Author: Kadeem Clarke

(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Hashflow is a decentralized exchange with features like interoperability, MEV-protected trades, and zero slippage. With Hashflow, you can trade assets on any chain by connecting your wallet

Ethereum has seen rapid growth on decentralized exchanges (DEXs) over the last year, with over $215 million traded on DeFi. The credit for this growth goes to Automated Market Makers (AMMs), who propagated explosive growth through simple and permissionless on-chain trading models.

Hashflow builds on the AMMs foundation by linking DeFi traders with top market makers in crypto.

What is Hashflow?

Hashflow is a decentralized exchange with features like interoperability, MEV-protected trades, and zero slippage. With Hashflow, you can trade assets on any chain by connecting your wallet. You can swap native assets across multiple chains without the need for bridges. All trades are free from commission and price quotes execute at displayed prices.

While most DEXs rely on AMMs to facilitate trading and buying assets, they are imperfect. AMMs are capital inefficient, prone to sandwich attacks and impermanent loss, and do not price non-spot assets.

Hashflow’s request-for-quote (RFQ) operation model market sets asset prices without limitations bound to stablecoins and blue-chip assets. It implies that you can now get more seamless trading of products like ETFs that previously proved impossible in DeFi.

Hashflow’s Key Features

Bridgeless cross-chain swapping

Users can quickly swap assets across multiple chains. The trades are further protected from slippage and MEV exploits regardless of their state, whether local on a particular chain or across various chains. So, how does this work?

Regardless of where you initiate your trade, you will always get your assets to the destination without losing value. Here are the steps involved in the life cycle of cross-chain swapping:

- Trader X requests a quote selling 10 ETH on the Ethereum blockchain (source chain) and buying 20 AVAX on the Avalanche blockchain (destination chain)

- The market maker provides X with a signed quote

- Using the signed quote as the payload, trader X submits the transaction to Ethereum

- Ethereum’s liquidity pool smart contract asserts security, transferring funds from X’s wallet to the pool, sending the payload, and finally calling the smart gate contract from the source chain

- If the source chain transaction is successful, an event is triggered by the smart gate contract

- X uses the event to validate the transaction and submits the payload and proof to the gateway endpoints on the source chain

- The relayer infrastructure proceeds to submit the payload into the destination chain – transferring AVAX to trader X’s wallet.

The process above is escrow and bridge free. You can swap any native assets by leveraging signature pricing.

Zero slippage

All quotes on Hashflow execute at their displayed prices.

MEV-protected trading

Front-running is impossible, thanks to cryptographic signatures.

The Hashverse

Story-driven, gamified DAO, and a governance platform. Hashflow’s story-verse development is in the hands of the leading Hollywood creative agency; Superconductor Hashverse represents the collection of token holders that comprise the Hashflow protocol.

Hashflow stats since August 2021:

- Trading records total over $10B

- Unique wallets trading total to over 150K

- The average aggregate daily trading volume is $25-30M

- The average daily active users (DAU) is 1,800

- The total trade volume on Polygon and Avalanche in the last six months is $1B

Further into Cross-Chain Swaps

Is Hashflow a bridge?

Hashflow is not a bridge. Its operation model does not call for minting wrapped assets into a destination chain, so a bridge is not required in cross-chain swapping.

What about the message-passing system?

In most cases, Hashflow executes on LayerZero for validations. However, its smart contracts are modular and plug into all generalized m-p systems.

Why use a professional market maker as opposed to an AMM?

With the AMM, execution prices are not guaranteed. Using an AMM together with bridges increases gas fees. It also causes high slippage risks.

Is the fee better than other solutions?

Users must pay the gas fee on both chains when using alternative platforms. The cost is relatively high when involving Ethereum due to its high gas fee. With Hashflow, the price is significantly lower, currently at 270K gas units on both chains engaged in a swap.

What currency is involved?

All fees are calculated and processed in the native source chain currency. For instance, if you sell USDT on Ethereum, the gas fee is paid in ETH. If you sell USDT on Avalanche, the gas fee is in AVAX.

How long does a cross-chain swap take?

On most occasions, most chains take 3-6 minutes apart from Polygon. Reorgs are more frequent on Polygon as compared to other chains. It is slower since you must wait for 500 block confirmations before initiating a transaction on the destination chain. It takes an average of 20 – 30 minutes to sell assets on Polygon.

