by Jack Inabinet

We break down the potential impacts of ETH’s next big upgrade.

After 5 long months, Ethereum’s next major network upgrade is just around the corner!

The successful implementation of the Merge in mid-September meant Ethereum completed its long-awaited transition from Proof of Work to Proof of Stake, reducing energy consumption by 99.95% and ETH issuance by 88%.

Post-Merge Ethereum is secured by stakers, instead of miners, each posting 32 ETH as collateral for the ability to store network data, process transactions, and add blocks to the chain; stakers accrue ETH rewards for securing the network.

Termed “Shapella,” Ethereum’s latest hard fork includes two major upgrades: Shanghai – an execution layer upgrade, and Capella – a consensus layer upgrade. Together, the two will allow stakers to withdraw both accrued staking rewards and their initial 32 ETH node collateral.

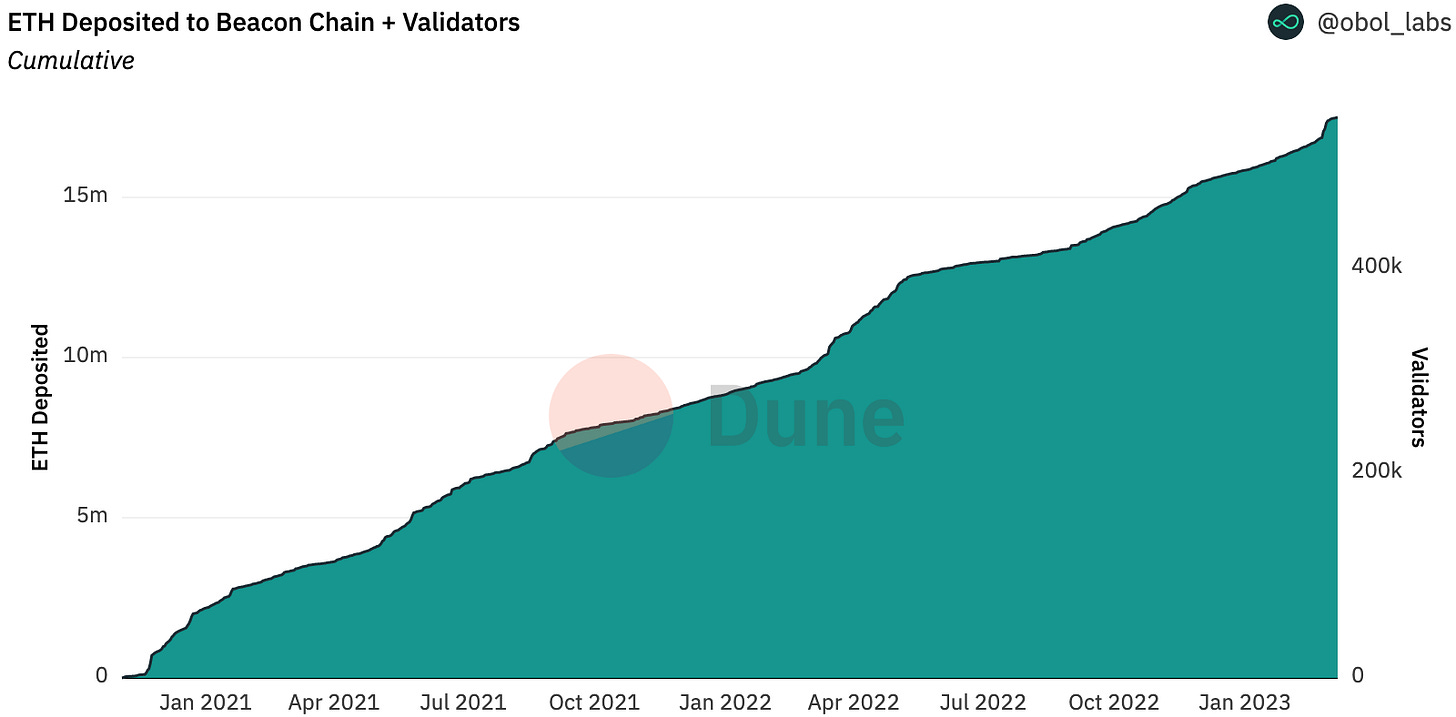

Ethereum’s validator count was one of crypto’s few up-only metrics during 2022, given the inability for existing stakers to exit the validator set. Over the past 30 days, the number of validators has increased by 6%!

