Introduction

2024 witnessed profound transformations and multifaceted challenges in the global crypto market. From the approval of spot Bitcoin ETFs at the start of the year to market volatility, innovations in Bitcoin Layer 2 (L2) and Ethereum Layer 2 technologies, the explosion of Meme and AI Agent sectors, and the widespread adoption of decentralized applications (DApps), the crypto industry evolved at an unprecedented pace. Despite a complex macroeconomic environment, the demand for crypto assets remained robust. DeFi, Web3 technologies, Layer 2 scaling solutions, AI Agents, and innovative projects continued to lead the industry’s cutting-edge development.

Simultaneously, the deep engagement of traditional financial institutions and enterprises further accelerated the mainstream adoption of the crypto sector. The approval of spot Bitcoin ETFs, significant inflows of institutional capital, and innovations in financial products based on Real World Assets (RWA) drove the crypto market toward diverse growth. According to market data, the total crypto market capitalization surged from $1 trillion at the beginning of 2024 to $4 trillion by year-end, representing an annual growth rate of 300%. This remarkable growth underscores the industry’s entry into a new phase of development, driven by technological breakthroughs and market expansion.

As we step into 2025, the global economic landscape and the crypto industry continue to face significant uncertainties. Against this backdrop, the ability to innovate within regulatory constraints will be a critical factor influencing the industry’s sustainable growth. As an active participant in the Web3 ecosystem, Web3Port has leveraged its practical experience and industry insights to systematically analyze the key changes in the crypto market during 2024 and to provide forward-looking perspectives on trends for 2025.

Section I: 2024 Crypto Market Overview

1. Market Summary and Performance

After the historic surge of 2021 and the market downturn in 2022, 2024 marked a year of gradual recovery and renewed growth for the crypto industry. Despite external challenges such as global inflationary pressures, rising interest rates, and geopolitical risks, the crypto market demonstrated notable resilience, emerging as a new avenue for capital seeking refuge. Overall, the market was characterized by “recovery-driven growth” and “technology-led innovation.”

1.1 Market Scale and Valuation Trends

In 2024, the crypto market experienced a significant recovery in total market capitalization. From Q4 2023 to the end of 2024, the total market value of cryptocurrencies surged from $1 trillion to $4 trillion, reflecting an impressive cumulative growth of 300%.

Bitcoin (BTC), the market leader and core driver, surpassed $1 trillion in total market capitalization in Q2 2024 and was boosted by positive news from the Trump campaign in Q4, when the price surpassed $100,000 for the first time and the market capitalization exceeded $2 trillion.

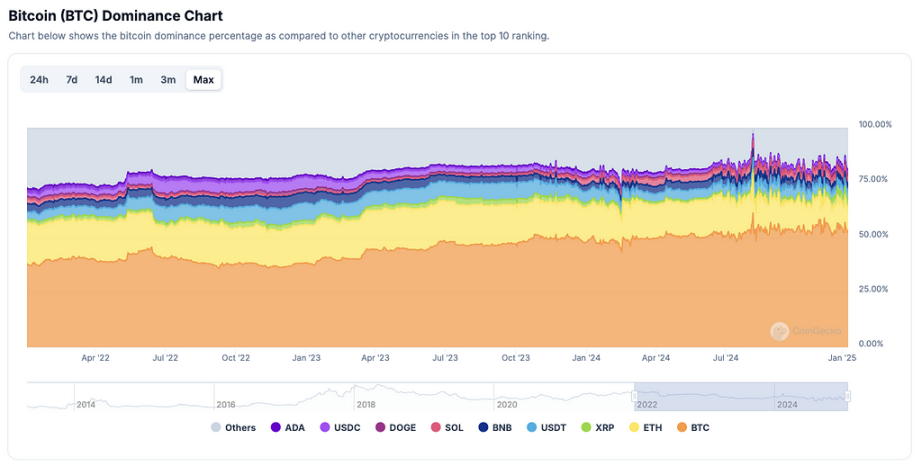

Meanwhile, BTC’s market share (market share of Top 10 cryptocurrencies) has further increased and is now more than 55%, consolidating its dominant position in the crypto industry.ETH, although it has also gained traction in 2024, the overall trend is significantly weaker compared to BTC, and its exchange rate against BTC continues to weaken and face uncertainty. The other Top 100 cottage coins that can outperform BTC are limited, and with ETH failing to explode, the cottage coin market lacks momentum and a basis for market speculation, with significant market volatility and a weak money-making effect.

1.2 ETFs & Institutional Investor Participation

One of the crypto market’s most defining characteristics in 2024 was the deepening involvement of institutional investors. Against the backdrop of uncertainties in traditional financial markets, more traditional financial institutions began to recognize the potential of crypto assets, accelerating their entry into the space. These institutions launched diverse financial products and services, fostering greater market maturity and regulatory compliance.

- Approval of Spot Bitcoin ETFs. On January 11, 2024, the U.S. Securities and Exchange Commission (SEC) simultaneously approved 11 spot Bitcoin ETFs. This milestone significantly lowered the entry barrier for institutional investors seeking exposure to the crypto market. By year-end, the market valuation of Bitcoin ETFs reached $110.494 billion, with total assets under management (AUM) hitting $111.858 billion, accounting for 5.89% of Bitcoin’s total market capitalization.

- Participation of Payment Giants and Banks. Major payment processors and banks also made notable strides in 2024. PayPal launched payment and custody services for Bitcoin and other cryptocurrencies while introducing the PYUSD stablecoin. Additionally, institutions like BlackRock intensified their investments in the crypto space, focusing on Bitcoin ETFs and blockchain infrastructure, cementing their roles as key market players. These organizations not only injected substantial capital into the market but also advanced regulatory and compliance processes.

- Innovation in Institutional Financial Products. The crypto derivatives market saw significant development in 2024, with institutional investors showing strong interest in crypto futures, options, and ETFs. Bitcoin ETFs and Ethereum futures contracts emerged as pivotal investment instruments. These innovations, particularly in the U.S. market, laid the foundation for the traditional financialization of crypto assets, bridging the gap between the digital asset economy and conventional finance.

1.3 Continued Growth of Decentralized Finance (DeFi)

Decentralized Finance (DeFi) remained one of the standout sectors in the 2024 crypto market. The DeFi ecosystem continued its expansion, showing robust growth in both transaction volumes and user adoption. Particularly on the Ethereum network, DeFi protocols demonstrated consistent innovation and application, ranging from foundational financial services like lending, trading, and liquidity mining to more sophisticated financial products such as insurance, derivatives trading, and algorithmic trading. This evolution underscored DeFi’s potential to surpass traditional financial systems.

In 2024, the DeFi market’s Total Value Locked Position (TVL) size shows a steady upward trend, rising from $54B at the beginning of the year to close to $140B in size, reaching about 80% of the 2021–2022 DeFi summer bull market.

Mainstream DeFi protocols such as Aave, Uniswap, and Compound all completed technology upgrades in 2024, enhancing the efficiency of their offerings and user experience. For example, Uniswap improved trading liquidity and efficiency in 2024 by launching a new generation of automated market maker (AMM) mechanism, attracting more users to participate in it, and Aave’s TVL reached a record high, exceeding $20B, surpassing the $20B TVL at its peak in 2022.

In 2024, the concept of decentralized stablecoins gradually became a core component of the DeFi ecosystem. The use of decentralized stablecoins like Dai and Frax in DeFi lending, payments, and exchanges gradually increased, driving the stability and utility of decentralized finance. Meanwhile, the market value of USDe launched by the new stablecoin project Ethena exceeded $5.9B, and the market value of USD0 launched by Usual.money exceeded $1.7B, contributing new liquidity to the DeFi ecosystem, and the mainstream DeFi protocols such as Aave, Maker, Morpho, and Pendle derive a large part of their TVLs and revenues from the programs such as Ethena and Usual.money.

1.4 The Surge of MemeCoins and the AI Narrative

In 2024, MemeCoins and the AI narrative outperformed other sectors, becoming the most lucrative areas in the crypto market. Data from CoinGecko further substantiates this trend:

The meme boom was fueled by the development of meme launch platforms, trading BOTs, and ticker tools, led by Pump.Fun. Its overall development started with GOAT as the AI meme narrative, exploded with AI launch platforms (Virtual, GRIFFAIN, Clanker), and culminated with AI frameworks (Ai16z & ELIZA, zerebro, swarm), which garnered most of the market’s attention.

As the MemeCoin and AI track markets grow, they are no longer short-term hype tools but important narrative tracks, market trends, and drivers of the crypto market.

1.5 Market Volatility and Macro-Economic Impact

In 2024, the uncertainty of the global economic and financial environment continued to significantly influence the cryptocurrency market. Fluctuations in global stock markets, the strength of the U.S. dollar, and shifts in central bank policies remained critical external factors impacting the crypto space. The price volatility of major cryptocurrencies like Bitcoin and Ethereum often mirrored the movements of traditional financial markets, particularly U.S. stock indices. This correlation was most pronounced during periods of macroeconomic instability, where the crypto market faced heightened pressure.

Overall, the crypto market in 2024 maintains a delicate balance between volatility and growth. Intrinsic drivers such as the continued influx of institutional funding, the maturation of decentralized finance (DeFi), and innovation in the NFT space, along with the external policy environment, have shaped the main tone of the market’s recovery.

The adoption of the Spot Bitcoin ETF

On January 11, 2024, the U.S. Securities and Exchange Commission (SEC) simultaneously adopted 11 spot bitcoin ETFs, a landmark event that paved the way for institutional investors to enter the crypto market and profoundly impacted the industry’s development. the launch of ETFs has made Bitcoin a more mainstream and accepted investment vehicle and has contributed to the maturation of the crypto market.

Launching the Spot Bitcoin ETF lowered the barriers for traditional institutions to enter the crypto asset space and marked a significant shift in regulators’ attitudes towards the crypto market. The approval of the ETF is considered one of the key factors that drove the price of Bitcoin to break through all-time highs, further cementing its status as digital gold in the minds of investors.

