By Dralle

Introduction

Since its inception in the aftermath of the 2008 Great Financial Crisis (“GFC”), during an era marked by loose policy, Bitcoin (“BTC”) has been perceived as an inflation hedge.

It proposed a unique value proposition that attracted retail and institutional investors alike through its speculative investment opportunities.

What started as a small-scale experiment with potential to revolutionize the current monetary system, soon became a new dominant asset class. This set the stage for a global financial system like we’ve never seen before.

This article will depict the prevalence of Bitcoin up to this point and discuss the factors driving its narrative going forward. We will use our deep knowledge of the Non-Fungible Token (“NFT”) sector to provide our view on how it will impact those who regularly engage in these digital assets.

Here’s what you need to know.

Article Outline

- Background

- Properties

- Comparisons

- Adoption and Correlation

- Regulation: The Path to Adoption

- Cycles to Adoption

- On-chain Metrics

- Macro Outlook (Inflation)

- Closing Remarks

Background

Bitcoin was launched in 2009, although the whitepaper was published in late 2008, by the pseudonymous Satoshi Nakamoto. It allows for:

“an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party”.

Since then, the decentralized protocol has experienced significant growth in terms of both price and adoption. Bitcoin has remained number one within crypto assets, despite the volatility. Most importantly, however, it spawned an entirely new industry that, at the top of the recent bull market, reached a market cap similar to that of the dot com bubble of $3 trillion USD.

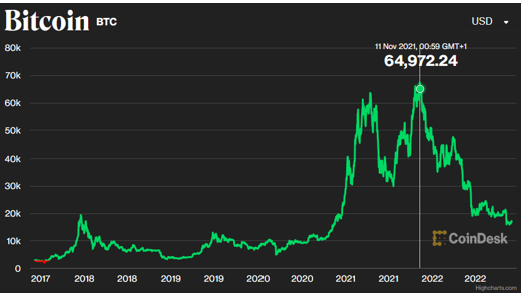

A year ago, Bitcoin hit an all-time high of $68.7k and most expected to see $100k before the end of the year (2021). One year earlier (2020), Bitcoin sat around $16.3k which is similar to today, corresponding to a 76% drawdown from its recent all-time high. Meanwhile, most NFT assets have experienced negative >90% return in USD terms. Currently, Bitcoin is experiencing an extremely risk-off conclusion to the current crypto market cycle.

As interest rate expectations changed in the early part of 2022, Bitcoin has remained, unlike before and despite unchanged fundamentals, highly correlated with both the Nasdaq and the S&P 500. Other risk-on assets, even more speculative in nature, such as NFTs tend to follow Bitcoin/Equities and have been affected similarly but often worse (see: Origins’ article on Risk management). The Federal Reserve (“The Fed”) soon intends to slow rate hikes.

How will this affect crypto assets such as Bitcoin and which factors should we pay attention to? Let’s start off by examining the properties of Bitcoin before comparing these to alternative assets.

Properties

Bitcoin contains several beneficial properties that make it an enticing asset class in this digital era.

It provides an alternative to the monetary system as a means to transact and store value. Its underlying technology has the potential to transform the current financial system, comparable to how the internet transformed publishing.

With almost immediate effect, any amount of Bitcoin can be transferred to anyone on the network in a secure and immutable way. It facilitates cross-border payments and remittances whilst reducing the impact of both intermediary and exchange fees.

Layer 2 Solutions

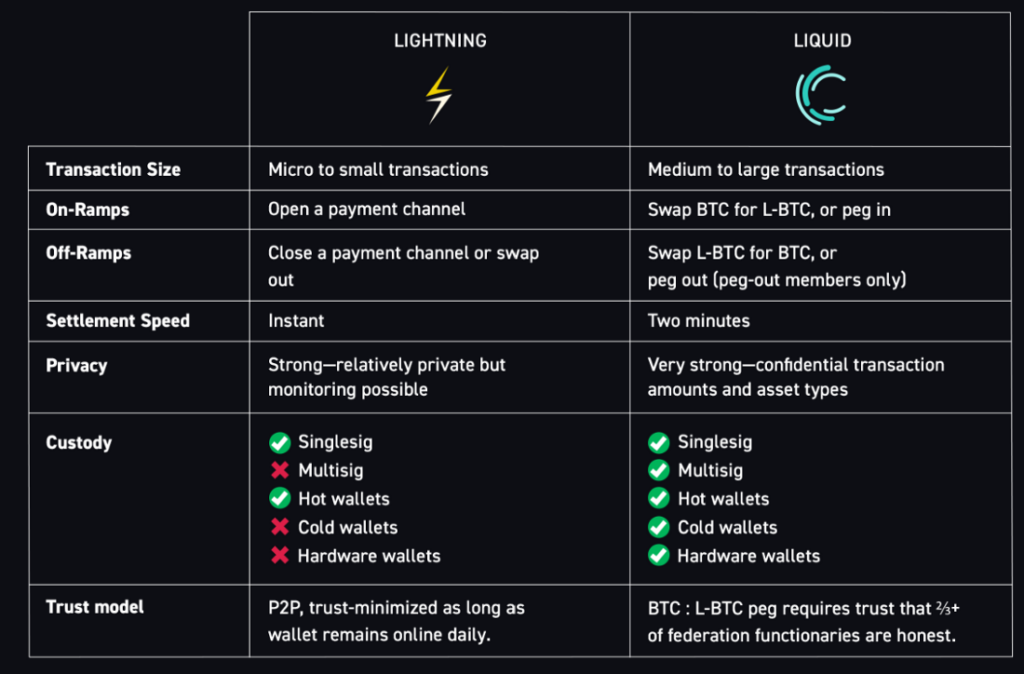

Bitcoin may not be a viable medium of exchange for day-to-day transactions, due to its current limitation in throughput of 5–7 transactions per second compared to thousands for Visa and Mastercard. This is where layer-2 side-chain solutions such as the Lightning Network and Liquid Network become relevant.

The Lightning Network provides a competitive throughput while retaining negligible fees, suitable for micro transactions, by opening a payment channel that can be used to update the layer-1 ledger through off-chain transactions.

Meanwhile, the Liquid Network aims to bring similar aspects, focusing on confidentiality, through a “2-way peg” more adept to individuals and institutions handling transactions involving larger amounts of Bitcoin:

The Mechanism

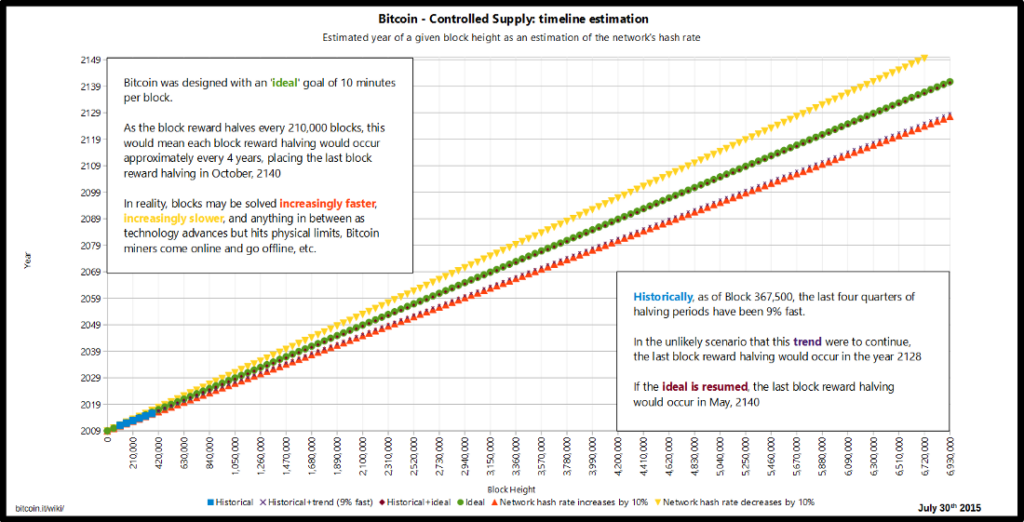

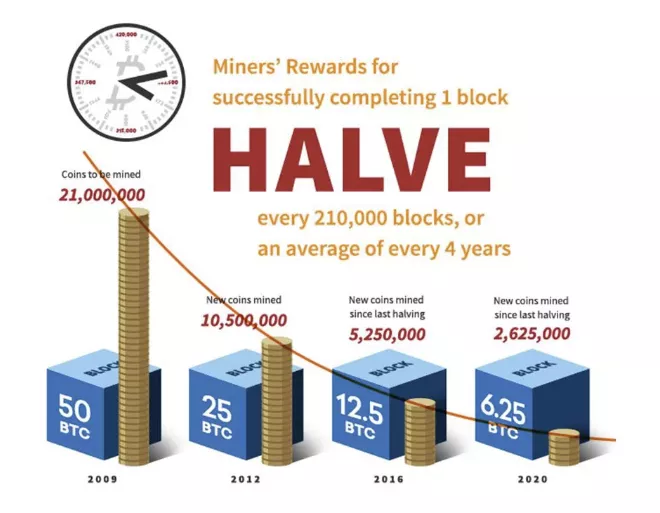

Bitcoin has a circulating supply of 19.2m and a final total supply of 21.0m. Its current emissions to miners is 900 Bitcoins per day, which is how the inflationary mechanism was originally designed and implemented. Mining rewards are used to incentivize network validators, ensuring its robustness, through maximizing decentralization.

