2022 was a rough one, but what do financial advisors think about crypto right now?

by Ryan Rasmussen, Bitwise Research Team

The capital allocation decisions of U.S. financial advisors are critical for an emerging asset class like crypto.

Financial advisors control over $20 trillion in wealth—roughly half of all wealth in America—and play a key role in educating consumers and institutions about the market.

The annual Bitwise/VettaFi survey plays a vital role in uncovering how advisors are evolving in their understanding and attitudes toward crypto. Now in its fifth year, the survey reveals important trends in how advisors engage with crypto, both individually and with their clients, and how they are shaping the crypto investing landscape.

So, how are advisors thinking about crypto today? Despite market volatility, financial advisors are long-term bullish on crypto. Both advisors and their clients remain interested in crypto and continue to allocate to it at near-all-time-high levels. At the same time, limited access, regulatory uncertainty and volatility continue to be major barriers to entry.

The following are the 6 key findings from the Bitwise/VettaFi 2023 Benchmark Survey of Financial Advisor Attitudes Toward Crypto Assets:

#1: Crypto allocation held steady, despite market volatility and other barriers.

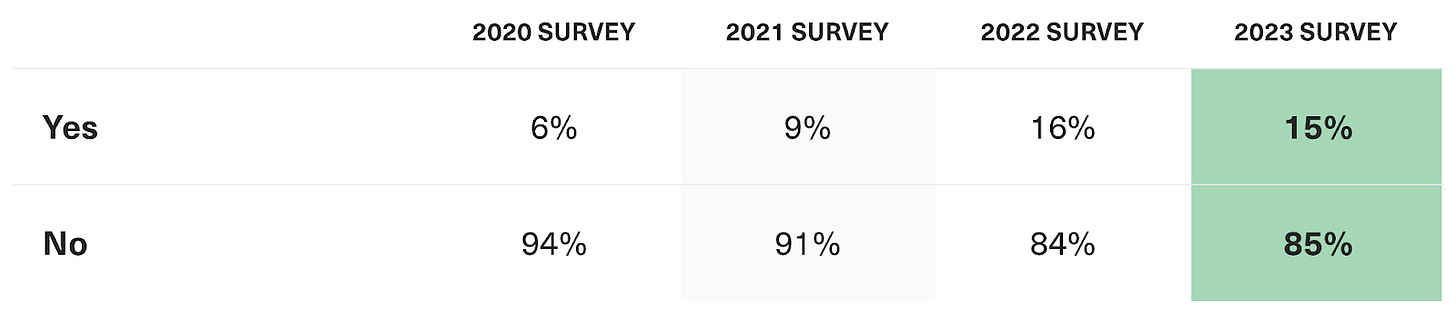

Impressively, given market conditions, the percentage of advisors allocating to crypto in client accounts held roughly steady in 2022, with 15% of respondents reporting advisor-managed allocations for clients. That’s roughly even with last year (16%) and substantially above 2021 (9%) and 2020 (6%).

In part, the slow climb is because access is a barrier to adoption—only 29% of advisors said they are able to buy crypto in client accounts. However, among that group, 52% currently allocate on behalf of clients, showing how important access is.

🗣️Do you currently allocate to crypto in client accounts?

#2: Once you invest, you tend to stay invested (or invest more).

Another telling finding was the difference in attitudes between advisors who have already allocated to crypto in client accounts and those who have not. Of those advisors who have yet to allocate for clients, 74% are either not planning on adding exposure in 2023 or still weighing the merits.

