Your bags may be suffering, but these five on-chain DeFi metrics are up-only!

Where is capital flowing in a post-FTX world? Curious about which projects have benefited from the FTX collapse? Searching for the light in the depths of crypto doom and gloom?

Then you’ve come to the right place!

⬇️ Today, we’ll unpack the answers to your questions, anon: just read on ⬇️

CEX Outflows

Rule #1: NOT YOUR KEYS, NOT YOUR CRYPTO!

It’s amazing how many people finally grasp the value of this core crypto tenet after a major catastrophe occurs. Too bad there is not readily available data on Ledger Nano sales because it’s certainly up only as well!

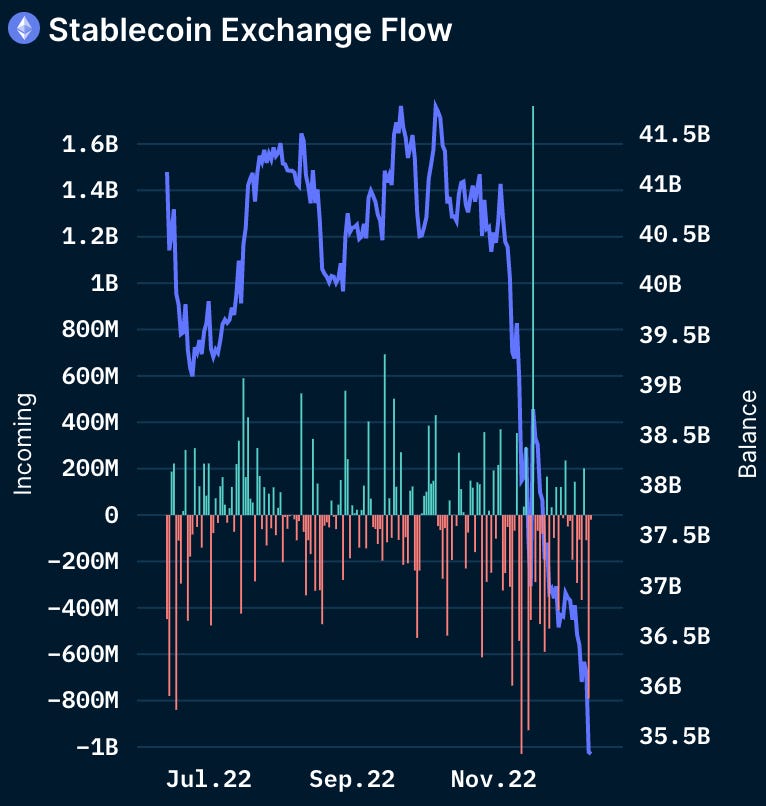

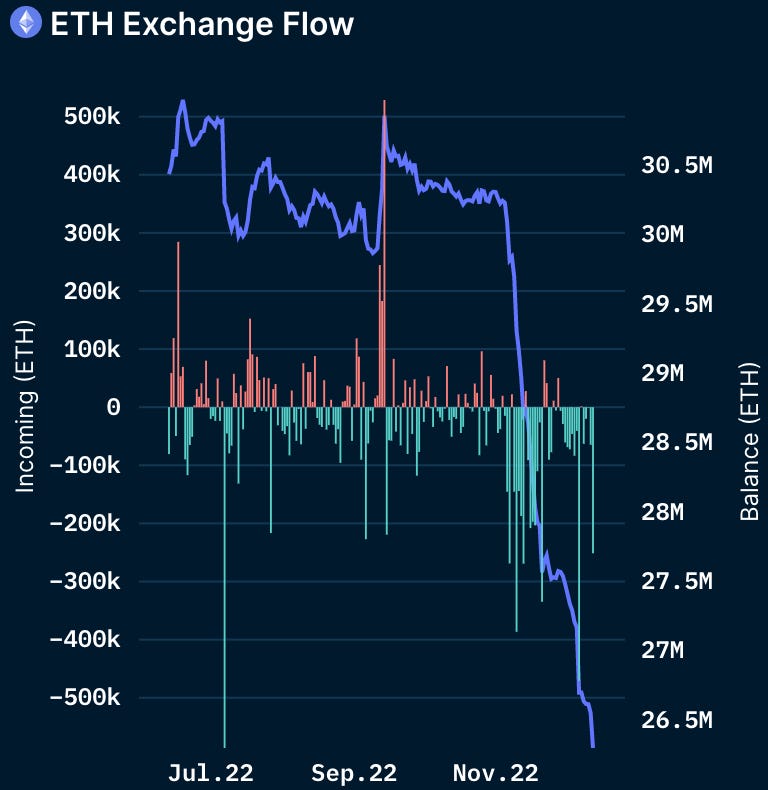

Exchanges have seen a net outflow of $4.675B in stablecoins since November 4, an 11.4% decrease in exchange stablecoin balances.

