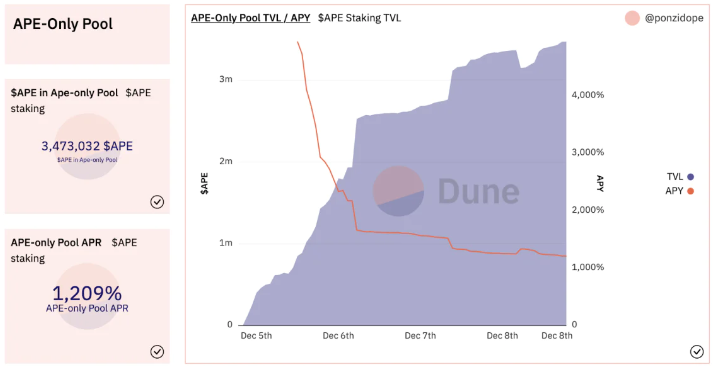

Yuga Labs, in partnership with Horizen Labs, officially launched the ApeStake.io website on December 5th and also kicked off the week-long pre-staking phase of Ape Staking. The official Ape token staking incentive will be released from December 12 and is expected to yield 1000%+ APY based on current pre-staking data.

Although we are still a few days away from the official start of staking and the expected APY yield at that time will drop after more APE tokens and BAYC/MAYC/BAKC NFTs are staked, Ape Staking is an investment opportunity that should not be missed for both investors and NFT collectors.

This article will explain in detail the official rules of Ape Staking and the risks involved, and compare the staking mechanism and expected returns of three third-party Ape Staking platforms (ParaSpace, BendDAO, Binance NFT) to help you make the most rational “Where to stake” decision.

ApeStake.io–The official platform

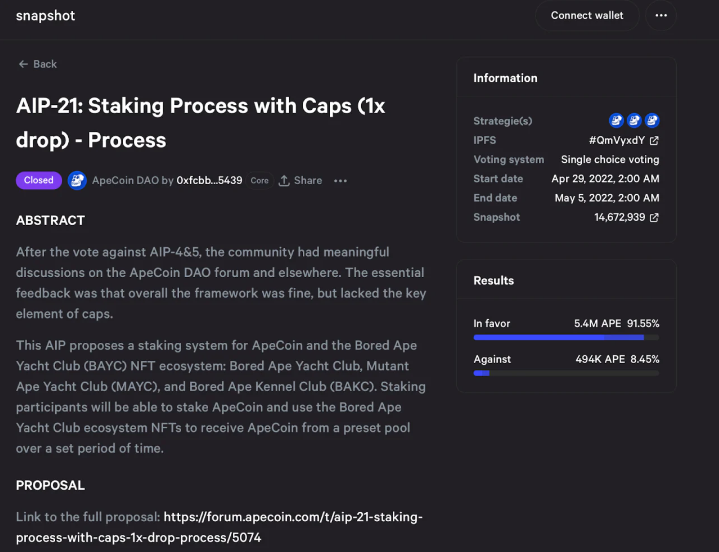

Ape Staking’s earliest proposals, AIP 4&5, were rejected by the DAO governance vote. After that, there was a lot of community discussion until AIP 21&22 was voted on and the Ape Staking event details were agreed upon by the community and the development was prepared.

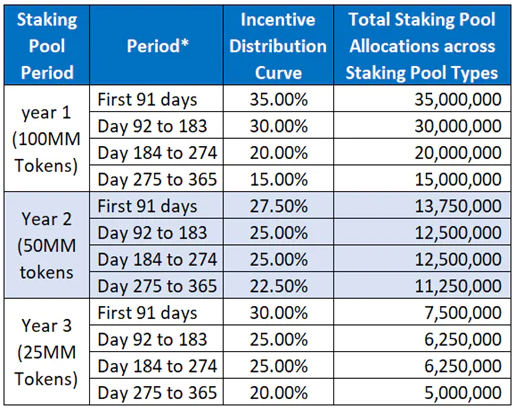

The chart below shows the release of APE token incentives for each quarter of the three-year Ape Staking campaign, which shows that early participants receive more APE token incentives and a higher expected rate of return.

