Web3.0 is not a perfectly competitive market, so most of the discussion does not hold. “Begin with the end in mind” rule applies well to Web3.0 investments, too. This article entails my thoughts on the Endgame of Web3.0 investments and opens up questions about investing in Web3.0.

Please bear with my top-to-bottom, macro-to-micro strcuture. This is merely personal opinions so DYOR. The project discussion is not meant to be investment advice.

TL;DR

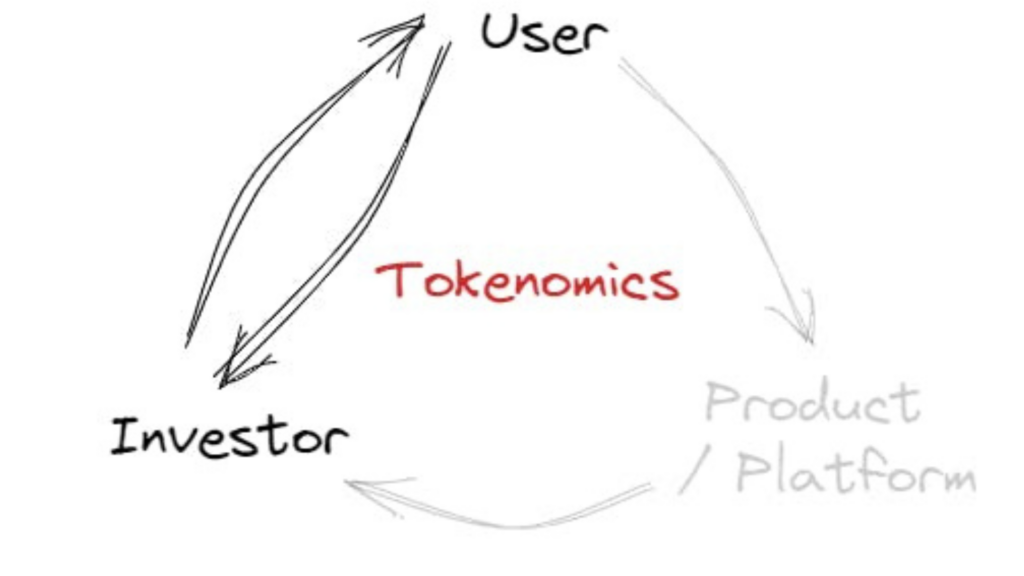

- Tokenomics ties users and investors together, making them closer and sometimes even mixing them together as an integral.

- Should venture capitalists choose User-friendly projects or Token-friendly projects?

- If it is agreed that DeFi Summer benefits from the money-printing in crypto world during the bull market, then NFT-Fi for sure CAN take place, albeit that the liquidity producer (projects that print money/ issue tokens) and a solid ecosystem (users who spend money/utilize tokens) are prerequisites.

There have always been many debates about Curve and Uniswap, from different angles and mixed views. I abstracted the competitive relationship, looked back through some past Web3.0 cases I analyzed at work, and generated some thoughts around Web3.0 investments.

Question: If all venture capitalists were given a chance, would they invest in Curve or Uniswap?

A follow-up question: Is the choice now the same as the choice after X years?

When I was thinking about my answer, I took the two different models of Curve and Uniswap, and compared them to traditional web2.0 business models.

