasing their branded content. These collections may encompass digital artwork, virtual items, collectibles, or immersive experiences linked to the brand. NFTs from these collaborations can be made available for purchase through diverse avenues, including auctions, limited editions, or direct sales.

- Real-world asset: This business model involves the tokenization and trading of ownership rights to physical or tangible assets on blockchain platforms. It enables the digital representation, fractional ownership, and transferability of real-world assets through NFTs. However, the current implementation of this model faces challenges due to the absence of time parameters and verification methods. To bridge the gap between real-world assets and NFTs in the blockchain world, additional parameters need to be integrated into NFT protocols. These parameters may include factors such as depreciation or amortization periods and rates. The following list outlines the key components of the business model for real-world assets.

- Asset tokenization: Physical assets such as real estate, artwork, collectibles, luxury goods, and intellectual property rights are transformed into unique NFTs on a blockchain. Through the tokenization process, ownership rights or asset characteristics are converted into digital tokens with distinct identifiers.

- Verification and authentication: Guaranteeing the authenticity and provenance of real-world assets is paramount. This can be achieved through various technologies, including digital certificates, verifiable metadata, and third-party authentication services. These measures enhance trust and add value to the NFT representing the real-world asset.

- Trading and secondary marketplaces: NFTs representing real-world assets can be bought, sold, or traded on specialized NFT marketplaces. These platforms provide a marketplace where buyers and sellers can exchange ownership of NFTs linked to real-world assets. Secure transactions, transparent ownership history, and automatic royalty or commission payments to the original asset owner are ensured through smart contracts.

- Utilities and applications: NFT utility enables creators, developers, and platforms to offer NFT holders unique experiences, benefits, or services. These utility models provide opportunities for monetizing digital assets, delivering exceptional experiences, and fostering user engagement. However, certain challenges, including scalability, adoption, maintaining the value and relevance of NFT utilities, and ensuring interoperability across platforms or ecosystems, must be addressed for long-term success.

- Gaming assets: Gaming assets within the realm of blockchain-based games can be effectively represented by NFTs. These digital tokens serve as unique and indivisible units that encapsulate in-game items, characters, or accessories, offering players the opportunity to possess and engage in trading activities with these virtual assets. By acquiring and exchanging NFT gaming assets, players can enrich their gaming experiences, unlocking new levels of personalization, customization, and progression within the game world. The value proposition of NFT gaming assets extends beyond their inherent utility within the game environment. The scarcity and demand associated with these virtual assets can potentially generate additional value for NFT holders. As the availability of certain rare or coveted NFT gaming assets diminishes, their desirability among players and collectors increases, leading to a potential appreciation in their market value. This interplay of scarcity, demand, and value creation imbues NFT gaming assets with an additional layer of economic significance and investment potential.

- Membership, access, and governance: NFTs can grant holders exclusive membership or access to specific platforms, communities, events, or services. This can include early access to releases, VIP privileges, or participation in special events or experiences. Additionally, NFTs can grant holders voting rights or influence over governance and decision-making processes within a digital ecosystem or platform. This allows holders to participate in shaping the rules, policies, or future development of the community.

- Community engagement and interaction: NFTs can foster an active and engaged community around the NFT utilities. They encourage collaboration, interaction, and participation among NFT holders through features such as forums, social platforms, or virtual meet-ups. Community-driven initiatives, challenges, or contests can also deepen the connection and involvement of NFT holders.

- Reward mechanisms: This involves the implementation of reward mechanisms for NFT holders based on their engagement, participation, or contributions to the ecosystem. This could cover token airdrops, loyalty programs, or incentives for promoting the platform or referring new users.

