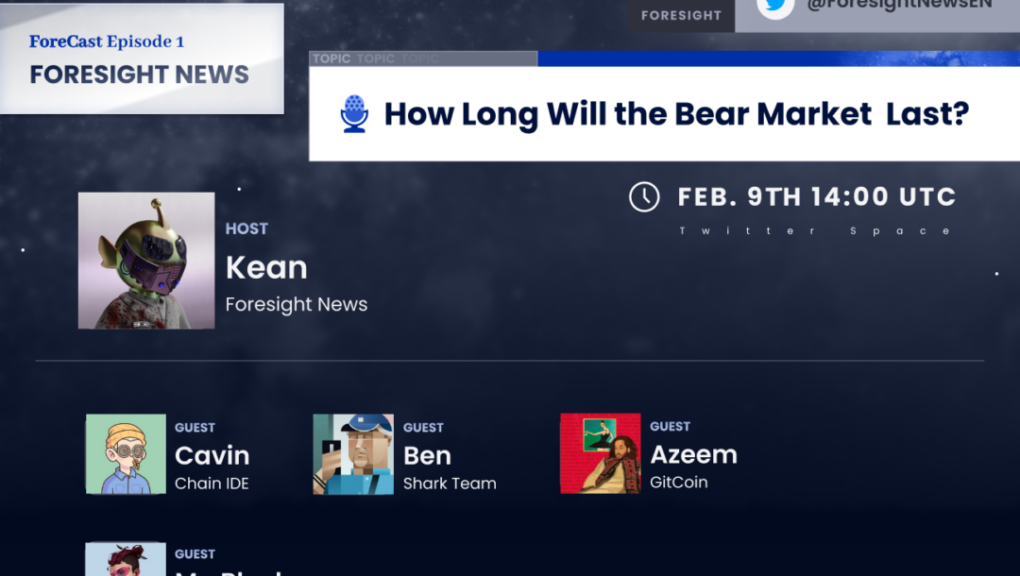

On Feb. 9, We invited four guests from the fields of DAO, DeFi, Infrastructure, and Blockchain Security to join us in a Twitter Space to discuss some phenomena in the bear market. Each guest shared their perspective from their respective field.

Host: Kean (Editor @Foresight News)

Alice (Researcher @Foresight Ventures)

Speaker: Azeem (the fundraising and partnership leader @GitCoin)

Mr. Block (core member @CurveFinance)

Cavin (eco manager @ChainIDE)

Ben (VP of Engineering @theSharkteam)

Editor: Kean, Poerain

Audio for this episode: ForeCast Episode 1 – Foresight News|Spotify

Kean: The current bear market began in Nov. 2021, and markets have been unstable and mostly dropping for 15 months in general. What are your thoughts on this bear market and when do you think it is going to end?

Cavin: From my personal perspective I think it’s really hard to guess how long it will be, but for Chain IDE, we have prepared a two-year plan for this bear market. I’m seeing from the past, generally speaking, the bear market will probably last more than two years. We’ve been operating Chain IDE for more than three years right now, and I’ve talked with our Chain IDE users (blockchain developers), and most of them think this market will last for at least two years. I think the bear market is still ongoing, but the most important thing for us is that we should be prepared for what is coming, for maybe one or two years.

Azeem: The current bear market in crypto is different from previous ones, and it’s being impacted by macroeconomic conditions like threats of nuclear explosions, the ongoing pandemic, and stocks being down 80% from their all-time highs. Many companies are struggling, and it’s hard to predict how long this downturn will last. In past bear markets, crypto’s problems were often self-inflicted due to CEO failures, but now there are amazing teams building real products to solve real problems, and there’s more than just promise. To end the bear market, we need to wait for macro conditions to improve, and if we see a resolution to the conflict between Russia and Ukraine, there could be a spike in crypto and stock prices. To understand when the bear market may end, we need to pay attention to what’s happening outside of crypto.

Ben: In my opinion, I have a more optimistic view of the current bear market. I believe we’re in the final phase and have been seeing signs of recovery in recent weeks, with prices of major cryptocurrencies going up and the market rebounding. It’s hard to predict whether this will end the bear market in the near future, but I have a good feeling that we’ll start a new cycle this year. My belief is backed up by Mr. Azeem’s observation that, when looking at the bigger picture outside of the crypto market, there are some major events that could impact it. These events are yet to unfold, but I believe they will also play a role in the market’s recovery.

