Table of Content

1. South Korea Announces the Virtual Asset Accounting Supervision Guidelines

2. Key Points: 1) Presentation of Accounting Guidelines

3. Key Points: 2) Mandatory Disclosure of Annotation, including Circulating Supply

4. The United States Initiates Accounting Standards for Crypto Assets

5. Final Words

1. South Korea Announces the Virtual Asset Accounting Supervision Guidelines

The Financial Services Commission has issued the Virtual Asset Accounting Supervision Guidelines. These guidelines, reflecting input gathered through industry and expert meetings over the past 18 months, aim to offer investors and customers more transparent and consistent information on virtual assets. The main aspects include 1) clear accounting treatment guidelines, 2) mandatory disclosure of annotation such as token’s circulating supply information, and 3) enhanced disclosure of client assets entrusted to exchanges. While the guidelines are not new accounting standards, the press release emphasizes the possibility of violating accounting standards without reasonable supervision if not followed. It is anticipated that companies dealing with virtual assets will proactively embrace these guidelines. The U.S. and Japan are already proposing accounting guidelines based on their own standards, and this move is seen as the initial step toward establishing virtual asset accounting standards in Korea.

2. Key Points: 1) Presentation of Accounting Guidelines

Recognition of Revenue upon Fulfillment of Performance Obligations outlined in the White Paper

A significant aspect of the supervisory guidelines is the provision of accounting treatment guidelines, specifically outlining criteria for recognizing revenue from the transfer of virtual assets after “fulfilling all the performance obligations described in the white paper.” Issuers are mandated to clearly assess if they have met their performance obligations, with auditors tasked to scrutinize compliance closely. Unlike traditional businesses where the provision of services, goods, and payment receipt is evident, virtual asset projects require a meticulous evaluation to determine if performance obligations have been fulfilled. This may pose challenges, especially in the early stages when examples are limited. Moreover, throughout this process, it appears that not only the accounting and finance teams but also the business teams actively utilizing virtual assets will need more robust accounting and financial support compared to previous requirements.

Reserved Tokens Excluded from Asset Recognition

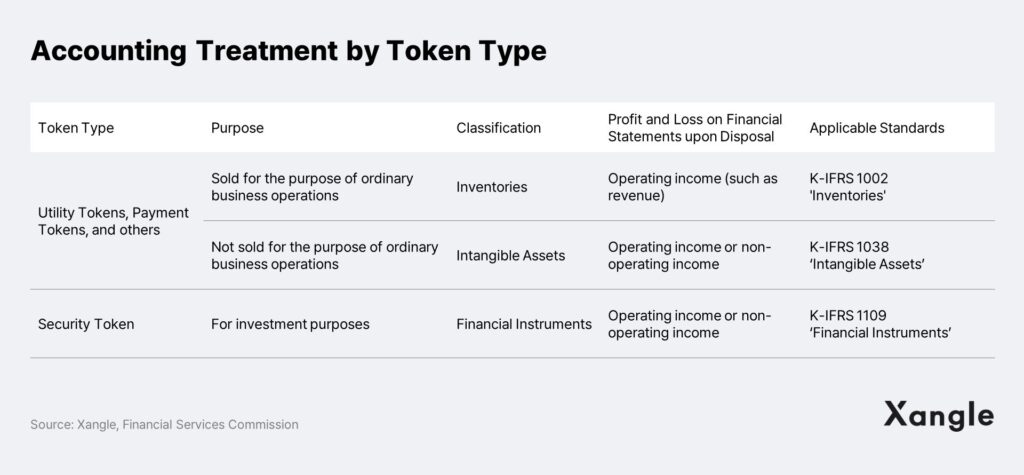

In addition to the revenue recognition criteria, regulatory guidance explicitly states that Reserve tokens held internally cannot be classified as assets. The rationale behind this directive is that undistributed reserve tokens, merely held by the issuer, lack measurable value as they do not generate economic benefits. Given that many projects follow tokenomics plans distributing reserved tokens gradually, recognition as an asset or liability is anticipated at the distribution time. In this scenario, both the quantity of reserved tokens and the distribution plan will carry accounting and earnings implications, necessitating transparent disclosure. The call for enhanced annotation disclosures, including details on circulating supply (to be elaborated in the next section), aligns with the same guiding principles. For entities acquiring virtual assets through non-issuer acquisitions, their categorization—whether as inventories, intangible assets, or financial instruments—depends on the acquisition’s purpose and whether the virtual assets meet the criteria for financial instruments.