Bitcoin’s current inflation is 1.7% and will be reduced to 0.8% after the next halving event in 2024. The halving will continue to occur every four years until the last Bitcoin is mined in the year 2140:

The consensus mechanism deters bad actors.

An attack would require the perpetrator to control most of the validators in the network. The collective of participants could subsequently fork the blockchain, retaining its original consensus mechanism to uphold the legitimate transactions going forward.

Additionally, the computing power, and energy incurred, to perform such an attack would be enormous, hence counterproductive.

Bitcoin’s controlled supply, diminishing inflation, and increasing demand as its digital provenance grows, set the foundations for interesting financial prospects from an economic standpoint alone. This is despite already being a globally transact-able currency, without any single centralized authority.

Comparisons

For a currency to gain widespread adoption, it should demonstrate six main attributes:

- Scarcity;

- Divisibility;

- Acceptability;

- Portability;

- Durability, and;

- Resistance to counterfeiting.

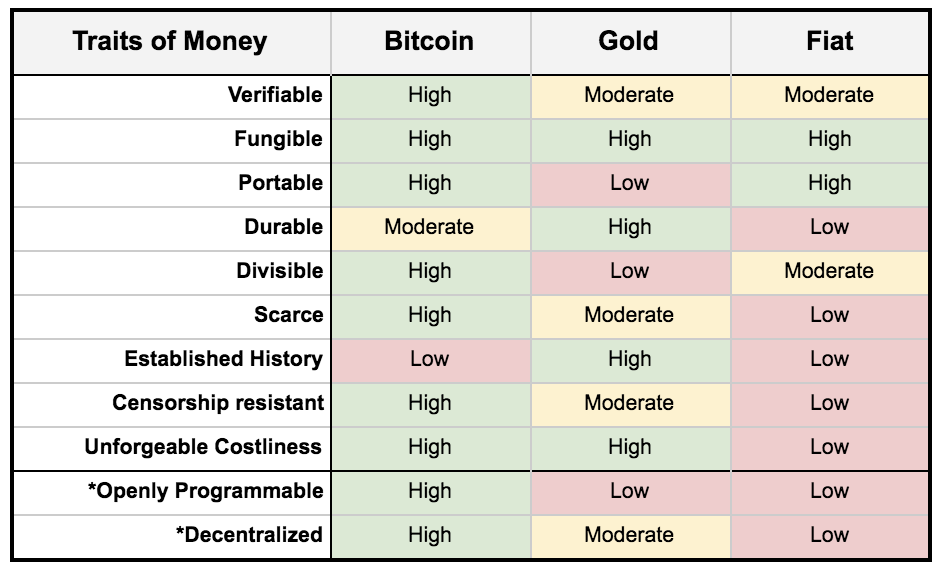

Gold:

The value proposition for gold mainly derives from its physical properties that serve industrial use-cases in relation to the cost of its extraction-process.

Its history as a scarce and durable commodity ascertains that its inflation is likely to remain stable and should therefore continue to function as a store of value. However, its lack of portability and divisibility makes it inferior to Bitcoin and fiat for day-to-day transactions on a global scale as well as irrelevant in terms of acceptability.

Fiat Currency:

Ever since fiat left the gold standard, its value proposition has relied solely on its centralized stronghold through banking and spread in society, as it upholds the fabric of economic activity and guarantees acceptability.

Its durability is lower than that of both Bitcoin and gold, but the ability to print fiat and inflate current supply has been useful to stay ahead in technological advancements and fund perpetual global warfare (eg. WW2) as well as protect from economic disaster (eg. COVID-19), at the expense of the population’s future purchasing power and deep recessions.

A more forward-looking comparison would be against Central-Bank-Digital-Currencies (“CBDCs”). These are prone to the same attributes as fiat with improved verifiability and divisibility. However, its centralized nature still makes it more prone to counterfeiting, compared to Bitcoin.

Bitcoin:

Conversely, Bitcoin did not inherit the ability to inflate its supply but similar to gold, Bitcoin’s value proposition partly derives its marginal cost of production.

Embedded in its source code is instead a hard cap which ensures absolute scarcity. All network participants are also incentivized to uphold the integrity of the network in a decentralized manner, which is how Bitcoin’s resistance to counterfeiting supersedes that of fiat and CBDC.

In addition, Bitcoin’s peer-to-peer and open source infrastructure provides superior verifiability and a portable equivalent to digital fiat payments. However, it’s contingent on a higher level of adoption to gain competitive acceptability:

Some would even propose a Bitcoin-backed dollar as a viable way to prolong the dollar’s status as a reserve currency over, for example, a gold-backed (petro-)ruble/yuan. Especially in light of growing distress towards the current dollar-centric petrodollar system, confirmed by Brazil, Russia, India, China and South Africa (“BRICS”). These constitute the five leading, emerging economies who intend to create a new reserve currency.

Proposing a gold-backed dollar would not be viable for the U.S. since Russia and China have far larger gold reserves.

Conversely, a push towards Bitcoin would supersede the current fiat proposition, where value can be seen as a contingency rather than a guarantee as well as make it far more trustworthy than any gold-backed equivalent.

Adoption and Correlation

Thirteen years into its existence, Bitcoin is experiencing unprecedented stress which may cast doubt over its usefulness for portfolio diversification alongside other crypto-assets. An otherwise widely pushed narrative, particularly apparent through Fidelity Digital in 2020.

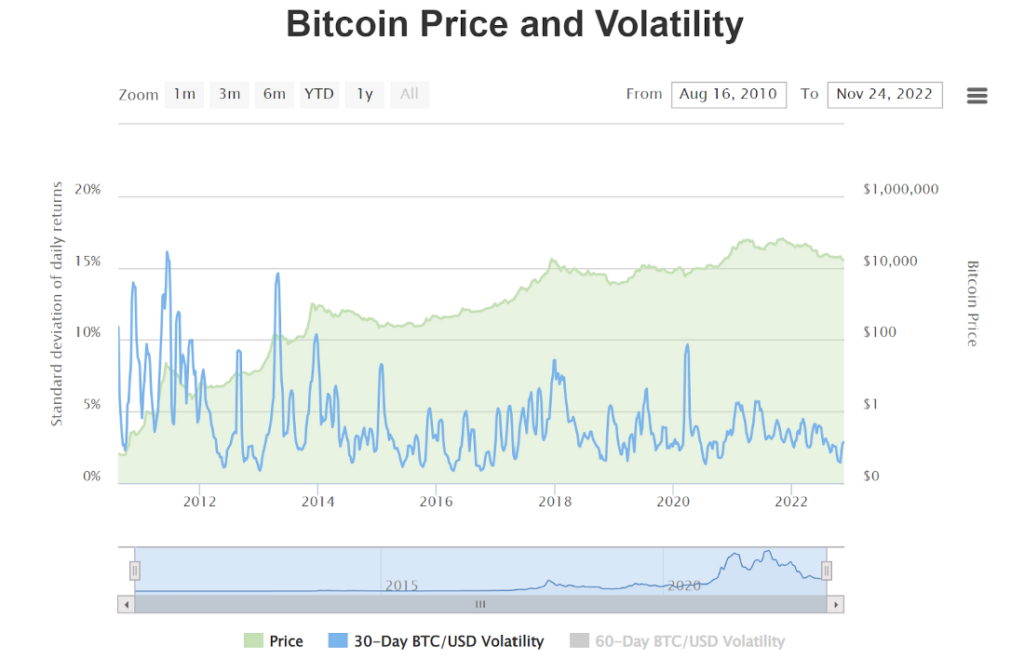

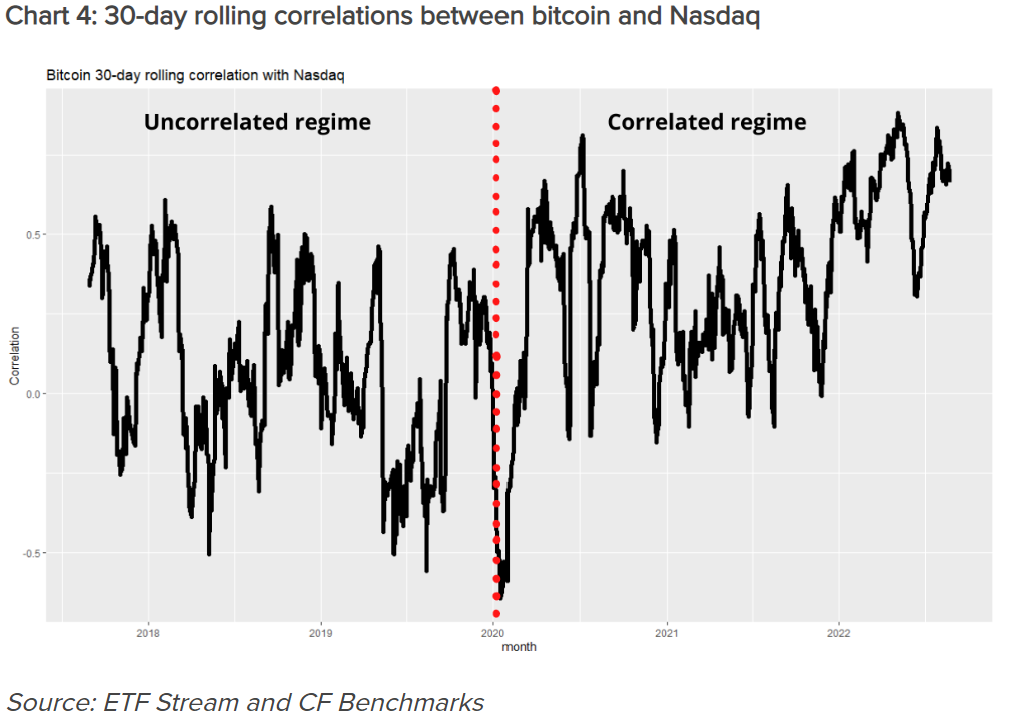

However, Bitcoin’s increased correlation with both the Nasdaq and the S&P 500, since early 2020, may be a sign that the whole crypto asset class is maturing. It becomes increasingly accepted and accessible for both institutional and retail investors, which coincides with less volatility overall:

Catalysts for Adoption:

Last year (2021), for example, the U.S. saw its first Bitcoin Exchange Traded Fund (“ETF”) and the ability to add Bitcoin as part of 401 (k) plans.