Shapella alters the paradigm, presenting stakers the ability to withdraw both accrued rewards and their initial node collateral!

Today, we’re trying to answer the questions on every ETH HODLers’ mind…

How will Shapella impact price?

While I lack the clairvoyance to peer into the post-withdrawal future and provide certifiably correct answers for this question, I can certainly present the prevailing arguments in a digestible format, adding subjective commentary along the way!

Remember, anon: DYORing is your key to success in crypto! This article in no fashion should be misconstrued as financial advice, however I highly recommend you incorporate the information below into your thought process as you work towards objectivity and attempt to form a holistic view of the post-withdrawal Ether landscape.

Withdrawal Process

To predict the potential impact of withdrawals on Ether price, it is crucial to understand the withdrawal process itself.

Withdrawal Queue

For stakers looking to withdraw accrued staking rewards (a partial withdrawal), the process is automatic, with partial withdrawals also avoiding the exit queue!

The withdrawal queue will process a combined maximum of 16 partial and/or full withdrawals per block, starting with the first validator established, working towards the most recently established validator, before restarting the process again at validator 0, similar to the hands of an analogue clock.

With 547.1k validators at the time of analysis, this process would take a maximum of 4.75 days for all stakers to receive accrued staking rewards and for the withdrawal queue to loop. Assuming all validators upgrade to 0x01-type credential, in slightly under five days post-Shapella, over 1M ETH in Consensus Layer rewards will become liquid.

Exit Queue

Full withdrawals are subject to the withdrawal queue and an additional exit queue. A much narrower bore, at the current validator set size, 8 validator exits can be processed per epoch, with the number of withdrawals that can be processed in a given epoch decreasing by 1 for every 65,536 validators that exit the set.

Additionally, full withdrawals are subject to a delay period, which varies depending on if the validator was slashed, something intended to disincentivize malicious behavior.

Potential Outflows

Shortly after withdrawals are enabled, over 1M Ether accrued as Consensus Layer rewards will become liquid, representing the largest slug of potential ETH sell pressure.

