Anon, have you ever wondered how you could make it in these market conditions?

What coins you should pick up for the imminent bull cycle?

Whether or not you have the right bags to make it in the next run?

Don’t worry I’ve got you covered – as we all know, nothing is certain, and no one can predict the future, but there have been some coins that have severely outperformed the markets in recent months: the Holy Trinity ($rlb $dmt $unibot).

In this week’s feature, I want to go into the Holy Trinity and how they may potentially be great add-ons to your portfolio, remember anon, this is by no means financial advice, just my opinion.

I will be talking about the projects’ bull cases and their fundamentals. Not sure if these 3 are for you? Don’t worry, read on anon.

Before going into the Holy Trinity, it may be worth taking a brief look into coins that saw an immense rise in price in 2020/21 – primarily $Aave (ETHLend) and Link, both of which gained popularity and managed to maintain hype into the bull cycle leading to an insane increase in price. Even though popularity and hype do not necessarily translate into a “100x”, it is justifiable to bet on teams that are consistently building, providing value, and are active in their respective communities, all of which are values that the Holy Trinity has.

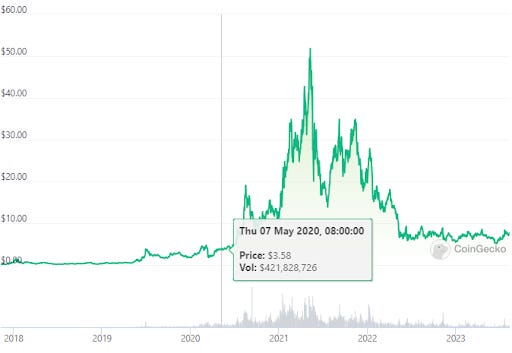

In May 2020, $link had been dubbed as a “popular” project, known to almost if not all crypto-native degens, and whilst maintaining hype along with shipping consistent updates, they were able to position themselves to be a flagship name in the crypto scene we know and love today. From May 2020 to May 2021, $link saw an increase of more than 1000% (10x), from 3.5b FDV to 48b FDV.

We also notice similar growth in $aave, previously known as EthLend. $Aave has now cemented its place as the flagship lending protocol, which saw an increase of more than 2000% (20x) from their 2020 price to 2021, from $416m FDV to an impressive $9.5b FDV at peak May 2021.

This upcoming cycle however, may be slightly different, there are tons of readily available protocols that are already live, almost too many to count and there are a ton more wallets active in the network.

In retrospect, by the end of 2021, the global crypto market had approximately 295 million users, as compared to 420 million currently.

To place things back into context, if the Holy Trinity were to be the $Link or $aave of this cycle, then their current market caps would be miniscule to the potential growth opportunities in the next cycle, given that there has been a significant increase in the global crypto market, it would not be out of the ordinary to see multiple folds in returns with these coins. Of course there is no guarantee, but it is a possibility.

Let’s dive into the Holy 3 and find out if they’ll be good add-ons into your portfolio!

Sanko GameCorp ($DMT)

$DMT rides on the coattails of an upcoming narrative that has been in talks for months, L3s.

To understand what L3s are, L2s first need to be explained; in essence, L2s (Layer 2 solutions) are a separate blockchain where users are able to transact off the main chain .

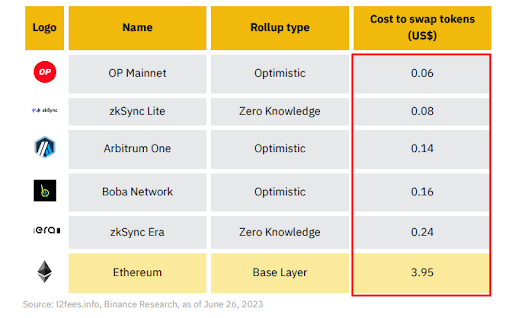

The most popular form of L2 scaling solutions are rollups such as Arbitrum, Optimism and zkSync. As mentioned in a previous newsletter feature, data storage is an issue for the blockchain industry – a standard transaction on Ethereum mainnet is approximately 156 bytes, considerably dense.

Rollups allow for transactions to be processed on the L2 environment before bundling them up into a single clean transaction that goes through the L1 regular state verification.

L2s regularly submit bundles of transactions on Ethereum L1 to benefit from its security whilst allowing users to benefit from the low costs.

However, even with such scalability and even with the end of year Ethereum upgrade which will reduce L2 fees by 10x more, this is still NOT enough for games.