US interest rate cuts and their market impact

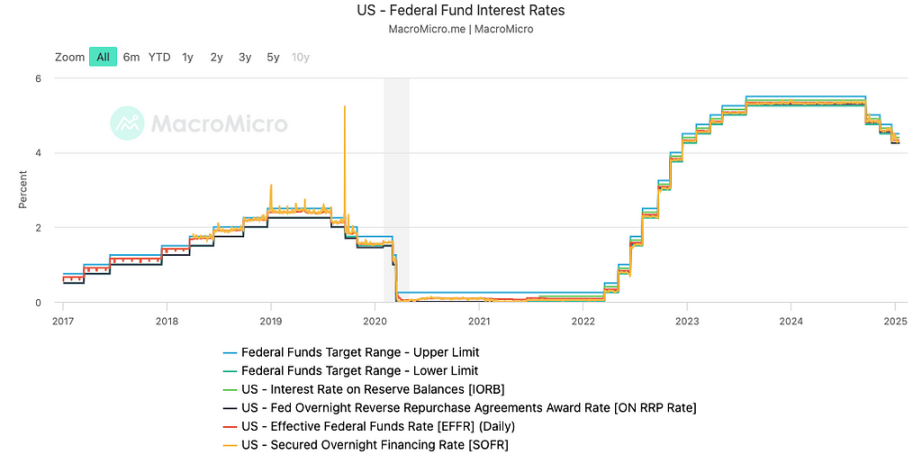

Since March 2022, the U.S. Federal Reserve Board (Fed) has begun a new cycle of interest rate hikes, with a total of eleven hikes, raising the federal funds rate to a range of 5.25%-5.50%, the highest level since 2007.

In 2024, the U.S. Federal Reserve (Fed) ended the rate hiking cycle that had been in place since March 2022 and began a process of rate cuts. The Fed cut rates by 50 basis points for the first time in September 2024, followed by another 25 basis point cut in November and December, bringing the range of the federal funds rate down from 5.25%-5.5% to 4.75%-5%, totaling a 1 percentage point cut, the lowest level in two years.

The Impact of U.S. Interest Rate Cycles on the Crypto Market

Rate Hike Phase. During periods of rising interest rates, the crypto market experiences heightened volatility and liquidity constraints. Higher rates reduce the appeal of riskier assets, including cryptocurrencies, applying downward pressure on the market.

Rate Cut Phase. Conversely, rate cuts alleviate liquidity tightness, encouraging capital inflows into crypto assets and fostering market recovery.

The rate-cutting policy also drove up the prices of major crypto assets, including Bitcoin and Ether, while boosting the flow of funds into areas such as Decentralized Finance (DeFi) and Real World Asset (RWA) Tokenization.

The Crypto Effect of Trump’s Election as President of the United States

On November 6, 2024, Trump defeated Harris and was elected as the new U.S. President. This result was seen as a major boon for the crypto industry, as Trump promised to support the development of cryptocurrencies during his campaign and was hailed as America’s first “Bitcoin President.”

Since Trump’s victory, the price of Bitcoin has risen dramatically from $70,000 to over $100,000 in just a few weeks, with the market capitalization reaching an all-time high of $2 trillion. Mainstream coins and a small portion of the cottage coin market have risen across the board, driven by this favorable development, and market sentiment has warmed up, opening up a new round of upward cycles.

Trump’s crypto-friendly policies, including the push for clarity in the regulatory framework with the facilitation of institutional capital inflows, have instilled confidence in the industry’s growth and further propelled the U.S. as a global center of innovation in crypto assets.

2. Key Sectors and Technological Innovations

In 2024, several sectors of the crypto market experienced remarkable growth, including decentralized finance (DeFi), Layer 2 solutions, Bitcoin L2, MemeCoins, AI + blockchain, real-world assets (RWA), and stablecoins, as well as the TON ecosystem. These sectors not only drove technological innovation but also significantly expanded the practical applications of blockchain technology, laying a solid foundation for future market growth.

2.1 Continued Expansion of Decentralized Finance (DeFi)

As a critical component of the crypto market, decentralized finance (DeFi) demonstrated robust expansion in 2024. Beyond trading and liquidity mining, DeFi delved deeper into areas such as lending, derivatives, re-staking, liquidity aggregation, and stablecoins. These advancements drove the decentralization and innovation of financial services.

- The Evolution of Decentralized Exchanges (DEX) and Liquidity Pools

In 2024, Decentralized Exchanges (DEX) further enhanced user experience and market efficiency through technological upgrades and mechanism optimization. For example, Uniswap V4 introduced a dynamic liquidity pool management mechanism, enabling liquidity providers to dynamically adjust their asset allocation according to market fluctuations, significantly improving profitability.

Meanwhile, cross-chain trading and multi-chain support have become an important trend in DEX development. Cross-chain messaging & protocol mainnet and tokens represented by LayerZero and Wormhole went online, providing underlying support for the efficient flow of assets between multiple chains. Cross-chain bridge projects (e.g. Stargate, Hop Exchange, Across, Synapse Bridge, etc.) saw significant growth during the year, contributing significantly to DeFi’s overall effectiveness and interoperability.

Through cross-chain protocols and cross-chain bridges, DEX’s trading pairs are not limited to a single blockchain network, and assets between multiple blockchains can flow freely. This cross-chain liquidity greatly improves DeFi’s overall effectiveness and enhances the interoperability of blockchain applications.

- Innovations in Decentralized Lending Platforms

Decentralized lending platforms continued to grow in 2024, especially projects such as Aave, MakerDAO, and Morpho, with several innovations in lending, leverage, and pledging. aave further lowered its borrowing costs in 2024 through its dynamic adjustment mechanism, helping users gain more flexible financing options in different market environments. morpho and aave By integrating Ethena’s sUSDe, not only did they significantly increase their TVL, they also gained access to higher revenue streams. makerDAO and Aave continued to make a push in the RWA market by allowing collateralized lending of RWA assets, pushing up their TVL and asset liquidity levels.

The transparency and flexibility of decentralized lending are providing important financial support to people around the world who do not have access to traditional financial services. With the development of decentralized identity (DID) and credit scoring systems, DeFi lending is expected to become an important part of global financial services in the future.

- The explosion of decentralized derivatives platforms

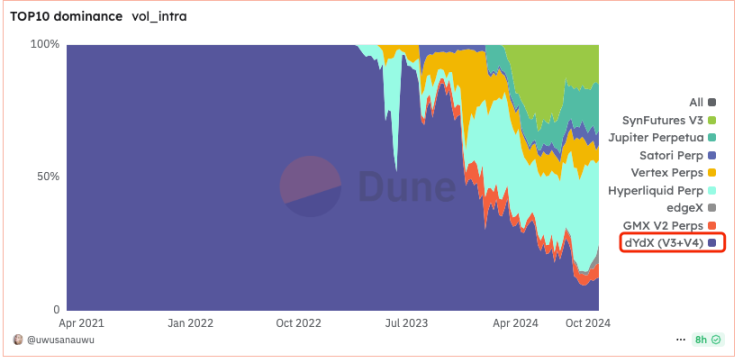

Thanks to the development of Layer2 solutions, the decentralized derivatives market continued to grow in 2024, with the innovative liquidity incentive model represented by GMX becoming the mainstream of the market, the mechanism of order books and AMMs gradually integrating, and the veteran derivatives platform Dydx boosting its market competitiveness using application chaining. Among them, SynFutures and Hyperliquid gained rapid development in 2024, and their market share was able to increase significantly. Especially Hyperliquid performed particularly well, and its share in the derivatives market gradually jumped to the first.

Hyperliquid created a new wave of airdrop wealth by airdropping 31% of its tokens (worth ~$1.8 billion at the TGE go-live price) directly to the community (rather than distributing to VCs). This innovative community-oriented distribution model broke the VC-dominated market landscape and galvanized community user loyalty and engagement. This behavior attracted a large number of funds (billions of dollars in volume) across the chain to the Hyperliquid platform, which further pushed the spot assets on the platform to see a 10x to 100x increase, creating a strong capital aggregation effect and market attention.

- Explosion of the Liquid Restaking Token (LRT) Sector

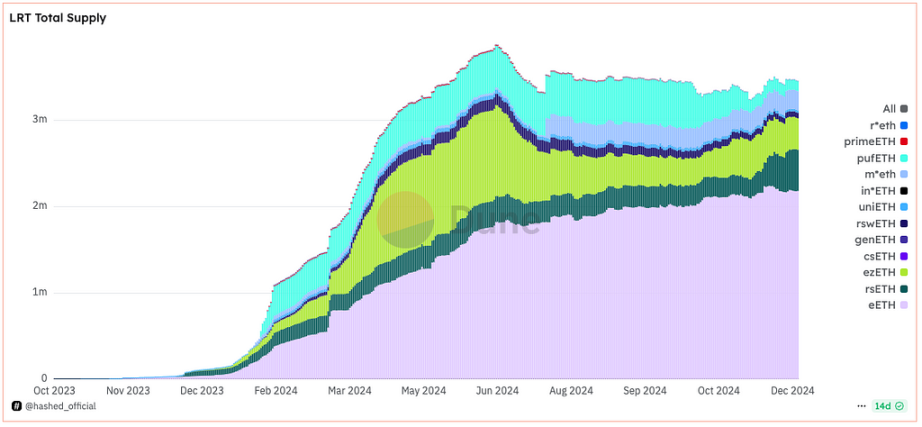

The explosion of the LRT circuit is an important narrative in the DeFi space in 2024, which was triggered by EigenLayer and gave rise to 2 sub-ecologies.

EigenLayer is an Ethereum-based restaking protocol that allows users to repledge ETH, lsdETH, and LP Token to other sidechains, prophecy machines, middleware, etc., to act as nodes and receive verification rewards. Third-party projects can enjoy the security of the ETH mainnet, and the ETH pledgers can earn more revenue, realizing a win-win situation.

Around the EigenLayer ecosystem, LRT (Liquidity Repledging) track projects have emerged, including Ether.fi, Puffer Finance, Kelp DAO, etc. To compete for market resources (ETH pledges), these LRT track projects have started the LRT War through airdrop points, multiple airdrop incentives, etc. At the peak of EigenLayer, there was a LRT War. At its peak, EigenLayer pledged more than $20.12B in TVL and more than 3.88M ETH on the network, and now the main network of EigenLayer has been launched, and the popular projects in the LRT track have also been launched, but the overall market performance is biased in comparison with the super-high market heat that it has generated.

At the same time, EigenLayer’s pooling of security through repledging has also given rise to the AVS (Actively Validated Services) active validation service ecosystem, including EigenDA, AltLayer, Brevis, Lagrange, Omni Network, Automata, and other ecological projects. However, the overall development of the AVS track is currently average, and the actual demand scenarios are not yet fully mature.

- The Trend of Liquidity Aggregation

The outbreak of the LRT track has triggered the trend of DeFi protocols and product liquidity aggregation, and to grab the crypto asset liquidity and market share in the market, liquidity aggregation products have appeared in the market, such as Uniswap unichain, a chain-wide liquidity public chain, and Zircuit pledge chain, and StakeStone, a cross-chain marketplace based on LST liquidity. and various DeFi liquidity aggregation protocols. These projects have significantly improved the availability and profitability of DeFi products by integrating multi-chain assets and liquidity.