In addition, due to increasing interest from institutions, Blackrock, the world’s largest asset manager, joined forces with Coinbase to offer cryptocurrency related products. Additionally, El Salvador’s announcement, as the first country in the world, to make Bitcoin legal tender.

Institutions are Ramping Up:

In Grayscale’s first Digital Asset Investment Report, institutions already accounted for 56% of all inflows in Bitcoin during 2018, corresponding to a 28% market share at the time.

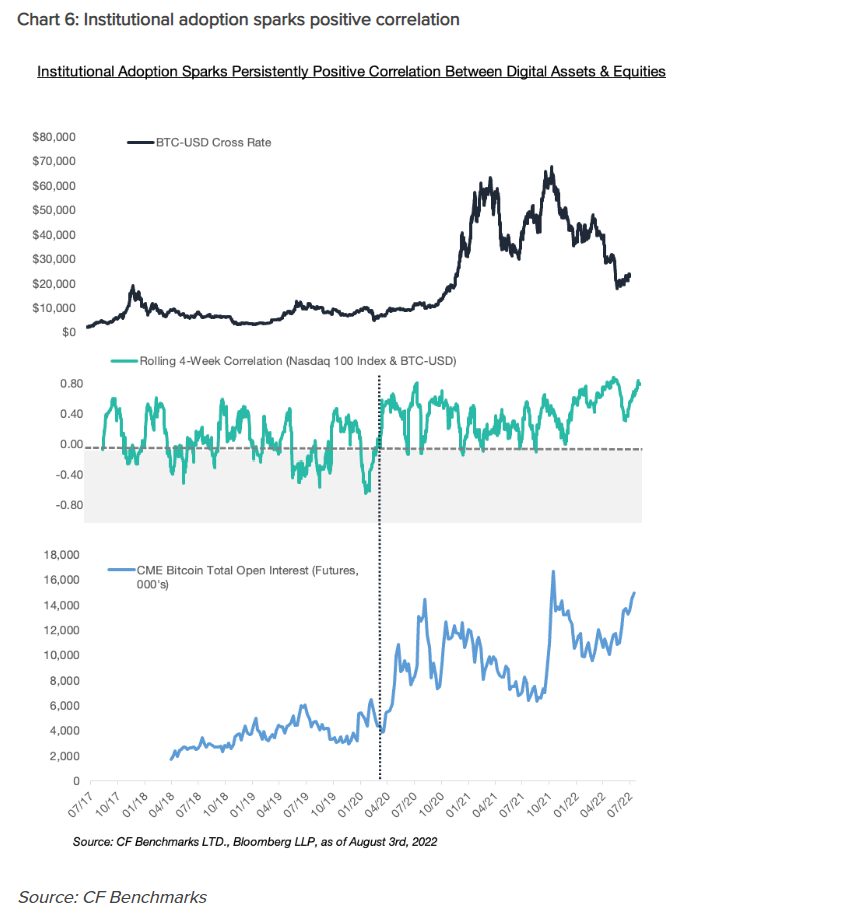

Within the period between September of 2020 to 2022, Chicago Mercantile Exchange (“CME”) total Bitcoin open interest futures increased from $4 billion to $10 billion as of August in 2022, topping out most recently in November of 2021 at $23 billion.

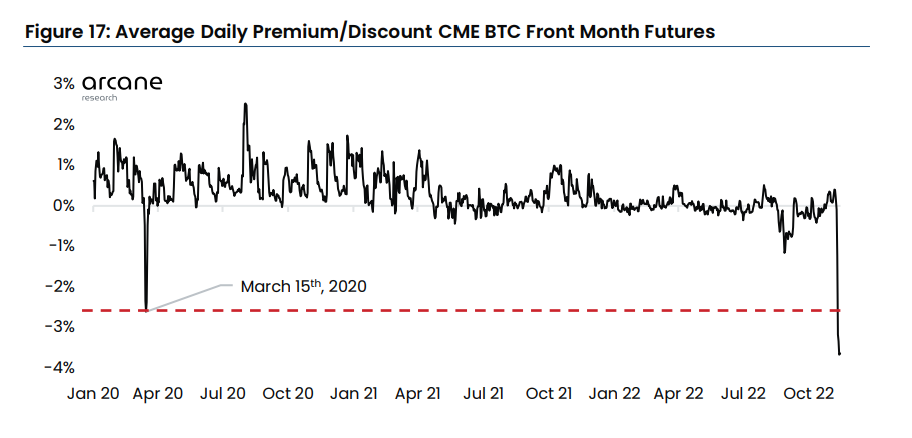

However, current positioning is abnormally bearish as CME’s futures traded at an all-time high discount to spot earlier this month, possibly due to the uncertainty associated with contagion following FTX’s collapse:

Glassnode also revealed that transactions greater than $10 million have increased from 7% of the market in 2020 to 83.2% of the market in 2022, portraying a view that institutions are getting comfortable trading Bitcoin besides traditional markets:

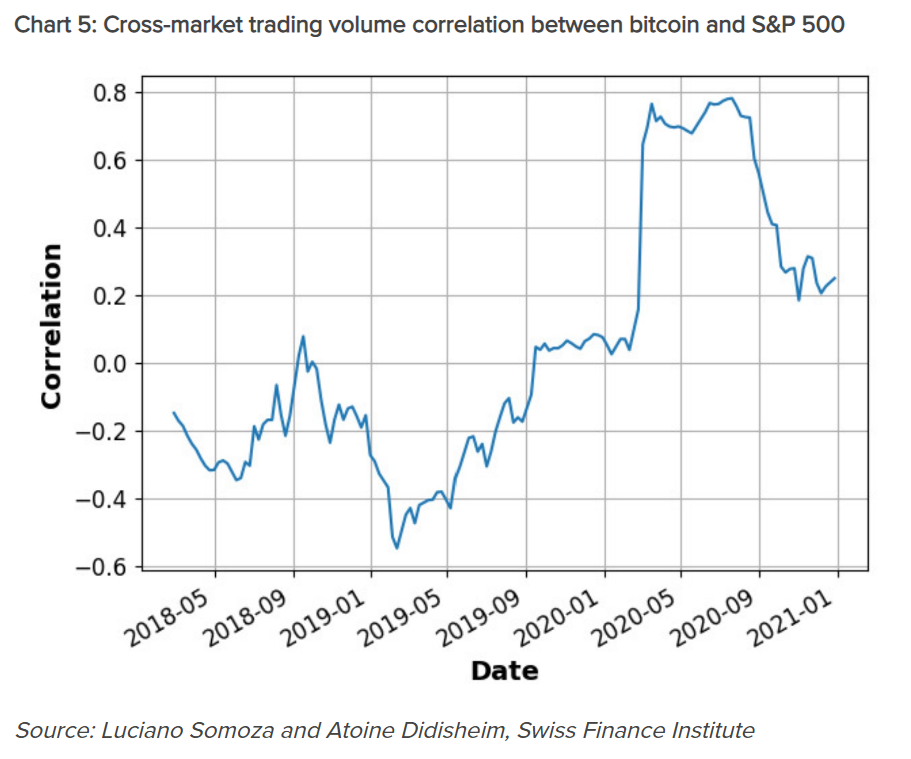

Furthermore, a report from the Swiss Finance Institute, suggests that Bitcoin’s increased correlativity could be driven by retail trading flows.

