A Deep Dive Into Curve

One advantage of DeFi is composability, which allows the system’s building blocks to interact freely with one another to create new services.

Stablecoins are an example of a token with a fixed exchange rate backed by token collaterals. While stablecoins can facilitate payments and exchanges, they can also generate returns in DeFi, potentially expanding.

TVL in DeFi

Policymakers focus on stablecoins due to their rapid growth, developing global use cases, and potential financial risk contagion channels.

Stablecoins, like unbacked crypto-assets, are part of the larger crypto-asset ecosystem.

Put in place in response to the high price fluctuations of unbacked crypto-assets like Bitcoin and Ether. Stablecoins’ low price volatility makes them ideal for various applications requiring these assets.

Stablecoin usage continues to climb in 2023, with hundreds of thousands of users relying on these US dollar-pegged cryptocurrencies daily, and the current stablecoin market cap is $ 145.29B.

Stablecoin Supply and Growth

Aside from easing the pains of traditional finance, DeFi also serves as a testing ground for new financial models. Curve Finance is one model that has changed the game for many DeFi projects by attracting billions of dollars in liquidity to its native token pools.

The tokenomics of CRV, which created a competitive and gamified incentive structure, was the driving force behind this shift.

Curve Finance

Launched in 2020 as a pegged asset DEX, Curve Finance almost immediately proved market demand for their platform.

Curve’s governance token operates the Curve DAO, spawning a pseudo-crypto economy with innovative financial tools.

According to Defi Llama, the protocol currently has a TVL of around $5 billion.

This report will dive into the protocol’s key metrics and the CRV token’s valuation.

Curve Finance supports ten blockchain networks, including;

- Ethereum

- Polygon

- Fantom

- Celo

- Arbitrum

- Avalanche

- Kava

- Glosis

- Moonbeam

- Optimism

History of Curve

Curve Finance was founded in January 2020 by Michael Egorov to provide a decentralized exchange built on an AMM architecture, optimizing the swapping of digital assets with identical pegs. Development was followed in August 2020 by the formation of the Curve DAO.

He co-founded NuCypher, a cryptocurrency firm that creates infrastructure and protocols to protect user privacy. He was appointed CTO of the company in 2015.

Following the success of Curve V1, Egorov created Curve V2 in mid-2021. This new version of the protocol would allow Curve to trade non-pegged assets. Curve now has several dozen liquidity pools to trade in, and daily volume can easily range from $100 million to several billion dollars.

It is also available on all popular Ethereum virtual machine, or EVM, compatible networks, including Ethereum, Arbitrum, Polygon, and Avalanche.

What Is the CRV Token?

CRV is the Curve protocol’s native utility token. Governance, LP rewards, increasing yields (as veCRV), and token burns are some of its key use cases.

Most DAOs are governed by governance tokens that grant holders voting rights. In this case, the Curve DAO is governed by the CRV token.

The CRV token can be purchased or earned by depositing assets into a liquidity pool in exchange for token rewards. By supplying DAI to a Curve liquidity pool, you receive the CRV token, fees, and interest. Gaining assets and owning a robust DeFi protocol are two advantages of yield farming the CRV token, which also increases the incentives to work as a Curve liquidity provider.

Furthermore, any party with a sufficient number of vote-locked CRV tokens may propose an update to the Curve protocol (meaning CRV crypto holders get to participate in the decision-making process of the protocol). Some examples of updates include shifting or relocating fees, establishing new liquidity pools, and adjusting yield farming rewards.

What Gives Curve Tokens Value?

Curve primarily uses AMM for stablecoin trading. It has received a lot of attention as a result of this mandate.

Given that CRV is a governance token and that users are assigned the token based on their liquidity commitment and length of ownership, the Curve DAO and its native token resulted in increased profitability.

The rise of DeFi trading, which has resulted in AMMs turning over enormous sums of liquidity and corresponding user gains, has ensured the longevity of the Curve.

How Many Curve Tokens Are There?

The token was released with a supply of 3.03 billion tokens, which were distributed in the following order:

- Liquidity providers: 62%

- Shareholders: 30%

- Employees: 3%

- Community reserve: 5%

Members of the team and investors received 30% of the token supply. This group’s tokens are vested for up to four years. Employees can keep their tokens for up to two years.

CRV began with 1.3 billion tokens, accounting for 43% of the total token supply.