Kean: We’ve been through a lot during this bear market, we saw many “crypto giants” fall within the last year such as Three-Arrow Capital, Luna, Celsius, FTX; and there are still uncertainties around the industry, like DCG’s chain-debt problems with Genesis and Gemini; Binance’s problems with its proof of reserves and lawsuits from US. government. What are the most important qualities for a Web3 company/project nowadays that will help them stay out of trouble? Could you guys share some insights with us?

Azeem: As a US citizen, the current year seems to be a scary one for people involved in the crypto industry. There are rumors going around that the US government wants to shut down ETH staking, which would be a huge blow. Instead of worrying about government regulations and anti-innovation, it might be best to focus on places that are becoming crypto-friendly. Singapore and Dubai are examples of such places that have regulations, tax laws, and access to capital and are welcoming towards the crypto industry. As an example, GitCoin is an entity that is registered out of the Cayman Islands, which is favorable for setting up operations for DAOs. The idea is to find places that allow for innovation so that we can innovate freely.

Mr. Block: Cryptocurrency regulation is a complex issue that varies from country to country, making it difficult for companies to stay compliant with regulations. With the evolution of the cryptocurrency industry and the emergence of new products such as GameFi, DeFi, and NFTs, it’s becoming even more challenging to navigate the regulatory landscape.

Many current rules and regulations were designed for the traditional financial industry and are outdated even for fintech companies, let alone cryptocurrency firms. However, adhering to these regulations is crucial to avoid legal trouble. One way to stay compliant is to choose countries that are geographically friendly to crypto, such as Singapore and Dubai, where there are regulations and tax laws that allow for innovation.

Despite the challenges, recent news about the SEC on liquid staking by Coinbase suggests that DeFi projects should be as decentralized as possible. This means companies should run their UI and data in a decentralized manner to comply with regulations. Additionally, user adoption of new ways to interact with DeFi and Ethereum will be crucial in 2023. As the industry evolves, it’s important to stay up to date with regulatory changes and find innovative solutions to stay compliant while pushing the boundaries of the crypto industry.

Ben: As a security team, our focus is on risk assessment and control in the market. In traditional finance, the saying goes that finance is all about risk control. However, in the crypto market, it seems like many people aren’t taking this approach. Recent events, such as the fall of companies like Three Arrows, Luna, and FTX, have caused a lot of uncertainty and doubt in the market. While the market is currently resilient, we are unsure how many more hits it can take.

To address these issues, we believe that there needs to be a comprehensive infrastructure in place to evaluate companies and projects in the crypto ecosystem. To protect themselves, companies must adopt risk awareness and control measures. This can be done through technical means such as smart contract auditing, screening, data analysis, and warning systems. Our team specializes in these services. Additionally, regulation can be an effective means of controlling risk. Some argue that regulation conflicts with the idea of decentralization, but we believe that regulation can be decentralized and applied in a way that doesn’t diminish the decentralizing power of the market. We can have the whole market to be the regulators so there is a decentralized regulating and blockchain is able to do that, in the other hand, centralized exchanges like Binance should be regulated to provide safer and more stable services to the entire market. In summary, a strong risk awareness and control program, combined with utilizing security tools and services, and being regulated by the market or by law, is the best way to stay out of trouble in the crypto industry.

Cavin: In the world of Web3 projects, it is important for startup teams to be careful and cautious in order to stay out of trouble. With limited resources and the wildness of the crypto world, teams must be mindful of their cash flow and carefully consider where they spend their money. This includes reducing costs in areas like team size, as we have seen with companies such as OpenSea and Coinbase cutting their workforce. It is not just about caring for their investment, but also caring for their own team’s cash flow efficiency. Despite these challenges, teams should keep their focus on their own project, while being aware of the risks and taking steps to protect themselves.

Kean: Looking back at the previous cycle – DeFi exploded in the summer of 2020, and it attracted millions of new users to Web3. NFTs became popular a year later in the summer of 2021, and it brought millions of new users into Web 3. Do you think Defi or NFTs will drag us out of the bear market? In your point of view, what could possibly take Web3 to the next level?