It refers to a change in retail trading behavior emerging in March 2020 and the tendency for retail investors to trade equities and cryptocurrencies simultaneously, in the same direction. The strongest correlation was shown between Bitcoin and stocks preferred by crypto-traders, especially where the cross-market trading volume was high:

ETH:BTC relationship

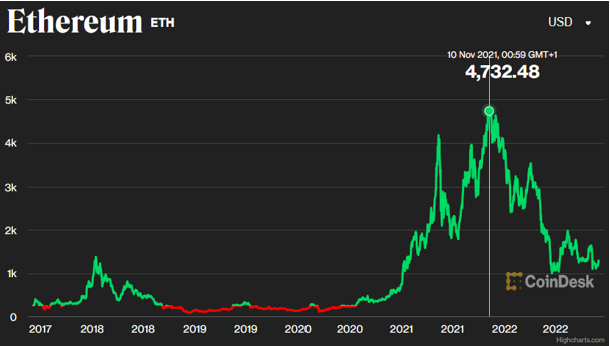

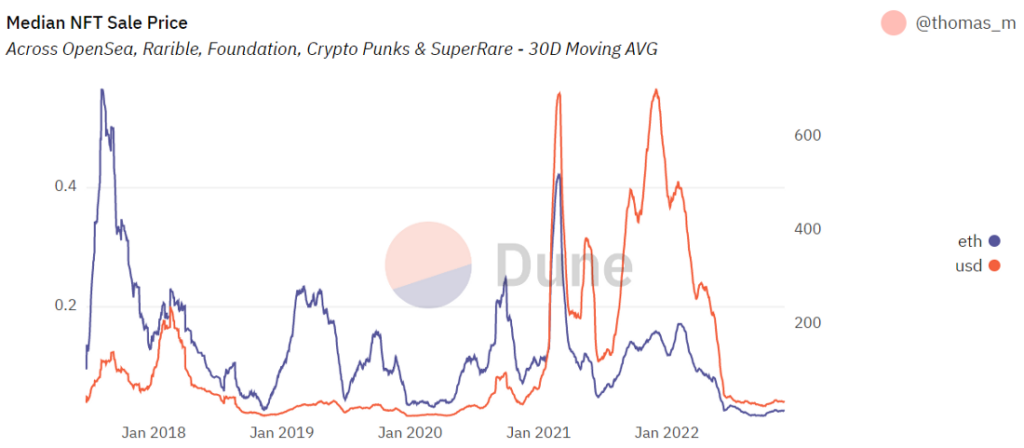

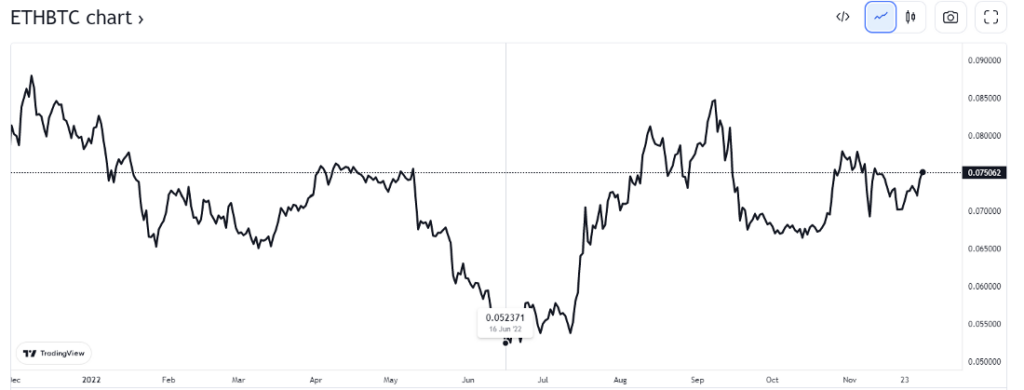

While Bitcoin has retained dominance in the crypto market, its intraday price movements as well as overall trend (top) has been a driver of Ethereum (“ETH”) price (mid) alongside other, risk-on, crypto assets such as NFTs (bottom), although least volatile. Most of the time, the correlation has been positive and strong although least volatile for Bitcoin:

Since June, Ethereum has outperformed, corresponding to the recent uptrend in the ETH:BTC chart (top), possibly as Ethereum’s transition to Proof-Of-Stake consensus, due to its deflationary mechanics whereas Bitcoin is inflating, has been positively perceived by the market:

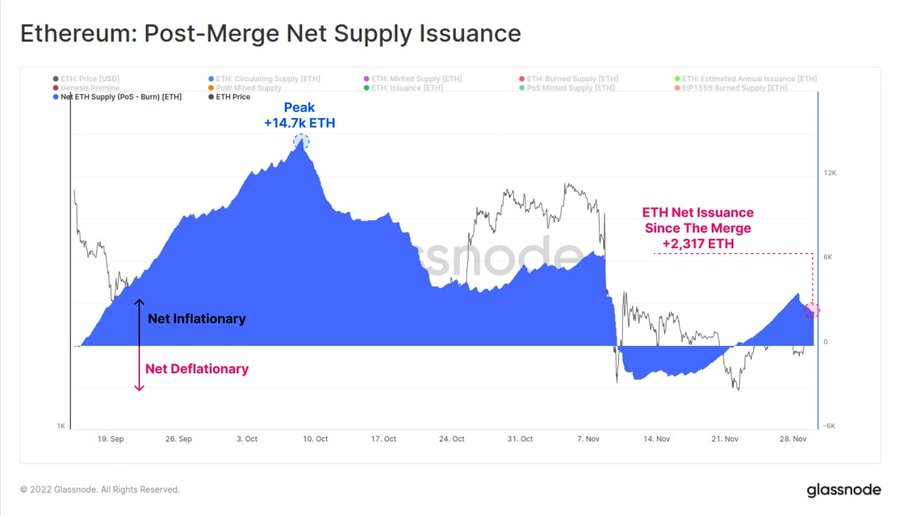

The Ethereum “Merge”, finalized on September 15th of 2022, has, apart from reducing the its energy usage by 99%, resulted in a reduced net supply issuance, hence the reference as “ultra-sound money”:

It’s all good and well talking about the price of Bitcoin and Ethereum, but how does this impact our “JPEGS”?

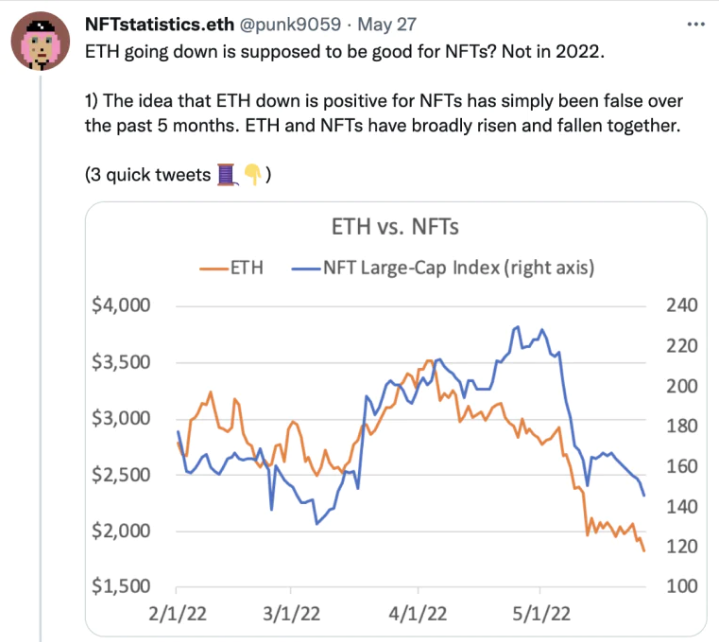

According to NFTstatistics.eth, based on the limited historical data, NFTs and Ethereum are positively correlated in a bear market as investors are prone to exit the illiquid assets and convert back to fiat. In a bull market, however, the negative correlation may return as investors are less concerned about this conversion:

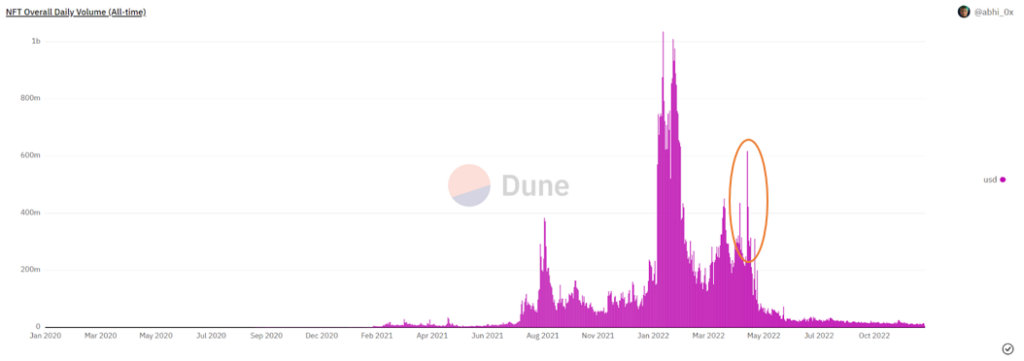

So far, periods of high volatility in both directions have imposed higher NFT trade volume, which could be due to its inherent speculative nature strongly driven by short term sentiment and/or momentum. NFTs are highly sensitive to announcements. Participants are aware of their volatile nature, hence stomaching a significant swing in price can be difficult. Concerned holders move to exit positions causing opportunistic traders to seize the NFT with a WETH offer, driving trading volume up.

For example, the most recent spike in NFT trade volume coincided with the confirmation on broader sentiment shift in interest rates due to macroeconomic stressors:

It is plausible that the same will occur when the macroeconomic stressors are reduced and new money flows back into both crypto and NFTs in search of these returns.

In addition, there may also be the first decoupling where we see independent price action from Ethereum, separate from the wider crypto market. Mainly, due to the soundness of the asset and the innovation, as well as adoption that it drives. One should also be aware of the ETH2.0 staking unlock that will commence in the beginning of 2023. Even though it is said to be a slow release, it could lead to adverse price action if the market is still struggling.

Regulation: The Path to Adoption

In light of recent events, it is clear that regulation becomes increasingly imperative to spur further innovation and, in extension, reach mainstream adoption. While enhancing the credibility of the space overall, it would also protect users from bad actors and miscellaneous events ultimately improving the user-experience.

Crypto-Assets Regulatory Framework:

In June of this year, the European Union (“EU”) reached an agreement on the Markets in Crypto-Assets (“MiCA”) regulatory framework for crypto-assets, crypto-assets issuers and crypto-asset service providers. There are, however, limitations to this framework that risk holding back innovation and many are voicing that a revised version is imperative, going forward, to ensure a more competitive crypto adoption within the EU.