Curve distributed the supplies in the following order:

- Liquidity providers: 5%

- Shareholders: 30%

- Employees: 3%

- Community reserve: 5%

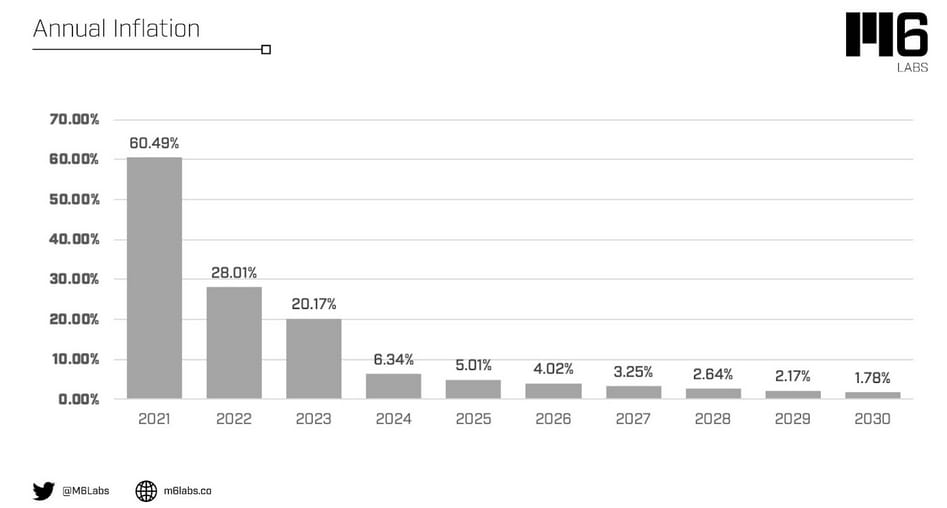

Inflation has been used by Curve to attract user growth because CRV is constantly minted to incentivize liquidity providers. This inflation will continue indefinitely, with the rate decreasing exponentially, making the next five years the most significant in terms of total supply released.

How Does Curve Finance Work?

Curve is the most important DEX in DeFi regarding balance and volume. As mentioned before, it is an automated market maker (AMM), which means that when people trade crypto assets, there are no intermediaries.

People who exchange cryptocurrencies on an AMM are trading peer-to-contract rather than peer-to-peer. The extensive liquidity pools that Curve controls make this possible.

Users can rely on Curve to exchange one type of cryptocurrency for another without fear of running out of liquidity. Furthermore, high liquidity aids in avoiding large price swings from one day to the next.

Curve also offers a few extra advantages that have contributed to its success:

- Low trading fees – 0.04% of each the value of each exchange. This is very low for a DEX.

- Composability – users can easily swap cryptocurrencies from different chains on Curve.

- StableSwap – The platform introduced the StableSwap mechanism. It enables users to swap tokens of the same value efficiently and is especially useful for whales who want to exchange large amounts of money.

- CRV token rewards – Curve offers excellent rewards to users for staking their crypto to increase liquidity in the pools.

Curve attracted many users who staked their assets on the platform and contributed to creating deep liquidity pools. There are currently several Curve pools, with new pools added all the time.

What are Curve fees?

When exchanging stable coins on Ethereum, swap fees are typically around 0.04%, which is thought to be the most efficient.

Deposit and withdrawal fees range between 0% and 0.02%, depending on whether the deposit and withdrawal are in balance. Users could, for example, deposit USDC and withdraw in USDT for free if fees were 0%. Balanced deposits and withdrawals are free of charge.

Risks Involved In Using Curve

Curve bears the risks of exchanging on DEXs and using AMMs, known as impermanent loss; however, by offering the ability to trade stablecoins, users eliminate the risk of asset volatility commonly associated with the crypto market.

Curve stacks risk using smart contracts from lending protocols on its own (for y & c pools only). As a result, these pools have greater security and lower risk, giving users an incentive to provide liquidity.

Although MixBytes and ChainSecurity have audited Curve, security audits do not eliminate risks.

Curve Wars

The Curve Wars is where the above tokenomics comes into play on a macro scale. It’s in every project’s interest to make their token as liquid and readily available for exchange as possible in the marketplace – which is Curve in this case.

Most projects reward liquidity providers with native tokens, but this can get expensive and isn’t always lucrative. With Curve, liquidity can be incentivized by getting a higher yield of CRV rewards if the project has enough veCRV.

