Foreword:

This series of articles focuses on web3, including the meaning of a series of emerging concepts such as NFTs, The Metaverse, Gamefi, and representative issues in the space. I will also describe what I think of their future from the perspective of practitioners as well as scholars.

What kind of projects should be labeled as web3? Why are NFTs so popular? What will be the final form of the Metaverse? Why have most celebrities and well-known brands failed with their NFT endeavors? How should Gaming, NFTs, and the metaverse be combined? As an entrepreneur, how to successfully issue an NFT? How should investors view this series of alternative assets that are more difficult to price than tokens in the future?

Ⅰ:Starting from Web3

Since 2021, the term web3 has garnered a lot of attention. However, many people still don’t have a full grasp of what exactly it means.

Web3 is like a mountain, and more and more people realize that there are many different kinds of treasures on this mountain. Some are called NFTs, some are called Metaverses, and some are labeled as Gamefi.

If we want to see the whole picture of this mountain clearly, we must first understand previous iterations such as web0, web1, and web2.

Web0 was before the internet, web1 was the information (PC) internet, web2 is the service (mobile) internet, web3 is the assets (digital/blockchain) internet.

The first feature of web3 is also the most important and most easily overlooked: assetization.

I will continue to convey and emphasize this point of view in the following, not just in this series, but in many of my articles——

The core of Web3 is assets. If you only look at web3 users from the perspective of consumers, it’s equivalent to reducing the value of potential customers by 100 times. In fact, every user of web3 is both a producer and a consumer, as well as a trader and a stakeholder.

Web1 is centralized content generation, web2 is self-media, and web3 is benefit sharing.

The second feature of Web3 is value confirmation.

Just like the web2 era, which is a prominent representative of the mobile internet, it greatly facilitates personal self-expression and strengthens UGC (User Generation Content), thus giving birth to a large number of KOLs and Internet celebrities; web3 uses blockchain technology to enable user-to-user independent ownership of assets, data, and information. It has strengthened UFB (User Financial Behavior) at the financial level, making users more willing to participate in cross-border transactions that were previously almost impossible to achieve, as well as financial strategies and asset interactions between strangers. This is in line with the development of the times. Once upon a time, VC and PE were representatives of the professionalization of financial institutions, but now there are more and more family offices, syndicates, and even independent angel investors and independent transaction analysts, preempting the original professional institutional financial markets.

This is closely related to the assetization characteristics of web3. When personal information, data, etc. are confirmed and privatized, they become tradable assets. As a result, information assets and data assets have become a much more ambitious asset class.

Web1 is the “line” from the media to users, web2 is the “area” connecting users and users from the platform, and web3 is the “body” where people from all over the world, even if they have never met before, can work together with digital currency bound by interests.

The third is interactivity.

Traditional Internet media and content distribution platforms, no matter how professional the content is and no matter how many editors and writers they employ, cannot surpass Twitter and Instgram.

In the Web3 era, no matter how many professional financial professionals and companies there are, no matter how profitable a company is, they cannot compare to a global open protocol that uses a unified crypto and token system across the world to capture more information across language and cultural bridges.

Just like We-Media is enables people to share information, tokens enable the sharing of benefits with different co-workers and partners. We imagine that future blockchain game items can be defined by a set of standards and protocols to achieve quick comparison, pricing, and transactions. A sword in World of Warcraft can be compared to a gun in Dota because of its rarity, creation quality, newness, usage activity and other parameters, so it can be valued in the same dimension more easily. And then trade directly on the public chain, the games of both parties will also give certain value to each other’s items; and a new battle game will directly “airdrop” their items to World of Warcraft users on the blockchain to encourage them Come play your own game for a cold start. Will World of Warcraft be robbed of users and reduce its value? No, because of their interactivity, their assets have become a new value anchor, and everyone will be more willing to hold them, thus having a higher financial value.

Most people still agree that web3 should have more features. The three features I proposed are explained in three aspects: media (assetization), consumption (value confirmation), and production (interactivity).

The most appropriate definition of Web3 should be: A Web3 project means that users contribute to the ecosystem and help the ecosystem grow. In addition to producing more assets and obtaining practical utility, they also share the capital benefits of ecological growth. Web3 projects also need to have a significant user autonomy mechanism to ensure that user behavior can have a significant impact on the project, rather than the project “technical developer” itself, and achieve low-friction interaction through powerful composability and more web3 projects .

