TokenInsight, a crypto data and research company, today released its Crypto Exchange Report 2023 Q2.

We have timely brought you the Q2 exchange quarterly report. We summarized the data performance of the exchange industry in the report, selected the top 10 centralized exchanges, and hope to help you understand the changes in the exchange market through the changes in the data.

The following content is only a partial summary of the report. To view the full report, please download the complete version at the end of the article for free. If you are interested in the previous reports, please click to read:

–Crypto Exchange Report 2023Q1

–Crypto Exchange 2022 Annual Report

TokenInsight Crypto Exchange Report 2023Q2 Key Takeaways

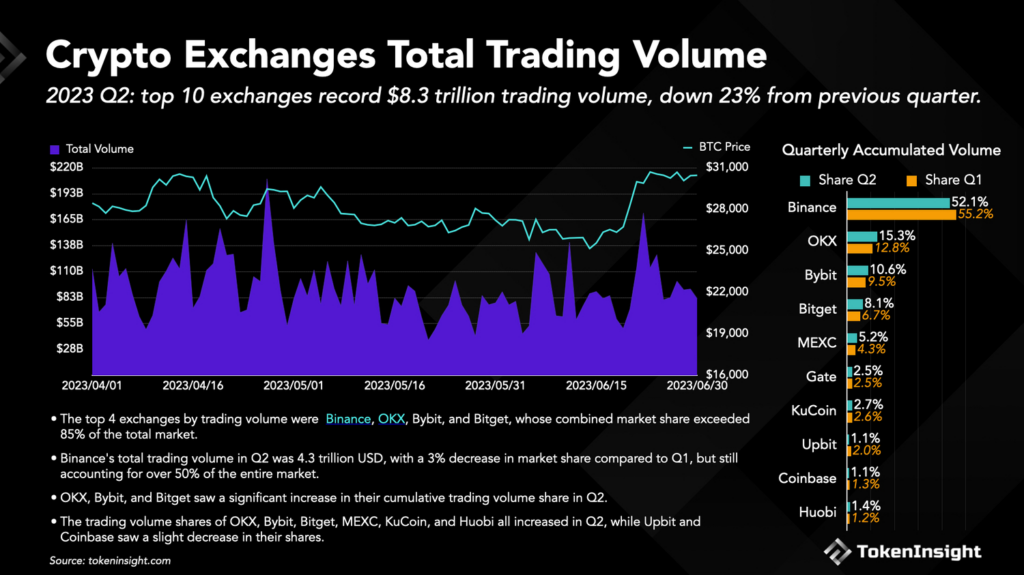

2023 Q2: top 10 exchanges record $8.3 trillion trading volume, down 23% from the

previous quarter.

● The top 4 exchanges by trading volume were Binance, OKX, Bybit, and Bitget, whose combined market share exceeded 85% of the total market.

● Binance’s total trading volume in Q2 was 4.3 trillion USD, with a 3% decrease in market share compared to Q1, but still accounts for over 50% of the entire market.

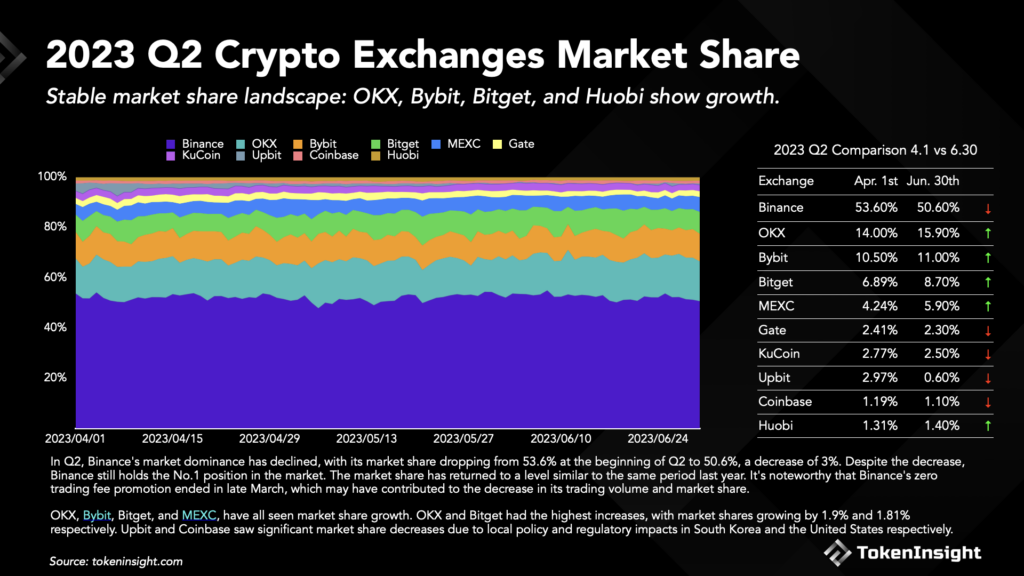

Stable market share landscape: OKX, Bybit, Bitget, and Huobi show growth.