Additionally, net Ether outflows from exchanges over the same period totaled $5.125B, representing 13.1% of total ETH previously held on CEXs.

Since November 4, $9.8B in stables and Ether has been withdrawn from CEXs.

With widespread Binance insolvency fears circulating CT, it is unlikely this trend of withdrawals will reverse anytime soon.

Today’s most sophisticated auditing solutions do little to reassure users of the safety of their assets on CEXs:

- Proof of Reserves audits only capture assets at a moment in time

- Users are unaware of liabilities and balances are not updated live

- The quality of crypto exchange auditors has come into question

- Complex crypto operations seem to turn to small firms that potentially lack the resources to conduct thorough audits of the firm

Reversing capital flight will require exchanges regain the trust of their customers, which is likely a difficult task at a time when crypto market participants are (rightfully) more suspicious of centralized custodians than ever.

GMX TVL

Just because FTX collapsed doesn’t mean that crypto’s thirst for leverage was satiated: GMX was a major beneficiary of CEX outflows from DeFi users looking to access a trustless trading experience.

😅It offers users up to 30x leverage, considerably higher than many DeFi protocols😅

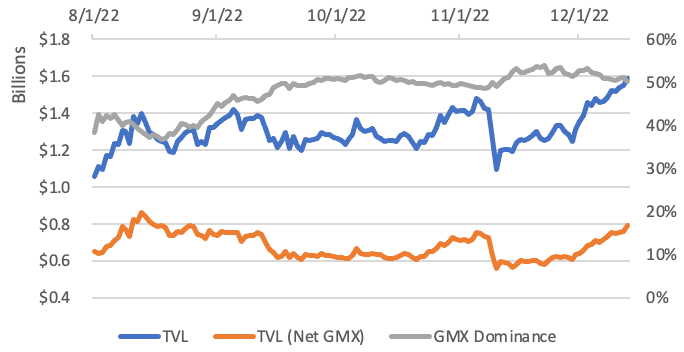

Few established crypto projects have higher TVLs today than they did at the start of November. USD-denominated TVL for GMX is up 9.9% from November 5.

When denominated in ETH, GMX’s TVL is up 41.0% since November 5!

Mayhem and cascading insolvencies following the FTX fiasco erased value throughout the crypto ecosystem. Because of this, viewing TVL in terms of ETH can provide a more accurate proxy for a given protocol’s growth in crypto market share.

For example, as GMX’s USD-denominated TVL fell 25.3% from November 5 to 10, while its ETH-denominated TVL rose by 12.1%!

Temporary decreases in GMX’s USD-denominated TVL were direct results of systemic corollary factors (i.e., risks not unique to the Protocol). Increases in ETH-denominated TVL indicate a greater percentage of crypto assets made their way onto the platform during this period, increasing market share.

Currently, GMX TVL is up, in terms of both USD and ETH, signaling that the platform has become a preferred choice for traders looking for decentralized alternatives to centralized exchanges.

Arbitrum TVL

GMX comprises over half of Arbitrum’s TVL. With this framing in mind, it is not shocking that Arbitrum’s TVL has been up only post-FTX.

What is shocking is that Arbitrum’s TVL, exclusive of GMX, has increased 7.6% from its pre-FTX high set on November 5.

Why is this shocking?

Let’s just say Layer 2 TVL recovery has been a little less ~optimistic~ when compared to Arbirtum: L2 USD-denominated TVL is 16.6% off its November 5 high.

High fee revenue from GLP has turbocharged the Arbitrum ecosystem, boosting TVL. Yields generated from the asset’s fee structure serve as the backbone for the chain’s economy.

Arbitrum developers depend on high GLP yields!