In contrast to the draft released in July, it appears that feedback from auditors and accounting practitioners has been taken into account. The effective date has been postponed until 2024, and enhancements have been implemented to enable the use of aggregated site prices, like those from CoinMarketCap, in fair value measurements. This adjustment is a response to practical concerns, recognizing that an immediate implementation in 2023 would necessitate a preparation period and that incorporating price data from a single exchange among many could pose challenges.

3. Key Points: 2) Mandatory Disclosure of Annotation, including Circulating Supply

While presenting clearer accounting guidelines, the guidelines also emphasize transparent disclosure of information related to virtual assets. Notably, information crucial in the virtual asset market, such as the circulation supply, is now part of the obligation for disclosure in the annotations and is subject to external auditor scrutiny. The information required in the annotations encompasses 1) key details from the white paper (total supply of virtual assets and performance obligations), 2) the status of internal reserves and free distribution, 3) particulars of customer-custodial virtual asset contracts, and 4) custodial risks.

The financial authorities’ guidelines for enhancing commentary disclosure are anticipated to introduce disclosure obligations for virtual asset issuers in conjunction with the Enforcement Decree of the Act on the Protection of Virtual Asset Users, slated for implementation in July of this year. According to Article 9 of the Enforcement Decree, issuers are required to disclose data crucial for fair trade practices, aiming to prevent unfair practices and ensure transparency in investment decision-making. This includes information such as the total supply of virtual assets issued, circulating supply plans, and business strategies, all of which could significantly impact reasonable investment judgment or the valuation of virtual assets.

Ultimately, the momentum toward information disclosure is undeniable, and the requirement to disclose information, initially applicable when listing on a virtual asset exchange, is expected to extend to unlisted virtual asset issuers not subject to accounting audits. Moreover, it is anticipated that domestic exchanges and DAXA, as the entities tasked with response including potential delisting actions in the event of circulation volume issues, might align with the recently introduced accounting supervision guidelines and The Act on the Protection of Virtual Asset Users when addressing regulatory matters.

4. The United States Initiates Accounting Standards for Crypto Assets

The U.S. Financial Accounting Standards Board (FASB) has recently ratified ASU 2023-08, a new accounting standard addressing crypto assets*. Key modifications include 1) transitioning the measurement standard for crypto assets from cost to fair value, and 2) mandating companies to disclose information regarding their crypto asset holdings and transactions.

* Notably, NFTs, stablecoins, wrapped tokens, and self-issued tokens (e.g., FTT tokens issued by FTX) fall outside the scope of crypto assets.

