By Tony Ling

*further translation and edits by Xiaochen Zhang and March Zheng

Abstract:

This series dives from a dual perspectives approach; by both being a practitioner in the blockchain market as well as a scholar. My goal is to convey my understanding of this market, consolidate the analytics behind my reviews, and give overall reflections on the sentiments and up to date situation of our industry. In my review today, I want to focus on the intersection between equity and token financing.

How should we treat emerging token projects? How can retail investors rationalize the token financing of these projects in the most efficient and effective way possible? How should regulators reconcile with the industry’s potential for self-regulation through technology? How can traditional VCs max impact participate in these emerging token projects under their legal equity frameworks? As an entrepreneur, how to choose between equity and token financing to further project developments?

Ⅰ

The Crypto industry in 2019 and 2020 had a very bearish undertone, as well as general frothiness in the public token markets. At that time, I was extremely worried that if the traditional giants of web 2.0 entered the market, they could completely scoop and overtake the crypto world in their own infrastructure. Facebook had the push for the Libra stablecoin, and it was at a time when the crypto world was overall short on funds and network effect developments. We didn’t think that small players and companies like us could compete with the infrastructure and rules put in place by the traditional tech incumbents.

Fortunately, my worries and concerns never came to fruition. Before these giants could fully enter the market and impose their infrastructures, the crypto world itself had grown into a towering tree. Its compounding network effects and development communities worldwide created an environment that has sprung the first cases for the future of Web 3.0.

For example, Facebook, which rebranded to Meta, intends to fully enter the metaverse. Various celebrities and traditional powerhouse brands have issued their own NFTs.

Paradigm has completed a new fundraising round of US$2.5 billion. A16Z completed a cumulative fundraising of US$5 billion+. Even against traditional tech fund powerhouses such as Sequoia Capital, as well as larger wall street institutions like Tiger Global, these token funds have gained the capital and network track to seriously compete.

What’s more, the spending power and influence of individual investors in the crypto world have reached an astonishing level. For example, a single JPG NFT can cost upwards of hundreds of thousands of dollars. Crypto KOLs (youtube, Tik Tok, Twitter etc) along with said wealthy crypto individuals are all bid competitors along with “traditional” celebrities and brands. Crazy.

“Ok, if people in the crypto worlds are so rich and wealthy, then why should I myself invest in tokens issued by a new crypto project? It has already hit its peak perhaps, how can it possibly access the deep liquidity and legitimacy that traditional financing has provided for hundreds of years?”

I believe that this is the main concern on the minds of the vast majority of traditional equity investors.

So, what are we talking about when we refer to entrepreneurial financing “strategies”?

For a long time, there has been a misunderstanding in both the investment and financial world. If given the option, the best financing strategy is to sell and transfer equity interests to well-known institutional investors. They will provide entrepreneurs with resource support and reputational endorsements.

The practices seen in Web 3.0 make people rethink the answer to best financing strategies. Let us think back, what is the most important aspect of financing? The core of investment and finance is to reward the people who devote the most resources, energy, and time to a project. These are the ones who are most likely to have the long term outlook, most willing to bet on the project’s growth benefits, and can literally speak most directly for the project. These people are the ones actually on the groundworks, are the earliest users who learn how to tool around with the product, and have the skin in the game as well. If the two respective parties (institutions or a hundred retail investors who are interacting directly with a project) gave the same amount of capital, I believe that most in Web 3.0 would choose 100 retail investors instead of 1 institution.

But in the pre-crypto world, this could not happen because:

(1) It is difficult to quickly find a large number of individuals to participate in a project investment, which has evolved into crowdfunding. At the beginning of the development of the project, the founder’s time is very precious, and it is impossible to spend too much energy negotiating with 100 retail investors. The rise of the mobile internet has allowed crowdfunding platforms to emerge and help start-up projects raise funds.

(2) There is no suitable technical basis or legal basis to guarantee the rights and interests of retail investors. A large number of self-employed investors participate in the investment, and from the perspective of the past equity investment paradigm, it is impossible to register and record on scale. Since the quota per person is generally small and because the exit path of the traditional equity markets are too long… thus if retail investors are restricted like institutions, it is difficult to obtain a substantial income consistently.

(3) It is impossible to clearly define the user’s contribution to the development of the project by technical means, and to give incentives at one time in a low-cost way.

We allow core seed users to participate in an early project investment to incentivize them to interact deeper with a project and make further contributions. It is necessary to let them know “what exactly to do” to be better evaluated and gain additional incentives. Therefore, the distribution of this incentive must be guaranteed to a certain extent, which makes it more convenient on the project side to operate.

