About Loi Luu

- Founder and Chairman of Kyber Network, an on-chain decentralised trading protocol for cryptocurrencies;

- Founder of Kyber Ventures, a web3-focused investment fund;

- Selected in the Forbes 30 under 30 list for Asia, and Top 10 Innovators under 35 for Asia Pacific by MIT Technology Reviews.

The 2014 Mt. Gox hack, a time when most were heading for the exit from Bitcoin, is the time I began my blockchain journey. As Bitcoin crashed from USD 1100 to less than USD 200, I witnessed the push for greater decentralization. It could no longer be about centralized setups like Mt Gox, where fund safety and order matching were completely reliant on whoever was running the exchange. I witnessed resolve across the industry from users to investors to developers alike, to adhere more to the founding principles of blockchain tech; namely transparency, trustlessness and verifiability.

For the next 8 years, many secure and non-custodial trading solutions sprouted up; from atomic swap to Layer-1s focused on DEXs (e.g. BitShares), from smart contract DEXs on EVM chains (such as Kyber, which I co-founded in 2017, Bancor, Uniswap) to hybrid onchain-offchain DEXs (0x, Airswap, dydx). Just when it felt like we were on track to establish the post-Mt Gox ideals and realize our vision of scaling a secure and transparent trading model for crypto, I was both shocked and disappointed to witness the implosion of FTX earlier this month, all in a matter of a few days.

Where are we now

FTX’s collapse is shocking not only because of the scale of damage to users (over 8 billion USD potentially lost), but also because FTX has always been considered one of the safest and most compliant CEXs in the industry. My colleagues and I were left with a host of questions. What could we have done to detect such fraud earlier? What warning signs did we miss? How did this come to be despite the strong resolve towards decentralization after Mt Gox? And, most importantly, where do we go from here?

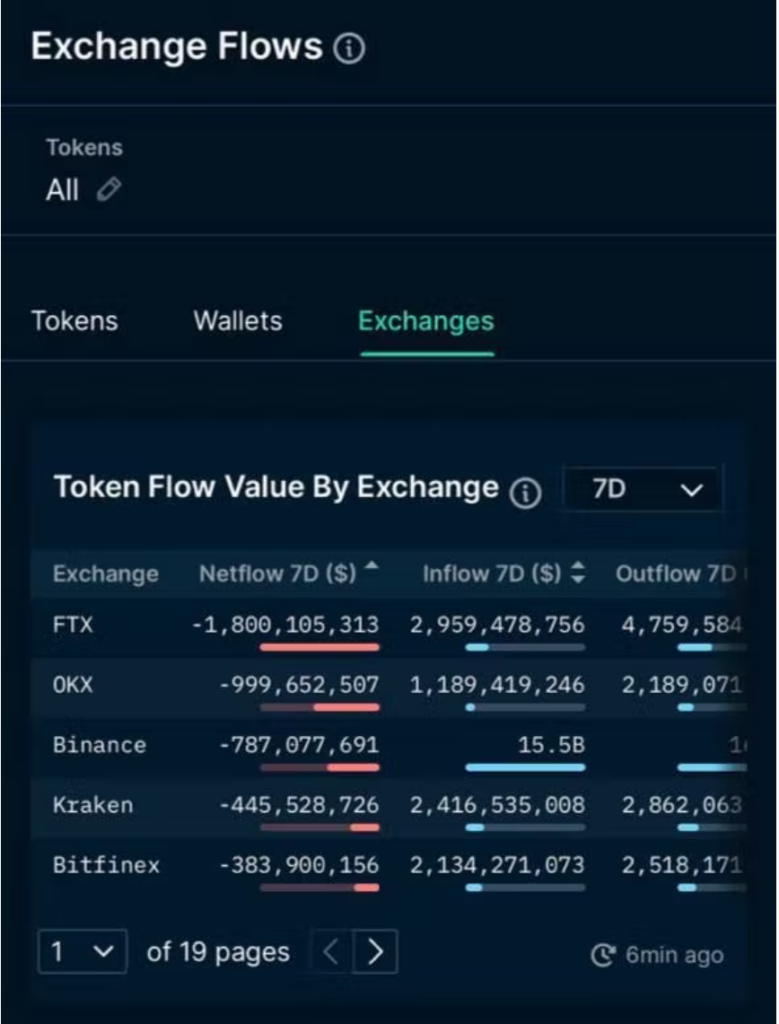

To start answering these questions, we think it’s important to first look critically at other centralized players in the space and whether they offer the security and reliability we so badly need.

The most obvious candidates for such analysis are other CEXs such as Binance and Coinbase. So far; CEXs have been custodial, holding users’ assets in their centralized wallets. There has been no transparency on how user funds are maintained and secured (e.g. via proof of reserves), or how they are used by the exchange (e.g. FTX providing customer assets to Alameda). Is this the best setup? Already, ideas such as non-custodial CEXs, fiat-only on/off ramp CEXs, and on-chain proof of assets solutions are being proposed in the FTX after-math. Given the collapse of several centralized players in the current bear market, addressing this weak link in the industry will form an important part of our recovery.

Another risk factor in the space is centralized stablecoins. Table 1 below gives an overview of the top 5 stablecoin issuers, representing a total market cap of 138 billion USD. Only 4% of this supply is managed by DAI; a decentralized issuer that is, however, currently backed more than 50% by USDC. This highlights the risk of contagion if any single point of contact were to fail, be over-regulated or depeg.