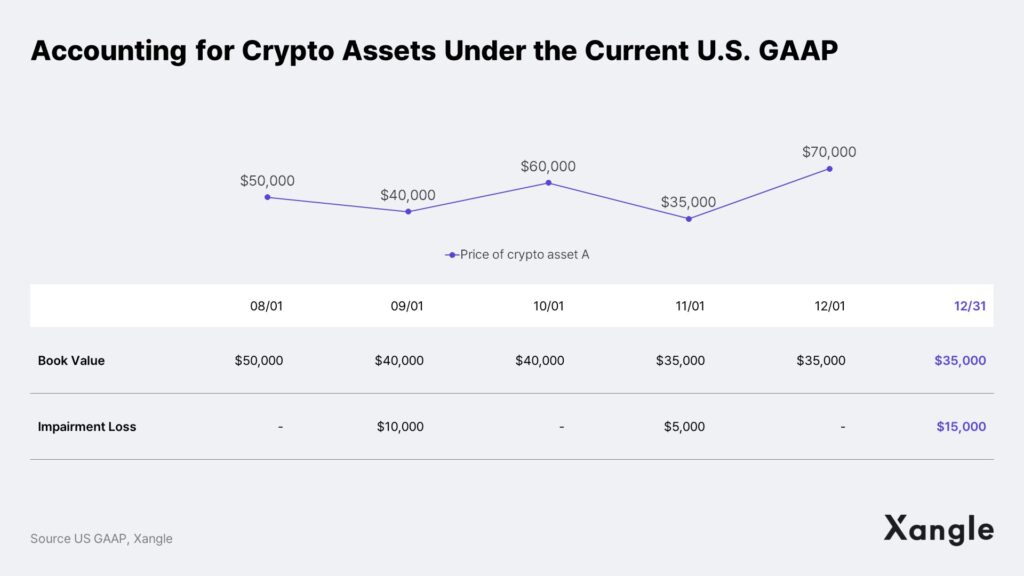

Under the existing U.S. Generally Accepted Accounting Principles (US GAAP), crypto assets are classified as indefinite-lived intangible assets. The cost model is subsequently applied, recognizing the book value as the amount after accounting for impairment losses post-initial recognition. However, the cost model presents challenges: 1) impairment losses impact profit or loss, recognized as operating expenses, and 2) gains and losses are only reflected as revenue upon asset disposal. This approach does not adequately capture the value of highly volatile crypto assets in financial statements (refer to the figure below).

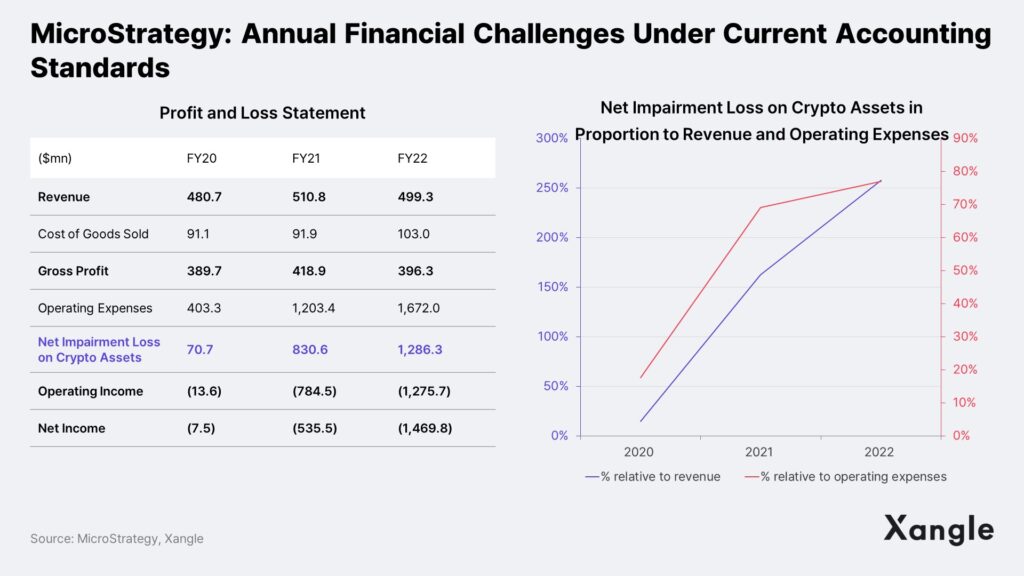

MicroStrategy, currently holding the largest amount of Bitcoin among publicly traded companies globally, has consistently reported substantial operating and net losses each year. The primary factor contributing to this underperformance is the surge in crypto impairment losses attributed to existing accounting standards. In fiscal years 2021 and 2022, MicroStrategy incurred annual crypto asset net impairment charges of $830.6 million and $1.3 billion, respectively, accounting for 69.0% and 76.9% of total operating expenses.