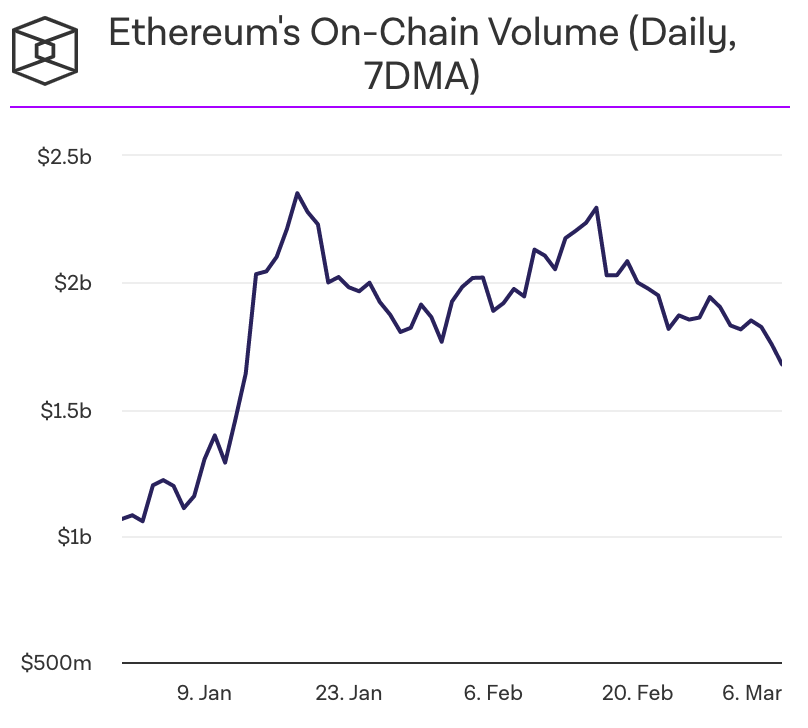

Data from The Block shows that on January 18th, seven-day moving average (7DMA) ETH exchange and on-chain trading volumes peaked at a combined $6.28B. At the time of analysis, 1M ETH is worth approximately $1.56B, representing slightly under 25% of the maximum 7DMA ETH trading volume.

With staking rewards becoming liquid over the course of 4.75 days, however, the maximum daily sell volume represents slightly over 5% of maximum combined 7DMA volumes.

It is worth noting, however, that withdrawal bulls may be discounting market illiquidity.

While the scenarios above contemplate trading volumes at 2023’s highs, we have also seen 7DMA moving average exchange and on-chain ETH trading volumes at a combined $2.43B.

Trading volumes have continued to trend downwards off of January 18th’s highs, and unexpectedly large post-Shapella rewards sell pressure could nuke the entire narrative that withdrawals are a net positive, causing apprehension in traders that may have considered bidding and creating a self-fulfilling, downward spiral prophecy.

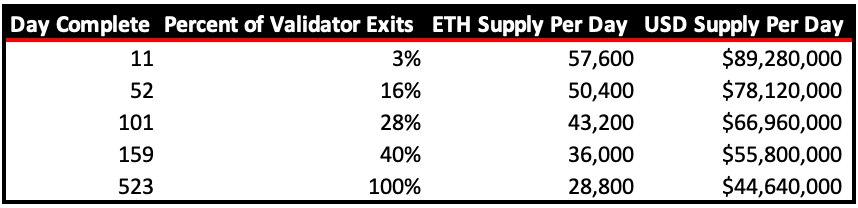

In terms of structural flows, after the initial 27-hour waiting period has passed – and assuming each validator has a balance of 32 ETH – a monstrous 57.6k of ETH is set to unlock daily for 11 days, reducing to 50.4k ETH over the next 41 days, and continuing to fall over subsequent months if continued staking outflows occur.

To put the magnitude of this supply into perspective, the heavily hyped Merge, while deflationary, has removed a meager 48k ETH since September 15: ETH burn is inconsequential compared to anticipated post-Shapella flows.

Operators

Not every staker is made alike.

