The US Supreme Court has rejected Battle Born Investments’ claim to $4.40 billion worth of Bitcoin, allowing the US government to continue selling the seized digital assets from the Silk Road marketplace. This development, along with the negative sentiment and geopolitical tensions it sparked, has offset the market’s earlier optimism, causing Bitcoin’s price to dip 2% intraday, challenging the 62k support level and driving a spike in actual volatility.

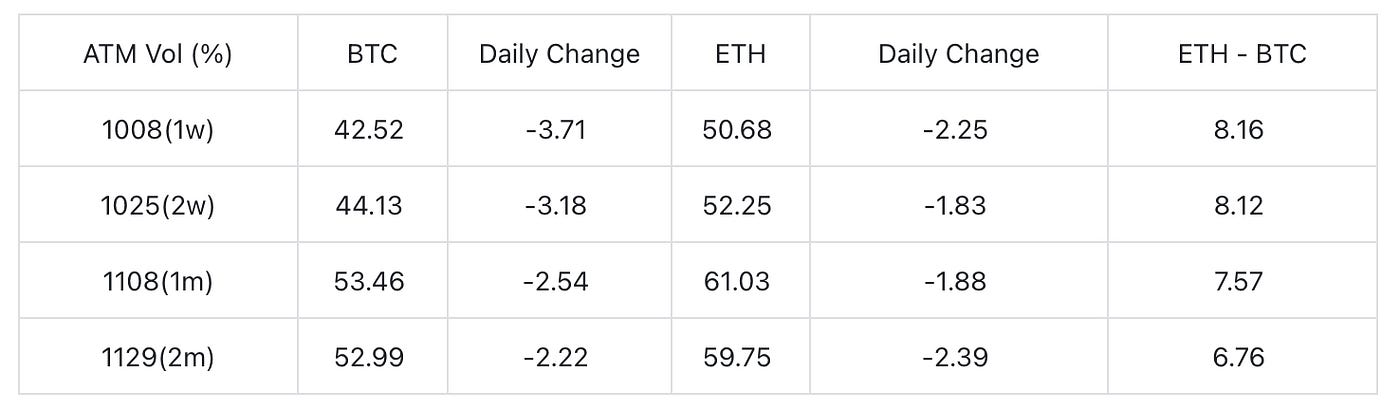

Despite this, some analysts view the current market movement as a healthy pullback for BTC. The risk aversion shown by high-level investors has allowed Bitcoin to temporarily stabilize within the support range above 60k, reducing the likelihood of sudden declines. The overall market sentiment has shifted from optimism to neutral, and implied volatility has significantly decreased. Additionally, the front-end curve has flattened, minimizing the uncertainty that would typically accompany the upcoming CPI report on October 11. This presents an opportunity for traders with a positive outlook on economic events to establish short-term calendar price spreads.