Events Review:

- Mazars, an audit company with rich experience in auditing crypto exchanges, announced that it would stop the auditing business for cryptocurrency firms.

- CZ was interviewed by the news media CNBC a few days ago, and most people thought CZ’s response was avoiding the truth.

- Kevin 0’leary, the spokesperson of FTX, targeted Binance at the FTX hearing. In addition, conspiracy theories suggest that the remaining power of SBF wants to bring down Binance. Some people suggest that the regulators want to bring down Binance since Binance is not under their supervision. Therefore, regulators want to keep listed companies like Coinbase because they are easier to control.

Since the collapse of FTX, the wind vane of current public opinion is to require the crypto exchanges to issue reserve certificates for the public. The French accounting firm Mazars is one of the largest audit companies that issue assessment reports for centralized crypto exchanges (CEX). Binance previously announced its reserve assessment report, audited by Mazars Group. Now, the audit company has announced that it will stop cooperating with all cryptocurrency customers, including Binance, Crypto.Com, and KuCoin, and deleted the website that hosted proofs-of-reserves work for cryptocurrency exchanges. On December 16, Binance’s spokesperson also made an announcement, Mazars stopped their cooperation with all cryptocurrency companies and delisted all issued certificates.

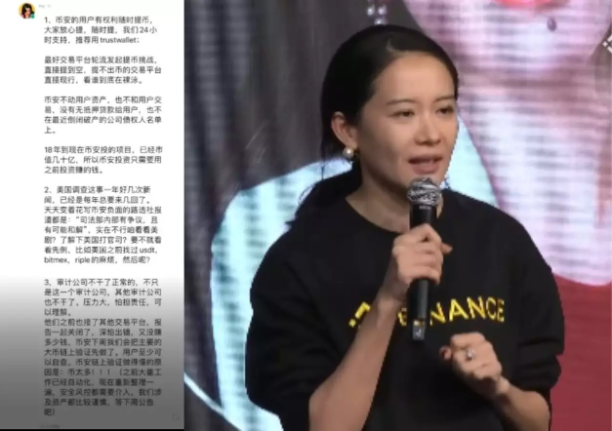

Yi He (Binance Co-founder) tries to put out the fire

In response to the auditing incident, Yi He, the co-founder of Binance, responded in the chat group in Chinese. In fact, CZ has already said before: everyone is welcome to withdraw their crypto assets, to test the pressure resistance of Binance. Yi also emphasized here that every exchange and trading platform should initiate the crypto-withdrawing challenge, until all users withdraw completely, those exchanges should be out of the game if users cannot withdraw their cryptos, and we can see who is misappropriating funds. Yi also said that Binance will not touch user assets, nor trade with users, and Binance will not mortgage loans to users. From 2018 to now, the market value of the projects invested by Binance has been very high. Therefore, if Binance needs money, it can directly use the income from its previous investments. Yi also said that Mazars did not cooperate with Binance because the audit company felt that it was too hard, the pressure was too high to take responsibility, and the paycheck was not worth it. She thought it was understandable. She said that the solution is that Binance will immediately verify the crypto assets with high market value on-chain first, and users can check it by themselves. People questioned why is it so slow. And still, the on-chain verification of Binance has not been completed yet. Yi’s response is because of the large volume of their crypto assets.

Thus, two key questions are left to us: First, what is the real reason for the audit firm to quit? Second, is the slow verification of Binance really due to the large volume of crypto assets?

CZ‘s interview triggers a wave of withdrawals

Binance CEO, CZ accepted an exclusive interview with CNBC in the U.S. The intention was to stabilize their users, but his interview caused panic among Binance users.

CNBC host asked CZ, how does he ensure users’ assets are secured with Binance when he claims that any withdrawal behavior will not affect Binance?

CZ said that when a user deposits Bitcoins, Binance will transfer this asset to a cold wallet, and of course, some will be kept in the hot wallet. He first explained Binance’s attitude and approach to handle users’ assets:

CZ: ” People can withdraw a hundred percent of the assets they have on Binance, we will not have an issue on any given day. So, if a hundred percent of users withdraw a hundred percent of the assets, we will be fine. This is very different for traditional financial people to understand because banks run on fractional reserves, and traditional regulators, many of them may think that it’s okay for crypto businesses to be running on fractional reserves. That is not okay, in crypto, there’s no central bank printing money to bail out banks when there’s a liquidity crash. So, crypto businesses have to hold user assets one-to-one, and that’s what we do. It’s very simple.”

The background of this discussion is some people assume that FTX may recover the investment profit of 2.1 billion US dollars from Binance, during the bankruptcy Liquidation.

CZ:” we want to be transparent; we want to set the golden standard for reliability and solidness.”

CNBC host Rebecca Quick:” Would you be able to handle it if somebody asked you for 2.1 billion dollars back? Would that be okay? Would you be able to still withstand this?”

CZ: “we’re financially okay.”

Rebecca Quick:” Including you have 2.1 billion dollars to give away? If somebody came to take that back, you’d still be fine?”

CZ:” we’ll let the lawyer handle it, we are financially strong, but audits don’t reveal every problem.”

Rebecca Quick interrupted:” CZ, you could get a big four auditor to say that, if you’re saying that someone of them doesn’t want to work with you, that raises question number two, they don’t want to work with you because you don’t have the files and the data that would make them feel comfortable signing off and giving that stamp of approval?”

CZ:” actually, many of them don’t even know how to audit crypto exchanges; they are used to auditing a firm.”

The host, Rebecca Quick, looked disdainful by the end of this conversation. In the section. CZ suggests that the cryptocurrency exchange is new, and many people don’t know how to audit it, which sounds reasonable. However, there is a CEX in the United States, Coinbase, which is also a listed company, and Deloitte, a Big Four accounting firm, audits it.