This is where L3s and $DMT come in. Similar concept, just that the L3 submits transaction bundles to the L2 that then submits transaction bundles to the L1. What this means is that gas fees on L3 are potentially close to 0.

Now back to how all this relates to $DMT and why this potentially should be in your bull-run bag.

Sanko GameCorp is a game publisher that produces games you can access directly in your browser, functioning much like an arcade, you deposit a $DMT coin to play.

$DMT’s vision is to be Arbitrum’s first L3 appchain and it is play-to-win, play-to-burn. In 2021 we saw a heavy rise of users and volume into play-to-earn (P2E) games and metaverses with the likes of Axie Infinity being the flagship game.

However, due to unsustainability in the P2E model, the majority of 2021 P2E games and metaverses are dead. With $DMT acting on the L3, it provides infinite scale, now let’s look briefly at their tokenomics and why it matters.

With $DMT, users spend 0.25 $DMT to play a game, with that, a third (⅓) gets burnt and two thirds (⅔) gets used to incentivise staking. $DMT rewards pay to high score players on leaderboards every 10 days, creating an environment where it is rewarding to play a game that users actually have fun doing.

One issue in 2021 was that initially games such as Axie were “fun” and “cute” however eventually it became a chore, something that was tiring to do, trust me, I experienced this firsthand; with Sanko GameCorp, users evidently are enjoying the games available!

With 2021 proving that the web3 gaming industry is evidently huge, it will not surprise me to see the gaming meta come back to life.

Sanko GameCorp is coming up with the solution to the 2021 crash in P2E gaming and metaverse coins; the team is also consistently building and providing value to the space, with its current FDV of $49.2M, there seems to be considerably more upside than the downside considering that $AXS peaked at a FDV of $42b and currently sits at an FDV of $1.6b.

Remember anon, there is nothing wrong with buying someone’s 50x for a mere 5-10x.

Here is a thread on $DMT:

I’ve been reading a lot that @SankoGameCorp $DMT is destined to $100 and there’s nothing anyone can do about it, so I figured I would check it out and come to my own conclusion… pic.twitter.com/Fa2NRZnQ1G

— Rafi_0x (@Rafi_0x) July 14, 2023

Rollbit ($RLB)

Rollbit – the flagship name of the GambleFi narrative. Rollbit offers its users the option to wager bets (gamble) on a variety of games, whether it be live dealer blackjack, baccarat, anything! You name it.

They were also the first online casino to normalise 1000x perps trading on a variety of coins, even providing a novel coin of their own (rollercoaster) that has extreme volatility.

