Ethereum is the world’s first self-maintaining financial system. That’s a big deal.

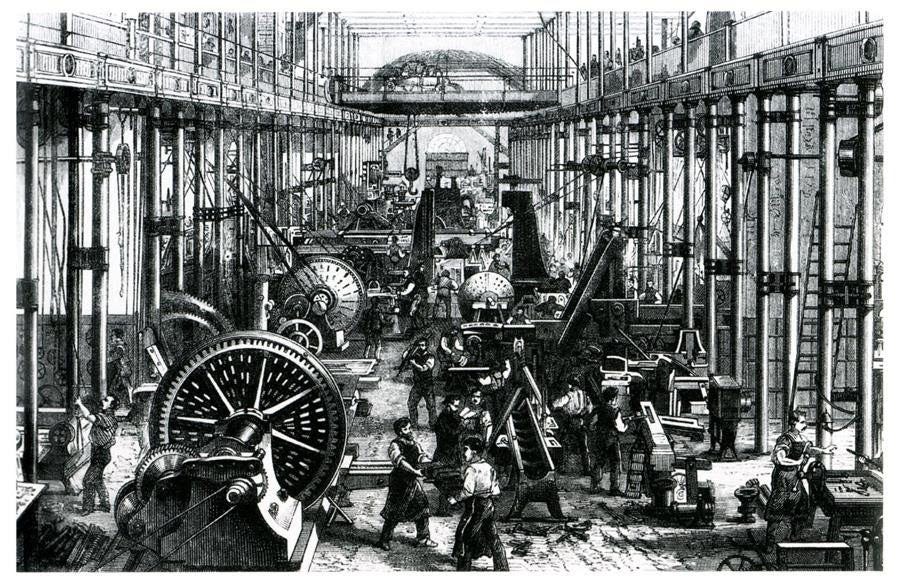

Ethereum’s Internet Industrial Revolution

Crypto-economic systems must find balance.

In order for crypto-systems to stand the test of time, they must be flexible in order to adapt to the changing environment around them. Rigidity is fragility. Rigid systems will ultimately require manual human intervention to keep from breaking down.

Therefore, crypto-economic structures must naturally and automatically discover a state of natural equilibrium, or else this becomes our inevitable future:

Humans have always used self-balancing mechanisms to control chaos and complexity.

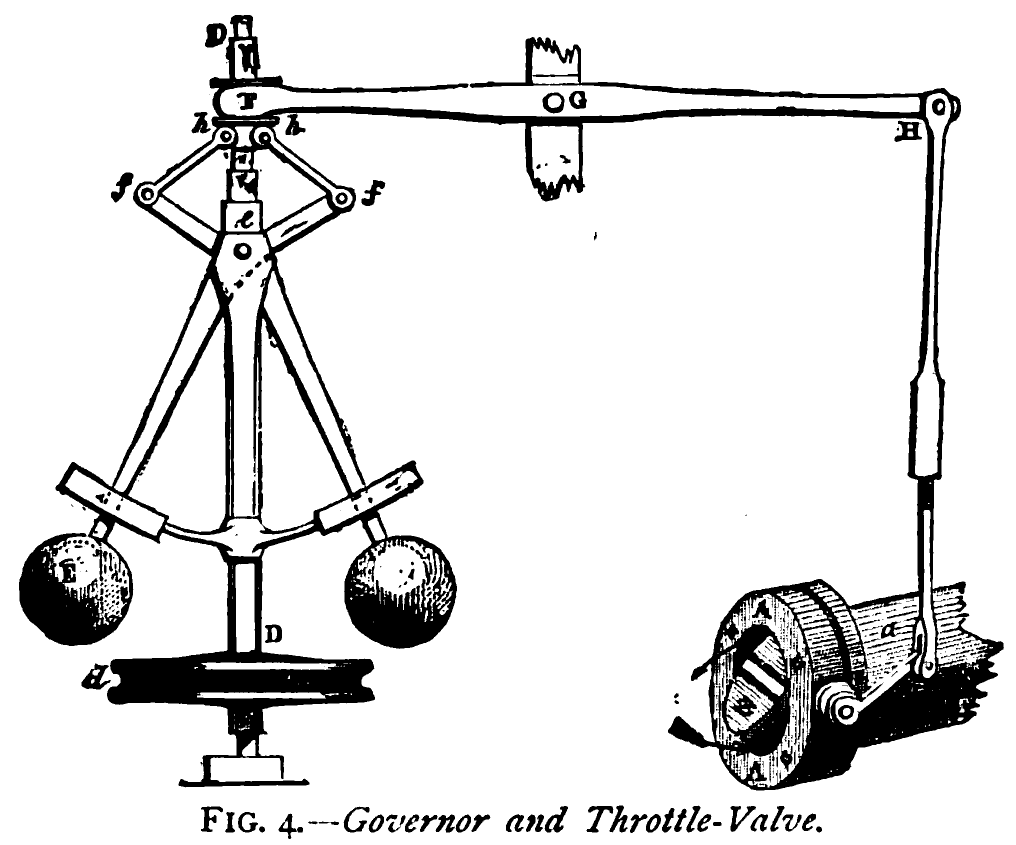

The development of early steam engines was a series of explosions and uncontrolled chaos. In order to be useful, steam engines needed to produce stable and predictable power output, but controlling the rate of output was an unsolved problem.