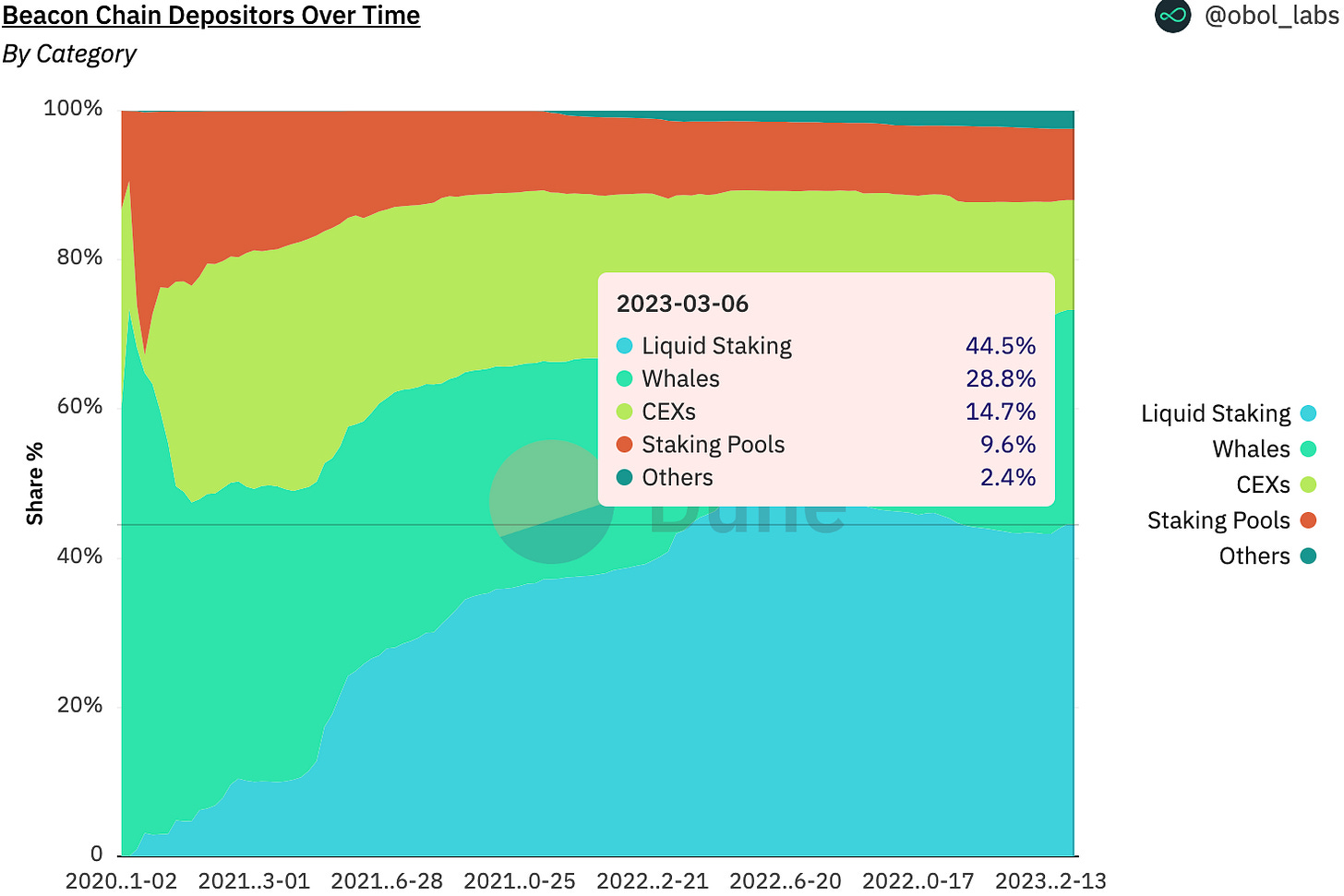

LSD HODLers are the least likely to sell: they have already had liquidity on their stake and accrued rewards have already been captured in the market prices of liquid staking tokens and have previously benefited from liquidity on their stake. Liquid staking protocols, inclusive of Coinbase, represent 44.5% of Beacon Chain depositors; slightly under half of the initial reward selling pressure has been reduced!

Some on CT have argued that staking pools and CEXs, representing an additional 24% of all staked ETH, have financial incentives to continue staking operations, and thus incentives to block withdrawals. However, it is possible that consumer demand pushes these providers to offer withdrawals of ETH, or risk damaging brand reputation while similar providers liquify stake.

Whales and “others” are more likely than fellow cohorts to view validating as a key part of providing security to Ethereum, rather than a financial investment and yield generation opportunity. An argument can be made that they are the least likely sellers.

While I buy the narrative that LSD validators represent the least likely source of sell pressure, it appears false that CEX, SaaS, and smaller staking operations are unlikely to be sellers.

Financial conditions have changed dramatically from when these individuals staked and stakers needing liquidity will become forced sellers. This belief that every category of staker is an unlikely seller is completely false and presents ETH HODLers with a false sense of security.

The Narratives

Some market commentators believe Shanghai has already been priced in. Nothing to worry about right, anon?

Crypto down on a bunch of FUD. Gox isn’t coming for many months. Shanghai is priced in. Voyager nearly done liquidating. Regulatory, worst likely behind us. Meanwhile we are making real progress towards a spot BTC ETF approval this summer. When do we start pricing that in? https://t.co/N9qYRp39gM

— Hal Press (@NorthRockLP) March 7, 2023

The reality?

