by ROUTE 2 FI

Over the past couple of weeks I’ve been sidelined, watching the markets, watching emerging trends come out but one caught my eye – attracted millions of volume, accrued tons of fees (comparable to even top-tier existing protocols/chains): Telegram bots.

Now as I’ve mentioned before, narratives come and go, but after spending some time interacting with various bots and taking the time to dive deeper, Telegram bots do put up a very strong case. Let’s dive in!

In this week’s newsletter feature, I want to discuss what Telegram bots are, how they work, and the scalability of such products.

Can’t decide if you need exposure anon? Don’t worry, read on and decide after hearing me out.

One of the largest barriers in crypto to mass adoption is bad user experience, we’ve all had those moments where our transactions have failed, where gwei suddenly spikes and we’re left there, bugged out, unable to speed transactions up.

Sometimes users just lack the knowledge, not knowing even how to increase the gas limit or as we call it – “jamming gas”.

With the introduction of Telegram bots, users are able to easily automate tasks and complete on-chain activities such as, but not limited to:

- Airdrop farming

- Trading directly from Telegram (accessibility at its best)

- Bridging (breaking cross-chain barriers with ease)

- Tracking (wallet/price/funding)

So what are Telegram bots in the crypto realm?

Well to sum things up, Telegram bots are essentially automated scripts that respond to very specific commands/triggers sent by Telegram users within the respective chats. It’s with no doubt that these sorts of bots are far from new, but they have become increasingly popular in recent weeks due to their ability to automate tasks without having the need to actually be at your computer – especially for users trading on their phones, making transactions especially on-chain can be an absolute nightmare, Telegram bots fill this gap.

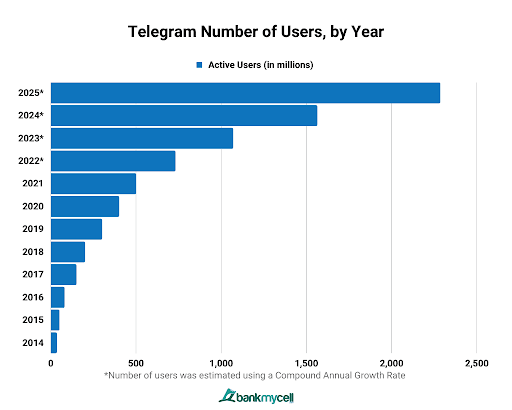

As of 2023, there is an estimate of approximately 420 million crypto users worldwide, whilst telegram boasts an impressive 1.06 billion estimate by the end of 2023 and ending 2022 with roughly 600 million users.

Just on this data alone, it is justified to ask: Could Telegram bots be the key to crypto mass adoption?

In hindsight, anon, you may argue: “Well, but there’s only unibot, it’s a trading bot. How will that onboard crypto users?”.

My response would be that there are wallet services directly enabled within the Telegram app, such as: The Open Network (TON) which allows users to buy, sell, trade, and store crypto directly from the app.

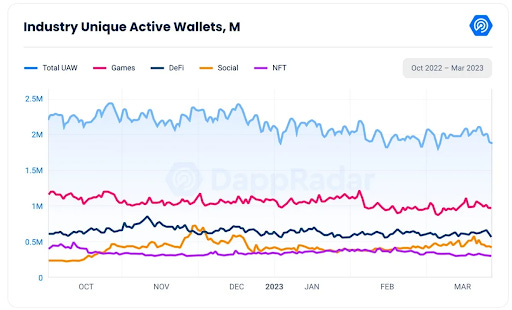

Bloomberg also recently mentioned Telegram bots are allowing retail users to gain entry into DeFi; this is huge news given that actual active on-chain users only account for less 10% of the 420 million crypto users worldwide.

As good as it may sound, there are ALWAYS risks involved when a user wants to gain access to Telegram bots, especially ones such as: Unibot, Wagiebot, Coco, etc, users are required to hold a small percentage (%) of the token, this would mean users directly expose themselves to the risk of price drops/protocol failure/exploits – in essence, price fluctuations.

At some point if and when FDV of such Telegram bot coins go up, your average retail users may even be outpriced to even use such bots, therefore hindering the growth to mass adoption.

Once users have access to the bots via sufficient holdings, users are GRANTING THEM ACCESS to your funds.

Here is how, for example, Unibot works – users are prompted to deposit funds into a wallet created by the protocol itself, all of which is done via a private chat with the bot on the app.

Now with these funds, the bot is able to act within specific parameters. The main risks here would be the protocol being exploited, or if the team decides to take control of the wallet (which they easily can) as such, using any Telegram bot for that matter of fact is a risk on its own, it would be advisable to not deposit large sums of money, and withdraw consistently.

Unibot

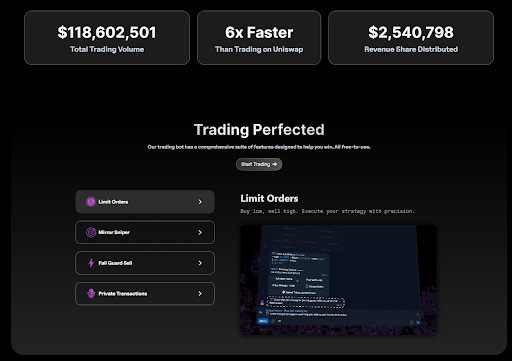

In short, Unibot provides its users with the ability to trade tokens, place limit orders, copy-trade wallets and make private swaps.