Cavin: In my opinion, Defi protocols are important for the web3 world, as they form the financial infrastructure of this ecosystem. However, I believe that NFTs are even more significant for the next stage of development. Traditional brands like Starbucks, Louis Vuitton, and Gucci are entering the NFT space by issuing their own tokens. For example, Starbucks launched its own NFT program called Score Odyssey last September, where consumers could collect virtual stamps on the Polygon network by completing quests on-chain. These collectibles allowed consumers to access special events provided by Starbucks, such as free coffee-making courses and visits to Starbucks coffee farms.

NFTs can be used to onboard more web2 users into web3 by offering loyalty programs or other incentives. Mobile web3 applications may be the next explosive point for web3. Currently, most web3 users access the ecosystem through web browsers on their PCs. However, mobile applications could bring more people into the market and attract more investment. For example, last year, Stepn brought hundreds of thousands of people who had no prior knowledge of crypto into the market. In summary, I believe that NFTs and mobile applications could be key drivers of growth and adoption for web3 in the future.

Azeem: NFTs have become a popular topic in the cryptocurrency world, and many are still unsure of their value. However, upon reflection, NFTs’ success makes sense because people tend to buy high-end items like houses and cars when they have money, and purchasing art is a natural next step. It was only logical that crypto-native people who had become wealthy would use their money to start buying crypto-native art.

Looking to the future, I believe that the next unlock in the crypto world will come from mainstream adoption, which will require developers to build products that are more user-friendly. At present, there are few mobile applications that show potential for wide adoption.

Decentralized finance, which relies on users being able to secure their assets and understand self-custody, is currently too difficult for most people. Gaming could be the key to onboarding the next billion people, but building a successful game takes time. I think the next big thing in crypto will come from media and entertainment. I believe that NFT music done the right way, has the potential to introduce a mainstream audience to the crypto world. I also believe that GitCoin’s idea of a social impact and grant-giving platform has a significant role to play in the future. With the recent events, such as earthquakes in Turkey and Syria, and how millions of dollars poured into those places in a frictionless and easy way. Thus, I think that social impact could be the force that propels the crypto world into the next stage while developers build out other products that people will use.

Mr. Block: I think NFT and Gamefi always been kind of a gateway drug for crypto, NFTs and GameFi have become a popular way for people to enter the world of cryptocurrency, but it’s a love-hate relationship. For example, the recent Porsche NFT drop attracted many Porsche fans to the crypto world, but it also left many confused about why a legacy brand like Porsche is launching an NFT. Additionally, some Degen groups pump up the price, leaving regular players unable to experience the game. This lack of balance makes it difficult to bring in new users and adopt from Web2 to Web3.

The key is to find balance, and there is still a long way to go. The younger generation seems to like NFTs, and we can expect more of those. However, the crypto world can be scary for many people, as there have been multiple hacks and exploits in the DeFi space. People are choosing safety over yields, so we are seeing blue-chip projects with single-digit yields still attracting users.

Overall, finding balance is the key to bringing in new users and adopting Web3. We can expect more forks and battle-tested contracts to be reinvented in the coming year. The crypto world is evolving rapidly, and it will be interesting to see how it develops in the future.

Ben: I have my doubts that DeFi or NFT alone can take web3 to the next level. While they are valuable in their respective sectors, their value has already been released. DeFi was the driving force behind the last market boom, but I don’t believe it is going to bring the bull back again.

To truly take web3 to the next level, there needs to be an application that can attract users from all industries, not just those within the web3 community. This is known as mass adoption. The key to achieving this is through an application that can connect both web3 and web2. One example of an application that is close to achieving this is Damus, but I don’t think it has quite reached its full potential yet. In my opinion, a game or a social application, that is not necessarily GameFi or SocialFi, but a real application of social tools, would be the best way to achieve this. That’s what I think could take web3 to the next level.

Alice: What would you pay more attention to in this bear market when you do investment than when you are in a bull market and specifically when you are making investments in the secondary market?