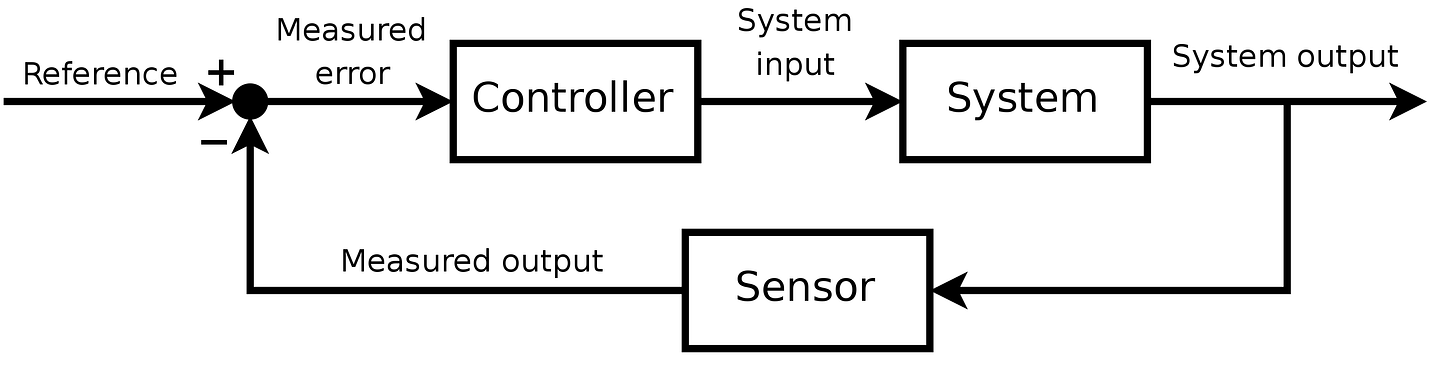

Through the application of a nifty little mechanism called a centrifugal governor, a negative feedback loop was established between energy input and output. As the power output of the system increased, the governor would begin to decrease the magnitude of its inputs.

With the simple application of control theory, the unbridled potential of steam was turned into the industrial revolution.

Control Theory: A field of mathematics that deals with the control of dynamical systems in engineered processes and machines. The objective is to develop a model or algorithm governing the application of system inputs to drive the system to a desired state, while minimizing any delay, overshoot, or steady-state error and ensuring a level of control stability; often with the aim to achieve a degree of optimality.