Umami Finance, for example, is working towards launching vaults that hedge price risk for GLP, while continuing to provide users with the associated high yield.. Higher yields on GLP make this vault, and by extension the dApp, more attractive to DeFi users. Projects on Arbitrum benefit from deeper liquidity and bolstered valuations when GMX yields are attractive.

The significance of yield earned on GLP to the ecosystem is evident in the resilience of the Arbirtum’s TVL to post-FTX drawdowns seen by competitive L2s.

Leveraged Farming TVL

Sentiment and Gearbox launched on October 21 and 23, respectively, and appear primed to prove that this bear market is a build market!

Both protocols allow users to access juiced yields on whitelisted DeFi protocols, via the aid of undercollateralized leverage (for more information on these protocols, check out The Ultimate Guide to Undercollateralized Lending in DeFi).

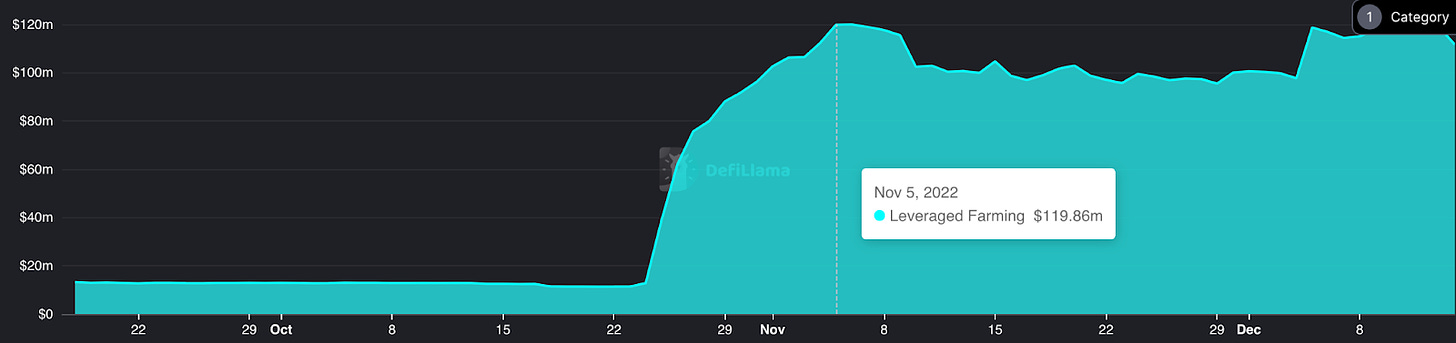

The launch of these protocols, Gearbox in particular, was a positive catalysts for the sector’s TVL, which grew from $11.4M on October 23 to $119.9M on November 5 an increase of 🌕952%🌕!

Unfortunately, the collapse of FTX slammed the brakes on the rapid TVL growth displayed in the leveraged farming sector and contributed to the segment’s observed 20.3% peak-to-trough TVL drawdown. While the sector had yet to gap-up to November 6 ATHs at the time of analysis, it was within 1% on December 13, with $118.9M in TVL.