2.2 Innovations and Developments in Layer 2 Solutions

In 2024, the Layer 2 (L2) ecosystem entered a crucial development phase, becoming one of the most dynamic areas within Ethereum and other public blockchain ecosystems. Through technological innovation and ecosystem expansion, Layer 2 solutions alleviated blockchain scalability bottlenecks while providing efficient, low-cost solutions for use cases such as decentralized finance (DeFi), NFT trading, and on-chain gaming, further driving the widespread adoption of blockchain applications.

Ethernet Layer 2 mainly consists of two technology tracks, Optimistic Rollups and zk-Rollups. 2024, Optimistic Rollups continue to grow steadily, driven by Arbitrum, Optimism, and Base, while zk-Rollups’ advantages in transaction efficiency and privacy protection drive its rapid rise as an important growth point in the Layer 2 track. advantages are driving their rapid rise as an important growth point in the Layer 2 track.

- Competition intensifies for Ethernet Layer 2

In 2023, Optimism and Arbitrum, which adopted the Optimistic Rollups technology scheme, have successively issued coins and constructed ecological construction, and dominated in Layer2. However, in 2024, zk-Rollups projects such as Manta, Starknet, ZKsync, Scroll, and so on have successively issued coins and constructed ecological construction, and the zk-Rollups technology scheme has gained rapid development, crowding out the ecological space of Optimism and Arbitrum.

- Explosion of the Base chain

Base Chain, supported by Coinbase’s traffic, has grown its Total Value Lockup (TVL) by $1.8 billion in one year, capturing 35.17% of the Layer 2 market, making it the market share leader.Base Chain has also become an active ecological powerhouse alongside Solana through its support of MemeCoin and AI ecological projects.

- The Rise of zk-Rollups

zk-Rollups gained rapid growth in 2024 by leveraging the technological advantages of Zero Knowledge Proofs (zk-SNARKs). zk-Rollups enable more efficient transaction validation by compressing transaction data while ensuring privacy protection. Representative projects such as zkSync, StarkWare, Manta, and Scroll have not only attracted a large number of developers and capital but also enhanced market competitiveness through strong ecological extensions.

zkSync has further strengthened its ecological foundation by supporting more DeFi protocols, NFT marketplaces, and decentralized data storage projects through the continuous upgrading of the zkSync Era network. zkSync’s StarkNet, which solves the computational bottleneck of zk-SNARKs through the zk-STARK technology and reduces the resource consumption of transaction validation, has attracted widespread attention from developers.

- Multi-chain interoperability and RaaS services

In 2024, the Layer 2 ecosystem will evolve toward multi-chain interoperability and servitization. optimism enables efficient collaboration and interoperability between multiple L2 networks through the Superchain model, while zkSync is developing cross-chain solutions to support seamless interoperability of assets and data across different networks. Other established L2s, including Polygon (Polygon CDK), Arbitrum, Starkware, and others, are also driving mass adoption by offering or announcing the open-sourcing of their proprietary technologies.

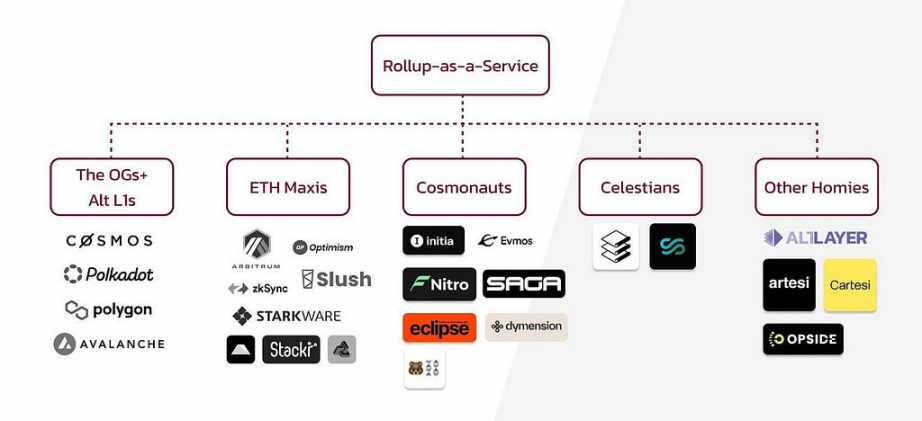

On this basis, RaaS (Rollup as a Service) providers have emerged.RaaS providers offer developers one-click access or creation of Rollup services by simplifying the operational processes of the Rollup chain, including node operations, infrastructure management, sorting, indexing, and analytics. Representative projects include:

- Conduit and Nexus Network: docking Optimistic Rollups (e.g. Optimism, Arbitrum);

- Truezk and Karnot: focusing on the zk-Rollups technology stack;

- Caldera and AltLayer: provide integration services across Optimistic and zk-Rollups.

These services significantly lower developers’ technical thresholds, driving the rapid expansion of the L2 ecosystem and enriching application scenarios.

2.3 Explosive Growth of Bitcoin Inscription and Layer 2 (L2)

In 2024, the Bitcoin Inscription and Bitcoin Layer 2 (L2) tracks show very different trends: the Inscription protocol is experiencing a rapid decline in popularity after an initial boom, while the Bitcoin L2 track shows growth potential, but the overall market size is still relatively limited.

Bitcoin Inscriptions:

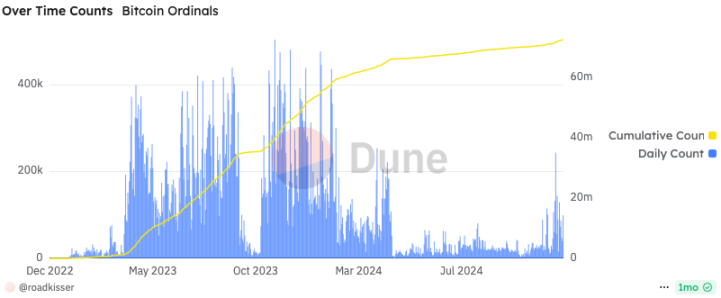

Thanks to Bitcoin’s advances in key technologies (e.g., SegWit, Bech32 encoding, Taproot upgrades, and Schnorr signatures), the Bitcoin network’s transactional efficiency, scalability, and programmability have been significantly improved. These technological innovations provided the technological foundation for the explosion of the inscription ecosystem, giving rise to a series of inscription protocols, including Ordinals & BRC20, Atomical & ARC20, Rune & Pipe, and Taproot Assets.

However, the growth momentum of the Bitcoin inscription ecosystem in 2024 is gradually slowing down: while inscription infrastructure (such as wallets, asset issuance platforms, and cross-chain bridges) has made some progress on a technical level, trading volumes and user activity for inscription assets have declined dramatically. Binance’s recent decision to remove the inscription marketplace is a further reflection of the track’s current predicament. With the inscription protocol failing to consistently attract market enthusiasm and ecological development stalled it remains to be seen whether its narrative can be revitalized in the future.

Bitcoin L2:

With the explosion of the Bitcoin inscription ecosystem, the growing demand for asset trading and cross-chaining of multiple inscription assets has indirectly fueled the development of the Bitcoin L2 ecosystem. Compared to Ether, the BTC L2 track got off to a late start, but 2024 saw the emergence of multiple legacy and emerging L2 projects attempting to propel the Bitcoin ecosystem into the realm of Decentralized Finance (DeFi) and Smart Contracts through scalable solutions.

- Continued development of traditional L2 projects: Veteran projects such as Lightning Network, Stacks, Rootstock, Liquid Network, and others are gradually expanding into a wider range of applications such as payments, DeFi, and cross-chain asset management by optimizing their infrastructure.

- Emerging BTC L2 Projects: With the help of Ether EVM technology, new Bitcoin L2 projects such as BitVM, Bsquare (B² Network), Bitlayer, BEVM, BounceBit, DLC, BOB, Botanix, and so on have emerged one after another. According to L2 Watch, 50+ BTC L2 projects have appeared in the market.

Despite some progress in technology development and a number of projects in the Bitcoin L2 track, its market performance is still limited. at the end of 2024, the total value locked position (TVL) on the Bitcoin chain grows to approximately $6.372 billion, but the gap is still significant when compared to the $66.11 billion TVL on the Ethereum chain. Fewer BTC L2 projects can achieve breakthroughs in market voice, asset volume, and user base. Current projects with on-chain TVL over $100 million include Bitlayer, BSquared, Rootstock, BOB, Merlin, and Stacks. popular BTC DeFi protocols include Babylon (TVL over $5 billion), Solv Protocol (on-chain TVL over $1 billion), and Avalon Labs.

2.4 The Explosive Growth of the MemeCoin Sector

In 2024, the MemeCoin explosion was the strongest narrative driver in the crypto market. As the MemeCoin market continues to expand, they have transformed from an early tool of modal cultural hype to a key narrative track and market trend in the crypto market, and have become a significant force driving the crypto industry.

According to CoinMarketCap, the total market capitalization of the MemeCoin market reached $9.738 billion, accounting for about 2.8% of the total market capitalization of the entire cryptocurrency market ($3.37 trillion). More strikingly, MemeCoin consistently holds a 6–10% share of trading volume, exhibiting the most concentrated liquidity and trading activity of any crypto track.

Unlike traditional crypto projects that are primarily driven by technology or products, MemeCoin’s core lies in its cultural narrative and community-driven nature. These tokens have no complex technical support or practical product application, and their value is primarily derived from the attention economy and cultural symbolism. memeCoin price fluctuations are entirely dependent on speculative demand and market sentiment, making it more of a social game or a speculative lottery.

In addition to the overproduction of Altcoin and the falsification of its narrative logic, the lack of a sustained narrative in the overall market sentiment, and the lack of market acceptance of institutional coins (high FDV, low liquidity), the development of the MemeCoin infrastructure is the most significant contributor to MemeCoin’s outbreak as a dominant narrative in the market in 2024.

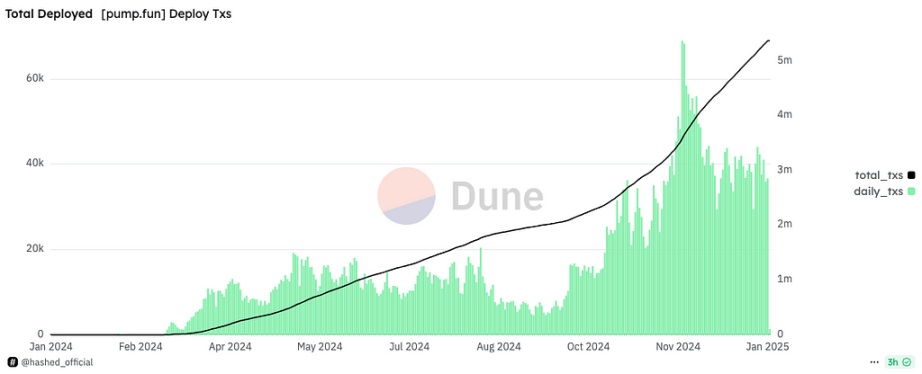

The MemeCoin fair launch platform, led by Pump.Fun in 2024, has completely reshaped the MemeCoin market landscape.Pump.Fun has greatly simplified the process of creating and trading Memecoins on the blockchain through simple token creation tools, dynamic pricing curves, and liquidity mechanisms, driving the democratization and community-based. By the end of 2024, the Pump.fun platform deployed more than 5 million MemeCoin and accumulated more than $400 million in revenue, making it the most profitable and successful Web3 application of 2024.