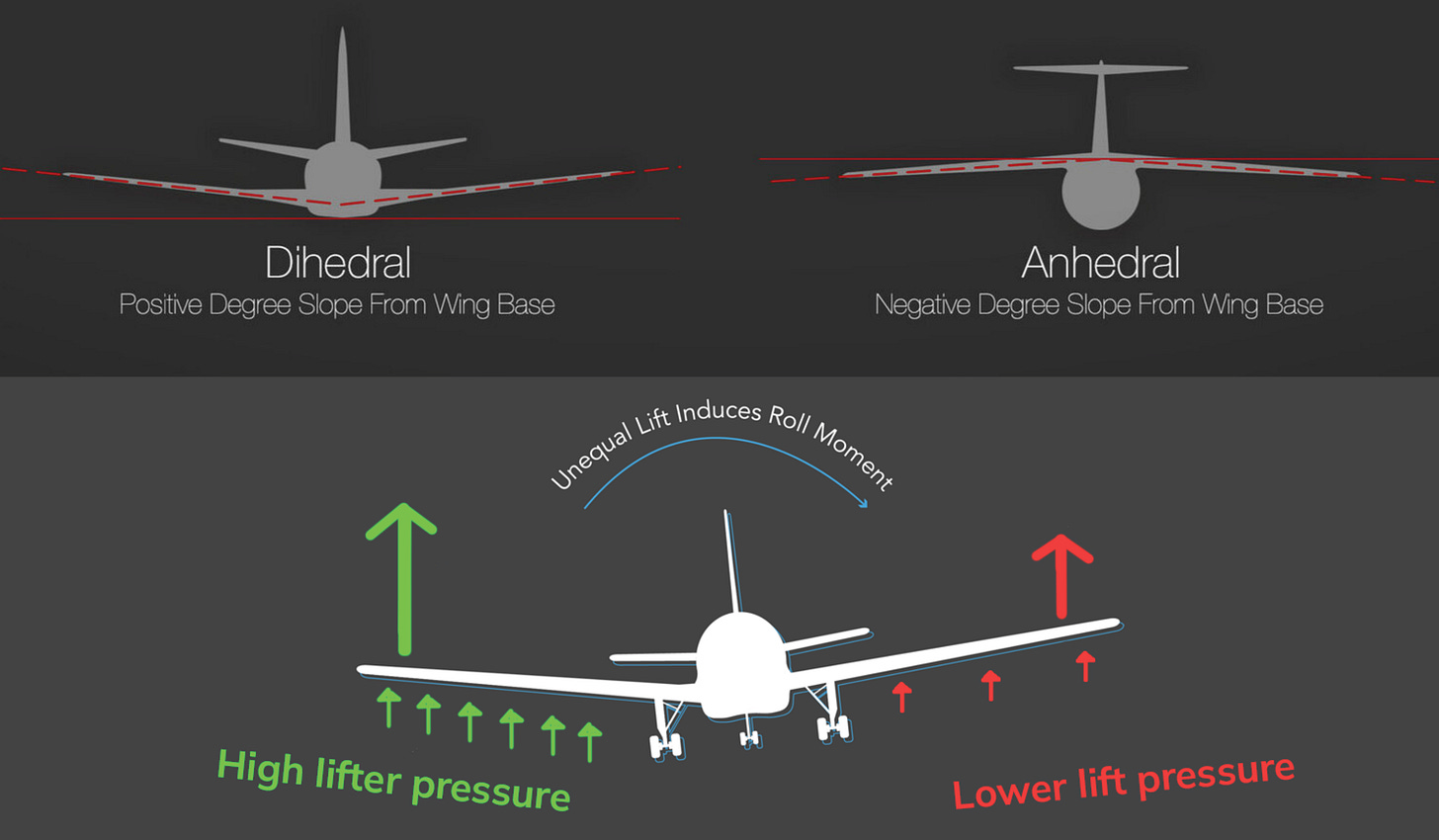

Alternatively, an airfoil (wing) is maximally effective when it’s 0° against the ground. When an airplane banks, the upwards force against an airplane wing diminishes since the wing is no longer perfectly ‘up’ anymore.

Dihedral wing angles auto-dynamically balance to maintain stability of the roll of the plane. As a dihedral plane rolls to one side, the upwards force on the wings naturally shifts to push against this role. It’s a negative feedback loop that helps maintain stability.

Anhedral wings do the opposite! As anhedral plane banks to one side, the pressure changes on the wings to encourage even more rolling! It’s a positive feedback loop!

Why do we design planes with anhedral wings then? Because their instability is easily controlled by external interventions (aka, steering), letting pilots benefit from other advantages of anhedral wing design. But, it still only works because of external influences on the system!

Can we apply these same principles of auto-dynamic balance to crypto-economic systems? How can we construct the Ethereum economy to balance itself, even while silly humans are doing crazy things upon it?

Similar to the centrifugal governor of a steam engine, or self-correcting aircraft design, cryptography has enabled us to produce self-governing economic systems.

The Ethereum project is an attempt to create and optimize properties of self-governance into the engine of its economy. Through key upgrades to Ethereum’s crypto-economics, we can now effectively harness the power output of Ethereum economy and translate it into productive economic output.

Can we build the world’s first self-maintaining financial system? Is this what’s needed to create a new industrial revolution, on the internet?

I believe all the signs are there. Let’s explore!

Ethereum, a self-balancing economic system

In May of 2021, the Ethereum engine was the hottest it’s ever been.

Gas fees sustained 200+ gwei for months, sometimes sustained 24hr periods of 600+ gwei. A Uniswap trade cost $175. An Aave position cost $400. Curve LPing was a $1,000 transaction.

Token speculation, yield farming, minting, and just overall economic activity was so lucrative, that exorbitant gas fees were an afterthought; there was so much money to be made! Ethereum was red hot.