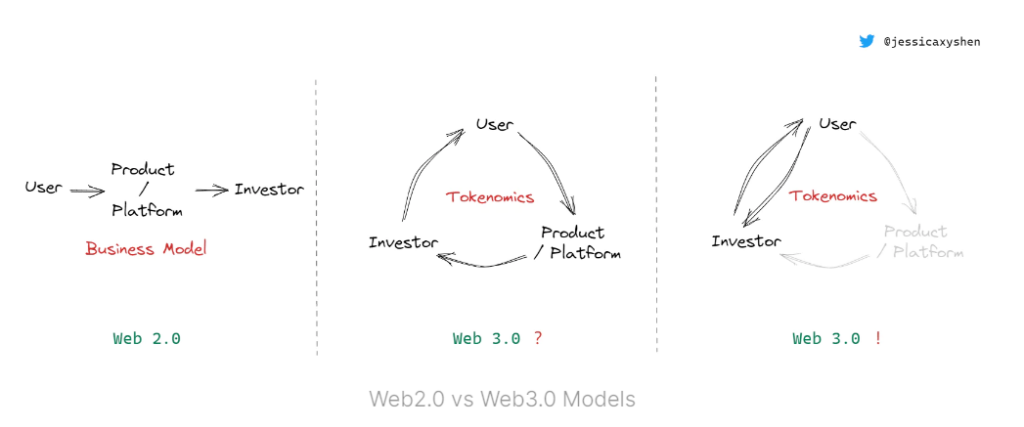

- Web2.0: Users create value for companies/platforms, and companies/platforms create value for investors. Therefore, the company’s mission is simply to cater to its users, and a legit business model is sufficient for them to survive, and investors can benefit from the success of the company in the end.

- Web3.0: Web3.0 breaks the traditional business model and how the value is normally captured in the flywheel. A significant difference from Web2.0 is that the tokenomics ties users and investors together, making them closer and sometimes even mixing them together as an integral.

Web 2.0 vs Web 3.0

Participants in many web3 projects often play the role of both users and investors, thanks to tokenomics. Private sale investors only provide financial support for project to jump start, but after the product launched, the influence of private sale investors is immensively undermined (even less than traditional Web2.0 investors, because of the often absent regulation and loose legal restriction. Equity investment is another story.) It is common that Web3.0 investors highly depend on their trust in the self-discipline of the project and the tokenomics model, which corresponds to the legal relationship and “business model + exit strategy” in Web2.0 context.

Based on a good tokenomis model, tokens are capable of value capture after the product launch. The value of “User-Product/Platform-Token/Investor” or “User-Token/Investor” is in a virtuous cycle. Like the Web2.0 world, “user” is the fundamental value driver in the entire value creation process. When the flywheel is running in a positive direction, more users will lead to a higher demand due to the design of the tokenomics, and thus the token price will continue to rise. Meanwhile, investors, also users, will also benefit from this, and some project parties will also take a cut from it, leading to a happy ending for all parties in the flywheel. (This is also the beginning of the often-said Ponzi Scheme, as well as the start of the economic cycle in the real financial world. Consumption and investment drive the economy, causing currency prices to rise.)

Web 3.0? Web 3.0!

But when users have a choice, they will naturally withdraw less value creation to the product/platform and retain more of their own interests. Namely, the key value creator stands at the opposite of the product/platforms, a key notion that should be well acknowledge among all Web3.0 startup teams at the design of tokenomics. Sometimes, a lack of platform value capture capability seems inevitable for a product to succeed in Web3.0 space.

We have been talking about the Web3.0 utopia (Web3.0 model on the far right of the picture above), where the value capture and retention of platforms are often omitted or downplayed (such as Uniswap). We believe that the open-source code and smart contracts should run on their own, without extracting a penny from users, and the value flow directly between users and tokens investors, while platforms no longer retain value, which is the essence of web3.0 — a paradigm shift where value returns to users rather than being captured by platforms. This model reduces the friction and loss of value transfer and improves efficiency, just as Uniswap provides a place where the platform no longer captures value in comparison to Curve. For users, a lower cost provides enough reasons to choose Uniswap for token swapping. What is even better is that the value that could have been captured by platforms is fed back to users (also investors because in the case of Uniswap, V3 LP users are investors).

So, if a flywheel is only maintained by a tokenomics model (Voting Escrow is one of them), Web3.0 products without tokenomics that help platforms capture value can better serve users and usher in the real Web3.0. (Web3.0 model on the far right of the picture above)

This leaves a question for all VC investors: Should you choose User-friendly products or Token-friendly products?

The perfect answer: Be the user of the former and the investor of the latter, if there is no conflict.

But if everyone in the market does the same, eventually the latter will fail. (But we also all know that the world doesn’t work that way. If it were, there wouldn’t be such a stupid question, and no such debates about Curve and Uniswap.)

