Recently, after learning about RWA, I once again felt the huge impact of defi on the financial world. Whether it is on or off the chain, defi plays an important role.

What are RWAs?

RWA, Real World Assets (RWAs), refers to physical assets that can be tokenized and represented on the blockchain. Examples of RWA include real estate (house and leasehold streams), loans, contracts and guarantees, and any high-value items that will be used in transactions.

The idea and operation of RWA are not new. The combination of off-chain and off-chain finance was mentioned and tried last time in 2017–2018. At that time, the concept of on-chain assets including real estate, luxury goods, and content copyrights was discussed, but there was not much noise at that time, and nothing happened later.

RWA can be understood more simply as that assets on the chain are invested off-chain and earn income; or assets off-chain are put on the chain in some form to obtain economic benefits on the chain.

Defi is an early way of combining on-chain and off-chain finance, but the current defi users are mostly individual players with small assets; with the in-depth promotion of RWA, traditional finance and off-chain large assets have begun to go on-chain, stirring up the encryption market together and re-promoting the development of the Defi ecosystem.

What is the value and significance of RWA?

The biggest advantage of Defi is that users who are rejected by traditional finance can participate in financial activities, so that everyone can enjoy financial services; in addition, defi decentralization and contract execution prevent users from being charged excessive intermediate fees and service fees by traditional financial service institutions, and complete the entire financial mortgage lending process through smart contracts to obtain fair and just benefits.

Put physical assets on the chain and tokenize them, so that offline financial users can realize liquidity and increase income through defi on the chain.

With the deepening of the cyclical bear market of cryptocurrencies, the liquidity of the DeFi market is also affected; some data show that the total TVL on each DeFi chain in 2023 has dropped by more than 70% from the historical high;

The rise of RWA can provide defi with sustainable, reliable income supported by traditional asset classes; at the same time, it will make defi more compatible with the external market, thereby bringing greater liquidity, capital efficiency and investment opportunities.

It can be said that RWA is an important bridge between traditional finance and defi, and it is also an important attempt for the encryption market to continue to find new liquidity as the bear market deepens.

What are some popular RWA projects?

There were discussions about RWA in the market a few months ago, and some big organizations have also tried the RWA track.

From the rootdata platform, you can see different project introductions and ecological backgrounds of the RWA track, including different investment methods such as defi, NFT, real estate, and bonds.

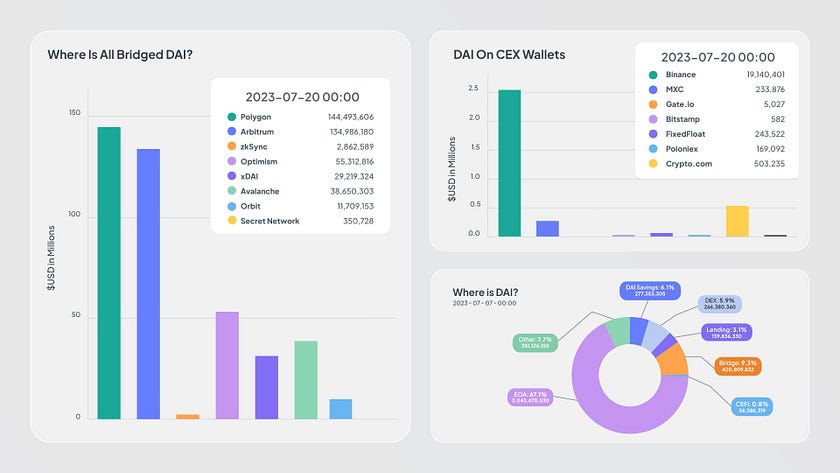

For example, the on-chain U.S. bonds issued by the established defi brand MakerDAO (MKR), and the stable currency DAI issued by it, are currently one of the common use cases for RWA.

MakerDAO adopted proposals for RWA as collateral in the form of tokenized real estate, invoices, and receivables in 2020 to expand the issuance of DAI. Several RWA vaults have been set up successively, most of which are used to purchase and invest in U.S. bonds.

Since June, MakerDAO has successively purchased more than $1.2 billion in U.S. bonds through BlockTower Capital and Monetalis Clydesdale Vault. The funds mainly come from Maker’s over-collateralized stablecoin DAI.

By purchasing short-term U.S. Treasury bonds, MakerDAO made a profit of $8.32 million in June, compared with $5.48 million in May and more than $3 million before April. With the increase in income and profits, the DAI deposit interest rate was raised from 1% to 3.49%, an increase of more than 3 times.

In addition, Goldfinch is also one of the popular projects on the RWA track, and has completed financing of 37 million US dollars.

Goldfinch mainly provides loans to debt funds and financial technology companies, provides USDC credit lines for borrowers, and supports converting them into legal tender for borrowers.

Goldfinch’s model is very similar to traditional financial banks, but with decentralized auditors, lenders and credit analysts, and its auditors who audit borrowers must have pledged governance tokens GFI.

The yield that Goldfinch can provide is very high, because of the low mortgage threshold, Goldfinch borrowers can pay 10–12% interest rate.

Some data predict that by 2025, the RWA market size will reach 350 billion U.S. dollars, while the current market value of BTC is more than 570 billion U.S. dollars.

The encryption market often has new narratives, and sometimes the next trend is brewing, and sometimes it is only a short-lived enthusiasm.

Regarding the future of RWA, no one knows what kind of opportunity it will be.

If you have spare time, pay attention to it, understand its concept and mode, and the popular projects on the track; combine your own gameplay, follow or not, you can understand first so that you will not be left behind too far.

The above is just my personal opinion, no investment advice. I’m Chuxiaolian, and I’m paying attention to Metaverse and web3.