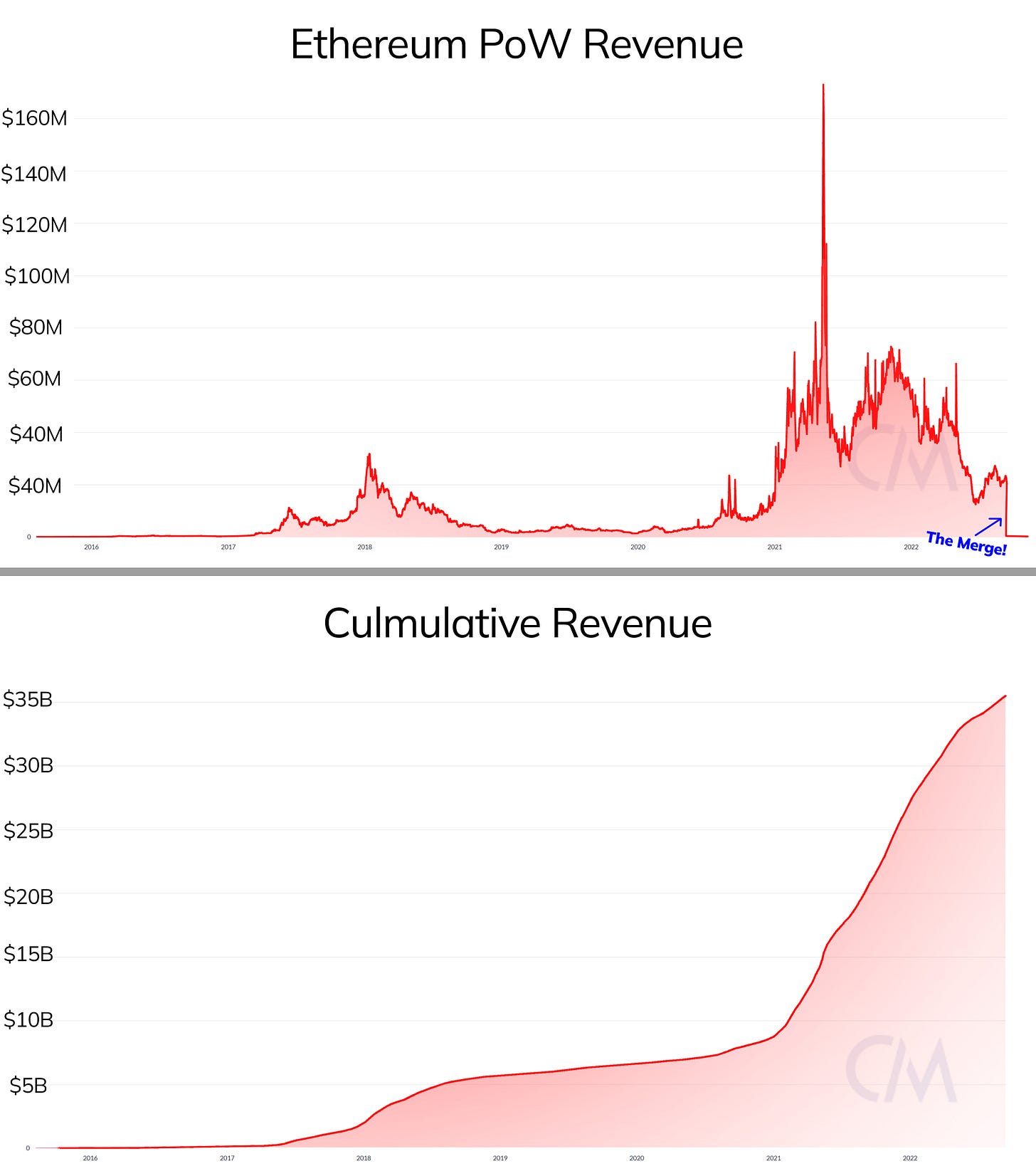

Ethereum’s PoW miners were also making an absolute killing. But due to the economics of PoW, miners were forced to sell their ETH to pay for electricity and GPUs; things that are external to Ethereum.

Ethereum was leaking its economic energy.

Ethereum’s source of revenue, gas fees for blockspace, ultimately went to pay for:

- Growth in mining operations

- Growth in energy production (and commensurate consumption)

- Growth in chip production

None of these things actually helped grow the economy of Ethereum. The external PoW industry absorbed the value of Ethereum’s blockspace without recirculating any value back into the economy.

Ethereum’s economic engine was producing massive outputs, but that energy was failing to be captured for the actual economy of Ethereum. The revenue captured by the Ethereum-focused PoW industry represents the total amount of economic leakage that Ethereum failed to contain.

Ethereum’s New Circulatory System

Two mechanisms added to Ethereum have vastly increased its power output, and have also translated that power into effective economic productivity.

EIP1559

EIP1559 translates blockspace demand into ETH value, the fuel that powers the Ethereum engine. With ETH at a higher value, Ethereum’s fuel has more power, and the engine is more productive.

EIP1559 is a mechanism that captures heat from the Ethereum economy and uses that energy to refine ETH into a more powerful economic fuel.

Proof of Stake

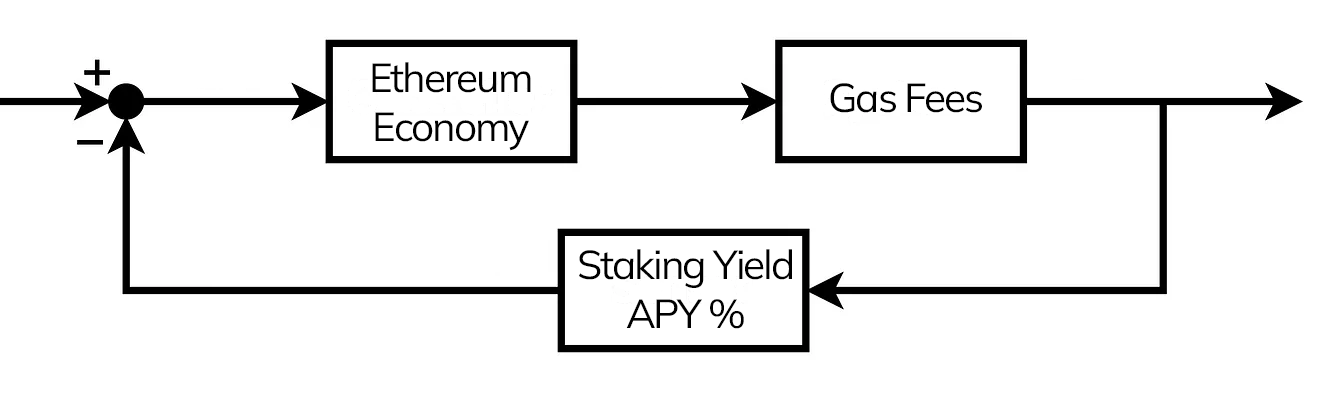

Proof of Stake translates blockspace demand into ETH staking yield.

Through PoS, stakers receive transaction tips, (fees paid above the EIP1559 basefee, predominately by MEV bots), amounting to ~20% of total transaction volume. By injecting transaction tips into the rewards paid to ETH staking, a pipe is connected between the heat of the Ethereum economy and staking returns.