In addition to Meme launch platforms, TG trading bots (Maestro Bot, Unibot, BananaGun, etc.), decentralized wallets (e.g., Ouyi Web3 wallet), and ticker software tools (e.g., GMGN, DEXTools, DEX Screener, moonshot, etc.), these three categories of products have facilitated the search for smart money on the chain and the threshold for discovering potential MemeCoins, simplifying the process of trading and facilitating the MemeCoin boom.

In 2024, a series of popular tokens emerged from the MemeCoin circuit, creating a market boom and wealth effect. Popular MemeCoins include $MEW, $NEIRO, $GOAT, $MOODENG, $PNUT, $ACT, $POPCAT, $TERMINUS, $PAC, $DEGEN, $SPX, $ CHILLGUY, etc. These tokens have not only created huge gains for early investors but have also become a hotspot for community engagement and discussion.

2.5 AI + Blockchain

In 2024, the Artificial Intelligence (AI) industry continues to show a high rate of development globally, with the maturation of big model technology, the wide application of multimodal AI, and the commercialization process of generative AI injecting new vitality into various industries. In this context, the combination of AI and Web3 has become a hot spot in the emerging field, bringing new narrative drivers and investment opportunities to the crypto market.

In the Web3 space, AI and Web3 are further converging, with at least 200+ Web3 + AI concept projects in the industry, covering infrastructure, data, prediction markets, compute and arithmetic, education, DeFi and cross-chain, security, NFT and gaming, and meta-universes, search engines, social and creator economy, AI chatbots, DID and messaging, governance, healthcare, transaction Robotics, and many other directions.

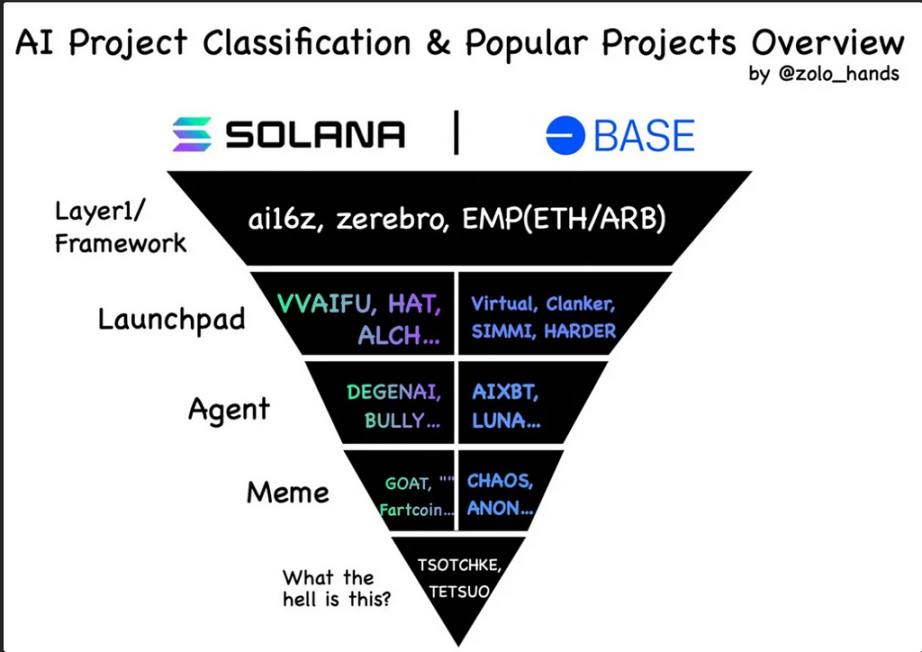

To summarize, there are four main types of AI tracks in the Web3 space:

- AI infrastructure: including AI public chain infrastructure and arithmetic resource network, providing basic services and resource support for AI applications. AI public chain infrastructure includes Near, Olas, Cortex, Fetch.ai, etc., while arithmetic resource networks include Filecoin, Render Network, Io.net, Aethir, Grass etc.

- Web3 + data/model + market/network/protocol: Through decentralized incentive mechanism and blockchain technology, a decentralized AI data, model, and network market is constructed to break the traditional resource monopoly and allow more participants (SMEs and individuals) to have the opportunity to enter and contribute resources to the AI ecosystem. Typical examples include: Bittensor is a decentralized AI model marketplace that allows developers to earn rewards by contributing and optimizing AI models; Ocean is a decentralized data marketplace that allows data assets to be tokenized and traded through blockchain and smart contracts; NEAR Tasks, officially released by NEAR, is a blockchain-based AI annotation platform; Measurable Data(MDT) is a decentralized data exchange economy system that aims to provide a blockchain-based data economy where data providers and data buyers can trade data securely and anonymously; Cortex is a decentralized AI platform that supports distributed training and inference of AI models.

- AI + Application Layer: Relying on AI technology and resources, we build AI+ Dapp application projects in the areas of on-chain data, chain tours, socialization, NFT, creator economy, DeFi, etc., and utilize AI-enabled smart contract decision-making and execution to better satisfy user’s intent-based needs and brand-new experiences. Typical cases include: Arkham, an on-chain AI data analysis project, AI chatbots (Myshell, CharacterX), AI search engines (Kaito, Pulsr, QnA3, Typox AI), and AI creator platforms (LiveArt, Art Blocks, Bottto).

- Web3 AI Agent: AI Dapps that merge AI with the Web3 crypto economy, including AI Agent frameworks (ai16z & Eliza, Zerebro, ARC, Swarms), AI Launchpad (VVAIFU, Virtuals, Clanker, HOLD), Web3 AI Agent (AIXBT, ACT, LUNA, Degenai), AI Meme (GOAT, Turbo, Fartcoin, CHAOS, ANON) and so on.

Currently in these 4 categories, the arithmetic resource network in the AI infrastructure has gained development this year, including Io.net, Ather, Grass and other arithmetic resource projects have been online this year, providing a boost to AI development resources.

Web3 AI Aget’s most rapid development began with the emergence of the AI Meme coin GOAT, followed by the AI Agent framework ai16z & Eliza gained massive attention economy, and its token $ai16z, based on not being online on large exchanges, exceeded $20B in market capitalization just through the liquidity of the DEX, which raised the AI Agent’s market capitalization The AI Agent’s market capitalization and influence have been raised. In addition, numerous AI Agent Token releases supported by AI Launchpad have triggered a wave of market speculation.

2.6 RWAs and Stablecoins

In 2024, RWAs (Real World Assets) and Stablecoins emerged as key drivers of the crypto market, facilitating the deeper integration of blockchain technology with traditional finance.

The RWA market is growing rapidly:

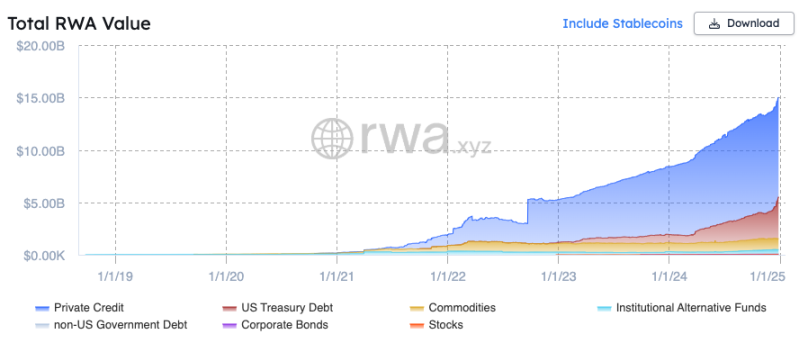

In 2024, the on-chain Real World Assets (RWA) market continued to expand with a total asset size of $15.2B, an increase of nearly $7B compared to 2023, and the number of holders exceeding 80,000 people. In terms of scale, Private Credit accounts for the largest proportion and its scale is gradually expanding; U.S. Treasury Bonds account for the second largest proportion and its scale is also gradually expanding; RWA assets such as commodities, corporate bonds, and equities are smaller in scale and their increase is weaker.

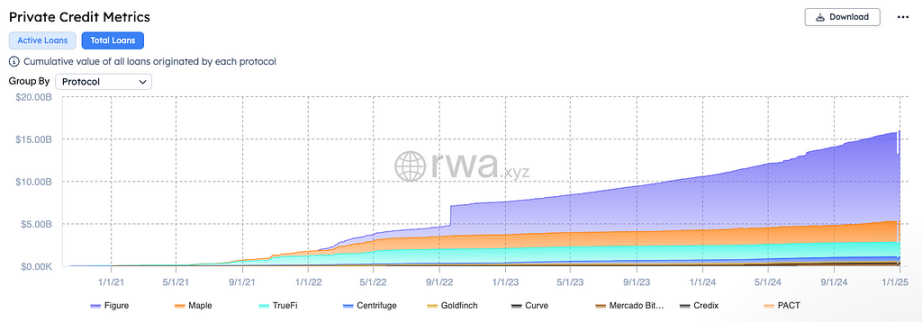

Private Credit dominates the RWA market, with Figure continuing to lead the way with over 70 percent market share in total loan volume and active loan inventory. Established programs such as Maple, TrueFi, Centrifuge, and Goldfinch maintained steady market share.

In terms of RWA projects, Ondo Finance has become a benchmark project in the RWA space by tokenizing U.S. Treasuries and corporate bonds, surpassing $3 billion in locked-in volume (TVL).MakerDAO has pushed to expand its decentralized stablecoin DAI’s backing assets from crypto to RWAs by launching its RWA Escrow Program, bringing $10 billion in assets onto the chain. OpenEden, a RWA (Real World Asset) tokenization protocol focused on bringing US debt on-chain, launched the OpenEden TBill Vault product, which allows users to mint TBILL tokens with USDC to generate revenue and partnered with Binance Labs to expand its market.

In terms of RWA innovation, USUAL, an innovative RWA stablecoin protocol, launched USD0, a license-free and fully compliant stablecoin backed by Real World Assets (RWA) 1:1, to integrate RWA token liquidity across platforms/companies, merging CeFi with DeFi.Usual is integrated with several decentralized finance (DeFi) platforms and protocols integration, including lending platform Morpho, revenue platform Pendle, and others, with a total locked-in value (TVL) of over $1.6B on-chain, demonstrating its strong growth momentum in the stablecoin space.