The form of participation in the APE Staking activity is further divided into 4 mutually independent staking pools: the APE token staking pool, the BAYC pool, the MAYC pool, and the BAKC paired pool. The Ape Token Staking Pool can directly stake any number of APE tokens, so participants’ earnings depend on the percentage of APE tokens they invest in the total pool.

In the BAYC and MAYC staking pools, NFT is more like a container for APE tokens, which need to be paired with APE tokens to participate in APE Staking mining. Its staking revenue is determined by the number of paired APE tokens, and each NFT has a cap on the number of paired APE tokens. BAKC, on the other hand, must first be paired with a BAYC/MAYC before it can be paired with APE tokens to participate in staking.

Please refer to the chart below for the specific APE token staking limit and the number of APE tokens released per asset pool.

Note: If you choose to participate in staking directly through ApeStake.io, please note that if you sell the corresponding Ape NFT during the staking period, then you will lose all the paired Ape tokens. Therefore, please remember to always uncommit the staked Ape NFT and reclaim all Ape tokens before the transaction takes place to prevent attacks by arbitrageurs.

The above is the official way to participate in Ape Staking, but please note that the prerequisite is that you must have both NFT of BAYC/MAYC/BAKC and APE tokens with the corresponding cap to achieve the highest expected yield. So if you only have the corresponding NFT or APE, or if you want to get a higher expected yield and more liquidity, then you have three better options: ParaSpace, BendDAO, and Binance NFT.

ParaSpace

The name ParaSpace may be unfamiliar to you, as it is indeed a new player in the NFT lending market, but its sister project Parallel Finance – the number one lending protocol in the Polkadot ecosystem – is certainly not new to you, and the development team is also Para Labs.

Para Labs’ first exploration for multi-chain deployment + multi-market layout is ParaSpace – an innovative NFT lending platform based on the Ethereum ecosystem, a strategic layout that is a bit similar to the logic of Uniswap Labs’ recent entrance into the NFT trading market. As its first battle to open up the Ethereum NFT lending market, the ParaSpace team also develops a new platform for Ape Staking and opens up an additional 30% APY mining incentives for APE tokens in the pre-staking stage to incentivize early users to participate.

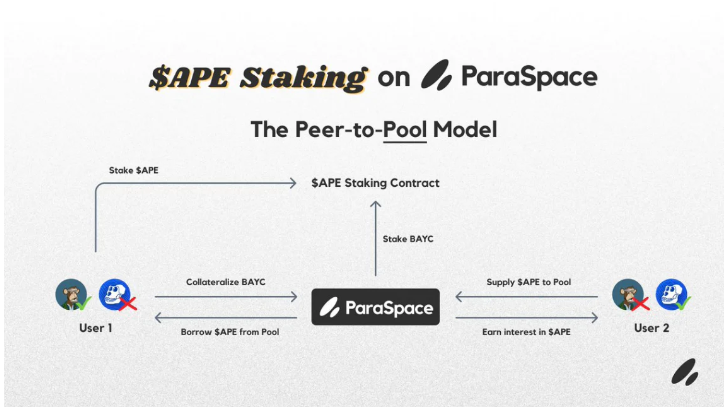

ParaSpace Ape Staking, like BendDAO which will be analyzed below, uses NFT collateral lending as the base logic of the platform, together with the mechanism of Ape Staking, and allows NFT holders to obtain additional liquidity funds through collateral lending while participating in Ape Staking to obtain continuous APE token rewards. However, ParaSpace has adopted an innovative Peer-to-Pool model, which greatly enhances the efficiency of capital utilization.

First, Ape NFT holders who stake their NFTs on the ParaSpace platform can borrow the APE tokens they need to match with their NFTs from the APE lending pool, rather than having to find a specific APE token holder to stake their tokens to the NFTs, greatly reducing market friction. At the same time, APE token holders only need to deposit their APE tokens into the ParaSpace lending pool to receive an APE Staking incentive in the form of a lending rate.