A few examples:

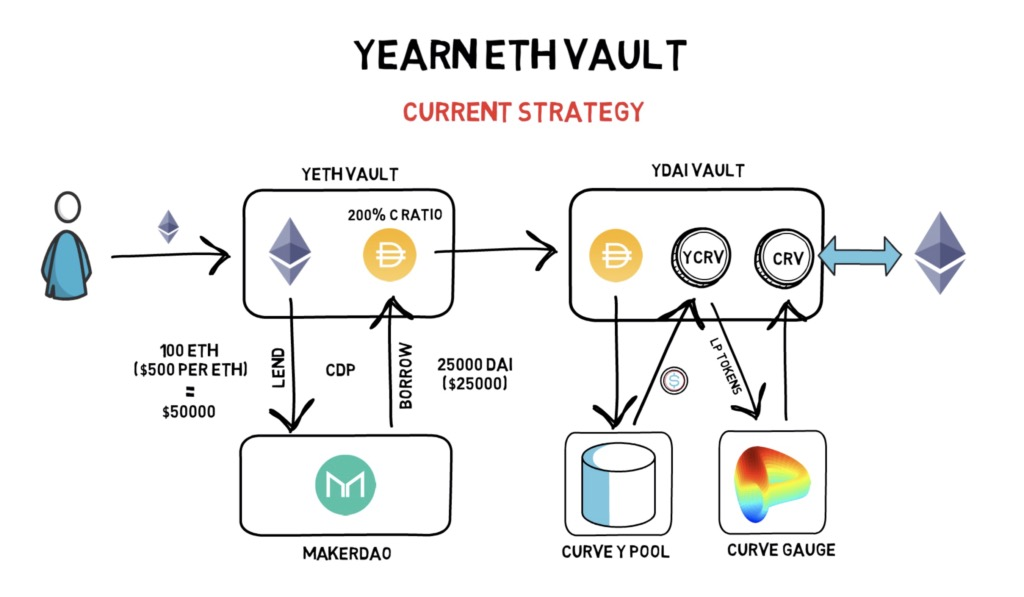

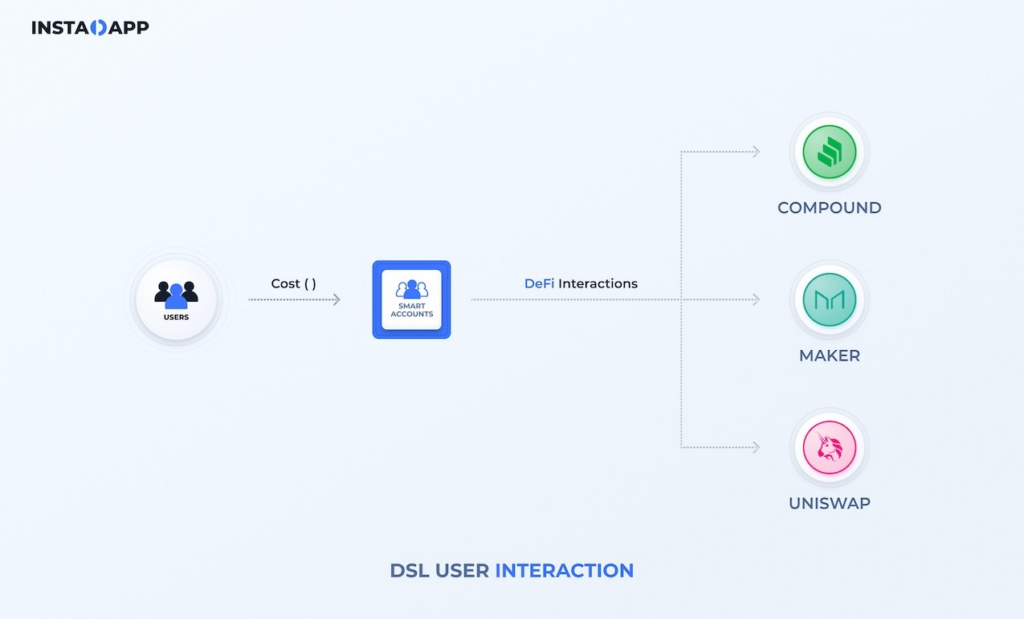

- The rise of Defi, Uniswap allows users to build their own pools for P2P interaction, Compound initate Liquidity mining, and YFI’s smart vault to be the revenue aggregator. All that makes retail investors not only passive recipients of income, but can interact with the agreement. Defi itself is not just as simple as putting the traditional financial gameplay on the blockchain.

- The rise of Opensea is due to the fact that hundreds of thousands of monthly active users participate in transactions every month and contribute immeasurable handling fees. In fact, Opensea has always been a relatively close to a “web3 NFT asset transaction with web2 thinking” project. Most core web3 users have great expectations for Opensea to be an open source protocol in the future, and to encourage those users who contributed a lot of income to Opensea in the early stage by issuing coins. At the beginning of 2022, the Opensea team announced that it chose to go public, tantamount to shattering this hope, which made the entire Web3 community angry. A large number of native web3 users left Opensea and turned to more native platforms such as Looksrare, X2Y2, and Blur. And $SOS took advantage of this opportunity to airdrop its own issued tokens to Opensea trading users, realizing the kick start of the project.