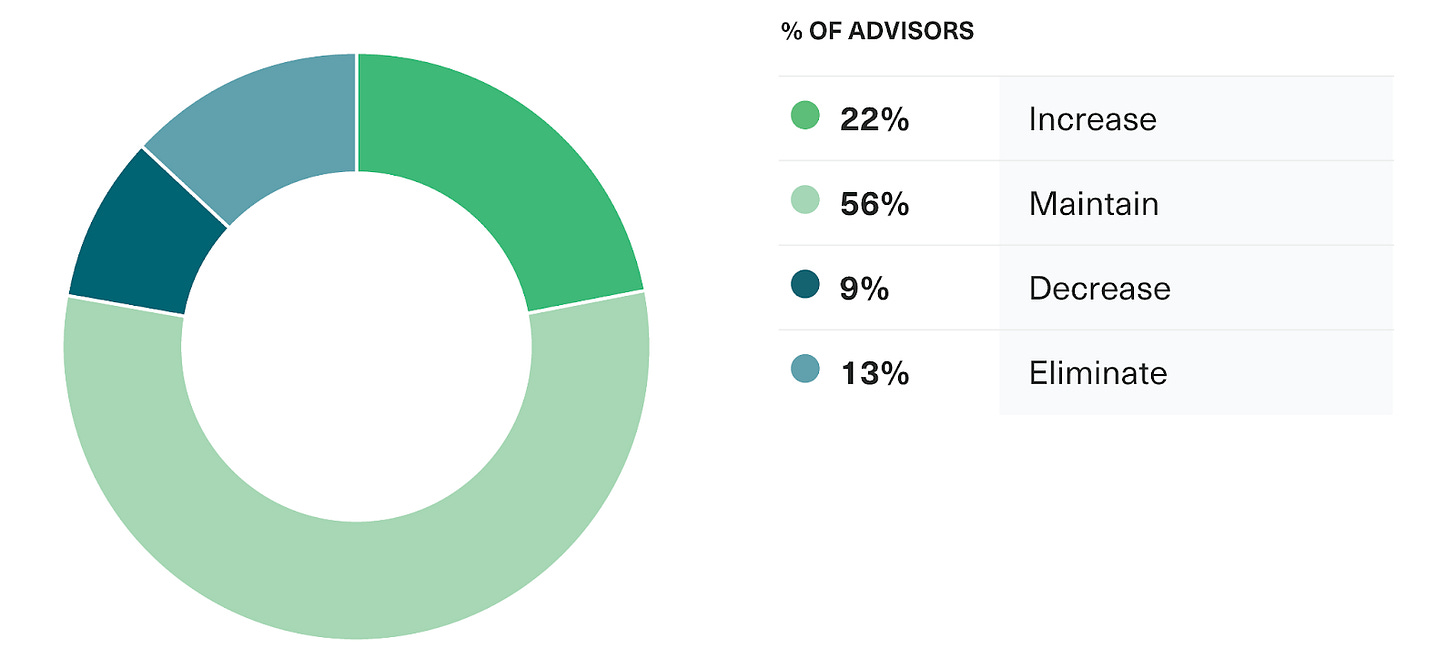

On the other hand, 78% of advisors who have already allocated to crypto in client accounts plan to maintain or increase the exposure. This suggests advisors who already have exposure may be more knowledgeable and comfortable with crypto’s opportunities and risks, while those who do not may have been repelled by 2022’s crypto winter.

🗣️If you currently allocate to crypto in client accounts, do you plan to increase, maintain, decrease, or eliminate your allocation in 2023?

#3: Client interest remains strong.

With an abundance of crypto headlines over the past year, client curiosity remained high, and was a significant factor behind advisors’ interest in crypto. 90% of advisors received a question about crypto from clients last year. Although that was down slightly from 94% in 2021, it was up from 81% in 2020 and 76% in 2019.

When advisors were asked what question they received most from clients, more than half (56%) selected: “Should I consider an investment in crypto?”

🗣️What percentage of clients have asked questions about crypto in the past 12 months?

#4: Clients are investing in crypto on their own.