The practices seen in blockchain and token projects solve these many issues from the traditional financing world. With blockchain technology, emerging projects can find KOLs and even powerful retail investors from all over the world to participate in the early investment of a said project. With smart contracts, users can easily identify their relative token amounts as a percentage of a total project. Moreover, the project issuer cannot issue additional tokens, and tokens can be withdrawn to digital currency exchanges for cash/stables at any time. With open and transparent on-chain data, both the project party and the user can easily verify the user’s contribution on-chain, supplementation of number of active addresses, code providing records, etc. The power of smart contracts also allows the standard for earning early token distributions and providing users incentives to vouch for certain distribution timelines.

Ⅱ

We need to make it clear that token rights, like equity and debt rights, are parallel concepts and are both financial mechanisms. Therefore, back to the question about why should you invest in token rights rather than equity rights? It is along the same lines of why should you invest in equity rather than take on debt for repayment later.

Therefore, companies in different eras with different business natures adapt to different financing methods and financial markets. There is no strict definition of good or bad, only a question of whether something is suitable or not.

Therefore, I think it is suitable for listed companies and large real estate companies to implement debt for financing. It is suitable for Web 0, Web 1.0 and Web 2.0 start-up companies to use equity for financing. For Web 3.0 companies, the most suitable financing method is through token financing. If Web 2.0 companies forcibly issue tokens, or Web 3.0 companies use equity financing, it does not imply a general failure of consensus or financial efficiency. However, it will greatly reduce the development potential of a project through capital structure methodologies.

Therefore, what is the main difference between Web 2.0 and Web 3.0? For the definition of Web 3.0, please see another series of articles titled “The Road to NFT”. I will not repeat it here.

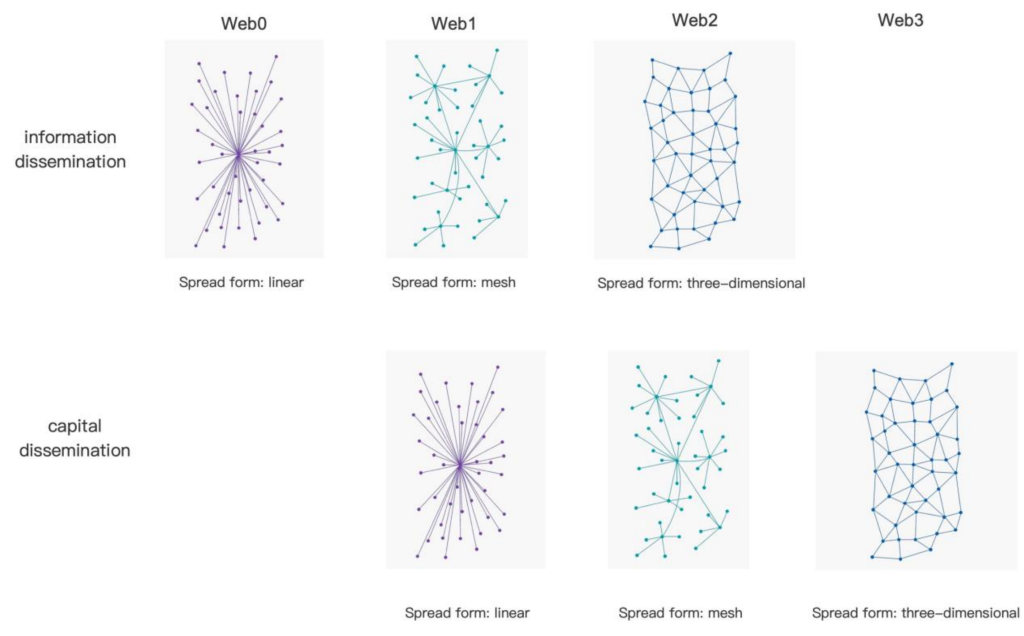

What I need to emphasize is that Web 2.0 and Web 3.0 is not a which is good or bad question. I have never felt like Web 3.0 is superior to others, as even today most of the wealth of societies is still in the hands of Web 1.0 and even Web 0. Web 3.0 originated from Web 2.0, just as blockchain technology originated from Internet technology. Because of the comprehensive innovation of Web 2.0 in the way of information dissemination, a large number of social media platforms have appeared. In the era where self-media is possible and powerful,, everyone has a chance to be a unique KOL and influence thousands of people without resorting to some official or “traditional” media. The capital utility of Web 3.0 can be quickly transmitted along with information channels of KOLs and friend circles. This in turn composes the potential and power of a single Web 3.0 project.

When a generation of individuals in a new era rises, they will forget some behavioral paradigms and so-called industry rules that the older generation is accustomed to or has built. From there, this new generation establishes new mechanisms and orders suitable for their own playbook and rules.

Ⅲ

What path should token rights financing follow?

Once again, let the people who devote themselves to the project the most, contribute the most, and have a long-term perspective share the major benefits. Let them speak for the project as they have the greatest skin in the game.