The biggest threat to ETH price remains the unclear macroeconomic and regulatory backdrop crypto operates within. While Ethereum the network is making major technological progress, price action has yet to reflect this as a result of the risk-off environment many funds and individuals are operating within.

The depth and extent of sell pressure remains unknown and will be highly reflexive to negative macro or regulatory news!

Admittedly, this trade is significantly less crowded than the Merge trade, with ETH/BTC longs on Bitfinex falling a staggering 81.5% from September 15.

Remember the crypto echo bubble effect, however, anon.

Practically every article and source used to compile this report has had a definite bullish tilt. Crypto market participants who have stuck around are in-the-know and while that may help them be early to the next bull run, over optimism in the short-term can burn you.

Fresh blood is not waiting on the sidelines at the moment, waiting to ape your bags because they can earn a 4.6% yield on a risky asset with extremely high beta! Short duration treasuries have higher yields and minimal market risk!

To the average observer, the risk-to-reward in crypto does not exist; markets are no longer consumed with FOMO and instead making more “rational” decisions, especially with respect to crypto currencies and blockchain assets. Structural flows that make ETH burn look like the kiddy pool are about to come online and you don’t want to be caught on the wrong side of that trade.

Another common narrative floating around CT has centered around withdrawals being a major derisking point on Ethereum’s roadmap.

Despite widespread hype, this narrative may be just that: narrative. While withdrawals reduce the risk of staking in the long-term, I wouldn’t bank on sidelined capital waiting to hop into ETH staking immediately post-Shapella.

With the rise of LSD primitives, crypto players have already had the ability to liquify stake.

Additionally, I can almost guarantee the exit queue will be packed with depositors who will wait weeks, if not months, to withdraw staked ETH from the Beacon Chain. Not only have potential stakers had access to liquid staking alternatives prior to Shapella, but in some ways, instant liquidity offered by a competitive market may in fact be superior to the liquidity offered by withdrawals.

While marginal inflows to staking are anticipated, it remains doubtful that they will overtake withdrawals until the exit queue backlog begins to diminish.

Still, some of my fellow CToors have concluded that stakers in the money (validator enters the set at an ETH price below the current market price) are MORE likely to sell than stakers underwater.

Validator Segments

— korpi (@korpi87) February 7, 2023

I split the entire validator set into segments by two dimensions:

– Staker Category

– Profit Group

Reasons:

– Categories differ, e.g. solo stakers are less likely to sell than CEX stakers.

– Stakers in the money are more likely to sell than underwater ones. pic.twitter.com/YjP5VIOGQb

While this mental gymnastics may help reach a bullish post-Shapella conclusion, such claims appear ludicrous at face value. Solo validators and staking-as-a-service participants who staked ETH during the bull run are actually the most likely cohort to sell! Validators may be looking for liquidity, given worsening macro conditions, imbuing forced sellers with the sell button for the first time!

It is worth noting, however, that a validator being underwater does not necessarily correlate to the operator’s ETH bag being underwater, however, it can provide a useful approximation into the number of stakers whose ETH bags are underwater.

🏴 Takeaway

Pondering who sells or how much they are selling is a frivolous endeavor. It is likely that exit queues will be slammed with withdrawal requests for many weeks post-Shapella, resulting in the max outflows.

The true alpha rests in analyzing these flows.

Understanding seller incentives to selling and tracking changes in the staking landscape is key to unlocking the entire image. When the seller dynamics begin to change and the most fervent withdrawal groups begin to slow their exit from the set, your entry may be just around the corner.

Trying to frontrun a widely known event, where your expected payoff is fairly low is not a winning strategy. There is no reason to sell out of your ETH positions, however believing that you will achieve some insane multiple off the back of an inherently negative event by going long is not the most intelligent play.

Pick your spots, assess the risks, and, as always, DYOR!