Under this provision, for example, cryptocurrency and stablecoins are not accepted as valid forms of digital payment even if all merchants must offer at least one digital payment solution. However, the overall sentiment from the Eurozone provides confirmation that the crypto space is an attractive place to stay ahead in, which increases the confidence in the space more than anything else.

Digital Commodities Consumer Protection Act:

The US still approaches regulatory frameworks on a state-level and has not yet provided equivalent clarity on the federal level.

However, an act is currently in motion that seeks to accomplish this, namely The Digital Commodities Consumer Protection Act. It aims to settle the dispute with the Security and Exchange Commission (“SEC”) regarding the definition of a “digital commodity” whilst also creating a jurisdiction on how national digital commodities exchanges should be regulated by the Commodities Futures Trading Commission (“CFTC”). If such a substantial act should pass Congress, enough confidence could be induced to see a relief in the whole crypto market.

Stablecoin Transparency Act:

Another Act currently in motion that could drive progress, and specifically make the US more competitive, is the Stablecoin Transparency Act.

It aims to determine that a stablecoin issuer is required to hold all the fiat currency reserves associated with the fiat-backed stablecoin in a 1 to 1 ratio, whilst requiring a third-party monthly audit. This trajectory for Stablecoins is important as they serve a more efficient, borderless, way for businesses to settle transactions, with less intermediary obstacles such as fees, in contrast to fiat and potentially even CBDCs.

For example, more widely adopted Stablecoins would provide greater liquidity between businesses and Defi protocols, globally. It would include unbanked or underbanked participants around the globe, where access to dollars may be restricted. That is how many developing countries stand to gain a significant improvement in their quality of life from increased crypto adoption, adding credibility to the technology that Bitcoin pioneered.

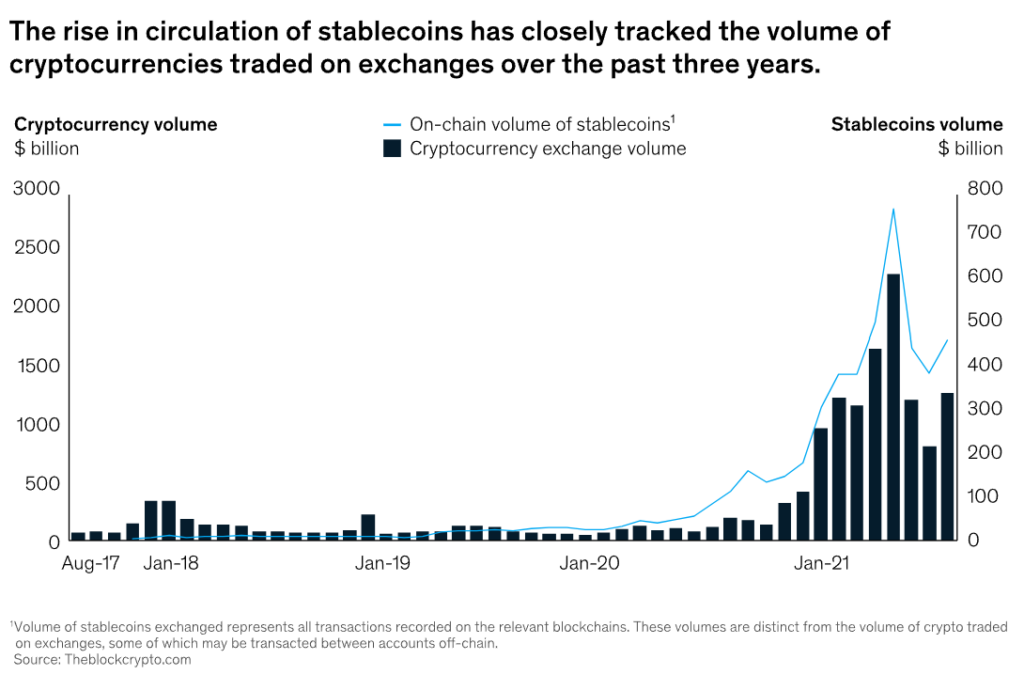

This is further validated by the reciprocity between on-chain stablecoin and cryptocurrency exchange volume:

Cycles to Adoption

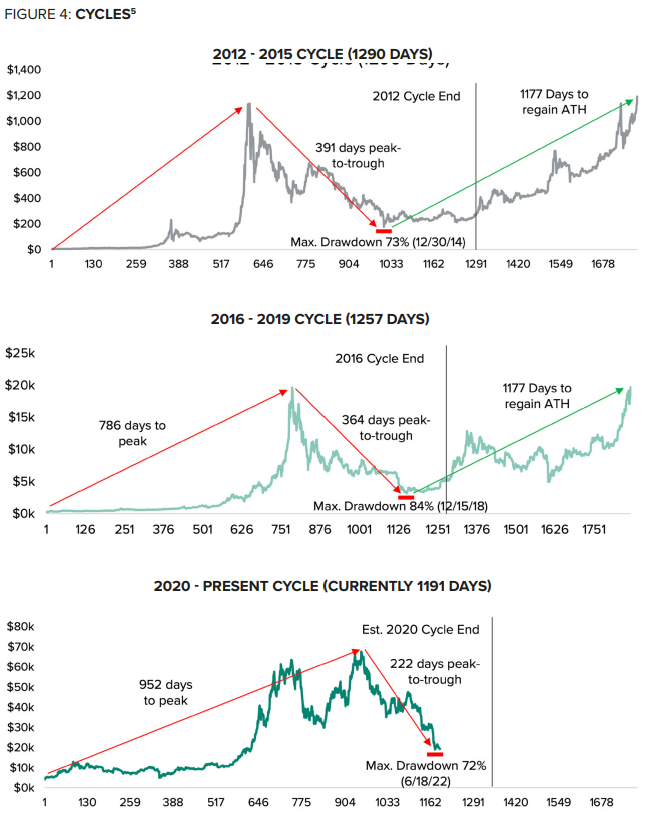

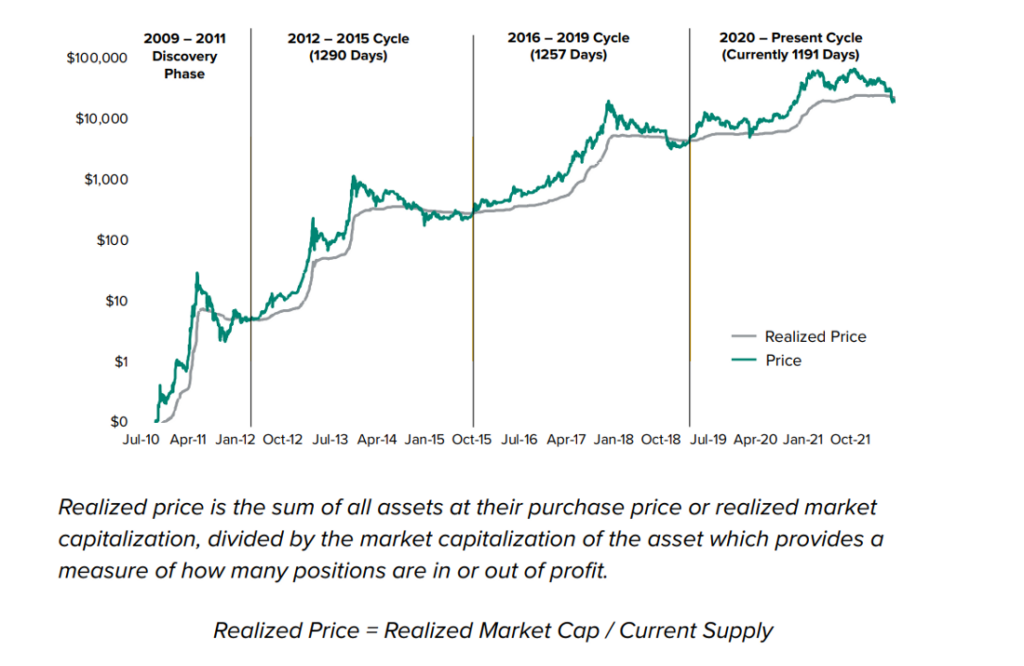

Many regard crypto as an emerging asset class. We’re currently in the final phase of the third crypto market cycle, if counting the 2009–2012 period as a discovery phase. Crypto market cycles occur approximately on a four-year basis according to a Grayscale report from July 2022, when using Bitcoin as a proxy:

For comparison, the U.S. economic cycles have occurred on a five and a half-year basis, on average, since the 1950s.