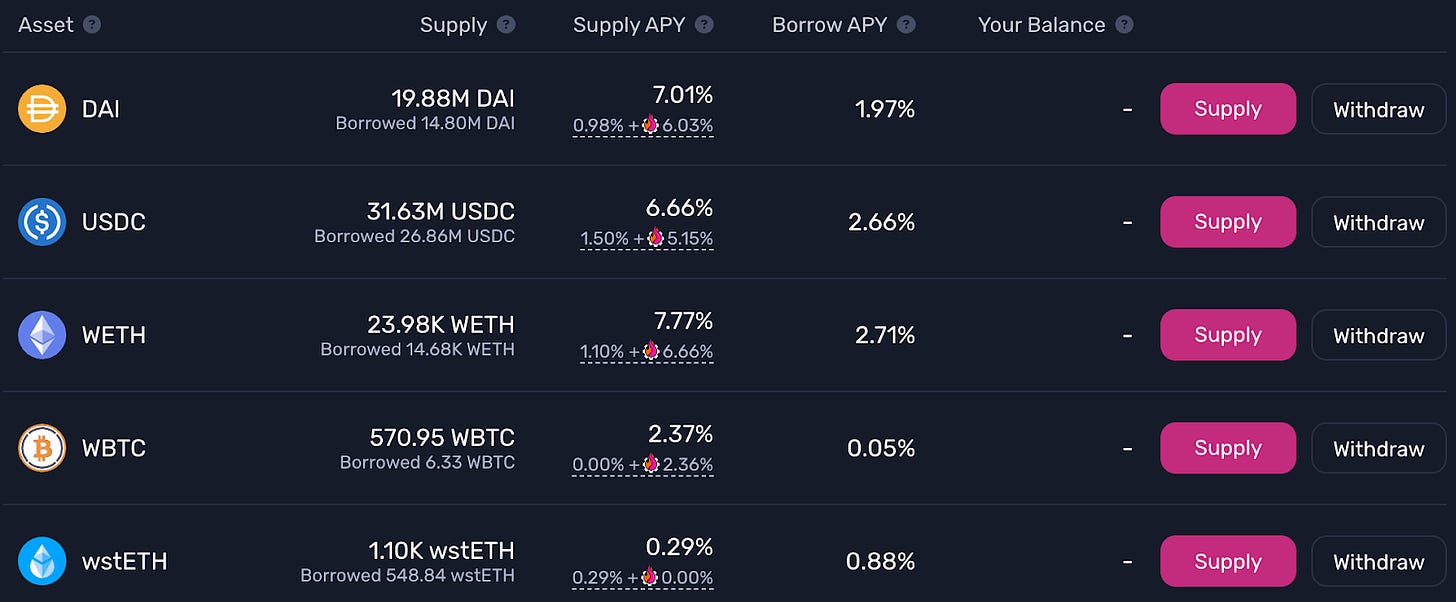

High TVL seen is likely unsustainable in the leveraged farming sector over the long-term. Gearbox represents 94% of the sector’s TVL and HEAVILY subsidizes its yields!

The Protocol rewards lenders with up to 6.66% APY in GEAR rewards on select pools to incentivize deposits.

Diluting holders via token incentives is not a viable long-term strategy. While acquiring new users is essential to protocol success, failure to retain current users decimates a protocol’s community and can jeopardize the future of the project.

Capital has flown into the leveraged farming sector because Gearbox, in particular, is a shiny new toy with token incentives attached. Unwinding these programs may result in TVL drawdowns for the sector.

Polygon NFTs

Did someone say collectible?

Starbucks did! They just opened the Starbucks Odyssey to beta testers.

