by ROUTE 2 FI

One of the hardest things to do as a trader is to ignore the PnL, and focus on % gain/loss instead.

Let’s say you have 100 ETH.

At a price of $2k per ETH, an increase from 2000 to 2050 will result in a $5,000 increase of your ETH stack. The funny thing is that this can happen within one minute. Not many weeks ago, $ETH increased by 4% in a 1-minute candle. This is equal to a move from 2,000 to 2,080 (+$8k).

But this could easily happen in the other direction too. The reason I’m talking about this is because crypto has huge swings (volatility). +/- 2% in the price is normal during a 24h period. If we go back to our example again, this is the same as +/- $4,000 per day.

According to Ansem’s poll, 50% of you live on less than $2,000 per month, and 72% of the people spend less than $5k monthly.

Seeing a PnL that swings like this on a daily basis could fuck you up mentally. That’s why you should focus on the % in itself, and hide the PnL. If you ever want to scale and go bigger this is a necessity.

Because if you go around and think that “Oh, today I lost 2 months of spending”, you will automatically be afraid and not daring to take risks. You will protect your downside, but you will sure as hell limit your upside also. This is of course not financial advice, but if you’re bullish on crypto for the next 12-18 months, I think it will be a no-brainer to take calculated risks going forward. You need to dare to see your % go down in order to make it big. There are no rewards without risks, and always being sidelined is not the strategy either.

You might remember my probability analysis, but if not, let’s look at it again.

Crypto is a game of probabilities, but most people treat it as gambling

Let’s do a very simplified exercise to illustrate how you can get +EV (positive expected value) on your bets.

Think about $BTC long-term and let’s make 4 scenarios:

I. $BTC will reach new ATH this year

II. $BTC will continue sideways in 2023, but make ATH in 2024/2025

III. $BTC has played its role, it will go down and stay there

IV. $BTC will go lower this year, but make ATH in 2024/2025

Now, let’s make some probabilities for each outcome:

I. Probability: 10%

II. Probability: 40%

III. Probability: 20%

III. Probability: 30%

$BTC is sitting at $30K at the moment.

What would be the best trade right now given the 4 scenarios?

I. Buy

II. Buy

III. Sell

IV. Buy

Buying is the best outcome in 80% of the scenarios.

I. 10% probability for a 135%+ upside

II. 40% probability for more than 135% upside long-term

III. 20% probability that $BTC will never come back

IV. 30% probability that we will lose money short-term, 135%+ upside for making money long-term.

For III you could make an invalidation point of let’s say 20%. In other words, you sell if $BTC goes below $26K

Summarized, you have an 80% probability of a 135%+ outcome and a 20% probability of a 20% loss.

Worth the risk, right?

This was a very simplified example.

You might disagree with the scenarios and the probabilities, I just wanted to show how you could think in bets.

If you want to learn more about this, check out this great Substack article by @cobie which inspired me:

So how can you get rid of your small thinking?

Most people that play the markets are short-term thinkers. It makes sense – they were likely attracted to this game by the allure of making a lot of money. Short-term thinkers tend to be more emotional.

They are the people who get bearish at support and bullish at resistance. People who can play the long game are the ones who tend to perform best.

I tend to believe that if you have a backup income or set aside some money so that you will survive eg. 12 months if you were to lose everything, you can afford to take bigger risks than if you play with money you can’t lose.

Ask yourself if you’re better to protect your capital or to risk your capital.

HighStakesCap (that made several hundred million in the last bull run) illustrated this perfectly with this tweet:

Personally, I’d definitely feel better about nr. 2, but extremely high IQ people, extremely low IQ people, and degens that have been trading for a long time may be able to completely turn off their emotions and bet big without the fear of losing.

Also having an obsessive-compulsive personality or mildly autistic traits are probably not a disadvantage.

As a trader, you need to know your strengths and weaknesses.

To start with myself I think my strengths are intuition, discipline, and good reading market movements. However, my weakness is that I often end up taking profits way too early (earlier than my plan, and in other words ruining my PNL). This has some negative consequences.

Let’s say my risk/reward for a trade is 1:2 (that means I risk losing 1 unit if I am wrong, but if I am right I win 2 units). Only taking trades like this should be a winning strategy in the long run (if your judgment of a 1:2 trade is correct obviously).

But to explain more about an error I make quite often, especially in scalp trading, let’s look at the current example:

Example

Let’s say you take a scalp 1:2 trade on $ETH, 2% SL, 4% TP, risking 1% of your total bankroll. Position size: Risk % / Distance to SL % = 1/2 = 50%.

Let’s say your portfolio is $100K.

You buy $ETH for $50,000, which is equal to 50% of your portfolio.

But you’re only risking 1% because your stop loss is 2%.

Confused?

You bought $ETH for $50,000. If $ETH goes down 2% ( $50,000 x 0.98) = $49,000.

It means that you have lost $50,000 – $49,000 = $1,000 which is equal to 1% of your initial $100,000.

In other words, your bet was 50% of your portfolio, but there was only 1% of the portfolio that was at risk.

A rule of thumb is to have a max. risk of 1-3% of your total portfolio.

Okay, back to one of my weaknesses that I tend to do often.

Let’s say I take the trade mentioned above, but out of boredom, I follow the trade closely. The trade starts deep underwater, let’s say that it at some point is -1.5% and I’m close to getting stopped. Then the trade turns around and it’s going positive and then crabbing around +0.5-0.7%. Because the trade started underwater my “fear system” alerts me and tries to convince me to secure some profit with the reasoning that I almost lost 2%, then I should secure at least some profits.