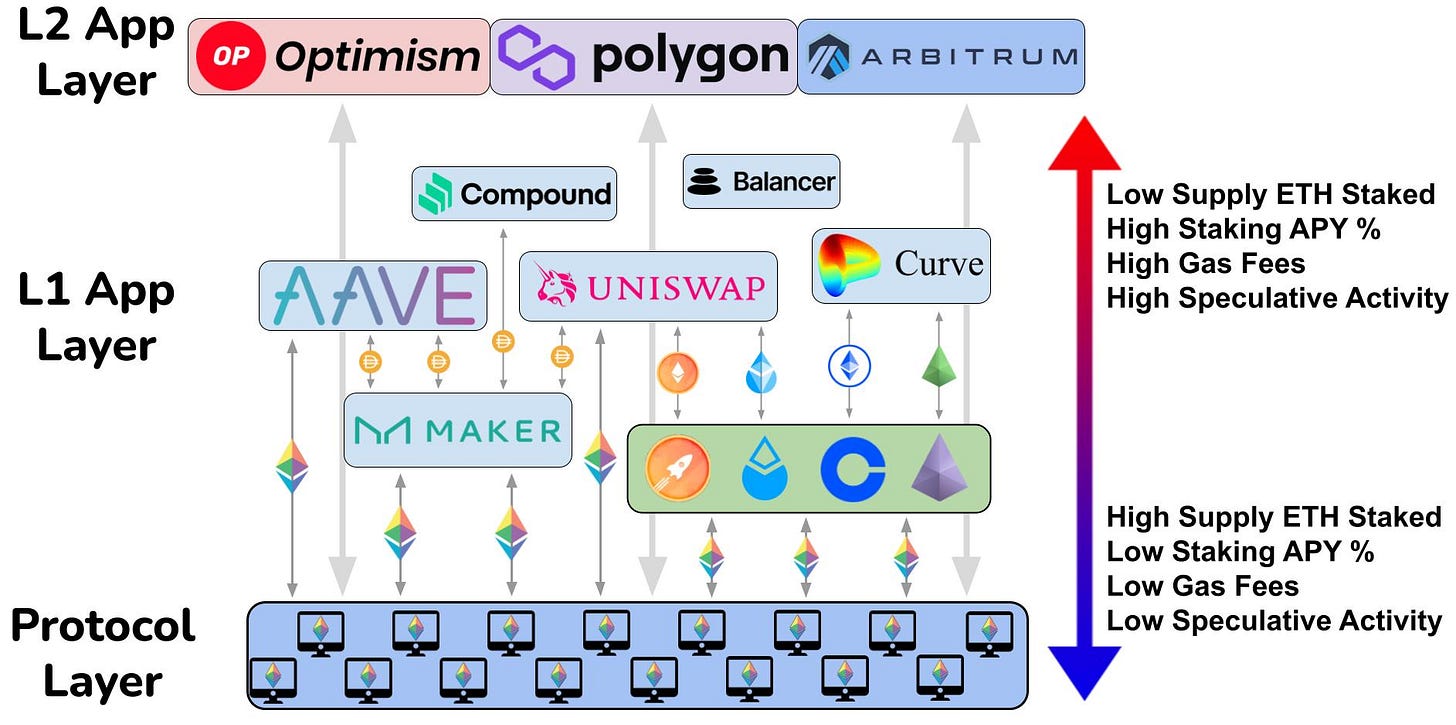

Through this pipe, a negative feedback loop is established between the heat of the Ethereum economy, and the incentive to stake ETH. Increasing staking APYs has a dampening effect upon the economy, as increasing ETH yields encourages capital outflows out of DeFi, and into staking.

Since we’ve all just finished our 2022 crash course of what raising interest rates does to the economy, this should be intuitive. The Fed raised interest rates in order to fight inflation and suppress an overheated economy. Ethereum does this same mechanism, by increasing staking yields as DeFi gets hot, and lowering them as DeFi cools. But it does it without needing to subjectively measure the economy, and without the influence of surrounding political interests.

Recapture and Regulation

The EIP1559 + PoS combo changes Ethereum’s economics from being lossy to regenerative.

The value previously one-way exported to PoW is instead redirected into the internal value of the Ethereum economy, and the signal created between transactional volume and ETH yields allows Ethereum to self-regulate between over-speculation and economic depressions.

The only inputs needed are human ingenuity in the app layer to induce economic demand for blockspace. Ethereum does the rest.

Equilibrium-Seeking Economics

Two key parameters enable the flexibility needed to produce this environment: ETH issuance and ETH recapture.

The rate of ETH issuance is governed by the PoS algorithm, and is slow to change. While PoS needs to be flexible in order to eliminate fragile rigidity, it ought to only change slowly, as it’s the foundation of security for all of Ethereum. It should be stable, not volatile.

EIP1559 governs over the rate of ETH capture. In contrast to the PoS algorithm, EIP1559 rapidly adapts to the changing economic conditions of the app layer. By default, blocks on Ethereum are 50% full, and EIP1559 automatically upregulates or downregulates both blocksize and gas fees, based on demand.

As gas fees go down, blocks get smaller. As blockspace demand increases, blocksize also increases, but so do gas fees! While the blocksize target always remains a constant (15m gas), momentary blocksize is allowed to flex up or down, depending on the demands of economic actors.

EIP1559 changes Ethereum blocksize by up to 12.5%, based on the fullness of the previous block. 12.5% inside of one block isn’t too much, but with blocks every 12 seconds, Ethereum blocks can double in size within 240 seconds. Blocksize also has a global max size, to ensure things don’t get out of hand. EIP1559 commensurately increases gas prices until demand quells and the target blocksize level is restored.

This mechanism is like gears in the Ethereum economy. When the Ethereum economy is hot, the engine shifts into high gear. Blocksize goes up to satisfy demand, fees follow, and ETH gets burnt. As demand leaves, Ethereum downshifts, lowers blockspace supply, and ETH burn tapers.

Ethernomics

Flexibility in Ethereum’s cryptoeconomics allows it to achieve a natural state of balance, even while dumb humans are doing stupid Ponzi-games on top of it.

The economics of Ethereum adapts to the environment around it.