In Q2, Binance’s market dominance declined, with its market share dropping from 53.6% at the beginning of Q2 to 50.6%, a decrease of 3%. Despite the decrease, Binance still holds the No.1 position in the market. The market share has returned to a level similar to the same period last year. It’s noteworthy that Binance’s zero trading fee promotion ended in late March, which may have contributed to the decrease in its trading volume and market share.

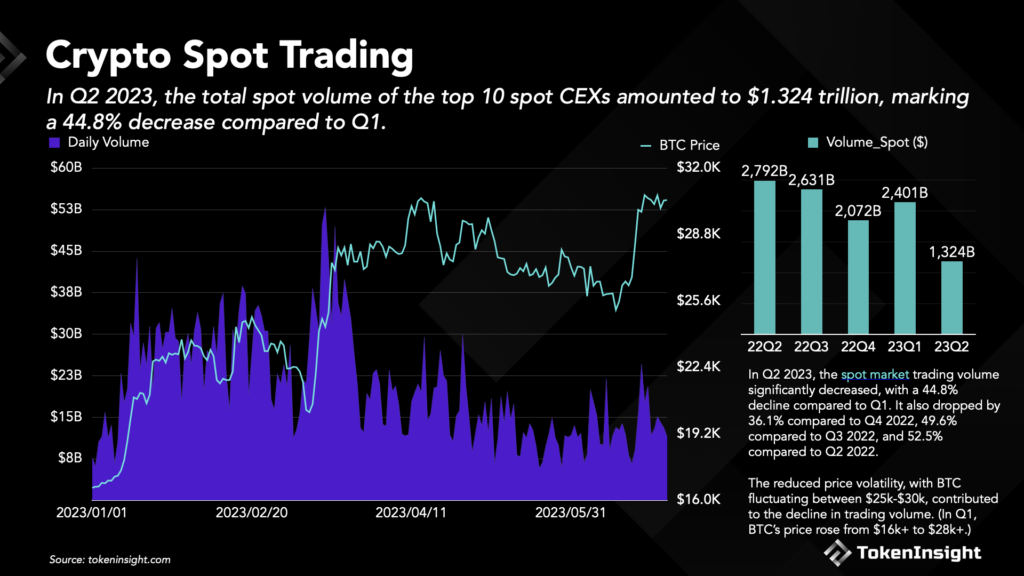

In Q2 2023, the total spot volume of the top 10 spot CEXs amounted to $1.324 trillion, marking a 44.8% decrease compared to Q1.