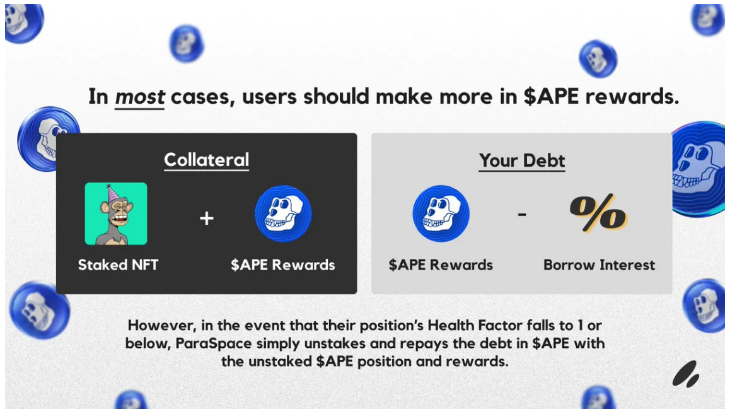

APE Staking paired mining in the form of NFT lending has the risk of Ape NFT being liquidated mechanically, but ParaSpace also solves this problem very cleverly. First of all, the coin price of APE tokens has a strong correlation with the floor price of Ape NFT, so the liquidation risk itself is lower than the NFT collateral lending ETH model. At the same time, in the extreme case, when the liquidation process is to be opened, ParaSpace will automatically redeem the already staked Ape NFT, but will deduct the necessary portion from its Staking reward to ensure the solvency of the APE token lending, while the Ape NFT itself will not really enter the liquidation auction process.

In addition to this, ParaSpace’s smart contract can also prevent the risk of the original holder losing the paired Ape tokens if the Ape NFT is sold during the staking period, as mentioned in the previous section. Any Ape NFT staked through ParaSpace, if a transaction occurs during the staking period, ParaSpace will automatically uncommit and return all the paired APE tokens before the transaction occurs. This fundamentally eliminates the occurrence of this bug in the official mechanism and ensures the security of its own APE lending pool.

Regarding the security aspect of the contract that users are most concerned about, although ParaSpace is a brand new NFT lending platform plus the new contract for Ape Staking will only be available on the main network on December 10, its contract has already undergone security audits by 0xQuit, Certik, trail of bits, and secure3io, while several other leading security auditing firms are in the final stages of security review, including SlowMist, VeridiseInc, and Quantstamp.

For users who want to participate directly in Ape Staking but are restricted by ApeStake.io due to geographic location, ParaSpace has developed a front-end interface that interacts directly with the official Staking contract to facilitate the access by restricted users.

BendDAO

BendDAO is no stranger to the vast majority of blue-chip NFT players and has been running smoothly for nearly 9 months, during which time BendDAO has also experienced dramatic fluctuations in blue-chip NFT prices resulting in numerous NFTs going into liquidation. Not long ago it was also questioned by the industry whether it would be the culprit of blue chip NFT prices going into a death spiral of decline and the ability to resolve bad debts, etc. However, along with the continuous iterative upgrading of the product and efforts to modify important parameters through community proposal decisions, BendDAO has proven its leading position in the NFTFi space with data and time. Therefore, BendDAO is also a very important third-party participation in Ape Staking’s activities.

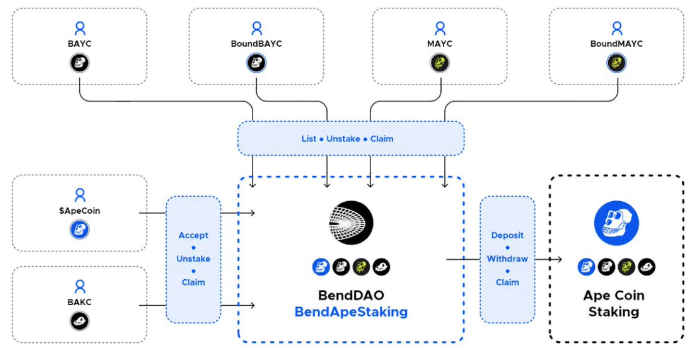

BendDAO’s product planning for supporting Ape Staking began with a community proposal and was followed by a proposal to vote on a 4% APE Staking protocol rate that BendDAO would charge, which can be considered a benchmark case for DAO governance in the NFTFi space.