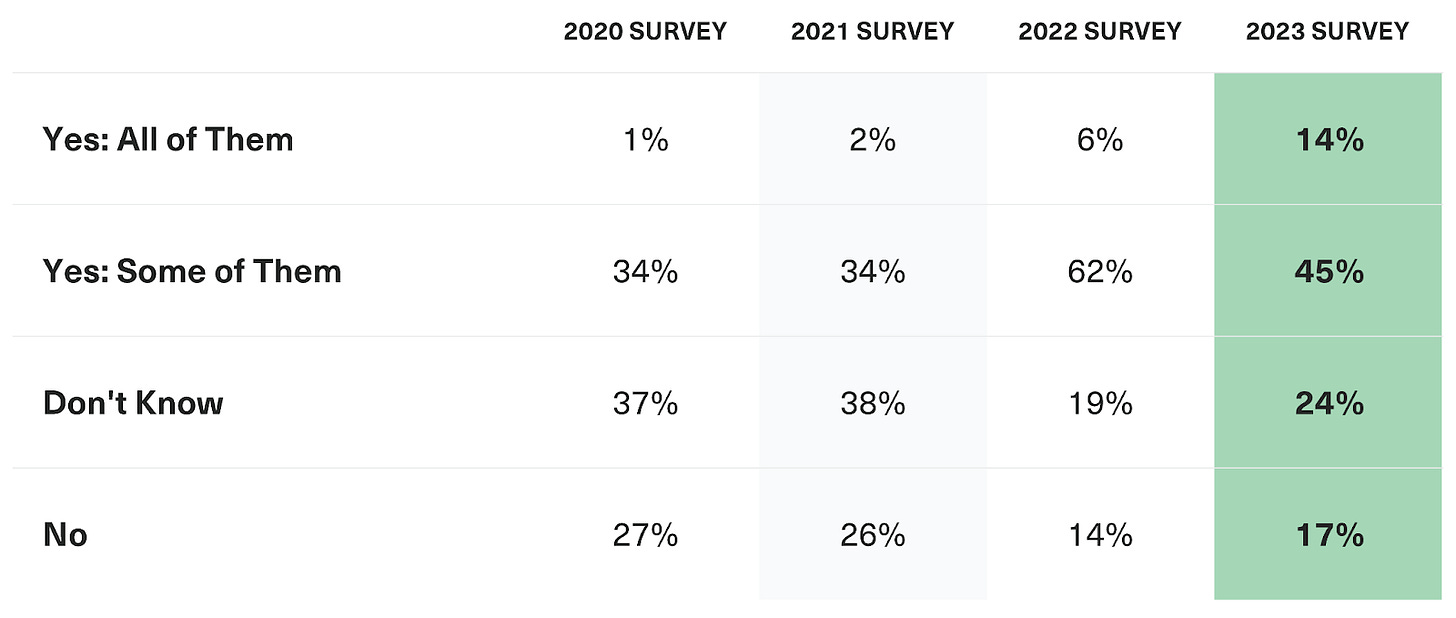

According to respondents, 59% of clients were investing in crypto outside their advisory relationship in 2022, compared to 68% in 2021.

Of clients investing on their own, 75% were getting exposure via centralized crypto platforms such as Coinbase, while 41% were doing so directly from their own crypto wallets. Interestingly, only 18% were gaining exposure through brokerage accounts they manage on their own, preferring more crypto-native approaches.

🗣️Do your clients invest in crypto on their own?

#5: Short-term bearish, long-term bullish.