In 2024, large financial institutions are also laying out the RWA track. BlackRock launched BUIDL, the first tokenized asset fund on the Ether network, and partnered with Securitize and Circle to support 24/7 real-time subscriptions and redemptions. Tether, the stablecoin USDT issuer, announced the launch of Hadron by Tether, an asset tokenization platform to simplify the process of tokenizing real assets (stocks, bonds, real estate, funds, loyalty points, etc.).

Stablecoins are growing rapidly:

With a total supply of $200B reaching an all-time high in 2024, Stablecoin has become a core driver of the crypto market, not only as a value anchoring tool but also as a liquidity base for DeFi protocols and exchanges.

In the stablecoin circuit, USDT continues to lead the way, achieving significant growth in both market capitalization and liquidity.USDT has undergone multiple additions on multiple blockchain networks (including Wavefield and Ether, among others), and as of December 2024, USDT’s market capitalization has surpassed $140B, an increase of nearly $50B, or more than 55%, from the beginning of the year.USDT’s market capitalization is now at $140B, up from $50B at the beginning of the year.

Meanwhile, Ethena is one of the best-performing stablecoin projects this year and has further spawned a boom in interest-bearing stablecoins.Ethena launched USDe with a market capitalization exceeding $5.9B, which not only contributes a lot of new liquidity to mainstream DeFi protocols such as Aave, Maker, Morpho, Pendle, etc. but is also the revenue of these DeFi protocols’ Main Source.

In addition to its rapid growth in the crypto space, the popularity of stablecoin applications in areas such as global payments and cross-border remittances is accelerating. According to estimates by Castle Island Ventures and Brevan Howard Digital, payment settlements in stablecoin have reached approximately $2.62 trillion in the first half of 2024, and are expected to surpass $5.28 trillion for the full year. On-chain stablecoins are traded by approximately 20 million active addresses per month, with more than 120 million addresses holding non-zero stablecoin balances.

In emerging markets, regions such as Brazil, India, Indonesia, Nigeria, and Turkey, the use of stablecoin has moved beyond traditional crypto transactions and into everyday financial activities. According to the survey, 69 percent of respondents use stablecoin for currency substitution, 39 percent for payment of goods and services, 39 percent for cross-border payments, and another 20 to 30 percent for payroll payments and business activities. Africa-based cross-border payments company Juicyway has processed over $1.3 billion in stablecoin transaction volume. Nigeria ranks second in global crypto adoption.

2024 Large corporations and banks are also scrambling to lay out the stablecoin track, with U.S. online payments company PayPal launching PayPal USD, a stablecoin pegged to the U.S. dollar, and announcing in September that it would allow merchants to buy, hold, and sell cryptocurrencies through their merchant accounts. Additionally, Stripe’s $1.1 billion acquisition of stablecoin platform Bridge resumed services for U.S. businesses to make crypto payments via Ether, Solana, and USDC on Polygon. Japan’s three largest banks — Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Banking Corporation (SMBC), and Mizuho Bank (Mizuho) — jointly launched a cross-border payment system called “Project Pax” in September 2024, which replaces traditional intermediary banks in cross-border payments with stablecoin to increase efficiency and reduce costs.

2.7 The Explosion of TON Ecosystem

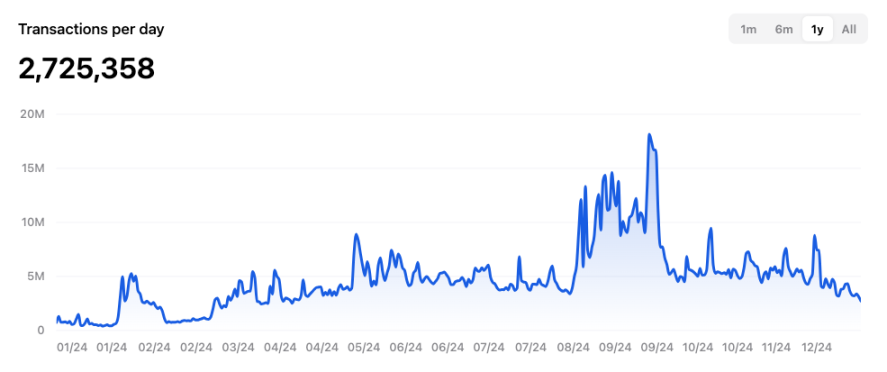

In 2024, TON public chain realized a large-scale explosion in the gaming and social fields of the huge user base of Telegram and the innovative Mini App product model and airdrop gameplay. The explosion of social games such as Notcoin, Hamster, Catizen, etc. quickly attracted a large number of Web2 and Web3 users in a short period of time, which enhanced the on-chain activity and market heat of TON public chain. public chain’s on-chain activity and market heat.

NOTCOIN became a phenomenon, attracting 5 million users within a week of its launch and surpassing 40 million users in just a few months with its Tap-to-Earn model, making it the most popular Web3 app in the Telegram Apps Center. Its tokens were fairly distributed at over $1 billion FDV, leading to the Telegram Mini Apps craze.

Following NOTCOIN, the continued popularity of gaming and social apps such as Catizen, Dogs, Hamster Kombat, Uxlink, etc., combined with the airdrop incentives and the wealth effect of the token launch, these Mini Apps projects have successfully focused the market’s attention.

With Telegram’s huge user base (over 900 million MAUs), TON provides Web3 projects with a powerful entrance for users and traffic. Numerous Web3 projects have leveraged TON to expand their user base and community traffic. This focus on users and traffic has also propelled Telegram to its first profit in 2024, with over 12 million Premium subscribers and over $1 billion in annual revenue.

Despite TON’s success in the gaming and social ecosystems, its DeFi and other ecosystems are relatively weak, and its main network is more like a traffic pool and user service platform. With the increase of homogenized projects within the ecosystem, the wealth effect gradually weakened and user stickiness significantly declined. The intensification of competition and the fading of project fervor caused the chain activity of the TON ecosystem to show a significant downward trend at the end of the year.

3. 2024 Crypto Market Financing Landscape and Investment Trends

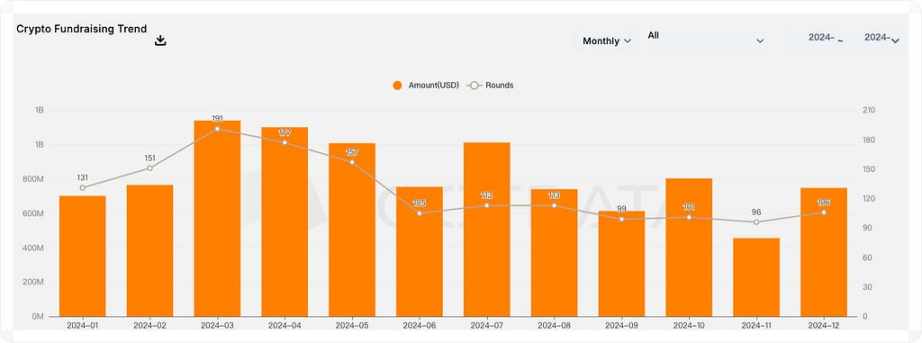

The crypto market is showing a diversification and gradual rebound in funding in 2024. Despite the volatility that the market has experienced over the past year, innovative and technology-driven projects continue to attract investor attention, especially in areas such as Web3 Infrastructure, DeFi, CeFi, Gaming, and AI+Blockchain, which have seen a significant increase in funding activity and amount.

3.1 Rebounding investment environment and capital injection

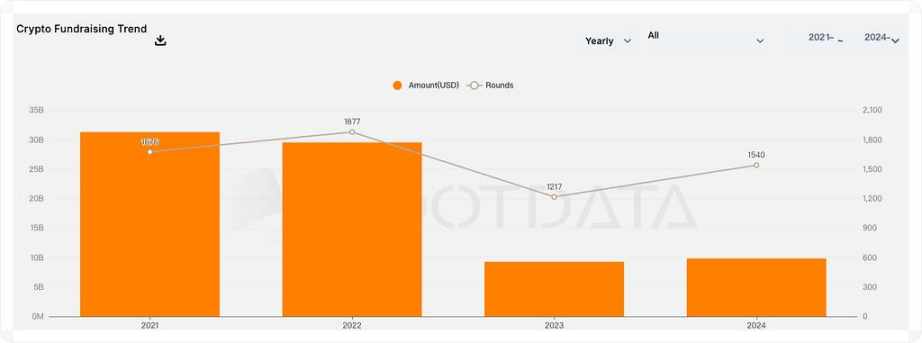

In terms of overall funding data, 2024 was a year of a rebound in funding for the crypto market. According to RootData data, the primary market in cryptocurrency and blockchain disclosed a total of 1,536 investment and financing events in 2024, totaling more than $10.1 billion, with an average financing amount of $9.13 million and a median financing amount of $4.1 million.

In terms of number of financings and financing amount, the investment and financing market situation in FY2024 was largely comparable to 2023, which saw 1,217 deals totaling $9.3 billion in financing. However, compared with the financing amount and number in 2021 and 2022, there is a considerable gap, reflecting that the crypto market financing situation has improved somewhat, but is far from recovering to the peak of the last round of the DeFi bull market, and the overall market investment trend is inclined to be cautious and rational.

3.2 Capital Flow and Sector Popularity:

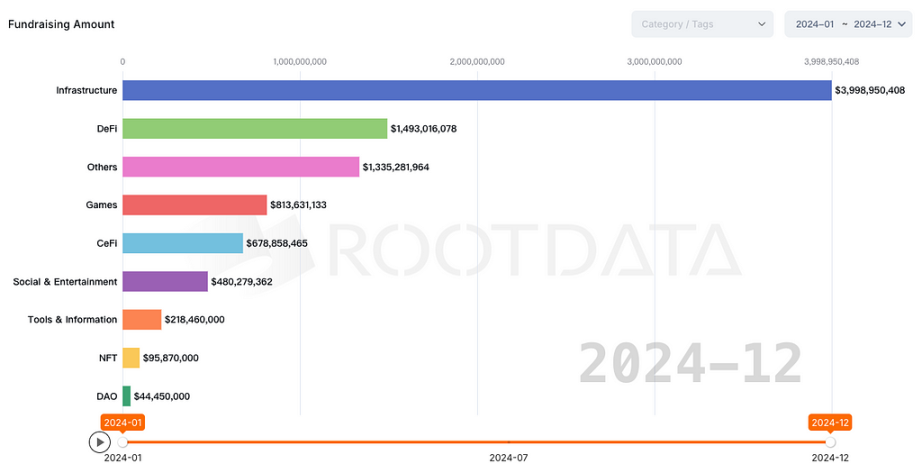

In 2024, the crypto market showed a clear trend of focused funding flows, with several tracks becoming the focus of investors’ attention. According to RootData, the Web3 Infrastructure, DeFi, Gaming and CeFI, Social Entertainment, and AI tracks received the most funding, especially the Web3 Infrastructure track received nearly $4 billion in funding, accounting for nearly 40% of the total funding amount.