Acknowledging the significance of NFTs as pivotal assets within the Web3 world, a plethora of applicable business models have emerged to cater to this rapidly evolving industry. OpenSea, a prominent player in the field, has successfully ventured into spot trading, while Blur has made notable advancements in facilitating large-scale NFT transactions. However, amidst the ever-evolving landscape of transaction methods and models, there exist untapped business opportunities that hold the potential to bolster trading volume and market liquidity. With the maturation of protocols and the flourishing of NFT projects aforementioned, a myriad of transaction models are poised to emerge and thrive within the market ecosystem. Drawing insights from the experiences garnered in traditional markets, several potential transaction models can be delineated, encompassing the following:

- Leasing: Leasing encompasses a business model in which individuals or businesses opt to rent or lease a product or asset for a predetermined period, typically longer than a short-term rental but shorter than the asset’s useful life. This approach offers individuals and businesses the flexibility to utilize an asset without the necessity of an outright purchase. The lessee makes regular payments, referred to as lease payments, to the lessor, thereby gaining the privilege to utilize the asset during the agreed-upon lease term.

- Collateral and pawn: Pawn refers to a financial service wherein individuals or businesses can obtain short-term loans by utilizing personal assets as collateral. This process is facilitated by pawn shops or pawnbrokers who accept valuable items and provide loans based on the appraised value of those items.

- Commercial factoring: The business model of commercial factoring encompasses a financial arrangement in which a specialized company, referred to as the factor, acquires the accounts receivable of another company, known as the client, at a discounted rate. This model facilitates prompt and consistent cash flow for the client by converting their invoices into readily available funds, thereby enabling them to efficiently manage their working capital. By leveraging the services of a factor, clients can effectively mitigate the challenges associated with delayed payment cycles and improve their liquidity position.

- Asset NFTization: As previously mentioned, NFTs serve as more than just a mechanism for establishing ownership and provenance of unique digital assets; they also provide a dedicated avenue for transferring wealth. Grounded in the real-asset model, asset NFTization emerges as a sophisticated financial business model that involves the consolidation and repackaging of various asset types, such as loans, mortgages, receivables, or leases, into a tradable financial instrument. This intricate process empowers financial institutions to convert illiquid assets into marketable NFT, which can then be presented to potential investors.

- Auction: The inherent scarcity of NFTs creates an engaging marketplace where traders can participate in bidding processes to acquire these unique digital assets. Auctions foster an environment in which potential buyers compete with one another by submitting increasingly higher bids, ultimately leading to the NFT being awarded to the highest bidder. Auctions can be conducted through various formats, such as live auctions held in physical venues, online auctions facilitated by digital platforms, or a hybrid approach that combines both virtual and physical auction settings.

- Prepayment: It is a way for the payer to provide funds to the recipient before the agreed-upon obligations are fulfilled. This approach involves making a payment or a series of payments in advance of the contractual repayment schedule. Prepayment methods provide assurance to the seller or service provider that the buyer is serious about their commitment and reduces the risk of non-payment or cancellation.

- Minimum spending requirement: This business model, commonly utilized by firms, especially in the luxury goods industry, entails setting a specific minimum purchase amount that customers must meet in order to avail themselves of particular benefits, rewards, discounts, or special privileges. This model can be effectively applied in the context of NFT trading, considering the inherent scarcity of NFTs. Its primary objective is to incentivize customers to increase their spending and foster greater loyalty towards the brand or business. By implementing a minimum spend requirement, companies aim to drive customer engagement, promote higher-value transactions, and cultivate a stronger relationship between customers and the brand.

- Customization: NFT customization revolves around offering personalized products or services tailored to individual customer preferences and requirements. It involves creating unique and personalized experiences to meet the specific needs and desires of each customer.

- “Lucky buy”: This NFT business model presents individuals with a captivating opportunity to potentially secure prizes through a randomized selection process. It combines elements of entertainment and gambling, subject to regulatory oversight by various governing bodies. The ticket grants customers the thrilling chance to win an array of prizes, ranging from modest sums or merchandise to life-changing jackpots in the form of NFT prizes. Although the NFTs may not be issued directly by the trading platform, they can be issued by other participating projects. The prize structure is meticulously crafted by the operator, ensuring a percentage of ticket sales is allocated towards the prize pool while maintaining profitability.