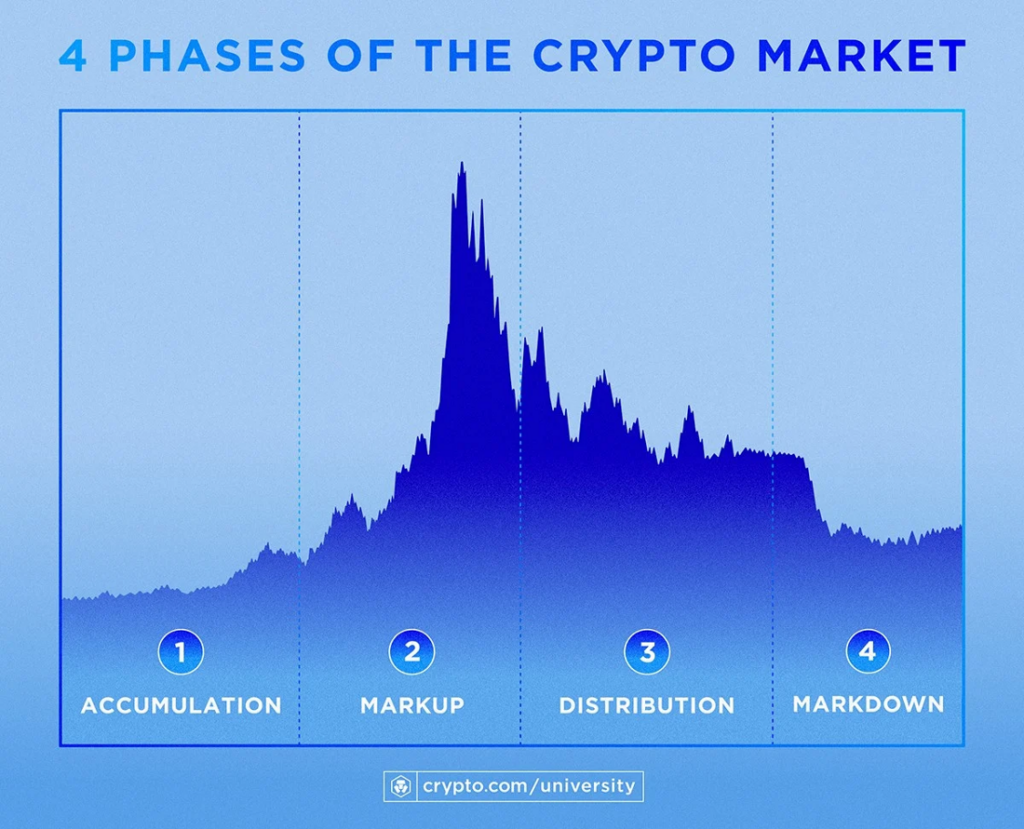

A crypto market cycle consists of four stages characterized by different sentiment and market activity.

- The first, named the accumulation phase, is where the previous markdown reaches a stabilized low price level which, historically, provides an attractive entry for long term investors.

- Then the markup phase begins, known as the bull market. This is where the price moves higher at an increasing rate while driving interest and excitement from new groups of participants entering the market.

- Shortly after the market reaches its peak, the third and distribution phase begins, characterized by equal proportion of buyers and sellers keeping the price within a limited, low volatile, range. It goes on until either the bulls, historically, surrender.

- The last is known as the markdown phase, where the selling pressure exceeds buying pressure as market participants experience loss of confidence. This tends to induce fear and lead to increasing sell-pressure during a volatile but short time frame event, leading into the accumulation phase once again:

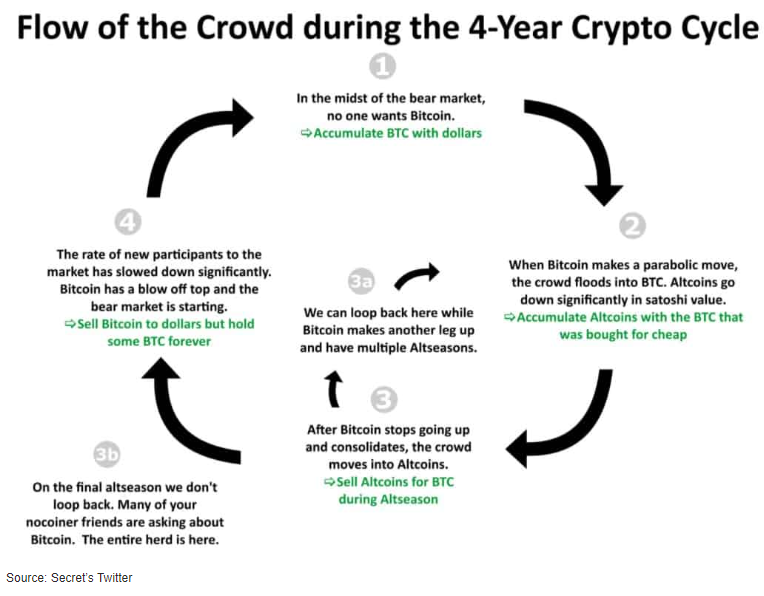

In the context of these crypto market cycles, Bitcoin has a tendency to follow a similar pattern that also affects alternative digital currencies (“Altcoins”):

Chris Dixon and Eddy Lazzarin, partners at the venture capital firm a16z, coin these “crypto price-innovation cycles’’ and put more weight on the activity behind each crypto market cycle rather than its market sentiment and price.

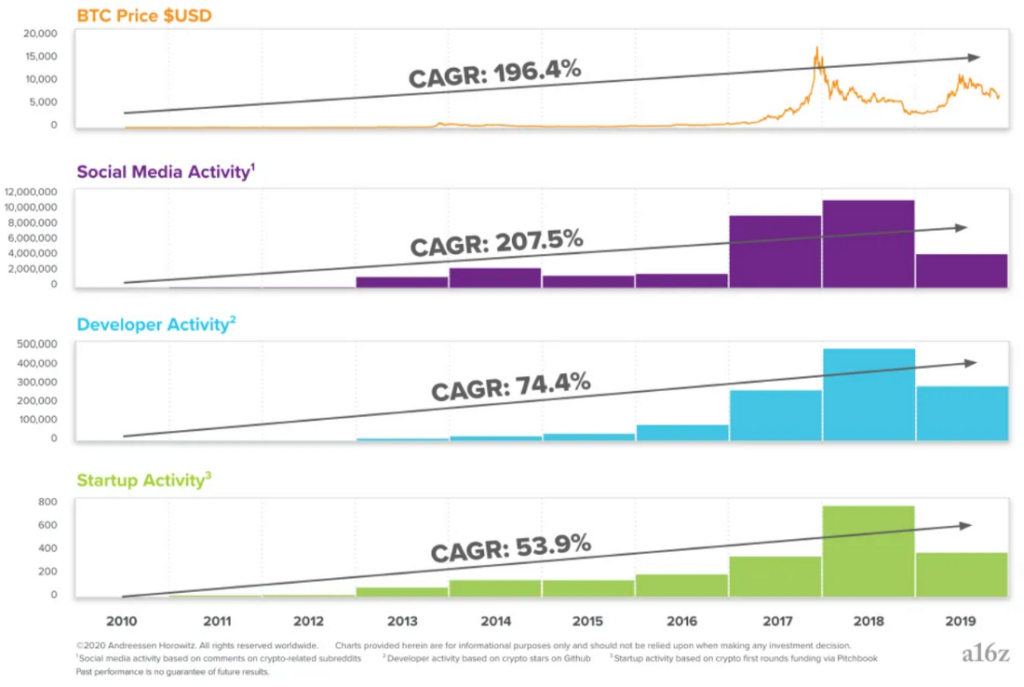

Their framework illustrates how the price increase, historically led by Bitcoin, surges interest for the whole asset which, in turn, leads to the formation of new ideas and new startups and projects. This is where bear markets give teams time to build out and, in extension, launch the products that drive the next wave of adoption and interest, culminating into the next cycle:

As the technology and its adoption is still nascent, the metric-based data has not been equally evident for each cycle. However, if gauging the compounding annual growth rate for each metric over time, the trend is clear:

On-chain Metrics

One should maximize the use of on chain metrics to gauge the sentiment for Bitcoin , and where it may head next. The correlation with Bitcoin ’s historical performance is strong.

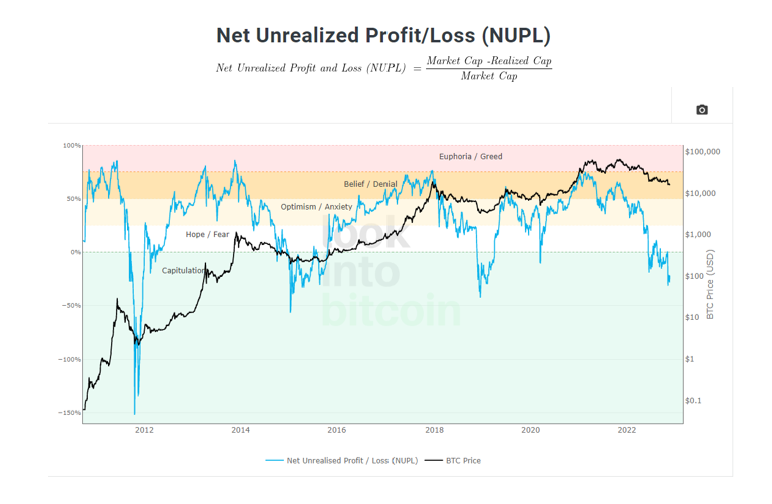

Net Unrealized Profit/Loss (“NUPL”):

The NUPL metric provides a measure of how many positions are in or out of profit. It’s currently in range of “capitulation”, implying that the gap between unrealized profits and unrealized losses within the network is closing in. It has only reached this range 5 times since its inception:

Additionally, in all these cases but one (March 2020, COVID-19), this has marked the end to a cycle, culminating the next where Bitcoin has provided huge returns:

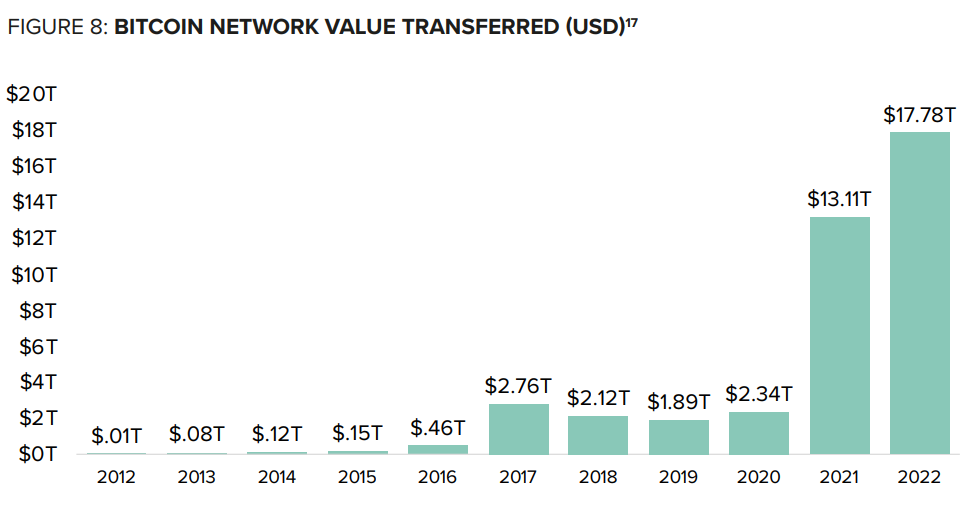

Bitcoin Network Value Transferred (USD)

Despite the hawkish environment, the underlying technology is functioning as per design and the value transferred on the Bitcoin network is increasing. According to Grayscale, it had already reached $17.8 trillion as of July 2022 in relation to the $13.1 trillion for the whole year of 2021:

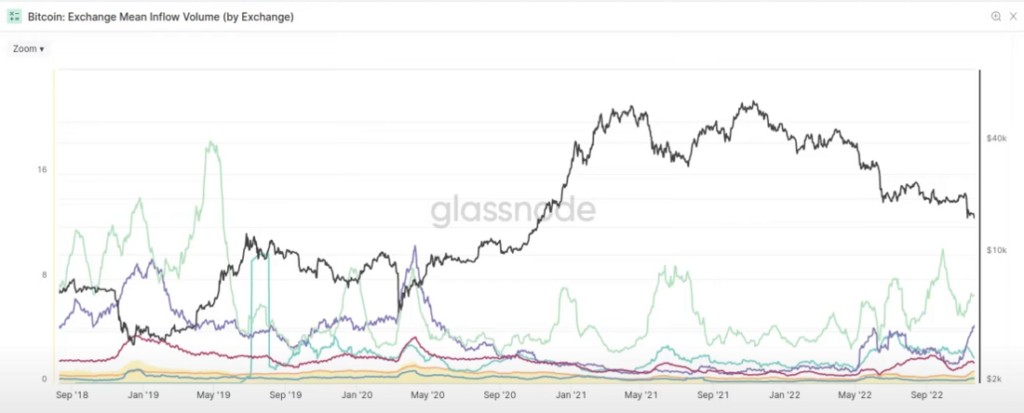

Mean USD Inflow Volume to Exchances

In general, whales and institutions tend to dominate the inflow to exchanges in the late stages of a bear market. This time seems to be no different since the average deposit in USD terms has increased over the last 6 months, when gauging the mean values.

The reason for this may be two-fold:

- For one, it may be due to the recent stress caused by the collapse of FTX where whales and institutions may have had to cover margin calls and/or protect against further uncertainty around its contagion.

- Secondly, most retail investors may have already capitulated and thus not meaningfully impacting the mean value:

Long-Term Holders

Meanwhile, the amount of long-term holders have been slowly increasing, especially these last 5 months, with no signs of reduced confidence:

Macro Outlook (Inflation)

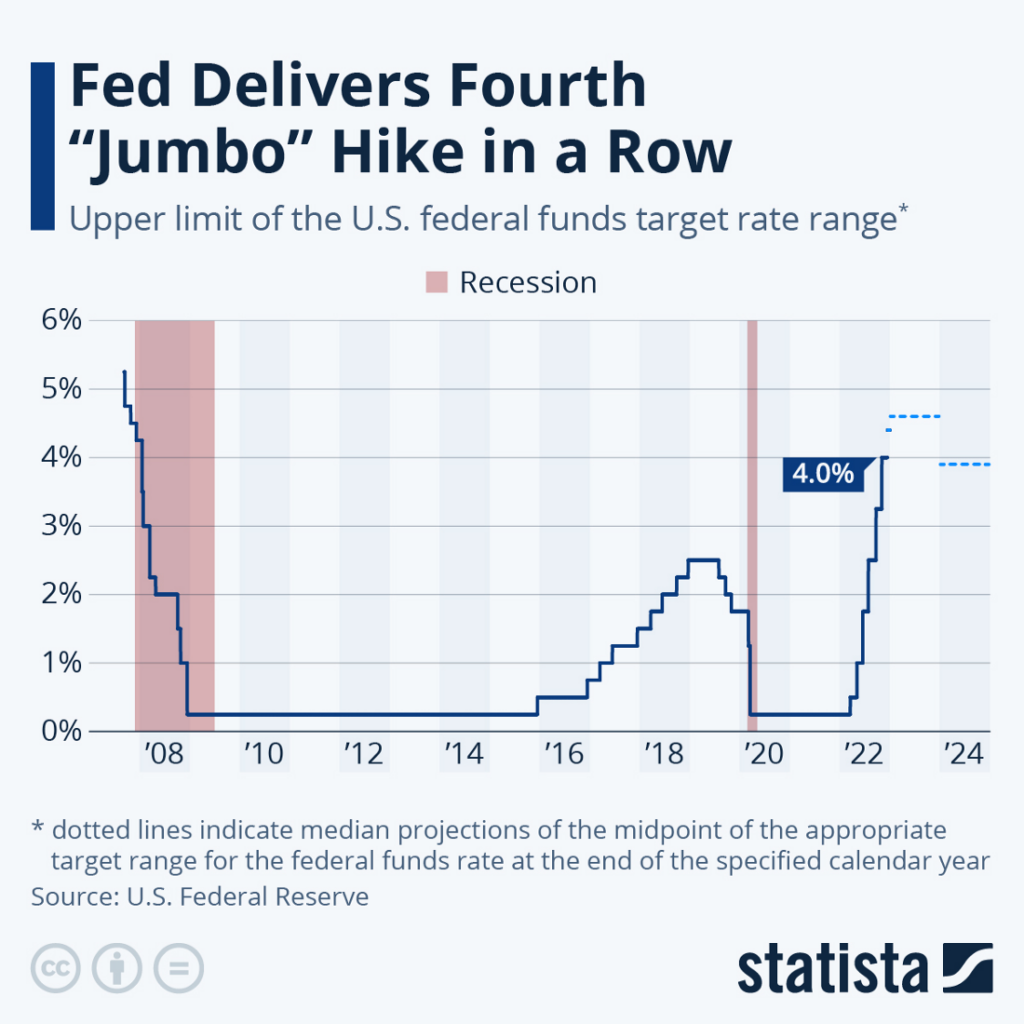

In order to reduce inflation, suggested as demand-driven, The Fed has drastically raised interest rates as a direct response.

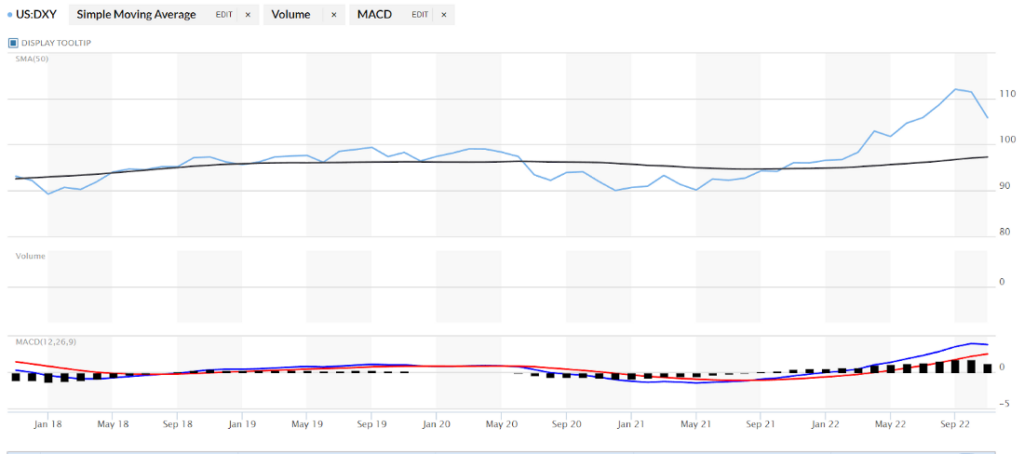

During this period, as The Fed has raised the interest rates faster than many countries, the dollar has been perceived as a safe haven currency, transcending what has been Bitcoin’s narrative the last decade:

In general, crypto is an “anti-fiat” asset class. Therefore, it has a very high negative correlation with the dollar index (“DXY”). A strong dollar, through The Fed’s shrinking balance sheets, puts pressure on dollar-denominated debt and gives less room for retail and institutional investors alike to make alternative, riskier, investments.