Table 1: Overview of stablecoin market caps (Source: Coinmarketcap)

Alongside centralization risk, we are also at a period of general decline in crypto adoption. NFT trading volumes are down 99% from peak. DeFi yields, which had earlier driven user adoption away from CeFi and its low interest rates, are no longer as attractive; with US T-Bills earning 4.15 to 4.65%. New product innovation has slowed down, with several copycat projects crowding the space without meaningful contribution to the industry. Finally, though we have seen a deluge of new L1 and L2 projects, it is unclear what marginal improvement they offer users. L1s with the best innovations over the past year offer users both cost savings and increased security, but they are only relevant when there are actual good and meaningful use cases for users to keep the chains busy.

Why are we where we are?

In an interview post collapse, SBF speaks about how a lot of the work he did at FTX was about presenting one image to the outside about certain values (open to regulation, altruism, risk management); while another set of values (becoming big, getting positive public opinion, money) was what guided his day to day decisions at FTX and Alameda.

What allows people like SBF, Do Kwon and Su Zhu to thrive so spectacularly in the industry? What pulls us into their orbits, away from the post-Mt Gox values we all committed to 8 years ago?

While there is no denying the significant damage such founders have inflicted on the the crypto space, we have to reflect on these questions to avoid similar incidents in the future.

I have also seen the crypto space develop too fast, without enough time for critical reviews or frameworks for self-regulation. Unbelievable price appreciation has led to an explosion of crypto projects and user adoption in a very short period of time; along with short-term, unrealistic visions of success (“to the moon”). After such attractive price action, we can assume most people did not jump in for the technology or to uphold the principles of blockchain; but instead to make a quick buck. Unfortunately most crypto VCs, which are expected to be more sophisticated investors, were also rushing into deploying capitals to fund new companies. Unlike TradFi, there are insufficient due-diligence processes and best practices; which has led to hot money floating in and out of random projects.

Finally, to acknowledge a painful reality, Web3 is still difficult to use and understand for most people. Decentralized solutions involve high technical background, developer focused UI/UX; which has been a major barrier of entry for mass adoption. While large DeFi yields or Play-to-Earn incentives prompted users to educate themselves in the past, this is no longer the case. There is a need for greater investment here, especially in areas such as (i) on/off ramping where CEXs have admittedly had an upper-hand; (ii) DeFi app and wallet interfacing; and (iii) integration with known payment UIs (e.g. in Web2 checkout flows).

Where should we go from here?

We learned some painful lessons after Mt. Gox, and FTX has brought us back to the same starting point. In many ways, our vision of building decentralized financial rails has been set back by a few years. Both retail and institutional investors who had started to enter the space might take a lot of time to dust off this crisis and build back confidence to get back into the space.

Our focus now should be on building a superior technology platform and user experience vs. CeFi. While there has been a tendency to throw everything about Web2 out the window in building Web3 over the last 2-3 years; I believe there are lessons we can learn from Web2 such as customer obsession, product management, data-driven decision making, and ruthless due-diligence of new projects before funding them. This last point is one VC’s and early-stage investors (including ourselves at Kyber Ventures) would do well to follow. There are reasons Web2 has been immensely successful over the past decades, and those lessons can form the foundation for our future growth going forward. Alex Svanevik’s tweet below summarizes these points aptly.

Furthermore, fiascos such as FTX, 3 Arrows Capital, and Celsius underscore the importance of “trust but verify”. If a CEX cannot publish their proof of reserves, proof of liability and provide real-time solvency updates; we need to move away. This topic is elaborated further by Vitalk Buterin, who offers ideas such as Merkle trees, Plasma and validiums to offer proof-of-solvency and ear-mark customer assets separately from CEX assets. Binance has already pledged support to implement Buterin’s proof-of-reserves methodology, with the Binance CEO commenting, “The industry can’t simply say, Trust me, bro.”

The bar has been irreversibly raised and users will be all the better protected by it. Centralized projects will need to work 10x harder to build user and investor confidence, and that extra cost may lead teams to choose decentralization as a default start mode vs. having unconvincing, ten-year plans for how they will eventually decentralize in the future.

For investors, opening up the hood and understanding concepts such as tokenomics, decentralized governance models, admin keys management, and determining product-market fit will be necessary, not optional. After all, seeing that FTX printed their tokens out of thin air with supply heavily sold to insiders and retail might have been an orange-flag to many savvy observers.

Finally, we need a way to support the unsung heroes and serious teams in the space that are contributing with actual innovations vs. ponzinomics or shady token deals. Crypto needs more public goods funding such as Gitcoin, which allows common-good projects to seek support and backing.

This too shall pass

In closing, despite the industry growth and legitimacy having been set back by a few years with all the recent incidents; I looked around for what still motivates me, and others around me to continue building amidst the wreckage. The answer here remains the same as when Mt. Gox imploded: we are still very early on the quest to make crypto mainstream. Given the low adoption numbers vs. Web2, the enormous opportunity for growth and innovation remains. For serious builders with long-term visions, now is as good as any time to stand out, build away from market noise, and differentiate themselves. Crypto and blockchain remain the only opportunity we have at the moment to revolutionize our financial tech stack. Ten years down the road, we will look back at all these events and realize they all happened for a good cause. This is a great wake up call for us to rebuild our industry with a better foundation and the right expectations. The case for decentralized infrastructure and protocols, and improving the Web3 UX is stronger than ever before.