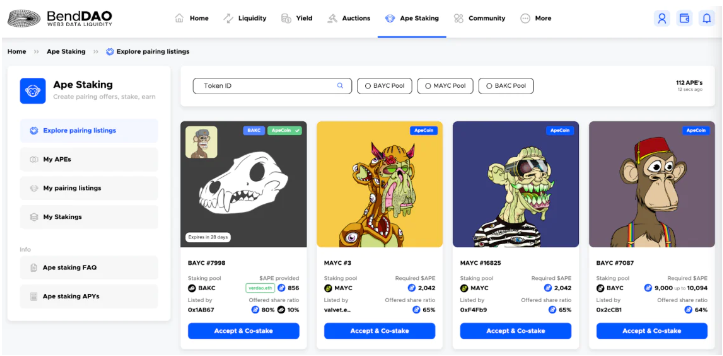

The Ape Staking product design idea adopted by BendDAO is different from ParaSpace’s Peer-to-Pool logic but adopts a Peer-to-Peer model with a higher degree of user flexibility. When each BAYC/MAYC is deposited into BendApe Staking, the NFT holder is free to set several parameters: 1, the percentage of the total APE token reward shared by each role of Ape NFT, APE tokens, and BAKC paired stakers. 2, the number of APE tokens required to be staked.

For holders of APE tokens, they can choose any of the Ape NFT pairs to stake, but the most important choice is definitely based on the pre-determined reward distribution ratio set by the Ape NFT holder.

This is BendDAO’s Peer-to-Peer model, which gives users maximum flexibility but also brings some problems of higher pairing friction, such as the setting of the reward distribution ratio. If the profit share of APE tokens staked is set high, then it is likely that there will be enough APE tokens to participate in the pairing stake, but the profit share of Ape NFT holders may not be as high as the expected return of other platforms; if the profit share of APE tokens staked is low, then there may be no APE tokens willing to be paired with this Ape NFT. Therefore, it is very likely that after the official start of the Ape Staking campaign, Ape NFT holders will keep redeeming and readjusting the reward distribution ratio according to the expected yield of other platforms, making it really hard for users of different roles to obtain long-term stable rewards.

Binance NFT

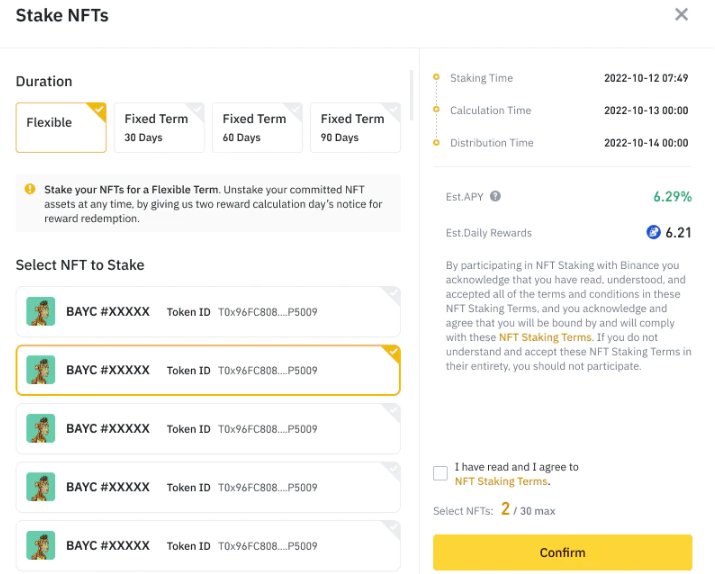

The centralized exchange has also found its entry point in the Ape Staking campaign. Binance NFT made an announcement on December 6, announcing that it will launch the Ape NFT staking campaign on December 12.

The rules of the campaign are the simplest and most straightforward among these Ape Staking programs. Users only need to stake BAYC and MAYC NFT on the Binance NFT platform to receive daily APE token rewards. It is equivalent to providing a centralized stake service for Ape NFT holders, and users do not need to worry about the pairing of APE tokens for higher profit in Ape Staking activities.

Users can choose to stake BAYC or MAYC NFT in a flexible form or for a fixed term of 30, 60 or 90 days. Although the difference in yield for different staking terms is not mentioned in the official announcement, it can be expected that a longer fixed term should correspond to a higher APY.