We react more negatively to a loss than positively to a similar gain. Likewise, we prefer steady gains instead of bigger lump-sum gains. This is called Loss aversion and is a very common bias to have among traders.

I find myself doing this as I said especially after being underwater at the start of the trade, and also if it’s late at night with the reasoning that I will sleep better if I close at breakeven, instead of sleeping badly knowing that I can lose (or win). But it is the potential loss I’m focusing on.

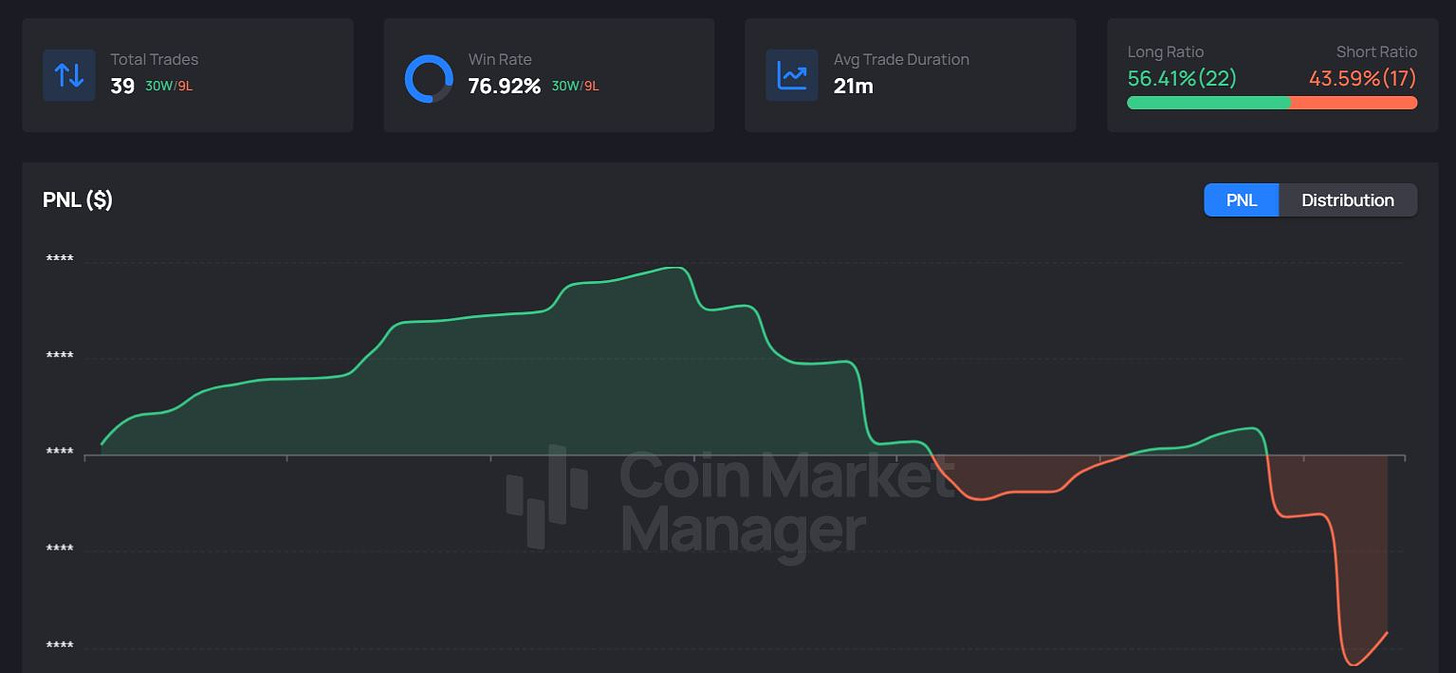

Let’s take a quick look at my scalp trading account below from the 1st to the 7th of January 2023 to illustrate what I mean.

I’ve taken 39 scalp trades during these 7 days. The win rate of 76.92% is pretty good, but that doesn’t help when my losses have been bigger than my gains.

Actually, I had 18 wins in a row and a perfect start to the year, but then my first loss came because I forgot to check funding. I ended up paying 2% to people who were in long positions. The position in itself actually ended slightly in plus, but since the funding rate was higher it’s shown as a loss, which is correct.

A little pissed off I wanted to make it back again quickly (yolo-mode), but just ended up losing for the rest of the day. Basically, a small tilt because I revenge-traded.

You can see on the chart that there are some small wins along the way after the first loss, but as I described earlier I became too defensive (I ended up taking profits way before my targets because I was so focused on not losing more). Unfortunately, I did the opposite of what you should do:

“Cut losers fast, let winners ride”.

I, on the other hand, cut the winning trades fast at a small profit and let my losing trades ride until I was stopped. It’s ironic because I knew exactly what to do, but I didn’t follow the plan. I let the psychology of my head get in the way of the psychology of trading.

The hardest thing about trading is not the math, the method, or the picking of the right coins. It is dealing with the emotions that arise with trading itself along with the ego’s need to be right.

Also, everyone tells you to forget about your portfolio alltime high, but you also need to forget about the coins ATH value (eg. $SOL at $259).

It is highly important that you reset your mind, especially if you got into crypto in the bull run.

Take $SOL again. It is still down 90% from ATH. It doesn’t feel like a great move if a coin that used to trade at $259, goes now from $24 to $36. Yet it did a +50%.

It’s all about psychology.

We are more willing to buy a token that is going up in price compared to buying it when it goes down.

And as a consequence, most people lose money in crypto…