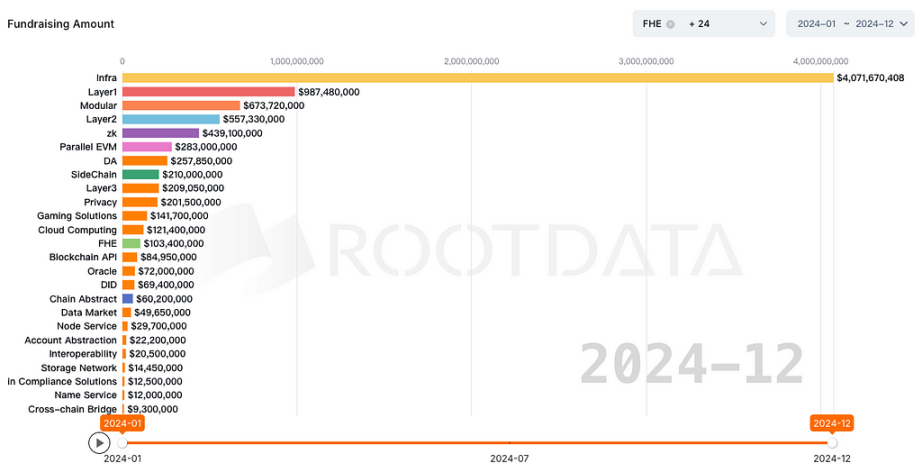

In the Web3 Infrastructure Grand Raceway, it can be seen that in 2024, public chain infrastructure and L2 scaling solutions, including Layer1, modular blockchain, Layer2, ZK, parallel EVM, DA, side chain, Layer3, etc., have become the preferred choice of investment institutions. This is also a side reflection of their preference for heavy infrastructure.

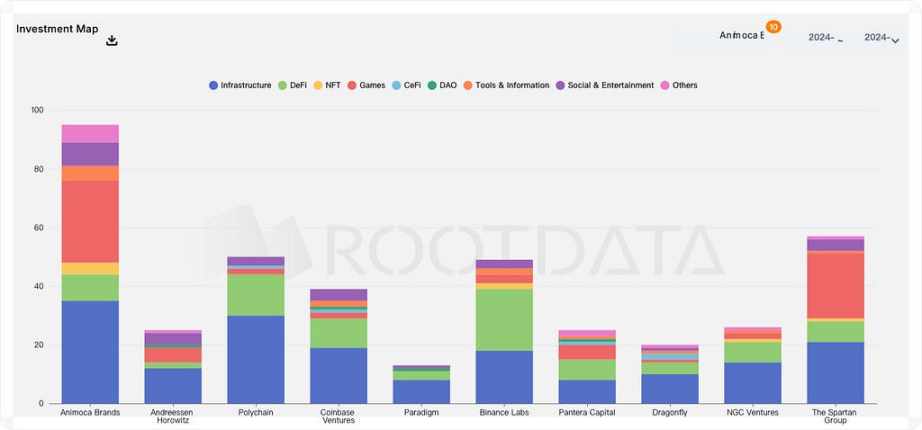

Leading VC organizations such as Animoca Brands, Andreessen Horowitz (a16z), Polychain, Coinbase Ventures, Binance Labs, Spartan Group, Paradigm, and others in 2024 have increased their blockchain and Web3 Investment Efforts. In terms of their investment preferences, the investment institutions all favor investments in Web3 infrastructure and DeFi, with Animoca Brands and Spartan Group preferring infrastructure and gaming tracks, both of which have invested the most.

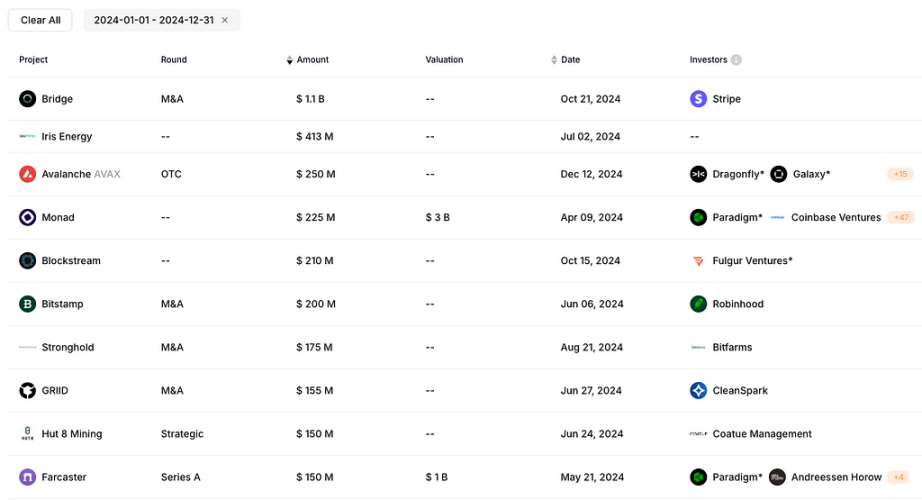

3.3 Popular investment cases

Typical examples of Web3 blockchain project funding in 2024 include $225 million for Monad public chain, $150 million for Farcaster Series A, $100 million for Berachain Series B, $100 million for EigenLayer Series B, and $100 million for HashKey Group Series A.

The scale of funding for these projects indicates that investment institutions increasingly favor projects with clear commercialization paths and innovative technologies. Capital is becoming more concentrated in protocols with long-term growth potential, cross-chain capabilities, and scalability. The Web3 investment and financing market is gradually transitioning from early-stage “bubble-style” investments to a more rational, technology-driven flow of capital.

3.4 The Rise of Mergers and Acquisitions (M&A) Activity for Crypto Projects

As the crypto market matures, mergers and acquisitions (M&A) activities become another major highlight of crypto market investment and financing in 2024. Many large companies are enhancing their competitiveness by acquiring innovative projects and technologies. Among them is payments company Stripe’s acquisition of stablecoin payment platform Bridge for $1.1 billion, making it the largest acquisition deal in the crypto space. Other acquisitions include Robinhood’s purchase of cryptocurrency exchange Bitstamp for $200 million, bitcoin mining company Bitfarms’ acquisition of Stronghold Digital for $175 million, mining company Cleanspark’s acquisition of bitcoin miner GRIID for $155 million, and Riot Platforms’ $92.5 million acquisition of bitcoin miner Bitcoin. M&A trends show that large companies are strengthening their market position by absorbing innovative projects and technologies.

Section 2: Outlook for the 2025 Crypto Market

With the continuous iteration of crypto technology and the growing market demand, 2025 will be a pivotal year for the development of the crypto industry. The crypto market is expected to reveal more possibilities, with the emergence of multiple new sectors and applications showing robust growth. We can make optimistic predictions about certain sectors and application trends within the crypto market. However, the new year will also bring risks and challenges, and industry participants must be well-prepared to address them.

1.0 “Bitcoin First” Strategy

Bitcoin (BTC), due to its fixed supply (21 million coins) and censorship resistance, is widely regarded as “digital gold.” This characteristic makes it the preferred asset to hedge against risks in the traditional financial system amid high inflation and increasing uncertainty in monetary policies. Moreover, Bitcoin’s long-term appreciation potential and its transparent decentralized network further solidify its status as a reserve asset.

As the global economic environment becomes more complex, Bitcoin’s “inflation-resistant” attributes will attract more attention from corporations and governments. In particular, in the face of fiat currency depreciation, economic sanctions, and instability in the traditional financial system, Bitcoin offers a value storage method independent of the traditional monetary system.

In 2025, some major tech companies (such as Apple, Microsoft, and Google) are expected to follow in the footsteps of pioneers like Tesla by incorporating Bitcoin into their balance sheets as part of their reserve assets. This strategy will diversify the risk exposure of traditional assets such as cash, bonds, and stocks while enhancing their position in Web3 and blockchain sectors through Bitcoin.

Meanwhile, amid shifting geopolitical dynamics and the gradual weakening of the dollar’s dominance, more countries may incorporate Bitcoin into their foreign exchange reserves to reduce dependence on the US-dollar-dominated monetary system. Emerging economies may hold Bitcoin as a hedge against dollar volatility and international economic sanctions.

The “Bitcoin First” strategy will continue to increase demand for Bitcoin, pushing the Bitcoin bull market forward. A price break above $200,000 is a likely scenario in the coming year.

1.1 AI Agent

In 2024, the Web3 AI sector is showing two main trends:

- Development of AI Infrastructure: Projects such as Io.net, Ather, and Grass have launched as computational resource networks, providing crucial infrastructure to support AI development. These projects leverage the sharing economy model to introduce a rich supply of computational power to the Web3 AI ecosystem. However, the practical demand-side application of AI infrastructure remains underdeveloped, and a balanced supply-demand dynamic has yet to be fully realized.

- Evolution of the AI Agent Narrative: In 2024, the AI Agent narrative has evolved from the speculative “AI MEME” hype to a multi-layered structure of “Individual AI Agent Applications → AI Agent LaunchPad → AI Agent Frameworks.” However, at present, this narrative remains primarily focused on speculative hype and lacks substantial commercial applications.

As demand for practical solutions increases, 2025 is expected to be a pivotal turning point for AI Agents, transitioning from hype to real-world application. More AI Agents with genuine demand and functionality are expected to emerge, addressing the current imbalance between supply and demand. Notably, AI projects from the Web2 space will gradually expand into Web3, bringing more advanced technologies and application frameworks to the Web3 ecosystem.

Four Key AI Agent Development Directions to Watch:

- The Chainification of AI Agent Frameworks: AI Agent frameworks may further evolve into dedicated Layer 1 infrastructures for AI. Such chain-based AI frameworks would enable deep integration between smart contracts and AI Agents, providing more efficient underlying support for AI task execution and resource allocation.

- AI Agent + DeFi Integration: Introducing AI Agents into on-chain trading platforms will become one of the most direct and impactful directions for Web3 adoption. AI Agents can autonomously execute financial services by understanding user transaction intentions, significantly enhancing the user experience. This convergence will also be a focal point for institutional investment and market attention.

- Optimization of AI Infrastructure: The development of AI infrastructure will become more aligned with real-world application needs, shifting from mere computational power supply to service-driven solutions. Only by achieving a balance in supply and demand, while generating sustainable revenue, can AI infrastructure truly become a cornerstone for industry growth.