In the future, most people agree that web3 gaming must break away from the idea of traditional games spending a lot of money to grab traffic, and have more focus on establishing interoperable game protocols to share user value.

Therefore, I emphasize that the public chains and agreements between web3 are more like countries. Only by opening up international trade instead of blindly implementing “trade protectionism” can a country’s productivity (GDP) be stronger and the society more prosperous.

Of course, everything has a limit. If your project does not have a good foundation and only wants to copy a protocol through the feature of “interactivity,” then it’s likely to fail. Even some well developed countries are facing economic crises due to a lack of labor force and major declines in productivity. Their past success as nations can allow them to get complacent they have a tendency to rely too much on help from other countries and cease to be self-reliant. As for how to do a good job on a web3 project, or to put it bluntly, how to issue coins, please refer to 《Crypto Capital Theory Part Two (Part 2): A Battlefield Without Gunpowder—VC or Token Fund?》,

In the web3 ecosystem there are many components——

NFT is the product (what), Metaverse is the scene (where), Gamefi is the gameplay (how); Crypto is the currency system, and blockchain is the legal rule. We have entered the metaverse era, and only these connections can produce a higher value. If you look at any one thing in isolation, it is not very appealing. We need more tools (web2) and more protocols (web3) to connect to users (who) to truly reduce marginal costs.

If you know of a web3 project that connects these perfectly, please let me know, I want to chat.

So, in regards to Metaverse, NFTs, and Gamefi….where do we start?

Ⅱ: Overview of NFT – capital first, utility later

I wanted to talk about the Metaverse originally first. But compared to the metaverse, I think it is the NFT that carries the value of the web3 world. Compared with everyone’s expectations for the metaverse, everyone’s opinions on NFT’s are different. Scenes that lack merchandise and content can appear empty. So I will start with NFTs, then talk about Metaverse and Gamefi, and finally turn back to how NFTs are traded.

Let’s get to the point first. Why NFTs will become the key to mass adoption of the entire web3 and crypto world. In the third chapter of my book “Unlocking New Passwords-From Blockchain to Digital Currency,” I mentioned the third aspect of the combination of blockchain and industry. Pan-entertainment is the key to realizing mass adoption. NFTs are the best carrier for this cross-border attribute – utility+capitalization. Bubbles are generated through capitalization and short-term attention; long-term value is maintained through utility regardless of its IP, community significance, or games. Therefore, NFTsare not digital credits, physical digitization, or the sale of IP products.

Please note that here, we emphasize NFT cross-attributes—utility+capitalization, but don’t just take one of them. People in the traditional currency circle pay too much attention to capitalization, so they can’t understand the community and usage attributes behind NFTs, what’s more surprising is that people who do traditional business only understand NFTs as a consumer product, but do not understand its investment attributes.