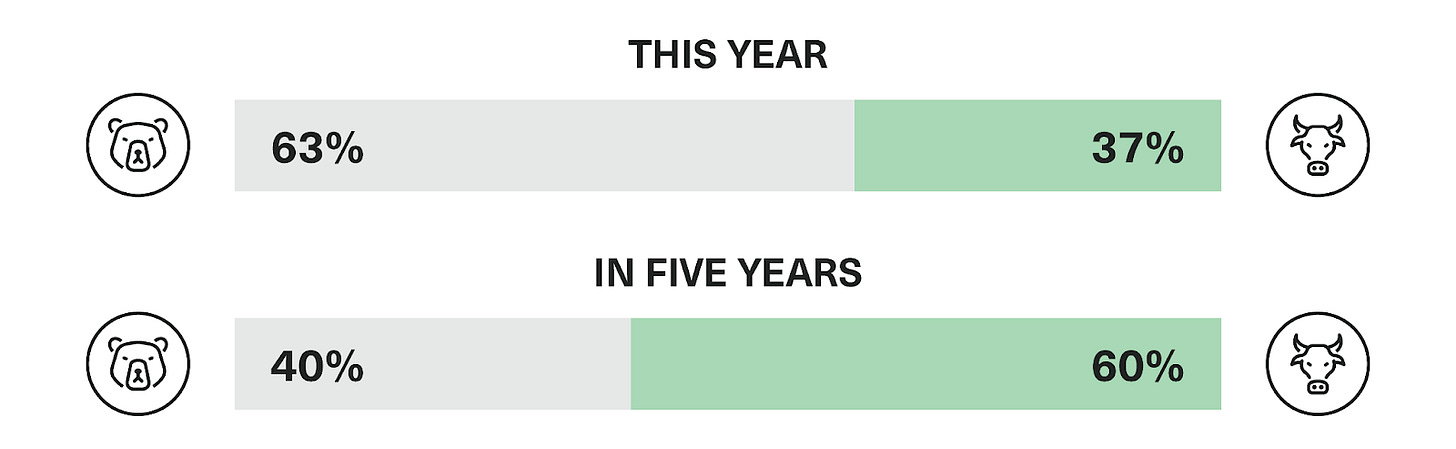

Historically, one of the survey’s most fascinating topics has been its gauge of investor expectations surrounding the price of bitcoin, the largest and most widely used crypto asset. Here the results reflected a short-term bearish bias.

Less than half (37%) of respondents believe that the price of bitcoin will be higher than it is today within the next year. But the same advisors have long-term confidence in its prospects: 60% believe that bitcoin will gain value over the next five years.

🗣️Will the price of bitcoin be higher than it is today within the next year? In five years?