- Rise of AI Middleware: As privacy and security requirements increase, the operational environment for AI Agents will need higher levels of trust. AI middleware solutions, such as Trusted Execution Environments (TEEs) and privacy protection protocols, will play a crucial role in ensuring that AI Agents can autonomously perform tasks in a secure environment.

1.2 Innovations in RWA and stablecoins

In 2024, on-chain RWA assets are centered on private credit and U.S. bonds, which have become important pillars of the DeFi market due to their stable returns and broad market acceptance. The introduction of such assets not only provides a stable source of income but also injects a large number of high-quality collateralized assets into decentralized finance, further promoting the improvement of capital efficiency on the chain.

It is expected that the RWA and stablecoin tracks will continue to see new changes in 2025 as the infrastructure of various RWA protocols improves:

- Expansion of the range of on-chain RWA assets: The range of on-chain RWA assets will be further expanded to include commodities (e.g., gold, oil), equities, ETFs, corporate bonds, and even more complex financial product areas (e.g., supply chain finance and expanded trade clearing). These emerging RWA asset types will be integrated into the DeFi and CeFi ecosystems as collateral or yield-generating assets for agreements, further increasing capital utilization. At the same time, these high-yield assets are expected to provide yield returns far over private credit and U.S. bonds, attracting more traditional institutions and investors into the chain finance space.

- The Rise of New RWA Stablecoins: In 2025, RWA asset-based stablecoins are expected to see significant growth. New stablecoins, represented by Usual.money, will be directly linked to U.S. Treasury Bills or other RWA-yielding assets, providing holders with an automatic dividend mechanism to realize higher holding returns.

- Diversification of Financial Institutions and Stablecoins: In 2025, stablecoin issuers will become more diversified, with traditional financial institutions (e.g., JPMorgan Chase, Wells Fargo) and fintech companies likely to enter the field, launching customized stablecoins based on RWAs for use in cross-border payments, lending, trade settlement, supply chain finance, and other scenarios.

1.3 Continued Development and Innovation in Decentralized Finance (DeFi)

The decentralized finance (DeFi) market maintained a steady growth momentum in 2024, with the total value lock-in (TVL) showing a steady upward trend. Mainstream DeFi protocols have significantly improved user experience through continuous upgrades in technology and products. Meanwhile, innovation tracks have emerged in the market, such as LRT (repledged liquidity) and innovative protocols such as Ethena and Usual.money, which have excelled in providing real returns and optimizing asset liquidity. These innovations have enriched the DeFi ecosystem and provided users with more diversified financial options.

By 2025, the DeFi market is expected to witness greater maturity and diversification. The following trends and innovative directions are worth watching:

- Asset Liquidity and Real Returns Capture: improvements in cross-chain bridges and interoperability protocols will enable users to easily migrate assets and operations across multiple blockchain networks, enhancing the liquidity of crypto assets. Meanwhile, RWAs will continue to be introduced into the DeFi ecosystem as a high-quality collateral type, providing a more stable revenue stream for the DeFi protocol and attracting funding from traditional financial institutions.

- AI Agent-driven update: With the development of AI Agent technology, more intelligent and autonomous DeFi applications are expected to emerge. For example, on-chain intelligent trading agents and automated strategy execution tools will help users achieve intent-based operations, provide more intuitive user interfaces (UIs) and user experiences (UXs), and significantly reduce the learning curve and operational thresholds for users to enter the DeFi market.AI Agents can play a role in the areas of user asset management, risk hedging, and return optimization, providing users with personalized financial solutions, driving mass adoption of DeFi products.

- Driven by regulatory compliance: After the Trump administration took office, the DeFi sector’s long-standing regulatory gray area is expected to improve due to its pro-cryptocurrency stance. In 2025, a clearer policy framework is expected to be introduced in the U.S. to facilitate DeFi compliance. This regulatory compliance will lead to the return of DeFi and Web3 to the U.S., further broadening DeFi’s user base and bringing more traditional capital inflows to the market.

- Convergence of DeFi and CeFi: Regulatory clarity will attract more traditional financial institutions to participate in the DeFi space, and large financial institutions and fintech are likely to launch hybrid financial products that combine the DeFi protocol with traditional financial instruments to satisfy institutional users’ dual needs for transparency and profitability.

1.4 The Meme Sector Continues to Explode

The development of meme launch platforms, transactional BOTs, and ticker tools, led by Pump.Fun in 2024, has fueled the meme boom and made MemeCoin one of the key tracks in the crypto market. The MemeCoin track, with its unique cultural consensus and community drive, is no longer limited to short-term speculation but is gradually forming one of the crypto market ecosystems with long-term appeal.

The MemeCoin track is expected to continue its strong growth momentum in 2025 with the following major trends and changes:

- MemeCoin Track Total Market Capitalization Growth: The total market capitalization of the MemeCoin track is expected to grow from the current $1,000+ billion to $1 trillion, increasing its market capitalization share in the overall crypto market from the current 2.4% to 8–10%, making it an important part of the crypto market.

- Rise of the Head MemeCoin: 1–2 MemeCoins are expected to surpass $100 billion in market cap (currently only DOGE and SHIB have the potential to compete), 5–10 MemeCoins are expected to surpass $10 billion, and 10–30 MemeCoins are expected to enter the Top 100 crypto market cap list (compared to the current 9), further cementing their position in the crypto market. 30 enter the Top 100 crypto market capitalization charts (compared to the current 9), further solidifying their position in the crypto market.

- Diversified narrative-driven: MemeCoin will no longer be limited to simple modal-driven and short-term speculation, but may combine with Decentralized Finance (DeFi), NFT, AI technology, etc. to expand the narrative space and application scenarios.

- More investors’ participation and purchase: In addition to retail investors, more venture capital firms, institutional traders, and traditional financial institutions will participate in MemeCoin investment and trading.

- Expansion of the MemeCoin community: The MemeCoin community is expected to continue expanding, with its distinctive cultural identity and strong market consensus gaining increased recognition among investors. MemeCoin’s robust user loyalty and inherent social dynamics will provide these projects with sustained vitality and growth potential.

1.5 Decentralized Science (DeSci)

In 2024, the Decentralized Science (DeSci) track saw growth due to landmark events such as Binance Labs’ investment in BIO Protocol and a16z’s lead investment in AminoChain, attracting the attention of several capitals and investors.

Looking ahead to 2025, the DeSci track is expected to show significant trends and innovations in research funding allocation, organizational forms, and interdisciplinary collaboration, driving the democratization of research and open access to scholarship, with the following trends expected to dominate the track:

- Emergence of DAOs focusing on different fields: As the DeSci track matures further, more DAOs focusing on specific academic research directions (e.g., medical and health, environment and climate, basic science, quantum computing, new materials, etc.) are expected to be established one after another. These DAOs will pool funds and talents through a decentralized model to improve the efficiency of scientific research and the success rate of translating findings into practical applications.

- Decentralized Research Funding and Resource Sharing Mechanism: DeSci will use blockchain to realize the transparent allocation of research funds and reduce the problem of misuse of funds and resource waste in the traditional research system. At the same time, these on-chain platforms will facilitate the global sharing of research data, equipment, and experimental tools, significantly lowering the threshold for research and facilitating research collaborations between different regions.

- Innovation of research process: Through the combination of blockchain technology and DAO, DeSci track will redefine the entire research lifecycle, from problem formulation, fundraising, and research execution, to results verification and commercialization, each step can be completed on the chain, thus improving efficiency and reducing human intervention.

- Capital Market Expansion: More VCs, sovereign funds, and large corporations will invest in DeSci projects, driving the flow of capital from traditional research to decentralized research ecosystems. DeSci can also support the tokenization of research results (e.g., patents, academic papers, and experimental data) to enable them to circulate in the secondary market and enhance the economic incentives for researchers.

1.6 Decentralized Physical Infrastructure Network (DePin)

The Decentralized Physical Infrastructure Network (DePin) track achieve significant growth in 2024, focusing on areas such as decentralized wireless networks, shared economy infrastructure, and edge computing.DePin, by combining blockchain technology and IoT devices, drives the development of low-cost, high-performance physical infrastructure networks.

Looking ahead to 2025, the DePin track is expected to continue to thrive with the following notable trends:

- More Verticals Covered: DePin Economy will expand to include more verticals, such as Energy Management, Logistics and supply Chain, Smart Agriculture, and Transportation Infrastructure.

- DePin Network Ecosystem Expansion: More DePin tracks and devices will be deployed, creating low-cost, high-coverage IoT globalization coverage and multi-protocol convergence.

- Real demand-driven and emerging business expansion: The outbreak of AI Agent and DeSci will jointly promote the demand for DePin resources. DePin, through its decentralized devices and network, provides a lot of support for AI Agent/DeSci, including crowdsourcing of human resources, device sensor data, and physical resource requirements, which makes DePin’s demand scenarios more concrete and visualized.

1.7 App Chain Layer 1

In 2024, App Chain Layer 1 (App Chain Layer 1) performed well in the market, with success stories including Hypeliquid’s high market buzz, Uniswap’s launch of Unichain, and the business growth of dYdX’s App Chain. These projects demonstrate the great potential of the application chain model for performance optimization, user experience enhancement, and economic model innovation, setting the stage for growth in 2025.

In 2025, application chaining Layer 1 is expected to enter a full-blown phase, with the following major trends to watch:

- Deployment of more application chains: The successful operation of Hypeliquid and Unichain has provided a demonstration effect for other projects, incentivizing more projects with stable business models and user traffic to design and deploy proprietary application chains. These newly deployed application chains will focus on optimizing specific business scenarios (e.g., high-frequency trading, decentralized lending, liquidity provision, etc.), improving overall performance, and bringing higher profitability and governance flexibility to the project ecosystem.

- Diversification of Application Chain Ecosystem: Application Chain Layer 1 will gradually expand from focusing on a single function (e.g. trading, lending, Liquidity) to a comprehensive ecosystem that covers multiple functions, including cross-chain payment, NFT ecosystem, DeFi service, and other comprehensive functions. More application chains targeting specific industries (e.g. healthcare, supply chain, entertainment) are expected to emerge to meet industry-level decentralization needs.

- Maturity and popularization of technology stack: The development technology stack of Application Chain Layer 1 will be more mature, and the modular blockchain development tools and RaaS services will provide one-stop services (including node management, sequencer configuration, and data storage support) for application chain developers, which will significantly reduce the development cost of the application chain, and attract more developers and small and medium-sized projects to join it.