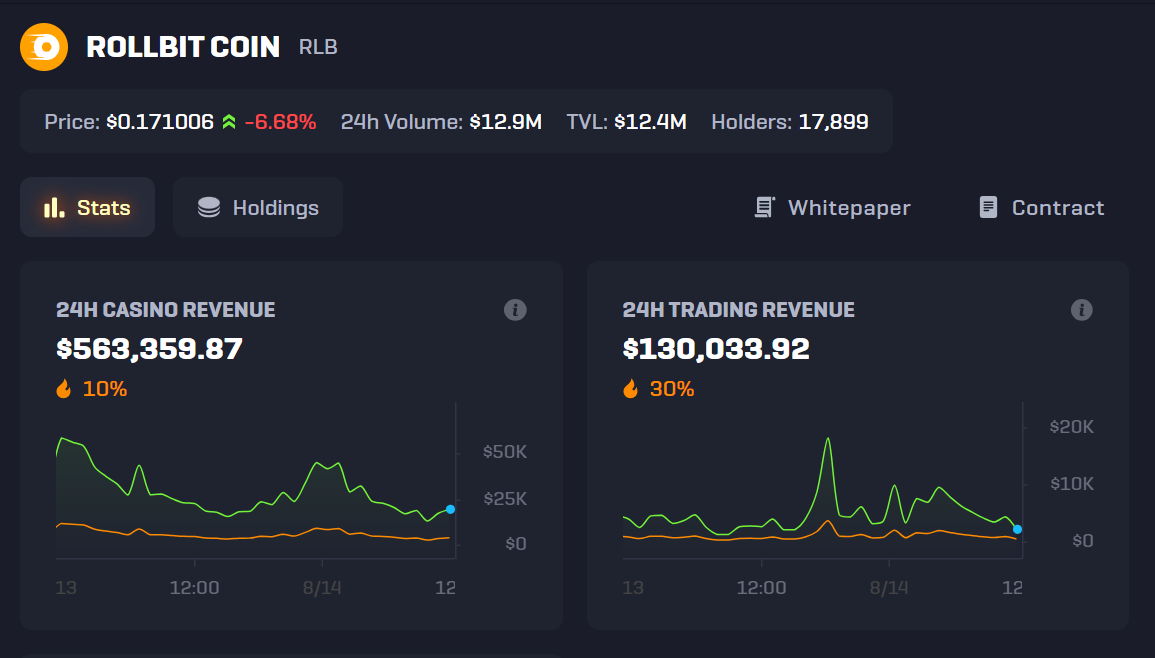

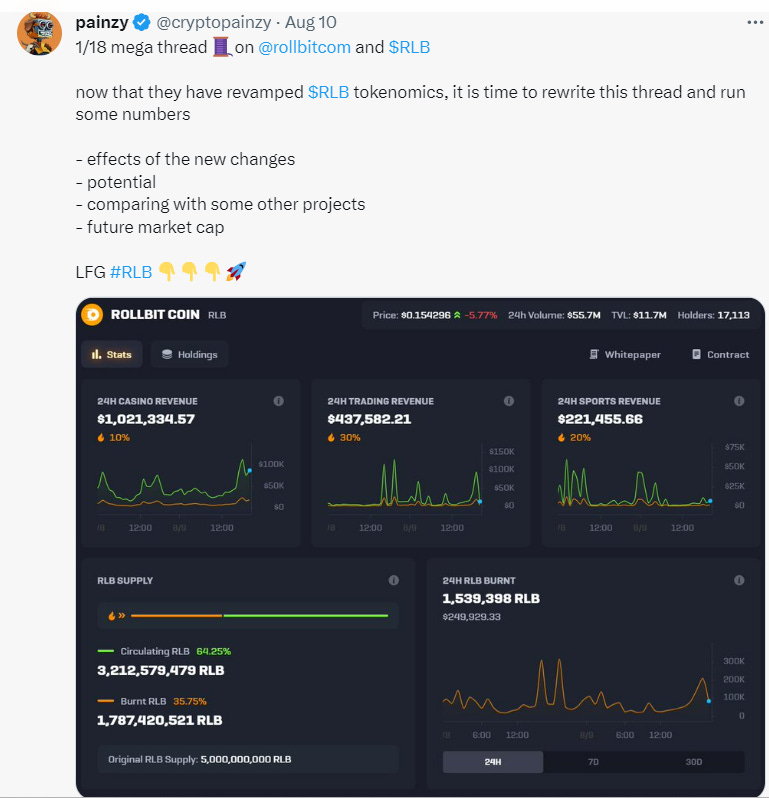

Recently, Rollbit has announced that they will be integrating a revenue share system via a buy back and burn model and this saw a huge increase in price, where Rollbit, as of time of writing (11/08/2023), is up a whopping 67% in the past 7 days and 128% in the past 14 days.

This revenue share system places Rollbit to be in an even better position to scale, ensuring that holders are incentivised.

The above image is a screenshot of Rollbit’s dashboard, from this it is evident that with the new buy back and burn mechanism their token, $RLB, is increasingly deflationary, with approximately 36% of their supply already burnt even before the announcement via lottery.

With Rollbit now diverting 10% of its casino revenue, 20% of its sportsbook revenue and 30% of its futures trading revenue into buying back and burning $RLB, it is no surprise that there is a huge influx of buyers into the coin, seemingly holding for the long-term.

Although the above image shows a “low” value for 24H sports revenue in comparison to the other 2 revenue streams, it is important to note that basketball and football are off-season. In peak seasons we can expect a spike in volume.

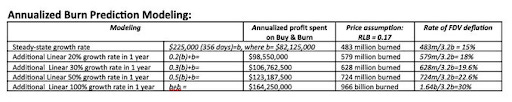

Fellow CT fren @crypto_condom touched on this as well and provided a well-made “annualized burn prediction” model

On top of this, Rollbit is also ahead of the GambleFi narrative where they accrue one of, if not, the largest betting volume in the crypto scene, and with the FDV only hovering around $900m at time of writing, it will not be out of the ordinary for $RLB to see multi-billion dollar FDV in a bull cycle.

At current market conditions, if $RLB were to be a top 20 coin, it would be a 10x from here (by FDV), this multiple is likely to be higher in peak bull conditions.