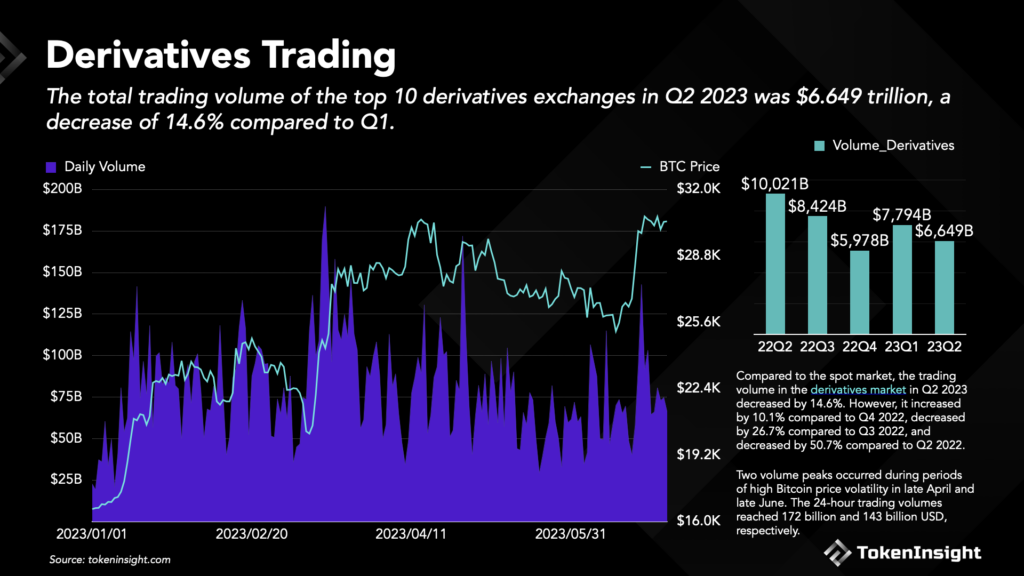

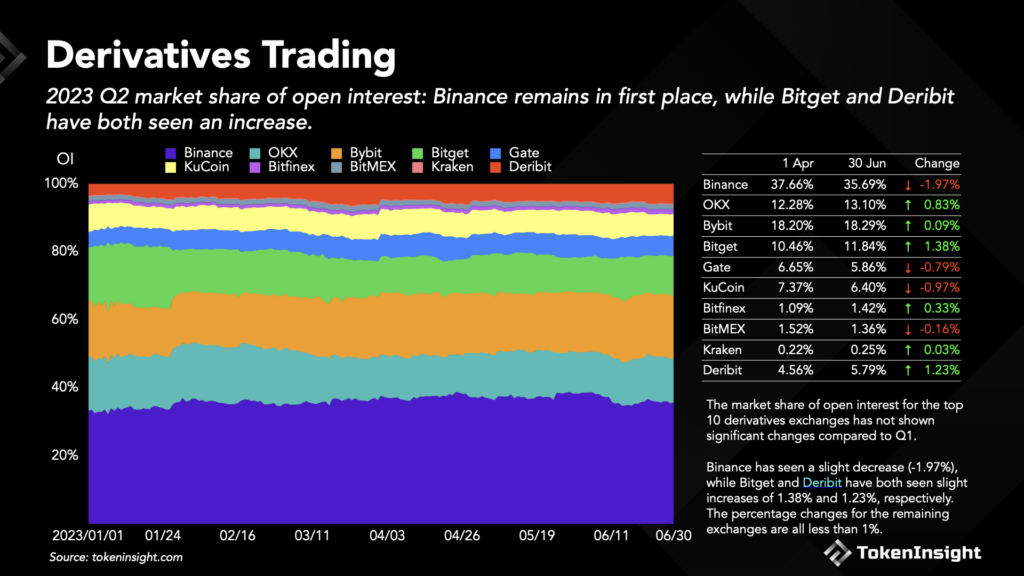

The total trading volume of the top 10 derivatives exchanges in Q2 2023 was $6.649 trillion, a decrease of 14.6% compared to Q1.

Compared to the spot market, the trading volume in the derivatives market in Q2 2023 decreased by 14.6%. However, it increased by 10.1% compared to Q4 2022, decreased by 26.7% compared to Q3 2022, and decreased by 50.7% compared to Q2 2022.

2023 Q2 market share of open interest: Binance remains in first place, while Bitget and Deribit have both seen an increase.

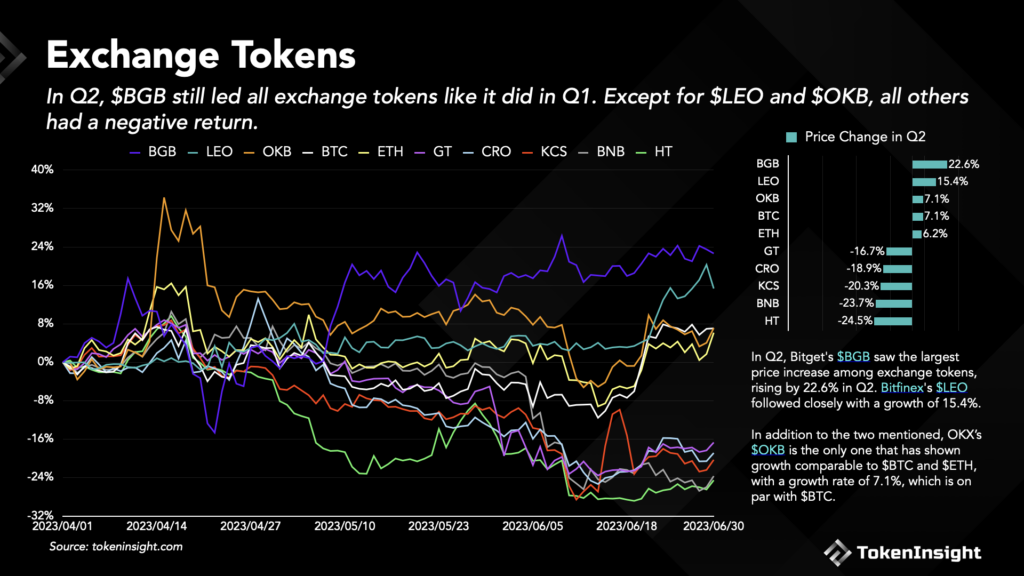

In Q2, $BGB still led all exchange tokens as it did in Q1. Except for $LEO and $OKB, all others had a negative return.

Download the press kit:

https://drive.google.com/drive/folders/1NHhmlrgvh3ex9OO2yHCv1h5Rnizx3AS-?us

Press Contact

Wayne Z

wayne@tokeninsight.com

CEO