The HFT token

Hashflow’s native token is $HFT, a governance token for the Hashflow protocol and Hashverse. Users stake HFT to unlock additional benefits in the ecosystem:

Governance

The governance structure follows a vote-escrow token model where appointments are made based on one’s HFT amount and duration of holding. If you stake a token, you are empowered with the right to vote and thus participate in managing the protocol. This structure involves users making decisions regarding protocol fees, code development, and marketing.

In-DAO Health and Rewards

In the Hashverse, a story-driven gamified DAO, the staked tokens determine the health metrics for users. To maintain health within the Hashverse, users must consistently adjust their durations and amount (value) of staked tokens. The protocol rewards the most active community users. Active users use the Hashverse to redeem their rewards.

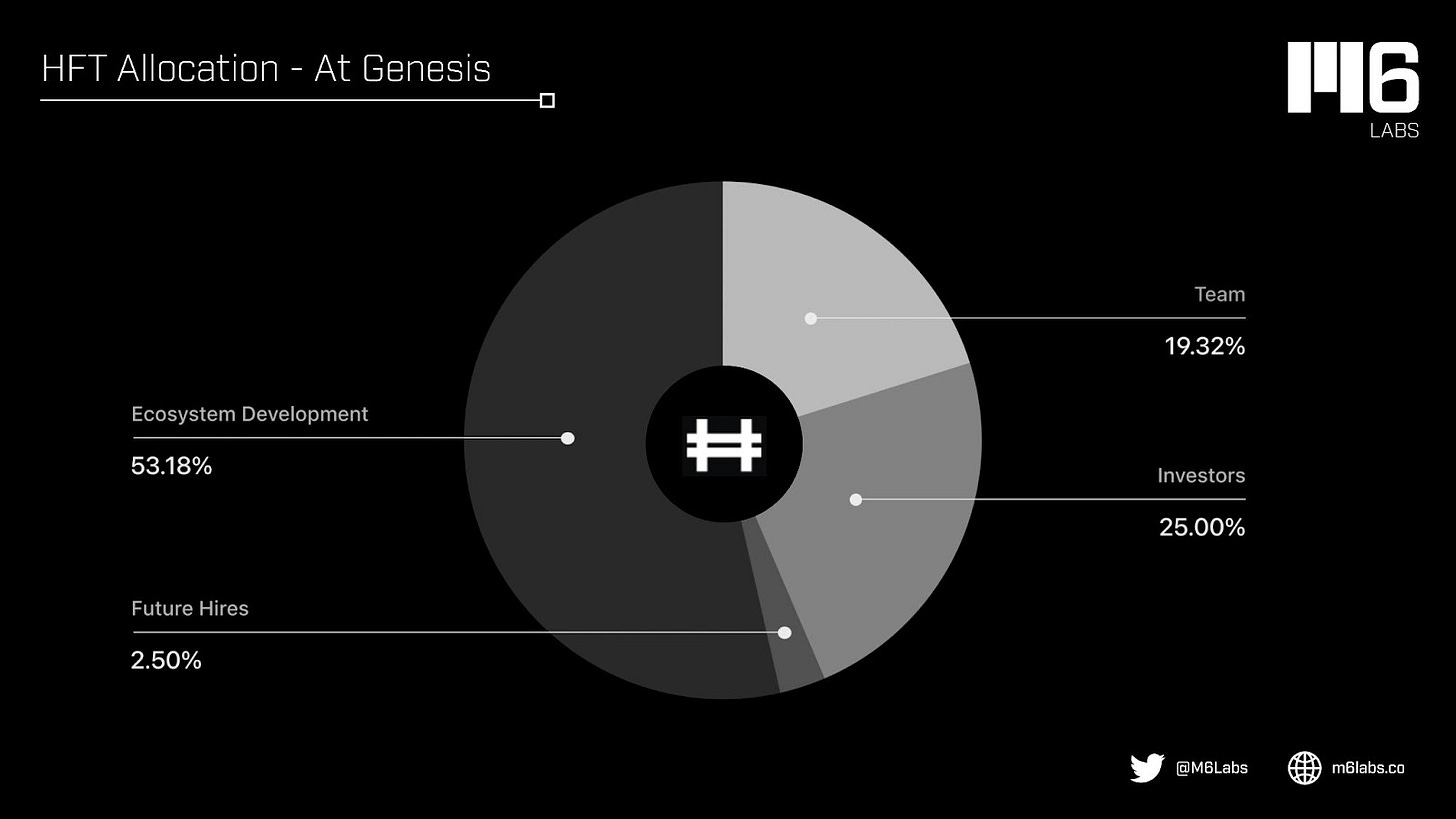

Token Distribution

To decentralize $HFT ownership, ecosystem partners and the community own most of the supply allocation, they own 53% of the genesis $HFT supply. The remaining 44% goes to the core team and investors.