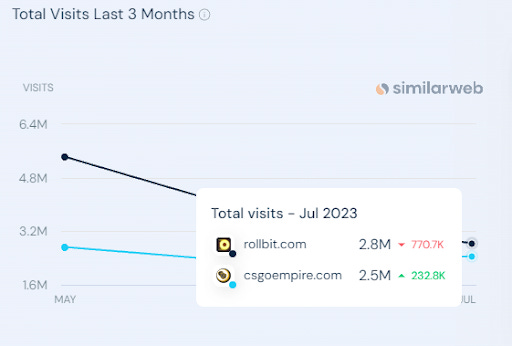

For some perspective, in July alone, Rollbit saw 2.8m unique visits as compared to 2.5m visits on CSgoempire, a giant that has been in the online betting scene for years.

Here is a good thread on Rollbit that deep dives even more into the numbers:

1/18 mega thread 🧵on @rollbitcom and $RLB

— painzy (@cryptopainzy) August 10, 2023

now that they have revamped $RLB tokenomics, it is time to rewrite this thread and run some numbers

– effects of the new changes

– potential

– comparing with some other projects

– future market cap

LFG #RLB 👇👇👇🚀 https://t.co/Bm3FPAXIdq pic.twitter.com/11WN7L22bE

Unibot ($Unibot)

Unibot provides its users with the ability to access a telegram bot that offers a variety of features such as but not limited to: trading tokens, sniping, limit orders, copy trading, private swaps.

I included not limited to due to the fact that the team consistently ships updates and are ever-hardworking. As previously mentioned in a separate newsletter feature, the telegram bot meta has the ability to automate tasks for users without needing them to actually be present at their computers, providing users the option to trade directly from their phones on a telegram chat, where previously this would be an absolute nightmare.

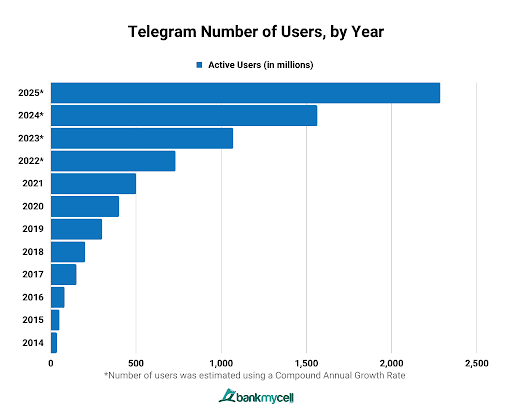

As of 2023, there is an estimate of 420 million crypto users worldwide, whilst telegram boasts an impressive 1.06 billion estimate by the end of 2023 and ending 2022 with roughly 600 million users. Therefore telegram bots could possibly be the key to crypto mass adoption.

Unibot is leading the telegram bot meta and although they may not necessarily be the catalyst to telegram bot mass adoption in crypto, they are indeed considered “first movers” (in terms of price discovery and popularity which brought life to this narrative)

Unibot has set itself up for success, having only been live for under 2 months, they have accrued close to $1,000,000 in revenue in the past 30 days alone, all of which comes from fees as of now. Unibot incentivises their holders by providing them with a large percent of the fees generated from bot usage and buy/sell taxes (5%) from dex trades – in the past 24 hours alone did $2.8m in volume, which translates to $140,000 in buy/sell tax revenue alone.

The revenue share model used by Unibot gives back 40% of their bot transaction fees and 1% of total Unibot traded volume to their holders. In order for holders to qualify, they would need to hold a minimum of 50 Unibot tokens.

With the understanding that telegram bots could be the key to mass adoption, it would be no surprise to see Unibot speedrun itself into a top 50 cryptocurrency, and in peak bull conditions would translate to multiple folds. As a wise CT user once said, “We need more fresh approaches to UX”.

Also sharing a good Unibot thread here:

Have you heard about $UNIBOT?

— francesco (@francescoweb3) June 9, 2023

How the hell is a Telegram Bot one of the Best performing Tokens?

Learn how @TeamUnibot is changing the trading game ⬇️ pic.twitter.com/BYA7TH8wFR

Okay, there you have the 3 coins everyone is talking about.

You also have 2 meme coins that I think will perform very well in the next bull run: $BITCOIN and $PEPE.

But that’s for another day.

Stay safe in the mean time. Only 8 months left to the Bitcoin halving!