This fight for yield by acquiring veCRV is called the Curve Wars. These wars now have layers of various protocols streamlining the process while eliminating the shortcomings of CRV’s tokenomics. Additionally, over time the war has unanimously been believed to have shifted to Convex Finance, which has attracted the majority of CRV tokens.

28.01%

28.01% is the inflation percentage rate of CRV for 2023. The current average daily locking rate is even lower at ~36%, which has increased from 28.5% after Yearn finance introduced its liquid wrapper yCRV.

In 2023, 35% of the 400m CRV inflation will be locked as veCRV, resulting in a 22% increase in the veCRV supply.

So the yield and bribes for veCRV would be diluted by 22% if trading volume and bribes stay the same.

The most important for Curve is to get more trading volume to compensate for the heavy dilution of the stakes over this and the following year. From August 2024, inflation will be significantly lower, and fees/bribes will likely cover it.

It is a very decisive moment for Curve, and the introduction of crvUSD could bring more volume to incentivize people to lock CRV over selling.

Convex Finance – a leader in the Curve Wars

Convex has emerged as a Curve Wars leader for a different reason. While many projects aim to attract liquidity for their pool, Convex is a Curve model layer that makes it easier for retail users to earn by providing liquidity.

Curve Finance allows you to lock CRV to increase your rewards and earn trading fees, but the veCRV amount required for locking and the locking period of 4 years is relatively inexpensive for smaller investors. Convex fills this void by aggregating CRV from all liquidity providers to deliver the highest yield.

Convex owns 85% of Curve’s TVL and nearly 50% of all available CRV supply, which is unsurprising.

However, Convex Finance has a DAO voting structure where CVX can vote on how Convex should use its veCRV. Convex then implements these decisions on Curve’s DAO via votes. It now makes more sense to acquire CVX tokens rather than CRV tokens for protocols that want more liquidity on their token. Bribes to CVX holders have also become a popular method of adding liquidity, confirming that the Curve Wars are now being fought on Convex’s turf.

Curve Wars continue

Despite market conditions, curve wars continue this time with Convex Finance and two new players, Yearn Finance and Stake DAO.

1/ Curve wars continue despite market conditions, this time with @ConvexFinance & 2 additional players: @iearnfinance & @StakeDAOHQ.

— Rudy | Mass 🌅🇨🇭 (@rudykadoch) January 4, 2023

A thread about depeg reasons, what makes all those wrappers different, & the new $cvxCRV tokenomics 👇 pic.twitter.com/Q90JxQmawo

ConvexFinance offered a 16% average APY to cvxCRV holders, while it was twice to four times higher for yCRV and sdCRV holders.

- People are looking to maximize their yield, which is why the yCRV APY increased to 70% in December, thanks to the Megaboost and Bribes. Yearn’s yCRV vault has received over 6 million CRV deposits, increasing its supply from 19M to 25.6M in one month.

- Most CRV deposited in the yCRV vault came from cvxCRV holders when the cvxCRV/CRV liquidity pool was already unbalanced.

- This event mentioned above dealt another crushing blow to the cvxCRV peg, which had reached 84% a few days ago.

- Convex Finance, Yearn Finance, and Stake DAO must keep their pegs close to one. The goal is to gather as much CRV as possible. If it is cheaper to buy CRV wrappers on the market rather than minting new ones, the protocols mentioned above will be unable to accumulate more CRV.

- It’s been 8 months since there were no more CRV locked into Convex because they were cheaper to buy elsewhere.

- To address this issue, which could be fatal in the long run, Convex Finance reacted on January 2nd by announcing new cvxCRV tokenomics:

Happy 2023 🎉! The first update of the year is here; updated dynamics for $cvxCRV staking are coming soon. More inside!https://t.co/tXey1HicjX

— Convex Finance (@ConvexFinance) January 2, 2023

Summary

More warriors are fighting for the CRV pie, including StakeDAO, Abracadabra, and protocols like Votium built on top of Convex to bring the Curve Wars to an end.

While ‘wars’ and ‘bribes’ don’t exactly cause for celebration, crypto enthusiasts regard them as goldmines.

Curve Finance distinguishes itself from other decentralized exchanges by concentrating solely on stablecoin liquidity pools. The DEX has much lower trading fees than other exchanges, which provides Curve with a lot of liquidity. This excess liquidity lowers slippage rates and attracts even more whales.