Next week the Federal Reserve is scheduled to meet. And yes, a few people will decide what happens with your money. And with this decision, will the Bull Run start?

This event in the United States could change everything for the markets. Next week the Federal Reserve is scheduled to meet. And yes, a few people will decide what happens with your money. It is widely expected that the Federal Reserve will slow down the extent of its interest rate hikes. And for months, the Federal Reserve has been very aggressive with interest rate hikes of 0.5% or 50 basis points. Currently, those rates are at 4.25%. Most people expect the Federal Reserve only to raise rates by 0.25% or 25 basis points next week, which would bring the rate to 4.5%.

This will also indicate a significant change in the aggressiveness of the Federal Reserve’s interest rate hike policy, and it also means that the Fed is, in its view, on the right track to fighting inflation and that rates may even stop rising very soon.

Indeed, the Fed has declared a target of 5.1%, which could indicate two additional interest rate hikes of 0.25% in February and March and then a final hike in April, a 0.1% increase.

And so if this 5.1% estimate holds, April will be the last month of rate hikes, assuming that inflation continues to fall.

So that scenario is becoming quite likely. The inflation figures for December showed that inflation is indeed still falling, and we went from 7.1% in November to 6.5% in December and were at 9.1% in June.

And so, every month, inflation is coming down. That indicates that the Federal Reserve is currently winning the war on inflation, at least for now, but the Fed’s inflation goal is to get to 2–3%. We must keep that goal in mind, and we have a long way to go on inflation to get there.

And if we reach a final interest rate of 5.1% in April, what does that mean for the markets? What happens when the rate hikes stop?

The short answer is that nobody knows.

But the speculation, there’s a lot of it. Some say we could have a boom period between now and later this year when rates stop rising, and we start to see them come down.

Markets like certainty and more or less stable rates would put us in a good position for the needs. A final rate of 5.1% would give the markets the narrative to hang on to the idea that rate hikes have stopped.

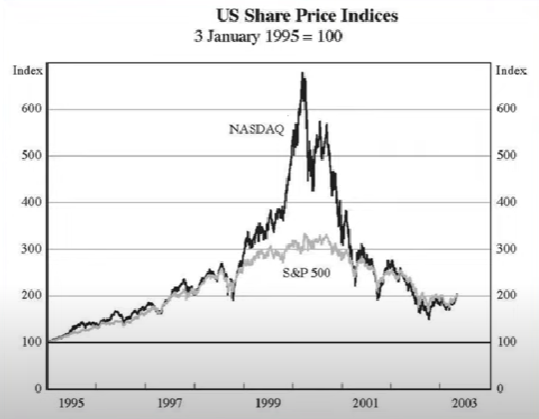

Take, for example, the environment we were in between 1995 and 2000. In a high-rate environment, rates were consistently around or above 5%, and the Dot-com Bubble boom happened during that period, and we saw the S&P 500 go up 250%. And one would also think that the Fed pivot narrative is already in effect here. Based on the anticipation of the 0.25% rate hike that will be announced next week.

So then we get into the potential rate cut later this year or early next year. Let’s make 2023 a year similar to what we saw in 2019. A pretty unpredictable situation that could help or hurt the market.

You have a rally early in the year followed by a crash later in the year. So the impact is what happened to cryptocurrencies or Bitcoin. The stock market in 2019 continued to climb.

So what’s important to note is that the Fed plans to cut rates to 4.1% in 2024 and 3.1% in 2025. And so those are the rates that it wants to achieve over the next few years, a rate cut to be expected over the next couple of years, but that all depends more broadly on how much damage the rate hikes have done.

And indeed, when rates rise, the impact on the economy takes time to be felt. And what the Fed is trying to do with this rate hike is to do damage to the economy.

The inflation problem, you know, it’s a problem that is serious if left unchecked and can lead us to a lot more problems. That is, they want you to lose your job, to see more wages go down, to enjoy the price of your house going down, to reduce demand, and for companies to go bankrupt or lay off more employees. The Fed here will do everything it can to bring that inflation down.

So the Fed is trying to bring things back to reasonable levels according to its indicators. Still, unfortunately, this is done by impacting millions of people because this situation affects the entire world.

So history shows us that interest rate cuts can happen quickly, especially in a crisis. This is why many people think that late rate cuts can cause stock markets to fall sharply.

But are we really in a recession at all? Many believe that we are not yet, so a recession could result from such an event. And so, ironically, this recession, if it happens, will be caused by rising interest rates. And while I’m talking about that scenario, the markets are looking at the best-case method of a potential return to average inflation in the coming months and a soft landing for the economy.

And that may be true, and that may be what’s going to happen. However, suppose a recession is still in the offing. In that case, you have to understand that the S&P 500 never bottomed out at the beginning of a recession, which means we would have lower values, whatever it is because it always bottoms out during a recession.

And so, of course, if the S&P 500 drops, drops in value, and do bitcoin and cryptos. And so even though some people expect interest rate cuts to lead to a severe crash, that’s not always the case when rates have fallen; there’s often a correlation between the two because of the harsh economic conditions, but if you look at 2019, the interest rate cuts started in August. They were pretty standard until February, so we went from 1% to 0%. But what did stocks do during that time? They went up.

Stocks in the market went up the whole time until February. And in the end, the only reason stocks crashed in March 2020 was the Covid of a health crisis. Otherwise, the markets would have continued to move in the same direction despite the rate cuts.

If the rate cuts happen during a terrible recession, stocks and cryptocurrencies will go down. If the rate cuts happen for a very mild recession or if there is no recession, there will still be a possibility that the markets will continue to rise.

And the third scenario is that if we don’t have interest rate cuts this year, the market can still go up because it’s going to continue to ride on the fact that there’s no interest rate cut, and so the market can still go up.

And for all these scenarios, we can find historical precedents. We can find examples that have happened, including our history over the last 50 years or the last 100 years.

But regardless of what happens, one thing is for sure, everyone is waiting to see what Jerome Powell will say at the Federal Reserve meeting next week. It also shows us that despite the plethora of possible scenarios, every investor needs to have a strategy in 2023. I think when we have a clear and psychologically comfortable plan for ourselves, we will succeed in the markets in the long run because I believe we should not FOMO “Fear of Missing out” or follow the shiny objects, but also not be afraid to invest in such a market in such conditions.

And so, both extremes could be better strategies. I think there’s a middle ground to always be in the market and so have exposure with a reasonable allocation, that it’s comfortable for yourself, to have an obvious strategy, and to be able to follow your portfolio over the long term and see it grow as you go along.