CNBC Host Joe Kernen:” CoinBases has a big four auditor.”

CZ:” actually, I don’t look at Coinbase. We don’t really look at Coinbase.”

The host also told CZ that SBF also guaranteed not to use the client’s assets in their program. In this extreme situation. Everyone was pushed back to the basics of the problem: show me the money. It seems there’s no other way to prove that the client’s assets have not been moved. Because of the FTX incident, any disturbance will make everyone question CEX, which is regrettable but very reasonable. Since many crypto exchanges are breaking the rules, and it’s closely related to users’ assets, Binance must be the best to follow the rules as a giant in the industry.

Binance Wallet Shrunk

The data analysis platform Nansen tweeted on December 17, on-chain wallet data shows that Binance’s holdings of cryptocurrency assets have decreased by $15 billion in a month. Data shows that on November 8, Binance accounts had $69.5 billion. Comparing it with the timeline of the FTX incident: CZ posted on November 6 that Binance would clear the FTT, so the 69.5 billion shown in the data is after CZ tweeted. As of December 29, this figure was around 53.5 billion.

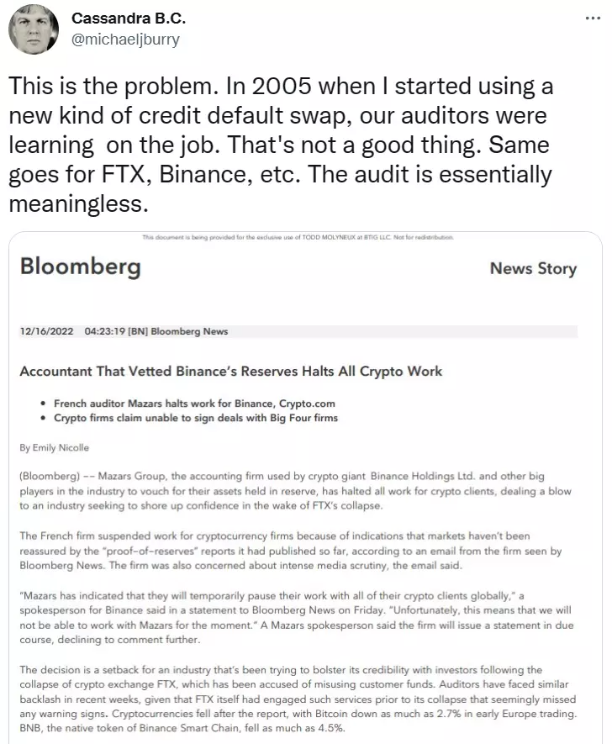

Michael Burry Questions Binance

Michael burry was portrayed by Christian Bale in the 2015 film “The Big Short” (he predicted the 2008 subprime crisis). He directly responded to the issue of CEX reserves on Twitter. He said that in 2005, he started to use a new credit default swap. At that time, the auditors of his company were learning on the job, because it was a new thing. He thinks it’s not a good thing and feels that the same thing is happening for FTX, Binance, and other crypto exchanges. Everyone is learning by doing, so he thinks that the audit results of FTX and Binance are meaningless.

The following is a speech of a well-known venture capitalist, Kevin 0’leary, at the FTX hearing. Kevin is a very successful venture capitalist and a celebrity on American TV. He participated in the American TV show Shark Tank. He is being discussed now because, as the spokesperson of FTX, he received a reward of 15 million US dollars, but after FTX went bankrupt, his money was also stuck in the FTX account and could not be withdrawn.

Senator Toomey:” why do you believe FTX failed?”

Kevin 0’leary:” I have an opinion; I don’t have the records. Here it is: after my accounts were scrapped, all of the assets and all of the accounting and trade information(disappeared). I couldn’t get answers from any of the executives in the firm, so I simply called SBF and said where is the money, Sam? He said he had been refused with the access to the server, and he no longer knew. I said okay, let’s step back; this is a simple case in my mind, where did the money go? I said Sam walk me back 24 months, tell me the use of proceeds of the assets to your company; where did you spend it? Then he told me about a transaction that occurred over the last 24 months: the repurchase of his shares from Binance, his competitor. I didn’t know this at the time, but at some point, CZ or Binance purchased 20 percent ownership of SBF’s firm.”

Kevin 0’Leary asked SBF where all the money was spent. SBF mentioned that a large amount of money was related to Binance. SBF said that CZ or Binance bought part of his company before, and SBF wanted to spend 2 billion US dollars to repurchase this part.

Kevin 0’leary:” and then, over time, I asked SBF what compelled you to spend two billion dollars (was the number SBF was giving me at that time); later in a subsequent conversation by 24 hours later, he told me that could have been as much as 3 billion dollars to buy back the shares from CZ. I asked him what would compel you to do that. Why wouldn’t you keep your assets on your balance sheet? And why would you offer this to just one shareholder?”

Kevin 0’Leary said that SBF’s answer at the time was that FTX had to apply for licenses in many regions and must disclose many company information. CZ is also a large shareholder of FTX, so CZ has the right to ask SBF not to reveal the company’s information. Therefore, it is difficult for SBF to do things (this article is skeptical about SBF’s statement, since SBF himself has gone credit bankrupt). Because of this, SBF may spend nearly 3.2 billion US dollars to buy back his control of FTX. Throughout the speech, Kevin 0’Leary’s point of view is that the bankruptcy of FTX is a conspiracy by Binance, and Binance’s strategy was to bring down FTX. In the end, he concluded that Binance is now big enough to monopolize the market.

Is Binance like what CZ said: “we are financially ok.”? Can the Binance empire survive this crisis? Would U.S. regulators take advantage of the FTX incident to eliminate Binance and leave Coinbase under their control? These questions remain for us.