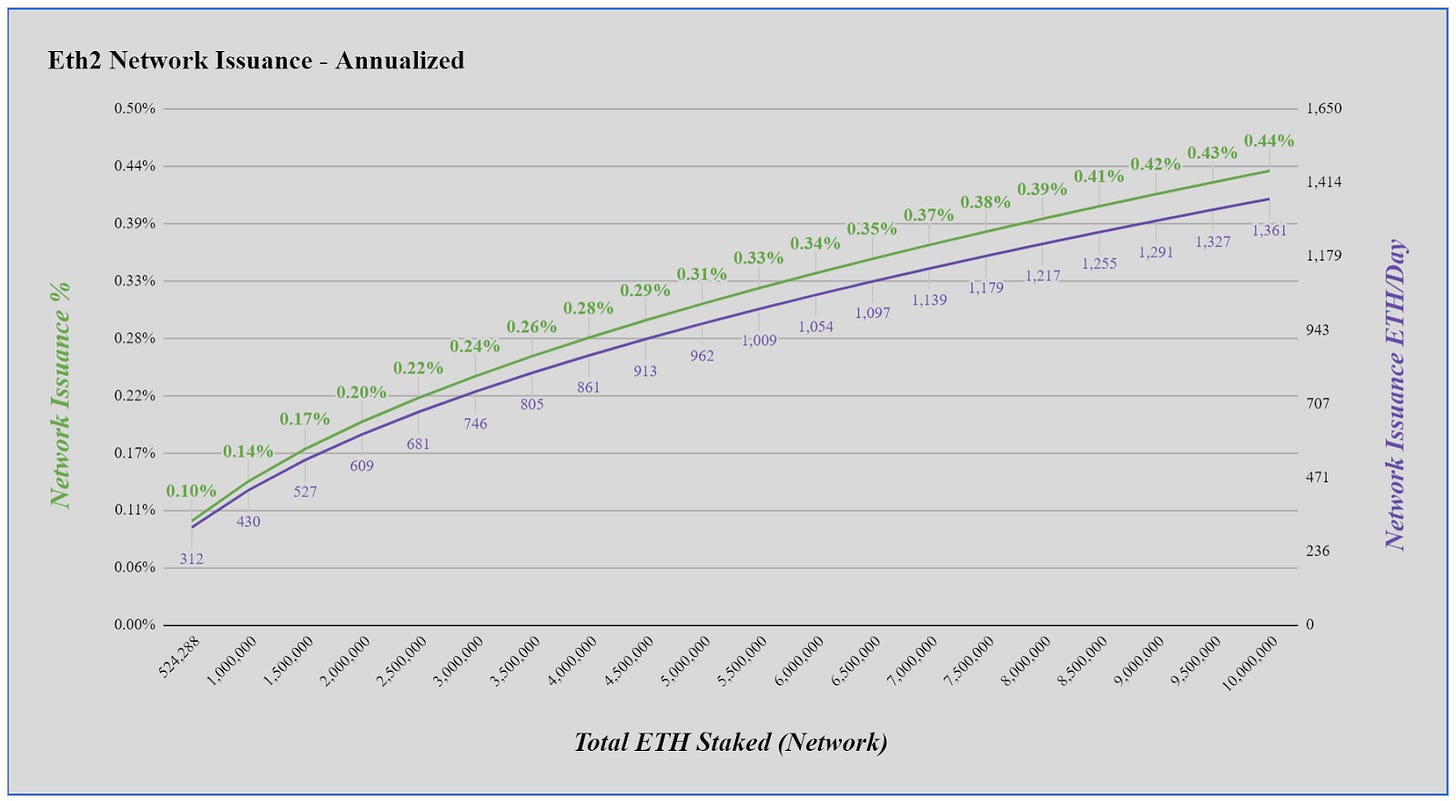

For example, the ETH issuance rate — as more ETH is staked to Ethereum, the issuance algorithm issues more ETH. But, it issues proportionally less ETH per validator, as the issuance is split among a higher supply of validators.

When the total amount of ETH being staked to Ethereum is low, the rate of return for individuals is high, but the total amount of ETH issued is low.

When the total amount of ETH staked to Ethereum is high, the rate of return for individual stakers is low, but the total amount of ETH issued is high.

ETH issuance curve:

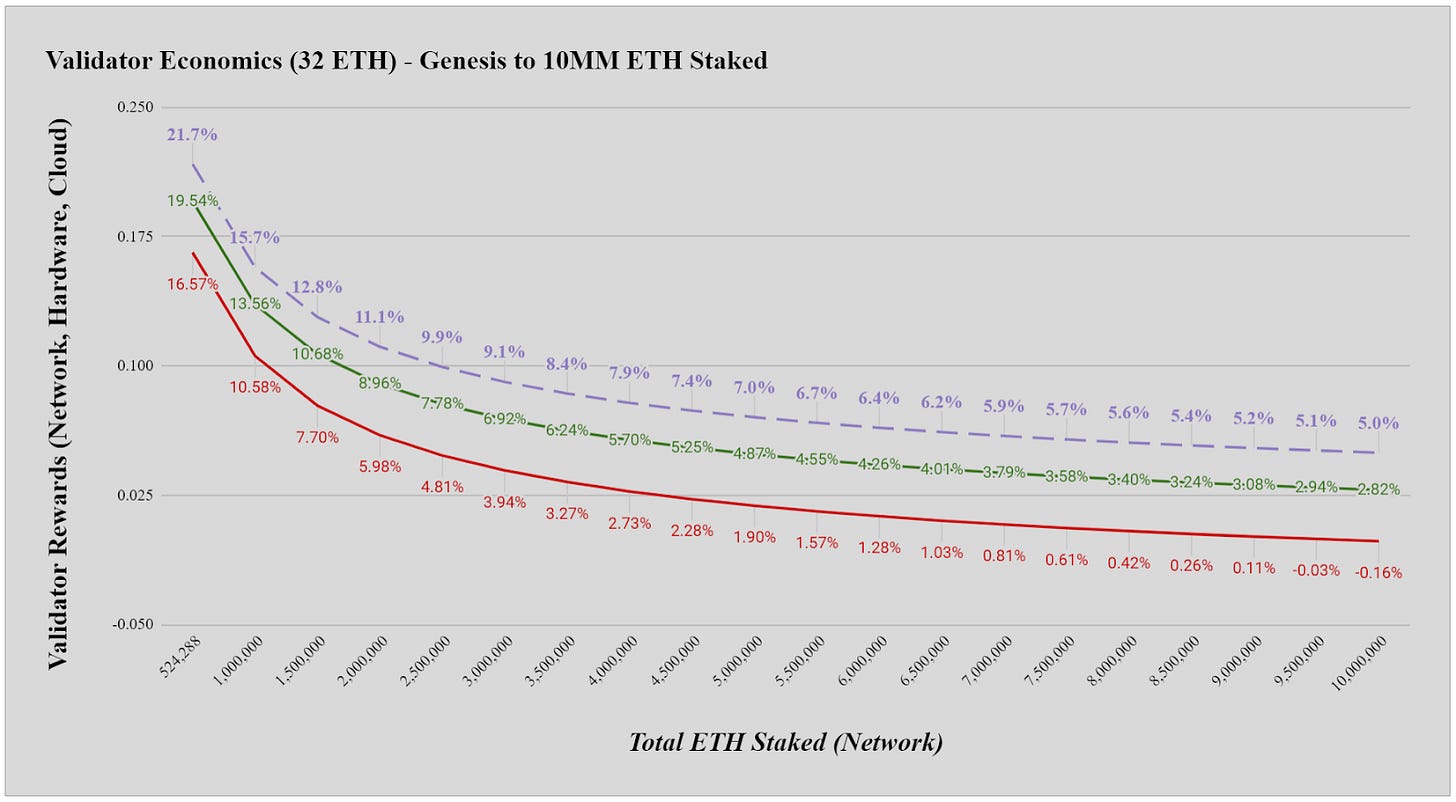

ETH staking yield curve:

Ethereum naturally pays more for security, when there is less ETH staked to it.

As more ETH is staked to Ethereum, yields reduce and issuance increases, which softens the breaks on economic activity, by encouraging ETH outflows from staking and into the Ethereum economy.

MEV

MEV is an important part of the Ethereum economy. MEV is the pipe that connects DeFi activity to ETH yield rates. It’s a transfer of value from arbitragers to stakers.

When anyone does almost anything on Ethereum, they leave a small trail of arbitrage in their wake. Buying ETH on Uniswap dislocates the price, and creates a micro-opportunity for arbitragers to rebalance the pool.

Economic actors dislocate market equilibrium, and arbitragers automatically relocate the system.

As the Ethereum economy heats up, arbitrage increases commensurately. Generalized economic activity on Ethereum shows up in the price of gas, but MEV activity specifically arises in gas ‘tips’; fees that are paid to ETH stakers beyond the required EIP1559 amount, to allow MEV transactors to skip the transaction queue and go first.

The net effect is a correlation between staking yields and the economic heat of Ethereum.

Finding Equilibrium

All of these various inputs into ETH issuance and ETH burn rates produce an organically balancing system, that allows Ethereum to be the hands-off crypto-economic system that produces the ‘sci-fi economics’ that make me so excited!

When the Ethereum economy is hot, gas prices are high, causing the ETH burn rate to be high. In this environment, MEV is high, raising the yields of ETH staking.

Higher ETH staking yields increase the incentive to stake ETH! This encourages capital outflows out of DeFi, and into the staking protocol, incurring an increase in the costs of capital inside of DeFi.

High ETH yields increase the opportunity cost of capital in DeFi, naturally raising the threshold on what is viable speculative activity.

Arbitragers will always ensure the costs of borrowing ETH in DeFi is higher than staking yields. If it’s not, then there is a free arbitrage opportunity to borrow from DeFi at a lower rate, to stake to the protocol and freely pocket the difference.

By increasing ETH yields at the base layer, Ethereum increases the cost of capital in DeFi.

This is Ethereum’s fantastically elegant homeostatic mechanism for balancing its own economy, and is what prevents humans from having to interfere in the economy. The only human input into the system is the aggregate of market activity! Ethereum does the rest.

As the Ethereum economy heats up, it naturally adds pressure to its own breaks! This also happens in reverse; as the economy cools, pressure is released. A cold economy incurs a high supply of ETH staked but low staking yields, causing external opportunities to look more attractive.

Economy 2.0

In TradFi, there is a tug-of-war between bond yields and equity valuations.

Low bond yields increase risk appetite, and capital flows from bonds to equities. Asset inflation sets in, and credit availability increases. The economy heats up and inflation sets in. The federal reserve responds by raising interest rates, and yields follow suit. Equities sell-off, as bond yields become enticing again.

The Fed has a hard job.

Humans are folly, and the Fed is not external to the system it governs. The inputs that the Fed uses to make governance decisions react to the Fed’s decisions.

Chaotic systems come in two shapes:

- Systems that do not react to predictions made about them. The weatherman’s predictions do not change the weather.

- Systems that do change as a result of predictions made by it.

Enter game theory.