Innovative financing methods continue to emerge in the crypto world. And the most popular concepts can be divided into two groups, both of which are essentially the same:

The first group, “IXO”.

From the concept of ICO (Initial Coin Offering) launched by Vitalik in 2013 and exploding in 2017, to IEO (Initial Exchange Offering) in 2019, and finally to IDO (Initial DEX Offering or Initial Defi Offering) in 2021 (today). It took Vitalik two years to bring Ethereum from concept to ICO before finally going onto exchanges. The early participants in Ethereum are daredevils, and they are also loyal believers of the Ethereum platform and Vitalik’s vision for Ethereum. Most of them are programmers, and they spontaneously have made unprecedented contributions to the Ethereum ecosystem. Many of them have become the core developers of Ethereum.

IEOs are a concept launched by Binance. Through the whitelist mechanism of the exchange, users who have been trading on the exchange for a long time were rewarded with access to strong token deals on the exchange (screening). These users are qualified core investors. In the process of Defi’s development and growth, IDOs can use DEXes to independently list tokens and establish liquidity pools, and allow users to trade. DEXes directly conducts transactions on the blockchain, and the transaction data is public and transparent.

In order to prevent CEXes from falsely creating whitelists, DEXes can mark the identity of trading users more authentic. By opening bounty programs, users are required to use smart contracts to link addresses in advance, and participate in promotional tasks such as answering questions, Twitter retweets, etc. From the above activities, a group of users who devote themselves to the project the most and contribute the most can be screened out.

Therefore, what is next? I think it is only a matter of time before INO (Initial NFT offering) explodes.

But people in the world are generally copycats. Many people see the explosion of “IXO”, but they never thought about how to “enable the people who devote to a project the most, contribute the most, and have the longest time frame, to share, speak and benefit the most”.

If you have never thought about an investment from a long term standpoint, you essentially just “share quotas” with people around you, even people who may not be qualified investors or truly have skin in the game on a long term basis. How could you and your investors achieve a win-win situation?

Correspondingly, in the evolution of the industry in the past few years, many “IXOs” have disappeared, which hasn’t left a deep impression on most people. For example, “IFO” (Initial Fork Offering), which was popular at the end of 2017, refers to the joint developers of some miners who manipulate a batch of computing power to hard fork Bitcoin to create “new Bitcoin” (typically represented by BCH, BSV, BCG, BCD, etc., but now only BCH and BSV remain alive but have a weak influence). They advocated that “new bitcoin” is superior to bitcoin in some characteristics, and then conduct a “new bitcoin” to bitcoin holders. They airdropped, attracted attention, and shilled for the transfer of network effects and developers to these “new bitcoins” This was a short-term trend after BCH forked from BTC and skyrocketed on August 1, 2017. At that time, there was really chaos in the markets. In just a few weeks, dozens or hundreds of “new bitcoins” appeared, all touting themselves as a “better bitcoin.” Of course, I don’t need to say more about the results :). These “pseudo-Bitcoin” projects that were airdropped to the original Bitcoin community but could not win any core supporters, without exception,soon died.

The second group, “XX is mining”.

“Transaction is mining” and “liquidity is mining” are the two most famous concepts. “Mining” is actually a behavior in which users contribute to the project at a cost. For example, Bitcoin miners buy mining machines and pay the cost of electricity, so they share an output of Bitcoin block production. Exchange users pay transaction fees, so they get platform tokens. Defi users, by pledging their assets to provide liquidity, get tokens of the Defi project. In other extensions, there are also many innovative forms. For distributed storage projects, “storage is mining”, for content creation projects “creation is mining”, and actions that are beneficial to the project ecology can all be termed as “mined”. In this process, the cost incurred may become a kind of income of sorts and is actually a “financing source” in disguise.

Ⅳ

There is always tension at the onset of war, and generally the population can sense it. The grand emergence of token rights financing has already made traditional VCs feel tremendous pressure.

At leas in Silicon Valley, or on the streets of Stanford University, options rights are not much less attractive than token incentives. “Join us, we will give you options” has been to a degree mitigated or replaced by, “Hey bro, are you interested in my idea? Let’s ICO together!” This is cool! .

We’ve been stuck in the old world long enough. The era of VCs are fading away. As Sequoia Partners put it, “Today’s venture capital operating model was invented in the 1970s and hasn’t changed in 50 years”. Each era has different investment targets through bonds, traditional stocks, internet stocks, and then digital currencies. The organizational form of investors will change with the times. From the earliest private capital lending, to bond financing, to large investment banks, and finally to around 1970 with the appearance of early venture capital financing. Now, it might be an era where Web 3.0 users collectively “crowdfund” based around blockchain technology with token rights.

In the next article, I will talk about equity and token rights, the battle between VCs and token funds.