Mr. Block: In this cycle, I haven’t been looking at many new projects because I feel like their valuations are still inflated from the last bull market. Instead, I’ve been focusing on the Curve ecosystem. There are a lot of projects using existing code and repurposing it in interesting ways. For example, Llama Air Force Union and Concentrator have redesigned existing tokens to reinvest and compound your yields.

Clever is another interesting project that is essentially an algorithmic force designed for Convex. They’ve minted stablecoins based on currencies like the Japanese Yuan and Korean Won. This is exciting because many new contracts last year had bugs and loopholes, but these are battle-tested contracts like Uniswap. People are not afraid to provide liquidity because they understand the contract.

I think Forex is another area with a lot of potential. The multi-trillion-dollar market doesn’t have a place to trade decentralized currencies like the Japanese Yuan, Swiss Franc, Korean Won, or Hong Kong Dollars. If you’re building in the Curve ecosystem, I think you should focus on this area.

Cavin: During this bear market, I haven’t made many investments in the Web3 space. In the past two years, I’ve seen many projects stop development and even disappear due to a lack of funding. Recently, I’ve been working on the Chain IDE incubation program and we’ve received many project applications. When evaluating these projects, we are very careful to examine the team’s background and experience building Web3 products. In the bull market, you could make quick investments without much research, but in this bear market, you have to be more cautious.

Ben: I’m not an expert in investments, but my advice for investing in a bear market is to be cautious. I tend to be risk-averse, so I always try to invest in teams or people that I know well before making any decisions. I don’t invest solely based on ideas or concepts. It’s important to be cautious, and that’s my advice. From our perspective, if we’re going to invest in a project, like a project’s token, we want to make sure the project is properly audited.

Azeem: I believe that investor confidence will play a crucial role in the future of the market. Last year, the market suffered significant setbacks and investors lost faith. My concern is that many believe the current upward trend is just a “bull trap” and that even a small dip will cause panic selling and send the market plummeting. To avoid this, we need long-term investors who are willing to take fluctuations of ten or fifteen percent, and allow builders to keep developing and delivering new products. This will help the market remain stable and encourage continued growth.

Alice: The markets apparently experiencing a small hype right now and some of us are quite positive about the future, although some of us are still quite cautious, so what do you think are the things that could possibly make this bear market longer? What would be the main factors if that really happens?

Ben: I think that the bear market could be prolonged by security incidents like the ones we saw with 3AC and Luna, or with more security breaches for smart contract loans of major DeFi protocols. I believe that the markets themselves are resilient, but people are not. These types of incidents have caused the current bear market, and if we continue to see more of them, it could make the bear market last longer. When people lose faith in the crypto market, it can be difficult to regain it. In any market, whether it’s crypto or stocks, people need to have faith in it for it to thrive. That’s why I hope we can develop a better infrastructure that will help us prevent security incidents from happening in the first place.

Cavin: I agree with Ben’s point about the security concerns in crypto, but I also believe that the duration of the bear market depends on other factors as well, such as the decisions made by the US Federal Reserve and the state of the macroeconomy. This is because the crypto markets are highly interconnected with the US stock market currently.

Mr. Block: I believe that regulation is a major factor affecting the crypto industry. In Taiwan, we were impacted by events such as FTX, Luna, and 3AC, which led to a black swan event and hurt their clients. While we may not see strict regulation this year, we’re starting to see some layouts and this is not obviously going to stop Bitcoin and the crypto innovation but it’s going to slow down a lot of these founders.

I do think that because of the Defi summer, NFT and GameFi happened, there are many more people building these sectors, but regulation is like the elephant in the room. In 2018, there were STO (security token offering), but it did not pass the Howey Test because of “crypto issues” (staking, yields, etc.). However, because everyone was doing it, many thought it was okay. I believe that regulation will eventually come, and it will depend on how they decide to regulate. To prepare for the possible impact of regulation, we need to start a movement to help users learn how to run their own nodes and understand how to access Ethereum in a decentralized manner. This will enable non-technical users to access Ethereum without relying on centralized solutions such as AWS or centralized DNS. If regulation comes and shuts down platforms like Uniswap or Compound, most users won’t be able to access them. I think this could be a black swan event. Metamask had no users in 2016, but now has more than fifty million downloads, so it’s possible for non-technical users to learn how to access Ethereum in a decentralized manner.