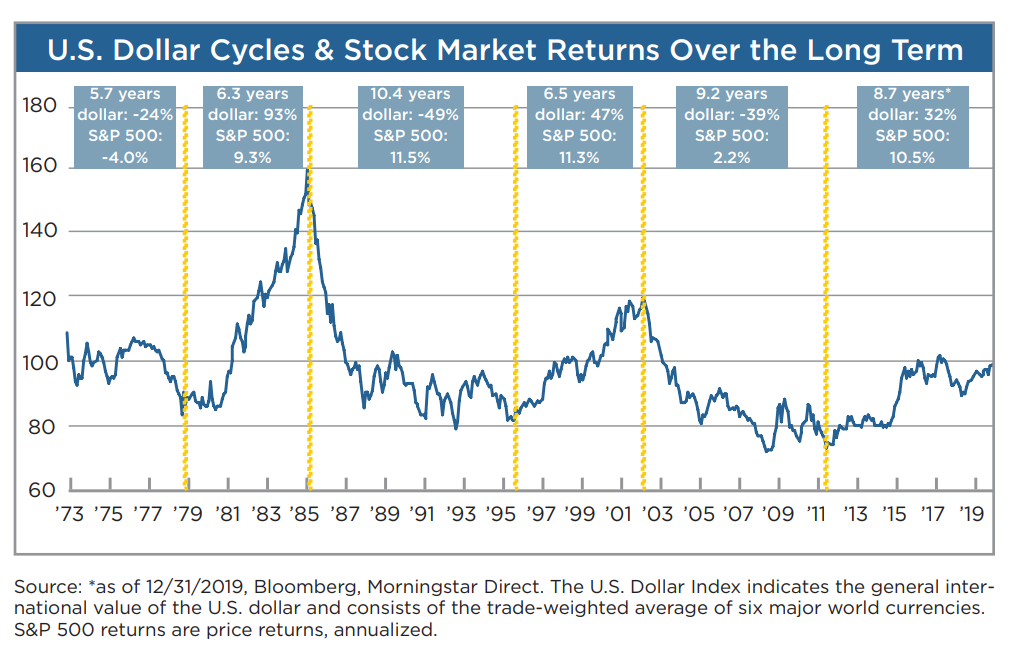

The dollar strength comes in cycles. This means Bitcoin has co-existed with a strong dollar. The next cycle, historically, correlates with a weaker dollar that could give more room to alternative investments depending on the severity of a potential recession:

Rate hikes are anticipated to slow, but it is expected to remain comparatively high over an extended period of time, implying a recessionary period of below-trend real Gross Domestic Product (“GDP”) growth whilst seeing how previous hikes have impacted the economy. Another 50 basis point (0.5 percent) hike is forecast in December which poses the question: What has the market already priced in and when can we expect The Fed to pivot?

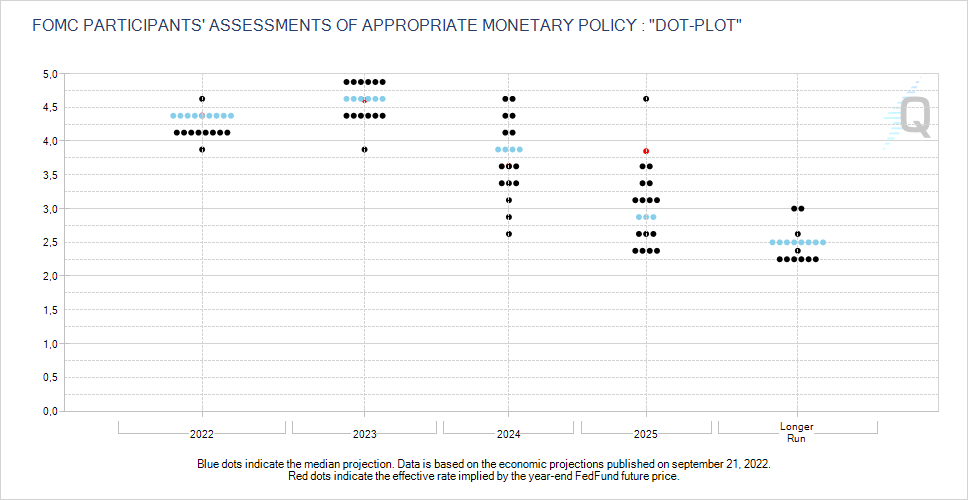

According to a panel of economists questioned by Consumer News and Business Channel (“CNBC”), The Fed Funds Rate is expected to peak at 4.83% and stay there for 10 months, before decreasing. Thomas Costerg (Pictet Wealth Management) refers to the stickiness in the Consumer Price Index (“CPI”) as a potential reason for this. It coincides with The Fed’s own “DOT-PLOT”, painting a gloomy outlook for risk-on assets:

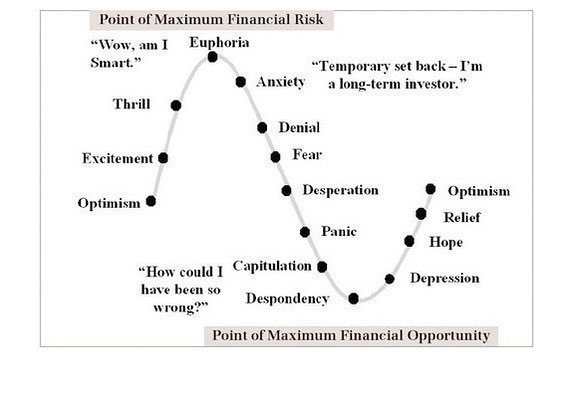

According to Andreas Steno Larsen at Steno Research (Editor at Real Vision) equities are currently going from “denial” to “fear” on the market psychology cycle, suggesting more pain to come:

Historical Anecdotes

According to Bob Loukas, expert in Market Cycles and 25 yrs in the field, the market tends to have already bottomed when The Fed confirms a recession.

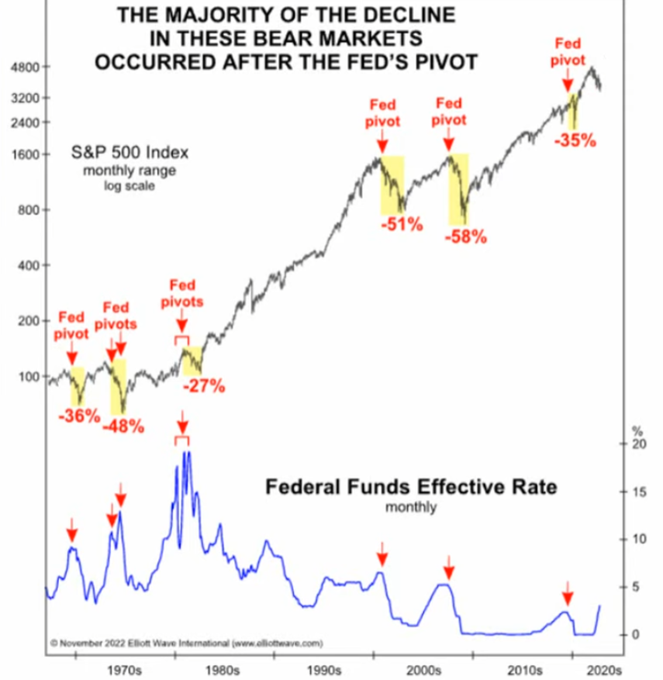

In addition, Morgan Stanley Chief Equity Strategist Mike Wilson, underlines that the worst bottom should be expected after The Fed pivots on interest rates since its effects are lagging:

This means we’re potentially in for more downwards pressure in equities with likelihood to spill over risk-on assets as funds continue to move to safer assets such as fiat. Especially, if the recession becomes worse and stays for longer than consensus expects.

Closing Remarks

The future narrative behind Bitcoin’s potential hinges on a multitude of dimensions and verticals.

Its foundation remains unchanged, whereas it still provides a unique value proposition for this digital age both as a speculative investment due to its absolute scarcity, continued interest/demand and decreasing supply mechanism. It also pioneers a new technology that:

A. provides a fully functioning, globally transactable, currency and;

B. spawned a new, trillion-dollar industry already transforming the current financial system

Despite many confidence-shattering industry events, the adoption of and innovation within crypto continues. As more products gain market validation, the credibility for the underlying technology that Bitcoin represents increases. From here, the narrative evolves.

For Bitcoin, innovations such as the Lightning Network and the Liquid Network serve to bring its most valued use-cases to an inquiring broader audience on a day-to-day basis. For the broader industry, regulations may serve as catalysts for further adoption through more user-friendly innovation. It may also shorten the time-period to mainstream adoption.

Bitcoin’s emerging nature, similar to that of Ethereum and NFTs, tends to correlate with equities during hawkish macro environments. Therefore, on a short term basis, it is unlikely to be profitable to invest in Bitcoin on the premise of it being an inflation hedge, or for being negatively correlated to risk-on assets. It’s also important to note that The Fed’s confirmation of a recession tends to come after equities bottom.

Bitcoin’s current direction as an integral part of the digital age, combined with historically bullish on-chain data and a weakening dollar, presents an optimistic view for its long term performance into the fourth crypto market cycle and beyond. That is, alongside other crypto assets such as NFTs that tend to be negatively correlated during bull markets.

Ultimately, whether Bitcoin will become an uncorrelated asset not subject to economic policies, causing ups and downs in equities, remains to be seen. If successful, it will be a sign that Bitcoin’s impact has matured from a speculative, volatile asset, to a self-sovereign hedge, store of value, and thus a necessary component of all portfolios similar to gold. If anything, Bitcoin will always remain the initial decentralized payment system that many subsequent cryptocurrencies iterated their network structures from as it presented a 0–1 moment in unlocking next dimension network effects.