According to Hashflow’s docs, $HFT will be distributed as follows:

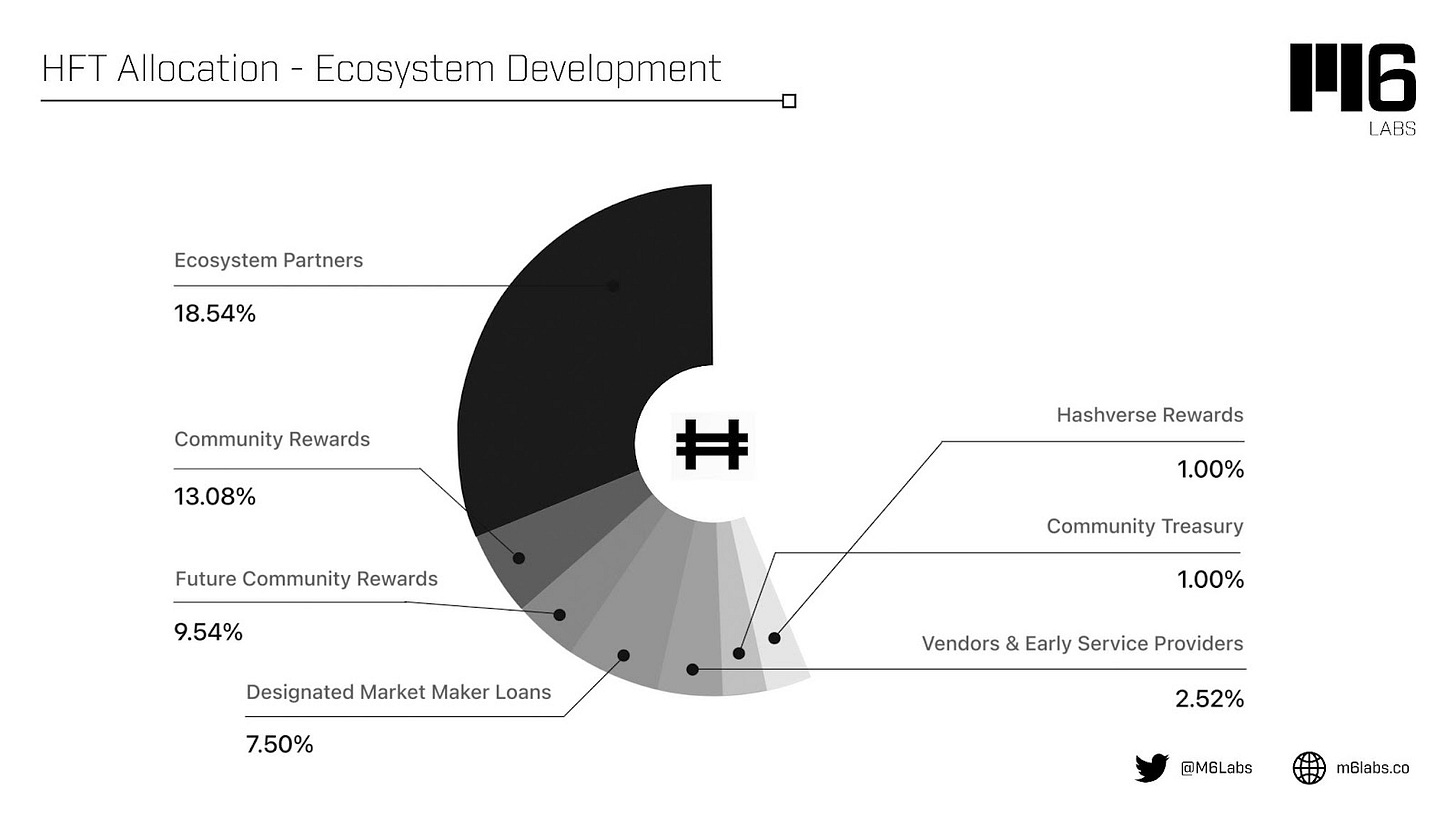

19.32%(193,200,000 HFT) to the Core Team25%(250,000,000 HFT) to Early Investors2.5%(25,00,000 HFT) for Future Hires53.18%(531,800,000 HFT) for Ecosystem Development as follows:18.54%to Ecosystem Partners13.08%to Community Rewards (NFTs + Rake the Rewards + Exchange Distribution)9.54%for Future Community Rewards7.50%to Designated Market Maker Loans2.52%to Vendors and Early Service Providers1.00%to the Community Treasury1.00%for Hashverse Rewards

