Meme tokens’ scores drive SOL to the milestone – contrary to the correction sentiment in the market. Solving the puzzle of Solana and its surge.

The native cryptocurrency of the Solana layer one (L1) blockchain network, SOL, crossed $200 for the first time since November 2021.

Solana is now 22% away from its all-time-high of $260, but its market capitalization has already broke the record, totalling over $81 billion, CoinMarketCap data shows.

As of reporting time, Solana (SOL) followed the downturn by 10% in the recent 24 hours.

On March 19, 2024, Solana also commands the sixth-largest trading volume among all cryptocurrencies, indicating $11.8 billion over the past day. By overcoming Binance Smart Chain (BNB) coin, SOL is now the fourth largest cryptocurrency in the market, facing only Bitcoin (BTC), Ethereum (ETH), and Tether US (USDT) ahead.

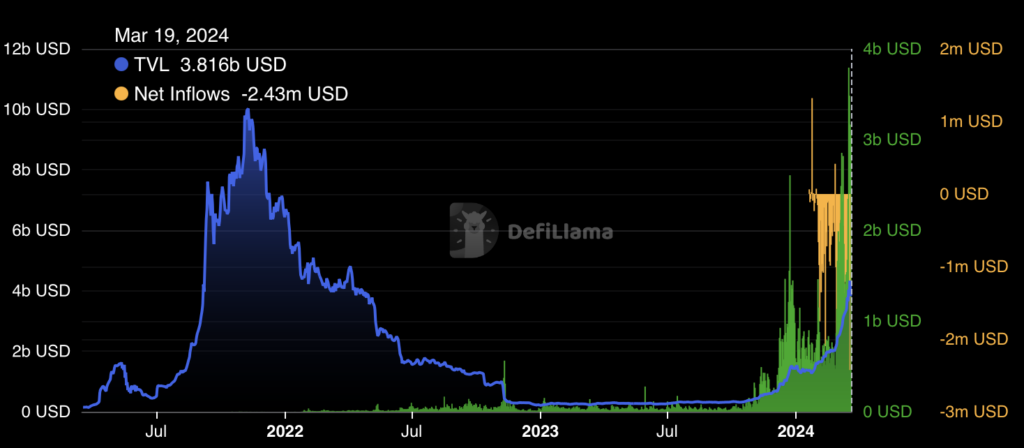

On-chain data indicates that various metrics, such as total value locked (TVL), active wallets, and network volumes crossed life-time peaks over the weekend amidst the surge in a pre-sale activity.

The network racked over $3.2 million in fees over a 24-hour period, while on-chain volumes topped over $3.2 billion, flipping a November 2022 record of $300 million.

Significantly, on-chain activity showed negative inflows over the past week, proving the lack of fund influx into the ecosystem.

Solana-based Memecoins Rally

Potentially, Solana’s latest surge was fuelled by market participant’s interest in memecoins, which were launched upon the network. For at least three months, different meme-inspired currencies took the centre stage, bursting out with gains amid the Bitcoin price upsoar.

Namely, Solana-based memecoin Bonk (BONK) has seen the market capitalization of $2.25 billion at its peak on March 5, while Dogwifhat (WIF) climbed up to 48th position in the market for its three-month existence.

This tendency has been proven by Santiment data, claiming that Solana and SOL-based memecoins took a leadership position in the market.

The story went further with SLERF – a new Solana-based meme asset that amassed more than $1.8 billion in trading volume over the past days, surpassing all Ethereum-based exchanges in trading volume within its first day of existence. However, its smooth sailing did not appear to keep on.

SLERF Bungled Launch and Scam Accusations

On March 18, Ki Young Zhu, CEO at CryptoQuant on-chain analytics service, expressed a critical attitude towards memecoins.

Meme coins harm the crypto industry. It’s frustrating to see billion-dollar-cap memecoins overshadow hardworking teams building legit products to advance this industry. Easy money can’t drive industry-wide progress, as shown by the 2018 ICO burst

– wrote Ki Young Zhu in his post for X.

Referring to the popular Web3 ecosystem projects with lower volume compared to memecoins (i.e. Whitechain, NEAR Protocol, Celestia etc.), the statement came as a reaction to the SLERF incident.

Specifically, the project’s developer lost all the funds received after accidentally sending the $10 million-worth tokens to a burn address, which is an address not under anyone’s control.

“I initially tried to burn the LP using solana tools vercel and it wouldn’t go through. So I went to sol incen and was clearing out the shitcoins people sent to the wallet and accidently burned them with the pile of other coins

– says the official statement by SLERF anonymous developer.

Responding swiftly to the market surge following the burn, an undisclosed Solana trader exchanged 9,894 SOL tokens, valued at around $1.98 million, according to data by Lookonchain. Promptly taking advantage of the intensified market activity, the investor sold SLERF holdings for an impressive 25,001 SOL.

The incident has sparked speculation about the potential involvement of the Ponzi scheme amidst ZachXBT’s investigation, claiming that crypto enthusiasts have lost 655K SOL tokens valued at over $122.5 million to fraudulent presales.

I was interested to see how much SOL has been sent as a result of the presale meta and calculated >655,000 SOL ($122.5M) raised from 27 presales. pic.twitter.com/dvsW4TSoov

— ZachXBT (@zachxbt) March 19, 2024

A reputable analyst believes that malicious actors have capitalised on the Solana-based memecoins trend to defraud unsuspecting market participants seeking to profit from the frenzy. ZachXBT identified at least 27 presale scams related to Solana memecoins.

It is possible that the scammers are able to amass the stolen crypto by implementing a wallet drain function. Before the memecoin scheme disclosure, ZachXBT unveiled the case of a fraudster who raised over $2.6 million within a day, following the aforementioned strategy.

The latest Solana-involved scam accusations heated the concerns in the crypto community, which extrapolated on the DeFi space overall.

Not to have a bear take here, but I don’t see how this won’t end up having severe consequences on the DeFi space as a whole. All of these raises were in relatively short time too, there’s no way SEC just sits back and allows it to continue

– commented Pennski, a crypto analyst, on his X page.