At present, it seems that the strategies that some VC investors take:

- Token-friendly Project: Market-making to sell tokens at ATH at the risk of notoriety and a reduced margin during the bear market;

- User-friendly Projects: Time will tell. It could be the next OpenAI or another failed project.

I once asked an admirable investor a question: If a Web3.0 project is fundamentally good, but weak at the token value capture capability, how would he make the decision? His replied without hesitation that, if it were indeed a project with good prospects, he would not worry about not being able to find a way to empower tokens in the future. His words inspired me at the moment and answered that question overhanging in my mind for long. I bear his words in mind from then on when I look at Web3.0 projects. Having said that, both of the above two strategies can help VCs make money, depending on what type of investments they want to make.

A short analysis of Curve and Uniswap:

Curve: Curve’s DEX business logic and VE token economic model logic is smooth, and the token value capture ability is good. However, in terms of blood transfusion users, Curve users have to pay more fees in many cases, and the token value capture ability The strongest loss is the loss of users to competitors with lower prices. The flywheel can still turn but slower, especially when there are other strong competitors of Uniswap.

Uniswap: Uniswap’s DEX business logic is smooth, but the ability to capture token value is weak, and the value is directly fed back to V3 LP. But the advantage is that users are basically in a state of self-hematopoiesis. Swap users create blood for V3 LP, and users empower themselves with the help of products. The loss of user value in the whole process is very small. Since swap fees are directly distributed to V3 LP, V3 LP users can be understood as investors of Uniswap. In this model, the relationship between users and investors can be instantaneously exchanged and exist at the same time. As for the FUD sentiment caused by the fact that LP income cannot cover free losses during the recent bear market, there may not be so much in the bull market, and everyone will happily use the cheap Swap method and choose to be happy in the rising market. do LP.

One of the few things shared by the two great projects is that, users stand at the core of the business, as a key driver in the value creation process. When the bull market comes, I believe that many people will still use Uniswap to swap tokens and provide liquidity to become LPs, but Curve will continue to exist just as well, because it has sharp advantages on cost saving for stablecoin swapping, and the Voting Escrow model will also continue to receive support from multiple project parties that call for liquidty.

When NFT-Fi Summer?

This reminds me that when DeFi Summer came, it was essentially because of token rewards created by DeFi projects, namely money-printing. The macroeconomic environment in the real world was in a short-time bull run at the moment after the Federal Reserve printed money provided much liquidty in the real world. After the epidemic, the TradFi funds eager to make up for the loss in the traditional financial markets eventually found an outlet in DeFi, and thus leading to the DeFi Summer. In essence, a large number of project parties have once again “printed money” through token issuance, providing huge amount of credit and increasing leverage in the market, pushing forward the vibrant DeFi Summer.

If it is agreed that DeFi Summer benefits from the money-printing in crypto world during the bull market, then NFT-Fi for sure can take place, albeit that the liquidity producer (projects that print money/ issue tokens) and a solid ecosystem (users who spend money/utilize tokens) are prerequisites. It is necessary for an NFT project party to issue NFT or FT to amplify the value of TradFi funds and stablecoins through token issuance, and users who join th party to support the demand side are also necessary.

Of course, there is a lot of differences between NFT-Fi and DeFi innately:

- The liquidity;

- The volume of circulation;

- The consensus creation and enhancement process. For example, the experience of staking UNI to Compound to acrue interest and COMP token rewards is quite different from that of staking BAYC to BendDAO to accrue interest and BEND token rewards. Notably, the experience of NFT is multi-dimensional, where time, emotion, content and money is all involved. It takes more time but also accumulated much more loyalty among users and token holders;

- Macro Environment. DeFi was born in a bull market vs NFT-Fi likeyly to grow up in a bear market;

- First come, first served. DeFi introduced many concepts and tokenomics to crypto users which lowers their learning costs during the NFT-Fi Summer. However, whether users retain that same curiosity and excitement when they were first introduced the concept of DeFi and related ones remain to be seen. In the crypto world where users always look for something more novel and more exciting, if NFT-Fi still plays the old tricks of DeFi, then I will be disappointed with this industry. But I believe, it won’t. In crypto we trust.