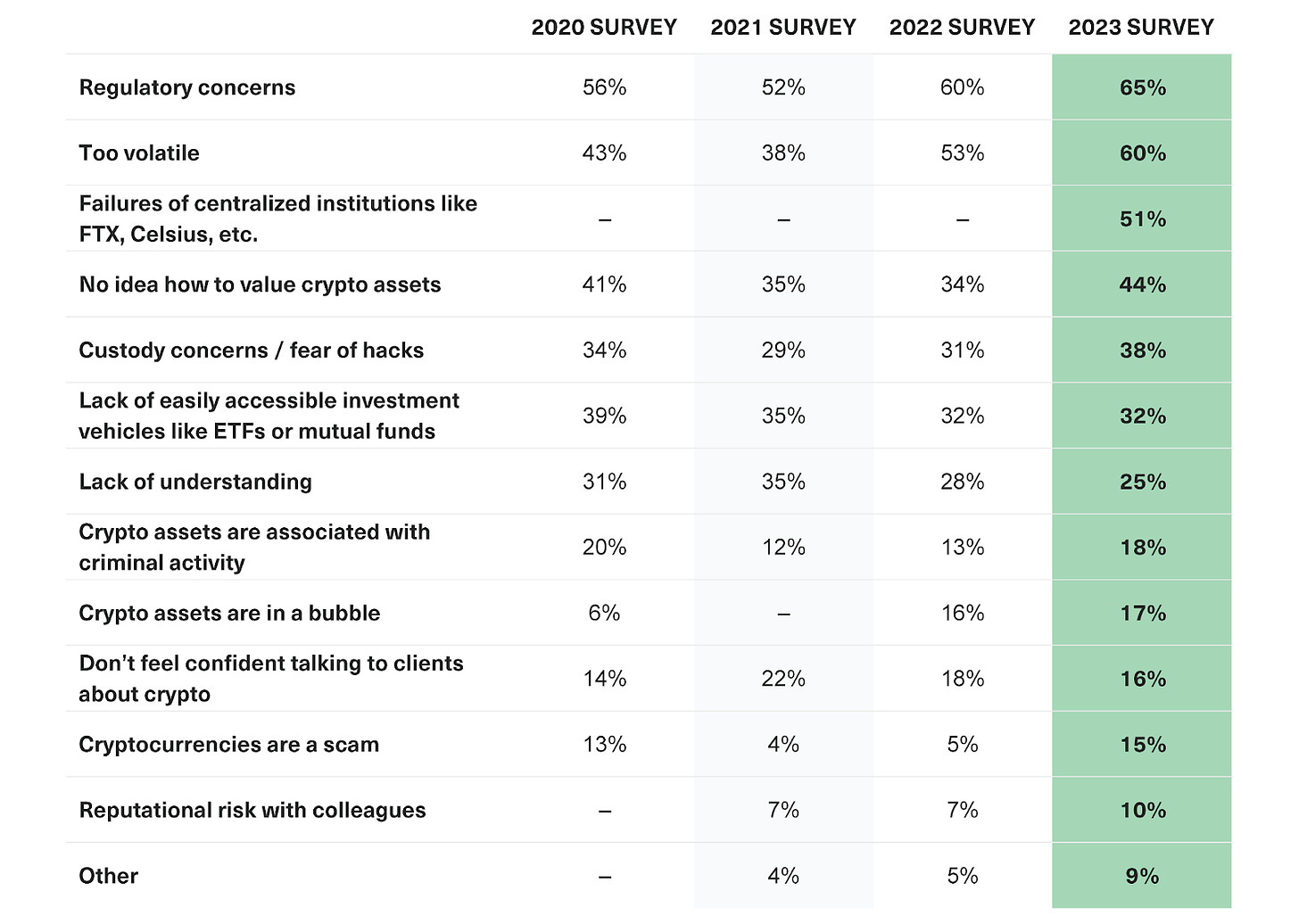

#6: Regulatory uncertainty and volatility are top concerns.

Crypto’s main pain points in 2022—company failures, large price swings, and lack of regulatory clarity—were reflected loud and clear as obstacles that prevented advisors from initiating or adding to their crypto exposure.

The chief concern—regulatory uncertainty—remained a perennial source of apprehension. Sixty-five percent of advisors claimed this was an obstacle to greater crypto adoption, higher than in 2021 (60%), 2020 (52%), and 2019 (56%). An encouraging finding, however, is that advisors’ confidence in their crypto knowledge appears to be growing: Fewer advisors selected “lack of understanding” (25%) or “lack of confidence talking about crypto” (16%) as roadblocks in 2022.

🗣️ What is preventing you from either increasing your investment in crypto assets or making your first allocation?

Note: The choices provided in previous surveys were slightly different. Numbers may not add to 100% due to rounding and/or survey design.

Concluding Thoughts

The survey’s findings confirm what we’ve heard in our daily conversations with thousands of financial professionals across the country throughout 2022: While failures like FTX and the market’s steep volatility are cause for concern, advisors and their clients continue to allocate to crypto, and interest levels remain high.

Still, the woes of 2022 aren’t easily shrugged off by institutional investors, and fears of crypto’s credit contagion are still lingering.

Just last month, the FTX collapse and resulting turmoil claimed another victim when Genesis Global, the largest crypto lender, filed for bankruptcy. The company faces billions in potential losses, and its bankruptcy has entangled Gemini, which has hundreds of millions of dollars of customer assets tied up at Genesis; both companies are facing an SEC lawsuit as a result. Meanwhile, crypto banking giant Silvergate saw a classic “run on the bank” in Q4, with customers withdrawing 68% of all deposits as people worried about its future. Regulatory questions are emerging too.

And then there are other idiosyncratic risks for 2023. People are worried about blow-ups at unregulated institutions like Tether and Binance; there are concerns we could see significant selling of bitcoin if the Mt. Gox bankruptcy is finally processed this year as planned; and many share similar worries about price pressures on Ethereum after a planned technological upgrade (Shanghai fork) that will allow staked ETH to start being withdrawn and sold in late Q1.

Against this backdrop, the Fed is still hiking interest rates, and recession fears linger. So it’s safe to say there is plenty to worry about this year.

And yet… we’re convinced the bulls will win out.

Maybe not in a straight line—there is too much risk to expect prices to march higher without interruption. But as we look at the data, we are increasingly confident in crypto’s long-term trajectory.