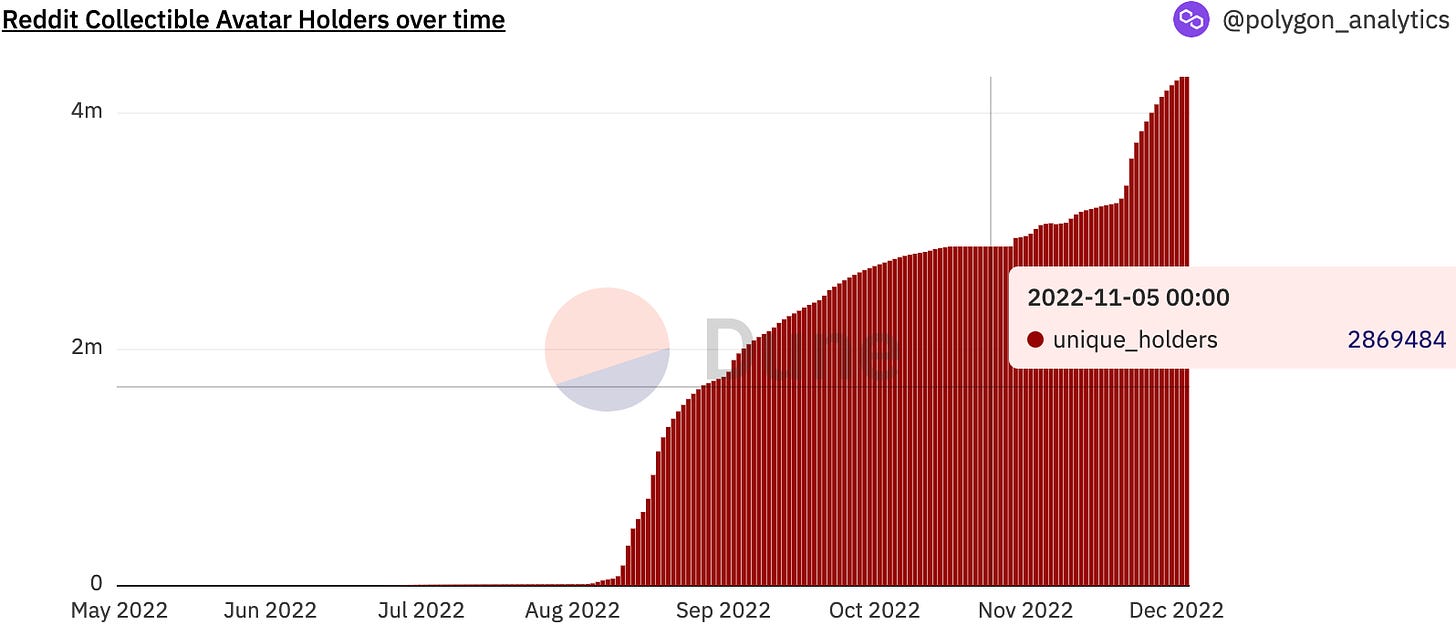

Redditooors did, too. The number of unique Reddit Collectible Avatar holders has increased by 50% since November 5th.

In an industry flush with declining user counts and falling levels of on-chain activity, Polygon’s expansion into the branded collectible market has proven surprisingly successful. Mints, transfers, and sales of these low-value collectibles have mooned NFT activity on Polygon.