Although built as a copy of Maestro bot, has seen large success in the marketing route and approach they have decided to take.

Unibot has set up itself for success, they have been live for just under 2 months and accruing roughly $830,000 revenue in the past 30 days alone, all of which comes from fees. What’s interesting is that Unibot rewards its holders with a large % of the fees generated from bot usage and tax on buys/sells (5%)(gud ponzinomics for scale).

The revenue share model used by Unibot incentivizes their holders by giving back 40% of their transaction fees and 1% of the total Unibot traded volume.

The way the rewards work is that they are calculated in 2 hour intervals, and are manually claimable after 24 hours, there is one disclaimer though: “Transferring more than 200 Unibot tokens between every 2 hour interval will result in forfeit of your revenue share […]”. In order for users to benefit from this immense revenue share, they are required to hold a minimum of 50 Unibot tokens, as of 2nd August 2023, worth $6281.

Lootbot

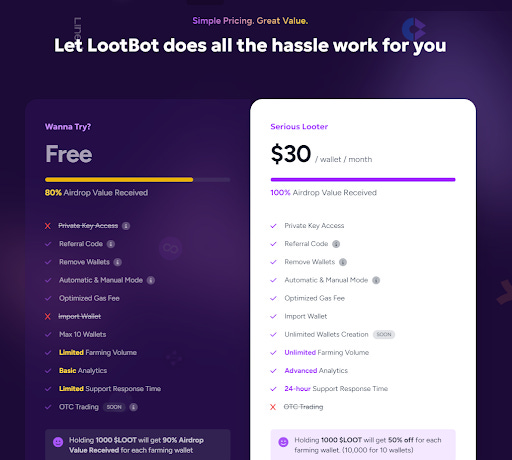

Lootbot – a farming bot that markets itself to specialize in airdrops. With all the hype in the lead-up to $ZRO (2.3x funding of Arbitrum) and $ZKS (3.7x funding Arbitrum), it’s safe to say Lootbot provides a fast solution for users chasing airdrops.

Lootbot essentially farms airdrops for users for a fixed fee, users can either subscribe for $30/wallet/month (ie: 50 wallets = $1500 per month sub fee) or a free-to-use option where users are to pay 20% of the airdrop’s value as commission.

The free-to-use option is extremely beneficial to the team, as you may ask: why would a bot like this even want to help others?

Well, running a bot that is funding hundreds of wallets may require generally high up-front capital, something perhaps the team may/may not have.

By allowing users the free-to-use option, users are funding the wallets while the team executes for free, earning 20% of the commission.

With bots, the whole point would be to automate tasks, the strategy for airdrops would be to interact with various functions on-chain, which includes but is not limited to: bridging, swapping, providing liquidity, minting NFTs and more.

Just as Unibot does, Lootbot holders are able to earn a % of protocol revenue. Although it sounds great, whether or not its airdrop farming strategy works, has yet to be put to the test – I wouldn’t keep my hopes so high given that $ZRO and $ZKS are likely to have extreme sybil detections to prevent the abuse in the system.

CocoBets

CocoBets launched recently amidst the huge influx of Telegram bot users, the numbers speak for themselves and the team is consistently building.

CocoBets identified the gambling desires of degens and put it to work, traditionally users would need to go onto an actual gambling site to play games such as: blackjack, roulette, baccarat etc, whereas now CocoBets allows its users to do so, directly from a Telegram chat.

Previously in crypto, we’ve all seen the GambleFi narrative, and this seems to be where that narrative is headed.

It’s simple, users deposit funds into their platform, just like any other Telegram bot or gambling site and in exchange, users are given tokens to start playing.

CocoBets also offers its users the option to play directly on the web page instead of a Telegram bot, if they decide to. One large drawing point to any coin in the GambleFi narrative is the revenue sharing, in casinos, the house ALWAYS wins, therefore its a no-brainer to be wanting to earn house revenue.

CocoBets has gone live with their revenue share as of 2nd of August and all bets and revenue are publicly accessible data.

Within the first 48 hours of launch, CocoBets saw some insane metrics, with a total of +/- $100,000 bets processed and total wagered amount of +/- $2,900,000.

Notable mention: WagieBot

Much like Unibot, Wagie boasts the very same features and slightly more, offering users the option to perform multichain sniping, tracking, trading, and copy trading. All of which at a speed 3x faster than Maestro and a whopping 10x faster than Unibot.

Recently, Wagie has integrated with GMX to allow its users the option to trade perpetuals, and plans to integrate GMX v2 down the line.

Although Wagie can be seen to have a “better” Unibot product, one thing sets them apart: revenue sharing/holder incentives. In the span of 2 weeks, Wagie has accrued more than $800,000 in fees, which puts them on track to compete with Unibot, however, unlike Unibot, Wagie does not have a revenue-sharing model and has yet to speak about it.

Users are not incentivized well enough to hold Wagie, as such it has deterred from the overall uptrend of other Telegram bot tokens.

The revenue-sharing model which Unibot has is what’s special about it as compared to Wagie, who seemingly has a “better” product, which accomplishes the same and more. Whilst $800,000 is an impressive feat in 2 weeks, none of the benefits go back to the holders.

All right, that was it for this time.

I could probably write a lot more about TG-bots, but this is a good intro.

Not sharing tickers here, because this is not FA, and you should do your own research.

Good luck, anon!