1.8 Consumer Crypto + PayFi Innovation

In 2024, crypto payments and consumer crypto products made significant breakthroughs globally, especially in cross-border payments, B2C consumer scenarios, and B2B payment solutions. With payments and cross-border remittances on the stablecoin chain totaling more than $5 trillion, stablecoin has become an important tool for payment settlements. We have also witnessed the success stories of Travala, a cryptocurrency-friendly travel booking platform, that exceeded $100 million in annual revenue, and Blackbird, a restaurant rewards app platform, that combines Web3 with the restaurant industry.

Lily Liu, President of the Solana Foundation, presented the PayFi concept at the Web3 Carnival in Hong Kong, creating an on-chain financial marketplace centered around the Time Value of Money, providing a theoretical foundation for future crypto payment models.

In 2025, crypto payments and Consumer Crypto, as well as PayFi innovations, are expected to see significant growth and 2 major trends:

- Innovations combined with Web2 business scenarios: stablecoin-based PayFi innovations and Consumer Crypto APPs will continue to increase, gaining adoption by more regional users, and several explosive products will emerge to ignite the market. These innovations will be centered on Web2’s specific scenarios such as food, clothing, housing, and transportation, using Web3’s Token economic incentive system to build Web2’s user loyalty program and behavioral data incentives, advancing business development and promoting the mass adoption of Consumer Crypto.

- Web3 Payment Popularization: More cross-border payment companies, fintech enterprises, and B2B payment solution providers will enter the Web3 payment market, promoting wider regional and global applications and accelerating the popularization of Web3 payment and the explosion of applications.

1.9 NFTs and the Comprehensive Development of Digital Art

The overall NFT market and volumes are recovering but far from exploding in 2024, thanks to the further adoption of NFT technology by brands, corporations, and organizations, the continued operations and innovation of blue-chip NFTs, and the development of AI-based generative art.

Looking forward to 2025, the NFT market is expected to witness explosive growth on multiple fronts, mainly in the following directions:

- Token Go-Live for Large NFT Projects: In 2025, major NFT platforms, including OpenSea and other blue-chip NFT projects such as Azuki and Doodles, are expected to launch native tokens (Tokens) one after another. These tokens may be used to reward holders, incentivize community participation, and serve as payment tools within the platform. The Token launch will not only increase market liquidity but will also attract more new users and capital inflows, which will stimulate the rebound of the NFT market.

- Full penetration of NFT in art and entertainment: In 2025, NFT will continue to lead the way in digital artwork and further penetrate the traditional art market. Artists, creators, brands, and others will publish and sell artworks, digital rights, limited edition content,t and more through the NFT platform. In addition to artwork, NFT will also expand into virtual fashion, sports collectibles, and gaming assets.

- NFT-driven cross-border cooperation and brand marketing: In 2025, NFT will not only be the norm in the art and entertainment world but will also lead to new trends in cross-border cooperation and brand marketing. Industries such as luxury, automotive, and FMCG will jointly launch digital goods or co-branded limited editions through NFT technology, expanding brand influence and attracting a new generation of consumers.

- Deep integration of NFT with real-world assets (RWA): In 2025, NFT will expand from purely digitized collectibles to digital transactions of real-world assets RWA. Physical assets such as real estate, commodities, and intellectual property IPs will be digitized through NFT and traded, verified, and transferred on the blockchain through smart contracts, enhancing their liquidity and market transparency.

1.10 The Rise of Enterprise Blockchain Applications

Over the past few years, the blockchain industry has experienced the process of conceptual speculation to being adjusted and gradually verified by the market, and blockchain has not only had some applications in the financial and digital asset fields but has also been piloted and adopted in enterprise-level applications. It is expected that in 2025, the development of blockchain technology in enterprise-level applications will enter a mature stage, and enterprise blockchain solutions will expand from pilot projects to large-scale industry applications, covering supply chain management, cross-border payment, financial technology, and other fields, and promoting the digital transformation of traditional industries.

- Optimization of supply chain management and logistics: the application of blockchain in supply chain management will greatly enhance data transparency and traceability. In 2025, more and more enterprises will adopt blockchain solutions to optimize their supply chains and drive transparency and intelligence in the global supply chain, thus reducing fraud and information asymmetry.

- Deepening cooperation between blockchain and the financial industry: cooperation between blockchain and traditional financial institutions, especially in the areas of payment, cross-border settlement, and asset management, will become an important trend in 2025. Financial institutions will work with blockchain technology companies to develop digital asset management tools, decentralized payment networks, and enterprise-level blockchain solutions to drive the financial industry’s digital transformation. Banks and insurance companies may use blockchain technology in smart contracts, supply chain finance, and digital identity authentication to improve transaction efficiency, reduce operational costs, and strengthen risk control.

- Industry Integration and Cooperation: In 2025, with the underlying blockchain infrastructure’s improvement and the market’s gradual maturation, the blockchain industry will further integrate with traditional industries. Industry integration and cross-industry cooperation will drive the full popularization and commercialization of blockchain technology. We will see more acquisitions and mergers and acquisitions (M&A) within the industry, cooperative models between blockchain projects and traditional enterprises, and cooperative trends between blockchain projects.

2. Market Risks and Challenges

As the crypto market is poised for significant opportunities in technological innovation and the expansion of application scenarios in 2025, it simultaneously faces a range of complex and critical risks. These challenges include market volatility, technical security vulnerabilities, and uncertainties surrounding regulatory and legal compliance. Below is an analysis of the key risks that may impact the crypto market and strategies for addressing them effectively.

2.1 Altcoin Market Volatility and Risk

One of the crypto market’s most distinctive features is its high level of market volatility compared to traditional financial markets. This volatility has frequently resulted in large losses for investors over the past few years, and in 2025, while the crypto market will continue to grow in size, market volatility will remain a risk that cannot be ignored.

For BTC and ETH, there will still be a steady inflow of OTC funds with the passage of ETF funds, and many Web2 institutions and companies will add Bitcoin as a capital reserve, so there is no shortage of liquidity for them.

The real lack of liquidity in the market is in torrents. With the wide variety of torrents and the constant emergence of new projects that will distract the market and the flow of funds, coupled with the continuation of the AI Agent and Meme tracks, it is expected that the liquidity of torrents will not fundamentally improve, but rather be further siphoned from its liquidity.

The lack of liquidity is a serious test for many cottage coin project parties. They need to reassess their development model and avoid relying solely on the short-term wealth effect brought about by “pulling the plate.” Instead, they should focus on actual value creation, business model optimization, and innovation.

Individuals and institutional investors should remain rational and avoid over-concentrating their investments in the Altcoin market. By setting stop-loss points, diversifying investment portfolios, and focusing on projects with real value support over the long term, losses due to market fluctuations can be effectively reduced.

2.2 Technology and security risks

As crypto market technology continues to evolve, technology and security issues remain one of the key risks facing the crypto market. From vulnerabilities in smart contracts to hacking of trading platforms to governance issues in decentralized applications (DApps) and the complexity of cross-chain and decentralized networks, technical and security challenges threaten the stability of the crypto market constantly.

In 2025, as blockchain technology continues to be deeply applied and integrated with the real economy, technical security issues cannot be ignored. Project parties and exchanges need to strengthen smart contract security auditing and testing and use multiple signatures, cold wallet storage, and secondary identity verification in asset management to enhance security and prevent potential risks. Investors need to raise security awareness, encourage the use of hardware wallets, enable dual identity verification, and be wary of phishing attacks.

2.3 Regulatory compliance and legal risk

Regulatory compliance issues in the crypto market are one of the key factors in the development of the global crypto industry. 2025 is expected to face tighter regulatory compliance frameworks from governments and regulators as blockchain technology continues to be deeply applied and integrated with the real economy and industries, especially in RWAs and stablecoins, crypto payments, and DeFi finance.

Thanks to Trump’s rise to power, nominated SEC officials, and pro-crypto stance, the market is shaping up to be more digital asset-friendly. A more crypto-friendly regulatory framework for cryptocurrencies is expected to be rolled out in the U.S., including tax transparency, classification definitions for securities and commodities, and strengthened anti-money laundering (AML) and counter-terrorist financing (CFT) measures.

Meanwhile, as the regulatory compliance environment in the crypto market continues to evolve, countries around the world will gradually establish clearer regulatory frameworks to cope with the rapid development of the crypto industry. Convergence of global compliance standards, innovations in regulatory technology, and deepening cross-border regulatory cooperation will further drive the standardization of the crypto market in 2025.

As the regulatory environment gradually clarifies and matures, 2025 will be a turning point for the crypto industry. Companies will need to make the most of compliance opportunities along the way to meet the dual challenges of technology and the market and achieve sustainable development and long-term growth.

Conclusion and Outlook

In 2024, the crypto market has demonstrated remarkable adaptability and resilience while experiencing multiple tests of technological innovation, market adjustments, and regulatory hikes. Despite the complex macroeconomic environment, technological innovations, ecological layouts, and capital flows within the industry continue to drive progress in the crypto industry. Tracks such as decentralized finance (DeFi), NFT, AI, and Web3 applications have gradually moved from “proof of concept” to practicality and commercialization, and the upgrading of infrastructure and the landing of diversified applications have laid a solid foundation for the long-term development of the industry.

This year is not only a critical stage for the crypto industry to optimize its own mechanism and explore cutting-edge technologies but also a turning point for the market to seek breakthroughs. From the approval of spot Bitcoin ETFs to the deep integration of AI and blockchain technology and the rise of RWA (Real World Assets), the market has demonstrated strong technological progress and application expansion capabilities. These changes have not only injected new growth momentum into the industry but also provided clearer guidelines for the future direction.

Looking ahead to 2025, the crypto market will move towards a more mature and robust stage. With advances in smart contracts, cross-chain technology, Layer 2 scaling solutions, and decentralized governance tools, the scalability and efficiency of blockchain technology will be greatly improved, driving the popularity and commercialization of decentralized applications (DApp). At the same time, crypto technology will integrate more deeply with the real economy, and in addition to the financial industry, it will achieve wide application in the supply chain, digital copyright, healthcare, education, and government governance, supporting the digital transformation of the global society.

At the same time, increased market compliance and regulatory transparency will steer the industry toward healthy and sustainable development. It is expected that major economies around the world will further clarify the regulatory framework for crypto assets in 2025, and the crypto industry will take important steps on the road to standardization and legitimization.

As a key participant in the Web3 ecosystem, Web3Port will continue to be committed to driving innovation and prosperity in the industry. Through the dual-drive model of Labs and Foundation, we will provide Web3 entrepreneurs and developers with financial support, technology acceleration, resource links, and strategic guidance. We believe that these efforts will help foster more breakthrough innovation projects and drive the global Web3 ecosystem to a higher level.

In 2025, we look forward to working with more industry partners to address market challenges, seize development opportunities, and help the crypto industry move toward a more open, inclusive, and innovative future.