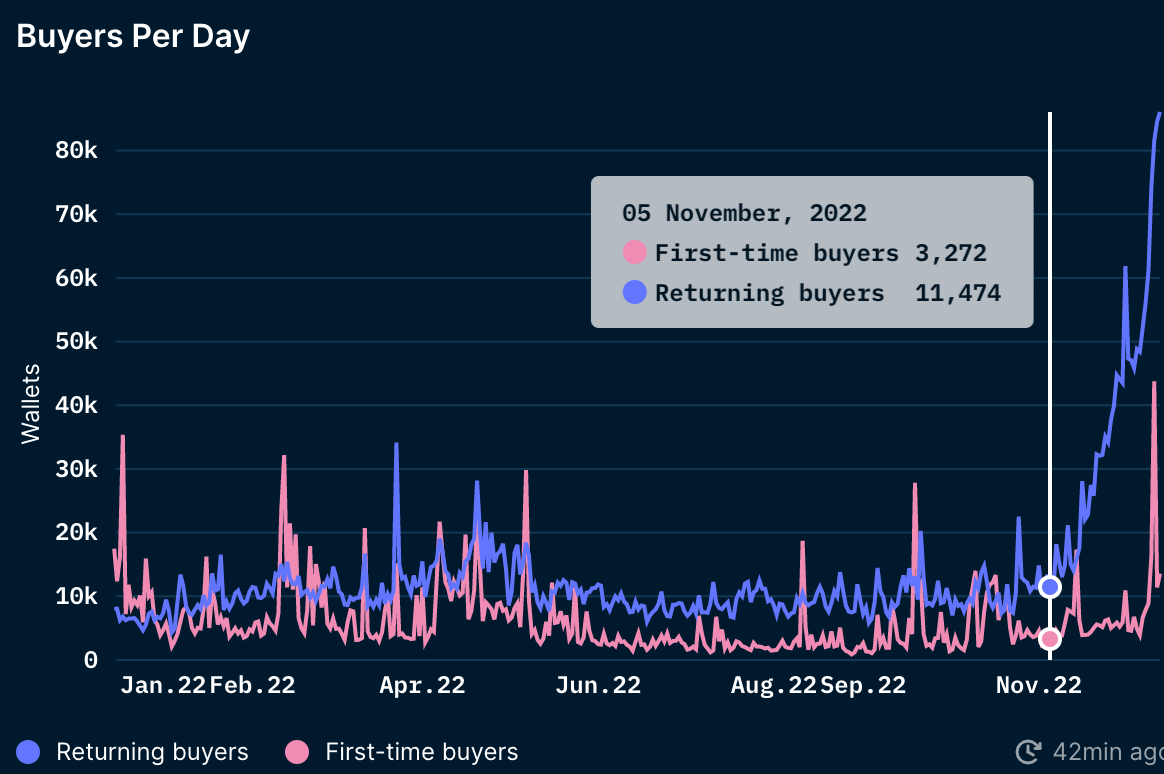

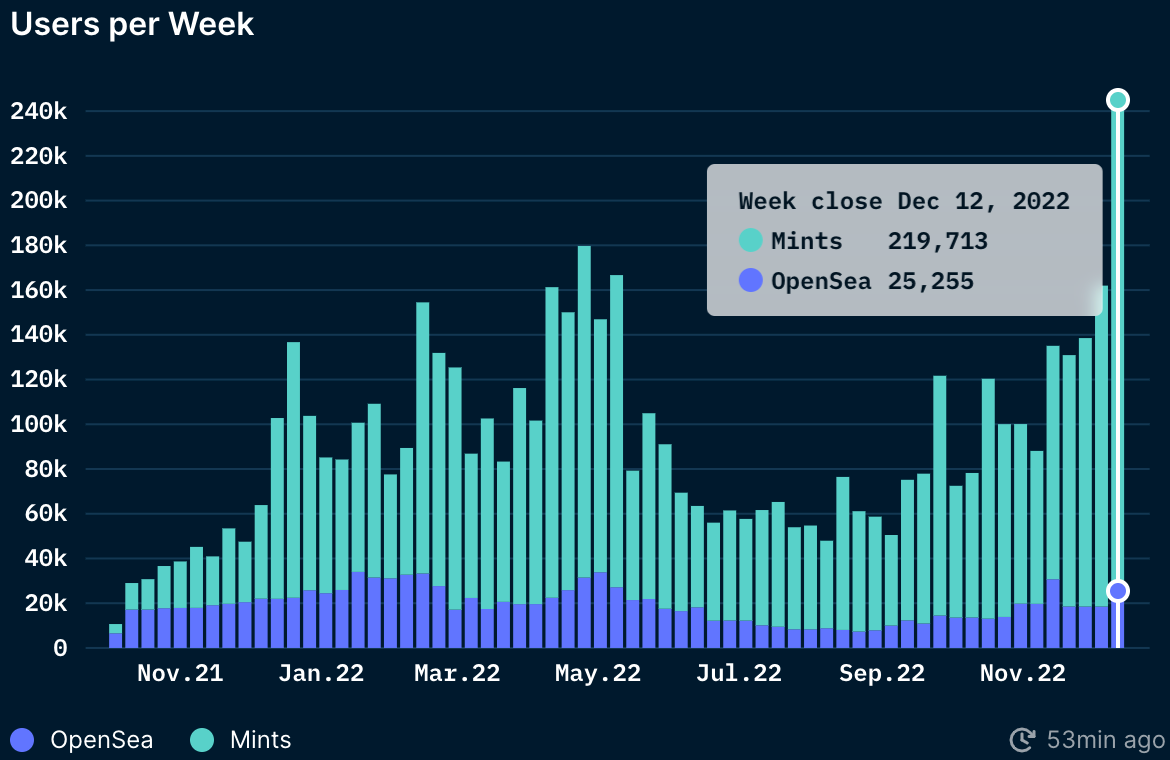

Over 84k returning users purchased a Polygon NFT on OpenSea December 12, an increase of more than 🚀630%🚀 from November 5!

Additionally, the number of weekly OpenSea users and NFT minters increased by 178% from the week ending November 7: almost 245k Polygon addresses performed one of these actions over the past week.

While these NFT projects masquerade under the guise of “collectibles” in an attempt to dissociate themselves with crypto’s perceived toxic culture, their success remains a testament to the viability of the NFTs and provides encouragement that corporates are moving to adopt and integrate blockchain technologies in their business models and loyalty programs.

Stick around…

Practically everything is down right now.

Practically everything was down after 3AC blew up.

Practically everything was down after the Fed raised rates.

Practically everything was down after COVID became serious.

Practically everything was down after the Chinese stock market crashed in 2015.

Practically everything was down after the American housing market exploded in 2008.

I could go on and on — I think I missed some events in between. The numbers on the screen go up and down, but the primitives that crypto is building are here to stay. We are building for the future we want.

Generate alpha and prepare for the next narrative. Will self-custody, DeFi, innovative fee structures, and branded communities make the cut? How does yield intersect with growth for crypto?

Stick around and find out, anon.