The recently enacted accounting standard, effective for fiscal years beginning after December 15, 2024 mandates companies to assess their cryptocurrency holdings at fair value quarterly. It requires them to recognize valuation gains and losses resulting from changes in fair value in net income. This marks a departure from previous practices, enabling companies to acknowledge gains and losses from fluctuations in cryptocurrency prices in their financial statements (refer to the figure below). This change has fostered two key conditions: 1) companies hesitant to invest in cryptoassets due to concerns about negative impacts on performance from declining prices can now actively engaging in crypto asset investments, and 2) companies holding crypto assets can now receive proper valuation.

However, the amendments did not incorporate accounting standards and disclosure obligations for crypto asset issuers. Given the fewer instances of U.S.-listed companies issuing crypto assets compared to Korea, the scope has not expanded to cover crypto asset issuers. Nevertheless, there is a growing recognition within the FASB about the necessity for accounting standards applicable to crypto asset issuers. Therefore, it is anticipated that future guidelines will be established, addressing issuers’ revenue recognition standards, the status of virtual assets held in reserve, and the disclosure of circulation information, similar to developments in Korea.

5. Final Words

Despite economic challenges, the cryptocurrency ecosystem is thriving, witnessing major Korean companies issuing tokens and venturing into the Web3 market through NFT businesses. Financial authorities appear to be proactive in keeping up with industry dynamics by proposing bills and regulatory guidelines. With a clear regulatory environment and well-defined guidelines, the cryptocurrency ecosystem is poised for increased transparency and expansion. This regulatory clarity may prompt even large companies, previously hesitant due to uncertainty, to reconsider entering the cryptocurrency business. Stakeholders, including issuers and auditors, are expected to benefit from the clarity of guidelines, making their tasks more manageable.

Overall, the introduction of regulations in emerging markets has the potential to attract more participants, fostering market growth.

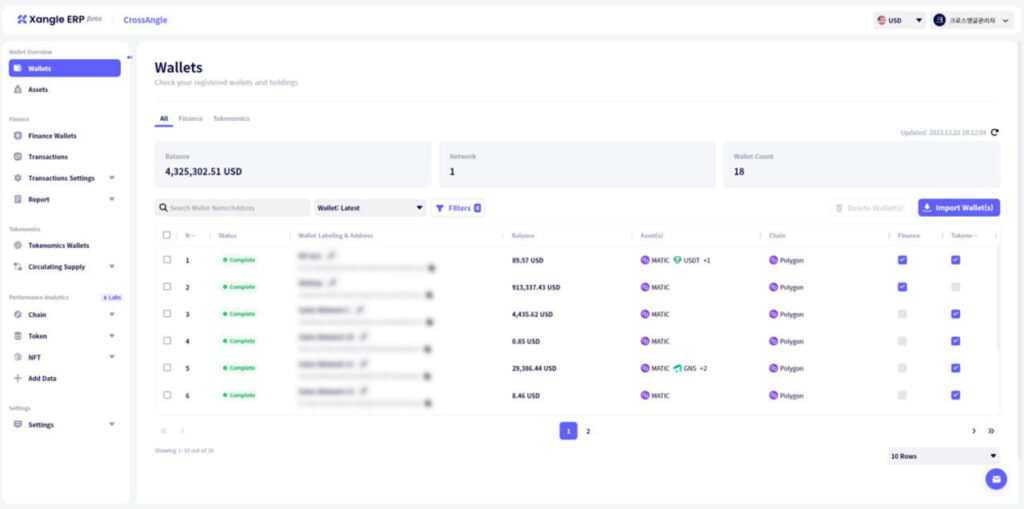

※ Xangle ERP Beta Version Now Available

Xangle has introduced Xangle ERP to tackle the complexities of accounting for virtual assets. Anticipated to significantly alleviate the workload for financial accounting teams, Xangle ERP offers convenient support for the emerging task of on-chain accounting. Moreover, it incorporates features for easily identifying circulating supply information, fulfilling commentary disclosure obligations, and managing circulating supply plans. This ensures agile responses to financial authority guidelines. If your project is interested in leveraging the service, please reach out to us at erp@crossangle.io, and we would be delighted to assist you in accessing the service for free during the beta period. We look forward to your inquiries.