Ecosystem Development

In the ecosystem development domain, HFT will be allocated as follows:

Release Schedule

Tokens issued to the team, investors, and ecosystem are subject to the following vesting schedule:

- Team – 25% Vested in one year succeeding TGE. 75% Linear monthly vesting in the cascading 3-5 years.

- Investors – 25% Vested in a year after TGE. 75% Linear monthly vesting over the subsequent 3-5 years.

- Community rewards – NFT holders can claim up to 30K HFT at TGE for all wallets holding NFTs respective of their snapshot dates. Afterward, all wallets with an excess of 30K HFT aggregate value can claim their balance in a linear daily vesting schedule with the floor value up to 1000 HFT per day – beginning a month after TGE. For instance, if your NFTs value is 200,000 HFT, you can claim 30,000 HFT at TGE. After one month, you start vesting 1k HFT over 170 days. In the case of Rake rewards, HFT earned before July 2022 will be fully distributed and claimable at TGE. HFT made after July is subject to linear daily vesting for 30 days after TGE.

Project Proposal Process

If you are an HFT holder with sufficient balance, you can submit a proposal to spend HFT in the treasury through the governance forum. Projects can include:

- Community growth programs

- Improving Hashflow’s technical structure

- Educational Programs

- Other initiatives growing Hashflow’s ecosystem

For a proposal to be valid, it should be structured as a Hashflow Improvement Proposal (HIP). It must have a champion ushering it from submission to acceptance.

Benefits of Hashflow

Hashflow impacts two stakeholders: market makers and traders

Market Makers

Hashflow allows market makers to source liquidity and price assets through off-chain methods backed by cryptographic signatures. Since the market is off-chain, users use more sophisticated strategies to factor in off-chain data. This is similar to historical asset prices, volatility, and other real-world information that allows them to price assets effectively. You can use Hashflow’s article to get started as a market maker.

Traders

Traders enjoy the following benefits: better prices because pricing off-chain creates tighter quotes. Hashflow ensures zero slippage, MEV resistance, and bridgeless swaps on multiple chains, as iterated in its key highlights.

Roadmap and Updates

Completed Milestones

Q1 2022

- Launched on Polygon, Twitter

- Launched on BNB, Twitter

- Launched on Arbitrum, Medium

- Launched on Avalanche, Medium

Q2 2022

- Launched on Optimism

- Launched bridgeless cross-chain swaps in Defi, Medium

Q3 2022

Q4 2022

- Announced the Hashverse, Medium

- Crossed $10B in trading volume

Roadmap

At the time of writing, Hashflow is working on the following:

- Launching the Hashverse DAO

- Deployment on non-EVM chains

- Routing smart orders

- Limiting Orders

- Structuring products like ETFs

- Creating more public tools – The tools enable delayed settlements to the market makers while improving capital efficiency.

The Core Team

- Varun Kumar – Founder and CEO – former aerospace engineer at the German Aerospace Center. Recently he deferred from his Ph.D. studies in Aeronautics and Astronautics at Stanford University.

- Victor Ionescu – Co-Founder and CTO – history in software development at companies like Airbnb, Facebook, and Google, being a team lead in large infrastructure projects. He is a graduate of Oxford in Computer Science and Mathematics.

- Vinod Raghavan – Co-Founder and COO – graduate of Columbia Business School and Columbia University. He started his career at Booz Allen Hamilton. He has experience as a consultant on C-Suite strategic issues working with firms like Goldman Sachs, JPMorgan Chase, Counsyl, and Morgan Stanley.

- Rahsan Boykin – General Counsel – over 20 years of experience in corporate attorney roles. He has also served as a lawyer for new media companies and tech startups. He has worked with Citigroup, GE Capital, and Google.

Putting it All Together

While most DeFi trading platforms use AMMs to facilitate their trading, large trades are often bound to high slippage. Hashflow’s operation model provides a unique solution for this. Users are also involved in the governance and impact the project’s direction.