It is worth noting that after the start of the stake, if users want to get back their staked Ape NFT, the official announcement reminds that the redemption process will take 48 hours for flexible stakes and up to 7 days for fixed term stakes, and they will lose the APE mining revenue for these 7 days, which is not a user-friendly redemption experience for the highly volatile NFT market.

At the same time, compared to ParaSpace and BendDAO, where all processes are carried out through smart contracts in the form of “DeFi” and guaranteed by numerous audit reports, Binance NFT’s centralized stake mechanism also has some risk of centralized operations, but Ape NFT holders can also check the data on-chain at any time through official channels that allow Ape NFT holders to check whether their BAYC/MAYC are involved in staking.

Binance NFT has not yet announced its specific profit methods and revenue expectations, including how it will be paired with APE tokens to participate in Ape Staking (the source of these APE tokens should be Binance Earn’s APE Staking campaign), and how much profit it will share from them, all of which are still unknown. Therefore, users will only be able to make a direct comparison and make their own decisions after the campaign goes live on December 12. However, it is estimated that the yield should be lower than the NFT + maximum APE token pairing yield, because there should be a commission charge for the Binance team.

Summary

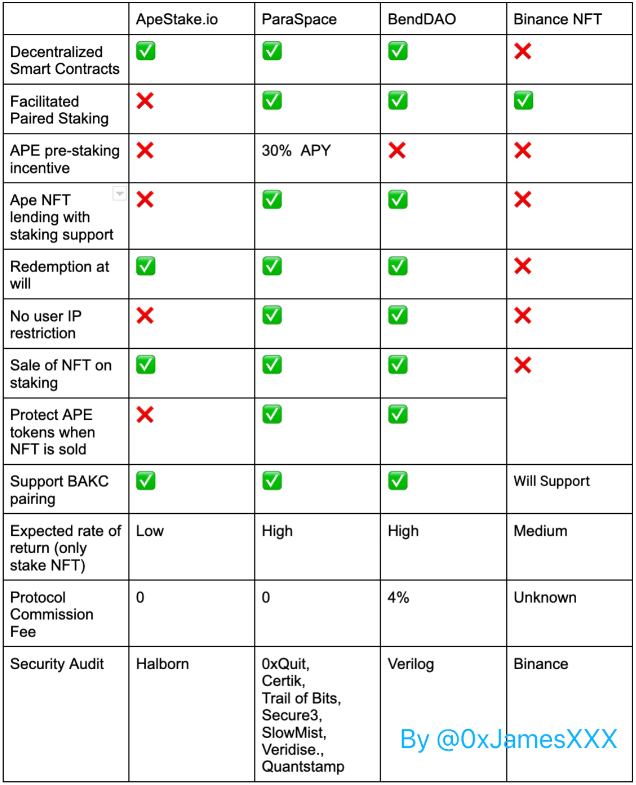

In order to facilitate a direct comparison of the four participating Ape Staking platforms mentioned above, I have created the following table for your reference.

Despite saying that, the design of the Ape Staking has received mixed reviews from both NFT users and token holders of the APE ecosystem. But as a DeFi researcher, I’m glad to see that the NFT native projects are integrating more of the DeFi design ideas, including the Art Gobblers, which was a big hit some time ago and borrowed the (3,3) model from the DeFi project OlympusDAO.

Meanwhile, the NFTFi track is even more so: LooksRare and X2Y2, which are trading-as-mining, Blur.io, which has upgraded to Listing + Bid as “mining” blind boxes, ParaSpace, BendDAO and JPEG’d, which have over-collateralized lending as the underlying logic of their products. These projects provide great support for the underlying liquidity of the NFT ecosystem and improve the overall efficiency of capital utilization.

I believe that with the continuous exploration of the whole NFT ecosystem for combining tokenomics, and the continuous efforts of the buidler of NFTFi track and the mechanism innovation combined with the characteristics of NFT itself, we will soon have more attractive PFP series, RWA on-chain investment opportunities underwritten by NFT, customized financial instruments, etc.

NFT will definitely assume a more important role in the future on-chain financial system.