The Fed is operating inside of a chaotic system that responds to the Fed’s own predictions about it. It is fundamentally constrained in its ability to produce stability for the economy it governs, because the Fed’s own inputs are a source of chaos in the system!

Of all the amazing technology that makes up Ethereum, its greatest achievement may simply be eliminating the focal point of a central manager of the economy. Economic participants can stop focusing on the Fed to make their financial decisions, because Ethereum put the Fed’s job into EIP1559 and Proof of Stake.

An internet industrial revolution

Ethereum is the first profitable blockchain in existence.

It is the first crypto-system that captures its own energy and directs it into productive output. By redirecting the blockspace revenue into ETH value, Ethereum naturally increases the aggregate value of capital in of DeFi!

DeFi grows as ETH absorbs flows from the Ethereum economy.

Because ETH is the dominant collateral in the DeFi economy, as the collateral grows in value, credit availability expands!

The Ethereum economy is denominated in ETH, and when ETH grows in value, everything downstream of ETH also grows in value.

Many tokens trade directly against ETH, through Uniswap or some other DEX. Tokens that denominate against ETH means that ETH appreciation is also token appreciation. Tokens that mostly trade with stablecoins still are influenced by ETH price, as the appetite for stablecoins grows when ETH can be used to borrow or mint them, and also borrow more of them as ETH becomes more valuable.

EIP1559 gives the entire Ethereum economy a tailwind of economic growth. As ETH grows in value, capital availability increases.

Wealth generation becomes easier. Investment in Ethereum grows.

The positive effects of EIP1559 don’t stop at simply increasing ETH’s value. ETH is intimately intertwined with DeFi, and ETH appreciation has significant positive downstream effects upon the entire Ethereum economy!

Call it: the “ETH Wealth Effect”.

Some people mistakenly think that ETH deflation will dampen economic activity on Ethereum. It’s exactly the opposite. ETH deflation increases the availability of all other forms of capital and encourages investment and activity of that capital

Ethereum will be able to finance itself into its own future.

Unlocking the Internet Industrial Revolution

We are watching the world of crypto-economics unlock a new engine of productivity for the internet age.

The internet revolution is incomplete without crypto-economics. Prior to digitally native money and finance, we were stuck in a pre-pubescent phase of the internet; the ‘data only’ version of the internet.

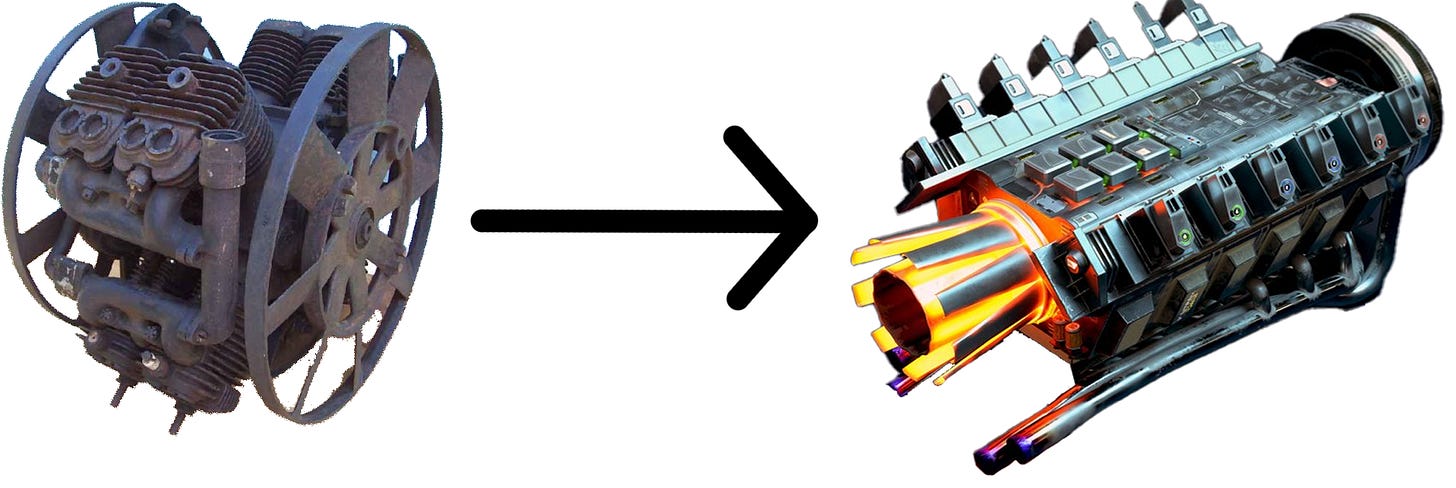

Crypto-economics is the study of building economic engines for the internet. With the invention of Bitcoin in 2009, a new engine class was discovered, and an entirely new industry was spawned around it.

Ethereum has been optimizing the science of crypto-economics ever since. What was previously a lossy and inefficient engine of productivity has been turned into a super-engine for the digital age.

Ethereum is heralding an industrial revolution on the internet. Similar to how the steam engine was the input required to kickstart the industrial revolution, Ethereum’s spiffy new crypto-economic engine is unlocking a new era of economic productivity and prosperity for the internet.

We’ve seen this story before. We know what happens next.

The dots being connected here are not that far apart.

Growth. Entrepreneurship. Inventions. Connectivity. Wealth. Prosperity. Increased standards of living and quality of life.

This is what lies ahead, as soon as we figure out how to drive the damn thing. 😅