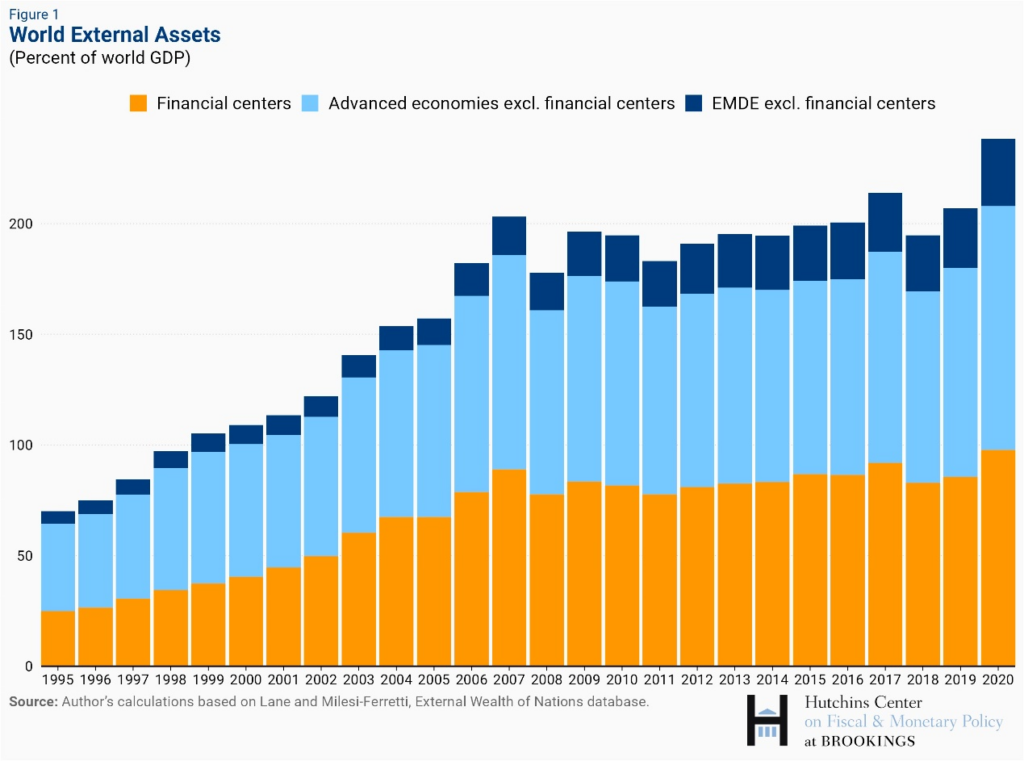

In the above, I mentioned that with the acceleration of information exchange, the liquidity of finance, and compared with this, that is, the consumer side of the financial market, I think the more drastic and neglected change is that in the existing global sovereign currency inflation under the system, the capitalization of everything is the production side of the financial market.

From a larger macro point of view, the capitalization of all “commercial media” in the world is the main theme – ranging from large organizations (enterprises) to small pieces of information, because the most mainstream asset – legal currency is constantly over-issued and printed out. The money must find new asset forms to complete the flow, and it has given birth to new capitalized industries one after another.

Four or five hundred years ago, there were not many global assets. However, in the subprime mortgage crisis of 2008, CDOs and graded bonds with real estate as collateral appeared, and alternative investment gradually became a common asset allocation. Then to crypto and NFTs, corresponding to the information explosion, financial assets are also exploding.

NFT capitalization is also a larger narrative – the embodiment of data and commodity capitalization. Because excess currency needs to generate better liquidity, on the one hand, push up the value of existing assets, on the other hand, it is necessary to create new forms of assets to complete the transfer of wealth, otherwise the world will be destroyed by class solidification.

The Internet has completed the process of opening people’s minds for free. The next step is not to follow what people think – the internet of consumption, but the internet of assets on the blockchain, which begins to create greater asset value.

In addition, don’t forget that the full name of NFTs is Non Fungible Token, so the asset attributes of tokens and the corresponding transaction scenarios contain the core values.

This type of asset naturally has the attribute of utility. ERC721 (or ERC1155 or ERC998) is more suitable as a carrier of utility than ERC20.

Therefore, I firmly oppose the argument that “the potential audience of NFTs are more in the consumer field, and companies should be mainly used as a point system on the consumer side, and used for corporate marketing to acquire customers.” In my opinion, the “blockchain points” issued by Starbucks and Nike (regardless of whether some companies issue their “NFT” on their own private chain instead of the public chain) are not NFTs at all, just like China’s domestic “ownership certificates” based on physical artworks are not NFTs, and should be called “digital collectables.”

Don’t NFTs also have utility?

I always believe that the ultimate goal of NFTs is to become a digital commodity in the metaverse era. In the future, in the metaverse, you will put some furniture for your home or a skin for your character (or something of the sort), and buy a ticket for traveling to another place —these are all NFTs. However, these “commodities” still lack the scene where the commodities exist. The attributes of NFT utility cannot keep up with the changes in the industry. Before the industry infrastructure matures, it will slowly evolve towards the “ultimate goal” in the future in an “intermediate” way. Now it is blindly digitizing physical goods to replace the future. The value of NFTs as a “digital commodity” is like traveling back to the Middle Ages with us, and giving light bulbs to people there. They only know how to install kerosene wicks to solve the problem of no electricity, and they will laugh at the uselessness of light bulbs. Of course, I will also focus on explaining below. In my opinion, before the metaverse scene matures in 8-10 years, the state and value storage of NFTs should be developed.

However, before this, just like houses and artworks used to be a kind of commodity, but after the capital market gradually matured, such high-end value-preserving items were first capitalized. So the NFT you see now, led by “digital identity certificates” such as land in Sandbox, Cryptopunks, Apes, etc., plus the financial attributes including tokens, have emphasized too much on the characteristics of assets, so NFT purchases are more behavioral. Like an investment.

Of course, there will be several repetitions along this road… because the road does not appear logically, because it is walked by people.

You can’t put an old paradigm on a new world.

Like just because of the pandemic, more and more people are dissatisfied with the real world, so they seek to build a free online world.

To link traditional currencies, we have created native stablecoins such as USDT and USDC.

With the need to empower physical art, a series of digital art works such as Beeple’s work have appeared.

Real estate STO? Why don’t we build the metaverse…

Therefore, when each of us talks about the “new world,” we must mention the metaverse, that is, the metaverse. What should it be like? In the next article, I will slowly expand.

January 25, 2023