- “Team up, price down”: The business model of “Team up, price down” represents a collaborative approach employed by enterprises to secure lower prices or improved terms from suppliers or service providers by harnessing their collective purchasing power. This model enables businesses to leverage their combined strength in order to achieve cost savings and enhanced procurement conditions. By forming a group or alliance, businesses unite as a cohesive entity to negotiate with suppliers or service providers. Through the consolidation of their purchasing volume, they amplify their influence and negotiation power. This collaborative approach empowers businesses to attain more advantageous pricing, discounts, or concessions that would be challenging to obtain individually. The central objective of “Team up, price down” is to augment the aggregate purchasing volume of the participating businesses. Suppliers or service providers are more inclined to offer improved terms, discounts, or reduced prices when confronted with a substantial upsurge in potential sales volume.

- Annuity: Annuities represent a financial product that aims to provide individuals and organizations with a steady and predictable income stream for a predetermined period or throughout their lifetime. Typically offered by insurance companies or financial institutions, annuities serve as a tool to assist individuals and organizations in managing their finances. For instance, one form of annuity known as an installment payment structure enables customers to acquire goods or services and make payments over an extended period through regular installments, rather than a lump sum upfront payment. This model offers customers the flexibility to distribute the cost of their purchases over time, making them more manageable and affordable.

Note: Due to the absence of crucial parameters such as “interest rate” and “time” in the existing protocols, as previously mentioned, the full development of the annuity business model is currently limited.

5. Potential Risks

It is crucial for all participants in the NFT market, including creators, collectors, and investors, to conduct meticulous research, exercise caution, and remain cognizant of the risks inherent in this rapidly evolving technology. While NFTs offer the potential for creating value and transferring wealth, it is important to acknowledge the various risks and limitations associated with them. Here are some potential risks that creators, collectors, and investors should be mindful of:

- Market volatility: NFT prices exhibit a high degree of volatility, leading to substantial fluctuations in value. The NFT market is relatively new and speculative, rendering it susceptible to rapid price changes, bubbles, and market crashes. Investors and collectors must be prepared for potential losses or a decrease in the value of their NFT holdings.

- Counterfeit and plagiarism: The digital nature of NFTs makes them vulnerable to counterfeiting and plagiarism. While blockchain technology provides provenance and authenticity for NFTs, instances of fraudulent or unauthorized NFT sales have occurred. It is imperative to verify the legitimacy and authenticity of NFTs before making a purchase.

- Intellectual property issues: NFTs associated with digital content give rise to concerns regarding intellectual property rights. Unauthorized minting or sale of NFTs representing copyrighted material can lead to legal disputes and infringements. Creators and buyers should ensure that the NFTs they engage with are linked to legitimate rights and permissions.

- Lack of liquidity: While certain NFTs can command high prices, others may struggle to find buyers or maintain liquidity. The NFT market is still evolving, with limited demand for certain types of NFTs. Sellers should be aware of the potential challenges they may encounter when selling NFTs and the possibility of illiquidity.

- Longevity risks: Annuity providers face the risk of customers living longer than expected. If customers outlive their life expectancy, the provider may need to continue making income payments for a longer duration, which can strain the profitability and sustainability of the annuity business.

- Interest rate risks: Annuity providers often rely on fixed-income investments to support income payments. Changes in interest rates can impact investment returns and the profitability of the annuity business. A decline in interest rates can reduce returns on invested funds and make it challenging to maintain promised income levels. This scenario applies to both the real-life banking system and the NFT markets in the borrowing and lending market.

- Inflation risks: Fixed-income annuities face the risk of inflation eroding the purchasing power of income payments over time. If the cost of living increases at a rate higher than fixed income payments, annuity recipients may find it difficult to maintain their desired standard of living.

- Author: Jake Zheng

- Twitter: @Jake_zheng_0305

- Email:Jake@antalpha.com